Cerebral Palsy Market

- The Cerebral Palsy market size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- According to DelveInsight’s estimates, in 2023, there were approximately 1.8 million diagnosed cases of cerebral palsy in the 7MM. Of these, the US accounted for 53% of the cases, while EU4 and the UK represented 35% and Japan represented 12% of the cases, respectively.

- The cerebral palsy market is set for steady growth, with a robust compound annual growth rate (CAGR) anticipated from 2024 to 2034. This expansion in the 7MM is driven by the introduction of innovative therapies such as MYOBLOC, and UDI-001, among others, along with advancements in genetic testing and diagnostic techniques.

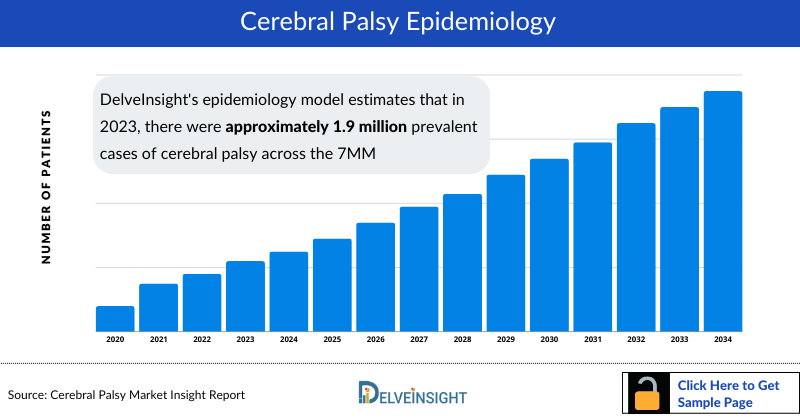

- According to DelveInsight’s analysis, the prevalence of cerebral palsy is projected to increase at a compound annual growth rate (CAGR) of around 3% from 2024 to 2034.

- Though therapies like DYSPORT and BOTOX can manage symptoms, there is no cure for cerebral palsy. Early intervention improves outcomes, allowing many children to lead near-normal lives. A tailored approach by a healthcare team, based on individual needs, is essential for enhancing quality of life.

- Cerebral palsy manifests with considerable variability in diagnosis, impairments, and severity, leading to diverse symptom profiles and co-morbid conditions in affected children. This diversity underscores the need for personalized management approaches.

- Leading Cerebral Palsy companies like Ipsen, Medtronic, and AbbVie are driving innovation in therapies and assistive technologies for patients.

DelveInsight’s “Cerebral Palsy Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of cerebral palsy, historical and forecasted epidemiology, as well as the cerebral palsy therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The cerebral palsy market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM cerebral palsy market size from 2020 to 2034. The report also covers cerebral palsy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Cerebral Palsy Market |

|

|

Cerebral Palsys Market Size | |

|

Cerebral Palsy Companies |

Ipsen, Abbvie, Supernus Pharmaceuticals, Rohto Pharmaceutical, and others |

|

Cerebral Palsy Epidemiology Segmentation |

|

Cerebral Palsy Treatment Market

Cerebral palsy overview

Cerebral palsy is a group of disorders that impact movement, muscle tone, or posture due to brain damage that typically occurs during early brain development, most often before birth. It affects motor function, leading to difficulties with both voluntary and involuntary movements, which may result in jerky or floppy motions.

Most children with cerebral palsy are born with it (congenital cerebral palsy), while a smaller number develop it later (acquired cerebral palsy). Acquired cerebral palsy can result from brain damage during the first few months or years of life, caused by brain infections like bacterial meningitis or viral encephalitis, blood flow issues, or head injuries from accidents or abuse.

The type and severity of cerebral palsy depend on the nature and location of the brain abnormalities. The different forms include spastic, dyskinetic, ataxic, and mixed cerebral palsy.

As the most common motor disability in childhood, several risk factors such as low birth weight, premature birth, infections during pregnancy, or exposure to toxic substances can increase the likelihood of a baby being born with cerebral palsy.

