Vascular Stents Market

Vascular Stents Market by Product Type (Coronary Stents, Peripheral Stents [Carotid Stents, Iliac Stents, Femoral Stents, and Others], Evar Stent Grafts [Abdominal Aortic Aneurysm Stents and Thoracic Aortic Aneurysm Stents]), Type (Bare-Metal Stents and Drug-Eluting Stents), Material (Metal and Polymer), Mode of Delivery (Balloon-Expandable Stents and Self Expandable Stents), By End-User (Hospitals and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising cases of cardiovascular disorders and associated risk factors, increasing awareness and screening programs, rising number of angioplasty procedures globally, and increase in product development activities among the key market players across the globe.

The global vascular stents market was valued at USD 11,232.93 million in 2024, growing at a CAGR of 6.35% during the forecast period from 2025 to 2032 to reach USD 18,277.68 million by 2032. The overall market for vascular stents is being significantly boosted by the rising cases of cardiovascular disorders and associated risk factors such as diabetes, hypertension, and obesity, which are driving the need for effective vascular interventions. Growing awareness about cardiovascular health and the expansion of screening programs are enabling early detection and treatment of arterial blockages, thereby increasing the adoption of stenting procedures. Additionally, the rising number of angioplasty procedures worldwide is directly fueling the demand for vascular stents, as they play a crucial role in restoring blood flow. Furthermore, continuous product development and innovation by key market players are enhancing clinical outcomes and expanding the use of stents across a wider patient base, collectively accelerating the growth of the vascular stents market during the forecast period from 2025 to 2032.

Vascular Stents Market Dynamics:

According to data provided by the British Heart Foundation (2025), globally, around 640 million people are living with heart and circulatory diseases across the world. Furthermore, as per the recent data provided by the British Heart Foundation (2024), coronary (ischemic) heart disease, the most commonly diagnosed worldwide, affects an estimated 200 million people globally. Approximately 110 million men and 80 million women were affected.

Thus, coronary (ischemic) heart disease is one of the primary drivers propelling the growth of the vascular stents market. This condition, characterized by the narrowing or blockage of coronary arteries due to plaque buildup, significantly restricts blood flow to the heart muscle, leading to chest pain, heart attacks, and other serious complications. Vascular stents, particularly drug-eluting stents, have become a mainstay in the management of ischemic heart disease as they help restore and maintain arterial patency after angioplasty making them a vital treatment option and significantly boosting market growth.

Furthermore, according to the data provided by the European Union (2024), in 2022, transluminal coronary angioplasties were most commonly performed, based on population size, in Croatia, Germany, and Bulgaria. On average, these procedures were done 500.1 times per 100,000 people in Croatia, 379.3 times in Germany, and 378.4 times in Bulgaria. In most of the other EU countries, they were carried out between 156 and 342 times per 100,000 people. As angioplasty is a common and minimally invasive method for treating blocked or narrowed blood vessels, the use of stents especially drug-eluting and bioresorbable types has become essential to ensure long-term vessel patency and prevent restenosis. With an increasing global burden of cardiovascular diseases, more patients are undergoing angioplasty, leading to a higher demand for vascular stents.

Moreover, the increasing product development activities in the vascular graft market are significantly fueling its overall growth by introducing advanced, more effective, and patient-specific solutions for vascular diseases. For instance, in April 2024, Abbott announced that the U.S. FDA approved the Esprit™ BTK Everolimus Eluting Resorbable Scaffold System for patients with chronic limb-threatening ischemia (CLTI) below the knee. The system was designed to keep arteries open, deliver Everolimus for vessel healing, and then fully dissolve. The Esprit BTK System is a dissolving stent that offers the possibility of better outcomes for people with the most severe form of PAD.

Thus, the factors mentioned above are expected to boost the overall market of vascular stents across the globe during the forecast period from 2025 to 2032.

However, the risk of complications due to thrombosis and restenosis and the stringent regulatory approvals may slightly hinder the growth of the market.

Vascular Stents Market Segment Analysis:

Vascular Stents Market by Product Type (Coronary Stents, Peripheral Stents [Carotid Stents, Iliac Stents, Femoral Stents, and Others], Evar Stent Grafts [Abdominal Aortic Aneurysm Stents and Thoracic Aortic Aneurysm Stents]), Type (Bare-Metal Stents and Drug-Eluting Stents), Material (Metal and Polymer), Mode of Delivery (Balloon-Expandable Stents and Self Expandable Stents), By End-User (Hospitals and Ambulatory Surgical Centers)

In the type segment of the vascular stents market, the drug-eluting stent segment is expected to hold a significant share in 2024. Drug-eluting stents (DES) are significantly boosting the overall market of vascular stents due to their ability to reduce the rate of restenosis compared to traditional bare-metal stents (BMS). These stents are coated with drugs that are slowly released to inhibit cell proliferation, which helps prevent the re-narrowing of the artery after angioplasty. As a result, drug-eluting stents have become the standard of care in many interventional cardiology procedures, especially for patients with complex coronary artery disease.

