Wearable Medical Devices Market Summary

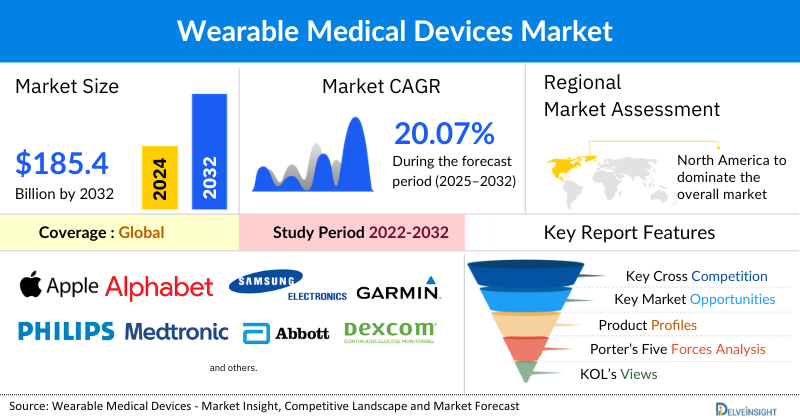

- The global wearable medical devices market is expected to increase from USD 42,981.29 million in 2024 to USD 185,415.73 million by 2032, reflecting strong and sustained growth.

- The global wearable medical devices market is growing at a CAGR of 20.07% during the forecast period from 2025 to 2032.

- The global wearable medical devices market is surging, fueled by rising chronic disease prevalence, the shift toward remote patient monitoring, and rapid tech advances. With miniaturized sensors, AI-driven insights, and 5G connectivity, wearables are evolving from fitness gadgets into essential medical tools for proactive and connected healthcare.

- The leading companies operating in the wearable medical devices market include Apple Inc., Alphabet Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Koninklijke Philips N.V., Medtronic, Abbott Laboratories, Dexcom, Inc., Boston Scientific Corporation, OMRON Corporation, ResMed, Becton, Dickinson and Company, iRhythm Technologies, Inc., Withings, Vital Connect, Inc., Masimo Corporation, Insulet Corporation, Zoll Medical Corporation, Biotricity Inc., Nuvo Group, Ypsomed, and Others.

- North America is expected to remain a dominant force in the wearable medical devices market, supported by advanced healthcare infrastructure, high per-capita healthcare spending, and a strong innovation ecosystem. Growth is also fueled by the adoption of both clinical-grade devices in hospitals and consumer-grade wearables that are increasingly securing FDA clearances for medical use.

- In the product type segment of the wearable medical devices market, the diagnostic & monitoring devices category is estimated to account for the largest market share in 2024.

Wearable Medical Devices Market Size and Forecasts

|

Report Metrics |

Details |

|

2024 Market Size |

USD 42,981.29 million |

|

2032 Projected Market Size |

USD 185,415.73 million |

|

Growth Rate (2025-2032) |

20.07% CAGR |

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia-Pacific |

|

Market Structure |

Consolidated-Fragmented |

Factors Contributing to the Growth of the Wearable Medical Devices Market

Rising prevalence of chronic diseases and aging population leading to a surge in the wearable medical devices market: The increasing incidence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders is a major market driver. These conditions require continuous monitoring and long-term management. Wearable medical devices offer a solution by providing a constant stream of data on vital signs like heart rate, blood pressure, and blood glucose, enabling:

- Early detection of complications.

- Personalized disease management.

- Improved patient outcomes and reduced healthcare costs.

Furthermore, the global aging population is fueling the demand for at-home healthcare and remote monitoring solutions. Wearable devices allow older adults to maintain independence while providing caregivers and healthcare providers with critical health data.

Shift Towards Remote Patient Monitoring and Home Healthcare: Healthcare systems are moving away from traditional in-clinic care models towards more convenient and cost-effective remote options. This shift has been significantly accelerated by events like the COVID-19 pandemic. Wearable devices are at the heart of this trend, enabling:

- Remote Patient Monitoring (RPM): Healthcare providers can monitor patients' health data from a distance, allowing for timely interventions and reducing the need for frequent hospital visits or readmissions.

- Telehealth and Telemedicine: Data from wearables can be seamlessly integrated into telehealth platforms, providing a more comprehensive view of a patient's health during virtual consultations.

Increased convenience and accessibility: Patients, especially those in rural areas or with limited mobility, can receive quality care without the logistical challenges of traveling to a clinic. - Advancement in Technology: Continuous innovation in hardware and software is making wearable medical devices more accurate, reliable, and user-friendly. Key technological advancements include:

Miniaturization of Sensors: Sensors are becoming smaller and more sophisticated, allowing for the development of more discreet and comfortable devices that can measure a wider range of physiological data, from heart rhythm (ECG) to blood oxygen saturation (SpO2) and beyond. - Integration of AI and Machine Learning: Artificial intelligence (AI) algorithms analyze the vast amount of data collected by wearables, providing actionable insights, predictive analytics, and personalized health recommendations.

