Chronic Pruritus Market Summary

- The Chronic Pruritus market in the 7MM was valued at approximately USD 3845 million in 2025.

- The Chronic Pruritus market is projected to grow at a CAGR of 8.6%, reaching USD 8110 million by 2034 in leading countries (US, EU4, UK and Japan)

Chronic Pruritus Market and Epidemiology Analysis

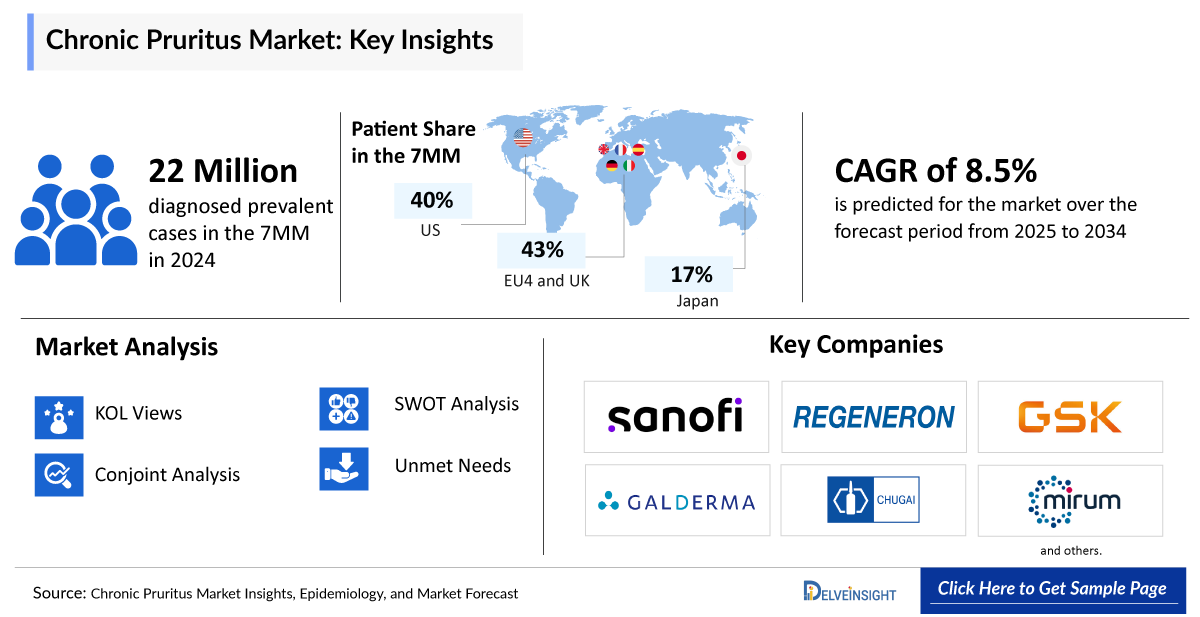

- According to DelveInsight’s estimates, there were approximately 98 million total prevalent cases of chronic pruritus in the 7MM in 2024. Among these, around 22 million were diagnosed cases. Of the total diagnosed prevalent cases in the 7MM, the United States accounted for 40%, EU4 and the UK collectively made up nearly 43%, and Japan represented 17%.

- The chronic pruritus market is projected to see consistent growth, with a robust compound annual growth rate (CAGR) anticipated from 2025 to 2034. This expansion across the 7MM will be driven by the introduction of innovative therapies like Dupilumab, Linerixibat, and Volixibat, among others. Furthermore, the rising prevalence of chronic pruritus, driven factors such as an aging population, increased exposure to environmental irritants, a higher occurrence of chronic inflammatory and autoimmune conditions, and improved diagnostic awareness among healthcare professionals—will further bolster market growth.

- According to DelveInsight’s analysis, the chronic pruritus market in the 7MM was valued at approximately USD 3,520 million in 2024. Over the forecast period from 2025 to 2034, this market is projected to grow at a CAGR of 8.5%.

- Currently, a range of treatments for managing chronic pruritus is available in the market. These include steroids, antihistamines, calcineurin inhibitors (such as cyclosporine and tacrolimus), as well as newer therapies like KORSUVA for moderate to severe Chronic Kidney Disease-associated Pruritus (CKD-aP), LIVMARLI for cholestatic pruritus associated with Alagille Syndrome (ALGS) and Progressive Familial Intrahepatic Cholestasis (PFIC), and BYLVAY/KAYFANDA for ALGS- and PFIC-related cholestatic pruritus, among others.

