Type 2 Diabetes Market

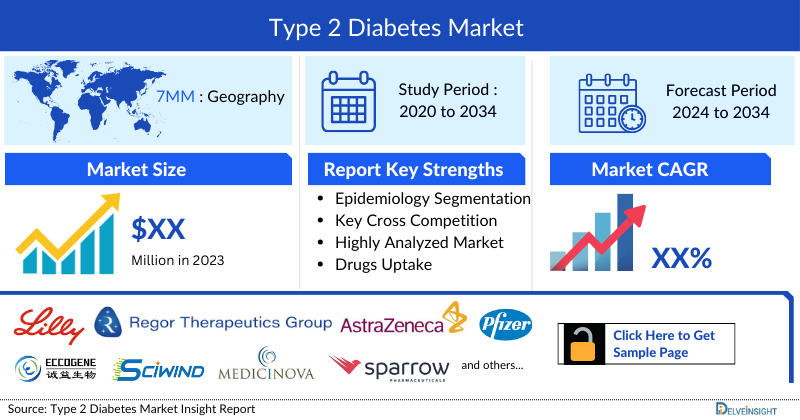

- The Type 2 Diabetes Market Size is expected to grow with a significant CAGR during the study period (2020-2034).

- Some of the Key Type 2 Diabetes companies working in the treatment market are Eli Lilly and Company, Regor Pharmaceuticals Inc., AstraZeneca, Eccogene, Pfizer, Sciwind Biosciences USA Co., Ltd., MediciNova, Sparrow Pharmaceuticals, HighTide, Biopharma Pty Ltd, Novo Nordisk A/S, Biomea Fusion Inc., and others are developing therapies for the Type 2 Diabetes treatment

- In June 2023, Pfizer Inc. announced its decision to continue to progress one oral late-stage glucagon-like peptide-1 receptor agonist (GLP-1-RA) candidate toward further clinical development for the potential treatment of adults with obesity and Type 2 diabetes mellitus (T2DM). Moving forward, the company will continue advancing the clinical program for danuglipron (PF-06882961), subject to results from the ongoing Phase 2 trial.

- In January 2023, Oramed Pharmaceuticals Inc., a clinical stage pharmaceutical company focused on the development of oral drug delivery platforms, announced top-line results from its Phase III randomized, doubleblind, placebo-controlled, multicenter clinical trial (ORA-D-013-1) comparing the efficacy of ORMD-0801 to placebo in patients with Type 2 Diabetes (T2D) at 26 weeks.

- Other Novel emerging drugs in the Type-2 Diabetes treatment market in the different clinical trials phases include - Research programme: type 2 diabetes mellitus therapeutics: Abarceo Pharma, NRDN-101: Neurodon, ECC5004: Eccogene, KN056: Suzhou Alphamab Co., Ltd., XW014: Sciwind Biosciences, RGT001-075: Regor Pharmaceuticals, HR17031: Jiangsu Hengrui Medicine Co, CPL207280: Celon Pharma, THDB0206: Tonghua Dongbao Pharmaceutical, LY-3209590: Eli Lilly and Company, Insulin icodec: Novo Nordisk, and others.

Request a sample to unlock the CAGR for Type 2 Diabetes Market

DelveInsight’s “Type 2 Diabetes Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Type 2 Diabetes, historical and forecasted epidemiology as well as the Type 2 Diabetes therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, France), and the United Kingdom, and Japan.

The Type 2 Diabetes market report provides current treatment practices, emerging drugs, Type 2 Diabetes market share of the individual therapies, and current and forecasted Type 2 Diabetes market size from 2020 to 2034, segmented by seven major markets. The report also covers current Type 2 Diabetes treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Type 2 Diabetes Market |

|

|

Type 2 Diabetess Market Size | |

|

Type 2 Diabetes Companies |

Eli Lilly and Company, Regor Pharmaceuticals Inc., AstraZeneca, Eccogene, Pfizer, Sciwind Biosciences USA Co., Ltd., MediciNova, Sparrow Pharmaceuticals, HighTide, Biopharma Pty Ltd, Novo Nordisk A/S, Biomea Fusion Inc., and others., and others. |

|

Type 2 Diabetes Epidemiology Segmentation |

|

Type 2 Diabetes Treatment Market

The DelveInsight’s Type 2 Diabetes market report gives a thorough understanding of Type 2 Diabetes by including details such as disease definition, symptoms, causes, pathophysiology, diagnosis, and treatment.

