VEGFR-2 Inhibitor Market

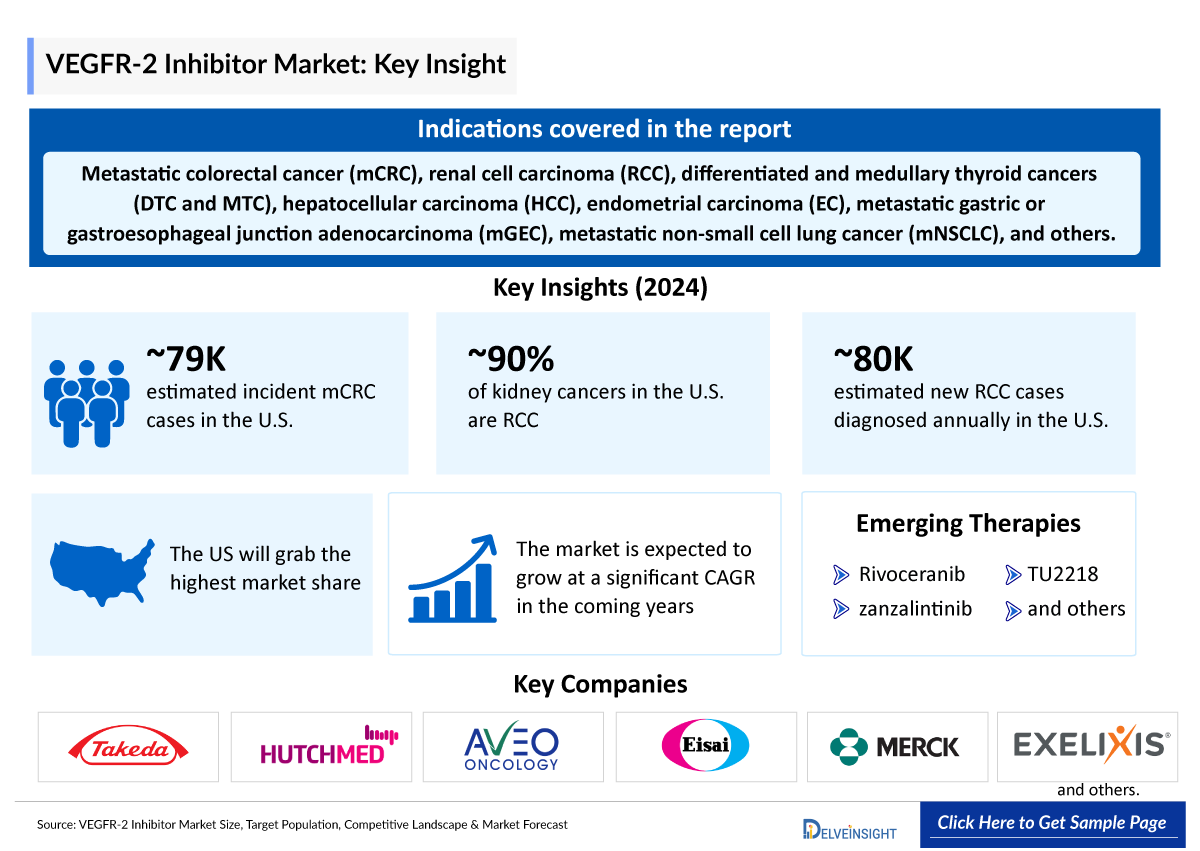

- The VEGFR-2 Inhibitor Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- VEGFR-2 is a critical target in cancer therapies due to its key role in tumor angiogenesis, with selective inhibitors showing promise in reducing tumor vascularization. However, current treatments face challenges with off-target effects, driving ongoing research to develop more specific agents for improved therapeutic outcomes.

