Sleep Apnea market size is projected to reach USD 5,681 million by 2034

Get a Sneak Peek at the Latest sleep apnea market size and forecast Report

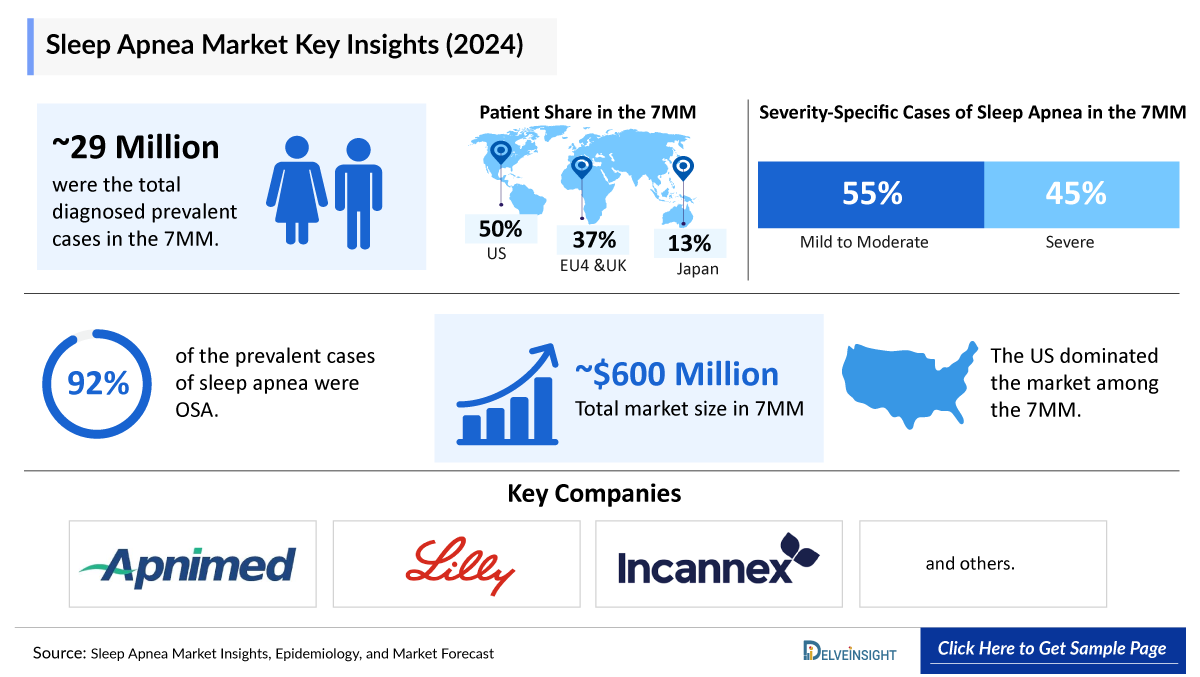

In 2025, the Sleep Apnea market size in the 7MM was valued at around USD 661 million and is projected to grow at a robust CAGR of 27%, reaching approximately USD 5,681 million by 2034. In 2024, the EU4 and UK together accounted for about USD 120 million of this market, representing nearly 20% of the total 7MM market share. DelveInsight’s comprehensive market research provides critical insights into such market trends, enabling stakeholders to understand growth drivers, emerging opportunities, and potential challenges within the Sleep Apnea landscape.

Between 2025 and 2034, emerging pipeline therapies such as Eli Lilly’s retatrutide and orforglipron, Incannex’s IHL-42X, and Apnimed’s AD109 are expected to drive substantial growth in the sleep apnea market. The treatment pipeline is rapidly progressing, primarily targeting obstructive sleep apnea (OSA). Notably, SASS-001 from Shionogi Apnimed Sleep Science is the only candidate currently being developed specifically for central sleep apnea (CSA).