Clinically, diabetes is classified into three types, type 1 diabetes (TD-1), type 2 diabetes (TD2), and gestation diabetes. Type 1 diabetes is the consequence of an autoimmune reaction that causes the pancreas to suppress insulin-producing β-cells and leads to severe insulin deficiency. Type 2 diabetes is linked with a genetic factor, which is far more common and substantially correlates with obesity and unhealthy lifestyles. Insulin resistance (inadequate reaction of peripheral cells to insulin) and pancreatic β-cell dysfunction (impaired insulin secretion) are marked by type 2 diabetes, leading to relative insulin deficiency.

Type 2 Diabetes Overview

Type 2 diabetes, the most common type of diabetes, it is a disease that occurs when the blood glucose, also called blood sugar, is too high. People who are middle-aged or older are most likely to get this kind of diabetes. It used to be called adult-onset diabetes. But type 2 diabetes also affects kids and teens, mainly because of childhood obesity.

Type 2 Diabetes Diagnosis

The diagnostic procedure to confirm type 2 diabetes fasting plasma glucose (FPG) test, A1C test, random plasma glucose (RPG), and oral glucose tolerance test are carried out. For A1C, the normal range should be below 5.7%, fasting plasma glucose should be 99 mg/dL or below, and oral glucose tolerance should be 139 mg/dL or below

Type 2 Diabetes Treatment

Focusing on the chronic and severe nature of TD1 and TD2, the treatment approach for them is quite comprehensive; regularization of glucose metabolism and control of risk factors (e.g., arterial hypertension) is the key treatment target for type 2 diabetes. Metformin, which is the most commonly prescribed initial treatment for the condition, lowers blood sugar levels for patients by improving how their body handles insulin. Many other therapies including Alpha-glucosidase inhibitors, Amylin analogs, or agonists and sodium-glucose cotransporter-2 inhibitors, etc. are prescribed to treat type 2 diabetes.

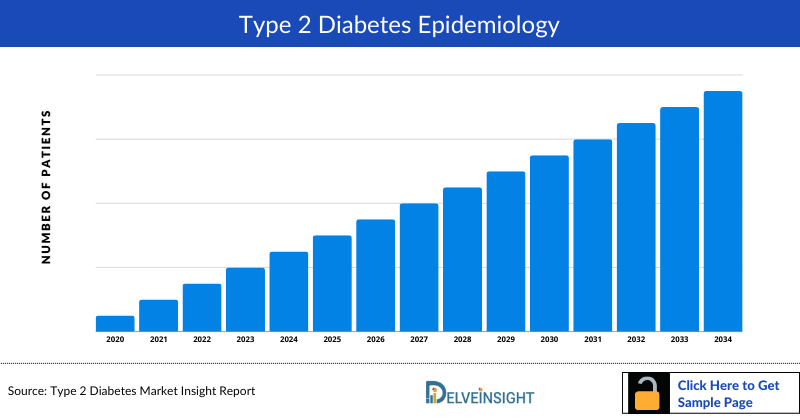

Type 2 Diabetes Epidemiology

The Type 2 Diabetes epidemiology section provides insights into the historical and current Type 2 Diabetes patient pool and forecasted trends for seven individual major countries. It helps recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the Type 2 Diabetes report also provides the diagnosed patient pool, their trends, and assumptions undertaken.

Key findings

- According to the Centers for Disease Control and Prevention, more than 34 million Americans have diabetes (about 1 in 10), and approximately 90-95% of them have type 2 diabetes. Type 2 diabetes most often develops in people over age 45, but more and more children, teens, and young adults are also developing it.

