Atherosclerotic Cardiovascular Disease Market

Key Highlights

- ASCVD remains the leading global driver of morbidity and mortality, with hypertension, diabetes, dyslipidemia, obesity, accelerating plaque progression, and creating complex multi-morbid patient profiles across coronary, cerebrovascular, peripheral, and aortic disease.

- Diagnosis increasingly relies on integrated risk assessment using lipid biomarkers, inflammation markers (hs-CRP), Lp(a), genetic variants (LDLR, APOB, PCSK9), and vascular imaging to enable more accurate stratification of high-risk patients.

- The rapid growth of diabetes, obesity, hypertension, and CKD is accelerating ASCVD onset and severity, leading to earlier disease presentation and significantly higher clinical complexity and cost burden.

- Peripheral artery disease (PAD) constitutes the largest share of ASCVD cases across all payer and demographic groups. Stroke, including ischemic stroke, is the second most common subtype, followed by coronary revascularization and recent acute coronary syndrome (ACS), underscoring the multi-system impact of atherosclerosis.

- Pharmacologic management centers on statins, ezetimibe, antiplatelets, and cardiometabolic therapies, with PCSK9-targeted agents (evolocumab, alirocumab, inclisiran) offering established ASCVD-approved options for patients with persistent LDL-C elevation.