- Enhanced Connectivity: Improvements in wireless technologies like Bluetooth and the rollout of 5G enable seamless and real-time data transmission from the device to a smartphone or a cloud-based health platform.

- Improved Battery Life: Longer-lasting batteries are making continuous monitoring more practical and reducing the need for frequent charging.

Wearable Medical Devices Market Report Segmentation

This wearable medical devices market report offers a comprehensive overview of the global wearable medical devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Product Type [Diagnostic & Monitoring Devices (Vital Sign Monitoring Devices, Sleep Moniotring Devices, Neuromonitoring Devices, Electrocardiographs Fetal and Obstetric Devices, and Others), Therapeutic Devices (Pain Management Devices, Insulin Delivery Devices, Respiratory Therapy Devices, Rehabilation Devices, and Others)], Device Type (Smartwatches, Wrist Bands, Smart Clothing, Wearable Patches, and Others), Device Grade (Consumer Grade Wearable Medical Devices, Clinically Grade Wearable Medical Devices), Application (General Health and Fitness, Remote Patient Monitoring, and Home Healthcare), Distribution Channel (Offline, Online), and geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing wearable medical devices market.

A wearable medical device is a type of electronic device that is worn on or attached to the body to continuously track and collect a user's health and fitness data. These devices use sensors to gather physiological information, which is then often transmitted wirelessly to a smartphone or other connected device for analysis and storage.

The global wearable medical devices market is witnessing rapid expansion, driven by the rising burden of chronic diseases, increasing adoption of remote patient monitoring and home-based care, and breakthrough technological innovations. Key enablers include the miniaturization of sensors that allow continuous, discreet tracking of vital signs, the integration of AI for predictive and personalized analytics, and the rollout of high-speed 5G networks enabling seamless real-time data transmission. Together, these forces are transforming wearables from simple fitness accessories into indispensable medical tools at the core of preventive, proactive, and connected healthcare.

What are the latest Wearable Medical Devices Market Dynamics and Trends?

The global wearable medical devices market is accelerating as miniaturized MEMS sensors, AI/ML analytics, and ubiquitous broadband converge to move care from episodic to continuous. This growth is fundamentally rooted in technical advancements. The miniaturization of sensors, powered by Micro-Electro-Mechanical Systems (MEMS), is allowing for the creation of discreet, comfortable devices that can measure a wider range of vital signs, from continuous glucose levels to high-resolution ECG readings. This hardware evolution is complemented by the rise of artificial intelligence (AI) and machine learning (ML), which transform raw sensor data into actionable, predictive insights. AI can identify early signs of conditions like atrial fibrillation or predict hypoglycemic events, thereby shifting healthcare from reactive to proactive. The increasing adoption of high-speed wireless networks, particularly 5G, is a critical enabler, facilitating the real-time transmission of this data for remote patient monitoring (RPM). At system level, 5G and modern mobile broadband make continuous remote patient monitoring (RPM) practical at scale, GSMA reports that by 2025 nearly a third of all global mobile connections will be 5G, improving bandwidth and latency for real-time health data flows.

In the U.S. alone, the number of patients using RPM is projected to reach more than 71 million (~26% of the population) by the end of 2025, as coverage expands and clinicians embed digital monitoring into chronic-care pathways. Based on DelveInisght analysis it can reduce hospital readmissions by as much as 75%. This convergence of high-tech sensors, intelligent analytics, and ubiquitous connectivity is not only enhancing the accuracy and utility of wearable devices but is also a cornerstone of modern, decentralized healthcare, promising a future of more personalized, efficient, and accessible patient care.

Further, the global surge in wearable medical devices is not just a technology trend, it is a direct response to an escalating health crisis. Chronic conditions are reaching unprecedented levels: In 2024, an estimated 589 million adults currently live with diabetes, a number set to soar to 853 million by 2050; 1.3 billion people now suffer from hypertension, yet only a fraction manage it effectively; and 53–59 million individuals are living with atrial fibrillation, a silent but growing cardiovascular risk. Beyond these, sleep health is emerging as a major focus, with up to 936 million adults affected by obstructive sleep apnea, many of whom remain undiagnosed. These staggering figures highlight why wearables are no longer optional, they are becoming a cornerstone of preventive, personalized, and proactive healthcare.

The wearable medical devices market, while experiencing exponential growth, faces a number of significant restraints and challenges that could impede its long-term potential. A primary concern revolves around data security and privacy. These devices collect highly sensitive personal health information, making them attractive targets for cyberattacks. The lack of a clear, unified regulatory framework for data governance, coupled with consumer distrust regarding data handling, creates a major barrier to widespread adoption.

Furthermore, the high cost and limited accessibility of many advanced, clinical-grade devices, combined with the lack of comprehensive reimbursement policies from insurance providers, puts them out of reach for a large portion of the global population, exacerbating health inequalities. Technical hurdles also persist, including issues with sensor accuracy and reliability, as data can be compromised by motion, skin tone, or environmental factors.

The constant demand for real-time monitoring clashes with current battery life and power management limitations, often leading to user non-compliance. Finally, regulatory and standardization hurdles, such as differing approval processes across countries and a lack of data interoperability, slow down market entry for manufacturers and prevent seamless integration of wearable data into existing healthcare systems.