- Several VEGFR-2 inhibitors, including FRUZAQLA (fruquintinib), FOTIVDA (tivozanib), and LENVIMA (lenvatinib), among others, are approved for treating various cancers such as metastatic colorectal cancer (mCRC), renal cell carcinoma (RCC), differentiated and medullary thyroid cancers (DTC and MTC), hepatocellular carcinoma (HCC), endometrial carcinoma (EC), metastatic gastric or gastroesophageal junction adenocarcinoma (mGEC), and metastatic non-small cell lung cancer (mNSCLC), among others.

- The current VEGFR-2 inhibitors market is highly competitive, with several established players such as Takeda/HUTCHMED, AVEO Oncology/Kyowa Kirin, and Eisai/Merck, among others leading the charge. Additionally, numerous companies, including Elevar Therapeutics, Exelixis, and Tiumbio/Merck, among others are evaluating their assets at various stages of development, highlighting the continued innovation and growing competition in the space.

- Emerging VEGFR-2 inhibitors in the pipeline include rivoceranib, zanzalintinib (XL092), and TU2218, among others all showing promise for expanding treatment options across various cancers.

- In October 2024, the US FDA accepted the resubmission of a new drug application (NDA) for Elevar Therapeutics’ rivoceranib, an investigational drug, in combination with camrelizumab as a first-line systemic treatment for unresectable or metastatic hepatocellular carcinoma. The US FDA set a Prescription Drug User Fee Act (PDUFA) target action date of March 2025, although the drug has not yet been approved.

DelveInsight’s “VEGFR-2 Inhibitor” Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the VEGFR-2 inhibitor, historical and projected epidemiological data, competitive landscape as well as the VEGFR-2 inhibitor therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The VEGFR-2 inhibitor market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM VEGFR-2 inhibitor market size from 2020 to 2034. The report also covers current VEGFR-2 inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

VEGFR-2 Inhibitor Epidemiology |

Segmented by:

|

|

VEGFR-2 Inhibitor Key Companies |

|

|

VEGFR-2 Inhibitor Key Therapies |

|

|

VEGFR-2 Inhibitor Clinical Relevance |

|

|

VEGFR-2 Inhibitor Market |

Segmented by:

|

|

Analysis |

|

VEGFR-2 Inhibitor Disease Understanding

VEGFR-2 Inhibitor Overview

Abnormal angiogenesis is a fundamental requirement for tumor growth and metastasis, with VEGF signaling playing a central role in this process. VEGF isoforms, including VEGF-A, B, C, D, and PIGF, bind specifically to VEGFR-1, VEGFR-2, and VEGFR-3, each governing distinct endothelial cell types. While structurally similar, these receptors differ in their activation and downstream effects. Notably, VEGFR-2 is the principal mediator of angiogenesis in vascular endothelial cells, making it a key target in anti-tumor therapeutic strategies aimed at disrupting the tumor’s blood supply.

Given its central role in tumor angiogenesis, VEGFR-2 remains a leading target in cancer therapy. Selective inhibition of VEGFR-2 has shown promise in reducing tumor vascularization and slowing progression. However, many current inhibitors suffer from a lack of specificity, leading to off-target effects that can limit their clinical efficacy. Ongoing research aims to develop more selective agents to effectively target VEGFR-2 signaling while minimizing adverse effects, thereby improving therapeutic outcomes. VEGFR-2 overexpression is observed in a variety of cancers, including breast, cervical, non-small cell lung, hepatocellular, and renal carcinoma, highlighting its importance across multiple malignancies.

VEGFR-2 Inhibitor Clinical Relevance

Several VEGFR-2 inhibitor therapies have received regulatory approval for a broad range of cancers, reflecting their clinical impact in targeting tumor angiogenesis. These include metastatic colorectal cancer (mCRC), renal cell carcinoma (RCC), differentiated and medullary thyroid cancers (DTC and MTC), hepatocellular carcinoma (HCC), endometrial carcinoma (EC), metastatic gastric or gastroesophageal junction adenocarcinoma (mGEC), and metastatic non-small cell lung cancer (mNSCLC), among others. Their approval across diverse tumor types highlights the central role of VEGFR-2-driven angiogenesis in cancer progression and underscores the therapeutic value of inhibiting this pathway in advanced and metastatic settings.