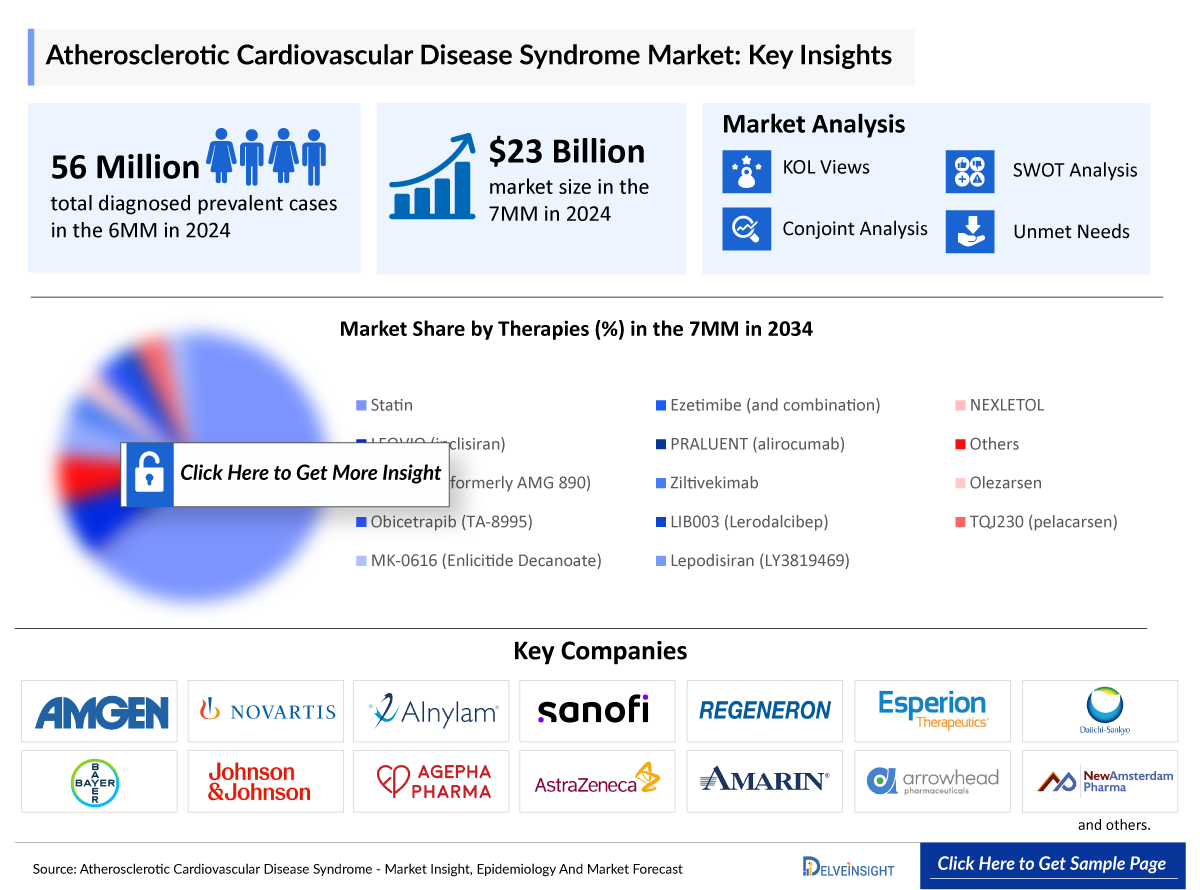

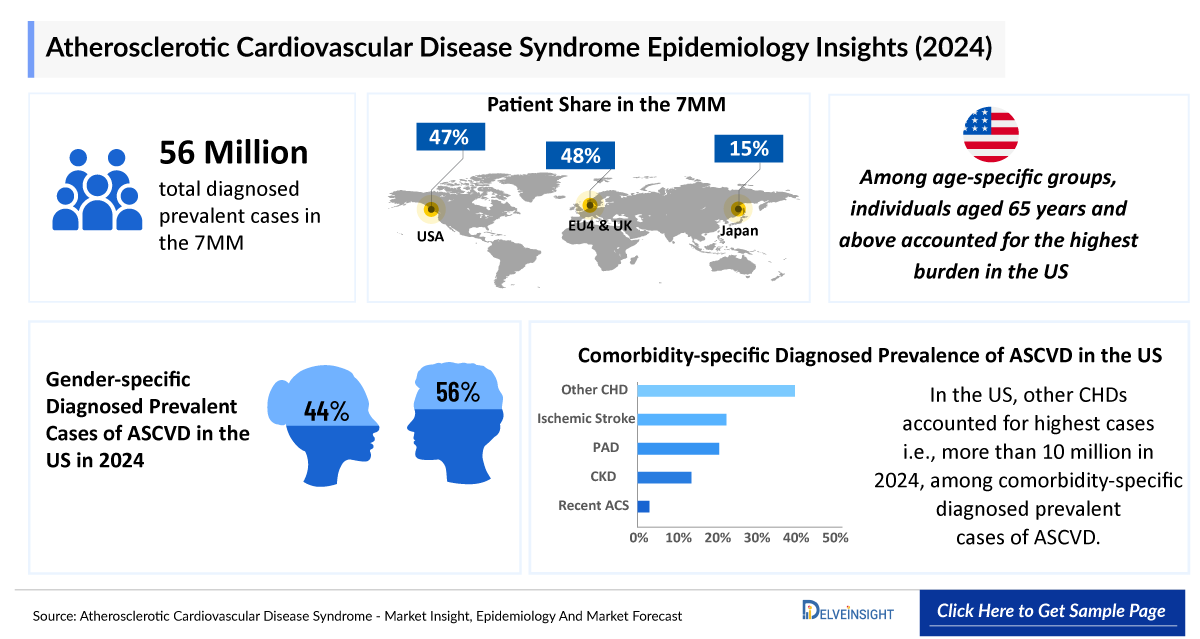

- In 2024, the total diagnosed prevalent cases of ASCVD across the 7MM were approximately 65 million, and this burden is projected to rise over the forecast period.

- The United States accounted for approximately 30 million ASCVD cases in 2024.

- The total market size of ASCVD in the United States was approximately USD 23,000 million in 2024 and is projected to increase during the forecast period (2025–2034).

DelveInsight’s “Atherosclerotic Cardiovascular Disease (ASCVD) – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of ASCVD, historical and forecasted epidemiology, as well as ASCVD market trends in the United States, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan.

ASCVD market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM ASCVD market size from 2020 to 2034. The report also covers current ASCVD treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

ASCVD Epidemiology |

Segmented by:

|

|

ASCVD Key Companies |

|

|

ASCVD Key Therapies |

|

|

ASCVD Market |

Segmented by:

|

|

Analysis |

|

Atherosclerotic Cardiovascular Disease (ASCVD) Understanding and Treatment Algorithm

Atherosclerotic Cardiovascular Disease (ASCVD) Overview

ASCVD is a medical condition characterized by the buildup of fatty deposits (plaques) on the inner walls of arteries. These plaques consist of cholesterol, fatty substances, calcium, and other cellular waste products. Over time, the plaques can harden and narrow the arteries, which reduces blood flow to vital organs and tissues. It is a progressive and chronic condition that can affect various arteries throughout the body, including those supplying the heart (coronary arteries), brain (cerebral arteries), and legs (peripheral arteries). The most common manifestations of ASCVD include Coronary Artery Disease (CAD), cerebrovascular disease (stroke), and Peripheral Arterial Disease (PAD). ASCVD often does not cause symptoms until an artery narrows or blocks. Some common symptoms of ASCVD include angina, shortness of breath, heart attack (myocardial infarction), stroke, PAD, and abdominal pain.