- Current treatments for chronic pruritus are often insufficient, offering only limited and short-term relief. Most therapies target symptoms rather than the underlying cause, resulting in ongoing discomfort and reduced quality of life.

- Sanofi/Regeneron, GlaxoSmithKline, Galderma/Chugai Pharmaceutical, and Mirum Pharmaceuticals, among others are progressing their assets through various clinical trial phases, driving innovation in the chronic pruritus market and creating significant growth opportunities.

- In November 2024, GSK reported positive headline results from GLISTEN, its global Phase III trial of linerixibat in adults with cholestatic pruritus associated with primary biliary cholangitis (PBC).

Chronic Pruritus Market size and forecast

- 2025 Chronic Pruritus Market Size: USD 3,845 million

- 2034 Projected Chronic Pruritus Market Size: USD 8110 million

- Chronic Pruritus Growth Rate (2025-2034): 8.6% CAGR

- Largest Chronic Pruritus Market: United States

Key Factors Driving Chronic Pruritus Market

Rising Chronic Pruritus Burden Elevating Market Potential

DelveInsight estimates that there were approximately 98 million prevalent cases and 22 million diagnosed prevalent cases of chronic pruritus across the 7MM in 2024. This patient pool is projected to grow steadily at a CAGR of 3.3% through 2034. Factors such as an aging population, increased exposure to environmental irritants, rising rates of chronic inflammatory and autoimmune diseases, and improved diagnostic awareness are key drivers of this growth. The expanding patient base underscores the urgency for targeted therapies that move beyond symptomatic relief.

Advancements in Chronic Pruritus Therapies

Traditional treatments such as steroids, antihistamines, and calcineurin inhibitors (e.g., cyclosporine and tacrolimus) continue to play a role in managing chronic pruritus, but recent innovations are reshaping the treatment landscape. Breakthroughs include KORSUVA (Cara Therapeutics/CSL/Vifor/Maruishi) for moderate to severe CKD-associated pruritus, LIVMARLI (Mirum Pharmaceuticals/Takeda) and BYLVAY/KAYFANDA (Ipsen/Jadeite Medicines) for cholestatic pruritus in ALGS and PFIC, and biologics like dupilumab, which is expected to generate approximately USD 700 million in the 7MM by 2034. Emerging therapies such as linerixibat, volixibat, and IL-31 inhibitors are further expanding options, offering extended relief with improved tolerability compared to conventional approaches.

Chronic Pruritus Clinical Trial Analysis

The chronic pruritus treatment paradigm is evolving from short-term symptom suppression to precision medicine approaches targeting key itch pathways. The chronic pruritus pipeline is advancing with promising candidates such as linerixibat (GSK) and volixibat (Mirum Pharmaceuticals) for cholestatic pruritus. IL-31 inhibitors like LOQTORZI (Eli Lilly) and nemolizumab (Galderma) are also in late-stage trials, showing potential for longer-lasting relief and better tolerability than conventional options. These agents highlight the shift toward targeted and precision-based approaches in itch management.

DelveInsight’s “Chronic Pruritus – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of chronic pruritus, historical and forecasted epidemiology, as well as the chronic pruritus market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The chronic pruritus market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM chronic pruritus market size from 2020 to 2034. The report also covers chronic pruritus treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Chronic Pruritus Understanding

Chronic Pruritus Overview

Chronic pruritus, defined as itch lasting longer than six weeks, is a complex condition that significantly affects quality of life. It may arise from dermatological, systemic, infectious, or neurological causes, with inflammatory and neuropathic mechanisms often involved. Triggers include liver and kidney disorders, medications, parasitic infestations, and skin infections. The condition may present as a “pure” itch or with burning or stinging sensations, with symptoms influenced by environmental factors. While the mechanisms remain unclear, pathways such as NK1R, JAK, and TRP ion channels are implicated, offering potential therapeutic targets.

Chronic Pruritus Diagnosis

Diagnosing chronic pruritus requires a comprehensive and systematic approach due to its wide range of potential causes. Initial evaluation includes a detailed clinical history and physical examination to identify visible skin changes or systemic signs. Laboratory tests are often conducted to assess liver, kidney, and thyroid function, as well as iron levels and markers of inflammation. Additional investigations, such as skin scrapings or biopsies, may be needed to rule out infections or malignancies. In cases with no clear dermatological findings, neurological assessments, including nerve conduction studies or imaging, may be warranted to identify neuropathic causes. Despite available tools, diagnosis is often delayed due to the condition’s complexity and lack of standardized protocols.

