Chronic Kidney Disease Market

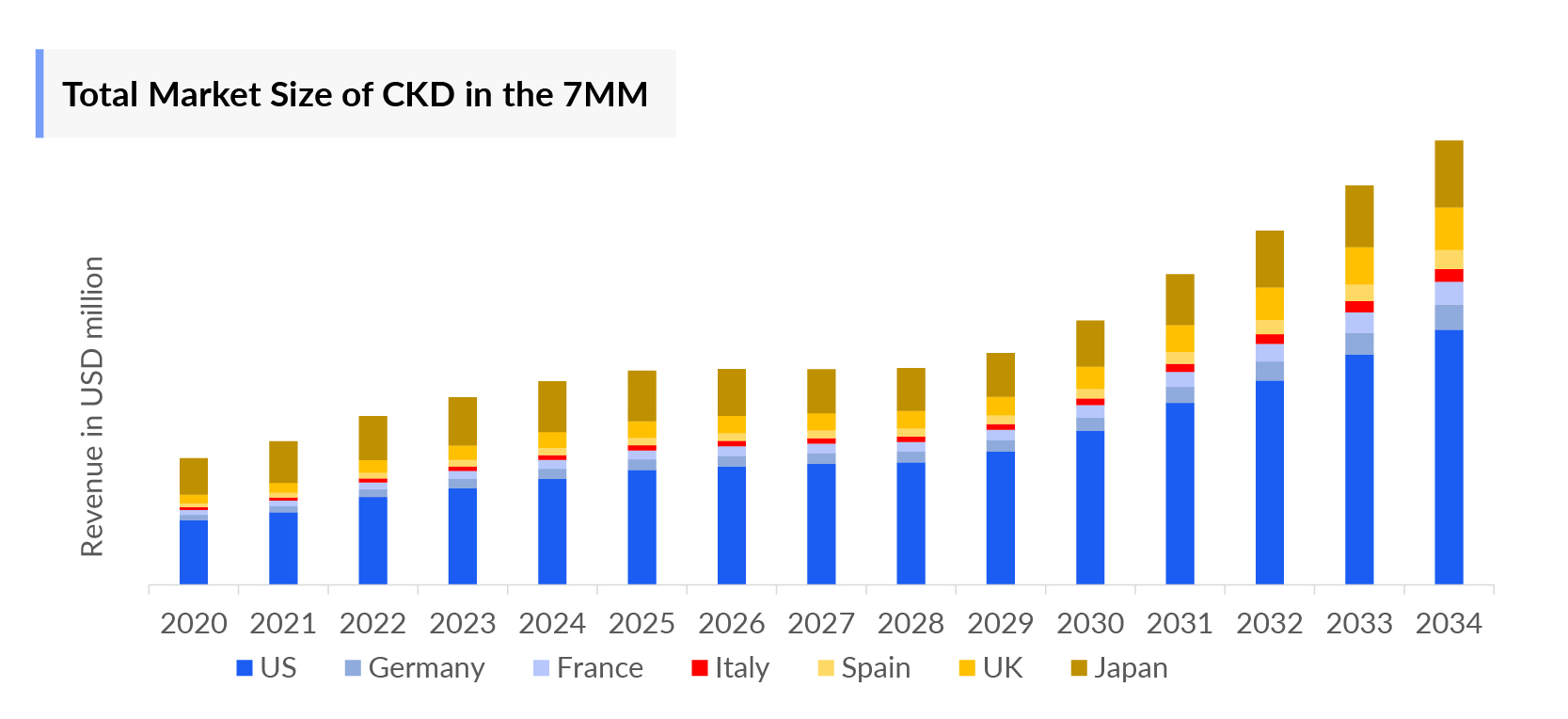

- The Chronic Kidney Disease Therapeutics Market Size in the US was ~USD 2,824 million in 2023, which is further anticipated to increase during the forecast period.

