Gastroenteropancreatic Neuroendocrine Tumors Market

- Neuroendocrine tumors (NETs) are heterogeneous malignancies arising from the diffuse neuroendocrine system. They frequently originate in the gastroenteropancreatic (GEP) tract and the bronchopulmonary tree.

- The incidence of gastroenteropancreatic neuroendocrine neoplasms has dramatically risen over the last three decades, probably due to the increased detection of asymptomatic lesions.

- The diagnostic workup for patients with suspected gastroenteropancreatic neuroendocrine neoplasms is based on conventional imaging, endoscopy, pathology, and functional imaging.

- The small intestine, rectum, colon, pancreas, and appendix are the most common primary NET sites in the digestive tract.

- Approximately 53% of patients with NETs present with localized disease, 20% have locoregional disease, and 27% have distant metastases at the time of diagnosis.

- The management of gastroenteropancreatic neuroendocrine tumors offers a spectrum of options, ranging from conservative approaches for asymptomatic lesions to surgical resection for localized disease. Key pharmaceutical companies like Novartis, Ipsen Biopharmaceuticals, and others are actively involved in providing treatments for these tumors, with somatostatin analog (SSA) therapy serving as a cornerstone, particularly for hormonally functional tumors and midgut carcinoids.

- Somatostatin analogs are expected to lead the market in Treatment Type during the forecast period, capturing the highest proportion of total market revenue.

- In April 2024, Novartis announced that the US Food and Drug Administration (FDA) approved LUTATHERA for the treatment of pediatric patients 12 years and older with somatostatin receptor-positive (SSTR+) gastroenteropancreatic neuroendocrine tumors, including foregut, midgut, and hindgut NETs. This approval makes Lutathera the first therapy specifically reviewed and approved for use in pediatric patients with GEP-NETs.

- In February 2024, RadioMedix and Orano Med announced that the United States FDA has granted Breakthrough Therapy Designation (BTD) to AlphaMedix (212Pb-DOTAMTATE) for the treatment of adult patients with unresectable or metastatic, progressive somatostatin receptor-expressing gastroenteropancreatic neuroendocrine tumors who are naïve to peptide receptor radionuclide therapy (PRRT).

- The market landscape for gastroenteropancreatic neuroendocrine tumors (GEP-NETs) is witnessing significant evolution, driven by advancements in treatment options and the active participation of major pharmaceutical companies. Notably, companies like Camurus AB, ITM Isotope Technologies Munich, and others are at the forefront of research and development efforts aimed at improving treatment options and influencing market trends.