Across the 7MM, an estimated 29 million diagnosed prevalent cases of sleep apnea were reported, with roughly 15.8 million classified as mild and 13 million as moderate to severe. Obstructive sleep apnea (OSA) dominated the disease landscape, representing about 92% of all prevalent sleep apnea cases.

The Sleep Apnea market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Sleep Apnea pipeline products will significantly revolutionize the Sleep Apnea market dynamics.

DelveInsight’s report “Sleep Apnea Market Insights, Epidemiology, and Market Forecast-2034” provides a comprehensive analysis of the Sleep Apnea landscape. The report delivers detailed insights into the disease, including historical and projected epidemiology, helping stakeholders understand the prevalence, incidence, and patient demographics across key regions.

To Know in detail about the Sleep Apnea market outlook, drug uptake, treatment scenario and epidemiology trends, Click here; Sleep Apnea Market Forecast

Some of the key facts of the Sleep Apnea Market Report:

- Key Sleep Apnea Companies: Apnimed, Eli Lilly and Company, Incannex Healthcare, Axsome Therapeutics/Jazz Pharmaceuticals, Bioprojet, and others

- Key Sleep Apnea Therapies: AD109 (Aroxybutynin + Atomoxetine), Retatrutide, Orforglipron, IHL-42X (Acetazolamide + dronabinol), ZEPBOUND/ MOUNJARO (tirzepatide), SUNOSI (solriamfetol), OZAWADE (Pitolisant), and others

- The Sleep Apnea epidemiology based on gender analyzed that in 2022, 61% cases of OSA were of males, while 39% cases were of Females in the 7MM

- The Sleep Apnea market is expected to surge due to the disease's increasing prevalence and awareness during the forecast period. Furthermore, launching various multiple-stage Sleep Apnea pipeline products will significantly revolutionize the Sleep Apnea market dynamics.

Sleep Apnea Overview

Sleep apnea is a sleep disorder in which breathing repeatedly stops and starts during sleep. It leads to poor sleep quality, loud snoring, and daytime fatigue. The most common types are obstructive sleep apnea (OSA), caused by airway blockage, and central sleep apnea (CSA), caused by the brain not sending proper signals to control breathing. If untreated, it can increase the risk of high blood pressure, heart disease, stroke, and diabetes.

Get a Free sample for the Sleep Apnea Market Forecast, Size & Share Analysis Report:

https://www.delveinsight.com/report-store/sleep-apnea-market

Key Trends in Sleep Apnea Therapeutics Market:

- Shift Toward Non-invasive Treatment Options: Increasing demand for oral appliances, positional therapy, and neuromodulation devices is driving innovation beyond traditional CPAP therapy.

- Emergence of Pharmacological Therapies: Development of novel drug candidates, such as cannabinoids and serotonin modulators, is expanding treatment options for obstructive sleep apnea (OSA).

- Integration of Digital Health Solutions: Wearable technologies, AI-powered diagnostic tools, and remote monitoring platforms are improving early detection and long-term management of sleep apnea.

- Rising Awareness and Diagnosis Rates: Growing recognition of sleep apnea’s link with cardiovascular and metabolic disorders is leading to higher screening and treatment adoption.

- Strategic Collaborations and FDA Approvals: Increasing partnerships between biotech firms and device manufacturers, along with regulatory approvals, are fueling market expansion and patient accessibility.

Sleep Apnea Epidemiology

The Sleep Apnea epidemiology section provides insights into the historical, current, and forecasted epidemiology trends in the seven major countries (7MM) from 2020 to 2034. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. The epidemiology section also provides a detailed analysis of the diagnosed patient pool and future trends.