The emerging pipeline of VEGFR-2 inhibitors is being explored across a diverse range of malignancies, including gastric cancer, adrenocortical carcinoma (ACC), colorectal cancer (CRC), unresectable hepatocellular carcinoma (uHCC), non-clear cell renal cell carcinoma (nccRCC), head and neck squamous cell carcinoma (HNSCC), biliary tract cancer (BTC), squamous cell carcinoma of the head and neck (SCCHN), and various solid tumors. This broad development strategy highlights the class’s potential to address angiogenesis-driven tumor biology across multiple difficult-to-treat cancers, reflecting its promise as a versatile anti-cancer approach.

Further details related to country-based variations are provided in the report…

VEGFR-2 Inhibitor Epidemiology

The VEGFR-2 inhibitor epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for VEGFR-2 Inhibitor, total eligible patient pool in selected indications for VEGFR-2 Inhibitor, and total treated cases in selected indications for VEGFR-2 Inhibitor in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Metastatic colorectal cancer (mCRC)

- In 2024, the total incident cases of mCRC in the US were estimated at approximately 79 thousand cases.

- Among the EU4 and the UK, Germany reported the highest incidence, with over 33 thousand mCRC cases, highlighting its significant disease burden in the region..

Advanced renal cell carcinoma (RCC)

- According to the secondary findings, RCC accounts for 90% of all kidney cancers.

- One in three people with RCC receive a diagnosis at the metastatic stage.

- RCC is difficult to detect in its early stages, and >30% patients with RCC have metastatic, or advanced, cancer at the time of diagnosis, meaning the cancer cells have spread beyond the kidney to other parts of the body.

- It was found that in the US, more than 80 thousand new cases of RCC are diagnosed each year.

- According to the Robert Koch Institute, approximately 14,160 new cases of kidney cancer were reported in Germany in 2020, highlighting the disease’s continued prevalence in the region.

Hepatocellular Carcinoma (HCC)

- According to data from the Surveillance, Epidemiology, and End Results (SEER) program, the incidence rate of hepatocellular carcinoma and intrahepatic bile duct cancer in the US was 9.0 per 100,000, corresponding to approximately 42,230 newly diagnosed cases in 2021.

Note: Indications are selected based on pipeline activity...

VEGFR-2 Inhibitor Drug Chapters

The drug chapter segment of the VEGFR-2 inhibitor reports includes a detailed analysis of VEGFR-2 inhibitor early-, mid-, and late-stage (Phase I, Phase II and Phase III) pipeline drugs. It also helps understand the VEGFR-2 inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

VEGFR-2 Inhibitor Marketed Drugs

Several VEGFR-2 inhibitors have been approved for the treatment of various cancers, including FRUZAQLA (fruquintinib), FOTIVDA (tivozanib), LENVIMA (lenvatinib), CYRAMZA (ramucirumab), and COMETRIQ (cabozantinib), among others.

FRUZAQLA (fruquintinib): Takeda/HUTCHMED

FRUZAQLA (fruquintinib) is an oral small molecule that selectively inhibits VEGFR-1, -2, and -3, with IC50 values of 33, 35, and 0.5 nM, respectively. Preclinical studies demonstrated its ability to block VEGF-driven endothelial cell proliferation, tubular formation, and VEGFR-2 phosphorylation, effectively suppressing tumor growth in a colon cancer xenograft mouse model. Clinically, FRUZAQLA is approved for adults with mCRC who have previously received fluoropyrimidine-, oxaliplatin-, and irinotecan-based chemotherapy, anti-VEGF therapy, and, if RAS wild-type and appropriate, anti-EGFR therapy.

