Gastroparesis Market Summary

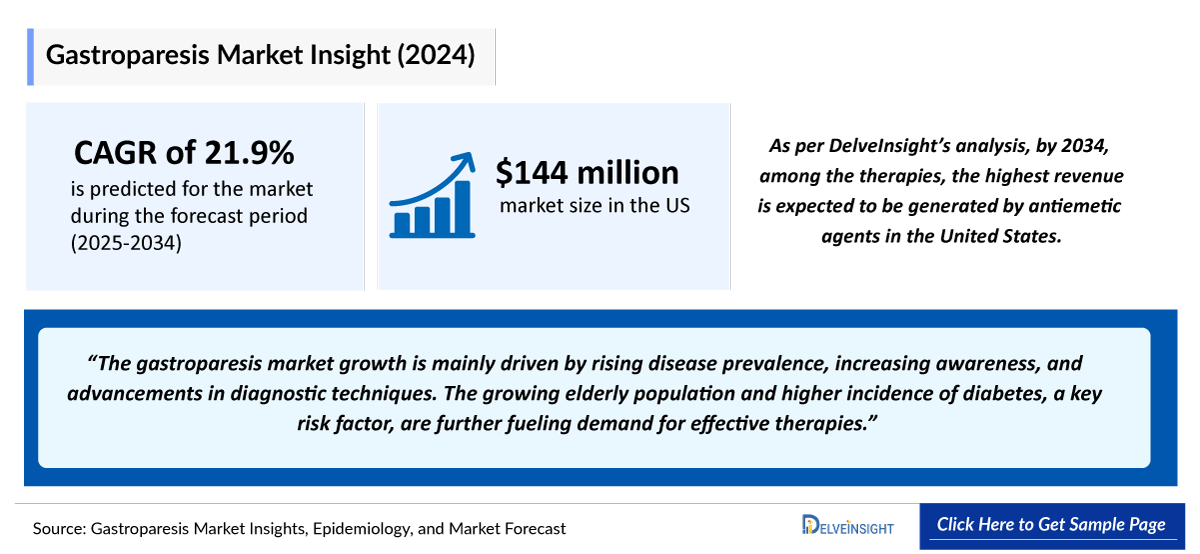

- The Gastroparesis Market is projected to grow at a significant CAGR by 2034 in leading countries like the US, EU4, UK, and Japan.