- As per Diabetes UK, Type 2 diabetes is, by far, the most prevalent form of diabetes. In the UK, type 2 diabetes accounts for about 90% of all diabetes cases. The risk of developing type 2 diabetes through family genes is much higher. Recently published information, based on data from the Health Survey for England, estimates that 10.7% of the English population (approximately 5 million people) are at increased risk of Type 2 diabetes with an HbA1c between 42-46 mmol/mol (6.0-6.4)

- The Type 2 Diabetes epidemiology covered in the report provides historical as well as forecasted Type 2 Diabetes epidemiology [segmented as Total Prevalent Cases of Type 2 diabetes, Total diagnosed prevalent cases of Type 2 diabetes, Total gender-specific prevalent of Type 2 Diabetes Total age-specific prevalent diagnosed cases of Type 2 Diabetes, and Treated Cases of Type 2 Diabetes] in the 7MM covering the United States, EU4 (Germany, France, Italy, Spain), and the United Kingdom, and Japan from 2020 to 2034.

- More than 34 million Americans have diabetes (about 1 in 10), and approximately 90-95%of them havetype 2 diabetes. Type 2 diabetes most often develops in people over age 45, but more and more children,teens, and young adults are also developing it (Centers for Disease Control and Prevention, n.d.).

- Type 2 diabetes is, by far, the most prevalent form of diabetes. In the UK, type 2 diabetes accounts forabout 90% of all diabetes cases. The risk of developing type 2 diabetes through family genes is muchhigher. Recently published information, based on data from the Health Survey for England, estimates that10.7 per cent of the English population (approximately 5 million people) are at increased risk of Type 2diabetes with an HbA1c between 42-46 mmol/mol (6.0-6.4) (Diabetes UK, n.d.).

- In Germany, a research study was conducted by Jacobs et al., 2019 wherein, the mean ± sd age at Type 2 diabetesdiagnosis in 2015 was 61.0 ± 13.4 years (95% CI 60.9–61.0) in men. Women were diagnosed ~2 years later than men(mean age 63.4 ± 14.9 years; 95% CI 63.4–63.5). The age range in which 50% of the population was diagnosed withdiabetes was 53–72 years for men and 54–76 years for women.

Country-wise Type 2 Diabetes Epidemiology

The epidemiology segment also provides the Type 2 Diabetes epidemiology data and findings across the United States, EU4 (Germany, France, Italy, Spain), and the United Kingdom, and Japan.

Get detailed insights into the historical as well as forecasted epidemiology trends in the 7MM, at: Type 2 Diabetes Epidemiology Forecast

Type 2 Diabetes Recent Developments

- In September 2025, Medtronic announced two FDA regulatory milestones for its MiniMed™ 780G system: clearance of the SmartGuard™ algorithm as an interoperable automated glycemic controller (iAGC) allowing integration with Abbott’s Instinct sensor for type 1 diabetes, and approval of the MiniMed™ 780G system for adults (18+) with insulin-requiring type 2 diabetes.

- In August 2025, Eli Lilly announced positive Phase 3 results for orforglipron, its oral GLP-1 receptor agonist, showing significant weight loss and A1C reduction in adults with obesity or overweight and type 2 diabetes.

- In June 2025, Bayer announced Phase II CONFIDENCE study results showing that simultaneous initiation of finerenone (Kerendia™) and empagliflozin significantly reduced urine albumin-to-creatinine ratio (UACR) in adults with CKD associated with type 2 diabetes, compared to either treatment alone.

- In April 2025, DexCom, Inc. (NASDAQ: DXCM) announced FDA clearance of the Dexcom G7 15-Day Continuous Glucose Monitoring (CGM) System for adults with diabetes in the U.S. The updated device, featuring an overall MARD of 8.0%, offers extended wear and builds on Dexcom’s proven ability to improve A1C, reduce glycemic variability, and increase time in range.

- In February 2025, Tandem Diabetes Care announced FDA clearance of its Control-IQ+ automated insulin delivery algorithm for type 2 diabetes patients.

