Gastroesophageal Reflux Disease (GERD) Market Summary

- GERD is a chronic, relapsing condition characterized by the reflux of gastric contents into the esophagus, leading to symptoms such as heartburn, regurgitation, chest discomfort, and potential mucosal injury.

- The hallmark symptoms of GERD include heartburn, regurgitation, and non-cardiac chest pain, and the condition is influenced by several risk factors such as hiatal hernia, older age, obesity, smoking, alcohol use, consumption of fatty or spicy foods, and a sedentary lifestyle.

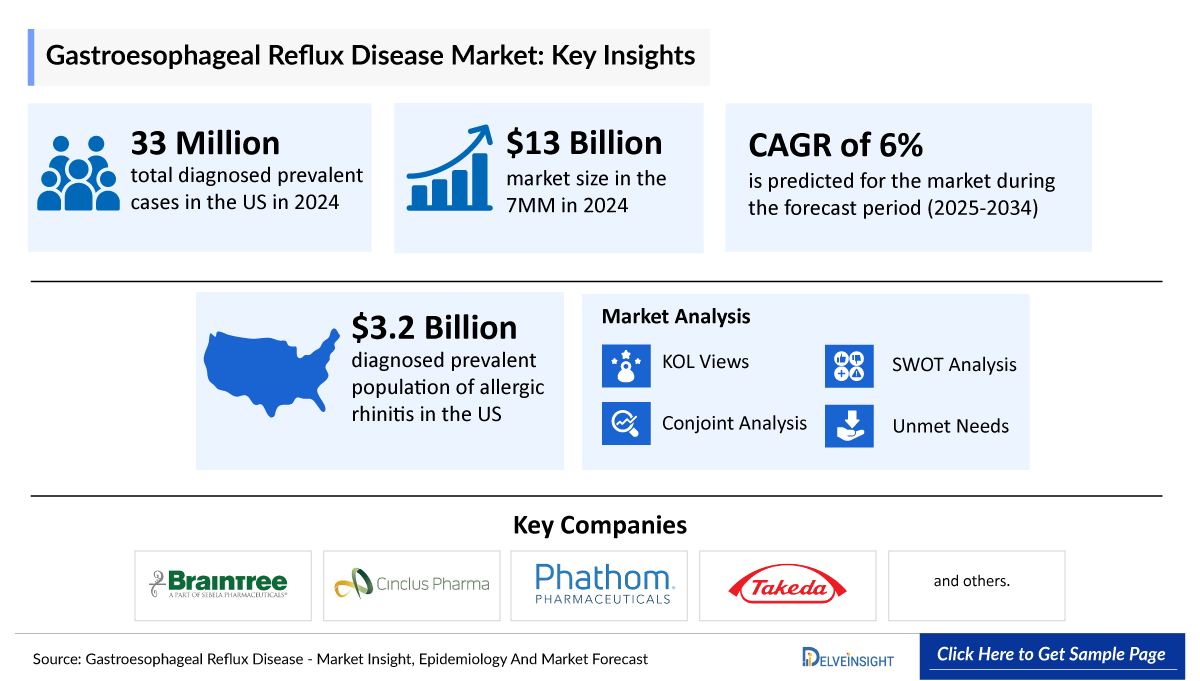

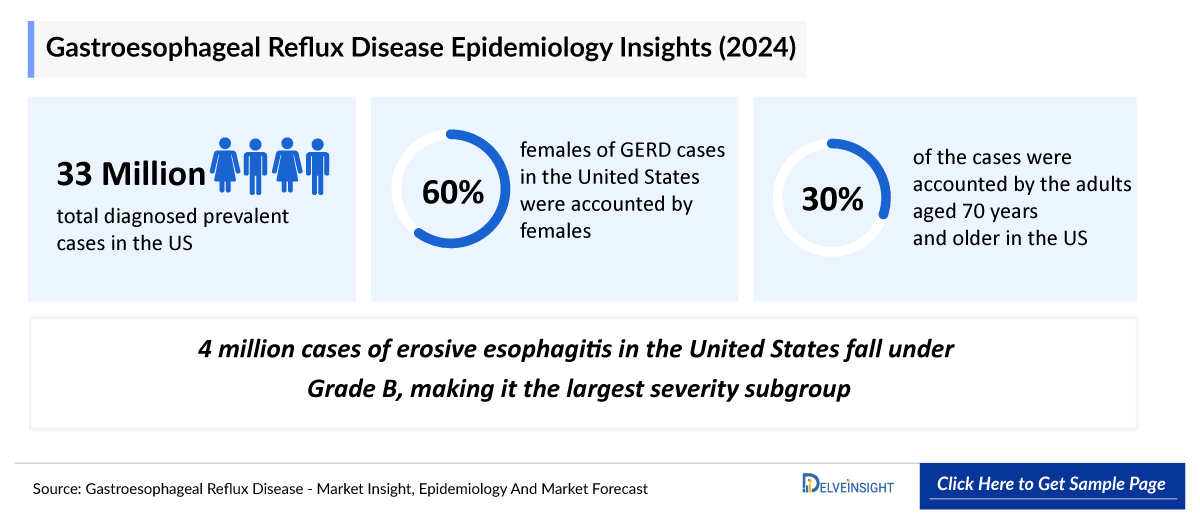

- According to DelveInsight, the United States recorded approximately 33 million diagnosed prevalent GERD cases in 2024, highlighting the substantial and growing clinical burden of reflux disease across the population.