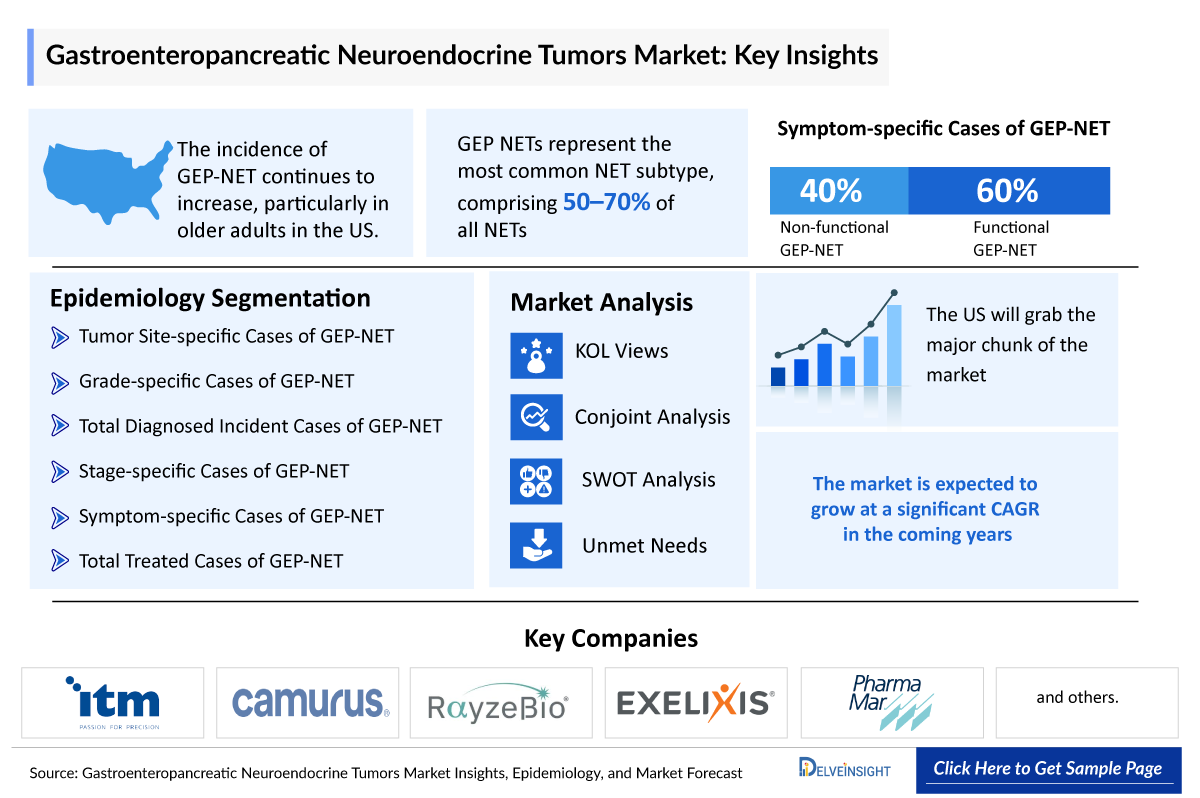

DelveInsight's “Gastroenteropancreatic NET Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Gastroenteropancreatic NET, historical and forecasted epidemiology as well as the Gastroenteropancreatic NET market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Gastroenteropancreatic NET market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Gastroenteropancreatic NET market size from 2020 to 2034. The report also covers current Gastroenteropancreatic NET treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Gastroenteropancreatic Neuroendocrine Tumours Market |

|

|

Gastroenteropancreatic Neuroendocrine Tumours Market Size | |

|

Gastroenteropancreatic Neuroendocrine Tumours Companies |

Novartis, Ipsen Biopharmaceuticals, Pfizer, ITM Isotopen Technologien Muenchen, Camurus AB, Hutchison Medipharma Limited, Bristol-Myers Squibb, Eisai Limite, Experior S.L., Tarveda Therapeutics, Roche Pharma A, Exelixis, Merck Sharp & Dohme Corp, Recordati Inc, Eli Lilly and Company, Genentech, Inc., Aveo Oncology Pharmaceuticals, Radiomedix, Orano Med, PharmaMar, Bayer, Trio Medicine, and others. |

|

Gastroenteropancreatic Neuroendocrine Tumours Epidemiology Segmentation |

|

Gastroenteropancreatic NET Treatment Market

Gastroenteropancreatic NET Overview, Country-Specific Treatment Guidelines, and Diagnosis

Neuroendocrine tumors (NETs) are heterogeneous neoplasms arising in secretory cells of the diffuse neuroendocrine system. They are characterized by a relatively indolent growth and the ability to secrete biogenic amines and peptide hormones. Gastroenteropancreatic NETs (GEP-NETs) include NETs of the gastrointestinal tract (GI-NETs) and pancreatic NETs (panNETs) and can be subdivided into well-differentiated (low-, intermediate- or high-grade) tumors and poorly differentiated carcinomas (NECs), according to their morphology and proliferative activity

The diagnosis of GEP-NETs is based on clinical presentation, pathology, and conventional or functional imaging. Conventional imaging plays a key role in the assessment of the location and extent of GEP-NETs. Cross-sectional imaging using computed tomography (CT) or magnetic resonance imaging (MRI) scans focus on the abdomen for pNETs and on the abdomen and pelvis for midgut carcinoids.

