Type 1 Diabetes Market

- The Type 1 Diabetes market size in the 7MM is anticipated to grow with a significant CAGR during the forecast period (2023-2034).

- Type 1 Diabetes is an autoimmune disease that leads to the destruction of insulin-producing pancreatic beta cells.

- The United States accounts for the largest Type 1 Diabetes Market Share (~89%) of T1DM market, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- In 2023, nearly half of the reported cases of Type 1 Diabetes in the United States were among individuals aged 40 and above.

- Among the seven major markets, during the forecast period (2024-2034), TZIELD (teplizumab) is expected to garner the highest market share followed by REMD-477.

- Insulin therapies are the mainstay of the treatment. Approved Type 1 Diabetes Drugs are TZIELD (Sanofi), TOUJEO/LANTUS XR (Sanofi), LYUMJEV (Eli Lilly and Company), FIASP (Novo Nordisk), and others.

- In March 2023, Sanofi announced acquisition of Provention Bio, which includes adding TZIELD to its portfolio. TZIELD is recognized as the first disease-modifying treatment designed to delay Stage 3 type 1 diabetes (T1D).

- In March 2024, Novo Nordisk received a positive opinion from the European Medicines Agency's Committee for Medicinal Products for Human Use (CHMP), endorsing the marketing authorization for AWIQLI (once-weekly basal insulin icodec) for treating diabetes in adults.

- Several promising therapies are under development to address the limitations of current treatments for Type 1 Diabetes. Key candidates include ladarixin (Dompé Farmaceutici), basal insulin-fc (Eli Lilly and Company), insulin icodec (Novo Nordisk), DIAMYD (Diamyd Medical), among others.

Request for Unlocking the Sample Page of the Type 1 Diabetes Market

DelveInsight's “Type 1 Diabetes Treatment Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Type 1 Diabetes , historical and forecasted epidemiology as well as the Type 1 Diabetes therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Type 1 Diabetes Treatment Market Report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Type 1 Diabetes market size from 2023 to 2034. The report also covers current Type 1 Diabetes treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain), and the UK, Japan |

|

Type 1 Diabetes Market |

|

|

Type 1 Diabetes Market Size | |

|

Type 1 Diabetes Companies |

Eli Lilly and Company, Landos Biopharma, Diamyd Medical, Gan&Lee Pharmaceuticals, Zealand Pharma, Kamada, AstraZeneca, Novo Nordisk, Provention Bio Preregistration, Histogen, Vertex Pharmaceuticals, Panbela Therapeutics, Arecor, Bioprojet, Novartis, ImCyse, Adocia, Anelixis Therapeutics, Tolerion, TikoMed, Avotres, REMD Biotherapeutics, Novo Nordisk, and others. |

|

Type 1 Diabetes Epidemiology Segmentation |

|

Type 1 Diabetes Treatment Market

Type 1 Diabetes Overview, Country-Specific Treatment Guidelines and Diagnosis

Diabetes mellitus (DM) describes a group of metabolic disorders characterized by hyperglycemia and defects in insulin secretion and/or insulin action. Heredity, obesity, lack of physical activity, poor diet, stress, urbanization, impaired glucose tolerance, and hypertension may increase the risk of diabetes. Chronic hyperglycemia in patients with diabetes is associated with long-term damage and dysfunction of different organs, particularly the eyes, kidneys, nerves, heart, and blood vessels, which eventually results in various diabetic complications.

Following tests are recommended for the diagnosis of T1DM- Fasting plasma glucose (FPG) test, Oral glucose tolerance test (OGTT), Random blood glucose test, Haemoglobin A1C (glycohemoglobin).

Type 1 Diabetes Treatment

All patients with T1DM require insulin therapy. The preferred treatment is multiple daily insulin injections (MDI) using a basal/bolus insulin regimen or continuous SC insulin infusion through an insulin pump. The patient’s weight in kilograms is multiplied by 0.5–0.6 units to calculate the initial total daily insulin dose (TDD) in an adult.

Type 1 Diabetes Epidemiology

The Type 1 Diabetes epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The Type 1 Diabetes epidemiology is segmented with detailed insights into diagnosed prevalent cases, age-wise prevalent, total treated cases of T1DM.

- Among the 7MM, the United States represented the majority of Type 1 Diabetes diagnosed prevalent cases, comprising approximately 56% of the total TIDM cases.

- Among EU4 and the UK, Germany accounted for the highest Type 1 Diabetes diagnosed prevalent cases (~30%) of the total cases.

- In Germany, around 230,000 patients with T1DM were reported to be aged over 40 years in 2023.