Wearable Medical Devices Market Segment Analysis

Wearable Medical Devices Market by Product Type [Diagnostic & Monitoring Devices (Vital Sign Monitoring Devices, Sleep Moniotring Devices, Neuromonitoring Devices, Electrocardiographs Fetal and Obstetric Devices, and Others), Therapeutic Devices (Pain Management Devices, Insulin Delivery Devices, Respiratory Therapy Devices, Rehabilation Devices, and Others)], Device Type (Smartwatches, Wrist Bands, Smart Clothing, Wearable Patches, and Others), Device Grade (Consumer Grade Wearable Medical Devices, Clinically Grade Wearable Medical Devices), Application (General Health and Fitness, Remote Patient Monitoring, and Home Healthcare), Distribution Channel (Offline, Online), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

By Product Type: Diagnostic & Monitoring Devices the Market Leader

The diagnostic and monitoring devices category accounted for over 60% of the global wearable medical devices market share in 2024, driven largely by mainstream adoption. Smartwatches and fitness bands from major players such as Apple, Samsung, and Fitbit have made functions like heart rate tracking, step counting, ECG monitoring, and sleep analysis standard consumer features. With massive scale, brand recognition, and integration into daily life, this category leads by volume and consumer penetration.

Key growth enabler include:

- Mass Consumer Adoption: Diagnostic and monitoring functions, such as heart rate tracking, step counting, and sleep analysis, have become standard features on mainstream consumer products like smartwatches and fitness bands from companies like Apple and Samsung. These devices have already achieved massive scale and brand recognition, making this category the largest by volume.

- Focus on Preventive Healthcare: There is a global shift towards personal wellness and preventative care. Diagnostic wearables empower individuals to take a proactive role in managing their health, allowing them to monitor vital signs and activity levels on a daily basis.

- Lower Regulatory Hurdles: Many diagnostic and monitoring features are classified as "wellness" products and do not require the same stringent regulatory approvals (like FDA clearance) as therapeutic devices, allowing for faster product cycles and wider market reach.

- While smaller in current share, the therapeutic wearables segment is projected to grow at a robust CAGR of ~23% during the forecast period from 2025 to 2032, signaling a transition into a higher-value phase of market evolution. Unlike diagnostic wearables, these devices play an active role in treatment and disease management, positioning them as critical tools in modern healthcare delivery.

Key drivers of growth include:

- Rising Chronic Disease Burden: With over 530 million people living with diabetes globally (IDF 2023) and increasing prevalence of cardiovascular and respiratory diseases, therapeutic devices like smart insulin pumps, neurostimulators, and wearable drug-delivery systems are becoming essential.

- Shift to Remote Patient Monitoring (RPM): Healthcare systems are integrating therapeutic wearables into RPM programs to manage aging populations, reduce hospital visits, and lower costs. Devices enable physicians to remotely track patient adherence, adjust therapies in real time, and intervene before complications arise.

- Technological Advancements: The rapid progress in sensor technology, miniaturization, and AI is making therapeutic devices more viable. For instance, advancements in micro-pumps and drug-delivery systems are making it possible to deliver therapies directly from a wearable patch. Furthermore, AI-powered analytics can personalize therapy, adjusting dosages or stimulation levels based on real-time biometric data.

- Regulatory Tailwinds: Regulatory bodies are increasingly recognizing the value of these devices, creating clearer pathways for their approval. As more therapeutic devices gain regulatory clearance (e.g., FDA approval), it builds trust among clinicians and insurance providers, paving the way for wider adoption and reimbursement.

By Device Type: Smartwacthes Categroy Dominate the Market

The smartwatches segment dominates the wearable medical devices market, contributing nearly 45% of global revenue in 2024, followed by wristbands. This leadership reflects their dual identity as both mass-market consumer electronics and increasingly credible medical devices. Backed by industry leaders such as Apple, Samsung, and Huawei, smartwatches and wristbands have achieved unmatched consumer penetration, leveraging a familiar, socially acceptable form factor and powerful brand ecosystems. Their appeal extends beyond healthcare, encompassing lifestyle functions such as communication, mobile payments, and entertainment, which make them indispensable in daily life. This broad adoption creates a scalable foundation for layering medical-grade features.

The boundary between fitness trackers and regulated medical devices is rapidly eroding. Flagship smartwatches now incorporate clinically validated tools such as electrocardiograms (ECG) for atrial fibrillation detection and continuous SpO₂ monitoring, transforming them into versatile platforms for both wellness and remote patient monitoring (RPM). Their ability to consolidate multiple vital-sign measurements into a single device enhances convenience and clinical value, making them highly attractive for preventive care models.

Technological progress is reinforcing this trend. Advancements include miniaturized, more accurate biosensors, AI-driven predictive health analytics, and expanded software ecosystems that support personalized insights. These innovations are steadily strengthening consumer trust and physician acceptance, positioning smartwatches as a cornerstone of decentralized and data-driven healthcare. Seamless smartphone integration and cloud interoperability further enable secure data sharing with providers, an essential feature for scaling RPM and chronic disease management programs.