The Gastroenteropancreatic NET report provides an overview of Gastroenteropancreatic NET pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report

Gastroenteropancreatic NET Treatment

Surgery, the only curative treatment for Gastroenteropancreatic NET, is generally considered a first-line treatment for localized NETs. However, despite advances in diagnostics, GEP-NETs are often not identified for up to 5–7 years after clinical symptoms appear, as the symptoms are not specific.

The frontline treatment for metastatic disease is somatostatin analogs, and currently, two agents are FDA-approved: SANDOSTATIN (octreotide acetate) and SOMATULINE DEPOT (lanreotide). If patients progress on frontline treatment, there is, at present, a lack of evidence regarding the next-best agent. Traditionally, mTOR inhibitor – everolimus or sunitinib [SUTENT] – was acknowledged second-line agent, but with the recent approval of PRRT [peptide receptor radionuclide therapy], the choice of second-line therapy is debatable.

Gastroenteropancreatic NET Epidemiology

The Gastroenteropancreatic NET epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. Gastroenteropancreatic NET epidemiology is segmented with detailed insights into total incident cases of GEP-NET, grade-specific cases, tumor site-specific Cases, stage-specific cases, and symptom-specific cases.

- GEP-NETs represent the second most common digestive cancer in terms of prevalence.

- According to findings, small intestine (30.8%), rectum (26.3%), colon (17.6%), pancreas (12.1%), and appendix (5.7%) are the most common primary NET sites in the digestive tract.

- According to the findings, 53% of patients with NETs present with localized disease, 20% have locoregional disease, and 27% have distant metastases at the time of diagnosis.

- The old age population is more susceptible to suffering from Gastroenteropancreatic NET.

Gastroenteropancreatic NET Drug Chapters

The drug chapter segment of the Gastroenteropancreatic NET report encloses a detailed analysis of Gastroenteropancreatic NET marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the Gastroenteropancreatic NET pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Gastroenteropancreatic NET Marketed Drugs

LUTATHERA: Novartis

Lutathera (lutetium Lu 177 dotatate*) is a lutetium Lu 177-labeled somatostatin analog peptide. Lutathera belongs to a class of treatments called Peptide Receptor Radionuclide Therapy (PRRT). Lutathera is comprised of a targeting molecule that carries a radioactive component. Lutathera has received orphan drug designation from the FDA and the European Medicines Agency (EMA). It was approved in 2018 by the US FDA for the treatment of adult patients with SSTR-positive GEP-NETs, including those in the foregut, midgut, and hindgut. Lutathera is also approved in Europe for unresectable or metastatic, progressive, well-differentiated (G1 and G2), somatostatin receptors (SSTR)-positive GEP-NETs in adults, and in Japan for SSTR-positive NETs.

SOMATULINE DEPOT: Ipsen Biopharmaceuticals

SOMATULINE DEPOT (lanreotide) is a somatostatin analog indicated for the treatment of adult patients with unresectable, well- or moderately-differentiated, locally advanced, or metastatic gastroenteropancreatic neuroendocrine tumors (GEP-NETs) to improve progression-free survival.

Note: Detailed current therapies assessment will be provided in the full report of Gastroenteropancreatic NET Drug

Emerging Gastroenteropancreatic NET Drugs

CAM2029: Camurus AB

CAM2029 is a long-acting octreotide subcutaneous depot under development for the treatment of three rare diseases: acromegaly, gastroenteropancreatic neuroendocrine tumors (GEP-NET), and polycystic liver disease (PLD). Studies completed to date demonstrate that CAM2029 has the potential to provide significantly higher octreotide bioavailability and octreotide exposure with the potential for improved treatment efficacy, compared to current market-leading products. CAM2029 is designed to enable easy self-administration, including the option of a pre-filled pen. CAM2029 is based on Camurus' proprietary FluidCrystal technology.

Currently, it is in Phase III of clinical development for the treatment of GEP-NET.

