Diabetic Gastroparesis Market

- Diabetic gastroparesis (DGP) is a chronic condition that can occur in people with poorly controlled diabetes, and is characterized by delayed gastric emptying. It can cause symptoms like bloating, nausea, vomiting, and feeling full before eating.

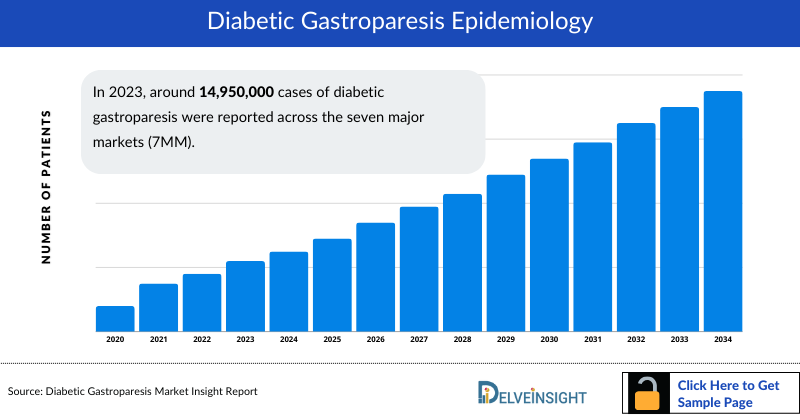

- In 2023, around 14,950,000 cases of diabetic gastroparesis were reported across the seven major markets (7MM). This number is expected to rise between 2020 and 2034 with the significant increase in the prevalence of diabetes gastroparesis and improved diagnostic techniques.

- In 2023, the United States had the highest prevalence of diabetic gastroparesis among the seven major markets (7MM), with 85% of these cases receiving treatment.

- In 2023, about 40% of diabetic gastroparesis cases in the United States were associated with Type 1 diabetes. Type 1 diabetes patients are more frequently affected by gastroparesis due to prolonged exposure to high blood glucose levels, which leads to nerve damage, particularly affecting the vagus nerve that controls stomach function.

- The US FDA has approved only one therapy for the treatment of diabetic gastroparesis—REGLAN (metoclopramide), and the treatment mainly focuses on improving gastric motility and alleviating symptoms such as nausea and delayed gastric emptying, though its long-term use is limited by potential side effects like tardive dyskinesia.

- The current pipeline for diabetic gastroparesis remains limited, with key drugs like CIN-102, tradipitant, and naronapride—developed by CINRx Pharma, Vanda Pharmaceuticals, and Dr. Falk Pharma, respectively—showing the most significant clinical progress.

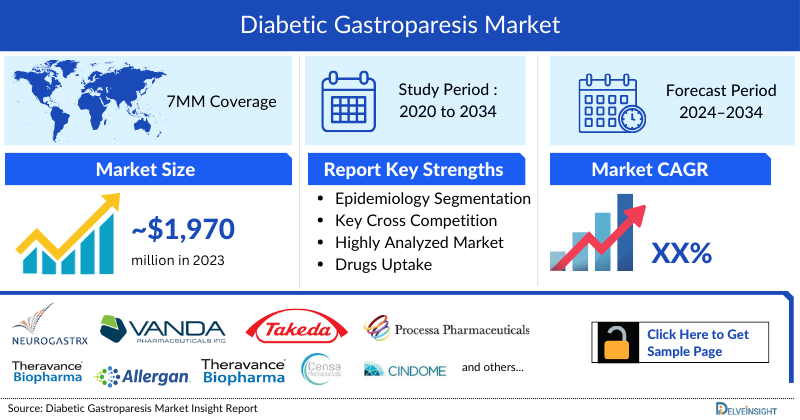

- According to DelveInsight’s estimates, in 2023 the total market for Diabetic gastroparesis across the seven major markets (7MM) was approximately USD 1,970 million with the United States capturing about 60% of the market.