FRUZAQLA received regulatory approvals across major markets, reflecting its global clinical relevance. The US FDA approved the therapy in November 2023, followed by the EMA in June 2024, and Japan in September 2024.

- In November 2024, HUTCHMED announced it would receive a milestone payment following the pricing approval and commercial launch of FRUZAQLA 1mg/5mg capsules in Japan. The launch was executed by its partner Takeda for the treatment of patients with previously treated mCRC.

- In October 2024, HUTCHMED announced it would receive a USD 20 million milestone payment from its partner Takeda, triggered by cumulative sales of FRUZAQLA for mCRC surpassing USD 200 million.

FOTIVDA (tivozanib): AVEO Oncology/Kyowa Kirin

FOTIVDA (tivozanib) is a tyrosine kinase inhibitor that blocks VEGFR-1, VEGFR-2, VEGFR-3, c-kit, and PDGFRβ at clinically relevant levels. It reduces angiogenesis, vascular permeability, and tumor growth in preclinical models, including renal cell carcinoma. It is approved for adults with relapsed or refractory advanced RCC after two or more prior systemic therapies.

FOTIVDA was approved by the US FDA in March 2021 for the treatment of adults with relapsed or refractory advanced RCC following two or more prior systemic therapies. Previously, in August 2017, the European Commission approved FOTIVDA for the treatment of adults with advanced RCC in the European Union.

LENVIMA (lenvatinib): Eisai/Merck

LENVIMA (lenvatinib) is a multi-targeted kinase inhibitor that blocks VEGFR1–3, FGFR1–4, PDGFRA, KIT, and RET, disrupting key pathways involved in angiogenesis and tumor progression. It has shown antiproliferative effects in FGFR-driven hepatocellular carcinoma models and enhances antitumor immunity in combination with PD-1 inhibitors. Preclinical data also support its synergy with everolimus, demonstrating superior antiangiogenic and tumor-reducing effects. Clinically, LENVIMA is approved for DTC, advanced RCC (both as monotherapy and in combination with pembrolizumab or everolimus), unresectable HCC, and advanced endometrial carcinoma in select patients.

It received initial approval from the US FDA in February 2015, by the Japanese MHLW in March 2015, and by the EMA in May 2015.

Note: Detailed marketed therapies assessment will be provided in the final report....

List of VEGFR-2 Inhibitor Marketed Drugs | |||||

|

Product Name |

Company |

Indication |

US Approval |

EU Approval |

JP Approval |

|

FRUZAQLA (fruquintinib) |

Takeda/HUTCHMED |

mCRC |

2023 |

2024 |

2024 |

|

FOTIVDA (tivozanib) |

AVEO Oncology/Kyowa Kirin |

Relapsed or refractory advanced RCC |

2021 |

2017 |

- |

|

LENVIMA (lenvatinib) |

Eisai/Merck |

DTC, advanced RCC (both as monotherapy and in combination with pembrolizumab or everolimus), unresectable HCC, and advanced endometrial carcinoma in select patients. |

2015 |

2015 |

2015 |

|

XX |

XX |

XX |

XX |

XX |

XX |

Note: The marketed drug list is indicative, the full list will be given in the final report...

VEGFR-2 Inhibitor Emerging Drugs

Rivoceranib: Elevar Therapeutics

Rivoceranib is a highly potent VEGFR-2 inhibitor with minimal off-target tyrosine kinase activity, providing a selective inhibition profile. It is currently being investigated both as a monotherapy and in combination with chemotherapy and immunotherapy. Clinical trials are underway or planned across several tumor types, including hepatocellular carcinoma (with camrelizumab), adenoid cystic carcinoma, colorectal cancer (with LONSURF), and gastric cancer.

Rivoceranib has received ODD for gastric cancer (in the US and EU), adenoid cystic carcinoma (in the US), and hepatocellular carcinoma (in the US).