Cerebral palsy typically results in impaired movement, abnormal reflexes, floppiness or stiffness in the limbs and trunk, involuntary movements, and unsteady walking. Symptoms can vary widely; some individuals may have mild challenges, such as walking awkwardly, while others may require assistive devices or long-term care. While cerebral palsy does not worsen over time, its symptoms may change as a person ages.

Cerebral palsy diagnosis

Most children with cerebral palsy are diagnosed within the first two years of life. Since there is no straightforward test for cerebral palsy, doctors typically conduct multiple assessments to evaluate the child's motor skills. These assessments often include imaging tests such as cranial ultrasounds, CT scans, electroencephalograms (EEGs), and MRIs.

During routine check-ups, doctors closely monitor the child's development, growth, muscle tone, motor control, hearing, vision, posture, and coordination to rule out other conditions that may present similar symptoms.

Further details related to country-based variations are provided in the report…

Cerebral palsy treatment

There is no universal therapy for cerebral palsy, as treatment plans are tailored to each individual. These programs may include physical and behavioral therapy, medications, surgical interventions, mechanical aids, and management of associated medical conditions. Ongoing Cerebral Palsy clinical trials aim to explore innovative therapies and improve treatment outcomes for patients with motor disabilities.

Common medications used to manage cerebral palsy include anticholinergics, anticonvulsants, antidepressants, antispastics, anti-inflammatories, and stool softeners. Antispastics like botulinum toxin (BT-A) are frequently used to treat overactive muscles in children with spastic movements. Intrathecal baclofen therapy, which involves an implantable pump delivering baclofen (a muscle relaxant) to the spinal cord fluid, is often recommended for individuals with chronic, severe stiffness or uncontrollable muscle movements.

In cases of significant mobility or muscle function challenges, surgery may be advised to improve or correct movement issues in the legs, ankles, feet, hips, wrists, and arms.

Cerebral Palsy Epidemiology

As the market is derived using a patient-based model, the cerebral palsy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases of cerebral palsy, total diagnosed cases of cerebral palsy, and total type-specific cases of cerebral palsy in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- DelveInsight's epidemiology model estimates that in 2023, there were approximately 1.9 million prevalent cases of cerebral palsy across the 7MM, with around 1.8 million diagnosed cases. This number is anticipated to rise throughout the study period (2020–2034).

- In 2023, the US had the highest number of diagnosed cerebral palsy cases among the 7MM, with nearly 932 thousand cases, representing approximately 53% of the total cases in these regions.

- In 2023, the UK had the highest number of diagnosed cerebral palsy cases among EU4 and the UK, with approximately 142 thousand cases, followed by Germany with nearly 134 thousand cases. Italy had the lowest number of diagnosed cases, with nearly 105 thousand.

- In 2023, Japan reported approximately 221 thousand cases of cerebral palsy, with numbers expected to change by 2034.

- In 2023, the distribution of type-specific cerebral palsy cases in the US included approximately 755 thousand cases of spastic, 26 thousand cases of dyskinetic, 24 thousand cases of ataxic, 26 thousand cases of hypotonic, and nearly 151 thousand cases of other/mixed types. These numbers are projected to rise throughout the study period.

Cerebral Palsy Country-Wise Analysis

Cerebral Palsy country wise analysis reveals significant disparities in diagnosis, treatment access, and support services. Variations in Cerebral Palsy prevalence across regions highlight the impact of healthcare infrastructure and early intervention programs. Understanding these differences is crucial for developing targeted policies to improve outcomes for affected individuals worldwide.

Cerebral Palsy Recent Developments

- In May 2025, Neuralink announced that it has received the FDA's "breakthrough" designation for its device aimed at restoring communication for individuals with severe speech impairment. The device, designed to assist patients with conditions like amyotrophic lateral sclerosis (ALS), stroke, spinal cord injury, cerebral palsy, and multiple sclerosis, represents a significant step forward in neurotechnology.

Cerebral Palsy Drug Chapters

The drug chapter segment of the cerebral palsy report encloses a detailed analysis of cerebral palsy-marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand cerebral palsy clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases. The Cerebral Palsy drugs market is evolving rapidly, driven by rising awareness, treatment advancements, and growing global healthcare investments.