DelveInsight's “Diabetic gastroparesis – Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of the indication Diabetic gastroparesis, historical and forecasted epidemiology as well as the Diabetic gastroparesis market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Diabetic gastroparesis market report provides real-world prescription pattern analysis, approved drugs, market share of individual therapies, and historical and forecasted 7MM Diabetic gastroparesis market size from 2020 to 2034. The report also covers current Diabetic gastroparesis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

Diabetic gastroparesis Epidemiology |

Segmented by:

|

|

Diabetic gastroparesis Key Companies |

|

|

Diabetic gastroparesis Key Therapies/Drug |

|

|

Diabetic gastroparesis Market |

Segmented By:

|

|

Analysis |

|

Diabetic gastroparesis Treatment Market

Diabetic gastroparesis Overview, Country-Specific Treatment Guidelines and Diagnosis

Diabetic gastroparesis (DGP) is a chronic condition that can occur in people with poorly controlled diabetes, and is characterized by delayed gastric emptying. It can cause symptoms like bloating, nausea, vomiting, and feeling full before you've eaten much. Diabetic gastroparesis is caused by dysfunction in the autonomic nervous system, and can be caused by a number of factors, including hyperglycemia, autonomic neuropathy, and enteric neuromuscular disturbances.

Symptoms can range from mild to severe, and may include: Feeling full or satiated sooner than expected, Undigested food being vomited hours after eating, Unpredictable responses to mealtime insulin, Upper abdominal pain, and Weight loss.

Diagnosis typically involves a gastric emptying study to measure the rate at which food leaves the stomach, and an endoscopy to rule out other potential issues. Imaging techniques like ultrasound or MRI may be used to examine the stomach and surrounding organs. Treatment primarily focuses on dietary modifications, such as consuming smaller, more frequent meals and avoiding high-fat, high-fiber foods to ease digestion.

Further details related to country-based variations in diagnosis are provided in the report

Diabetic gastroparesis Treatment

The treatment approach for diabetic gastroparesis focuses on relieving symptoms, improving gastric emptying, and managing blood glucose levels. Dietary modifications play a crucial role, with recommendations for small, frequent meals and a diet low in fat and fiber to ease digestion. Medications such as prokinetics (e.g., metoclopramide) are used to stimulate stomach muscle contractions, while antiemetics (e.g., ondansetron) help control nausea and vomiting. Adjusting insulin therapy is essential to maintain stable blood glucose levels despite the delayed digestion. Lifestyle changes, including regular moderate exercise and stress management, also support symptom relief. In more severe cases, advanced therapies like gastric electrical stimulation or feeding tubes may be considered. Surgical options are rarely needed but may be explored in extreme situations.

Diabetic gastroparesis Epidemiology

The Diabetic gastroparesis epidemiology chapter in the report provides historical as well as forecasted prevalence in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The Diabetic gastroparesis epidemiology is segmented with detailed insights into:

- Total Prevalent Cases of Diabetes Mellitus in the 7MM [2020-2034].

- Diagnosed Prevalent Cases of Diabetes Mellitus in the 7MM [2020-2034]

- Gastroparesis associated with Types of Diabetes Mellitus Cases in the 7MM [2020-2034]

- Total Prevalence of Diabetic Gastroparesis in the 7MM [2020-2034]

- Gender-specific Cases of Diabetic gastroparesis in the 7MM [2020-2034].

- Symptom-specific Cases of Diabetic gastroparesis in the 7MM [2020-2034]

- Treated Cases of Diabetic gastroparesis in the 7MM [2020-2034]

Key Epidemiological Highlights

- As per DelveInsight's estimates, in the year 2023, the total prevalent cases of Diabetic gastroparesis were 14,950,000 cases in the 7MM, which might rise by 2034 at a CAGR of XX%.

- EU4 and the UK, accounted for approximately 32% of the total prevalent cases of diabetic gastroparesis in the year 2023.