- In 2024, females accounted for nearly 60% of GERD cases in the United States.

- Current management remains largely driven by generic PPIs and H2RAs due to long-standing clinical familiarity and easy OTC availability, but PPIs have notable limitations—including slow onset, inconsistent acid control, reduced nocturnal efficacy, and suboptimal healing in moderate-to-severe erosive esophagitis (LA Grade C/D).

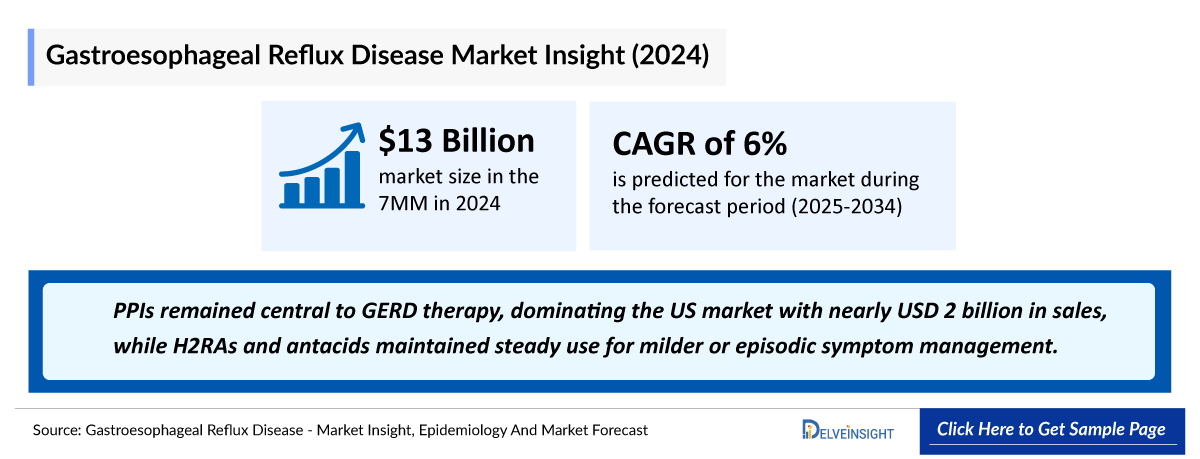

- In 2024, the US GERD market reached approximately USD 3.3 billion, underscoring the substantial commercial impact of a disease driven by high prevalence, persistent symptom burden, and growing demand for therapies that offer more reliable and sustained acid control than traditional PPIs.