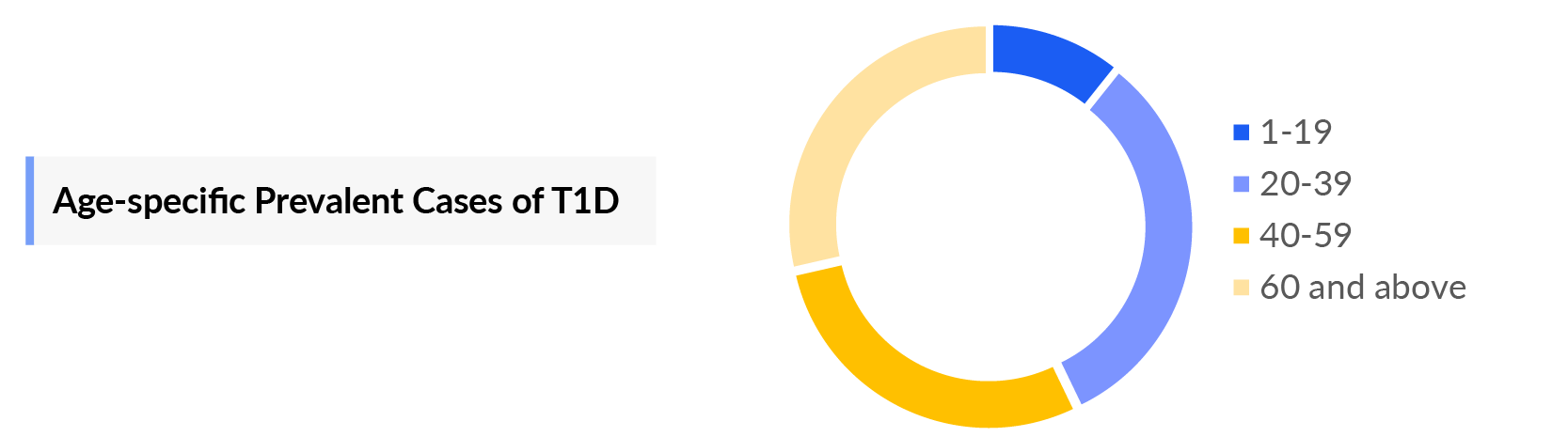

- In the year 2023, the age-specific cases of T1DM (7MM) were ~19%, ~33%, ~38%, and ~10% cases for 1-19 years, 20-39 years, 40-59 years, and more than 60 years of patients respectively.

Recent Developments in the Type 1 Diabetes Treatment Market Landscape

- In Sept 2025, Lexicon Pharmaceuticals submitted new clinical data to the FDA supporting a potential resubmission of Zynquista® (sotagliflozin), an oral SGLT1/SGLT2 inhibitor for type 1 diabetes. This follows FDA concerns about diabetic ketoacidosis risk raised in a 2024 complete response letter. The data comes from three investigator-initiated studies aimed at addressing the benefit-risk profile.

- In April 2025, DexCom, Inc. (NASDAQ: DXCM) announced FDA clearance of the Dexcom G7 15-Day Continuous Glucose Monitoring (CGM) System for adults with diabetes in the U.S. The updated device, featuring an overall MARD of 8.0%, offers extended wear and builds on Dexcom’s proven ability to improve A1C, reduce glycemic variability, and increase time in range.

- In February 2025, NLS Pharmaceutics, Kadimastem, and iTolerance announced the results of a Type B pre-IND meeting with the FDA on iTOL-102, a potential Type 1 Diabetes cure. The treatment combines Kadimastem’s stem cell-derived pancreatic islets with iTolerance’s immunomodulator, without requiring lifelong immune suppression.

- In February 2025, COUR Pharmaceuticals announced that the FDA cleared its Investigational New Drug (IND) application for CNP-103, a nanoparticle therapy in development to target the underlying autoimmunity of Type 1 diabetes (T1D). COUR is a clinical-stage biotechnology company focused on disease-modifying therapies that induce antigen-specific tolerance for immune-mediated diseases.

- In January 2025, Rise Therapeutics announced that the FDA has accepted its IND application to begin a Phase 1 cancer trial for R-5780, marking the company’s fourth clinical program. Ongoing studies for other products are focused on ulcerative colitis, rheumatoid arthritis, and type 1 diabetes.

Type 1 Diabetes Drugs Market Chapters

The drug chapter segment of the Type 1 Diabetes treatment market report encloses a detailed analysis of Type 1 Diabetes marketed drugs and late-stage (Phase III and Phase II) Type 1 Diabetes pipeline drugs. It also deep dives into the Type 1 Diabetes clinical trials details, recent and expected market approvals, patent details, the latest Type 1 Diabetes news, and recent deals and collaborations.

