Food Allergy market size is projected to reach USD 9,205 million by 2034

Get a Sneak Peek at the Latest food allergy market insights and forecast Report

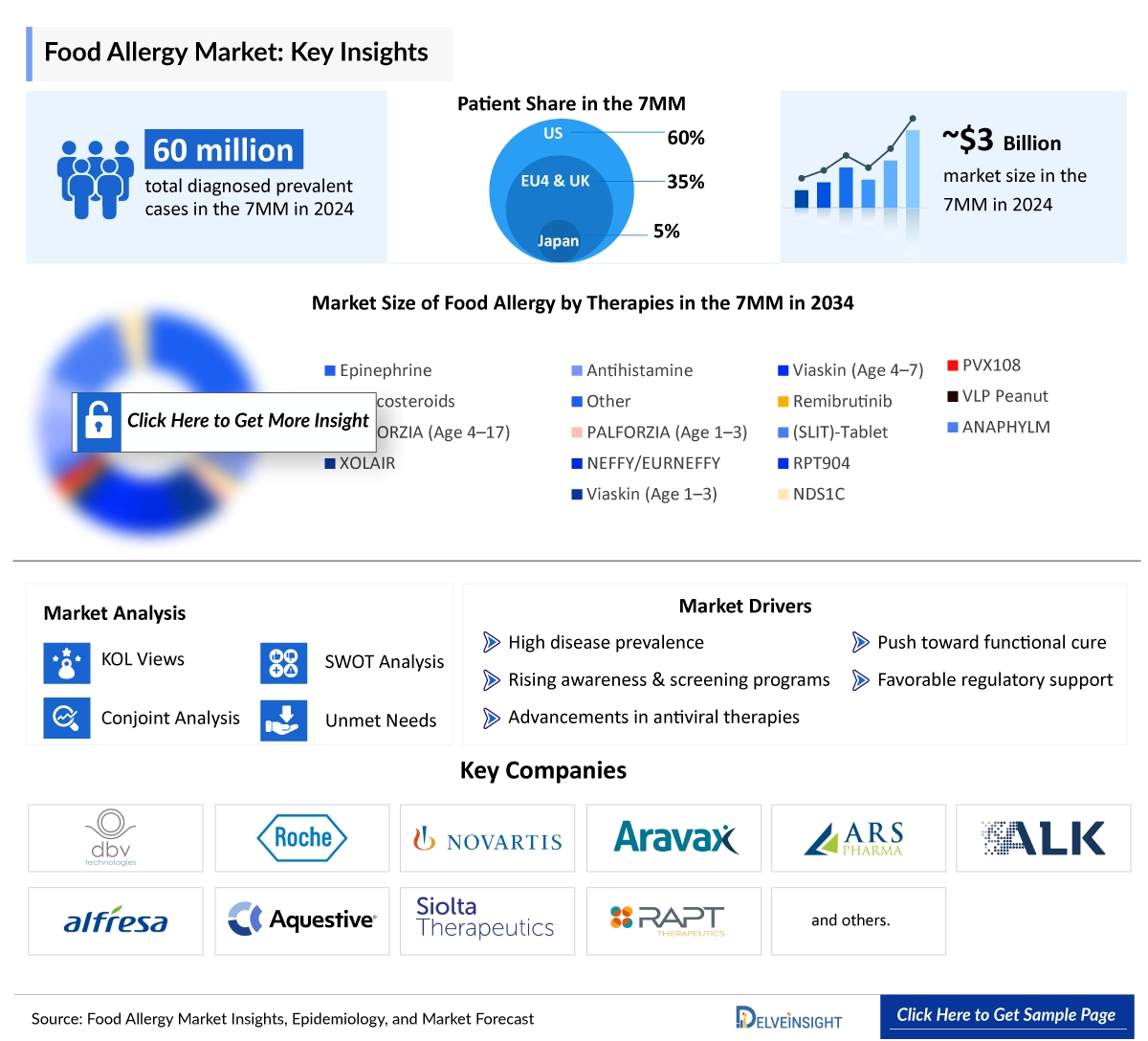

In 2025, the Food Allergy market across the 7MM was estimated at around USD 3,518 million and is expected to expand at a CAGR of 11.3%, reaching approximately USD 9,205 million by 2034 over the forecast period. DelveInsight’s comprehensive market research provides critical insights into such market trends, enabling stakeholders to understand growth drivers, emerging opportunities, and potential challenges within the Food Allergy landscape.

In 2024, the United States accounted for the largest portion of the Food Allergy market within the 7MM, with an estimated value of around USD 2,420 million. Among existing Food Allergy treatments, Epinephrine generated the highest revenue, totaling approximately USD 1,420 million in the US. Looking ahead to 2034, ANAPHYLM is expected to capture the largest market share among emerging Food Allergy therapies across the 7MM.