Other categories are also evolving but remain niche in comparison. Wearable patches, particularly in continuous glucose monitoring (CGM) and cardiac monitoring, are forecast to post the highest CAGR due to their clinical specificity. However, their adoption will be limited to patients with defined conditions, keeping their overall market volume smaller. Smart clothing and headbands, though innovative, face barriers such as comfort, durability, and consumer adherence, delaying their transition into mainstream use.

In short, smartwatches and wristbands will remain the dominant growth engines of the wearable medical devices market over the next decade, owing to their consumer ubiquity, multifunctionality, and accelerating medical-grade integration, while other segments expand more narrowly within specialized niches.

By Device Grade: Consumer-Grade Wearable Medical Devices Dominates the Market

Consumer-grade wearable devices account for the majority share of the global wearable medical devices market, projected to exceed 70% in the coming years. Their dominance is fueled by the mass adoption of smartwatches (Apple, Samsung, Huawei) and fitness trackers (Fitbit, Xiaomi), which combine accessibility, affordability, and multi-functional appeal. Unlike clinical-grade devices, these products are sold through diverse distribution channels, from online marketplaces to retail electronics chains, and marketed as lifestyle essentials rather than specialized healthcare tools. This ubiquity, backed by aggressive branding and ecosystem integration, has made consumer-grade wearables a mainstream household item across demographics.

The appeal of consumer-grade devices lies in their broad-based focus on health and wellness rather than specific medical conditions. They track steps, calories, heart rate, sleep quality, and stress levels, serving the needs of an increasingly health-conscious population. This generalized, preventive health focus ensures a far wider target audience compared to clinical-grade wearables, which cater to patients with defined chronic or acute conditions.

However, while consumer-grade wearables dominate the market share, the clinical-grade segment is projected to grow at a faster CAGR. These devices, such as continuous glucose monitors (Abbott, Dexcom), cardiac monitoring systems, and remote rehabilitation solutions, are designed for high-stakes, condition-specific use cases where accuracy and regulatory compliance are critical. Their adoption is being accelerated by the rising burden of chronic diseases, aging populations, and the global push toward remote patient monitoring (RPM). Unlike consumer wearables, clinical-grade devices are prescription-driven, clinically validated, and integrated into care pathways, making them indispensable for managing diabetes, cardiovascular disorders, respiratory diseases, and post-acute rehabilitation.

In essence, consumer-grade devices will remain dominant in absolute market share due to their scale, affordability, and mass appeal, while clinical-grade devices will capture the growth spotlight by driving higher value, higher accuracy applications in digital health and remote care.

By Distribution Channel: Hospitals Dominate the Market

The online distribution channel is projected to dominate the global wearable medical devices market in terms of both revenue growth and CAGR during the forecast peirod, even though offline channels still accounted for more than 50% of total sales in 2024. The online segment is expected to expand at a robust CAGR of around 26% from 2025 to 2032, positioning it to overtake, or at least reach parity with, offline revenues by the end of the forecast period.

The offline channel, which includes pharmacies, hospitals, specialty clinics, and retail stores, remains critical, especially for therapeutic and clinically-certified wearables such as continuous glucose monitors or cardiac monitoring devices. These products often require physician guidance, prescriptions, and in-person counseling, making offline distribution indispensable. Many patients also value the ability to physically inspect devices, receive immediate support, and build trust with pharmacists or healthcare providers, factors that continue to sustain offline relevance.

In contrast, the online channel is on a rapid growth trajectory, driven by its unparalleled convenience and cost competitiveness. E-commerce platforms allow consumers to research, compare, and purchase devices anytime, a feature particularly attractive for consumer-grade wearables like smartwatches and fitness trackers, which are frequently bought on impulse. Online marketplaces also foster intense competition, leading to lower prices, frequent discounts, and exclusive sales campaigns, advantages far less common in brick-and-mortar outlets.

The COVID-19 pandemic accelerated consumer comfort with purchasing medical and health devices online, a behavioral shift that has now become entrenched. Coupled with rising internet penetration, digital payments, and the expansion of global e-commerce giants into health technology, this trend is expected to strengthen further.

In conclusion, offline channels will remain essential for clinical-grade, high-value devices requiring medical oversight, but the online segment is set to capture the lion’s share of future growth. Its strong alignment with the high-volume, consumer-grade wearable category, backed by convenience, competitive pricing, and evolving digital buying behaviors, positions it as the primary growth engine of the market through 2032.

Wearable Medical Devices Market Regional Analysis

North America Wearable Medical Devices Market Trends

North America, led by the U.S., accounted for a dominant ~43% share of the global wearable medical devices market in 2024, supported by advanced healthcare infrastructure, high per-capita healthcare spending, and a strong innovation ecosystem. Growth is fueled by the adoption of both clinical-grade devices in hospitals and consumer-grade wearables that are increasingly securing FDA clearances for medical use, blurring the line between consumer health and clinical care. The U.S. remains a hub for technological innovation and reimbursement-driven adoption of remote monitoring solutions.

