Cushing’s Disease Market Summary

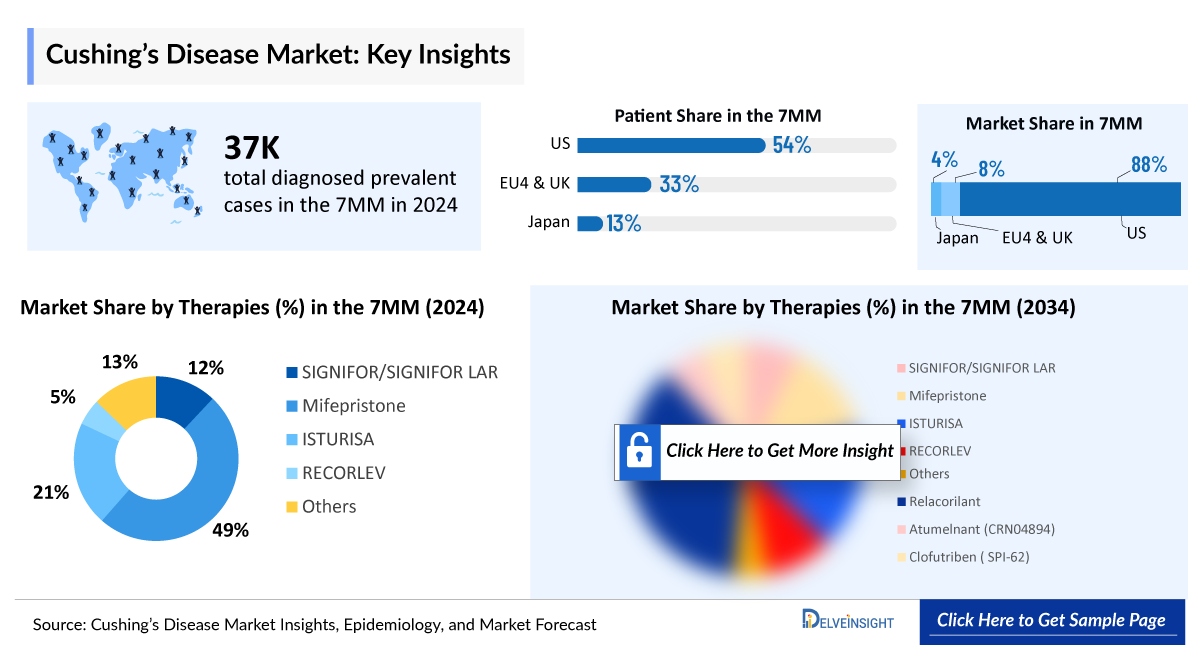

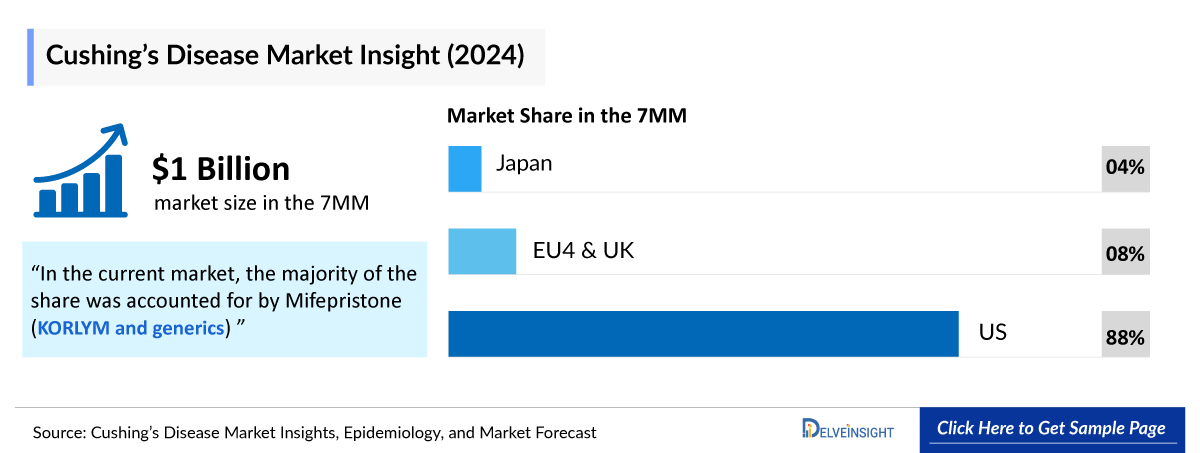

- The Cushing’s disease market in the 7MM is valued at approximately USD 1,089 million in 2025.