Further details are provided in the final report…

Atherosclerotic Cardiovascular Disease (ASCVD) Diagnosis

The diagnosis of ASCVD combines laboratory testing, genotyping, imaging, and monitoring to guide risk assessment and management. Laboratory tests include traditional lipids (total cholesterol, LDL-C, HDL-C, triglycerides) and nontraditional markers (apoB, hsCRP, Lp(a), Lp-PLA2) to evaluate atherogenic burden and inflammation. Genotyping (APOE, LDLR, APOB, PCSK9, LDLRAP1) helps identify familial hypercholesterolemia or premature coronary disease risk. Monitoring via periodic lipid panels assesses therapy adherence, with targets based on risk category. Imaging tests such as ultrasound, CT, MRI/MRA, and catheterization assesses plaques, stenosis, calcification, and vascular structure.

Further details are provided in the final report…

Atherosclerotic Cardiovascular Disease (ASCVD) Treatment

The management of ASCVD primarily focuses on prevention through lifestyle optimization, including a heart-healthy diet, regular physical activity, and avoidance of tobacco and secondhand smoke. A patient-centered approach assesses individual cardiovascular risk to guide the timely use of pharmacologic therapies, such as statins, PCSK9 inhibitors, antihypertensives, antiplatelets, and diabetes medications, while emphasizing lifestyle goals. For patients with established ASCVD, interventions may include revascularization procedures, thrombolysis, and other targeted therapies to manage acute events. This integrated strategy combines lifestyle modification with pharmacologic and procedural treatments to reduce cardiovascular risk and improve long-term outcomes.

Further details are provided in the final report…

Atherosclerotic Cardiovascular Disease (ASCVD) Epidemiology

The epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of ASCVD, gender-specific diagnosed prevalent cases of ASCVD, age-specific diagnosed prevalent cases of ASCVD, comorbidity-specific diagnosed prevalent cases of ASCVD, and systemic inflammation in ASCVD covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, males accounted for approximately 55% of ASCVD cases in the United States.

- In the United States, systemic inflammation–associated ASCVD cases were estimated at approximately 17 million in 2024.

- In EU4 and the UK, Germany has the highest number of diagnosed prevalent cases of ASCVD, with approximately 8 million cases in 2024.

- Among age-specific groups, individuals aged 65 years and above accounted for the highest burden, with approximately 16 million diagnosed ASCVD cases in the EU4 and the UK in 2024.

- In Japan, among comorbidity-specific ASCVD cases, other CHD represented the largest share of diagnosed prevalent cases at approximately 5 million in 2024, followed by PAD with around 2 million cases.

Atherosclerotic Cardiovascular Disease (ASCVD) Drug Chapters

The drug chapter segment of the ASCVD report encloses a detailed analysis of marketed and emerging late-stage (Phase III) pipeline drugs. It also deep dives into ASCVD pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Therapies

Evolocumab (REPATHA): Amgen

Evolocumab is a human IgG2 monoclonal antibody directed against human PCSK9. The drug has an approximate molecular weight of 144 kDa and is produced in genetically engineered mammalian cells. It binds to PCSK9 and inhibits circulating PCSK9 from binding to the LDL receptor, preventing PCSK9-mediated LDL receptor degradation and permitting the LDL receptor to recycle back to the liver cell surface. By this inhibition, REPATHA increases the number of LDL receptors available to clear LDL from the blood, thereby lowering LDL-C levels, The drug received FDA and EMA approval in 2015 for treatment of HeFH or clinical ASCVD and HoFH, respectively. In Japan, the drug was approved in 2016 for treatment of hypercholesterolemia.