Key Drivers:

- Favorable Reimbursement Policies: The U.S. healthcare system has been increasingly implementing reimbursement policies for remote patient monitoring (RPM), creating strong financial incentives for providers to adopt wearable medical technologies. The Centers for Medicare & Medicaid Services (CMS) introduced specific CPT codes to support RPM reimbursement: 99453 (initial patient setup and education), 99454 (supply of devices and data transmission), 99457 (first 20 minutes of clinical monitoring and management per month), and 99458 (each additional 20 minutes). These policies significantly lower adoption barriers, making RPM financially sustainable while expanding the use of CGMs, wearable ECG monitors, and connected blood pressure devices. This alignment of clinical value and economic incentive is accelerating the integration of wearables into mainstream, value-based healthcare.

- High Chronic Disease Burden: The high prevalence of chronic diseases such as diabetes and cardiovascular disorders is a key growth driver of the North America wearable medical devices market. With over 38 million Americans living with diabetes and ~127 million affected by cardiovascular diseases, the need for continuous monitoring is accelerating adoption of advanced solutions like continuous glucose monitors (CGMs), wearable ECG devices, and remote patient monitoring tools. This growing demand is further supported by payer incentives, clinician adoption of digital health platforms, and a strong consumer shift toward proactive health management.

- Technological Sophistication: A high level of digital literacy and a strong presence of major market players (e.g., Apple, Abbott, Medtronic) lead to continuous product innovation and consumer adoption.

Europe Wearable Medical Devices Market Trends

The European wearable medical devices market is emerging as a strong growth hub, shaped by a mix of mature economies and expanding adoption of home healthcare solutions. Growth is underpinned by the region’s aging population, rising chronic disease burden, and government-backed digital health initiatives such as Germany’s DiGA framework and the EU’s European Health Data Space (EHDS) project. Mature markets like Germany, the UK, and France are driving adoption of both clinical-grade and consumer-focused wearables, while Southern and Eastern European countries are catching up, supported by rising healthcare digitization. However, the market faces structural hurdles, including fragmented data-sharing policies post-GDPR, diverse reimbursement frameworks, and the complexity of navigating multiple national healthcare systems. For companies, success often depends on tailoring go-to-market strategies country by country, forging local partnerships, and ensuring compliance with stringent EU medical device regulations (MDR).

Germany, as the region’s innovation hub, held over 20% of Europe’s market share in 2024 and is projected to grow at a staggering CAGR. Adoption is being propelled by Europe's aging population, rising chronic disease burden, and growing demand for remote and preventive healthcare, especially in home-based care

Key Drivers:

- Aging Population and Chronic Diseases: The demographic shift towards a rapidly aging population, particularly in mature European economies like Germany and the UK, is creating an existential pressure on their state-funded healthcare systems. As the population of individuals over 65 grows, so too does the prevalence of chronic diseases like cardiovascular conditions and diabetes, which require sustained, long-term management. This dynamic is a primary driver for the adoption of wearable medical devices, as these technologies offer a sustainable solution to the looming crisis of hospital capacity and the shortage of healthcare professionals. By enabling remote patient monitoring (RPM) and home-based care, wearables allow for continuous, non-intrusive supervision of patients, reducing the frequency of costly hospital visits and empowering individuals to manage their health proactively, thus offloading a significant burden from traditional clinical settings.

- Government Support for Digital Health: In Europe, the proactive push for digital health and mHealth solutions is a direct response to systemic challenges, with initiatives designed to integrate wearables into mainstream healthcare. Governments and the European Union are actively creating a legal and financial framework to support this transition. A prime example is Germany's Digital Healthcare Act (DiGAV), which allows doctors to prescribe digital health applications, including apps that use wearable data, as a recognized and reimbursable part of standard medical care. Similarly, the European Health Data Space (EHDS) aims to establish a secure, interoperable system for sharing health data across borders, which is crucial for the scalability of wearable devices. In parallel, national telehealth programs in the UK, France, and Nordic countries are embedding remote patient monitoring into chronic disease management, while EU-level funding under Horizon Europe continues to support digital health innovation.

These policy actions are not merely promoting technology; they're fundamentally addressing key barriers like data fragmentation and a lack of standardized reimbursement, which are essential for driving widespread adoption beyond the consumer market into genuine clinical practice.

Asia-Pacific Wearable Medical Devices Market Trends

The Asia-Pacific wearable medical devices market is projected to grow at an impressive CAGR of 24.7% globally, fueled by its vast population base, rising middle-class healthcare spending, and the world’s highest diabetes and hypertension burden. Governments across China, India, Japan, and South Korea are actively investing in digital health ecosystems, expanding telemedicine infrastructure, and incentivizing local manufacturing of wearables, which is lowering costs and accelerating adoption. Rapid smartphone penetration and affordable data plans further enable mHealth integration, while regional startups and tech giants are innovating aggressively in AI-driven diagnostics and connected health platforms. As a result, APAC is not just a growth engine but a potential trendsetter, shaping the future of affordable, scalable, and tech-driven healthcare delivery.