- The Cushing’s disease market is projected to grow at a CAGR of 5.90% by 2034 in leading countries like US, EU4, UK and Japan.

Cushing’s Disease Market and Epidemiology Analysis

- Endogenous Cushing’s syndrome is classified as Adrenocorticotropic Hormone (ACTH)-dependent or ACTH-independent. ACTH-dependent Cushing’s syndrome accounts for 80–85% of cases. Of these, 75–80% are due to ACTH production from a pituitary adenoma (Cushing’s disease).

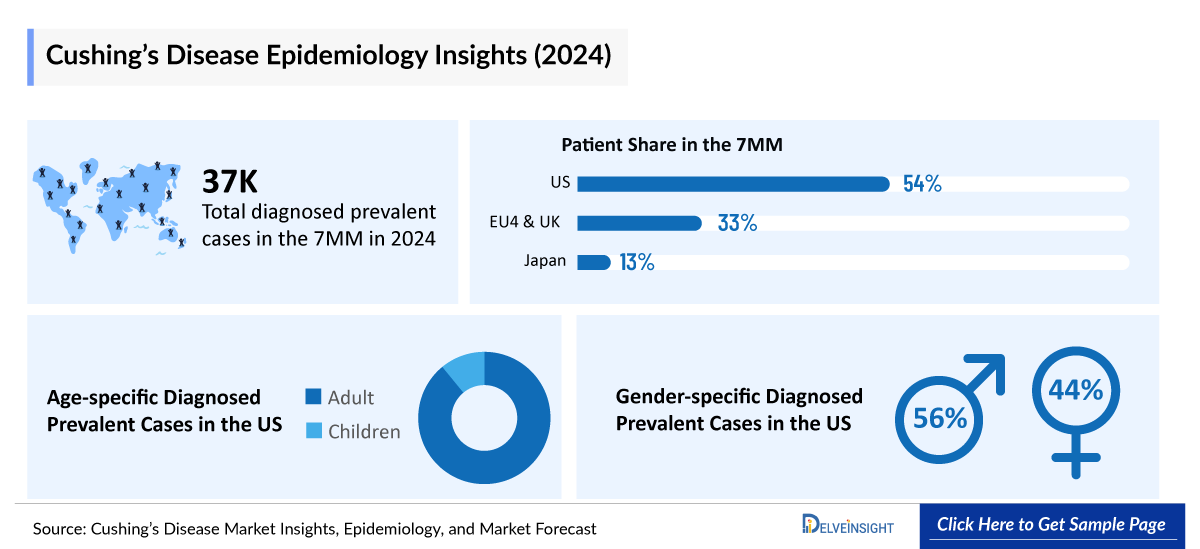

- There were nearly 37,100 diagnosed prevalent cases of Cushing’s disease in the 7MM in 2024. Among these, the US accounted for the highest number of diagnosed prevalent cases of Cushing’s disease.

- In 2024, the number of females diagnosed with prevalent cases of Cushing's disease was higher than that of males across the 7MM.

- The diagnosis of Cushing’s disease is particularly challenging due to its rarity, symptom overlap with other conditions, and diverse manifestations, with 40–60% of patients having a visible tumor on conventional MRI and an average diagnostic delay of 7 years.

- The estimated 5-year survival rate for untreated Cushing’s disease is ~50%.

- Surgical removal of the pituitary tumor is the current first-line therapeutic option, but around 20% of patients do not experience remission after pituitary surgery, and around 15% of patients with apparent remission present recurrences after initially successful pituitary surgery, even many years after the remission, with an increasing rate over time; this evidence implies that at least one-third of patients with Cushing’s disease is not cured by pituitary surgery and requires additional treatments.