- VOQUEZNA (vonoprazan), developed by Phathom Pharmaceuticals, is the first approved PCAB for GERD in the US and delivers faster onset, more consistent acid suppression, and superior early healing versus lansoprazole, positioning it as a strong option for patients with high acid burden, nocturnal symptoms, or relapse during PPI tapering.

- In October 2025, Cinclus Pharma announced that the first patient has been dosed in the company's Phase III clinical trial, HEEALING 1, evaluating linaprazan glurate for the treatment of erosive GERD.

- Two next-generation PCABs are advancing the US GERD landscape. BLI5100 (tegoprazan) from Braintree Laboratories (Sebela Pharmaceuticals) and linaprazan glurate from Cinclus Pharma are in late-stage development and are expected to compete with VOQUEZNA by providing additional options for patients who remain inadequately controlled on standard PPI therapy.

Report Summary

- The report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the GERD market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM GERD market.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

7MM |

|

Epidemiology |

Segmented by:

|

|

Market |

Segmented by:

|

|

Market Analysis |

|

Gastroesophageal Reflux Disease (GERD) Drug Chapters

The section dedicated to drugs in the GERD report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to GERD. The drug chapters section provides valuable information on various aspects related to clinical trials of GERD, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting GERD.

Marketed Therapies

VOQUEZNA (vonoprazan): Phathom Pharmaceuticals/Takeda

VOQUEZNA (vonoprazan) is an oral small-molecule potassium-competitive acid blocker (P-CAB), a newer class of agents that suppress gastric acid secretion by directly inhibiting proton pumps.

In the US, VOQUEZNA is approved for adults with erosive esophagitis (erosive GERD), for the relief of heartburn associated with both erosive and non-erosive GERD, and for the treatment of H. pylori infection when used in combination with amoxicillin, with or without clarithromycin.

Phathom in-licensed the US rights to vonoprazan from Takeda, which markets the product in Japan and numerous other countries in Asia and Latin America.

In October 2025, Phathom Pharmaceuticals announced that the results of additional analyses from its pivotal Phase III pHalcon-NERD-301 trial evaluating VOQUEZNA (vonoprazan) tablets in patients with NERD have been published in the American Journal of Gastroenterology.

Note: Detailed assessment will be provided in the final report of GERD…

Emerging Therapies

BLI5100 (tegoprazan): Braintree Laboratories

BLI5100 (tegoprazan) is a next-generation P-CAB in development by Braintree, a division of Sebela Pharmaceuticals, for the treatment of acid-related gastrointestinal conditions. As an oral PCAB, it provides rapid and sustained gastric acid suppression by directly inhibiting the proton pump at the parietal cell, a mechanism that does not depend on H?/K?-ATPase activation as PPIs do.

Its molecular design enables binding closer to the luminal side of the pump, contributing to a faster onset of action relative to traditional PPIs and potentially other PCABs. BLI5100 is currently being evaluated in two Phase III clinical trials in the US for erosive esophagitis and NERD.

In August 2025, Braintree Laboratories, a subsidiary of Sebela Pharmaceuticals, reported positive topline results from the 24-week maintenance phase of the pivotal Phase III TRIUMpH study evaluating tegoprazan, a novel P-CAB, for the treatment of GERD.

Linaprazan glurate: Cinclus Pharma

Linaprazan glurate is a next-generation P-CAB and the prodrug of linaprazan, a compound originally developed by AstraZeneca. It offers a novel mode of action, improved pharmacokinetics, and the potential for superior efficacy.

Clinical studies have shown stronger gastric acid suppression compared with current therapies. Linaprazan glurate is being developed for patients with moderate to severe erosive GERD and H. pylori infection who do not respond adequately to available treatments.