Key Drivers:

- Massive Population and Rising Income: The massive populations of China and India, combined with a rapidly expanding middle class and rising disposable incomes, are creating one of the world’s largest addressable markets for wearables. In China, an estimated 148 million adults (ages 20–79) were living with diabetes in 2024, with prevalence at approximately 11.9% of the adult population, In India, about 89.8 million adults within the same age group were living with diabetes in 2024, corresponding to a 10.5% prevalence rate. These numbers fueling demand for continuous glucose monitors and connected health tools. At the same time, growing health awareness and affordable smart devices are pushing consumer-grade wearables into mainstream use, while government-led digital health initiatives are accelerating the shift toward medical-grade applications. This dual momentum is positioning both countries as pivotal drivers of global wearable adoption, blending scale with rapid technology uptake.

- Increasing Health Awareness: In Asia-Pacific, the rising emphasis on preventive healthcare and wellness is fueling rapid adoption of fitness trackers and smartwatches, particularly among the expanding middle-class population. Countries like China, India, and South Korea are witnessing a surge in health-conscious consumers who are proactively monitoring heart rate, sleep quality, and physical activity. Moreover, government-led initiatives such as India’s Fit India Movement and China’s Healthy China 2030 are further normalizing preventive health practices, positioning consumer wearables as entry points into broader digital health ecosystems. This trend is not just lifestyle-driven but also a response to the escalating burden of chronic diseases, making wearables a bridge between wellness and clinical monitoring in the region.

- Government Initiatives and Digitalization: Governments across Asia-Pacific are channeling significant investments into digital health ecosystems, creating fertile ground for medical wearables:

Japan: With nearly 29% of its population aged 65+ (2024, World Bank), the highest globally, Japan is spearheading initiatives such as the Digital Health Strategy and the promotion of remote monitoring tools to ease hospital burden. Wearables that track heart rhythm, blood pressure, and glucose levels are being fast-tracked for clinical integration.

China: Through its Healthy China 2030 plan, the government is prioritizing smart healthcare solutions, including wearable sensors for chronic disease management. Pilot programs in provinces like Zhejiang are integrating wearable monitoring into public hospitals.

India: The Ayushman Bharat Digital Mission (ABDM) is building a nationwide digital health ID and telehealth ecosystem, creating opportunities for wearable devices to connect with Electronic Health Records (EHRs) and improve access in rural areas. - Broader APAC impact: Countries like South Korea and Singapore are deploying government-backed remote patient monitoring (RPM) reimbursement frameworks, accelerating the use of wearable ECG and sleep monitors in mainstream care.

Who are the major players in the Wearable Medical Devices Market?

The following are the leading companies in the Wearable Medical Devices market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Garmin Ltd.

- Koninklijke Philips N.V.

- Medtronic

- Abbott Laboratories

- Dexcom, Inc.

- Boston Scientific Corporation

- OMRON Corporation

- ResMed

- Becton, Dickinson and Company

- iRhythm Technologies, Inc.

- Withings

- Vital Connect, Inc.

- Masimo Corporation

- Insulet Corporation

- Zoll Medical Corporation

- Biotricity Inc.

- Nuvo Group

- Ypsomed

- Others

How is the competitive landscape shaping the Wearable Medical Devices Market?

The global wearable medical devices market is best described as having a hybrid structure, partially consolidated at the top and fragmented below. The competitive landscape of the wearable medical devices market is a dynamic and characterized by a mix of consumer tech giants, traditional medical device companies, and innovative startups. As the Market concentration is high at the top, where a handful of dominant players, including Apple, Samsung, and Alphabet (through Fitbit), have leveraged their brand recognition and vast ecosystems to secure significant market share, particularly in the consumer-grade segment.

However, the market remains fragmented with numerous smaller players and startups focusing on specialized, clinical-grade devices for specific conditions, such as continuous glucose monitoring (Dexcom, Abbott) or cardiac monitoring (Medtronic, iRhythm Technologies). The key competitive strategies shaping the market are a blend of technological innovation, strategic partnerships, and a focus on regulatory approval. Consumer tech companies are rapidly adding medically-certified features to their smartwatches (e.g., ECG, irregular heart rhythm notifications) to bridge the gap between wellness and clinical applications.

Meanwhile, traditional medical device companies are miniaturizing their products and integrating wireless connectivity to compete in the home healthcare and remote patient monitoring segments. This intense competition is driving rapid product cycles and a continuous push for more accurate, user-friendly, and clinically-validated devices.

Recent Developmental Activities in the Wearable Medical Devices Market

- In May 2025, Masimo Corporation received FDA 510(k) clearance for its Masimo W1 watch. This approval expanded the watch's indications to include continuous and spot-check measurements of heart rate and oxygen saturation (SpO2), making it a viable option for a range of clinical settings.