ITM-11: ITM Isotope Technologies Munich

ITM-11 (177Lu-edotreotide), being developed by ITM Isotope Technologies Munich, is an innovative Targeted Radionuclide Therapy agent consisting of two components: firstly, Edotreotide (DOTATOC), an octreotide-derived somatostatin analog, and secondly, EndolucinBeta (no-carrier-added (n.c.a.) lutetium-177 chloride) a synthetic, low-energy beta-emitting therapeutic radioisotope.. It is currently being investigated in two Phase III clinical trials, COMPETE (NCT03049189) and COMPOSE (NCT04919226). While COMPETE is evaluating ITM-11 for the treatment of patients with grade 1 and grade 2 GEP-NETs, the radiopharmaceutical candidate is also being investigated in COMPOSE, for patients with well-differentiated high grade 2 and grade 3 GEP-NETs. ITM-11 received an orphan designation as a treatment for GEP-NETs based on the data from a Phase II clinical study, which demonstrated a significant benefit (substantially improved progression-free survival, PFS).

Note: Detailed emerging therapies assessment will be provided in the final report...

|

Therapy Name |

Company Name |

ROA |

MOA |

Phases |

Any Special Status |

|

RYZ101 |

RayzeBio/ Bristol Myers Squibb |

Infusion |

Ionizing radiation emitters |

III |

NA |

|

AlphaMedix |

RadioMedix |

IV |

Pb212 labeled Somatostatin analogue Targeted Alpha-emitter Therapy |

II |

BTD/ ODD |

Gastroenteropancreatic NET Market Outlook

Key players, such as ITM Isotope Technologies Munich, Camurus AB, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of Gastroenteropancreatic NET.

Systemic treatment options for advanced GEP-NETs are expanding. Somatostatin analog (SSA) treatment remains a cornerstone of GEP-NET therapy, primarily for patients with hormonally functional tumors and midgut carcinoids.

An expanding number of systemic treatment options are available for treating advanced NETs. Targeted drugs inhibiting angiogenesis and mTOR pathways have been developed, but the role of cytotoxic chemotherapy continues to be debated. Consequently, practice patterns vary considerably by country. New insights into the genetic landscape of GEP-NETs will undoubtedly lead to the development of predictive biomarkers that will allow for more rational and individualized sequencing of therapies.

The United States accounts for the largest market size of Gastroenteropancreatic NET, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

Gastroenteropancreatic NET Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Gastroenteropancreatic NET Activities

The report provides insights into Gastroenteropancreatic NET clincial trials within Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Gastroenteropancreatic NET emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging treatment patterns of Gastroenteropancreatic NET. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers’ concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Gastroenteropancreatic NET Market Report

- The report covers a segment of key events, an executive summary, descriptive overview Gastroenteropancreatic NET, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Gastroenteropancreatic NET market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Gastroenteropancreatic NET market.

Gastroenteropancreatic NET Report Insights

- Gastroenteropancreatic NET Patient Population

- Gastroenteropancreatic NET Therapeutic Approaches

- Gastroenteropancreatic NET Pipeline Analysis

- Gastroenteropancreatic NET Market Size and Trends

- Existing and future Market Opportunity

Gastroenteropancreatic NET Report Key Strengths

- Ten Years Forecast

- 7MM Coverage

- Gastroenteropancreatic NET Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- Gastroenteropancreatic NET Drugs Uptake

- Key Gastroenteropancreatic NET Market Forecast Assumptions

Gastroenteropancreatic NET Report Assessment

- Current Gastroenteropancreatic NET Treatment Practices

- Gastroenteropancreatic NET Unmet Needs

- Gastroenteropancreatic NET Pipeline Product Profiles

- Gastroenteropancreatic NET Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Gastroenteropancreatic NET Market Drivers

- Gastroenteropancreatic NET Market Barriers

FAQs

- What is the growth rate of the 7MM Gastroenteropancreatic NET treatment market?

- What was the Gastroenteropancreatic NET total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the treatment of Gastroenteropancreatic NET?

- How many companies are developing therapies for the treatment of Gastroenteropancreatic NET?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy Gastroenteropancreatic NET Market Forecast Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Gastroenteropancreatic NET Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-pipeline.png&w=256&q=75)

.png&w=256&q=75)