Type 1 Diabetes Marketed Drugs

- TZIELD: Provention Bio

TZIELD is an anti-CD3 monoclonal antibody being developed for the delay of clinical type 1 diabetes in at-risk individuals, as indicated by the presence of two or more type 1 diabetes-related autoantibodies.

In November 2022, Provention Bio's TZIELD has received approval from the US FDA for delaying the onset of Stage 3 type 1 diabetes in adults and children aged eight years and older. First drug to delay type 1 diabetes (T1D) in people at risk.

- LYUMJEV (insulin lispro-aabc injection): Eli Lilly and Company

LYUMJEV is a rapid-acting insulin designed to swiftly absorb into the bloodstream, aiding in controlling elevated blood sugar levels following meals. It shares the same active ingredient as HUMALOG but is formulated for faster absorption. It's proven to reduce A1C levels in adults with type 1 and type 2 diabetes and minimize post-meal blood sugar spikes, mimicking the action of natural insulin in non-diabetic individuals. Administer LYUMJEV at the start of a meal or within 20 min after starting a meal subcutaneously into the abdomen, upper arm, thigh, or buttocks.

Note: Detailed current therapies assessment will be provided in the full report of Type 1 Diabetes...

Type 1 Diabetes Emerging Drugs

- Basal Insulin-FC (LY3209590): Eli Lilly and Company

Basal insulin-FC is a fusion protein that combines a single-chain insulin variant with a human immunoglobulin G fragment crystallizable domain. The weekly insulin from Eli Lilly, BIF, is a selective agonist for insulin receptors and provides full agonism, although it has a lower affinity for this than human insulin. It is internalized by the insulin receptor to a similar extent to human insulin but has reduced potency.

The molecules are being studied in Phase III clinical trials for patients with T1DM.

- Insulin icodec: Novo Nordisk

Insulin icodec is a long-acting basal insulin analog intended for once-weekly treatment, developed by Novo Nordisk to treat T1DM.

In March 2024, Committee for Medicinal Products for Human Use (CHMP) gave positive opinion based on results from the ONWARDS Phase IIIa clinical trial programme.

|

Therapy Name |

Company Name |

ROA |

MOA |

Phases |

Any Special Status |

|

Ladarixin |

Dompé Farmaceutici |

Oral |

IL-8 Inhibitor |

III |

N/A |

|

Basal Insulin-FC (LY3209590) |

Eli Lilly and Company |

SC |

Insulin receptor agonist |

III |

N/A |

|

AWIQLI (INSULIN ICODEC) |

Novo Nordisk |

SC |

Insulin agonist |

IIIa |

N/A |

Type 1 Diabetes Drugs Market Insights

The emergence of weekly insulins in T1DM space has demonstrated a widespread potential for this patient population as a long acting basal insulin. Moreover, the upcoming therapies could also muscle its way into this treatment space as adjunct therapy to insulin for the preservation of ß cells to delay the T1DM disease progression. These other class of therapies includes IL-8 inhibitor, anti-CD3 monoclonal antibody, diabetes vaccine, and allogeneic pancreatic islets.

Type 1 Diabetes Market Outlook

The leading Type 1 Diabetes Companies such as MannKind Corporation, Astellas Pharma, AstraZeneca, Zealand Pharma, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of T1DM.

- Among the seven major markets, the United States had the highest Type 1 Diabetes Treatment Market Size in 2023, which accounts for approximately 89.3% of the total 7MM market.

- In 2023, insulin aspart generated the highest Type 1 Diabetes Drugs Market revenue followed by insulin glargine.

- Among the EU4 countries and the UK, Germany had the highest market size of T1DM in 2023.

- Among the seven major markets, during the forecast period (2024-2034), TZIELD (teplizumab) is expected to garner the highest market share followed by REMD-477.

- The growth of the T1DM market is anticipated to be propelled by the introduction of novel therapies boasting improved clinical profiles, expanded market penetration of advanced treatments, heightened research and development efforts, deeper insights into the disease, rising T1DM prevalence, and forthcoming drug launches.