The US FDA has accepted the resubmission of a NDA for rivoceranib, an investigational drug, in combination with camrelizumab as a first-line systemic treatment for unresectable or metastatic hepatocellular carcinoma (uHCC). The US FDA set a PDUFA target action date of March 2025, although the drug has not yet been approved.

Rivoceranib is currently being evaluated in Phase III clinical trials for gastric cancer as a third-line/fourth-line treatment, in Phase II trials for ACC and as a third-line treatment for CRC (in combination with LONSURF), as well as in exploratory trials for gastric cancer in combination with paclitaxel as a second-line treatment and for multiple solid tumors in combination with OPDIVO.

- In January 2025, Elevar Therapeutics announced the results of a post-hoc analysis from the international CARES-310 study, which evaluated camrelizumab plus rivoceranib versus sorafenib as a first-line treatment for patients with uHCC of viral and non-viral etiology. The post-hoc analysis was presented in a poster at the 2025 American Society of Clinical Oncology’s annual Gastrointestinal Cancers Symposium (ASCO GI).

Zanzalintinib (XL092): Exelixis

Zanzalintinib is a third-generation oral tyrosine kinase inhibitor that targets receptor tyrosine kinases such as VEGF receptors, MET, AXL, and MER, which are implicated in cancer growth, metastasis, tumor angiogenesis, and resistance to therapies, including immune checkpoint inhibitors.

Exelixis has entered into multiple collaboration and supply agreements to evaluate zanzalintinib in combination trials, including with Roche’s atezolizumab, BMS’ nivolumab, ipilimumab, and relatlimab, as well as Merck’s pembrolizumab and belzutifan. These agreements support the exploration of zanzalintinib’s tolerability and activity in combination with established cancer therapies, as Exelixis continues to expand its broad development program for the drug.

It is currently being evaluated across multiple clinical trials, including Phase III trials for CRC (STELLAR-303) and nccRCC (STELLAR-304), a Phase II/III trial for SCCHN (STELLAR-305), and two Phase II trials for multiple solid tumors (STELLAR-001 and STELLAR-002).

Additionally, a Phase III pivotal trial evaluating zanzalintinib compared with everolimus as a first oral therapy in patients with advanced NET, regardless of site of origin, is expected to be initiated in H1 2025.

- In January 2025, Exelixis announced results from an expansion cohort of the Phase Ib/II STELLAR-001 trial evaluating zanzalintinib alone or with atezolizumab (TECENTRIQ) in previously-treated mCRC. The findings were presented at the ASCO GI 2025 in January during Poster Session C: Cancers of the Colon, Rectum, and Anus.

Data from this randomized expansion cohort reaffirms Exelixis’ decision to initiate STELLAR-303, evaluating zanzalintinib in combination with atezolizumab compared to regorafenib in patients with mCRC. Data from this trial are anticipated in the second half of 2025, depending on study event rates.

TU2218: Tiumbio/Merck

TU2218 is a novel oral immuno-oncology therapy that acts as a dual inhibitor of TGFR1 and VEGFR2, targeting the TGF-β and VEGF pathways known to limit immune checkpoint inhibitor (ICI) activity. Positioned as a potential first-in-class treatment, TU2218 is designed to enhance the efficacy of ICIs such as PD-1 and CTLA-4 inhibitors, aiming to address key unmet needs in cancer immunotherapy.

In October 2024, TiumBio dosed the first patient in its Phase II trial of TU2218, evaluating its combination with KEYTRUDA in HNSCC, BTC, and CRC. The Phase II trial builds on Phase Ia/Ib results that assessed TU2218’s safety, pharmacokinetics, and pharmacodynamics in patients with advanced solid tumors, helping establish dosing levels.

Note: Detailed emerging therapies assessment will be provided in the final report....