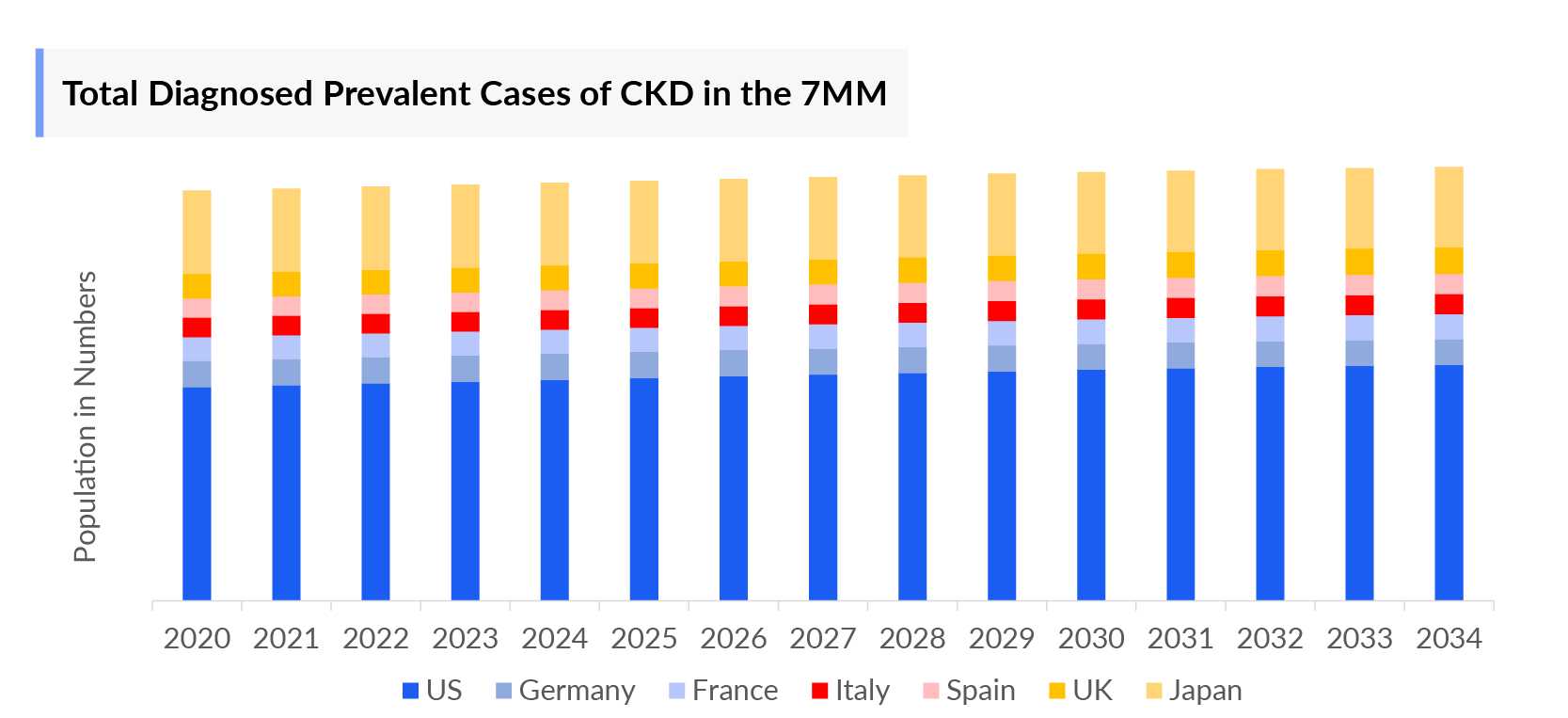

- In 2023, the Chronic Kidney Disease Prevalence was highest in the US among the 7MM, accounting for nearly 40 million cases which is further expected to increase by 2034.

- In the United States, in 2023, ~2 million males and ~3 million females were affected with Chronic Kidney Disease.

- The current Chronic Kidney Disease Market includes erythropoietin stimulating agents (ESA), angiotensin-converting-enzyme inhibitors, angiotensin receptor blockers (ACE-I and ARBs), antidiabetics, secondary hyperparathyroidism treatment (SHPT), and urate-lowering therapies, making up a market size of USD 5,479 million in the 7MM in 2023. The market size is expected to increase with the projected launch of emerging therapies during the forecast period (2024–2034).