- In April 2025, WHOOP, Inc. obtained FDA clearance for its WHOOP ECG feature. This clearance validates the feature's ability to provide a single-lead electrocardiogram, enabling it to detect and provide notifications for certain heart rhythm irregularities. This approval represents a significant step for a consumer-grade device moving into a more medical-focused space

- In April 2025, VitalConnect, Inc. received FDA 510(k) clearance for its VitalRhythm biosensor. The approval validates the device's ability to continuously monitor and record an ECG, heart rate, and respiratory rate, enhancing its utility for remote patient monitoring.

- In September 2024, Apple Inc. received FDA clearance for its Sleep Apnea Notification Feature (SANF) on the Apple Watch. This feature analyzes sleep data to provide a notification if a user's sleep patterns suggest a potential for sleep apnea, encouraging them to seek a professional diagnosis.

- In June 2024, Abbott received FDA clearance for its Libre Rio CGM System. This over-the-counter continuous glucose monitor is the first of its kind, specifically cleared for adults with Type 2 diabetes who do not use insulin. This marks a major shift in making medical-grade glucose monitoring accessible without a prescription.

- In May 2024, Dexcom received FDA clearance for its Stelo CGM System. Similar to Abbott's product, the Stelo is a prescription-free CGM aimed at non-insulin-dependent adults with diabetes, broadening the market for continuous glucose monitoring.

- In May 2024, Huawei received CE Mark certification in the European Union for its Huawei Watch D. The device is cleared as a medical device for blood pressure monitoring and ECG analysis, marking a significant step for the Chinese tech giant in expanding its health-focused wearable products in the European market.

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Wearable Medical Devices Market CAGR |

20.07% |

|

Key Companies in the Wearable Medical Devices Market |

Apple Inc., Alphabet Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Koninklijke Philips N.V., Medtronic, Abbott Laboratories, Dexcom, Inc., Boston Scientific Corporation, OMRON Corporation, ResMed, Becton, Dickinson and Company, iRhythm Technologies, Inc., Withings, Vital Connect, Inc., Masimo Corporation, Insulet Corporation, Zoll Medical Corporation, Biotricity Inc., Nuvo Group, Ypsomed, and Others. |

|

Wearable Medical Devices Market Segments |

by Product Type, by Device Type, by Device Grade, by Application, by Distribution Channel, and by Geography |

|

Wearable Medical Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Wearable Medical Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Wearable Medical Devices Market Segmentation

· Wearable Medical Devices Product Type Exposure

o Diagnostic & Monitoring Devices

§ Vital Sign Monitoring Devices

§ Sleep Moniotring Devices

§ Neuromonitoring Devices

§ Electrocardiographs Fetal and Obstetric Devices

§ Others

o Therapeutic Devices

§ Pain Management Devices

§ Insulin Delivery Devices

§ Respiratory Therapy Devices

§ Rehabilation Devices

§ Others

· Wearable Medical Devices Device Type Exposure

o Smartwatches

o Wrist Bands

o Smart Clothing

o Wearable Patches

o Others

· Wearable Medical Devices Device Grade Exposure

o Consumer Grade Wearable Medical Devices

o Clinically Grade Wearable Medical Devices

· Wearable Medical Devices Application Exposure

o General Health and Fitness

o Remote Patient Monitoring

o Home Healthcare

· Wearable Medical Devices Distribution Channel Exposure

o Offline

o Online

· Wearable Medical Devices Geography Exposure

o North America

§ United States

§ Canada

§ Mexico

o Europe

§ United Kingdom

§ Germany

§ France

§ Italy

§ Spain

§ Rest of Europe

o Asia-Pacific

§ China

§ Japan

§ India

§ Australia

§ South Korea

§ Rest of Asia-Pacific

o Rest of the World

§ South America

§ Middle East

§ Africa

Wearable Medical Devices Market Recent Industry Trends and Milestones (2022-2025)

|

Category |

Key Developments |

|

Wearable Medical Devices Product Launches |

Apple Watch Series 10, Garmin Venu 3X, Samsung Galaxy Ring, Aktiia CBPM Wristband, Abbott Lingo CGM, Empatica EpiMonitor, Nanowear SimpleSense, BD HealthBand, NeuroMetrix Quell 3.0, Ypsomed mylife Loop, Nutromics "Lab-on-a-Patch", Masimo W1 Medical Watch, Felix NeuroAI Wristband, SONU Band, VIV Ring, Peri (by IdentifyHer), Pulsetto |

|

Wearable Medical Devices Regulatory Approvals |

Fasikl (Felix NeuroAI Wristband) – FDA, Nanowear (SimpleSense-BP) – FDA, Element Science (Jewel® Patch-WCD) – CE Mark |

|

Partnerships in the Wearable Medical Devices Market |

· Strategic data-sharing partnership; DexCom invested $75M in Ōura. Enables CGM-glucose data to integrate with ring-based health metrics like sleep, stress, and activity · Medtronic obtained exclusive rights to distribute Corsano’s multi-parameter wearable (ECG, SpO₂, BP) in Western Europe, enhancing its acute care portfolio · Fitbit and Quest Diagnostics have collaborated on the WEAR-ME (Wearables for Metabolic Health) pilot study, pairing Fitbit's biometric and behavioral data with Quest lab test results to explore how wearables can improve metabolic health assessment and disease prevention |