Thus, the effectiveness of drug-eluting stents in reducing the need for repeat procedures (revascularization) has driven their adoption globally. Their advantages include lower restenosis rates, improved long-term vessel patency, reduced incidence of major adverse cardiac events (MACE), and better outcomes in high-risk patients such as those with diabetes or small vessel disease.

In addition, continuous innovations in polymer technologies, stent designs, and drug formulations have enhanced the performance and safety of drug-eluting stents, further supporting their growing demand. Additionally, key market players are actively investing in the development of next-generation drug-eluting stents with improved biocompatibility and bioresorbable properties, which is also expanding the market. The superior clinical benefits and ongoing R&D innovations in drug-eluting stents are collectively accelerating the growth of the vascular stents market. For instance, in August 2022, Medtronic announced the launch of its latest drug-eluting coronary stent, the Onyx Frontier™, after receiving CE Mark approval. The stent featured an improved delivery system and built on the proven performance and clinical data of the Resolute Onyx™ DES, aiming to enhance deliverability and acute performance in complex cases.

Thus, the factors mentioned above are expected to boost the segment thereby boosting the overall market of vascular stents across the globe.

|

Report Metrics |

Details |

|

Study Period |

2020 to 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2024 to 2030 |

|

CAGR | |

|

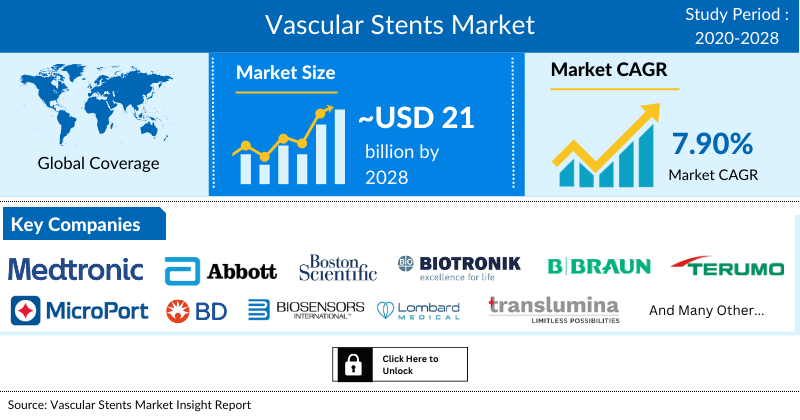

Vascular Stents Market Size |

~USD 21 billion by 2030 |

|

Key Vascular Stents Companies |

Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, B. Braun Melsungen AG, Terumo Corporation, eucatech AG, MicroPort Scientific Corporation., Meril Life Sciences Pvt. Ltd., Vascular Concepts (SMT), W. L. Gore & Associates, Inc., Becton, Dickinson and Company., ENDOLOGIX LLC., Biosensors International Group, Ltd., Lombard Medical, Translumina GmbH, JOTEC GmbH, iVascular, Cordis, Cook, and Many Others. |

North America is expected to dominate the overall vascular stents market:

North America is expected to account for the highest proportion of the Vascular Stents market in 2024, out of all regions. North America is expected to dominate the overall vascular stents market due to the high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and strong presence of key market players. Additionally, increased healthcare spending, favorable reimbursement policies, and the rapid adoption of advanced technologies contribute to the region's leading position in the market.

According to recent data from the Centers for Disease Control and Prevention (2024), in 2022, approximately 4.9% of adults were diagnosed with coronary heart disease. Furthermore, by 2023, an estimated 12.1 million individuals in the United States were projected to have atrial fibrillation. Additionally, each year, over 795,000 people in the U.S. experience a stroke, with around 610,000 of these being first-time strokes. Notably, nearly 185,000 of these strokes, or about one in four, occur in individuals who have previously had a stroke. High rates of obesity, diabetes, hypertension, and unhealthy lifestyles have led to a surge in coronary artery disease cases and strokes increasing the need for surgical interventions such as coronary angioplasties. Vascular stents are essential in these procedures to restore proper blood flow to the heart.

Additionally, in the United States, several recent initiatives have been launched to raise awareness about cardiovascular health which further boosts the market of vascular stents due to early diagnosis, preventive care, and timely surgical interventions. For instance, American Heart Month, February 2024, was organized by the American Heart Association (AHA), this annual campaign emphasizes the importance of heart health. Activities include Heart Walks, advocacy efforts, and sharing heart-healthy recipes to encourage lifestyle changes.