Further details related to country-based variations are provided in the report…

Chronic Pruritus Treatment

Chronic pruritus is managed by treating the underlying cause when possible and providing symptom relief through topical, systemic, light-based, and behavioral therapies. Topical treatments include emollients, anesthetics, coolants, steroids, and calcineurin inhibitors. Systemic options involve antihistamines, neuroactive drugs, antidepressants, and opioid modulators. Light therapy can help in select cases, and behavioral approaches support itch control and reduce scratching.

Chronic Pruritus Epidemiology

As the market is derived using a patient-based model, the chronic pruritus epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases of chronic pruritus, total diagnosed prevalent cases of chronic pruritus, gender-specific diagnosed prevalent cases of chronic pruritus, age-specific diagnosed prevalent cases of chronic pruritus, severity-specific diagnosed prevalent cases of chronic pruritus, and etiology-specific diagnosed prevalent cases of chronic pruritus in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Chronic Pruritus Epidemiological Analyses and Forecast

- DelveInsight estimates that there were approximately 98 million prevalent and 22 million diagnosed prevalent cases of chronic pruritus across the 7MM in 2024. These diagnosed prevalent cases are projected to rise by 2034 at a CAGR of 3.3%.

- In 2024, the US accounted for around 9 million diagnosed prevalent cases of chronic pruritus, expected to increase by 2034.

- Among EU4 and the UK, Germany had the highest number of diagnosed prevalent cases of chronic pruritus in 2024, with approximately 3 million cases, followed by Italy with nearly 2 million cases. Spain had the lowest, with around 1 million cases.

- In 2024, Japan recorded nearly 4 million diagnosed prevalent cases of chronic pruritus, which is expected to rise by 2034.

- In terms of gender-specific diagnosed prevalent cases of chronic pruritus, France had approximately 730 thousand male and 900 thousand female cases in 2024, with these numbers expected to rise by 2034.

- Regarding age-specific diagnosed prevalent cases of chronic pruritus, the UK reported nearly 150 thousand, 280 thousand, 440 thousand, and 750 thousand cases in the 0–17 years, 18–44 years, 45–64 years, and 65+ age groups in 2024. These numbers are expected to grow by 2034.

- In 2024, Japan had approximately 370 thousand mild, 2 million moderate, and 1 million severe cases of chronic pruritus, with projections expected to increase by 2034.

- In 2024, among the etiology-specific diagnosed cases of chronic pruritus across the 7MM, there were approximately 8 million cases associated with atopic dermatitis, 3 million cases linked to psoriasis, 4 million cases related to Chronic Kidney Disease (CKD), 2 million cases due to neuropathy, 2 million idiopathic/unknown cases, and 3 million cases attributed to other causes. These figures are expected to rise by 2034.

Chronic Pruritus Epidemiology Segmentation

- Total Prevalent Cases of Chronic Pruritus

- Total Diagnosed Prevalent Cases of Chronic Pruritus

- Gender-specific Diagnosed Prevalent Cases of Chronic Pruritus

- Age-specific Diagnosed Prevalent Cases of Chronic Pruritus

- Severity-specific Diagnosed Prevalent Cases of Chronic Pruritus

- Etiology-specific Diagnosed Prevalent Cases of Chronic Pruritus

Chronic Pruritus Drug Analysis

The drug chapter segment of the chronic pruritus report encloses a detailed analysis of chronic pruritus-marketed drugs and pipeline drugs. It also helps understand the chronic pruritus clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Chronic Pruritus Marketed Drugs

KORSUVA/KAPRUVIA (difelikefalin): Cara Therapeutics/CSL/Vifor/Maruishi

KORSUVA is a kappa opioid receptor agonist indicated for the treatment of moderate-to-severe CKD-aP in adults undergoing hemodialysis. By modulating itch signaling in the central and peripheral nervous systems, it helps reduce pruritus in this patient population. KORSUVA has not been studied in individuals receiving peritoneal dialysis, and its use is not recommended in this group. KORSUVA is approved in the EU and the UK with the tradename KAPRUVIA.

KORSUVA (difelikefalin) has achieved several regulatory approvals for the treatment of CKD-aP in adults undergoing hemodialysis. In August 2021, it was approved by the US FDA. In April 2022, it received EU-wide marketing authorization and was also approved by the UK’s Medicines and Healthcare products Regulatory Agency (MHRA). In May 2023, it was recommended by the UK’s National Institute for Health and Care Excellence (NICE). In September 2023, it was approved in Japan as an intravenous injection syringe.