In October 2025, Amgen presented detailed results from the Phase III VESALIUS-CV clinical trial of REPATHA at the 2025 American Heart Association Scientific Sessions and simultaneously published in the New England Journal of Medicine

Alirocumab (PRALUENT): Sanofi/Regeneron Pharmaceuticals

Alirocumab is a fully humanized monoclonal antibody used for individuals with cardiovascular diseases to reduce the risk of heart attack, stroke, and certain types of chest pain conditions. It is also indicated, along with diet and statin therapy, to reduce LDL-C in adults with primary hyperlipidemia, including HeFH and HoFH. Further, it is used for children aged 8 years and older with HeFH to reduce LDL-C levels. The drug was first approved in 2015 by the FDA for adults with HeFH or clinical ASCVD, followed the same year by EMA approval for primary hypercholesterolemia (HeFH and non-familial), and in 2016 by Japan’s Ministry of Health for adults with hypercholesterolemia at high cardiovascular risk.

In August 2025, Novartis announced positive results from V-DIFFERENCE, a Phase IV study evaluating inclisiran compared to placebo, in patients with hypercholesterolemia who have not achieved guideline-recommended low-density LDL-C goals.

|

Marketed Drug Comparison | ||||||

|

Drug |

Developer |

MoA |

RoA |

Molecule Type |

Patient segment |

Approval |

|

Evolocumab (REPATHA) |

Amgen |

PCSK9 inhibitor |

SC |

Human monoclonal antibody |

Primary hyperlipidemia, HeFH, HoFH, myocardial infarction, stroke, unstable angina requiring hospitalization, coronary revascularization. |

US: 2015 |

|

EU: 2015 | ||||||

|

JP: 2016 | ||||||

|

Alirocumab (PRALUENT) |

Sanofi/ Regeneron Pharmaceuticals |

PCSK9 inhibitor |

SC |

IgG monoclonal antibody |

Adults with HeFH or clinical ASCVD who require additional lowering of LDL-C. |

US: 2021 |

|

Adults with established cardiovascular disease. |

US: 2019 | |||||

|

Adults patients with HoFH |

US: 2021 | |||||

|

Pediatric patients aged 8 and older with HeFH. |

US: 2024 | |||||

|

Patients with primary hypercholesterolemia (HeFH and nonfamilial). |

EU: 2015 | |||||

|

Adults with established ASCVD by lowering LDL-C levels as an adjunct to the correction of other risk factors. |

EU: 2019 | |||||

|

Adults patients with hypercholesterolemia at high cardiovascular risk. |

JP: 2016 | |||||

Emerging Therapies

Obicetrapib (TA-8995): NewAmsterdam Pharma/Menarini

Obicetrapib is an investigational, highly selective Cholesteryl Ester Transfer Protein (CETP) inhibitor developed by NewAmsterdam Pharma for lowering LDL-C in patients with ASCVD and HeFH. It works by inhibiting CETP, which reduces LDL-C by increasing LDL receptor expression and clearance. In preclinical studies, inhibiting CETP with obicetrapib reduced LDL-C levels by decreasing hepatic cholesterol, which led to an upregulation of LDL receptor expression and increased LDL clearance. The drug is currently being evaluated in Phase III clinical trial.

- In August 2025, NewAmsterdam Pharma announced that the EMA has validated the Marketing Authorization Application for obicetrapib 10 mg monotherapy and 10 mg obicetrapib plus 10 mg ezetimibe fixed-dose combination for patients with primary hypercholesterolemia, both heterozygous familial and non-familial or mixed dyslipidemia.

- In May 2025, NewAmsterdam Pharma presented additional data from the BROADWAY and TANDEM pivotal Phase III studies as late-breaking oral presentations at the European Atherosclerosis Society Congress (EAS) 2025 and simultaneously published in The New England Journal of Medicine (BROADWAY) and The Lancet (TANDEM).

Olpasiran (AMG 890): Amgen/Arrowhead Pharmaceuticals

Olpasiran is an investigational siRNA therapy developed by Amgen to reduce elevated Lp(a) levels in adults with ASCVD. It functions by reducing Lp(a) production in liver cells through RNA interference, specifically inhibiting Lp(a) expression. Currently, the drug is being evaluated in Phase III clinical trial.