|

Acquisitions in the Wearable Medical Devices Market |

· Medtronic to Acquires EOFlow Co., Ltd. · Samsung Electronics Acquires Xealth |

|

Company Strategy |

· Companies like Apple and Samsung are leading a major strategic shift by actively pursuing regulatory approval for their consumer-grade devices. · Established medical technology firms are changing their approach to compete with the consumer tech giants. They are focused on making their products smaller, more user-friendly, and more accessible. · A universal strategic shift across all major players is the deep integration of AI into their devices. Companies are moving from simply collecting data to providing intelligent, predictive insights. This allows for personalized health analytics, early warning systems, and automated therapy adjustments, fundamentally changing the value proposition of a wearable device |

|

Emerging Technology |

· Flexible and Stretchable Biosensors · Advanced Non-Invasive Monitoring Technologies · Deep Integration of AI and Machine Learning · Internet of Medical Things (IoMT) and Cloud Integration |

Impact Analysis

AI-Powered Innovations and Applications:

The integration of AI into the wearable medical devices market is a transformative force that is fundamentally reshaping healthcare by converting raw biometric data into actionable insights. AI-powered wearables are moving beyond simple data collection to sophisticated analysis that enables enhanced diagnostics and predictive capabilities, allowing for the early detection of conditions like atrial fibrillation or the prediction of hypoglycemic events in diabetics. Furthermore, AI delivers personalized and actionable insights by analyzing a user's unique health baseline to provide customized recommendations for diet and exercise, effectively turning the device into a personal health assistant. For healthcare providers, AI streamlines clinical workflows and enables remote patient monitoring (RPM) by filtering vast amounts of data to present only the most relevant information, thereby reducing hospital visits and improving patient outcomes. Finally, AI also addresses core technical challenges by improving data accuracy, filtering out noise from sensor readings, and enhancing the overall user experience, solidifying its role as the brain of the wearable medical device ecosystem.

In short, AI is the "brain" of the wearable medical device market. It is transforming wearables from simple data loggers into intelligent health companions that not only monitor health but also predict, prevent, and personalize care, ultimately empowering both patients and clinicians.

U.S. Tariff Impact Analysis on the Wearable Medical Devices Market:

The new U.S. tariffs on imported goods are a significant and complex headwind for the global wearable medical devices market. By raising the cost of essential components sourced from countries like China, tariffs of up to 54% are directly increasing production expenses. This forces manufacturers to either absorb the costs, which erodes profit margins, or pass them on to consumers, potentially slowing down market growth. In response to this, companies are strategically reevaluating and diversifying their supply chains to regions with more favorable trade agreements, and even considering "reshoring" production to the U.S. This shift is particularly challenging for smaller enterprises, which lack the resources to manage these disruptions. The tariffs' impact is felt across all segments, increasing the cost of both consumer-grade health trackers and critical clinical-grade devices, ultimately creating a volatile and uncertain market landscape that could jeopardize the accessibility and affordability of these vital technologies for patients.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends

|

Company Name |

Total Funding |

Main Products |

Stage of Development |

Core Technology |

|

Gate Science |

N/A (Undisclosed, likely seed or Series A) |

RELAY |

Prototype/Clinical Trials |

Combines pharmacologic blockade and neuromodulation in a single wearable device for pain management. |

|

CleverPoint |

N/A (Undisclosed) |

CleverPoint 6 & 12 |

Prototype/Early Clinical |

A VR-integrated wearable for neurofeedback, assessing brain processes and patient reactions to VR content for medical use. |

|

ABIORO |

N/A (Undisclosed) |

Abioro RX Patch |

Clinical Trials |

A wearable patch that leverages bio-sensing and deep learning to accurately diagnose cardiac arrhythmia for remote patient monitoring. |

|

ABLE Human Motion |

€1.94 million |

Robotic Exoskeleton |

Prototype/Early Clinical |

Developing robotic exoskeletons to improve the quality of life for people with disabilities, a therapeutic wearable. |

|

Peri (ex-IdentifyHer) |

Raising ≈€1M |

Peri wearable — perimenopause symptom tracker and analytics wearable |

Prototype / early pilot; selected for CES 2025 awards; small pilot shipments planned. |

Wearable sensor + app for symptom tracking, analytics for women’s mid-life health. |

|

ABLE Human Motion |

€1.94 million |

Robotic Exoskeleton |

Prototype/Early Clinical |

Developing robotic exoskeletons to improve the quality of life for people with disabilities, a therapeutic wearable. |

|

Pulsetto |

€2M |

tVNS (transcutaneous vagus nerve stimulation) wearable for stress, sleep, resilience. |

Early commercial / expansion; product FCC-certified and selling in some markets; additional funding for expansion. |

Non-invasive neuromodulation (tVNS) in a neck/ear wearable; focus on digital therapeutics and wellness/clinical adjacencies |

Key takeaways from the wearable medical devices market report study

- Market size analysis for the current wearable medical devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the wearable medical devices market.

- Various opportunities available for the other competitors in the wearable medical devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current wearable medical devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the wearable medical devices market growth in the future?