LIVMARLI (maralixibat): Mirum Pharmaceuticals/Takeda

LIVMARLI, an ileal bile acid transporter (IBAT) inhibitor, is approved for the treatment of cholestatic pruritus in patients with ALGS aged 3 months and older, as well as for the treatment of cholestatic pruritus in patients with PFIC aged 12 months and older.

LIVMARLI (maralixibat) has received multiple regulatory approvals for the treatment of cholestatic pruritus in patients with ALGS and PFIC. In September 2021, the US FDA approved it for ALGS in patients aged one year and older. This was followed by a label expansion in March 2023, allowing treatment from three months of age. In December 2022, the European Commission approved LIVMARLI for ALGS in patients aged two months and older. In March 2024, the US FDA approved it for PFIC, and in July 2024, the European Commission granted marketing authorization for PFIC in patients aged three months and older. Most recently, in March 2025, Japan approved LIVMARLI as the first treatment for cholestatic pruritus in patients with ALGS and PFIC.

Additionally, maralixibat is being studied in a Phase III clinical trial for pruritus associated with cholestatic liver disease.

BYLVAY/KAYFANDA (odevixibat): Ipsen/Jadeite Medicines

BYLVAY is an IBAT inhibitor approved for the treatment of pruritus associated with two rare liver disorders. It is indicated for use in patients aged 3 months and older with PFIC, though it may not be effective in a subset of PFIC type II patients who have specific ABCB11 gene variants that lead to a non-functional or absent BSEP protein. Additionally, BYLVAY is approved for the treatment of cholestatic pruritus in patients aged 12 months and older with ALGS.

Ipsen’s odevixibat has received multiple regulatory approvals for the treatment of cholestatic pruritus in ALGS and PFIC. In July 2021, it was approved in the European Union for PFIC in patients aged six months and older, followed by US FDA approval for the same indication. In June 2023, the US FDA approved BYLVAY for ALGS in patients from 12 months of age. In September 2024, the European Union approved KAYFANDA, a rebranded version of odevixibat, for ALGS in patients aged six months and older. This followed a regulatory setback in October 2023, when the EMA’s Committee for Orphan Medicinal Products (COMP) issued a negative opinion on maintaining orphan designation for BYLVAY in ALGS, prompting Ipsen to pursue reauthorization under a new name.

|

MoA |

RoA |

|

Kappa opioid receptor agonist |

IV |

|

IBAT inhibitor |

Oral |

|

IBAT inhibitor |

Oral |

|

XXX |

X |

Chronic Pruritus Emerging Drugs

DUPIXENT (dupilumab): Sanofi/Regeneron

DUPIXENT (dupilumab) is a fully human monoclonal Antibody (mAb) that inhibits Interleukin-4 (IL-4) and Interleukin-13 (IL-13) signaling, key drivers of Type 2 inflammation. It is not an immunosuppressant and has demonstrated significant clinical benefit in various inflammatory diseases. DUPIXENT is currently being evaluated for chronic pruritus of unknown origin, a condition characterized by persistent itching without an identifiable cause. Given its role in reducing Type 2 inflammation, DUPIXENT has the potential to address the underlying inflammatory mechanisms contributing to Chronic Pruritus of Unknown Origin (CPUO), offering a targeted treatment option for patients suffering from this debilitating condition.

In September 2024, the Phase III LIBERTY-CPUO-CHIC trial evaluating DUPIXENT in adults with uncontrolled, severe CPUO did not meet statistical significance for its primary itch responder endpoint, though it showed favorable numerical trends. The study achieved nominally significant improvements across all other itch-related endpoints. The Phase III program includes Study A (LIBERTY-CPUO-CHIC) and the planned pivotal Study B.

Linerixibat (GSK2330672): GlaxoSmithKline

Linerixibat, an IBAT inhibitor, is an oral therapy with the potential for treating cholestatic pruritus in PBC, a rare autoimmune liver disease. By blocking bile acid reuptake, it targets an underlying cause of cholestatic pruritus.

Additionally, the drug is being evaluated in a long-term safety and tolerability Phase III study for patients with PBC.

In November 2024, GSK announced positive headline results from GLISTEN, its global Phase III trial evaluating linerixibat in adults with cholestatic pruritus associated with PBC. The full results of GLISTEN will be presented at a future scientific congress.