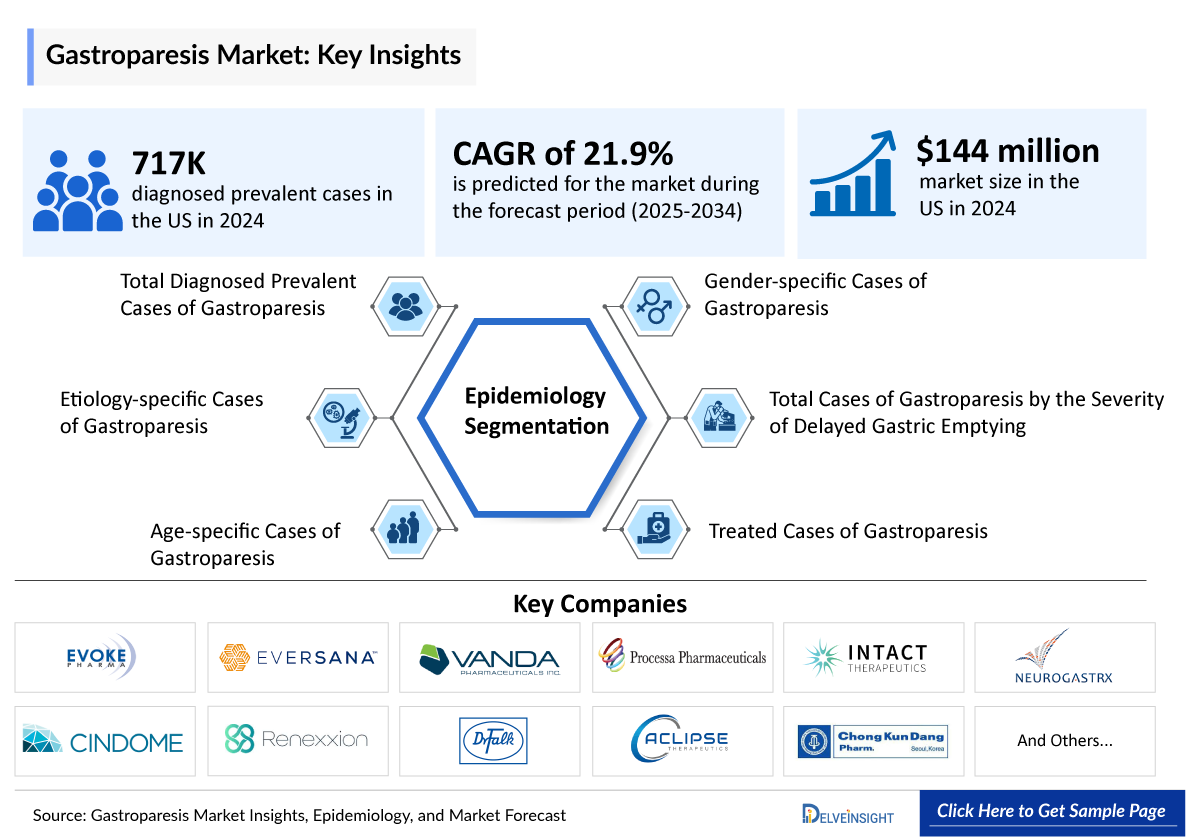

- The leading Gastroparesis Companies such as Vanda Pharmaceuticals, Processa Pharmaceuticals, Evoke Pharmaceuticals, Neurogastrx, CinDome Pharma, Renexxion Ireland, Dr. Falk Pharma GmbH, Aclipse Therapeutics, Chong Kun Dang Pharmaceuticals, RaQualia Pharma, and others.

Gastroparesis Market & Epidemiology Analysis

- Diabetic gastroparesis is the most common subtype, followed by postsurgical cases, with most pipeline therapies targeting idiopathic and diabetic forms due to their higher prevalence and commercial potential.

- Oral metoclopramide has long been the sole Food and Drug Administration (FDA)-approved option for diabetic gastroparesis. In June 2020, GIMOTI became the first FDA-approved nasal formulation, providing faster symptom relief and overcoming absorption issues tied to delayed gastric emptying, while its use is still limited by tardive dyskinesia risks and treatment duration guidelines.

- The growing use of GLP-1 agonists, such as OZEMPIC and WEGOVY, is contributing to new gastroparesis cases by slowing gastric emptying and increasing patient risk. Evoke Pharma saw a ~47% year-over-year rise in Q2 2025 net sales (USD 3.8 million vs. USD 2.6 million in 2024), driven by a 20% growth in new prescribers and 70% refill rates. At the same time, the market faces substantial costs, with about 30% of hospitalized patients readmitted within 30 days, leading to annual expenditures of approximately USD 3–4 billion.

- Tradipitant’s development illustrates the challenges in gastroparesis drug approval. Despite being the only late-stage candidate for this indication, its New Drug Application (NDA) submitted in December 2023 was rejected in September 2024, and the FDA’s July 2025 proposal to deny a hearing further limits near-term market potential. Conversely, the motion sickness program is advancing smoothly, with NDA acceptance and a PDUFA date in December 2025, highlighting the variable regulatory landscape across indications.

- Gastric Peroral Endoscopic Myotomy (G-POEM) achieves success rates of about 80%, offering faster recovery and shorter hospital stays than traditional surgery. It is safe and minimally invasive, with durable symptom relief demonstrated up to 3-4 years in many patients. However, long-term data beyond 24 months remains limited. G-POEM is emerging as a preferred option for refractory gastroparesis, especially in patients with moderate-to-severe symptoms who have not responded to other treatments.

- Other medications (erythromycin, domperidone, antiemetics) offer symptomatic relief but lack robust long-term efficacy, and domperidone faces regulatory hurdles for prescription access.

- Several companies, including Targacept, Tranzyme, Takeda, Ironwood, and Allergan, have faced setbacks, with several candidates failing efficacy trials or being halted for business reasons, highlighting the ongoing challenges in developing effective gastroparesis therapies.

- No approved therapies currently exist for moderate-to-severe gastroparesis. Investigational drugs like PCS12852, NG101, and Naronapride target this segment, offering significant opportunities for innovation and market leadership by addressing a critical unmet medical need.