- Current market therapies for Cushing's syndrome (including Cushing’s disease) include SIGNIFOR (pasireotide), SIGNIFOR LAR (pasireotide), and ISTURISA (osilodrostat) by Recordati, RECORLEV by Xeris Pharmaceuticals, and KORLYM (mifepristone) by Corcept Therapeutics.

- SIGNIFOR and SIGNIFOR LAR are the only therapies specifically approved for the treatment of Cushing's disease, whereas ISTURISA is used as a treatment for Cushing’s disease in the US and for endogenous Cushing's syndrome in the EU and Japan.

- ISTURISA, approved by the FDA in 2020 for treating Cushing’s disease in adults, is now being evaluated in a Phase II trial for children and adolescents suffering from Cushing's disease.

- The steroidogenesis inhibitors, such as ketoconazole, metyrapone, and more recently, ISTURISA and RECORLEV, have been shown to improve the symptoms and signs of hypercortisolism significantly. However, their long-term use is constrained by notable hepatic toxicity and the eventual diminishing of therapeutic efficacy in the majority of patients.

- Medical therapy can be used initially for certain circumstances (e.g., surgery is contraindicated or a tumor is unresectable), but typically, medical therapy is the second-line or add-on therapy to surgery or radiotherapy.

- The Cushing’s disease pipeline features promising late- and mid-stage therapies. Among the most promising candidates includes Relacorilant (CORT125134) (Corcept Therapeutics), Clofutriben (SPI-62) (Sparrow Pharmaceuticals), and Atumelnant (CRN04894) (Crinetics Pharmaceuticals).

Cushing’s Disease Market size and forecast

- 2025 Market Size: USD 1,089 million in 2025

- 2034 Projected Market Size: USD 1,823 million in 2034

- Growth Rate (2025-2034): 5.90% CAGR

- Largest Market: United States

Key Factors Driving the Cushing’s Disease Market

Cushing’s Disease prevalence shaping market needs

Cushing’s Disease, caused by ACTH-secreting pituitary adenomas, affects approximately 37K patients in the 7MM in 2024, making it an ultra-rare endocrine disorder. These numbers are expected to increase by 2034, driven by Improved diagnostic awareness and imaging, which are expanding the identifiable patient pool.

Cushing’s Disease treatment market

The Cushing’s disease treatment market is growing, with medical therapies playing a key role when surgery isn’t an option or as adjuncts to surgery and radiotherapy. SIGNIFOR and SIGNIFOR LAR by Recordati are the only drugs specifically approved for Cushing’s disease. Recordati’s ISTURISA, approved in 2020 for adults, is expanding into pediatric trials and is also approved for endogenous Cushing’s syndrome in the EU and Japan. Other treatments like RECORLEV (Xeris) and KORLYM (Corcept) further broaden options, addressing unmet needs in this complex disorder.

Cushing’s Disease clinical trials activities

The Cushing’s Disease pipeline includes promising therapies like Relacorilant (Corcept), Clofutriben (Sparrow), Lu AG13909 (H. Lundbeck), and ST-002 (Stero Therapeutics), along with next-gen steroidogenesis inhibitors and targeted pituitary treatments. ST-002 has Orphan Drug Designation and is in Phase II trials. AstraZeneca’s AZD4017 completed Phase II in 2020 but shows no further development and is not in their current pipeline. These innovations highlight ongoing efforts to improve Cushing’s disease treatment.

DelveInsight’s “Cushing’s Disease – Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of historical and forecasted epidemiology as well as market trends in the United States, EU4 (Germany, France, Italy, Spain) and the United Kingdom, and Japan. Cushing’s disease market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM market size from 2020 to 2034. The report also covers current treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Cushing’s Disease Understanding

Cushing’s Disease Overview

Cushing’s disease is an endocrine disorder characterized by increased ACTH production from the anterior pituitary, leading to excess cortisol release from the adrenal glands. A pituitary adenoma often causes this, or it results from excess CRH production from the hypothalamus. It is mainly sporadic and is rarely seen in the context of endocrine tumor syndromes. In the last few years, the advancement of next-generation sequencing technologies has brought a renaissance in the understanding of the genetic events underlying the pathogenesis of Cushing’s disease.