- In March 2023, Boehringer Ingelheim posted promising 14-week Phase II data for BI-690517, a novel selective aldosterone synthase inhibitor (ASI). The results showed a significant reduction of albuminuria, a marker of kidney damage, by up to 39.5% when BI 690517 was given on top of empagliflozin, a sodium glucose cotransporter (SGLT2) inhibitor, versus placebo. This is the first clinical trial testing this novel treatment class on top of the standard of care, including empagliflozin, in people with Chronic Kidney Disease. The findings were presented as a high-impact clinical trial at the American Society of Nephrology (ASN)’s Kidney Week 2023.

- The Chronic Kidney Disease (CKD) Market Size in Japan was USD 1,402 million in 2023, which is expected to rise at a significant CAGR by 2034.

DelveInsight’s “Chronic Kidney Disease Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the Chronic Kidney Disease, historical and forecasted epidemiology as well as the Chronic Kidney Disease therapeutics market trends in the United States, EU4 and the UK (Germany, France, Italy, Spain), and the United Kingdom, and Japan.

The Chronic Kidney Disease Treatment Market Report provides current treatment practices, emerging Chronic Kidney Disease therapies, market share of the individual therapies, current and forecasted 7MM Chronic Kidney Disease market size from 2020 to 2034. The Chronic Kidney Disease therapeutics market Report also covers current Chronic Kidney Disease treatment market practices, market drivers, market barriers, SWOT analysis, reimbursement and market access, and Chronic Kidney Disease unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Chronic Kidney Disease Drugs Market |

|

|

Chronic Kidney Disease Market Size | |

|

Chronic Kidney Disease Companies |

|

Key Factors Driving the Chronic Kidney Disease Market

Rising CKD Prevalence

As per DelveInsight analysis, in 2024, there were approximately 82 million prevalent and nearly 14.5 million total diagnosed prevalent cases of CKD in the 7MM. These cases are projected to increase further during the forecast period (2025-2034), due to the increasing geriatric population.

Potential for Label Expansion

Current therapies for CKD have the potential for label expansion, enhancing efficacy, and driving significant market growth, as emerging evidence supports broader indications and improved outcomes in diverse patient populations.

Advancements in Biomarkers

Advancements in biomarkers such as KIM-1 and NGAL enable earlier and more precise detection of CKD compared to traditional methods, enhancing the potential for timely intervention and improved patient outcomes.

CKD Competitive Landscape

The expected launch of emerging therapies, such as Novo Nordisk’s (Ziltivekimab), AstraZeneca’s (Zibotentan/Dapagliflozin and Baxdrostat/dapagliflozin), Boehringer Ingelheim (Vicadrostat + Empagliflozin), Mineralys Therapeutics (Lorundrostat), ProKidney’s (Rilparencel), and others, are expected to create a positive impact on the market.

Chronic Kidney Disease Understanding & Algorithm

Chronic Kidney Disease is a long-term condition characterized by a gradual loss of kidney function over time. It is commonly caused by diabetes and hypertension, which damage the blood vessels in the kidneys. Symptoms often include fatigue, swelling, and changes in urination. CKD progresses through five stages, from mild damage (stage 1) to kidney failure (stage 5), also known as end-stage renal disease (ESRD). Early detection through blood and urine tests is crucial for managing the disease.

Chronic Kidney Disease Diagnosis

Chronic Kidney Disease is often diagnosed through a combination of blood tests, urine tests, and imaging studies. The primary blood test used is the glomerular filtration rate (GFR), which measures how well the kidneys are filtering waste from the blood. A GFR below 60 mL/min/1.73 m² for three months or more indicates CKD. Urine tests, such as albumin-to-creatinine ratio (ACR), check for the presence of protein in the urine, which can be an early sign of kidney damage. Imaging studies, including ultrasound or CT scans, are used to visualize the kidneys and detect abnormalities in size, shape, and structure.