- Companies like Vanda Pharmaceuticals (Tradipitant), Neurogastrx (NG101), CinDome Pharma (Deudomperidone), Renexxion Ireland (Naronapride), Processa Pharmaceuticals, and Intact Therapeutics (PCS12852), and others are investigating their key products for gastroparesis.

Request for Unlocking the Sample Page of the "Gastroparesis Treatment Market"

Key Factors Driving the Gastroparesis Market

-

Rising Gastroparesis Prevalence

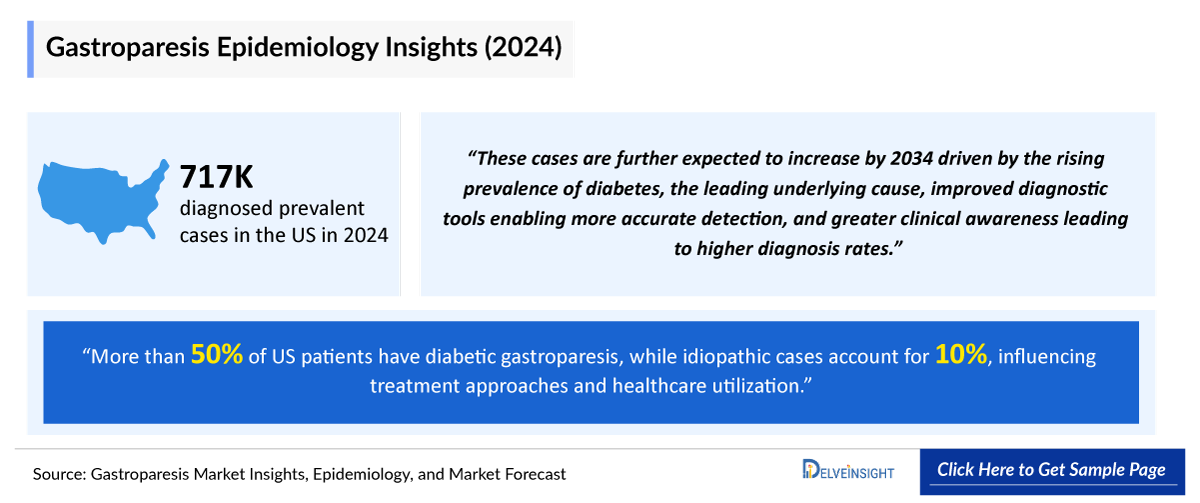

According to DelveInsight analysis, the United States accounted for approximately 715K cases of gastroparesis in 2024. These cases are anticipated to increase by 2034. This upward trend is driven by the rising prevalence of diabetes, the leading underlying cause, improved diagnostic tools enabling more accurate detection, and greater clinical awareness leading to higher diagnosis rates

-

GIMOTI’s Role in Optimizing Healthcare Efficiency

GIMOTI is the only approved drug demonstrated to reduce hospitalizations, emergency room visits, medical office visits, and associated healthcare costs compared to oral metoclopramide, providing a clear clinical and economic advantage.

-

Clinical Promise of Naronapride

Naronapride uniquely integrates 5-HT4 receptor agonist with D2 receptor antagonism within a single molecule. Given its promising clinical profile and the growing unmet need in gastrointestinal disorders, there is a compelling opportunity for Renexxion Ireland and Dr. Falk Pharma GmbH to expand its research into dual-targeted therapeutic approaches.

-

Novel Gastroparesis Competitive Landscape

Companies like Vanda Pharmaceuticals (Tradipitant), Neurogastrx (NG101), CinDome Pharma (Deudomperidone), Renexxion Ireland (Naronapride), Processa Pharmaceuticals and Intact Therapeutics (PCS12852), and others are investigating their key products for gastroparesis.

-

Emergence of Novel Drug Classes

The pipeline of novel therapeutic candidates targeting diverse mechanisms such as NK-1R antagonists (Tradipitant), 5-HT4 receptor agonists (PCS12852), D2 receptor antagonists (NG101), dopamine D2/D3 receptor antagonists (CIN-102), and others demonstrates strong innovation and commitment to addressing unmet needs in gastroparesis treatment.