In 2024, there were an estimated 60,276,500 diagnosed prevalent cases of food allergies across the 7MM. In the United States, males accounted for the majority of these cases, with approximately 19,309,000 reported that year. In 2024, among the EU4 and the UK, Spain reported the highest number of food allergy cases at approximately 5,775,500, while France recorded the lowest. In Japan, the total diagnosed prevalent cases of food allergy were estimated to be around 2,669,600 during the same year.

In 2024, across the 7MM, severe food allergy cases among adults were the most prevalent, totaling around 24,979,000—higher than mild to moderate cases and these figures are anticipated to increase by 2034. In the United States, shellfish allergy was the most common type, with approximately 8,549,100 reported cases.

DelveInsight’s report “Food Allergy Market Insights, Epidemiology, and Market Forecast-2034” provides a comprehensive analysis of the Food Allergy landscape. The report delivers detailed insights into the disease, including historical and projected epidemiology, helping stakeholders understand the prevalence, incidence, and patient demographics across key regions.

To Know in detail about the Food Allergy market outlook, drug uptake, treatment scenario and epidemiology trends, Click here; Food Allergy Market Forecast

Some of the key facts of the Food Allergy Market Report:

- Key Food Allergy Companies: Aimmune Therapeutics, Inc., Novartis Pharmaceuticals, DBV Technologies, Intrommune Therapeutics, Xencor, Vedanta Biosciences, Alladapt Immunotherapeutics, Aravax, Regeneron, DBV Technologies, Novartis AG, Camallergy, Genentech, GI Innovation, and others

- Key Food Allergy Therapies: Palforzia, Ligelizumab, Viaskin Peanut, INT301, AIMab7195, VE416, ADP101, PVX-108, Dupilumab, DBV 135, Ligelizumab, CA002, Omalizumab, GI 301, and others

- The Food Allergy market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Food Allergy pipeline products will significantly revolutionize the Food Allergy market dynamics.

Food Allergy Overview

A food allergy develops when the immune system identifies a particular food as harmful and responds by triggering symptoms, which is known as an allergic reaction. These allergic reactions are caused by allergens, which are specific foods that induce immune responses in susceptible individuals.

Get a Free sample for the Food Allergy Market Forecast, Size & Share Analysis Report:

https://www.delveinsight.com/report-store/food-allergy-market-insights

Key Trends in Food Allergy Therapeutics Market:

- Rising Focus on Immunotherapy: Increasing adoption of oral and epicutaneous immunotherapies (EPIT and OIT) is revolutionizing long-term desensitization strategies for food allergy management.

- Emergence of Biologic Therapies: Monoclonal antibodies such as omalizumab and ligelizumab are gaining traction as promising options for severe and multi-food allergic patients.

- Growing Research on Preventive Approaches: Early introduction of allergenic foods in infants and novel vaccines are being explored to prevent food allergies.

- Increased Regulatory Support: Accelerated approvals and favorable guidelines from the FDA and EMA are promoting faster clinical development of food allergy treatments.

- Expanding Pipeline and Collaborations: Strategic partnerships between biotech firms and academic institutions are driving innovation and expanding the therapeutic pipeline globally.

Food Allergy Epidemiology

The Food Allergy epidemiology section provides insights into the historical, current, and forecasted epidemiology trends in the seven major countries (7MM) from 2020 to 2034. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. The epidemiology section also provides a detailed analysis of the diagnosed patient pool and future trends.

Food Allergy Epidemiology Segmentation:

The Food Allergy market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases of Food Allergy

- Allergen-specific Diagnosed Prevalent Cases of Food Allergy

- Gender-specific Diagnosed Prevalent Cases of Food Allergy

- Severity-specific Diagnosed Prevalent Cases of Food Allergy

Download the report to understand which factors are driving Food Allergy epidemiology trends @ Food Allergy Epidemiology Forecast

Recent Development In The Food Allergy Treatment Landscape:

- In May 2025, Intrommune Therapeutics announced that an independent editorial featured groundbreaking safety data for its novel peanut allergy treatment. The investigational therapy successfully met all primary and secondary endpoints, demonstrating excellent safety and tolerability, with no reports of moderate or severe systemic reactions or anaphylaxis among treated participants.

- In March 2025, Allergy Therapeutics reported that its VLP Peanut Phase I/IIa PROTECT trial has advanced to the final stage of treatment, with healthy participants reaching the highest dose levels and no safety concerns identified so far.

- In February 2025, researchers at Imperial College’s National Heart & Lung Institute (NHLI) shared promising results from the initial phase of clinical trials for a novel peanut allergy vaccine. Working alongside industry partner Allergy Therapeutics, the Imperial team developed the vaccine using virus-like particle (VLP) technology to deliver the peanut allergen protein Ara h2. According to their recent publication in the Journal of Allergy and Clinical Immunology (JACI), the Phase 1 first-in-human trial confirmed the vaccine’s safety and tolerability, showing no allergic reactions during skin prick tests when compared to control treatments.

- In September 2024, DBV Technologies (Euronext: DBV – ISIN: FR0010417345 – Nasdaq: DBVT), a clinical-stage biopharmaceutical firm, has announced the completion of patient screening for the Phase 3 VITESSE trial (Viaskin Peanut Immunotherapy Trial to Evaluate Safety, Simplicity, and Efficacy). This study evaluates the modified Viaskin Peanut Patch in children aged 4 to 7 years with peanut allergy.

Food Allergy Drugs Uptake and Pipeline Development Activities

The drugs uptake section focuses on the rate of uptake of the potential drugs recently launched in the Food Allergy market or expected to get launched during the study period. The analysis covers Food Allergy market uptake by drugs, patient uptake by therapies, and sales of each drug.

Moreover, the therapeutics assessment section helps understand the drugs with the most rapid uptake and the reasons behind the maximal use of the drugs. Additionally, it compares the drugs based on market share.

The report also covers the Food Allergy Pipeline Development Activities. It provides valuable insights about different therapeutic candidates in various stages and the key companies involved in developing targeted therapeutics. It also analyzes recent developments such as collaborations, acquisitions, mergers, licensing patent details, and other information for emerging therapies.

Food Allergy Therapies and Key Companies

- INT301: Intrommune Therapeutics

- AIMab7195: Xencor

- VE416: Vedanta Biosciences

- ADP101: Alladapt Immunotherapeutics

- PVX-108: Aravax

- Dupilumab: Regeneron

- DBV 135: DBV Technologies

- Ligelizumab: Novartis AG

- CA002: Camallergy

- Omalizumab: Genentech

- GI 301: GI Innovation

Discover more about therapies set to grab major Food Allergy market share @ Food Allergy Treatment Landscape

Food Allergy Market Drivers

- Rising Prevalence of Food Allergies: Increasing incidence, particularly among children, is driving demand for effective diagnosis and treatment solutions.

- Growing Awareness and Early Diagnosis: Enhanced public health initiatives and better diagnostic tools are contributing to early detection and management.

- Advancements in Immunotherapy and Biologics: Development of novel desensitization therapies and biologic drugs is transforming treatment approaches.

- Supportive Regulatory and Research Initiatives: Government funding and clinical research support are accelerating innovation in the field.

Food Allergy Market Barriers

- Limited Approved Treatments: The lack of curative therapies restricts patient options, with most management focused on avoidance and emergency care.

- High Cost of Advanced Therapies: Expensive immunotherapies and biologics reduce accessibility, especially in low-income regions.

- Challenges in Accurate Diagnosis: Overlapping symptoms and limited testing accuracy can lead to underdiagnosis or misdiagnosis.

- Regulatory and Safety Concerns: Stringent approval processes and potential safety risks in immunotherapy trials may slow down new product launches.

Scope of the Food Allergy Market Report

- Study Period: 2020–2034

- Coverage: 7MM [The United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan]

- Key Food Allergy Companies: Aimmune Therapeutics, Inc., Novartis Pharmaceuticals, DBV Technologies, Intrommune Therapeutics, Xencor, Vedanta Biosciences, Alladapt Immunotherapeutics, Aravax, Regeneron, DBV Technologies, Novartis AG, Camallergy, Genentech, GI Innovation, and others

- Key Food Allergy Therapies: Palforzia, Ligelizumab, Viaskin Peanut, INT301, AIMab7195, VE416, ADP101, PVX-108, Dupilumab, DBV 135, Ligelizumab, CA002, Omalizumab, GI 301, and others

- Food Allergy Therapeutic Assessment: Food Allergy current marketed and Food Allergy emerging therapies

- Food Allergy Market Dynamics: Food Allergy market drivers and Food Allergy market barriers

- Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies

- Food Allergy Unmet Needs, KOL’s views, Analyst’s views, Food Allergy Market Access and Reimbursement

To know more about Food Allergy companies working in the treatment market, visit @ Food Allergy Clinical Trials and Therapeutic Assessment

Need more?

- ✅ Connect with our analyst to learn how this research was developed

- ✅ Expand the scope with additional segments or countries through free customization

- ✅ Discover how this report can directly influence your business growth

Related Reports

Food Allergy – Epidemiology Forecast—2034

DelveInsight's Food Allergy (FA) - Epidemiology Forecast 2034 report delivers an in-depth understanding of the disease, historical, and forecasted epidemiology of Food Allergy (FA)..

Food Allergy- Pipeline Insight, 2025

"Food Allergy Pipeline Insights, 2025" report by DelveInsight outlays comprehensive insights of present clinical development scenario and growth prospects across..