Type 1 Diabetes Drugs Uptake

This section focuses on the uptake rate of potential Type 1 Diabetes drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Type 1 Diabetes Pipeline Development Activities

The Type 1 Diabetes drugs market report provides insights into Type 1 Diabetes Clinical Trials within Phase III and Phase II stages. It also analyzes key Type 1 Diabetes Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Type 1 Diabetes drugs market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Type 1 Diabetes emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging Type 1 Diabetes Drugs Market Trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving Type 1 Diabetes Treatment Markete Landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging treatment patterns of Type 1 Diabetes Mellitus (T1DM. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

Region |

KOL Views |

|

United States |

“Families with high risk of type 1 diabetes in their children should be especially alert for symptoms of diabetes following COVID, and pediatricians should be alert for an influx of new cases of type 1 diabetes, especially since the Omicron variant of COVID spreads so rapidly among children.” |

|

Europe |

“There is a huge divide in who actually has access to insulin pumps. Nearly 50 years removed from the invention of the first insulin pump, the conversation has shifted from the potential benefits to eliminating barriers preventing optimized uptake of these devices. As the prevalence of pump use has increased, an understanding of contemporary barriers to insulin pump access stands to have a tangible impact on patient-level care and diabetes management as a whole.” |

|

United Kingdom |

“It is possible to delay a diagnosis of Type 1 diabetes in some people, through research that tackles the root cause – the immune attack against the insulin-producing beta cells in the pancreas. With the positive outcomes of Teplizumab–opens up possibilities for the future, with further research needed to fully understand the effects and for whom treatments like this could benefit.” |

|

Japan |

“Nearly 15-20,000 youth are diagnosed with Type 1 Diabetes every year and nearly 20-40% of children with newly diagnosed diabetes present in Diabetes Ketoacidosis (DKA). People with undiagnosed type 1 diabetes can also have concurrent illnesses, such as a common cold or strep throat that can mask the symptoms of diabetes. Therefore, it is very important to rule out the diagnosis and start with the immediate treatment as required.” |

Type 1 Diabetes Therapeutics Market Report Scope

- The Type 1 Diabetes therapeutics market report covers a segment of key events, an executive summary, descriptive overview explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the Type 1 Diabetes epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific Type 1 Diabetes Treatment Market guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current Type 1 Diabetes Treatment Market Landscape.

- A detailed review of the Type 1 Diabetes Therapeutics Market, historical and forecasted Type 1 Diabetes Drugs Market Size, Type 1 Diabetes Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Type 1 Diabetes Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Type 1 Diabetes Drugs Market.

Type 1 Diabetes Therapeutics Market Report Insights

- Patient-based Type 1 Diabetes Market Forecasting

- Type 1 Diabetes Therapeutic Approaches

- Type 1 Diabetes Pipeline Analysis

- Type 1 Diabetes Drugs Market Size and Trends

- Existing and future Type 1 Diabetes Therapeutics Market Opportunity

Type 1 Diabetes Therapeutics Market Report Key Strengths

- 11 Years Type 1 Diabetes Market Forecast

- 7MM Coverage

- Type 1 Diabetes Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- Type 1 Diabetes Drugs Uptake

- Key Type 1 Diabetes Market Forecast Assumptions

Type 1 Diabetes Therapeutics Market Report Assessment

- Current Type 1 Diabetes Treatment Market Practices

- Type 1 Diabetes Unmet Needs

- Type 1 Diabetes Pipeline Product Profiles

- Type 1 Diabetes Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Type 1 Diabetes Market Drivers

- Type 1 Diabetes Market Barriers

- What is the growth rate of the 7MM Type 1 Diabetes treatment market?

- What was the Type 1 Diabetes treatment market size, the Type 1 Diabetes drugs market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the Type 1 Diabetes treatment?

- How many companies are developing therapies for the Type 1 Diabetes treatment?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy Type 1 Diabetes Market Forecast Report

- The patient-based Type 1 Diabetes market forecasting report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Type 1 Diabetes Drugs Market.

- Insights on patient burden/disease Type 1 Diabetes Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing Type 1 Diabetes Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the Type 1 Diabetes Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Type 1 Diabetes Therapeutics Market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- First Gene Therapy for Severe Hemophilia A; FDA Approves CellTrans’s Type 1 Diabetes Cellular Therapy

- FDA Approves Teplizumab to Delay the Onset of Type 1 Diabetes

- REVIAN RED System Delivers Positive Results, Insulet’s Omnipod Provides Notable Improvement in Type 1 Diabetes

- AstraZeneca’s COVID-19 vaccine; Type 1 diabetes research updates; FDA nod to Zebra's X-ray modelling AI; UniQure/CSL haemophilia B gene therapy curbs bleeding in phase 3

- Toujeo to treat Type 1 Diabetes; TauRx for Alzheimer’s patients

- Teplizumab delays the progression of Type 1 Diabetes

- European Commission gives a nod to Zynquista for type 1 diabetes in adults

- Type 1 Diabetes Market Infograhics

- Latest DelveInsight Blogs

.png)

-01.png)

in the 7MM-01.png)

.png)