In October 2025, Cinclus Pharma Holding reported that it received favorable guidance from the US FDA following a recent Chemistry, Manufacturing, and Controls (CMC) meeting, endorsing the continued development of its lead candidate, linaprazan glurate.

|

Drug Name |

Company |

MoA |

RoA |

Phase |

Molecule Type |

Patient Segment |

Designations |

|

BLI5100 (Tegoprazan) |

Braintree Laboratories |

P-CAB |

Oral |

III |

Small molecule | Patients with NERD or healed erosive esophagitis |

N/A |

|

Linaprazan glurate |

Cinclus Pharma |

P-CAB |

Oral |

III |

Small molecule |

Patients with partial symptom relief but persistent endoscopic non-healing after 8 weeks of PPI therapy. |

N/A |

Gastroesophageal Reflux Disease (GERD) Market Outlook

During the forecast period (2025–2034), pipeline candidates such as BLI5100 (tegoprazan) (Braintree Laboratories), Linaprazan glurate (Cinclus Pharma), and others are expected to drive the rise in 7MM GERD market size.

- In 2024, PPIs remained central to GERD therapy, dominating the US market with nearly USD 2 billion in sales, while H2RAs and antacids maintained steady use for milder or episodic symptom management.

- By 2024, VOQUEZNA established its early presence as the first US P-CAB, and is projected to expand rapidly over the next decade as demand rises for faster and more durable acid suppression beyond conventional PPIs.

- The anticipated entry of next-generation P-CABs such as Tegoprazan and Linaprazan Glurate is expected to reshape the competitive landscape over the 2025–2034 forecast period, with both agents positioned to capture meaningful market share by addressing incomplete symptom control in patients who remain inadequately managed on PPIs.

- The GERD market remains limited by few approved therapies and ongoing unmet needs, especially in patients inadequately controlled on PPIs. However, improved diagnostic practices and the emergence of next-generation agents like PCABs are expected to drive steady growth through 2025–2034. While it is early to predict the exact impact of late-stage candidates, current momentum suggests a meaningful shift ahead. With rising healthcare investment and innovation, the GERD market is positioned for a positive transformation in the coming years.

Further details are provided in the report…

Gastroesophageal Reflux Disease Understanding and Treatment

Gastroesophageal Reflux Disease Overview

GERD is a disorder characterized by the backward movement of stomach contents into the esophagus or even further into areas such as the mouth, larynx, or lungs, mainly leading to inflammation of the esophageal lining. This condition is regarded as one of the most frequently diagnosed disorders by gastroenterologists and primary care physicians.

Reflux esophagitis resulting from GERD is generally categorized as Nonerosive Reflux Disease (NERD), which presents with symptoms but no visible esophageal damage, or as erosive reflux disease, which involves symptomatic cases with esophageal erosions.

Further details are provided in the report…

Gastroesophageal Reflux Disease Diagnosis

GERD is diagnosed through clinical assessment, response to an empiric PPI trial, and selective use of diagnostic testing. Patients without alarm features—such as dysphagia, bleeding, or unexplained weight loss—may begin lifestyle measures and an eight-week standard-dose PPI trial, with symptom improvement supporting the diagnosis. Those with alarm features, atypical presentations, or persistent symptoms should undergo esophagogastroduodenoscopy (EGD) and, when appropriate, ambulatory reflux monitoring.

Ambulatory pH or impedance-pH monitoring is used to confirm abnormal reflux or evaluate refractory symptoms, performed off PPIs when establishing diagnosis and on PPIs when assessing persistent or non-acid reflux. Esophageal manometry is primarily reserved for pre-surgical evaluation to rule out motility disorders, while barium swallow studies have limited utility and are not recommended for routine GERD diagnosis.

Further details related to country-based variations are provided in the report…

Gastroesophageal Reflux Disease Treatment

GERD management begins with lifestyle modification and an empiric PPI trial for patients with typical, uncomplicated symptoms. Key recommendations include weight reduction, avoiding late meals, elevating the head of the bed, and limiting dietary triggers, smoking, and alcohol use. PPIs remain the primary therapy for healing and symptom relief, with H2RAs or antacids used as needed for breakthrough symptoms. For patients who do not respond adequately, management may include dose escalation, switching to a more potent PPI, adding a nighttime H2RA, or using a potassium-competitive acid blocker (P-CAB) such as vonoprazan.

Patients with persistent symptoms despite optimized medical therapy—or those who prefer non-pharmacologic options—may be candidates for endoscopic or surgical interventions. Available approaches include laparoscopic fundoplication, magnetic sphincter augmentation, and TIF, selected based on symptom profile and anatomical considerations. Pre-procedure evaluation typically involves esophageal manometry and acid exposure testing to confirm abnormal reflux and exclude motility disorders. Procedures such as Stretta may be used selectively in refractory cases. Treatment ultimately escalates from lifestyle changes and medication to endoscopic or surgical options when symptoms remain uncontrolled.

Further details related to treatment and management are provided in the report…

Gastroesophageal Reflux Disease Epidemiology

The GERD epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by prevalent cases, diagnosed prevalent cases, gender-specific cases, age-specific cases, type-specific cases, grade specific cases and total treated cases of GERD in the 7MM from 2020 to 2034.

- In 2024, adults aged 70 years and older represented the largest share of GERD cases in the United States at around 30%, followed by those aged 60–69 years at approximately 20%. In contrast, the 20–29-year age group accounted for only about 5%, marking the lowest proportion across all age segments.

- In 2024, NERD accounted for the majority of GERD cases in the United States, with approximately 23 million cases, while erosive esophagitis represented a smaller share at around 10 million cases.

- In 2024, erosive esophagitis in the United States showed a clear severity gradient, with Grade B representing the largest subgroup at roughly 4 million cases, followed by Grade A at about 3.5 million. Only around 600 thousand patients fell into Grade D, highlighting that while severe mucosal injury is relatively uncommon, the burden of mild-to-moderate erosive disease remains substantial and clinically significant.

KOL Views

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of GERD, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the 7M004D.

Our team of analysts at Delveinsight connected with more than 10 KOLs across the 7MM. We contacted institutions such as the Northwestern University, the Columbia University, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the GERD market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Tegoprazan 100 mg and 50 mg both maintained healing over 24 weeks, meeting non-inferiority to lansoprazole and showing superiority for overall maintenance, with the 100 mg dose outperforming lansoprazole in severe EE (LA C/D). Both doses matched lansoprazole on 24-hour heartburn-free days, and in a 4-week NERD study, tegoprazan was superior to placebo for heartburn, regurgitation, and nighttime symptoms.

Linaprazan glurate showed strong healing efficacy in eGERD, achieving 100% healing in PPI partial responders within four weeks and 93% healing in moderate to severe eGERD, both markedly higher than lansoprazole in the same populations.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

VOQUEZNA (vonoprazan) provides cost-saving opportunities for eligible patients through its Savings Card program, along with support resources to guide them throughout treatment. Under this program, commercially insured individuals who qualify may pay as little as USD 25 for a 30-day prescription.Eligibility requires that the patient be a US resident aged 18 or older, have commercial insurance with VOQUEZNA coverage, and not be enrolled in any government-funded healthcare program.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

GERD Report Insights

- Patient Population

- Therapeutic Approaches

- GERD Market Size and Trends

- Existing Market Opportunity

GERD Report Key Strengths

- Ten-year Forecast

- The 7MM Coverage

- GERD Epidemiology Segmentation

- Key Cross Competition

GERD Report Assessment

- Current Treatment Practices

- Reimbursements

- Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in GERD management recommendations?

- Would research and development advances pave the way for future tests and therapies for GERD?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of GERD?

- What kind of uptake will the new therapies witness in the coming years in GERD patients?

-pipeline.png&w=256&q=75)