Additionally, a thorough medical history and physical examination are crucial. Physicians look for risk factors like diabetes, hypertension, and a family history of kidney disease. Blood pressure measurements and a comprehensive metabolic panel can provide further insights. In some cases, a kidney biopsy may be performed to determine the exact cause of kidney damage. Early diagnosis and monitoring are essential for managing CKD, preventing progression, and reducing complications. Regular follow-ups and appropriate interventions, including lifestyle changes and medications, are vital to improving patient outcomes.

Further details related to diagnosis are provided in the chronic kidney disease drugs market report…

Chronic Kidney Disease Treatment

Chronic Kidney Disease treatment aims to manage symptoms, slow progression, and reduce complications. It typically includes lifestyle changes such as a balanced diet low in sodium, regular exercise, and cessation of smoking. Medications may be prescribed to control blood pressure, blood sugar, and cholesterol. Angiotensin-converting enzyme (ACE) inhibitors or angiotensin II receptor blockers (ARBs) are often used to protect kidney function. For advanced CKD, dialysis or kidney transplantation may be necessary. Regular monitoring and early intervention are crucial to managing CKD effectively. Collaborative care involving nephrologists, dietitians, and primary care providers enhances treatment outcomes.

Further details related to treatment are provided in the chronic kidney disease therapies report…

Chronic Kidney Disease Epidemiology

As the Chronic Kidney Disease market is derived using a patient-based model, the Chronic Kidney Disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by, Total Prevalent Cases of Chronic Kidney Disease, Total Diagnosed Prevalent Cases of Chronic Kidney Disease, Gender-specific Diagnosed Prevalent Cases of Chronic Kidney Disease, Age-specific Diagnosed Prevalent cases of Chronic Kidney Disease, Complication-specific Prevalent Cases of Chronic Kidney Disease, Severity-specific Diagnosed Prevalent cases of Chronic Kidney Disease, and Etiology-specific Diagnosed Prevalent cases of Chronic Kidney Disease in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- In the assessment done by DelveInsight, the estimated total diagnosed prevalent cases of Chronic Kidney Disease in the 7MM were nearly 16 million in 2023.

- The highest total diagnosed prevalent cases of Chronic Kidney Disease were accounted by the US in 2023 (5 million), which are expected to show a rise in the future.

- Among the European countries, the United Kingdom had the highest diagnosed prevalent cases of Chronic Kidney Disease with ~2 million cases, followed by Germany, which had diagnosed prevalent population of ~1 million in 2023. On the other hand, Italy had the lowest prevalent population (731 thousand cases).

- Japan had nearly 3 million total diagnosed prevalent cases of Chronic Kidney Disease in 2023, accounting for approximately 22% in 7MM.

- Based on Severity-specific segmentation, the people in Stage 3 were affected the most by Chronic Kidney Disease in the US, accounting for approximately 2,940 thousand cases in 2023.

- The DelveInsight analysis indicates that among the EU4 and the UK, more females are affected than males, with approximately 3,550 thousand female cases and 3,400 thousand male cases in 2023.

Recent Developments in the Chronic Kidney Disease Market:

- In Sept 2025, eGenesis received FDA clearance for its Investigational New Drug (IND) application to start clinical trials of EGEN-2784, a genetically engineered porcine kidney, for treating end-stage kidney disease (ESKD). The Phase 1/2/3 study will evaluate safety and efficacy in dialysis-dependent patients aged 50 and older on the transplant waitlist.

- In March 2025, the FDA expanded the approval of Furoscix to include the treatment of edema in patients with chronic kidney disease, including nephrotic syndrome.

- In March 2025, the FDA approved an expanded indication for furosemide injection (Furoscix; scPharmaceuticals, Inc.) to treat edema in adult patients with chronic kidney disease (CKD), including nephrotic syndrome. The expanded treatment is expected to be available by April 2025. This approval follows the FDA's acceptance of the supplemental new drug application in July 2024.

- In January 2025, the FDA approved a new indication for semaglutide to reduce the risk of worsening kidney disease, kidney failure, and cardiovascular death in adults with type 2 diabetes and chronic kidney disease, according to Novo Nordisk.

- On November 11, 2024, Unicycive Therapeutics (Nasdaq: UNCY) announced that the U.S. FDA has accepted its New Drug Application (NDA) for Oxylanthanum Carbonate (OLC), with a PDUFA target action date of June 28, 2025. If approved, OLC could significantly improve treatment for hyperphosphatemia in Chronic Kidney Disease patients on dialysis.

Chronic Kidney Disease Drug Chapters

The drug chapter segment of the Chronic Kidney Disease therapeutics market report encloses a detailed analysis of Chronic Kidney Disease off-label Chronic Kidney Disease therapies and late-stage (Phase-III and Phase-II) Chronic Kidney Disease therapies analysis. It also helps to understand the Chronic Kidney Disease clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest Chronic Kidney Disease news and press releases.

Chronic Kidney Disease Marketed Drugs

- KERENDIA (finerenone): Bayer HealthCare Pharmaceuticals Inc.

KERENDIA is a nonsteroidal mineralocorticoid receptor antagonist (MRA) indicated to reduce the risk of sustained eGFR decline, end-stage kidney disease, cardiovascular death, nonfatal myocardial infarction, and hospitalization for heart failure in adult patients with Chronic Kidney Disease associated with type 2 diabetes. In February 2022, KERENDIA was granted market authorization by the European Commission for the treatment of chronic kidney disease (with albuminuria) associated with Type 2 diabetes mellitus in adults.

- INVOKANA (canagliflozin): Janssen Research & Development, LLC

INVOKANA (canagliflozin) is a prescription medicine used with diet and exercise to lower blood sugar in adults with type 2 diabetes. INVOKANA, is the class of medications called sodium glucose co-transporter 2 (SGLT2) inhibitors, approved in the United States in 2013. The label was expanded to cover more indications such as diabetic kidney disease in the subsequent years in the US along with EU and Japan.

Chronic Kidney Disease Emerging Drugs

- Ocedurenone (KBP-5074): KBP Biosciences

Ocedurenone (KBP-5074) is a nonsteroidal MRA discovered and developed by KBP Biosciences. KBP-5074 selectively binds to recombinant human MRs with much higher affinity than recombinant human glucocorticoid, progesterone, and androgen receptors, which can produce antihypertensive, renal, and cardioprotective effects. Currently, the Phase III clinical trial for Ocedurenone's first indication—advanced Chronic Kidney Disease and uncontrolled hypertension—is in progress.

- Dapagliflozin (Farxiga)

Dapagliflozin (Farxiga) is a selective SGLT2 inhibitor approved for the treatment of type 2 diabetes mellitus, heart failure, and chronic kidney disease. It lowers blood glucose by promoting urinary glucose excretion independent of insulin, while also providing cardiovascular and renal protection, blood pressure reduction, and modest weight loss. Administered orally once daily, dapagliflozin continues to be evaluated in Phase III studies to further strengthen its role in diabetes management.

BI 690517 + Empagliflozin

BI 690517 is a novel, potent, highly selective aldosterone synthase inhibitor (ASi), which is intended to slow the progression of kidney damage and to reduce cardiovascular events in people with CKD. The compound was discovered and developed by Boehringer Ingelheim and is part of its research and development portfolio in cardiovascular-renal-metabolic conditions.

|

Drug |

Chronic Kidney Disease MoA |

RoA |

Company |

Phase |

|

KBP-5074 |

Mineralocorticoid receptor antagonists |

Oral |

KBP Biosciences. |

III |

|

BI 690517 + Empagliflozin |

Aldosterone synthase inhibitor + SGLT2 inhibitor |

Subcutaneous |

Novo Nordisk A/S |

II |

|

XX |

Aldosterone synthase inhibitors |

XX |

XX |

III |

Note: Detailed emerging therapies assessment will be provided in the final report of Chronic Kidney Disease.