Volixibat: Mirum Pharmaceuticals

Volixibat is an oral, minimally absorbed IBAT inhibitor that may provide a novel approach to treating adult cholestatic diseases. By blocking bile acid recycling, it aims to reduce systemic and hepatic bile acid levels, potentially addressing disease-related complications.

- The drug is currently in Phase IIb studies for cholestatic pruritus, including the VISTAS study in Primary Sclerosing Cholangitis (PSC) and the VANTAGE study in PBC.

- In June 2024, Mirum Pharmaceuticals announced interim results from two Phase IIb studies evaluating Volixibat in patients with PBC and PSC.

- The VISTAS study is expected to complete enrollment in the second-half of 2025, while the VANTAGE study is projected to complete enrollment in 2026.

|

MoA |

RoA |

Company |

|

IL-4/IL-13 pathway inhibition |

SC |

Sanofi/Regeneron |

|

IBAT inhibitor |

Oral |

GlaxoSmithKline |

|

IBAT inhibitor |

Oral |

Mirum Pharmaceuticals |

|

XXX |

X |

XXX |

Chronic Pruritus Drug Class Analysis

The current hallmark of treatment for chronic pruritus includes steroids, antihistamines, calcineurin inhibitors like cyclosporine and tacrolimus, gabapentin, pregabalin, serlopitant, fluoxetine, sertraline, nalfurafine hydrochloride, kappa opioid receptor agonist, and IBAT inhibitors.

Steroids and antihistamines for broad symptom control, though their effectiveness varies by cause. Calcineurin inhibitors like cyclosporine and tacrolimus are used to modulate immune-driven itch, particularly in dermatologic conditions. Additional agents such as gabapentin, pregabalin, serlopitant, fluoxetine, sertraline, and nalfurafine hydrochloride target neural or serotonergic pathways, offering relief in neuropathic or refractory pruritus where conventional therapies are inadequate.

KORSUVA, a kappa opioid receptor agonist, is approved for chronic pruritus in patients with chronic kidney disease on dialysis, targeting peripheral sensory pathways to reduce itch with minimal central effects. LIVMARLI and BYLVAY/KAYFANDA, both ileal bile acid transporter inhibitors, are used for cholestatic pruritus in Alagille Syndrome and Progressive Familial Intrahepatic Cholestasis. These agents reduce systemic bile acid levels, addressing the underlying driver of itch in liver disorders. Their mechanism-based targeting highlights a shift toward precision therapies in managing chronic pruritus across distinct etiologies.

Continued in report…

Chronic Pruritus Market Outlook

Chronic pruritus, defined as itching lasting more than six weeks, is a complex condition with dermatologic, systemic, neurologic, or psychogenic origins. It significantly impacts quality of life and is increasingly recognized as a distinct clinical disorder. Effective management requires identifying the underlying cause and applying targeted therapies. With growing understanding of itch pathways, treatment is shifting toward precision medicine using novel agents that address the condition's diverse pathophysiology.

.png)

Management of pruritus varies by underlying condition. In dermatologic diseases like atopic dermatitis and psoriasis, topical corticosteroids reduce inflammation and itch, while calcineurin inhibitors offer a steroid-sparing alternative for sensitive areas. Systemic biologics such as DUPIXENT target Type 2 inflammation in moderate-to-severe atopic dermatitis. In CKD-aP, KORSUVA, a selective kappa-opioid receptor agonist, provides effective relief with minimal central side effects. For cholestatic pruritus in liver diseases, treatment focuses on reducing bile acid accumulation using bile acid sequestrants, rifampin, or IBAT inhibitors like LIVMARLI.

Approved in the US in August 2021, KORSUVA (difelikefalin) is indicated for moderate-to-severe pruritus in adults on hemodialysis, acting as a selective kappa-opioid receptor agonist with peripheral action to minimize central side effects. LIVMARLI targets cholestatic pruritus in pediatric patients with ALGS from 3 months of age and PFIC from 12 months, addressing a key gap where traditional treatments are limited. BYLVAY, an IBAT inhibitor, is also approved for pruritus in both conditions, though its efficacy in PFIC may be reduced in patients with ABCB11 mutations, highlighting the need for genetic screening to guide treatment decisions.

Companies like Sanofi/Regeneron’s DUPIXENT, GlaxoSmithKline’s Linerixibat, and Mirum’s Volixibat, among others are involved in the development of Phase III and Phase II drugs.

- The total market size of chronic pruritus in the 7MM was approximately USD 3,520 million in 2024 and is projected to increase during the forecast period (2025–2034).