Cerebral Palsy Marketed Drugs

DYSPORT (abobotulinumtoxin A): Ipsen

DYSPORT is an injectable botulinum neurotoxin type A product derived from Clostridium bacteria. It works by inhibiting nerve impulse transmission, thereby reducing muscle contractions. The product is provided as a lyophilized powder.

In the US, DYSPORT is approved for treating upper and lower limb spasticity in pediatric patients aged 2 years and older, including those with spasticity due to cerebral palsy. In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) has approved DYSPORT for the symptomatic treatment of focal spasticity in the upper limbs of pediatric patients with cerebral palsy, also aged 2 years and older.

Botox (Onabotulinum toxin A): Abbvie (Allergan)

OnabotulinumtoxinA is a purified botulinum toxin type A, derived from the Hall strain of Clostridium botulinum type A. It is produced through fermentation, dialysis, and acid precipitation, forming a complex of neurotoxin and accessory proteins. This complex is then dissolved in a sterile sodium chloride solution with Albumin Human, filtered, and vacuum-dried.

In July 2020, the US FDA approved a supplemental Biologics License Application (sBLA) for BOTOX to treat spasticity in pediatric patients aged 2 years and older, including those with lower limb spasticity from cerebral palsy

|

Drug |

MoA |

RoA |

Company |

|

DYSPORT (abobotulinumtoxin A) |

Acetylcholine Inhibitor |

IM |

Ipsen |

|

Botox (Onabotulinum toxin A) |

Acetylcholine Inhibitor |

IM |

Abbvie (Allergan) |

Note: Further marketed drugs and their details will be provided in the report...

Cerebral Palsy Emerging Drugs

MYOBLOC (RimabotulinumtoxinB): Supernus Pharmaceuticals

RimabotulinumtoxinB (MYOBLOC), a botulinum toxin type B, is derived from the bacteria that causes botulism. It inhibits acetylcholine release, reducing muscle activity temporarily. MYOBLOC works by blocking cholinergic transmission at neuromuscular and salivary junctions through a series of steps: binding to nerve terminals, internalizing, translocating its light chain into the nerve’s cytosol, and cleaving synaptic Vesicle Associated Membrane Protein (VAMP), essential for acetylcholine release.

MYOBLOC is approved for cervical dystonia and chronic sialorrhea and is being investigated in Phase II/III trials for spasticity due to cerebral palsy.

UDI-001: Rohto Pharmaceutical

UDI-001, developed by Rohto Pharmaceuticals, is a novel candidate for treating neurological disorders such as cerebral palsy. It utilizes umbilical cord-derived mesenchymal stromal cells (UC-MSCs), which are noted for their strong anti-inflammatory effects and low cancer risk. While the precise mechanisms of action are not fully understood, UC-MSCs are being explored globally for various therapeutic uses. Additionally, human adipose-derived mesenchymal stem cells (hAd-MSCs) have shown potential for differentiating into multiple cell types, including adipocytes, myocytes, chondrocytes, and osteocytes.

|

Drug |

MoA |

RoA |

Company |

Phase |

|

MYOBLOC (RimabotulinumtoxinB) |

Acetylcholine inhibitor |

IM |

Supernus Pharmaceuticals |

II/III |

|

UDI-001 |

Cell replacements |

IV |

Rohto Pharmaceutical |

I/II |

|

XX |

XX |

XXX |

XX |

X |

Note: Further emerging therapies and their detailed assessment will be provided in the final report...

Drug Class Insights

The current treatment landscape of cerebral palsy involves both pharmacological and surgical therapies. Pharmacological therapies play a crucial role in managing muscle pain and stiffness in pediatric patients with cerebral palsy. Options include oral medications and baclofen pumps, which are implanted under the skin. Surgical interventions can correct common issues such as dislocated hips and scoliosis, while leg braces assist with mobility. A diet rich in calcium, vitamin D, and phosphorus can further enhance bone health.