- In February 2025, Sotagliflozin, FDA-approved for type 2 diabetes and kidney disease, was shown to significantly reduce heart attack and stroke risk in high-risk patients, offering a new treatment for cardiovascular protection.

- In January 2025, the FDA approved a new indication for semaglutide to reduce the risk of worsening kidney disease, kidney failure, and cardiovascular death in adults with type 2 diabetes and chronic kidney disease, according to Novo Nordisk.

- In December 2024, the FDA approved the first generic version of Victoza (liraglutide injection) for adults and pediatric patients over 10 with type 2 diabetes, according to a recent news release.

Type 2 Diabetes Drug Chapters

The drug chapter segment of the Type 2 Diabetes report encloses the detailed analysis of Type 2 Diabetes marketed drugs and late-stage (Phase III and Phase II) Type 2 Diabetes pipeline drugs. It also helps understand the Type 2 Diabetes clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Type 2 Diabetes Marketed Drugs

Rybelsus: Novo Nordisk

In September 2019, the US Food and Drug Administration approved Rybelsus (semaglutide) oral tablets to improve the control of blood sugar in adult patients with type 2 diabetes, along with diet and exercise. Rybelsus is the first glucagon-like peptide (GLP-1) receptor protein treatment approved for use in the United States that does not need to be injected. GLP-1 drugs are non-insulin treatments for people with type 2 diabetes.

Trijardy XR: Eli Lilly and Boehringer Ingelheim

In January 2020, the US FDA approved Trijardy XR to lower blood sugar in adults with type 2 diabetes, along with diet and exercise. Trijardy XR provides three type 2 diabetes medicines in one pill, including Jardiance (empagliflozin), Tradjenta (linagliptin) and metformin hydrochloride extended-release. In the US, both Jardiance and Tradjenta are once-daily tablets used along with diet and exercise to lower blood sugar in adults with type 2 diabetes. The drug is being marketed by Boehringer Ingelheim Pharmaceuticals and Eli Lilly and Company

Note: Detailed Current therapies assessment will be provided in the full report

Emerging Type 2 Diabetes drugs

Danuglipron (PF-06882961) - Pfizer

Danuglipron (PF-06882961), an oral small-molecule, GLP-1R agonist being developed by Pfizer. The drug is currently in Phase II of development. In Phase I, danuglipron demonstrated robust reductions in fasting plasma glucose of -66.6, -80.6, and -89.7 mg/dL at doses of 15, 70, and 120 mg respectively, compared to a -24.8 mg/dL reduction for placebo. Danuglipron also reduced HbA1c by -0.9, -1.2, and -1.2% at doses of 15, 70 and 120 mg respectively, compared to a -0.4% reduction for placebo-treated subjects. The results with the highest dose tested in a phase 2 trial show promising HbA1c lowering and weight loss.

Dapagliflozin (Farxiga)

Dapagliflozin (Farxiga) is a selective SGLT2 inhibitor approved for the treatment of type 2 diabetes mellitus, heart failure, and chronic kidney disease. It lowers blood glucose by promoting urinary glucose excretion independent of insulin, while also providing cardiovascular and renal protection, blood pressure reduction, and modest weight loss. Administered orally once daily, dapagliflozin continues to be evaluated in Phase III studies to further strengthen its role in diabetes management.

ORMD-0801- Oramed

Oramed’s oral insulin ORMD-0801 is a Phase III drug has the potential to create a new paradigm in the treatment of diabetes by oral delivery of insulin at an earlier stage of treatment, potentially slowing disease progression and delaying or even eliminating late-stage complications. The drug is being evaluated in two Phase III trials ORA-D-013-1 and ORA-D-013-2 with the company anticipating the approval in 2024.

Other Noverl emerging drugs in teh Type-2 Diabetes treatment market in teh different clinical trials phases include - Research programme: type 2 diabetes mellitus therapeutics: Abarceo Pharma, NRDN-101: Neurodon, ECC5004: Eccogene, KN056: Suzhou Alphamab Co., Ltd., XW014: Sciwind Biosciences, RGT001-075: Regor Pharmaceuticals, HR17031: Jiangsu Hengrui Medicine Co, CPL207280: Celon Pharma, THDB0206: Tonghua Dongbao Pharmaceutical, LY-3209590: Eli Lilly and Company, Insulin icodec: Novo Nordisk, and others.

Note: Detailed emerging therapies assessment will be provided in the full report

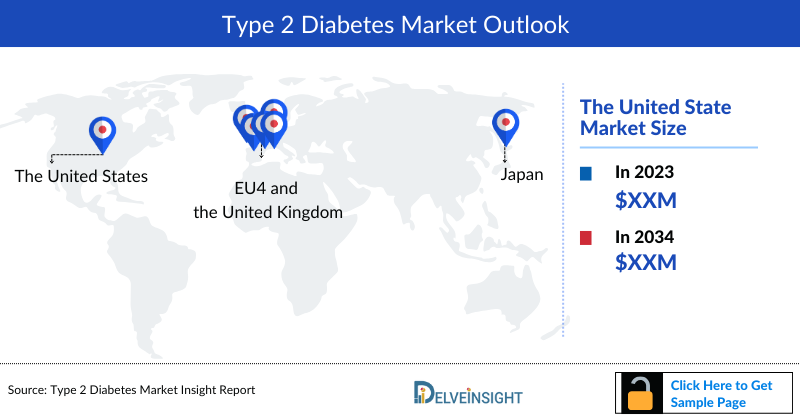

Type 2 Diabetes Market Outlook

The Type 2 diabetes market is a crowded and competitive landscape with multiple, generic, and biosimilar drugs entering the market. The diabetes drugs market is moderately fragmented, with few significant and generic players. The market competitors are launching not only novel pharmaceuticals and therapies but also equipment and tools that can be used in the treatment and diagnosis of type 2 diabetes. The expansion of the healthcare sector and favorable government regulations are fueling the growth of the type 2 diabetes market.

According to DelveInsight, the Type 2 Diabetes market in 7MM is expected to witness a major change in the study period 2020–2034 with factors such as the increasing prevalence of diabetes, the growing geriatric population and demand for novel treatment.

Key findings

This section includes a glimpse of the Type 2 Diabetes market in 7MM.

The United States: Type 2 Diabetes Market Outlook

This section provides the total Type 2 Diabetes market size and market size by therapies in the United States.

EU4 and the UK Countries: Type 2 Diabetes Market Outlook

The total Type 2 Diabetes market size and market size by therapies in Germany, France, Italy, Spain, and the United Kingdom are provided in this section.

Japan: Type 2 Diabetes Market Outlook

The total Type 2 Diabetes market size and market size by therapies in Japan are also mentioned.

Type 2 Diabetes Drug Uptake

This section focuses on the rate of uptake of the potential drugs recently launched in the Type 2 Diabetes market or expected to get launched in the market during the study period 2020–2034. The analysis covers the Type 2 Diabetes market uptake by drugs, patient uptake by therapies, and sales of each drug.

This will help in understanding the Type 2 Diabetes drugs with the most rapid uptake and the reasons behind the maximal use of new drugs and allows the comparison of the drugs based on market share and size, which again will be useful in investigating factors important in the market uptake and in making financial and regulatory decisions.

Type 2 Diabetes Pipeline Development Activities

The Type 2 Diabetes report provides insights into Type 2 Diabetes Clinical Trails within Phase II and Phase III stages. It also analyzes Type 2 Diabetes companies involved in developing targeted therapeutics.

Type 2 Diabetes market clinical trial development activities

The report covers detailed information on collaborations, acquisitions, and mergers, licensing patent details, and other information for Type 2 Diabetes emerging therapies.