- In 2023, about 40% of diabetic gastroparesis cases in the United States were associated with Type 1 diabetes. Type 1 diabetes patients are more frequently affected by gastroparesis due to prolonged exposure to high blood glucose levels, which leads to nerve damage, particularly affecting the vagus nerve that controls stomach function

- In 2023, the United States had the highest prevalence of diabetic gastroparesis among the seven major markets (7MM), with 85% of these cases receiving treatment

- In 2023, females accounted for approximately 80% of gastroparesis cases, reflecting a notably higher prevalence in this group. This gender disparity may be due to hormonal differences, which can affect gastrointestinal motility, as well as higher rates of certain conditions linked to gastroparesis that are more common in women.

Diabetic gastroparesis Drug Chapters

The drug chapter segment of the Diabetic gastroparesis market report encloses a detailed analysis of Diabetic gastroparesis emerging candidates. It also deep dives into the Diabetic gastroparesis pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Approved Diabetic gastroparesis Drugs

REGLAN (metoclopramide)

Metoclopramide stimulates motility of the upper gastrointestinal tract without stimulating gastric, biliary, or pancreatic secretions. Its mode of action is unclear. It seems to sensitize tissues to the action of acetylcholine. The effect of metoclopramide on motility is not dependent on intact vagal innervation, but it can be abolished by anticholinergic drugs. Metoclopramide increases the tone and amplitude of gastric (especially antral) contractions, relaxes the pyloric sphincter and the duodenal bulb, and increases peristalsis of the duodenum and jejunum resulting in accelerated gastric emptying and intestinal transit.

- Metoclopramide is currently the only medication that is US FDA approved for the treatment of gastroparesis.

Emerging Diabetic gastroparesis Drugs

CIN-102: CINRx Pharma

An investigational drug primarily targeting cancer treatment. Its mechanism of action (MOA) involves selective inhibition of the protein Mcl-1 (myeloid cell leukemia 1), which plays a crucial role in regulating apoptosis (programmed cell death). By inhibiting Mcl-1, CIN-102 aims to promote cancer cell death and enhance the efficacy of other therapies.

- CIN-102 is currently in Phase II clinical trials.

Tradipitant: Vanda Pharmaceuticals

Tradipitant is an investigational drug developed by Vanda Pharmaceuticals for the treatment of diabetic gastroparesis. Tradipitant is a neurokinin-1 (NK1) receptor antagonist. It works by blocking the NK1 receptors, which are involved in the regulation of gastrointestinal motility and can help alleviate nausea and vomiting associated with gastroparesis.

|

Emerging Drugs | |||||

|

Drug Name |

Company |

RoA |

MoA |

Phase |

Designations |

|

CIN-102 |

CINRx Pharma |

Oral |

Na+/K+ ATPase inhibitor |

II |

NA |

|

Tradipitant |

Vanda Pharmaceuticals |

Oral |

Neurokinin-1 (NK1) receptor antagonist |

III |

NA |

|

Naronapride |

Dr. Falk Pharma |

Oral |

Serotonin type 4 (5-HT4) receptor agonist |

II |

NA |

Further details about emerging drugs will be provided in the report.