Sleep Apnea Epidemiology Segmentation:

The Sleep Apnea market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Prevalent Cases of Sleep Apnea

- Total Diagnosed Prevalent Cases of Sleep Apnea

- Type-specific cases of Sleep Apnea

- Age-specific Cases of Sleep Apnea

- Gender-specific Cases of Sleep Apnea

- Severity-specific Cases of Sleep Apnea

Download the report to understand which factors are driving Sleep Apnea epidemiology trends @ Sleep Apnea Epidemiology Forecast

Recent Development In The Sleep Apnea Treatment Landscape:

- In August 2025, Newly released data from the Phase 2 RePOSA trial (NCT06146101) demonstrated that IHL-42X (Incannex), an investigational treatment for obstructive sleep apnea (OSA), produced clinically significant improvements across key objective and subjective endpoints. Following these positive results, the company is preparing for an End-of-Phase 2 meeting with the FDA to refine the Phase 3 trial design and finalize its regulatory development strategy.

- In July 2025, Apnimed reported positive topline findings from LunAIRo, its second Phase 3 trial of AD109 (aroxybutynin 2.5 mg, atomoxetine 75 mg) in adults with obstructive sleep apnea. Earlier, in May, the company shared results from its SynAIRgy trial of AD109.

- In May 2025, Apnimed reported positive Phase III SynAIRgy trial results for AD109, an oral OSA therapy. The study achieved its primary endpoint, demonstrating a significant reduction in the apnea-hypopnea index (AHI) at 26 weeks compared to placebo. Effectiveness was observed across all severities of OSA and various weight groups. AD109 was well-tolerated, with no serious treatment-related adverse events. These findings support AD109’s potential as a first-in-class oral treatment for OSA.

- In Jan 2025, Mineralys Therapeutics, Inc. announced that the FDA has approved its IND application for a Phase 2 clinical trial to assess lorundrostat for the treatment of Sleep Apnea (OSA) and hypertension. The trial is set to begin in the first quarter of 2025.

- In December 2024, Eli Lilly and Company (NYSE: LLY) announced that the U.S. Food and Drug Administration (FDA) has approved Zepbound® (tirzepatide) as the first and only prescription treatment for adults with moderate-to-severe Sleep Apnea (OSA) and obesity. Zepbound is intended to help alleviate sleep disorders in adults affected by both OSA and obesity.

- In June 2024, Eli Lilly and Company (NYSE: LLY) shared detailed findings from the SURMOUNT-OSA Phase III clinical trials, which assessed tirzepatide injection (10 mg or 15 mg) for treating moderate-to-severe Sleep Apnea (OSA) in adults with obesity, both with and without positive airway pressure (PAP) therapy. Lilly has submitted tirzepatide for the treatment of moderate-to-severe OSA and obesity to the US Food and Drug Administration (FDA) and plans to begin submissions to other global regulatory authorities in the coming weeks.

- In April 2024, Incannex's IHL-42X, a cannabinoid-based combination product, is progressing into phase II/III trials for Sleep Apnea (OSA). Early results have shown promise, enhancing its market potential. The trials, which will begin in the US and expand to Europe, are designed to tackle patient non-compliance with PAP devices.

- In May 2024, Incannex Healthcare Inc., a pharmaceutical company focused on developing innovative medicinal cannabinoid and psychedelic therapies, announced that patient dosing has begun in its Phase II/III clinical trial to evaluate the safety and efficacy of IHL-42X in patients with Sleep Apnea.

Sleep Apnea Drugs Uptake and Pipeline Development Activities

The drugs uptake section focuses on the rate of uptake of the potential drugs recently launched in the Sleep Apnea market or expected to get launched during the study period. The analysis covers Sleep Apnea market uptake by drugs, patient uptake by therapies, and sales of each drug.

Moreover, the therapeutics assessment section helps understand the drugs with the most rapid uptake and the reasons behind the maximal use of the drugs. Additionally, it compares the drugs based on market share.

The report also covers the Sleep Apnea Pipeline Development Activities. It provides valuable insights about different therapeutic candidates in various stages and the key companies involved in developing targeted therapeutics. It also analyzes recent developments such as collaborations, acquisitions, mergers, licensing patent details, and other information for emerging therapies.