- The market size for chronic pruritus in the US was approximately USD 1,840 million in 2024 and is anticipated to increase due to the launch of emerging therapies.

- The total market size of EU4 and the UK was calculated to be approximately USD 1,270 million in 2024, which was nearly 36% of the total market revenue for the 7MM and is expected to increase by 2034.

- In 2024, Germany dominated the market among EU4 and the UK, generating around USD 430 million, followed by Italy with approximately USD 240 million, while France recorded around USD 210 million.

- In 2024, the total market size of chronic pruritus was approximately USD 410 million in Japan which is anticipated to increase during the forecast period (2025-2034).

- Estimates suggest that dupilumab is expected to generate approximately USD 700 million in the 7MM by 2034.

Chronic Pruritus Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

Chronic Pruritus Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for chronic pruritus.

Latest KOL Views on Chronic Pruritus

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on chronic pruritus evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of California, US, Emory University, US, University of Cologne, Germany, University Hospital Münster, Germany, Chu Brest - Hospital Morvan, France, IRCCS Azienda Ospedaliero-Universitaria di Bologna, Italy, Hospital Universitario Virgen Macarena, Spain, University of Edinburgh, UK, Juntendo University, Japan, and National Defense Medical College, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or chronic pruritus market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on Chronic Pruritus Patient Trends?

As per the KOLs from the US, for patients with chronic pruritus and no primary skin lesions, a comprehensive history and symptom review are essential to uncover potential systemic associations. The duration of symptoms is a key factor, as pruritus lasting less than one year may necessitate a more in-depth diagnostic evaluation. In such cases, baseline laboratory testing—including a complete blood cell count, complete metabolic panel, and thyroid function tests—can help identify underlying hematologic malignancies, liver disease, kidney dysfunction, or thyroid abnormalities.

As per the KOLs from France, mental health-related and neuropathic pruritus are major causes of chronic pruritus, often underdiagnosed due to limited psychiatric consultations. Small-fiber neuropathy is a key contributor, requiring specialized diagnostics. Comorbidities like diabetes and hypothyroidism play a role, but rarely stopping treatments changes outcomes. Idiopathic pruritus in older adults challenges the concept of senile pruritus.

As per the KOLs from Japan, chronic pruritus involves a complex itch pathway spanning the skin, peripheral sensory nerves, spinal cord, and brain. Pruritogens activate sensory nerves, transmitting signals that are modulated by opioid and GABA systems in the spinal cord before reaching brain regions like the precuneus, which links itch to subjective discomfort. While chemical itch mechanisms are well-characterized, the pathways underlying mechanical itch and heightened itch sensitivity remain unclear, underscoring the need for further research.

Chronic Pruritus Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Chronic Pruritus Market Access and Reimbursement

LIVMARLI - Mirum Access Plus Support Program

Approximately 94% of patients are approved by insurance, and 98% pay USD 10 or less per fill. LIVMARLI is covered by 100% of insurance plans as of January, 2023.

The Mirum Access Plus Savings Program allows eligible commercially insured patients to pay as little as USD 10 per fill (not available for patients using government-funded insurance). For patients without insurance, the Mirum Patient Assistance Program provides LIVMARLI at no cost for up to one calendar year, with an annual eligibility review.

Further details will be provided in the report.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Chronic Pruritus Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of chronic pruritus, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the chronic pruritus market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM chronic pruritus market.

Chronic Pruritus report insights

- Patient Population

- Therapeutic Approaches

- Chronic Pruritus Pipeline Analysis

- Chronic Pruritus Market Size and Trends

- Existing and Future Market Opportunity

Chronic Pruritus Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Chronic Pruritus Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Drugs Uptake and Key Market Forecast Assumptions

Chronic Pruritus Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions Answered in the Chronic Pruritus Market Report

Market Insights

- What was the total market size of chronic pruritus, the market size of chronic pruritus by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will linerixibat affect the treatment paradigm of chronic pruritus?

- How will LIVMARLI compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of chronic pruritus? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to chronic pruritus?

- What is the historical and forecasted chronic pruritus patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent chronic pruritus population during the forecast period (2025–2034)?

- What factors are contributing to the growth of chronic pruritus cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of chronic pruritus? What are the current clinical and treatment guidelines for treating chronic pruritus?

- How many companies are developing therapies for the treatment of chronic pruritus?

- How many emerging therapies are in the mid-stage and late stage of development for treating chronic pruritus?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of chronic pruritus?

Reasons to Buy Chronic Pruritus Market Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the chronic pruritus market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for chronic pruritus, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

.png)