Chronic Kidney Disease Market Outlook

Chronic Kidney Disease treatment focuses on slowing disease progression, managing symptoms, and preventing complications. Lifestyle modifications are fundamental, including dietary changes, regular exercise, and smoking cessation. Patients are often advised to limit salt, potassium, and protein intake to reduce kidney workload. Pharmacological interventions play a critical role in managing CKD. Angiotensin-converting enzyme (ACE) inhibitors and angiotensin II receptor blockers (ARBs) are commonly prescribed to control hypertension and reduce proteinuria, thereby slowing disease progression. Statins are used to manage hyperlipidemia, reducing cardiovascular risks, which are heightened in CKD patients.

Blood glucose control is essential for diabetic CKD patients, often requiring medications such as metformin and SGLT2 inhibitors, which have shown kidney-protective effects. Erythropoiesis-stimulating agents (ESAs) and iron supplements are used to treat anemia, a common complication of CKD.Advanced CKD may necessitate renal replacement therapies. Hemodialysis and peritoneal dialysis help perform the kidney's filtering functions when renal function is significantly impaired. For end-stage renal disease (ESRD), kidney transplantation offers the best chance for a normal life, though it requires lifelong immunosuppressive therapy to prevent organ rejection.

Managing Chronic Kidney Disease also involves addressing underlying causes, such as controlling blood pressure, blood sugar, and cholesterol levels. Regular monitoring and timely interventions are crucial to improving outcomes and enhancing the quality of life for CKD patients.

- The Chronic Kidney Disease Therapeutics Market Size in the US was ~USD 2,824 million in 2023, which is further anticipated to increase during the forecast period.

- The United States accounted for the highest Chronic Kidney Disease Treatment Market Size approximately 52% of the total market size in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Among the EU countries, the United Kingdom had the highest market size with nearly USD 421 million in 2023, while Italy had the lowest market size for Chronic Kidney Disease with USD ~132 million in 2023.

- The Chronic Kidney Disease Therapeutics Market Size in Japan was estimated to be about USD 1,402 million in 2023.

Chronic Kidney Disease Drugs Uptake

This section focuses on the uptake rate of potential Chronic Kidney Disease drugs expected to launch in the market during 2020–2034. For example, KBP-5074 in the US is expected to be launched by 2026 with a peak share of 5%. KBP-5074 is anticipated to take 7 years to peak with a medium uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Key Medications in chronic renal failure therapeutics market include multiple inhibitors as well as different drugs such as: Lisinopril, Enalapril, Ramipril, Losartan, Valsartan, Irbesartan, Dapagliflozin, Canagliflozin, Empagliflozin, Liraglutide, Semaglutide, Dulaglutide and others.

Chronic Kidney Disease Pipeline Development Activities

The chronic kidney disease Pipeline drugs market report provides insights into Chronic Kidney Disease clinical trails within Phase III, Phase II, and Phase I stage. It also analyzes key Chronic Kidney Disease Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The chronic renal failure therapeutics market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Chronic Kidney Disease emerging therapies and the chronic kidney disease prevalence.

KOL Views

To keep up with current chronic renal failure market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Chronic Kidney Disease evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from University of Arizona College of Medicine, Phoenix, the US, Department of Renal Transplantation, Mayo Clinic – Minnesota, Rochester, the US, Mayo Clinic – Minnesota, Rochester, the US; Université Cheikh Anta Diop de Dakar, Senegal, France, Université Claude Bernard, Lyon, France; Health Economics and Outcomes Research Ltd., Cardiff, Wales, the UK, Kings College Hospital, NHS Foundation Trust, the UK, Endocrinology, Diabetes, and Internal Medicine, Bermuda Hospitals Board, the UK; National University in Niigata, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Chronic Kidney Disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Chronic Kidney Disease Therapeutics Market Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging chronic renal failure therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Chronic Kidney Disease Therapeutics Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global Chronic Kidney Disease drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment. The Chronic renal failure therapeutics market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Chronic Kidney Disease Treatment Market Report Scope

- The Chronic Kidney Disease Drugs Market report covers a segment of key events, an executive summary, descriptive overview of Chronic Kidney Disease, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the chronic kidney disease epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Chronic Kidney Disease therapeutics market, historical and forecasted Chronic Kidney Disease (CKD) market size, Chronic Kidney Disease drugs market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The Chronic Kidney Disease therapeutics market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Chronic Kidney Disease drugs market.