Diabetic Gastroparesis Market Outlook

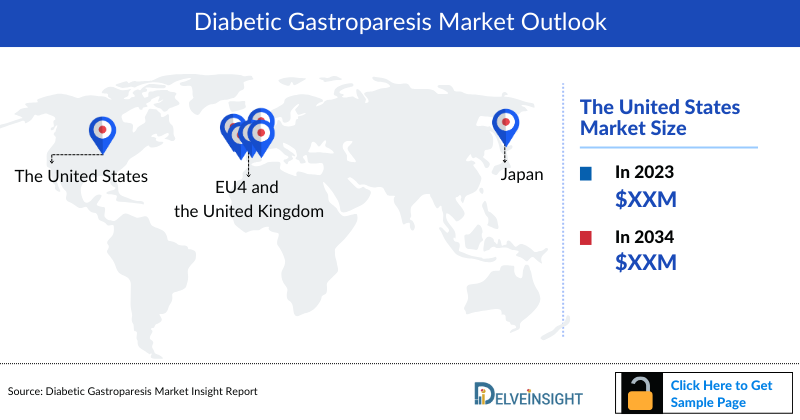

In 2023, the total market for Diabetic gastroparesis therapies across the seven major markets (7MM) reached USD 1,970 million, with the US capturing about 60% of Diabetic gastroparesis market. The Diabetic gastroparesis US market significantly outpaced the EU4 (Germany, Spain, Italy, France), the UK, and Japan. Diabetic gastroparesis market is expected to grow due to increasing awareness, advancements in diagnostic methods, and the potential introduction of new therapies such as Tradipitant by Vanda Pharmaceuticals. Key growth drivers include heightened research and development, progress in emerging therapies, and greater awareness of the disease.

- The United States represents the largest share of the Diabetic gastroparesis market, accounting for a significant proportion compared to the EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Among EU4 and the UK, Germany had the largest Diabetic gastroparesis market size accounting for approximately USD 225 million, followed by the UK, with Spain having the smallest treatment market size in 2023.

- Current Diabetic gastroparesis treatments, such as metoclopramide and domperidone, are often limited by safety concerns, including the risk of tardive dyskinesia and cardiac issues, which restrict their long-term use. There is a need for safer, more effective prokinetic agents that can be used over extended periods without serious adverse effects.

- Metoclopramide along with other prokinetics like domperidone and erythromycin, captured approximately USD 1,000 million in the global gastroparesis treatment market. These medications are commonly prescribed due to their ability to enhance gastrointestinal motility and relieve symptoms such as nausea and delayed gastric emptying.

Diabetic gastroparesis Drug Uptake

This section focuses on the uptake rate of potential Diabetic gastroparesis drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Diabetic gastroparesis Activities

This section provides insights into different therapeutic candidates. It also analyzes key Diabetic gastroparesis companies involved in developing targeted therapeutics.

Pipeline Development Activities

This section covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging Diabetic gastroparesis therapies.

KOL Views

To keep up with the real-world scenario in current Diabetic gastroparesis market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current treatment patterns of Diabetic gastroparesis. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Diabetic gastroparesis drugs market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy.

Diabetic gastroparesis Market Access and Reimbursement

The section provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Diabetic gastroparesis Market Report

- The Diabetic gastroparesis market report covers a segment of key events, an executive summary, descriptive overview of Diabetic gastroparesis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of the current therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Diabetic gastroparesis market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Diabetic gastroparesis market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Diabetic gastroparesis.

Diabetic gastroparesis Market Report Insights

- Diabetic gastroparesis Patient Population

- Diabetic gastroparesis Therapeutic Approaches

- Diabetic gastroparesis Pipeline Analysis

- Diabetic gastroparesis Market Size

- Diabetic gastroparesis Market Trends

- Existing and future Diabetic gastroparesis Market Opportunity

Diabetic gastroparesis Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Diabetic gastroparesis Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved therapies

- Key Cross Competition

- Diabetic gastroparesis Conjoint analysis

- Diabetic gastroparesis Drugs Uptake

- Key Diabetic gastroparesis Market Forecast Assumptions

Diabetic gastroparesis Market Report Assessment

- Current Treatment Practices

- Diabetic gastroparesis Unmet Needs

- Diabetic gastroparesis Pipeline Product Profiles

- Diabetic gastroparesis Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the growth rate of the 7MM Diabetic gastroparesis treatment market?

- What was the Diabetic gastroparesis total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label Diabetic gastroparesis therapies?

- How would the market drivers, barriers, and future opportunities affect the Diabetic gastroparesis market dynamics and subsequent analysis of the associated trends?

- What are the current options for the treatment of Diabetic gastroparesis?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Diabetic gastroparesis therapies?

Reasons to buy

- The Diabetic gastroparesis market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Diabetic gastroparesis Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing Diabetic gastroparesis market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Detailed analysis and ranking of class-wise potential current therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.