Medications target both primary symptoms and secondary complications of cerebral palsy. For instance, drugs like Botox and Baclofen are essential for controlling spasticity, while anticholinergics manage tremors and drooling, and anticonvulsants help prevent seizures. Antidepressants can address depression and anxiety, and muscle relaxants are commonly used to manage spasticity, improve range of motion, and delay the need for surgery. Anti-inflammatory drugs reduce pain, particularly in cases linked to hypoxic-ischemic encephalopathy. For constipation, stool softeners and laxatives can be effective when dietary changes are insufficient.

Dysport is an injectable form of a botulinum neurotoxin type A product, which is a substance derived from Clostridium bacteria producing botulinum toxin type A (BoNT-A) that inhibits the effective transmission of nerve impulses and thereby reduces muscular contractions. It is supplied as a lyophilized powder.

Continued in report...

Cerebral Palsy Market Outlook

Cerebral palsy has no cure, but therapies and resources can help children reach their full potential. Early intervention with movement, learning, speech, and emotional therapies is crucial. Medications, such as Baclofen and Botox, address muscle pain and spasticity. Surgical options can correct dislocated hips and scoliosis, while leg braces aid walking. A diet rich in calcium, vitamin D, and phosphorus supports bone health.

Treatment aims to improve quality of life, enhance independence, and prepare patients for daily life. Medications manage both primary symptoms and secondary issues, with options including anticholinergics for tremors, anticonvulsants for seizures, antidepressants for mood disorders, and muscle relaxants to reduce spasticity and prevent deformities.

Currently, there is no cure for cerebral palsy, but various therapies can significantly improve a child's development and quality of life. Early diagnosis allows for the initiation of therapies to address movement, learning, speech, and emotional development. Pharmacological treatments, such as Baclofen and Botox, manage muscle pain and spasticity, while surgeries and leg braces address physical issues like dislocated hips and scoliosis. A diet rich in calcium, vitamin D, and phosphorus supports bone health.

Medications target both primary symptoms and secondary issues. Muscle relaxants, anticholinergics, anticonvulsants, and antidepressants help manage spasticity, tremors, seizures, and depression. Non-pharmacological treatments, including physical and speech therapies, also play a crucial role. Emerging therapies like stem cell treatment offer new hope by potentially replacing damaged brain cells.

Despite advances, cerebral palsy remains challenging to manage due to diagnostic difficulties and the absence of a cure. However, ongoing research and clinical trials by companies such as Rohto Pharmaceutical, and Supernus Pharmaceuticals, among others are exploring new treatment options, bringing hope for improved management of the condition.

Continued in report...

Cerebral Palsy Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report...

Cerebral Palsy Pipeline Development Activities

The report provides insights into different Cerebral Palsy clincial trials within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for cerebral palsy.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on cerebral palsy evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the Department of Pediatric and Adolescent Medicine in the US, Université de Bretagne Occidentale in France, University Hospitals Bristol in the UK, South West AHSN PReCePT Clinical Lead in the UK, and Kyushu University Hospital in Japan, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or cerebral palsy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, the fact that there is no cure for cerebral palsy has persuaded science and technology to a newer side where the researchers are working on stem cell transplant technology to cure the disease. However, it would be too early to say anything on this, but the upcoming data might prove to be beneficial in such cases

As per the KOLs from Germany, preclinical research has recently proven effective, and a pharmaceutical product generated from the patient's own (autologous) cord blood has been produced to heal brain injury in infants and children, thereby averting cerebral palsy. The European Medicines Agency (EMA) has also recognized this medicinal breakthrough, and the European Commission has granted Orphan Medicinal Product Designation for the treatment of brain damage in preterm and term newborns.

As per the KOLs from Japan, The Japan Obstetric Compensation System for cerebral palsy (JOCS-CP) was launched in 2009 to help families with monetary compensation when cerebral palsy cases were detected. The program was launched after the country faced deteriorating perinatal care and low birthrate.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement for BOTOX

- One of the most common symptoms of cerebral palsy is muscle stiffness and spastic movements. Children living with cerebral palsy often struggle with their unpredictable, spastic movements and may even experience pain with them. There are many different treatment options but no cure for the muscle difficulties of cerebral palsy.