Chronic Kidney Disease Therapeutics Market Report Insights

- Patient-based Chronic Kidney Disease Market Forecasting

- Chronic Kidney Disease Therapeutic Approaches

- Chronic Kidney Disease Pipeline Drugs Market Analysis

- Chronic Kidney Disease Market Size

- Chronic Kidney Disease Market Trends

- Existing and Future Chronic Kidney Disease Drugs Market Opportunity

Chronic Kidney Disease Therapeutics Market Report Key Strengths

- 11 years Chronic Kidney Disease Market Forecast

- The 7MM Coverage for Chronic Kidney Disease Prevalence

- Chronic Kidney Disease Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Chronic Kidney Disease Drugs Uptake

- Key Chronic Kidney Disease Market Forecast Assumptions

Chronic Kidney Disease Therapeutics Market Report Assessment

- Current Chronic Kidney Disease Treatment Market Practices

- Chronic Kidney Disease Unmet Needs

- Chronic Kidney Disease Pipeline Drugs Analysis

- Chronic Kidney Disease Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Chronic Kidney Disease Market Drivers

- Chronic Kidney Disease Market Barriers

Key Questions Answered In The Chronic Kidney Disease Market Report:

Chronic Kidney Disease Drugs Market Insights

- What was the Chronic Kidney Disease treatment market size & share (%) distribution in 2020 and how it would look like in 2034?

- What would be the total Chronic Kidney Disease treatment market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the Chronic Kidney Disease drugs market across the 7MM and which country will have the largest Chronic Kidney Disease market size during the forecast period (2024–2034)?

- At what CAGR, the Chronic Kidney Disease drugs market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the Chronic Kidney Disease market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the Chronic Kidney Disease market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the Chronic Kidney Disease Drugs market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Chronic Kidney Disease Epidemiology Insights

- What is the disease risk, burden, and Chronic Kidney Disease Unmet Needs?

- What is the historical Chronic Kidney Disease patient population in the United States, EU4 (Germany, France, Italy, Spain), and the United Kingdom, and Japan?

- What would be the forecasted patient population of Chronic Kidney Disease at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Chronic Kidney Disease?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Chronic Kidney Disease during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Chronic Kidney Disease Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Chronic Kidney Disease along with the approved therapy?

- What are the current treatment guidelines for the treatment of Chronic Kidney Disease in the US, Europe, And Japan?

- What are the Chronic Kidney Disease marketed drugs and their Chronic Kidney Disease MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, and efficacy, etc.?

- How many companies are developing therapies for the treatment of Chronic Kidney Disease?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Chronic Kidney Disease?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, licensing activities related to the Chronic Kidney Disease therapies?

- What are the recent therapies, targets, Chronic Kidney Disease mechanism of action and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Chronic Kidney Disease and their status?

- What are the key designations that have been granted for the emerging therapies for Chronic Kidney Disease?

- What are the 7MM historical and forecasted Chronic Kidney Disease Therapeutics Market?

Reasons to Buy the Chronic Kidney Disease Drugs Market Forecast Report

- The Chronic Kidney Disease Therapeutics Market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Chronic Kidney Disease Drugs Market.

- Insights on patient burden/disease Chronic Kidney Disease Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing Chronic Kidney Disease Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles:-

- Promising Data from the First Dedicated Kidney Outcomes Trial with GLP-1 Receptor Agonist, Semaglutide, in Patients with Type 2 Diabetes and Chronic Kidney Disease

- Ardelyx Overcomes Hurdles to Secure FDA Approval for Xphozah in Chronic Kidney Disease Treatment

- Evolving Therapeutics in Chronic Kidney Disease (CKD) Treatment Market

- Chronic Kidney Disease: Complex Debilitating Condition

- Chronic Kidney Disease Market: Infographics

- Latest DelveInsight Blogs

-02.jpg)

.png&w=256&q=75)

-market.png&w=256&q=75)