DelveInsight’s “Gastroparesis Treatment Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the gastroparesis, historical and forecasted epidemiology, as well as the gastroparesis market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Gastroparesis Treatment Market Report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM gastroparesis market size from 2020 to 2034. The report also covers current gastroparesis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the Gastroparesis Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Gastroparesis Epidemiology |

Segmented by:

|

|

Gastroparesis Companies |

|

|

Gastroparesis Therapies |

|

|

Gastroparesis Market |

Segmented by:

|

|

Analysis |

|

Gastroparesis Disease Understanding and Treatment Algorithm

Gastroparesis Overview

Gastroparesis is a condition of delayed gastric emptying, lasting at least 3 months in the absence of mechanical obstruction. The illness is defined by symptoms such as nausea, vomiting, bloating, early satiety, and abdominal pain. Delayed or ineffective gastric emptying results from abnormalities in gastrointestinal motor function, a complex sequence of events involving the parasympathetic and sympathetic nervous systems, gastric smooth muscle cells, pacemaker cells within the stomach and intestine, and the pyloric sphincter. The most common etiology of gastroparesis is idiopathic, followed by diabetic, postsurgical, and postinfectious causes. It has been increasing over the last few decades, attributed to increases in diabetes, obesity, and causative medications. Clinically, many patients have symptoms overlapping with functional dyspepsia, and the two disorders commonly co-occur. Diagnostic testing is essential to document the presence of gastroparesis.

Gastroparesis Diagnosis

Gastroparesis should be suspected in patients with chronic nausea, vomiting, early satiety, postprandial fullness, abdominal pain, or bloating. Evaluation includes history, physical exam, labs, and imaging (CT, MRI, or endoscopy) to rule out obstruction. The Scintigraphic Gastric Emptying Study (GES) is the gold standard, grading severity based on gastric retention after four hours. Alternatives include the Gastric Emptying Breath Test (GEBT), Wireless Motility Capsule (WMC), and gastric ultrasonography, each with limitations in accuracy, cost, or practicality, but useful in select cases. A combination of tests is often needed for accurate diagnosis, and selection depends on availability, patient profile, and clinical suspicion.

Further details related to country-based variations in diagnosis are provided in the report…

Gastroparesis Treatment

There is no cure for gastroparesis, so treatment focuses on symptom relief and nutrition. Dietary modification with easy-to-digest, high-calorie foods is first-line, often with a dietician's support, especially for diabetics. Acupuncture and GI psychology may help, but have limited evidence. Medications include antiemetics for nausea and prokinetics like metoclopramide, used short-term due to side effects. Off-label options such as domperidone, cisapride, erythromycin, and prucalopride may improve symptoms but carry risks and restrictions. Opioids and cannabis worsen gastric emptying and should be avoided. For refractory cases, options include botulinum toxin, pyloromyotomy, GPOEM, and Gastric Electrical Stimulation (GES), with gastrectomy reserved for severe, unresponsive patients. Feeding tubes may be needed in cases of severe malnutrition.

Note: Further Details are provided in the final report.

Gastroparesis Epidemiology

The epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of gastroparesis, etiology-specific cases of gastroparesis, age-specific cases of gastroparesis, gender-specific cases of gastroparesis, total cases of gastroparesis by the severity of delayed gastric emptying, and treated cases of gastroparesis covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key findings from the Gastroparesis Epidemiological Analysis and Forecast

- In 2024, the US recorded 715,000 diagnosed prevalent cases of gastroparesis, projected to grow by 2034. This upward trend is driven by the rising prevalence of diabetes, the leading underlying cause, improved diagnostic tools enabling more accurate detection, and greater clinical awareness leading to higher diagnosis rates.

- More than 50% of US patients have diabetic gastroparesis, while idiopathic cases account for 10%, influencing treatment approaches and healthcare utilization.

- Gastroparesis shows a strong female predominance, with studies consistently reporting that 65–75% of diagnosed cases occur in women. Hormonal influences, particularly estrogen and progesterone, are known to affect gastrointestinal motility and may contribute to delayed gastric emptying in women.

- Mild cases account for the majority of gastroparesis (>40%) and are generally manageable with dietary or pharmacologic measures, while moderate-to-severe cases usually require advanced drug therapy, device interventions, or surgery.

- Over time, the number of treated cases is gradually increasing, largely due to growing disease awareness, better diagnostic tools, and rising prevalence driven by diabetes and medication-induced cases.

Gastroparesis Epidemiology Segmentation

- Total Gastroparesis Diagnosed Prevalent Cases

- Gastroparesis Etiology-specific Cases

- Gastroparesis Age-specific Cases

- Gastroparesis Gender-specific Cases

- Total Cases of Gastroparesis by the Severity of Delayed Gastric Emptying

- Gastroparesis Treated Cases

Gastroparesis Drug Analysis

The drug chapter segment of the gastroparesis report encloses a detailed analysis of marketed and emerging drugs of late-stage (Phase III, Phase II, Phase I) pipeline drugs. It also deep dives into the gastroparesis pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations. GIMOTI is the only approved drug with currently no generics available for the relief of symptoms of gastroparesis.

-

GIMOTI (metoclopramide): Evoke Pharma and EVERSANA

GIMOTI is a D2 antagonist indicated for the relief of symptoms in adults with acute and recurrent diabetic gastroparesis. Evoke Pharma and EVERSANA collaborated to utilize EVERSANA’s integrated suite of outsourced services to commercialize and distribute GIMOTI in the United States.

- In June 2020, Evoke Pharma announced that the US FDA had approved the NDA for GIMOTI nasal spray, the first and only nasally-administered product indicated for the relief of symptoms in adults with acute and recurrent diabetic gastroparesis.

- In August 2025, Evoke Pharma, with EVERSANA, announced the addition of Omnicell, a leader in medication management and fulfillment. This relationship is expected to expand patient access to GIMOTI, the only FDA-approved nasal spray for adults with acute and recurrent diabetic gastroparesis specifically, into large gastroenterology organizations.

- In August 2025, Evoke Pharma announced the official issuance of a new US patent related to its product GIMOTI. The patent, US Patent No. 12,377,064, covers the use of intranasal metoclopramide in patients with moderate to severe symptoms of gastroparesis, and has now been issued by the United States Patent and Trademark Office (USPTO).

|

Comparison of Marketed Drugs | ||||||

|

Drug Name |

Company Name |

MoA |

Molecule Type |

RoA |

Patient Segment |

US Approval Date |

|

GIMOTI (metoclopramide) |

Evoke Pharma and EVERSANA |

Dopamine-2 (D2) antagonist |

Small molecule |

Nasal Spray |

Acute and recurrent diabetic gastroparesis |

2020 |

|

REGLAN (metoclopramide)* |

ANI Pharmaceuticals |

D2-receptor antagonist |

Small molecule |

Injection |

Diabetic gastroparesis |

1979 |

|

Oral |

1980 | |||||

|

*This is the generic version, originally approved in 1979 for the oral formulation and in 1980 for the injectable form | ||||||

Emerging Drugs

Tradipitant (VLY-686): Vanda Pharmaceuticals

Tradipitant, a small molecule NK-1R antagonist, is currently being investigated for the treatment of gastroparesis. Developed by Vanda Pharmaceuticals, this product is a New Chemical Entity (NCE) and an investigational drug not yet approved for any indication; it was licensed by Eli Lilly in 2012. After the issuance Complete Response Letter (CRL) by the FDA, Vanda has been pursuing further regulatory review, including legal action against the FDA.

In April 2025, Vanda once again sought summary judgment on its gastroparesis NDA; however, in July 2025, the Center for Drug Evaluation and Research issued a proposed order denying a hearing on the matter. As of now, the Company’s lawsuit against the FDA remains pending.

In January 2024, Vanda Pharmaceuticals announced the publication of an article titled “The Efficacy of Tradipitant in Patients with Diabetic and Idiopathic Gastroparesis in Phase III Randomized Placebo-Controlled Clinical Trial” in the clinical gastroenterology and hepatology journal, which follows a previously published study of tradipitant in the treatment of gastroparesis.

PCS12852 (YH12852): Processa Pharmaceuticals and Intact Therapeutics

PCS12852 is a selective 5-HT4 receptor agonist that completed a Phase IIa trial demonstrating strong safety, tolerability, and efficacy signals in patients with diabetic gastroparesis. PCS12852 is designed to restore normal gastric emptying without the cardiovascular and central nervous system side effects seen with older agents in this class.

In June 2025, Processa Pharmaceuticals announced that it had entered into a binding term sheet with Intact Therapeutics, granting Intact an exclusive option to license PCS12852, a best-in-class 5-HT4 receptor agonist with the potential to become a first meaningful treatment for gastroparesis and other gastrointestinal motility disorders.

In connection with the Term Sheet, Yuhan Corporation executed Amendment No. 1 to our existing license agreement dated August 19, 2020, effective June 11, 2025, which, among other things, extended the deadline to dose the first patient in a Phase IIB clinical trial, Phase III clinical trial or other pivotal clinical trial from 48 months to 108 months from the effective date of the original agreement.

|

Comparison of Emerging Drugs Under Development | ||||

|

Drug Name |

Company |

Highest Phase |

Indication |

MoA |

|

Tradipitant |

Vanda Pharmaceuticals |

Regulatory (Phase III) |

Idiopathic or diabetic gastroparesis |

Neurokinin-1 Receptor (NK-1R) antagonist |

|

PCS12852 |

Processa Pharmaceuticals and Intact Therapeutics |

II |

Moderate-to-severe gastroparesis |

5-hydroxytryptamine-4 (5-HT4) receptor agonist |

|

NG101 (metopimazine) |

Neurogastrx |

II |

Moderate to severe symptomatic diabetic or idiopathic gastroparesis |

Dopamine D2 receptor antagonist |

|

CIN-102 (deudomperidone) |

CinDome Pharma |

II |

Gastroparesis (diabetic and idiopathic) |

Dopamine D2/3 receptor antagonists |

|

Naronapride (ATI-7505) |

Renexxion Ireland and Dr. Falk Pharma GmbH |

II |

Moderate idiopathic or diabetic gastroparesis |

Serotonin 5-HT4 receptor and dopamine D2 receptor antagonist |

|

RQ-00000010 |

RaQualia Pharma |

I |

Gastroparesis |

5-HT4 Agonist |

Drug Class Insights

Currently, the market includes a range of therapeutic options for gastroparesis, such as a Dopamine D2 receptor antagonist (GIMOTI). Meanwhile, novel therapies like Neurokinin-1 Receptor (NK-1R) antagonist (tradipitant), 5-hydroxytryptamine-4 (5-HT4) receptor agonist (PCS12852), and other emerging mechanisms are under development to expand treatment choices.

Dopamine D2 receptor antagonists

Dopamine D2 receptor antagonists, such as metoclopramide and domperidone, help manage gastroparesis by targeting both gastric motility and nausea. In the gastrointestinal tract, activation of D2 receptors inhibits the release of acetylcholine, which is essential for smooth muscle contraction and normal gastric emptying. By blocking these receptors, D2 antagonists increase acetylcholine release, enhancing gastric contractions and improving emptying. Additionally, they block D2 receptors in the chemoreceptor trigger zone of the brain, reducing nausea and vomiting. Metoclopramide acts both centrally and peripherally, while domperidone primarily acts peripherally, lowering the risk of central nervous system side effects.

Gastroparesis Market Outlook

The treatment of gastroparesis remains complex and largely focused on managing motility and symptoms rather than providing a cure. Management begins with lifestyle interventions such as dietary modifications, glycemic control, and hydration, but these offer only modest benefit for most patients. Pharmacologic therapy is the mainstay, with prokinetics (metoclopramide, domperidone, erythromycin) used to enhance gastric emptying, while antiemetics (ondansetron, granisetron, phenothiazines) and neuromodulators (tricyclic antidepressants, SNRIs, delta ligands) help control nausea, vomiting, and other symptoms. GIMOTI, a nasal formulation of metoclopramide, provides a non-oral alternative for patients who remain symptomatic on oral therapy. Despite these options, many patients continue to struggle with inadequate symptom control. In severe, refractory cases, advanced interventions such as gastric electrical stimulation or G-POEM may be considered, though both are costly, invasive, and supported by limited efficacy data. Overall, current therapies highlight significant unmet needs, underscoring the importance of developing safer, more effective, and accessible treatment options for gastroparesis.

The gastroparesis treatment landscape is evolving as new therapies advance through development. Companies like Vanda Pharmaceuticals (tradipitant), CinDome Pharma (deudomperidone), Processa Pharmaceuticals (PCS12852), Renexxion Ireland, and Dr. Falk Pharma GmbH (Naronapride), Neurogastrx (NG101) are actively exploring candidates to address symptoms and improve disease management across the 7MM.

- The total market size of gastroparesis in the United States was approximately USD 150 million in 2024 and is projected to increase during the forecast period (2025–2034).

- As per DelveInsight’s analysis, by 2034, among the therapies, the highest revenue is expected to be generated by antiemetic agents in the United States.

Key updates

- In June 2025, CinDome Pharma announced that the first participant had been dosed in the ENVISION GI Phase II clinical trial of CIN-102 in adults with idiopathic gastroparesis. Based on a strong safety signal and notable reductions in nausea and vomiting symptoms observed in a blinded interim analysis of the ongoing Phase II Envision3D study in patients with diabetic gastroparesis, CinDome has raised an additional USD 40 million of new capital to initiate this Phase II trial to investigate deudomperidone as a treatment for a broader population of patients with this chronic disease.

- In May 2025, Renexxion Ireland, in collaboration with its partner Dr. Falk Pharma GmbH, announced the successful completion of patient enrollment for the global Phase IIb MOVE-IT study evaluating the safety and efficacy of naronapride for the treatment of gastroparesis. The MOVE-IT study achieved its target enrolment of 320 patients.

- In May 2025, Renexxion Ireland anticipates top-line results of naronapride in the second half of 2025.

- In November 2024, Renexxion Ireland announced a major milestone in its intellectual property portfolio. The USPTO has granted the fifth patent (Patent No. 12,098,149) in a comprehensive series, securing broad protection for a novel crystal isoform of naronapride, Renexxion’s lead compound, and its use in the treatment of gastrointestinal disorders.

- According to Aclipse’s development pipeline, the company is expected to initiate a Phase II clinical trial of M107 in 2025.

Gastroparesis Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies' drug uptake in the report…

Gastroparesis Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase III, II, and I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for gastroparesis emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including MDs, PhD, Senior Researcher, and others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the University of Trieste, Western Pennsylvania Hospital, University of North Carolina, University of Mississippi Medical Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or gastroparesis market trends.

|

Region |

KOL Views |

|

United States |

“Current therapies used for symptom management include prokinetics, antiemetics, or analgesics, as well as dietary or surgical modifications, although many patients are dissatisfied with the treatments currently available. Gastroparesis carries a substantial patient burden, with a negative correlation observed between symptom severity and patient quality of life; the disease also has wider impacts on health care burden, such as increased hospitalization, and associated direct and indirect economic consequences.” |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders.

Evoke Pharma Saving Program for GIMOTI

Patients can get GIMOTI by prescription for a low (or USD 0) co-pay and exclusively through ASPN Pharmacies.

USD 0 per prescription

No co-pay card needed

USD 0 – If the commercial insurance covers GIMOTI

To qualify for the GIMOTI Savings Program to pay USD 0 per prescription, the patient must:

- Be at least 18 years of age

- Have commercial or private insurance that does not cover the entire cost of the prescription.

- Have a GIMOTI prescription for an FDA-approved indication

- Be a resident of the United States or a territory of the United States

USD 20 co-pay for eligible patients

USD 20 – If the commercial insurance does not cover GIMOTI, or if one is paying cash.

Cash-paying patients may be eligible to pay only USD 20 per prescription. A “cash-paying” patient is someone who does not have insurance coverage or has commercial insurance that does not cover GIMOTI. Medicare Part D enrollees who are in the prescription drug coverage gap (“donut hole”) are not considered cash-pay patients and are not eligible for co-pay assistance. The Program is void where prohibited, taxed, or otherwise restricted by law. Patients using Medicare, Medicaid, Medigap, Veterans Affairs, Department of Defense, TRICARE, or any other federal or state government program for their Evoke Pharma medicine are not eligible for the Program, and purchases made under the Program may not be claimed in any Part D True Out-of-Pocket Cost Submission.

The Program benefit is not transferable and may not be used with any other discount, coupon, rebate, free trial, or similar offer. The Program is not health insurance. If the patient’s insurance status changes, they must notify the Program immediately. Evoke Pharma reserves the right to rescind, revoke, or amend this offer without notice at any time.

NOTE: Further Details are provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of gastroparesis, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborate profiles of late-stage and prominent therapies, will impact the current treatment landscape.

- A detailed review of the gastroparesis market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM gastroparesis.

Gastroparesis Report Insights

- Patient Population

- Therapeutic Approaches

- Gastroparesis Pipeline Analysis

- Gastroparesis Market Size and Trends

- Existing and future Market Opportunity

Gastroparesis Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Gastroparesis Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Gastroparesis Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Analyst Views

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted gastroparesis patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the total gastroparesis market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for treating gastroparesis?

- How many companies are developing therapies to treat gastroparesis?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the gastroparesis Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.