Patients with Cushing’s disease almost always have a pituitary adenoma, often not evident by imaging. However, rare cases may result from diffuse corticotroph cell hyperplasia, even without ectopic secretion of CRH. The tumors are usually microadenomas (<10 mm in size); only about 5–10% are macroadenomas. Macroadenomas are more likely to produce abnormally high ACTH concentrations than microadenomas (83% vs. 45%).

Several genetic mutations are responsible for these adenomas. The most common mutation is USP8 (ubiquitin-specific peptidase 8). These mutations lead to abnormal expression of growth factors, which act with ACTH to increase cortisol levels.

Cushing’s Disease Diagnosis

Diagnosis of Cushing’s disease is often delayed for years, partly because of a lack of awareness of the insidious, progressive disease process and testing complexity. Screening and diagnostic tests for Cushing’s syndrome assess cortisol secretory status: abnormal circadian rhythm with Late-night Salivary Cortisol (LNSC), impaired glucocorticoid feedback with overnight 1 mg Dexamethasone Suppression Test (DST) or Low-dose 2-day Dexamethasone Test (LDDT), and increased bioavailable cortisol with 24-h Urinary Free Cortisol (UFC) In this setting, the sensitivity of all tests is higher than 90%; the highest sensitivity rates are obtained with DST and LNSC and the lowest with UFC. Specificity is somewhat lower than sensitivity, with LNSC being the most specific and DST and UFC being the least specific. Magnetic Resonance Imaging (MRI) is the imaging method of choice for detecting ACTH-secreting pituitary adenomas. However, in part because most lesions are very small, with the use of standard 1.5T MRI, only approximately 50% of microadenomas are depicted.

A noninvasive approach using a combination of three or four tests, specifically CRH and desmopressin stimulation plus MRI, followed by whole-body CT if the diagnosis is equivocal, correctly diagnosed Cushing’s disease in approximately half of patients in one series

Further details related to country-based variations are provided in the report…

Cushing’s Disease Treatment

Cushing’s disease, a condition caused by a pituitary adenoma that leads to excessive secretion of ACTH, requires a comprehensive treatment approach aimed at reducing cortisol levels in the body. The first-line treatment is typically transsphenoidal surgery to remove the pituitary tumor, which has a high success rate for achieving remission. However, some patients may experience relapse over time. If surgery is not successful or feasible, medical therapies are employed to manage cortisol levels.

Several medical therapies have been employed as treatment strategies for Cushing’s disease, with some of these therapies being central to the management of the condition. While certain medications are specifically approved for Cushing’s syndrome, they continue to play a pivotal role in the treatment of Cushing’s disease, especially in cases where surgical intervention is not an option or has proven ineffective. In the US, no therapies are widely marketed specifically for this condition. KORLYM (mifepristone), developed by Corcept Therapeutics, is approved for managing hyperglycemia caused by hypercortisolism in adults with endogenous Cushing’s syndrome who have Type 2 diabetes or glucose intolerance and have either failed surgery or are not candidates for it. The drugs specifically approved for Cushing’s disease include SIGNIFOR (pasireotide) and SIGNIFOR LAR. Another 2021 approved drug is ISTURISA (osilodrostat) for Cushing’s syndrome. Off-label treatments commonly used in the United States include ketoconazole, metyrapone, cabergoline, mitotane, and etomidate. HRA Pharma markets ketoconazole, metyrapone, and mitotane in some European countries.

Further details related to treatment will be provided in the report…

Cushing’s Disease Epidemiology

As the market is derived using a patient-based model, the Cushing’s disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of Cushing’s disease, gender-specific diagnosed prevalent cases of Cushing’s disease, and age-specific diagnosed prevalent cases of Cushing’s disease in the 7MM covering the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Cushing’s Disease Epidemiological Analyses and Forecast

- In 2024, the total diagnosed prevalent cases of Cushing’s disease in the United States were approximately 19,950 cases, projected to increase during the forecast period (2025–2034).

- In 2024, gender-specific diagnosed prevalent cases accounted for approximately 4,450 and 15,500 cases for males and females, respectively, in the US.

- The total diagnosed prevalent cases of Cushing’s disease in EU4 and the UK were approximately 12,400 in 2024. Males accounted for approximately 2,650 cases, and females had approximately 9,750 cases.

- Among the total age-specific diagnosed prevalent cases of Cushing’s disease in the US, adults were observed to have higher cases, i.e., ~17,950, and children were observed to have the lower number of cases, i.e., ~2,000 in 2024. The cases are anticipated to increase during the forecast period (2025–2034).

Cushing’s Disease Epidemiology Segmentation

- Total diagnosed prevalent cases of Cushing’s disease

- Gender-specific diagnosed prevalent cases of Cushing’s disease

- Age-specific diagnosed prevalent cases of Cushing’s disease

Cushing’s Disease Market Recent Developments and Breakthroughs

- Relacorilant has assigned a PDUFA target action date of December 30, 2025, to treat patients with endogenous hypercortisolism.

- In March 2025, Corcept Therapeutics announced that the FDA has assigned a PDUFA target action date of December 30, 2025, for relacorilant to treat patients with endogenous hypercortisolism (Cushing’s syndrome).

- In the 2024 annual report, the company mentioned the submission of the sNDA for the label extension of ISTURISA for Cushing’s disease into Cushing’s syndrome in the US in June 2024, with a regulatory decision expected in mid-2025. It is now being evaluated in a Phase II trial for children and adolescents suffering from Cushing's disease.

- In June 2024, Sparrow Pharmaceuticals mentioned that the company anticipates initiating a Phase III trial in 2025 for endogenous Cushing’s syndrome.

- In June 2024, Xeris Pharmaceuticals presented a post-hoc analysis from its previously published SONICS study on the effects of RECORLEV in adults with Cushing’s syndrome at ENDO 2024 in Boston.

To be continued in the report….

Cushing’s Disease Drug Analysis

The drug chapter segment of the disease report encloses a detailed analysis of Cushing’s disease-marketed drugs and mid and late-stage pipeline drugs. It also helps understand the Cushing’s disease clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Cushing’s Disease Marketed Drugs

ISTURISA (osilodrostat): Recordati

ISTURISA is a novel, potent oral steroidogenesis inhibitor with a non-steroidal chemical structure, recently approved for the treatment of adult patients with endogenous Cushing's syndrome and Cushing's disease not cured by pituitary surgery or in whom pituitary surgery is not an option. It is a cortisol synthesis inhibitor. It inhibits 11ß-hydroxylase (CYP11B1), the enzyme responsible for the final step of cortisol biosynthesis in the adrenal gland.

In March 2020, Recordati announced the FDA approval of ISTURISA for the treatment of patients with Cushing’s disease for whom pituitary surgery is not an option or has not been curative.

In January 2020, EMA granted the approval for ISTURISA for the treatment of patients with endogenous Cushing’s syndrome for whom pituitary surgery is not an option or has not been curative, and in Japan, it was approved for Cushing’s syndrome.

RECORLEV (levoketoconazole): Xeris Pharmaceuticals

RECORLEV is a cortisol synthesis inhibitor for the treatment of endogenous hypercortisolemia in adult patients with Cushing’s syndrome for whom surgery is not an option or has not been curative. It is the pure 2S, 4R enantiomer of ketoconazole, a steroidogenesis inhibitor. The drug had demonstrated in two successful Phase III studies to reduce mUFC significantly. RECORLEV received ODD from the FDA and the EMA for the treatment of endogenous Cushing's syndrome.

In December 2021, Xeris Pharmaceuticals announced the FDA approval of RECORLEV for the treatment of endogenous hypercortisolemia in adult patients with Cushing’s syndrome for whom surgery is not an option or has not been curative.

Cushing’s Disease Emerging Drugs

Relacorilant (CORT125134): Corcept Therapeutics

Relacorilant is a selective cortisol modulator that binds to the glucocorticoid receptor but not to the body's other hormone receptors. Corcept is studying relacorilant in a variety of serious disorders in addition to endogenous hypercortisolism (Cushing’s syndrome), including ovarian and prostate cancer. Relacorilant is proprietary to Corcept and is protected by the composition of matter, method of use, and other patents.

In December 2024, Corcept Therapeutics presented results from its Phase III long-term, open-label extension study of relacorilant to treat patients with endogenous hypercortisolism (Cushing’s syndrome) at the WCIRDC.

In March 2025, Corcept Therapeutics announced that the US FDA filed its NDA submission for relacorilant to treat patients with endogenous hypercortisolism (Cushing’s syndrome).

Clofutriben (SPI-62): Sparrow Pharmaceuticals

Clofutriben (SPI-62) is a proprietary, oral small molecule and new chemical entity developed as an 11ß-hydroxysteroid Dehydrogenase type 1 (HSD-1 inhibitor) aimed at reducing intracellular cortisol levels and alleviating its harmful effects. It is currently being developed for conditions caused by excessive cortisol production in the body. It could potentially introduce the first new mechanism of action in decades for patients suffering from endogenous Cushing’s syndrome. In October 2024, Sparrow Pharmaceuticals announced that clofutriben has been granted Orphan Drug Designation (ODD) by the US FDA for the treatment of endogenous Cushing’s syndrome.

Cushing’s Disease Drug Class Analysis

Selective Glucocorticoid Receptor Antagonist

Selective glucocorticoid receptor antagonists are essential in treating Cushing’s syndrome by targeting the effects of excess glucocorticoids. Their mechanism of action involves blocking the glucocorticoid receptor, which plays a key role in mediating cortisol's physiological effects. Medications like relacorilant (Corcept Therapeutics) and KORLYM utilize this mechanism to manage Cushing’s disease.

ACTH Inhibitors

ACTH inhibitors work by reducing the secretion of ACTH from the pituitary gland, which in turn lowers cortisol production by the adrenal glands. In Cushing’s disease, where ACTH overproduction causes excess cortisol, these inhibitors help regulate cortisol levels and alleviate the disease’s symptoms.

Cushing’s Disease Market Outlook

Cushing's disease, a condition caused by a pituitary adenoma that leads to excessive secretion of ACTH, requires a comprehensive treatment approach aimed at reducing cortisol levels in the body. The first-line treatment is typically transsphenoidal surgery to remove the pituitary tumor, which has a high success rate for achieving remission. However, some patients may experience relapse over time. If surgery is not successful or feasible, medical therapies are employed to manage cortisol levels.

Several medical therapies are used to treat Cushing's disease, especially when surgery is not viable or effective. While no therapies are specifically marketed for the condition in the US, certain medications play a critical role in its management. KORLYM a product of Corcept Therapeutics, approved for managing hyperglycemia in Cushing's syndrome with Type 2 diabetes or glucose intolerance, faces competition from Teva Pharmaceutical's generic version launched in 2024 as well as Corcept Therapeutics has already made a generic version available. Other approved treatments include SIGNIFOR/ SIGNIFOR LAR, ISTURISA, and RECORLEV. Off-label treatments like ketoconazole, metyrapone, cabergoline, mitotane, and etomidate are also used in the US, with HRA Pharma marketing some of these drugs in Europe.

The first ever developed therapy for Cushing's disease is SIGNIFOR (pasireotide), a product of Recordati. The drug was granted its FDA approval in 2012, along with the approval in the EU. SIGNIFOR, a somatostatin analog, is indicated for the treatment of adult patients with Cushing’s disease in cases where pituitary surgery is either not feasible or has failed to achieve a curative outcome. Another drug marketed by Recordati is SIGNIFOR LAR (pasireotide), which received approval from the FDA and PMDA in 2018. This formulation offers an alternative route of administration, given Intramuscularly (IM) while maintaining the same mechanism of action as SIGNIFOR. SIGNIFOR LAR is a long-acting injectable form of pasireotide indicated for the treatment of Cushing's disease, and is administered intramuscularly once every 4 weeks.

Recordati is seen as the leading pharmaceutical company exploring this segment. The third product from this company is ISTURISA (osilodrostat). It is the first FDA-approved medicine for Cushing’s disease that works by blocking an enzyme that helps make cortisol. It inhibits 11ß-hydroxylase inhibitor (CYP11B1), the enzyme responsible for the final step of cortisol biosynthesis in the adrenal gland. The oral route of administration of ISTURISA makes it one of the most patient-compliant products, offering greater convenience and ease of use compared to injectable treatments. ISTURISA is the only drug currently expanding its product range, with a Phase II trial (NCT03708900) underway to evaluate its use in children and adolescents.

RECORLEV, developed by Strongbridge Biopharma but then acquired by Xeris Pharmaceuticals, is one of the latest approved products by the FDA. RECORLEV received FDA approval in 2021 for the treatment of endogenous hypercortisolemia in adult patients with Cushing’s syndrome for whom surgery is not an option or has not been curative. RECORLEV works by inhibiting cortisol synthesis at multiple stages of the steroidogenesis pathway, reducing the production of cortisol in the adrenal glands which makes it unique concerning ISTURISA.

Along with the above products, there is another product, KORLYM, marketed by Corcept Therapeutics. It is indicated to control hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing’s syndrome who have Type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery.

The clinical development landscape is quite constrained currently. Consequently, in light of this scarcity, our forecast considers the potential impact of Corcept Therapeutics’s relacorilant, Sparrow Pharmaceuticals’s clofutriben, and Crinetics Pharmaceuticals’s atumelnant. The approval of these therapies is anticipated to reshape the market dynamics during the forecast period (2025–2034).

- In 2024, the US captured the highest market share, i.e., nearly USD 930 million out of all the 7MM countries.

- EU4 and the UK accounted for nearly USD 85 million of the market share, and Germany accounted for the highest share in EU4 and the UK in 2024.

- In Japan, the Cushing’s disease market size accounted for nearly USD 45 million in 2024, and is expected to increase at a significant CAGR during the forecast period (2025–2034).

- In 2024, among all the current therapies for Cushing’s disease, the highest revenue was generated by Mifepristone (KORLYM and generics) in the US.

Cushing’s disease Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034. The landscape of Cushing’s disease treatment has experienced a profound transformation with the uptake of novel drugs.

KORLYM (mifepristone), marketed by Corcept Therapeutics is available in the market since 2012. It is indicated to control hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing’s syndrome who have type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery. Mifepristone acts as a selective antagonist of the progesterone receptor at low doses and blocks the glucocorticoid receptor (GR-II) at higher doses. Recently, Corcept Therapeutics made an authorized generic version of KORLYM available for the same indication to maintain its market position. In addition, Teva Pharmaceutical initiated the launch of a generic version of mifepristone in early 2024, providing it the tough competition in the market.

Looking ahead, Relacorilant a emerging product developed by Corcept Therapeutics, has been assigned a PDUFA target action date of December 30, 2025, to treat patients with endogenous hypercortisolism. Unlike mifepristone, Relacorilant may offer a differentiated safety and efficacy profile, potentially driving adoption and shifting prescribing patterns. However, its approval would also solidify Corcept Therapeutics' presence in the Cushing’s disease market, ensuring it retains a significant share despite increasing competition. By offering both KORLYM and Relacorilant, Corcept is positioned to address different patient needs, mitigating the impact of generic competition while reinforcing its dominance in this therapeutic space.

Further detailed analysis of emerging therapies drug uptake in the report…

Cushing’s Disease Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I/II. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Cushing’s disease emerging therapies.

Latest KOL Views on Cushing’s Disease

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, PhD, Research Project Manager, Director, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Cushing’s disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Ohio State University Wexner Medical Center, Université Paris Cité, University of California, University of California, University-Hospital of Padua, etc., were contacted. Their opinion helps understand and validate Cushing’s disease epidemiology and market trends.

What KOLs are saying on Cushing’s Disease Patient Trends?

- “Many centers save blood samples from the procedure and measure the prolactin concentrations if the results of the Inferior Petrosal Sinus Sampling (IPSS) need further analysis. To avoid false-positive results, IPSS must be performed while the patient is hypercortisolemic. If IPSS is performed in the absence of sustained hypercortisolism, the normal corticotrophs are not suppressed and will respond to CRH. The resulting inferior petrosal sinus–to–peripheral ACTH gradient will suggest Cushing’s disease, regardless of the etiology of Cushing’s syndrome and in normal subjects.”

- “Nowadays, medical therapy represents a relevant option in the treatment of patients with Cushing’s disease, particularly in those with persistent or recurrent Cushing’s disease, and especially when the alternative second-line treatments, including repeat pituitary surgery, pituitary radiotherapy, and bilateral adrenalectomy, are not feasible, not indicated or not preferred by patients.”

Cushing’s Disease Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Cushing’s Disease Market Access and Reimbursement

The cost of newly approved medications is usually high, and because of it, patients escape from proper treatment or opt for off-label and cheap medications. It affects market access to newly launched medications, and reimbursement is crucial. The decision to reimburse often comes down to the drug’s price relative to the benefit it produces in treated patients. Market access and reimbursement options can differ depending on regulatory status, target population size, the setting of care, unmet needs, the magnitude of incremental benefit claims, and costs.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

The United States

ISTURISA (osilodrostat): R.A.R.E. (Recordati Access, Resources, and Engagement) Patient Support Program

The R.A.R.E. Patient Support Program can provide support, encouragement, tools, and information to help patients manage the many aspects of the treatment.

Recordati Rare Diseases offers a USD 20 co-pay for qualified patients with commercial insurance.a Eligibility requirements, restrictions, and limitations apply.

Further detailed analysis of emerging therapies drug uptake in the report…

Scope of the Cushing’s Disease Market Report

- The report covers a descriptive overview of Cushing’s disease, explaining its causes, signs and symptoms, pathogenesis, and currently available and promising emerging therapies.

- Comprehensive insight has been provided into Cushing’s disease epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Cushing’s disease is provided, along with the assessment of new therapies that will have an impact on the current treatment landscape.

- A detailed review of the Cushing’s disease market, historical and forecasted, is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends shaping and driving the 7MM Cushing’s disease market.

Cushing’s Disease Market Report Insights

- Cushing’s Disease Patient population

- Cushing’s Disease Therapeutic approaches

- Cushing’s disease pipeline analysis

- Cushing’s disease market size and trends

- Cushing’s Disease Market opportunities

- Impact of upcoming Cushing’s Disease therapies

Cushing’s Disease Market Report Key Strengths

- Ten years forecast

- 7MM coverage

- Cushing’s disease epidemiology segmentation

- Key cross competition

- Highly analyzed market

- Drugs uptake

Cushing’s Disease Market Report Assessment

- Current treatment practices

- Unmet needs

- Pipeline product profiles

- Market attractiveness

- Qualitative analysis (SWOT and conjoint analysis)

Key Questions Answered in the Cushing’s Disease Report

- What was Cushing’s disease market share (%) distribution in 2020, and what would it look like in 2034?

- What would be the Cushing’s disease total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- Which country will have the largest Cushing’s disease market size during the study period (2020–2034)?

- What are the disease risks, burdens, and unmet needs of Cushing’s disease?

- What is the historical Cushing’s disease patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Cushing’s disease?

- How many emerging therapies are in the mid- and late-stage of development for the treatment of Cushing’s disease?

- What are the key collaborations (Industry–Industry, Industry–Academia), mergers and acquisitions, and licensing activities related to Cushing’s disease therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Cushing’s disease and their status?

- What are the key designations that have been granted for the emerging therapies for Cushing’s disease?

Reasons to Buy Cushing’s Disease Market Report

- The report will help in developing business strategies by understanding trends shaping and driving Cushing’s disease.

- To understand the future market competition in the Cushing’s disease market and an Insightful review of the SWOT analysis of Cushing’s disease.

- Organize sales and marketing efforts by identifying the best opportunities for Cushing’s disease in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Cushing’s disease market.

- To understand the future market competition in the Cushing’s disease market.