Explore more about the emerging therapies and key companies actively working in the market: Type 2 Diabetes Pipeline Insights

Type 2 Diabetes Reimbursement Scenario

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In a report, we consider reimbursement to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

KOL Views

To keep up with current epidemiology and market trends, we take KOLs and SMEs' opinions working in the Type 2 Diabetes domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps to understand and validate current and emerging therapies and treatment patterns along with Type 2 Diabetes market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Competitive Intelligence Analysis

We perform competitive and market intelligence analysis of the Type 2 Diabetes market by using various competitive intelligence tools that include – SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Type 2 Diabetes Market Report

- Descriptive overview of Type 2 Diabetes, disease overview, patient journeys, treatment algorithms, diagnosis, and currently available therapies

- Comprehensive insight into the Type 2 Diabetes epidemiology and forecasts in the 7MM

- An all-inclusive account of both the current and emerging therapies for Type 2 Diabetes, along with the assessment of new therapies, expected to have an impact on the current treatment landscape

- Exhaustive analysis of the Type 2 Diabetes market; historical and forecasted covering drug outreach in the 7MM

- Detailed patient-based market forecasting determines the trends shaping and driving the global Type 2 Diabetes market

Type 2 Diabetes Market Report Highlights

- In the coming years, the Type 2 Diabetes market is set to change due to the rising awareness of the disease and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence Type 2 Diabetes R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- Several major Type 2 Diabetes companies are involved in developing therapies for better treatment outlook. The launch of emerging therapies will significantly impact the Type 2 Diabetes market

- A better understanding of Type 2 Diabetes pathogenesis will also contribute to the development of novel therapeutics for Type 2 Diabetes

- Our in-depth analysis of the Type 2 Diabetes pipeline assets across different stages of development (Phase III and Phase II), emerging trends, and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

Type 2 Diabetes Report Insights

- Patient-Based Market Forecasting

- Type 2 Diabetes Therapeutic approaches

- Type 2 Diabetes pipeline analysis

- Type 2 Diabetes market size and trends

- Type 2 Diabetes market opportunities

- Impact of Upcoming Type 2 Diabetes Therapies

Type 2 Diabetes Report Key Strengths

- 11 years forecast

- 7MM Coverage

- Type 2 Diabetes epidemiology segmentation

- Key cross competition

- KOL views

- Type 2 Diabetes drugs uptake

Type 2 Diabetes Report Assessment

- Current Type 2 Diabetes treatment practices

- Type 2 Diabetes Unmet needs

- Type 2 Diabetes pipeline product profiles

- Type 2 Diabetes market attractiveness

- Type 2 Diabetes Market Drivers

- Type 2 Diabetes Market Barriers

Key Questions Answered In The Type 2 Diabetes Market Report

Type 2 Diabetes market insights:

- What would be the Type 2 Diabetes market growth till 2034, and what will be the resultant market size in 2034?

- What was the Type 2 Diabetes drug class share (in percentage) distribution in 2020, and how would it look in 2032?

- What would be the Type 2 Diabetes total market size and market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings of the market across 7MM, and which country will have the largest Type 2 Diabetes market size during the forecast period (2024–2034)

- How would the unmet needs affect the Type 2 Diabetes market dynamics and subsequent analysis of the associated trends?

Type 2 Diabetes Epidemiology Insights:

- What are the disease risk, burden, and regional/ethnic differences of Type 2 Diabetes?

- What is the historical and forecasted Type 2 Diabetes patient pool in 7MM, and where can one observe the highest patient population and growth opportunities?

- What are the key factors driving the epidemiology trends for seven major markets covering the United States, EU4 (Germany, Spain, France, Italy), and the UK, and Japan?

Current Type 2 Diabetes Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current treatment guidelines and treatment options, in addition to approved therapies for Type 2 Diabetes in the US, Europe, and Japan?

- What are the key collaborations (Industry–Industry, Industry-Academia), mergers and acquisitions, and licensing activities related to Type 2 Diabetes therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Type 2 Diabetes and its status, along with the challenges faced?

Reasons to Buy Type 2 Diabetes Market Report

- The patient-based market forecast analysis will help in developing business strategies by understanding trends shaping and driving the Type 2 Diabetes market

- Organize sales and marketing efforts by identifying the best opportunities for Type 2 Diabetes in the US, EU4 (Germany, Spain, Italy, France), and the United Kingdom, and Japan

- Identification of strong upcoming Type 2 Diabetes companies in the market that will help devise strategies that will help in getting ahead of competitors