List of VEGFR-2 Inhibitor Emerging Drugs | |||||

|

Drug Name |

Company |

Indication |

ROA |

Phase |

NCT ID |

|

Rivoceranib |

Elevar Therapeutics |

Gastric cancer, ACC, CRC, and uHCC |

IV |

NDA accepted |

NCT03764293 |

|

Zanzalintinib (XL092) |

Exelixis |

CRC, nccRCC, SCCHN, and multiple solid tumors |

Oral |

III |

NCT05425940 |

|

TU2218 |

Tiumbio/Merck |

HNSCC, BTC, and CRC |

Oral |

Ib/IIa |

NCT05784688 |

|

XX |

XX |

XX |

XX |

XX |

XX |

Note: The emerging drug list is indicative, the full list will be given in the final report...

VEGFR-2 Inhibitor Market Outlook

The VEGFR-2 inhibitors market is witnessing strong momentum, fueled by the growing global prevalence of cancer and age-related diseases like macular degeneration, particularly in aging populations. Advancements in angiogenesis research have strengthened the clinical relevance of VEGFR-2 as a therapeutic target, supporting its adoption across a wide spectrum of malignancies including gastric, colorectal, and biliary tract cancers.

A rich late-stage pipeline, featuring candidates like Rivoceranib (Elevar Therapeutics), Zanzalintinib (Exelixis), and TU2218 (Tiumbio/Merck), among others, highlights sustained innovation and intensifying competition, positioning the market for continued growth across both oncology and ophthalmology sectors.

VEGFR-2 Inhibitor Drug Uptake

This section focuses on the uptake rate of potential approved and emerging VEGFR-2 inhibitor expected to be launched in the market during 2020–2034.

VEGFR-2 Inhibitor Pipeline Development Activities

The VEGFR-2 Inhibitor pipeline report provides insights into different VEGFR-2 Inhibitor clinical trials within Phase III, Phase II and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for VEGFR-2 inhibitor market growth over the forecasted period.

VEGFR-2 Inhibitor Pipeline Development Activities

The VEGFR-2 Inhibitor clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for VEGFR-2 inhibitor emerging therapies.

KOL Views on VEGFR-2 Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on VEGFR-2 inhibitor’s evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or VEGFR-2 inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

VEGFR-2 Inhibitor Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

VEGFR-2 Inhibitor Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the VEGFR-2 Inhibitor Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of VEGFR-2 inhibitor, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the VEGFR-2 inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM VEGFR-2 inhibitor market.

VEGFR-2 Inhibitor Market Report Insights

- VEGFR-2 Inhibitor Targeted Patient Pool

- VEGFR-2 Inhibitor Therapeutic Approaches

- VEGFR-2 Inhibitor Pipeline Analysis

- VEGFR-2 Inhibitor Market Size and Trends

- Existing and Future Market Opportunity

VEGFR-2 Inhibitor Market Report Key Strengths

- 10 Years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

VEGFR-2 Inhibitor Market Report Assessment

- Current VEGFR-2 Inhibitor Treatment Practices

- VEGFR-2 Inhibitor Unmet Needs

- VEGFR-2 Inhibitor Pipeline Product Profiles

- VEGFR-2 Inhibitor Market Attractiveness

- Qualitative Analysis (SWOT)

- VEGFR-2 Inhibitor Market Drivers

- VEGFR-2 Inhibitor Market Barriers

Key Questions Answered In The VEGFR-2 Inhibitor Market Report:

- What was the VEGFR-2 inhibitor total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for VEGFR-2 inhibitor?

- Which drug accounts for maximum sales among VEGFR-2 inhibitors?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for VEGFR-2 inhibitors evolved since the first one was approved? Do patients face any access issues driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with VEGFR-2 inhibitor? What will be the growth opportunities across the 7MM for the patient population on VEGFR-2 inhibitor?

- What are the key factors hampering the growth of the VEGFR-2 inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for VEGFR-2 inhibitor?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy VEGFR-2 Inhibitor Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the VEGFR-2 inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.