- In November 2020, the FDA has granted Fast Tract Designation to olpasiran for elevated Lp(a).

- In August 2023, Amgen presented data from the final analysis of the Phase II OCEAN(a)-DOSE study of olpasiran during the Late-Breaking Science Session at the European Society of Cardiology (ESC) 2023 Annual Meeting.

|

Comparison of Emerging Drugs Under Development | ||||||

|

Drug Name |

Company |

Indication |

Highest Phase |

Molecule type |

ROA |

MOA |

|

Olpasiran (AMG 890) |

Amgen/Arrowhead Pharmaceuticals |

ASCVD, CVD |

III |

siRNA |

SC |

mRNA degradation |

|

Obicetrapib (TA-8995) |

NewAmsterdam Pharma and Menarini Group |

ASCVD, hypercholesterolemia |

III |

Small molecule |

Oral |

CETP inhibitor |

|

Apabetalone (RVX000222) |

Resverlogix |

Atherosclerosi, CAD |

III |

Small molecule |

Oral |

BET inhibitor |

|

Pelacarsen (TQJ230) |

Ionis Pharmaceuticals/ Novartis |

Elevated Lp(a), ASCVD |

III |

ASO |

SC |

mRNA degradation |

Drug Class Insights

The current treatment landscape for ASCVD focuses on a combination of supportive care, such as lifestyle management, risk factor control, and symptom relief, with pharmacological therapies targeting cholesterol, blood pressure, and inflammation. Established agents include statins, PCSK9 inhibitors, Factor Xa inhibitors, ANGPTL3 inhibitors, anticoagulant, P2Y12 receptor antagonist, and others, while emerging therapies aim to further reduce residual risk and improve cardiovascular outcomes.

Proprotein Convertase Subtilisin/Kexin, Type 9 (PCSK9) inhibitors

PCSK9 inhibitors are a class of targeted biologic therapies that significantly lower LDL cholesterol by blocking the PCSK9 protein, which normally promotes the degradation of LDL receptors in the liver. By inhibiting PCSK9, these drugs increase the number of LDL receptors available to clear LDL-C from the bloodstream, leading to substantial reductions in LDL-C levels. PCSK9 inhibitors, such as alirocumab and evolocumab, are typically used in patients with familial hypercholesterolemia or those at high cardiovascular risk who do not achieve adequate LDL-C reduction with statins alone. They have been shown to reduce the risk of major cardiovascular events with a generally favorable safety profile.

Atherosclerotic Cardiovascular Disease (ASCVD) Market Outlook

The ASCVD treatment landscape is dominated by LDL-C–lowering therapies supplemented by lipid-lowering, antiplatelet, anti-inflammatory, and anticoagulant agents targeting both primary and secondary prevention. Beyond lipid-lowering drugs, several antithrombotic and inflammation-modulating therapies form an essential part of the ASCVD treatment landscape across the 7MM. AstraZeneca’s ticagrelor (BRILINTA), approved in the US and EU in 2011, is indicated for patients with ACS and those with a history of myocardial infraction, targeting secondary prevention by reducing recurrent ischemic events. An emerging anti-inflammatory strategy is represented by LODOCO (low-dose colchicine 0.5 mg), approved in markets such as the US (2023), and increasingly adopted in the EU; it targets adults with established ASCVD to reduce major cardiovascular events by targeting vascular inflammation rather than cholesterol.

PCSK9 inhibitors remain central to high-risk ASCVD management. Amgen’s evolocumab (REPATHA) and Sanofi/Regeneron’s alirocumab (PRALUENT), both monoclonal antibodies that directly block circulating PCSK9 protein. In contrast to the PCSK9 monoclonal antibodies (mAbs), Novartis’ inclisiran (LEQVIO), a first in class siRNA has charted a different trajectory. Inclisiran was first approved in the EU in late 2020.

While marketed therapies have cemented PCSK9 inhibition as a powerful intervention, uptake challenges have left room for innovation. This gap is now fueling a new wave of competition with oral, long-acting, and gene-editing approaches. Currently, there are several Phase III candidates, obicetrapib, MK-0616, lerodalcibep, olpasiran, and others, are advancing in development, targeting reductions in LDL-C, elevated Lp(a), and overall ASCVD risk across the 7MM.