- Botulinum toxin A, often referred to as Botox presents a temporary treatment option via injectable therapy to reduce muscle spasticity.

- The BOTOX Savings Program could assist patients with out-of-pocket costs not covered by insurance. Some patients may pay as little as USD 0 per treatment.

- For many patients with commercial insurance, the average out-of-pocket cost for BOTOX is USD 163 per 12-week treatment. Additional costs for the procedure may apply, varying by healthcare provider and insurance coverage.

- Eligible patients with private or commercial insurance may receive reimbursement for out-of-pocket treatment costs not covered by insurance, up to USD 1,000 per treatment and USD 5,000 per year.

The BOTOX Savings Program helps eligible patients receive money back on any out-of-pocket costs not covered by insurance.

Program Terms, Conditions, and Eligibility Criteria:

- Offer applies only with a valid prescription for BOTOX (onabotulinumtoxinA).

- Reimbursement may be up to USD 1,300 for the first treatment in a year and USD 1,000 for each subsequent treatment, with a maximum annual savings limit of USD 4,000; patient out-of-pocket expenses may vary.

- Offer excludes:

- Patients enrolled in Medicare, Medicaid, TRICARE, or other government healthcare programs, or private indemnity or HMO insurance plans that cover the entire cost of prescription drugs.

- Medicare-eligible patients with employer-sponsored health plans or retiree prescription benefits.

Cash-paying patients.

- Valid for up to 5 treatments within 12 months.

- Applies only to BOTOX and related treatment costs not covered by insurance. In Massachusetts and Rhode Island, the offer covers only the cost of BOTOX.

- Claims must be submitted within 180 days of treatment, including an Explanation of Benefits (EOB), a Specialty Pharmacy receipt for BOTOX, or other documentation of payment for out-of-pocket costs.

- A BOTOX Savings Program check will be issued upon claim approval.

- AbbVie reserves the right to amend or rescind the offer without notice.

- Valid only in the USA, including Puerto Rico, at participating retail locations.

- Void where prohibited by law, taxed, or restricted.

- Offer does not constitute health insurance. The maximum annual benefit available under the copay assistance program is USD 4,000 per calendar year, subject to terms and conditions.

Abbvie also provides patient assistance through the myAbbvieAssist program to help patients access BOTOX.

Further details will be provided in the report...

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Cerebral Palsy Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of cerebral palsy, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the cerebral palsy market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM cerebral palsy market.

Cerebral palsy Market Report Insights

- Cerebral Palsy Patient Population

- Cerebral Palsy Therapeutic Approaches

- Cerebral Palsy Pipeline Analysis

- Cerebral Palsy Market Size and Trends

- Existing and Future Market Opportunity

- Cerebral palsy Drugs Market

Cerebral palsy Market Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Cerebral Palsy Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Cerebral Palsy Drugs Uptake

- Key Cerebral Palsy Market Forecast Assumptions

Cerebral palsy Market Report Assessment

- Current Cerebral Palsy Treatment Practices

- Cerebral Palsy Unmet Needs

- Cerebral Palsy Pipeline Product Profiles

- Cerebral Palsy Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

- Cerebral Palsy Market Drivers

- Cerebral Palsy Market Barriers

Key Questions Answered In The Cerebral Palsy Market Report:

Cerebral Palsy Market Insights

- What was the total market size of cerebral palsy, the market size of cerebral palsy by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will UDI-001 affect the treatment paradigm of cerebral palsy?

- How will DYSPORT (abobotulinumtoxin A) compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Cerebral Palsy Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of cerebral palsy? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to cerebral palsy?

- What is the historical and forecasted cerebral palsy patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent cerebral palsy population during the forecast period (2024–2034)?

- What factors are contributing to the growth of cerebral palsy cases?

Current Cerebral Palsy Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of cerebral palsy? What are the current clinical and treatment guidelines for treating cerebral palsy?

- How many companies are developing therapies for the treatment of cerebral palsy?

- How many emerging therapies are in the mid-stage and late stage of development for treating cerebral palsy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of cerebral palsy?

Reasons to Buy Cerebral Palsy Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the cerebral palsy market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for cerebral palsy, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy