KRAS Inhibitors Market Size in the 7MM was ~USD 7,847 Million by 2034, it is expected to grow at a CAGR of 35% by 2034, estimates DelveInsight

Get a Sneak Peek at the Latest kras inhibitors market Report

The KRAS inhibitors market size in the 7 major markets (7MM) was valued at approximately USD 526 million in 2025 and is expected to experience substantial growth, expanding at a compound annual growth rate (CAGR) of 35% to reach USD 7,847 million by 2034 during the forecast period from 2025 to 2034. DelveInsight’s comprehensive market research provides critical insights into such market trends, enabling stakeholders to understand growth drivers, emerging opportunities, and potential challenges within the KRAS Inhibitors landscape.

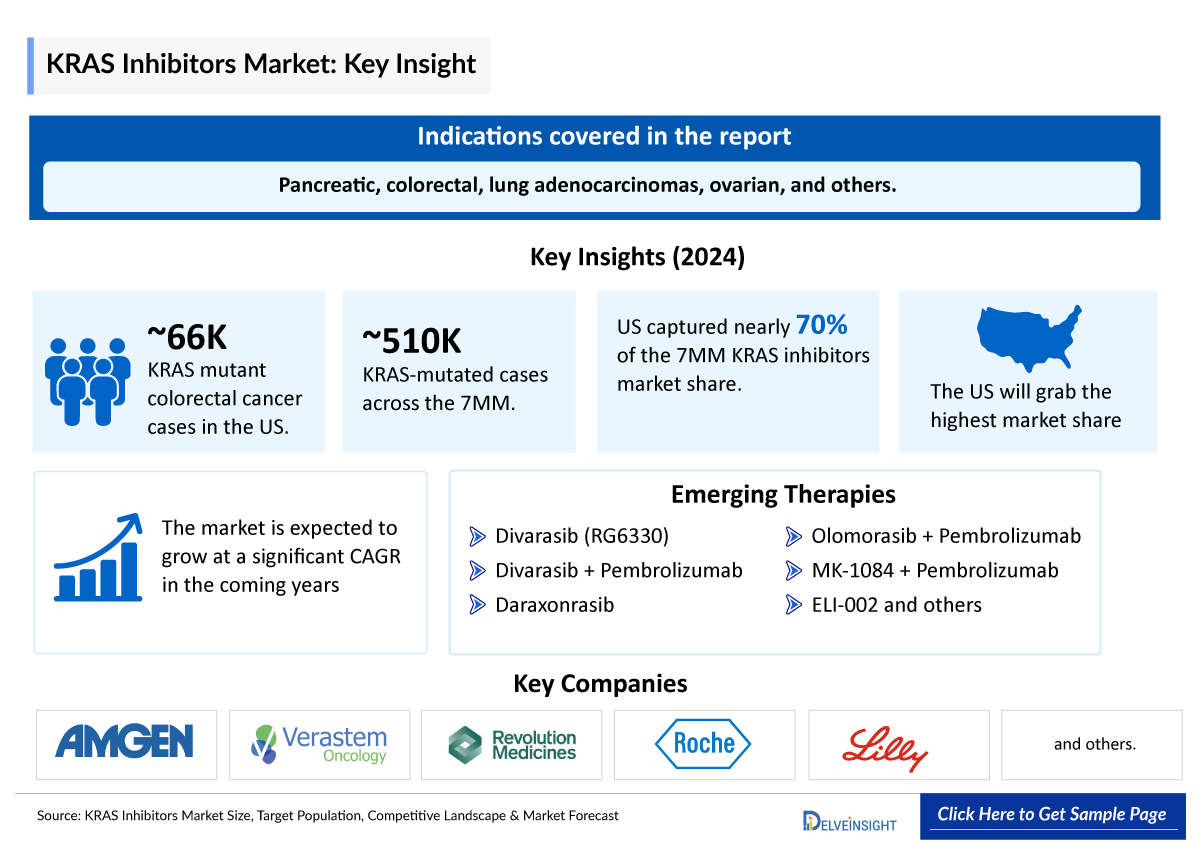

According to BMS’s Q1 2025 presentations, early-stage data for KRAZATI (KRYSTAL-17) in first-line NSCLC patients with TPS <50% are expected in 2025. In 2024, the United States accounted for the largest share of the KRAS inhibitors market within the 7 major markets (7MM), representing roughly 70% of the total market value. Among the three RAS genes, KRAS is the most frequently mutated, followed by NRAS and HRAS, with KRAS mutations commonly associated with cancers such as pancreatic, colorectal, lung adenocarcinomas, ovarian, and others.

Among approved therapies in the United States, KRAZATI is expected to generate higher revenue than LUMAKRAS over the forecast period (2020–2034). The US also reported the largest share of KRAS-mutated NSCLC cases within the 7 major markets (7MM), representing roughly 46% of all such cases.

Several companies developing KRAS inhibitors are focusing on pan-KRAS candidates, including Cardiff Oncology (onvansertib), Immuneering Corporation (IMM-1-104), Jacobio Pharma (JAB-23E73), and Eli Lilly (LY4066434), among others. These therapies are expected to have substantial market potential due to the broad patient population they can address. In 2024, total KRAS-mutated cases across the 7 major markets (7MM) exceeded approximately 509,700 and are projected to increase over the forecast period.

Among the cancer types analyzed, KRAS mutations are most commonly observed in colorectal cancer (CRC), followed by pancreatic cancer, NSCLC, and LGSOC. In the United States, around 66,000 KRAS-mutant CRC cases were reported in 2024.

The G12C mutation is the most frequently observed KRAS variant in NSCLC, whereas G12D predominates in colorectal cancer (CRC), pancreatic cancer, and LGSOC. In the United States, KRAS G12C represents about 37% of NSCLC cases, while KRAS G12D is found in roughly 42% of pancreatic cancer cases, 30% of CRC cases, and 42% of LGSOC cases.

Among the approved KRAS inhibitor therapies, AVMAPKI combined with FAKZYNJA is expected to capture a larger market share than KRAZATI and LUMAKRAS over the forecast period (2020–2034).

DelveInsight’s report “KRAS Inhibitors Market Insights, Epidemiology, and Market Forecast-2034” provides a comprehensive analysis of the KRAS Inhibitors landscape. The report delivers detailed insights into the disease, including historical and projected epidemiology, helping stakeholders understand the prevalence, incidence, and patient demographics across key regions.

Additionally, it examines KRAS Inhibitors market dynamics, offering a thorough assessment of current and emerging market trends, treatment patterns, and therapeutic developments. The analysis spans major markets, including the United States, EU4 (Germany, Spain, Italy, France, and the United Kingdom), and Japan, equipping decision-makers with actionable intelligence for strategic planning, investment, and research initiatives.

To Know in detail about the KRAS Inhibitors market outlook, drug uptake, treatment scenario and epidemiology trends, Click here; KRAS Inhibitors Market Forecast

Some of the key facts of the KRAS Inhibitors Market Report:

- Key KRAS Inhibitors Companies: Pfizer, Roche/Chugai/Genentech, Revolution Medicines, Eli Lilly and Company, Merck, Taiho, and Astex Pharmaceuticals, Elicio Therapeutics, Jiangsu Hengrui Pharmaceuticals, Cardiff Oncology, Genfleet Therapeutics and Innovent, Jacobio Pharma, Tyligand Pharmaceuticals (Suzhou), Silexion Therapeutics and Catalent, Astellas Pharma, Incyte, Quanta Therapeutics, and others

- Key KRAS Inhibitors Therapies: PF-07934040, Divarasib (RG6330), Daraxonrasib (RMC-6236), Olomorasib + Pembrolizumab ± Chemotherapy, MK-1084 + Pembrolizumab:, Onvansertib + Bevacizumab + FOLFIRI/ FOLFOX, ELI-002, HRS-4642 + Gemcitabine + Albumin-bound Paclitaxel, DUPERT (Fulzerasib/GFH925) + Cetuximab, JAB-23E73, TSN1611, SIL204, ASP3082, INCB186748, QTX3544, and others

- The KRAS Inhibitors market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage KRAS Inhibitors pipeline products will significantly revolutionize the KRAS Inhibitors market dynamics.

KRAS Inhibitors Overview

KRAS Inhibitors are a class of targeted cancer therapies designed to block the activity of mutant KRAS proteins, which drive uncontrolled cell growth in several cancers, including non-small cell lung cancer (NSCLC), colorectal cancer, and pancreatic cancer. By specifically inhibiting KRAS mutations such as G12C, G12D, and others these drugs help slow tumor progression and improve treatment outcomes. They are part of precision oncology, often used alone or in combination with other therapies to enhance effectiveness.

Get a Free sample for the KRAS Inhibitors Market Report:

https://www.delveinsight.com/report-store/kras-inhibitors-market

Key Trends in KRAS Inhibitors Therapeutics Market:

- Expansion beyond initial KRAS G12C targets to broader mutation subtypes: After early successes with G12C inhibitors like sotorasib and adagrasib, development focus is shifting toward agents targeting G12D, G13D and other KRAS variants, as well as pan-KRAS inhibitors to widen patient eligibility across cancers such as pancreatic and colorectal.

- Strong clinical pipeline and combination strategies: A robust clinical pipeline with many next-generation KRAS inhibitors and trials exploring combination regimens (e.g., with immunotherapies, SHP2/MEK inhibitors) aims to improve efficacy, overcome resistance and move these therapies into earlier treatment lines.

- Biomarker-driven precision oncology and companion diagnostics: Wider adoption of advanced diagnostics like next-generation sequencing and liquid biopsies is enabling tailored patient identification and driving uptake of KRAS inhibitors as precision oncology tools.

- Strategic collaborations and geographic expansion: Partnerships between pharma companies and research institutions are accelerating R&D and trial enrollment, while emerging markets (Asia-Pacific, Latin America) are increasingly targeted for clinical development and regional approvals.

- Market growth and regulatory momentum: The KRAS inhibitors market is projected to expand significantly in coming years, supported by regulatory approvals, label expansions (e.g., colorectal cancer), and increasing integration into standard oncology care pathways.

KRAS Inhibitors Epidemiology

The KRAS Inhibitors epidemiology section provides insights into the historical, current, and forecasted epidemiology trends in the seven major countries (7MM) from 2020 to 2034. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. The epidemiology section also provides a detailed analysis of the diagnosed patient pool and future trends.

KRAS Inhibitors Epidemiology Segmentation:

The KRAS Inhibitors market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Prevalence of KRAS Inhibitors

- Prevalent Cases of KRAS Inhibitors by severity

- Gender-specific Prevalence of KRAS Inhibitors

- Diagnosed Cases of Episodic and Chronic KRAS Inhibitors

Download the report to understand which factors are driving KRAS Inhibitors epidemiology trends @ KRAS Inhibitors Epidemiology Forecast

Recent Development In The KRAS Inhibitors Treatment Landscape:

- In May 2025, Verastem Oncology announced that the U.S. FDA has granted approval for AVMAPKI + FAKZYNJA CO-PACK (avutometinib capsules and defactinib tablets) for the treatment of adult patients with KRAS-mutated recurrent low-grade serous ovarian cancer (LGSOC) who have previously received systemic therapy. This combination marks the first and only FDA-approved treatment for this condition. The approval was granted under the accelerated approval pathway, based on tumor response rate and duration of response (DoR).

- In April 2025, BMS announced anticipation of Phase III trial data readouts for KRYSTAL-10 by 2026 for 2L CRC, KRYSTAL-7 trial results in 2028 for 1L NSCLC PD-L1=50%, and KRYSTAL-4 trial results in 2029 for 1L.

- In March 2025, Verastem Oncology announced plans to launch avutometinib in the first-half of 2025 to maximize market opportunity in KRAS mutant recurrent LGSOC. The company plans to submit for National Comprehensive Cancer Network (NCCN) Guideline inclusion upon FDA approval, which may enable patients with KRAS wild-type LGSOC to access therapy.

- In January 2025, Elicio Therapeutics announced that, based on the feedback from the FDA in the End of Phase I Type B meeting, the company anticipates submitting a BLA contingent upon the results of a planned Phase III trial.

KRAS Inhibitors Drugs Uptake and Pipeline Development Activities

The drugs uptake section focuses on the rate of uptake of the potential drugs recently launched in the KRAS Inhibitors market or expected to get launched during the study period. The analysis covers KRAS Inhibitors market uptake by drugs, patient uptake by therapies, and sales of each drug.

Moreover, the therapeutics assessment section helps understand the drugs with the most rapid uptake and the reasons behind the maximal use of the drugs. Additionally, it compares the drugs based on market share.

The report also covers the KRAS Inhibitors Pipeline Development Activities. It provides valuable insights about different therapeutic candidates in various stages and the key companies involved in developing targeted therapeutics. It also analyzes recent developments such as collaborations, acquisitions, mergers, licensing patent details, and other information for emerging therapies.

KRAS Inhibitors Therapies and Key Companies

- PF-07934040: Pfizer

- Divarasib (RG6330): Roche/Chugai/Genentech

- Daraxonrasib (RMC-6236): Revolution Medicines

- Olomorasib + Pembrolizumab ± Chemotherapy: Eli Lilly and Company

- MK-1084 + Pembrolizumab: Merck, Taiho, and Astex Pharmaceuticals

- Onvansertib + Bevacizumab + FOLFIRI/ FOLFOX: Cardiff Oncology

- ELI-002: Elicio Therapeutics

- HRS-4642 + Gemcitabine + Albumin-bound Paclitaxel: Jiangsu Hengrui Pharmaceuticals

- DUPERT (Fulzerasib/GFH925) + Cetuximab: Genfleet Therapeutics and Innovent

- JAB-23E73: Jacobio Pharma

- TSN1611: Tyligand Pharmaceuticals (Suzhou)

- SIL204: Silexion Therapeutics and Catalent

- ASP3082: Astellas Pharma

- INCB186748: Incyte

- QTX3544: Quanta Therapeutics

Discover more about therapies set to grab major KRAS Inhibitors market share @ KRAS Inhibitors Treatment Market

KRAS Inhibitors Market Drivers

- High unmet clinical need across multiple cancers: KRAS mutations are among the most common oncogenic drivers in cancers such as NSCLC, colorectal, pancreatic and others, creating a large addressable patient population for targeted therapies.

- Advances in precision oncology and diagnostics: Next-generation sequencing (NGS) and liquid biopsies enable accurate identification of KRAS mutations, expanding patient access to mutation-specific therapies.

- Progress with combination treatment strategies: Pairing KRAS inhibitors with immunotherapies, chemotherapy, or other targeted agents enhances efficacy and durability, supporting broader clinical adoption and expanding potential use cases.

- Pipeline expansion beyond G12C toward pan-KRAS and other subtypes: Development of next-generation inhibitors targeting G12D, G13D and pan-KRAS variants is broadening the patient base and opening new therapeutic avenues.

- Strategic partnerships and industry investment: Collaborations between biotech firms and large pharma, along with strong R&D investment, are accelerating innovation and market entry of new KRAS-targeted therapies.

KRAS Inhibitors Market Barriers

- Drug resistance and limited monotherapy efficacy: Tumor heterogeneity and adaptive resistance mechanisms can reduce long-term effectiveness of KRAS inhibitors, necessitating more complex treatment regimens.

- High development and treatment costs: Substantial R&D expenses and premium pricing of KRAS inhibitors limit patient access and strain healthcare budgets, especially in cost-sensitive markets.

- Diagnostic access gaps: Uneven availability of companion diagnostic testing (e.g., NGS) in some regions slows identification of eligible patients and inhibits real-world adoption.

- Regulatory and reimbursement hurdles: Complex regulatory pathways and uncertainty around coverage decisions delay launches and reduce market uptake in certain countries.

- Technical formulation and clinical trial complexities: Developing stable, effective formulations and conducting robust trials across diverse patient subgroups increases timelines, costs and barriers to entry.

Scope of the KRAS Inhibitors Market Report

- Study Period: 2020–2034

- Coverage: 7MM [The United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan]

- Key KRAS Inhibitors Companies: Pfizer, Roche/Chugai/Genentech, Revolution Medicines, Eli Lilly and Company, Merck, Taiho, and Astex Pharmaceuticals, Elicio Therapeutics, Jiangsu Hengrui Pharmaceuticals, Cardiff Oncology, Genfleet Therapeutics and Innovent, Jacobio Pharma, Tyligand Pharmaceuticals (Suzhou), Silexion Therapeutics and Catalent, Astellas Pharma, Incyte, Quanta Therapeutics, and others

- Key KRAS Inhibitors Therapies: PF-07934040, Divarasib (RG6330), Daraxonrasib (RMC-6236), Olomorasib + Pembrolizumab ± Chemotherapy, MK-1084 + Pembrolizumab:, Onvansertib + Bevacizumab + FOLFIRI/ FOLFOX, ELI-002, HRS-4642 + Gemcitabine + Albumin-bound Paclitaxel, DUPERT (Fulzerasib/GFH925) + Cetuximab, JAB-23E73, TSN1611, SIL204, ASP3082, INCB186748, QTX3544, and others

- KRAS Inhibitors Therapeutic Assessment: KRAS Inhibitors current marketed and KRAS Inhibitors emerging therapies

- KRAS Inhibitors Market Dynamics: KRAS Inhibitors market drivers and KRAS Inhibitors market barriers

- KRAS Inhibitors Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies

- KRAS Inhibitors Unmet Needs, KOL’s views, Analyst’s views, KRAS Inhibitors Market Access and Reimbursement

To know more about KRAS Inhibitors companies working in the treatment market, visit @ KRAS Inhibitors Clinical Trials and Therapeutic Assessment

About DelveInsight

DelveInsight is a leading Healthcare Business Consultant, and Market Research firm focused exclusively on life sciences. It supports Pharma companies by providing comprehensive end-to-end solutions to improve their performance.

It also offers Healthcare Consulting Services, which benefits in market analysis to accelerate the business growth and overcome challenges with a practical approach.

Need more?

- ✅ Connect with our analyst to learn how this research was developed

- ✅ Expand the scope with additional segments or countries through free customization

- ✅ Discover how this report can directly influence your business growth

Related Reports

KRAS Inhibitors – Epidemiology Forecast – 2034

DelveInsight's KRAS Inhibitors - Epidemiology Forecast 2034 report delivers an in-depth understanding of the disease, historical, and forecasted epidemiology..