Sleep Apnea Therapies and Key Companies

- AD109 (Aroxybutynin + Atomoxetine): Apnimed

- Retatrutide: Eli Lilly and Company

- Orforglipron: Eli Lilly and Company

- IHL-42X (Acetazolamide + dronabinol): Incannex Healthcare

- ZEPBOUND/ MOUNJARO (tirzepatide): Eli Lilly and Company

- SUNOSI (solriamfetol): Axsome Therapeutics/Jazz Pharmaceuticals

- OZAWADE (Pitolisant): Bioprojet

Discover more about therapies set to grab major Sleep Apnea market share @ Sleep Apnea Treatment Landscape

Sleep Apnea Market Drivers

- Rising Prevalence of Sleep Disorders: Increasing cases of obesity, cardiovascular diseases, and aging populations are contributing t0 higher sleep apnea incidence globally.

- Growing Awareness and Diagnosis Rates: Enhanced screening programs and public awareness campaigns are leading to earlier diagnosis and treatment adoption.

- Technological Advancements in Sleep Devices: Innovations in CPAP machines, oral appliances, and wearable sleep monitoring devices are improving patient compliance and treatment outcomes.

- Supportive Reimbursement Policies: Favorable insurance coverage for sleep apnea diagnosis and treatment is driving market growth.

- Increasing Adoption of Home Sleep Testing: The convenience and affordability of home-based diagnostic tools are expanding market reach.

Sleep Apnea Market Barriers

- High Cost of Treatment Devices: Expensive CPAP machines and maintenance costs limit accessibility in low-income regions.

- Poor Patient Compliance: Discomfort and inconvenience associated with CPAP therapy often result in low adherence rates.

- Limited Awareness in Developing Regions: Lack of education and underdiagnosis hinder the growth potential in emerging markets.

- Stringent Regulatory Requirements: Complex approval processes for medical devices slow down product launches.

- Competition from Alternative Therapies: Increasing preference for surgical interventions and lifestyle modification limits device market expansion.

Scope of the Sleep Apnea Market Report

- Study Period: 2020–2034

- Coverage: 7MM [The United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan]

- Key Sleep Apnea Companies: Apnimed, Eli Lilly and Company, Incannex Healthcare, Axsome Therapeutics/Jazz Pharmaceuticals, Bioprojet, and others

- Key Sleep Apnea Therapies: AD109 (Aroxybutynin + Atomoxetine), Retatrutide, Orforglipron, IHL-42X (Acetazolamide + dronabinol), ZEPBOUND/ MOUNJARO (tirzepatide), SUNOSI (solriamfetol), OZAWADE (Pitolisant), and others

- Sleep Apnea Therapeutic Assessment: Sleep Apnea current marketed and Sleep Apnea emerging therapies

- Sleep Apnea Market Dynamics: Sleep Apnea market drivers and Sleep Apnea market barriers

- Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies

- Sleep Apnea Unmet Needs, KOL’s views, Analyst’s views, Sleep Apnea Market Access and Reimbursement

To know more about Sleep Apnea companies working in the treatment market, visit @ Sleep Apnea Clinical Trials and Therapeutic Assessment

Need more?

- ✅ Connect with our analyst to learn how this research was developed

- ✅ Expand the scope with additional segments or countries through free customization

- ✅ Discover how this report can directly influence your business growth

Related Reports

Sleep Apnea - Pipeline Insight, 2025

Sleep Apnea Pipeline Insights, 2025 report by DelveInsight outlays comprehensive insights of present clinical development scenario and growth prospects across the Sleep Apnea market.

Sleep Apnea - Epidemiology Forecast - 2034

DelveInsight's Sleep Apnea - Epidemiology Forecast 2034 report delivers an in-depth understanding of the disease, historical, and forecasted epidemiology of Sleep Apnea in the United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan.