Cystinosis Market Summary

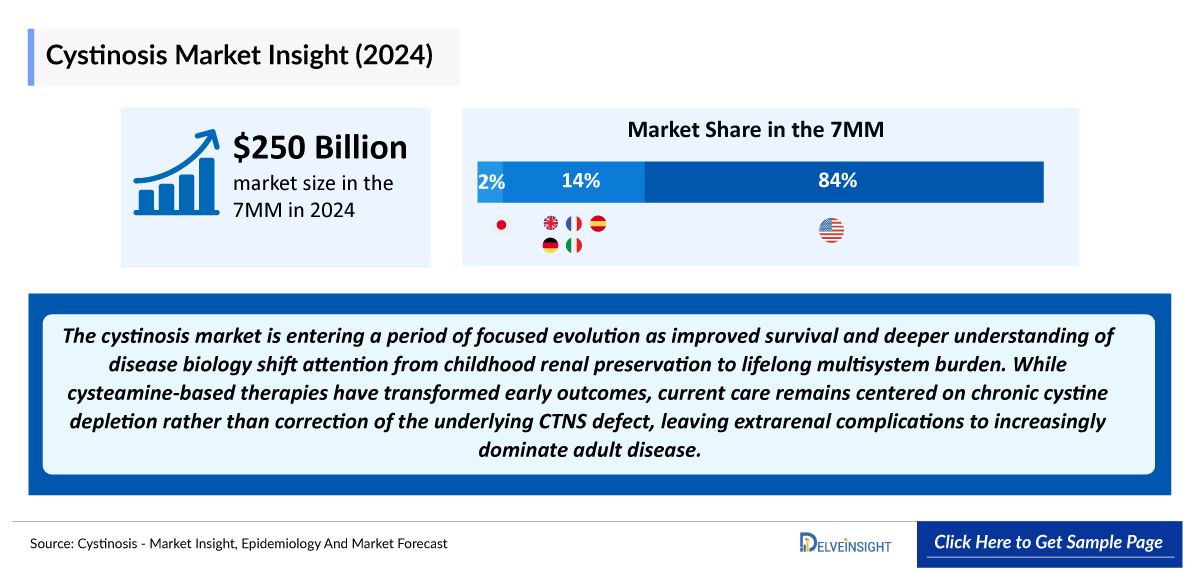

- The Cystinosis Market Size was valued at ~USD 250 million in 2024 and is anticipated to grow with a significant CAGR during the study period (2020-2034).

- The Cystinosis companies developing therapies in the treatment market include - Amgen, Chiesi Farmaceutici, Recordati Rare Diseases, Viatris, Leadiant Biosciences, Thiogenesis Therapeutics, Novartis, and others.

Cystinosis Market and Epidemiology Analysis

- The cystinosis market size in the United States surpassed USD 210 million in 2024 and is anticipated to grow further as new mechanism-driven therapies targeting the disease’s underlying neurobiological pathways enter the market.

- In 2024, the combined cystinosis market across the EU4 and the UK was valued at approximately USD 35 million, representing about 14% of the total revenue in the 7MM. This market size is projected to evolve by 2034.

- In 2024, Japan’s cystinosis market was valued at over USD 0.7 million and is expected to witness changes throughout the forecast period.

- Cystinosis is a rare, inherited lysosomal storage disorder caused by defective cystine transport, leading to intracellular accumulation and progressive multisystem involvement, particularly of the kidneys and eyes; elevated leukocyte cystine levels and CTNS gene mutations, supported by characteristic clinical findings, confirm diagnosis.

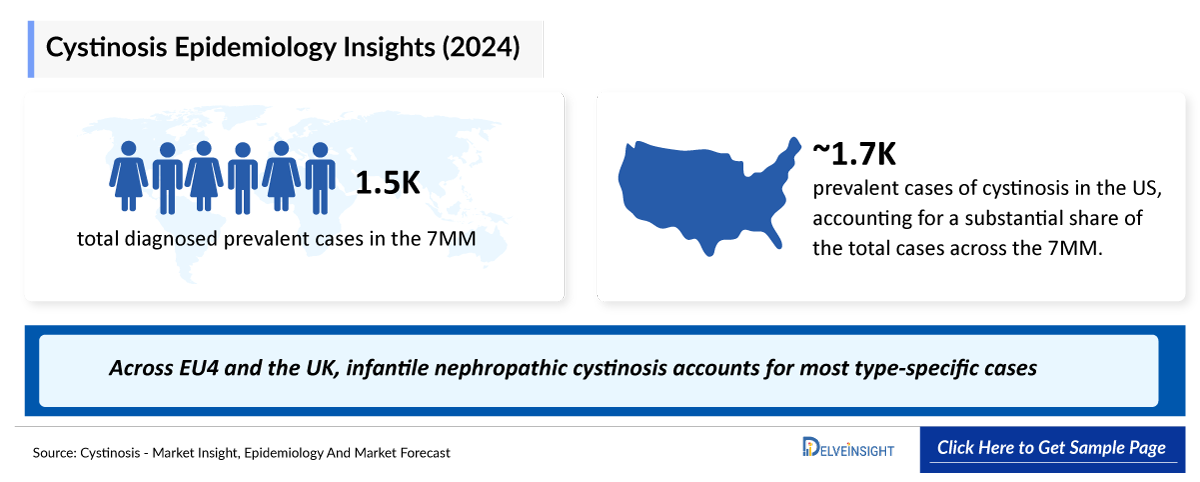

- According to DelveInsight’s 2024 analysis, the total diagnosed prevalent cases of cystinosis across the 7MM were estimated at 1,540, reflecting its rarity and the concentration of diagnosed patients within specialized metabolic and nephrology care settings.

- Cystinosis therapy remains confined to long-standing cysteamine products, including PROCYSBI and CYSTAGON/NICYSTAGON (cysteamine bitartrate), as well as CYSTADROPS and CYSTARAN (cysteamine hydrochloride). With no meaningful innovation, tolerability issues, high dosing burden, and adherence challenges, highlighting a clear unmet need for improved therapeutic options, limit their use.

- The cystinosis pipeline is steadily evolving, with a defined group of emerging therapies including TTI-0102, DFT383, and others progressing through development. This focused set of candidates reflects a measured yet meaningful advance in innovation for a rare, multisystem disease with high unmet need, signaling momentum beyond conventional cysteamine-based approaches.

Request for unlocking the Sample Page of the "Cystinosis Market Insights"

Key Factors Driving the Cystinosis Market

- Growing Awareness and Diagnosis Rates: Increased global awareness of Cystinosis, particularly among clinicians and rare disease networks, has led to earlier detection and more accurate diagnosis. Newborn screening initiatives and improved genetic testing capabilities are helping identify patients earlier in life, expanding the diagnosed population and driving demand for effective treatments.

- Advances in Targeted Therapies and Pipeline Innovation: Therapeutic innovation including next-generation cystine-depleting agents and emerging gene therapies is accelerating. These targeted approaches aim to improve cystine removal from cells, slow disease progression, and enhance patient outcomes, broadening the treatment landscape beyond conventional options.

- Regulatory Incentives and Support for Rare Diseases: Orphan drug designations, priority review vouchers, and accelerated approval pathways incentivize pharmaceutical investment in cystinosis therapies. These policies help reduce development risk, shorten time to market, and attract greater R&D funding into the field.

- Rising Treatment Adoption and Life Expectancy Improvements: With advances in long-term management, including better supportive care and adherence to cystine-depleting therapies, patients are experiencing improved survival and quality of life. This has increased long-term engagement with specialized therapies, contributing to market expansion.

- Strengthening Patient Advocacy Networks: Active support from cystinosis patient groups and advocacy organizations is raising disease visibility, promoting patient education, and pushing for greater access to innovative treatments and clinical trials. Their involvement enhances clinical trial recruitment and supports health policy reforms.

DelveInsight’s “Cystinosis Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the cystinosis, historical and projected epidemiological data, competitive landscape as well as cystinosis market tends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The cystinosis market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM cystinosis market size from 2020 to 2034. The report also covers emerging cystinosis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the Cystinosis Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

Cystinosis Market |

|

|

Cystinosis Market Size | |

|

Cystinosis Companies |

Amgen, Chiesi Farmaceutici, Recordati Rare Diseases, Viatris, Leadiant Biosciences, Thiogenesis Therapeutics, Novartis, and others |

|

Cystinosis Epidemiology Segmentation |

|

Cystinosis Disease Understanding

Cystinosis Overview

Cystinosis is a rare, inherited metabolic disorder defined by defective lysosomal cystine transport that leads to progressive intracellular cystine accumulation despite early recognition and long-term therapy. Widespread crystal deposition drives multisystem dysfunction, most prominently affecting the kidneys, eyes, endocrine organs, muscles, and nervous system, resulting in renal impairment, visual complications, growth delay, and reduced physical endurance. Although manifestations often begin in infancy, cystinosis persists throughout life and progressively impacts daily functioning, quality of life, and long-term survival. Advances in molecular genetics and cellular biology have clarified the underlying pathophysiology, enabling more accurate diagnosis and earlier intervention while supporting the development of next-generation therapies. Despite these advances, challenges remain in long-term disease control, treatment burden, and access to specialized multidisciplinary care. Cystinosis remains an evolving field, with expanding scientific insight and therapeutic innovation shaping future strategies for durable, patient-centered disease control.

Cystinosis Diagnosis

Cystinosis is diagnosed through a structured, confirmatory process that centers on identifying pathological cystine accumulation and excluding other causes of renal and multisystem dysfunction. Evaluation typically begins with clinical suspicion based on early-onset renal Fanconi syndrome, growth failure, or ocular findings, followed by targeted laboratory assessment. Definitive diagnosis is established by demonstrating elevated intracellular cystine levels in leukocytes and confirming pathogenic variants in the CTNS gene. Supportive investigations such as renal function testing, ophthalmologic examination for corneal crystal deposition, endocrine evaluation, and neurocognitive assessment are used to characterize disease extent and exclude alternative metabolic or genetic disorders. Because clinical features can overlap with other renal and lysosomal conditions, accurate diagnosis relies on integrating biochemical, genetic, and systemic evaluations to confirm cystinosis and define its multisystem impact.

Cystinosis Treatment

A long-term disease-control framework that prioritizes early identification, continuous suppression of intracellular cystine accumulation, and prevention of irreversible multisystem damage drives management of cystinosis. Current care is built around cysteamine-based therapies, with PROCYSBI and CYSTAGON/NICYSTAGON addressing systemic disease and CYSTADROPS and CYSTARAN targeting ocular involvement, collectively forming the therapeutic foundation. However, their clinical impact is tempered by tolerability limitations, intensive dosing requirements, and adherence challenges, which can compromise sustained cystine control over time. As a result, effective care extends beyond pharmacologic intervention to include coordinated, multidisciplinary monitoring of renal, endocrine, ocular, and neuromuscular complications, reflecting the need for a comprehensive, lifelong, and patient-centered disease management paradigm.

Further details related to disease overview are provided in the report…

Cystinosis Epidemiology

The cystinosis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented total prevalent cases of cystinosis, total diagnosed prevalent cases of cystinosis, and type-specific diagnosed prevalent cases of cystinosis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Cystinosis Epidemiological Analyses and Forecast

- In 2024, DelveInsight estimated approximately 1,700 prevalent cases of cystinosis in the US, accounting for a substantial share of the total cases across the 7MM. Despite its rarity, this concentration highlights the significant clinical burden of cystinosis and its long-term, multisystem impact on affected patients.

- Across EU4 and the UK, infantile nephropathic cystinosis accounts for most type-specific cases, comprising 94% of the total in 2024, supported by early identification of Fanconi syndrome and timely diagnosis within structured pediatric nephrology referral systems.

- In 2024, DelveInsight estimated that the EU4 and the UK together accounted for a notable share of diagnosed prevalent cystinosis cases, with the UK representing the largest national burden at approximately 250 cases. In contrast, Spain reported the lowest number within this region, with approximately 65 diagnosed individuals, highlighting marked variation across European markets.

- In 2024, DelveInsight estimated that total prevalent cases of cystinosis in Japan exceeded 100 cases, representing a comparatively smaller yet clinically significant patient population within the 7MM and underscoring the persistent burden of this rare, lifelong multisystem disorder.

Cystinosis Epidemiology Segmentation

- Total Prevalent Cases of Cystinosis

- Total Diagnosed Prevalent Cases of Cystinosis

- Type-specific Diagnosed Prevalent Cases of Cystinosis

Cystinosis Drug Analysis

The drug chapter segment of the cystinosis reports encloses a detailed analysis of cystinosis late-stage (Phase III and Phase I) and early stage Cystinosis pipeline drugs. It also helps understand the cystinosis clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Cystinosis Marketed Drugs

PROCYSBI (cysteamine bitartrate): Amgen/Chiesi Farmaceutici

PROCYSBI is a delayed-release oral cysteamine formulation approved for nephropathic cystinosis in pediatric and adult patients aged 1 year and older. It provides sustained cysteamine exposure for long-term control of intracellular cystine levels, with weight-based dosing titrated to white blood cell cystine concentrations. PROCYSBI is available as delayed-release capsules (25 mg, 75 mg) and oral granules (75 mg, 300 mg) and is approved for use in the US and Europe.

- In October 2023, Amgen completed the acquisition of Horizon Therapeutics in an all-cash transaction valued at approximately USD 27.8 billion, thereby expanding its rare disease portfolio to include PROCYSBI.

- In December 2020, the US FDA approved PROCYSBI delayed-release oral granules for the treatment of nephropathic cystinosis in patients aged one year and older.

- In December 2017, the US FDA approved an expanded indication for PROCYSBI delayed-release capsules to include children aged one year and older with nephropathic cystinosis.

- In August 2015, the US FDA expanded the indication of PROCYSBI to include pediatric patients aged 2 to 6 years with nephropathic cystinosis, based on supportive long-term efficacy and safety data, making it approved for patients aged 2 years and older in the US.

- In September 2013, the European Commission approved PROCYSBI gastro-resistant hard capsules of cysteamine for the treatment of nephropathic cystinosis.

- In April 2013, the US FDA approved PROCYSBI (cysteamine bitartrate), a delayed-release oral therapy, for the management of nephropathic cystinosis in pediatric and adult patients, initially indicated for individuals aged 6 years and older.

CYSTADROPS (cysteamine hydrochloride): Recordati Rare Diseases/Viatris

CYSTADROPS, developed by Recordati Rare Diseases, is a viscous gel eye drop containing cysteamine hydrochloride that reduces corneal cystine crystal accumulation by converting cystine into more soluble compounds. Its prolonged ocular residence enables four-times-daily dosing, improving convenience and patient adherence.

- In April 2025, the EMA expanded the indication of CYSTADROPS from Recordati Rare Diseases to include infants from six months of age, following a positive CHMP recommendation.

- In March 2024, Viatris launched CYSTADROPS Ophthalmic Solution 0.38% in Japan under exclusive rights from Recordati Rare Diseases, becoming the first approved therapy in the country shown to reduce corneal cystine crystal deposits in cystinosis.

- In August 2020, the US FDA approved CYSTADROPS (cysteamine ophthalmic solution) 0.37%, developed by Recordati Rare Diseases, for reducing corneal cystine crystal deposits in patients with cystinosis.

- In January 2017, the European Commission granted marketing authorization for CYSTADROPS from Recordati Rare Diseases, marking the first ophthalmic cysteamine formulation approved in the EU for treating corneal cystine crystal deposits in adults and children aged 2 years and older with cystinosis.

CYSTAGON/NICYSTAGON (cysteamine bitartrate): Viatris

CYSTAGON is an oral capsule originally developed by Mylan Pharmaceuticals, now Viatris, containing cysteamine bitartrate equivalent to 50 mg or 150 mg of cysteamine; in Japan, it is marketed as NICYSTAGON and is indicated for the treatment of nephropathic cystinosis in pediatric and adult patients.

- In August 1994, the US FDA approved CYSTAGON, developed by Mylan, for the treatment of nephropathic cystinosis.

- In June 1997, the European Medicines Agency granted marketing authorization for CYSTAGON to Recordati Rare Diseases for the treatment of cystinosis.

- In July 2014, Mylan received approval for CYSTAGON from the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, where it was approved as NICYSTAGON.

- In April 2018, Recordati completed an agreement with Mylan to acquire international rights, including Europe, to CYSTAGON for the treatment of nephropathic cystinosis in children and adults; the product had previously been commercialized in Europe by Orphan Europe under license from Mylan.

Comparison of Cystinosis Marketed Drugs | |||

|

Drug |

MoA |

RoA |

Company |

|

PROCYSBI (cysteamine bitartrate |

Cystine-depleting agent |

Oral |

Amgen/Chiesi Farmaceutici |

|

CYSTADROPS (cysteamine hydrochloride) |

Cystine-depleting agent |

Ocular |

Recordati Rare Diseases/Viatris |

|

CYSTAGON/ NICYSTAGON (cysteamine bitartrate) |

Cystine-depleting agent |

Oral |

Viatris |

|

XXX |

XXX |

X |

XXX |

Cystinosis Emerging Drugs

DFT383: Novartis

DFT383 is an investigational gene therapy for nephropathic cystinosis designed to deliver a functional CTNS gene and address lysosomal cystine accumulation. Also known as AVR-RD-04 or CTNS-RD-04, the program was acquired from AVROBIO and is being evaluated in pediatric patients in a Phase I/II setting, following earlier adult studies. References by Papillon Therapeutics reflect shared scientific lineage and platform validation, not development ownership.

- In May 2023, AVROBIO entered into an Asset Purchase Agreement with Novartis, selling the cystinosis gene therapy program AVR-RD-04 and related assets for USD 87.5 million, while granting Novartis exclusive intellectual property rights.

- In July 2021, the US FDA granted Fast Track designation (FTD) for AVR-RD-04 for the treatment of cystinosis.

- In July 2021, the AVROBIO received clearance from the US FDA for an IND, application for AVR-RD-04 for the treatment of cystinosis. This IND clearance allows the company to initiate a company-sponsored long-term follow-up study for patients enrolled in the Phase I/II.

- In March 2021, European commission granted Orphan Drug designation (ODD) for AVR-RD-04, the AVROBIO’s investigational gene therapy for the treatment of cystinosis. The drug has also received ODD in the US from the US FDA.

TTI-0102: Thiogenesis Therapeutics

TTI-0102, developed by Thiogenesis Therapeutics, is an oral cysteamine prodrug designed to overcome limitations of traditional thiol therapies. Leveraging the 505(b)(2) pathway, it builds on existing cysteamine safety data, has shown good tolerability at high doses, preserves cystine depletion and antioxidant activity, and qualifies as a New Chemical Entity with five years of exclusivity. The program is advancing toward a pivotal Phase III trial, with IND submission expected in the second half of 2026.

- In its December 2025 presentation, Thiogenesis reported plans to submit an IND application in the second-half of 2026 to support a pivotal Phase III trial of TTI-0102 in cystinosis.

- In November 2025, Thiogenesis Therapeutics reported that it expanded its plans for a pivotal Phase III trial of TTI-0102 in nephropathic cystinosis, with the IND expected in 2026, and highlights that TTI-0102 is designed to improve tolerability and simplify dosing.

- In November 2025, Thiogenesis reported positive interim Phase II results for TTI-0102 in MELAS and announced plans to submit an IND to support a pivotal Phase III trial in nephropathic cystinosis, based on favorable pharmacokinetic and biomarker data.

Comparison of Cystinosis Emerging Drugs | ||||

|

Drug |

MoA |

RoA |

Company |

Phase |

|

TTI-0102 |

Small molecule |

Oral |

Thiogenesis Therapeutics |

III |

|

DFT383 |

HSC gene therapy |

IV infusion |

Novartis |

I/II |

|

XXX |

XXX |

X |

XXX |

X |

Cystinosis Drug Class Insights

The cystinosis treatment landscape is largely defined by long-standing cysteamine-based therapies rather than next-generation, curative or fully disease-modifying interventions. Systemic control relies on PROCYSBI and CYSTAGON/NICYSTAGON (cysteamine bitartrate), while ocular involvement is addressed with CYSTADROPS and CYSTARAN (cysteamine hydrochloride). Although these agents reduce cystine accumulation and have improved survival, their clinical impact is constrained by high dosing frequency, tolerability issues such as gastrointestinal effects and odor, formulation limitations, and adherence challenges, often resulting in incomplete and variable long-term disease control. This dependence on burdensome, decades-old therapies highlights persistent gaps in efficacy, convenience, and quality-of-life outcomes for patients with this lifelong multisystem disorder.

Emerging therapies in cystinosis are beginning to reshape the landscape by targeting the underlying disease biology more directly and addressing key limitations of existing options. Programs such as TTI-0102 and DFT383 represent a shift toward improved systemic cystine control and potential disease modification, including approaches that leverage optimized cysteamine delivery or gene-based correction of the CTNS defect. By moving beyond incremental refinements of traditional therapy, these advances signal progress toward more effective, durable, and patient-centric strategies capable of transforming long-term outcomes in cystinosis.

Cystinosis Market Outlook

The cystinosis market is entering a period of focused evolution as improved survival and deeper understanding of disease biology shift attention from childhood renal preservation to lifelong multisystem burden. While cysteamine-based therapies have transformed early outcomes, current care remains centered on chronic cystine depletion rather than correction of the underlying CTNS defect, leaving extrarenal complications to increasingly dominate adult disease.

Real-world use of systemic and ocular cysteamine continues to be limited by high treatment burden, tolerability issues, and long-term adherence challenges, resulting in variable disease control over time. As the adult cystinosis population grows, gaps in durable efficacy, convenience, and quality-of-life outcomes are becoming more clinically visible and strategically important.

Looking ahead, cystinosis is moving toward a more biology-driven phase, with innovation increasingly focused on reducing lifelong treatment burden and achieving broader, more durable multisystem control. These shifts position the disease at a clear inflection point, where emerging science has the potential to meaningfully redefine long-term care and patient outcomes.

- According to DelveInsight’s 2024 analysis, the cystinosis market across the 7MM was valued at approximately USD 250 million, driven by its lifelong multisystem disease burden, the need for continuous long-term therapy, and improved survival leading to an expanding treated patient population.

- The market size for cystinosis in the US exceeded USD 210 million in 2024 and is projected to expand further with the introduction of novel, mechanism-based therapies targeting the underlying neurobiology of the disorder.

- The total market size of cystinosis in the EU4 and the UK was nearly USD 35 million in 2024, accounting for around 14% of the total 7MM market revenue, and is expected to change by 2034.

- In 2024, the total market size of cystinosis in Japan was more than USD 0.7 million, which is anticipated to change during the forecast period.

Cystinosis Competitive Landscape

The cystinosis market features a focused but growing competitive landscape driven by companies developing both established supportive therapies and innovative mechanism-based treatments aimed at the underlying pathology of the disease. As an ultra-rare metabolic disorder, this market is characterized by targeted niche players, strategic partnerships, and emerging biotech involvement.

Key Highlights:

- Established Therapies: Current standards such as cysteamine bitartrate (oral and delayed-release formulations) remain core treatments to reduce cystine accumulation and delay organ damage.

- Pipeline Innovation: Emerging therapies including novel small molecules, alternative cystine-depleting agents, and gene therapy approaches are advancing through clinical development to improve efficacy, tolerability, and long-term outcomes.

- Biotech & Specialty Focus: Smaller biotech firms and rare disease specialists are increasingly active in R&D, leveraging deeper biological insights and innovative delivery platforms.

- Strategic Collaborations: Partnerships between rare disease developers and larger pharmaceutical companies help accelerate clinical programs, expand geographic reach, and access regulatory expertise, especially for global submissions.

- Regulatory Incentives: Orphan drug designations, fast-track pathways, and market exclusivity benefits attract investment and support trial progression in this highly specialized space.

Key Cystinosis Companies

The Key Cystinosis companies actively involved in the Cystinosis treatment landscape include -

- Amgen

- Chiesi Farmaceutici

- Recordati Rare Diseases

- Viatris

- Leadiant Biosciences

- Thiogenesis Therapeutics

- Novartis, and others

Cystinosis Drugs Uptake

This section focuses on the rate of uptake of the potential Cystinosis drugs recently launched in the Cystinosis treatment market or expected to get launched in the market during the study period 2020-2034. The analysis covers Cystinosis market uptake by drugs; patient uptake by therapies; and sales of each drug.

Cystinosis Drugs Uptake helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allow the comparison of the drugs on the basis of Cystinosis market share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Cystinosis Clinical Trial Development Activities

The Cystinosis pipeline report provides insights into different Cystinosis clinical trials within Phase III, Phase II, Phase I, and early stage molecule. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for cystinosis market growth over the forecasted period.

Cystinosis Pipeline Development Activities

The Cystinosis clinical trial analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for cystinosis emerging therapies.

Latest KOL Views on Cystinosis Market Report

To keep up with current and future market trends, we take industry experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on cystinosis evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers like the University of California San Diego, US; University Hospital Hamburg-Eppendorf, Germany; Hôpital Necker Enfants Malades APHP, France; University of Padua, Italy; University of Barcelona, Spain; University of Sunderland, UK; Hiroshima University, Japan; among others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or cystinosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Cystinosis Physician’s View

As per KOL from the US, “Cystinosis arises from mutations in the ubiquitously expressed CTNS gene and unfolds as a progressive multisystem disorder. The condition chiefly impacts renal function, beginning with Fanconi syndrome and advancing to chronic kidney disease that may require transplantation. Additional ocular, respiratory, and neurological involvement deepens the disease burden and markedly reduces quality of life.”

As per KOL from the UK, “Diagnosis often relies on detecting elevated cystine levels in white blood cells, though differing biochemical assays can introduce variability across laboratories. Molecular analysis of the CTNS gene has become a reliable standard, providing clearer confirmation of the disorder. Together, these approaches support earlier and more accurate identification of cystinosis.”

As per KOL from Japan, “Over two decades of experience with aminothiol cysteamine has shown clear benefits in managing systemic aspects of cystinosis. However, because the cornea lacks vasculature, oral therapy cannot address ocular involvement. This limitation led to the development of topical cysteamine, which successfully dissolves corneal cystine crystals, lowers crystal density, and alleviates photophobia, offering targeted relief for ocular manifestations.”

Cystinosis Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Cystinosis Market Access and Reimbursement Scenario

The report further details country-wise reimbursement and accessibility status, cost-effectiveness assessments, patient assistance initiatives that improve affordability, and insights into coverage under government prescription drug programs.

PROCYSBI

Support and resources

Amgen By Your Side is a comprehensive patient support program designed to assist individuals and families in accessing PROCYSBI (cysteamine bitartrate). The program provides support with insurance coordination, reimbursement navigation, and treatment access education. Upon enrollment, patients are paired with a dedicated Patient Access Liaison (PAL) who offers personalized, one-on-one, non-clinical assistance, helps address coverage and reimbursement questions, and guides patients through the steps following prescription and completion of enrollment.

Scope of the Cystinosis Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of cystinosis, explaining their mechanism and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will affect the current landscape.

- A detailed review of the cystinosis market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM cystinosis.

Cystinosis Market Report Insights

- Cystinosis Targeted Patient Pool

- Cystinosis Therapeutic Approaches

- Cystinosis Pipeline Analysis

- Cystinosis Market Size and Trends

- Existing and Future Market Opportunity

Cystinosis Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Attribute Analysis

- Cystinosis Drugs Uptake

- Key Cystinosis Market Forecast Assumptions

Cystinosis Market Report Assessment

- Current Cystinosis Treatment Practices

- Cystinosis Unmet Needs

- Cystinosis Pipeline Product Profiles

- Cystinosis Market Attractiveness

- Qualitative Analysis (SWOT)

- Cystinosis Market Drivers

- Cystinosis Market Barriers

Key Questions Answered In The Cystinosis Market Report:

- What was the cystinosis total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for cystinosis?

- Which drug accounts for maximum cystinosis sales?

- What are the risks, burdens, and unmet needs of treatment with cystinosis? What will be the growth opportunities across the 7MM for the patient population cystinosis?

- What are the key factors hampering the growth of the cystinosis market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for cystinosis?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy Cystinosis Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the cystinosis Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis, ranking of indication-wise current, and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.