Furthermore, the growing product development activities among the key market players of vascular stents further escalate the market. For instance, in August 2024, Renata Medical announced that the U.S. FDA had approved its first-of-its-kind Minima Growth Stent, specifically designed for neonates, infants, and young children, with the ability to be re-expanded as they grow. This marked a major advancement in treating congenital heart defects, addressing a decades-long request from pediatric cardiologists.

Thus, the above-mentioned factors are expected to escalate the market of vascular stents in the region.

Vascular Stents Market Key Players:

Some of the key market players operating in the vascular stents market include Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, B. Braun Melsungen AG, Terumo Corporation, eucatech AG, MicroPort Scientific Corporation., Meril Life Sciences Pvt. Ltd., Vascular Concepts (SMT), W. L. Gore & Associates, Inc., Becton, Dickinson and Company., ENDOLOGIX LLC., Biosensors International Group, Ltd., Lombard Medical, Translumina GmbH, JOTEC GmbH, iVascular, Cordis, Cook, SCITECH, and others.

Recent Developmental Activities in the Vascular Stents Market:

- In June 2024, Royal Philips, a global leader in health technology, announced the first implant of the Duo Venous Stent System, an implantable device used to treat symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI), following premarket approval (PMA) from the U.S. FDA.

- In January 2024, W. L. Gore & Associates, Inc. (Gore) announced FDA approval of a lower profile GORE® VIABAHN® VBX Balloon Expandable Endoprosthesis (VBX Stent Graft).

- In January 2024, Reflow Medical, Inc., a developer of innovative medical devices focused on cardiovascular disease, announced that it had received CE (Conformité Européenne) Mark certification in the European Union for the Bare Temporary Spur Stent System. The device was intended to treat de novo or restenotic lesions in the infrapopliteal arteries with a commercially available drug-coated balloon (DCB) to enhance drug absorption.

Key Takeaways from the Vascular Stents Market Report Study

- Market size analysis for current vascular stents market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the vascular stents market.

- Various opportunities available for the other competitors in the vascular stents market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current vascular stents market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for vascular stents market growth in the coming future?

Target Audience Who Can Benefit from this Vascular Stents Market Report Study

- Vascular stent product providers

- Research organizations and consulting companies

- Vascular stents-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in vascular stents

- Various end-users who want to know more about the vascular stents market and the latest technological developments in the vascular stents market.

Frequently Asked Questions for the Vascular Stents Market:

1. What are vascular stents?

- Vascular stents are small mesh-like tubes inserted into blood vessels to keep them open and ensure proper blood flow, commonly used to treat conditions like narrowed or blocked arteries.

2. What is the market for vascular stents?

- The global vascular stents market was valued at USD 11,232.93 million in 2024, growing at a CAGR of 6.35% during the forecast period from 2025 to 2032 to reach USD 18,277.68 million by 2032.

3. What are the drivers for the vascular stents market?

- The overall market for vascular stents is being significantly boosted by the rising cases of cardiovascular disorders and associated risk factors such as diabetes, hypertension, and obesity, which are driving the need for effective vascular interventions. Growing awareness about cardiovascular health and the expansion of screening programs are enabling early detection and treatment of arterial blockages, thereby increasing the adoption of stenting procedures. Additionally, the rising number of angioplasty procedures worldwide is directly fueling the demand for vascular stents, as they play a crucial role in restoring blood flow. Furthermore, continuous product development and innovation by key market players are enhancing clinical outcomes and expanding the use of stents across a wider patient base, collectively accelerating the growth of the vascular stents market during the forecast period from 2025 to 2032.

4. Who are the key players operating in the vascular stents market?

- Some of the key market players operating in the vascular stents are Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, B. Braun Melsungen AG, Terumo Corporation, eucatech AG, MicroPort Scientific Corporation., Meril Life Sciences Pvt. Ltd., Vascular Concepts (SMT), W. L. Gore & Associates, Inc., Becton, Dickinson and Company., ENDOLOGIX LLC., Biosensors International Group, Ltd., Lombard Medical, Translumina GmbH, JOTEC GmbH, iVascular, Cordis, Cook, SCITECH, and others.

5. Which region has the highest share in the vascular stents market?

- North America is expected to account for the highest proportion of the vascular stents market in 2024, out of all regions. North America is expected to dominate the overall vascular stents market due to the high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and strong presence of key market players. Additionally, increased healthcare spending, favorable reimbursement policies, and the rapid adoption of advanced technologies contribute to the region's leading position in the market.