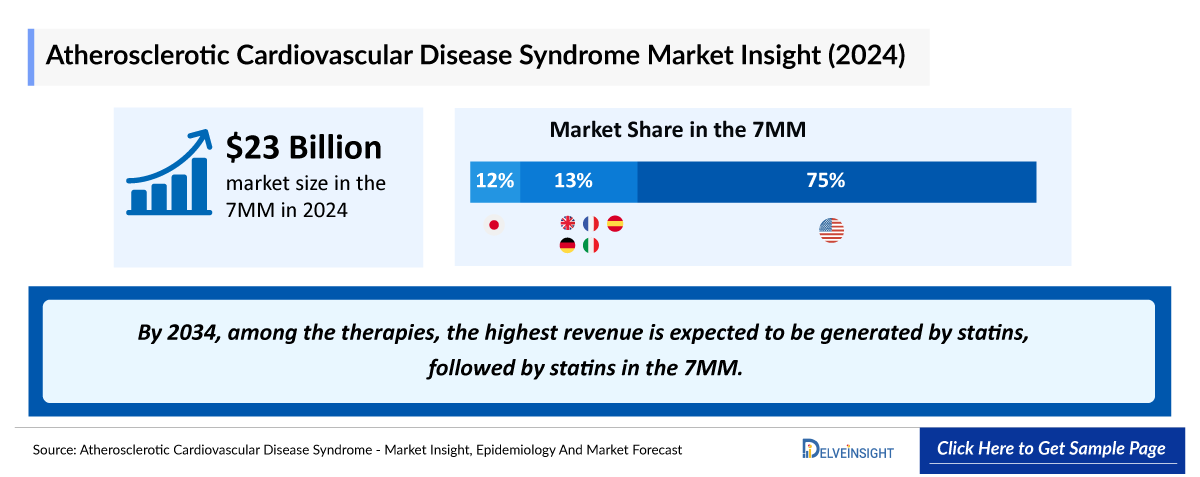

- The total market size of ASCVD in the 7MM was approximately USD 23,000 million in 2024 and is projected to increase during the forecast period (2025–2034).

- As per DelveInsight’s analysis, by 2034, among the therapies, the highest revenue is expected to be generated by statins, followed by statins in the 7MM.

- Throughout the 7MM, the US captured the maximum ASCVD market share in 2024 with about USD 17,200 million.

- Among EU4 and the UK, Germany is expected to capture the maximum market share, followed by Italy and the UK by 2034.

Atherosclerotic Cardiovascular Disease (ASCVD) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies' drug uptake in the report…

Atherosclerotic Cardiovascular Disease (ASCVD) Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase III, II, and I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for ASCVD emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including MDs, PhD, Senior Researchers, and others.

|

KOL Views |

|

“Among high-risk patients with ASCVD, fewer than 50% remain on statin therapy after the first year or receive statins at the intensity recommended by clinical guidelines. Further, many high-risk patients with ASCVD require additional nonstatin Lipid-lowering Therapies (LLTs) such as ezetimibe, bempedoic acid, and PCSK9i to achieve LDL-C targets. However, clinical practice surveys show that therapies are also significantly underutilized.” ̶ Researcher, Jacksonville Center for Clinical Research, US |

|

“ASCVD stands as the primary cause of disability in the Western world. Surprisingly, the awareness among patients, clinicians, and the government about the importance of risk factors in contributing to ASCVD remains low, despite their high prevalence.” – MS, Cardiovascular Prevention Institute, France |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of ASCVD, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborate profiles of late-stage and prominent therapies, will impact the current treatment landscape.

- A detailed review of the ASCVD market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM ASCVD.

Atherosclerotic Cardiovascular Disease (ASCVD) Report Insights

- Patient Population

- Therapeutic Approaches

- ASCVD Pipeline Analysis

- ASCVD Market Size And Trends

- Existing And Future Market Opportunities

Atherosclerotic Cardiovascular Disease (ASCVD) Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- ASCVD Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Atherosclerotic Cardiovascular Disease (ASCVD) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Analyst Views

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted ASCVD patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the total ASCVD market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for treating ASCVD?

- How many companies are developing therapies to treat ASCVD?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios.

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the ASCVD Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-market.png&w=256&q=75)