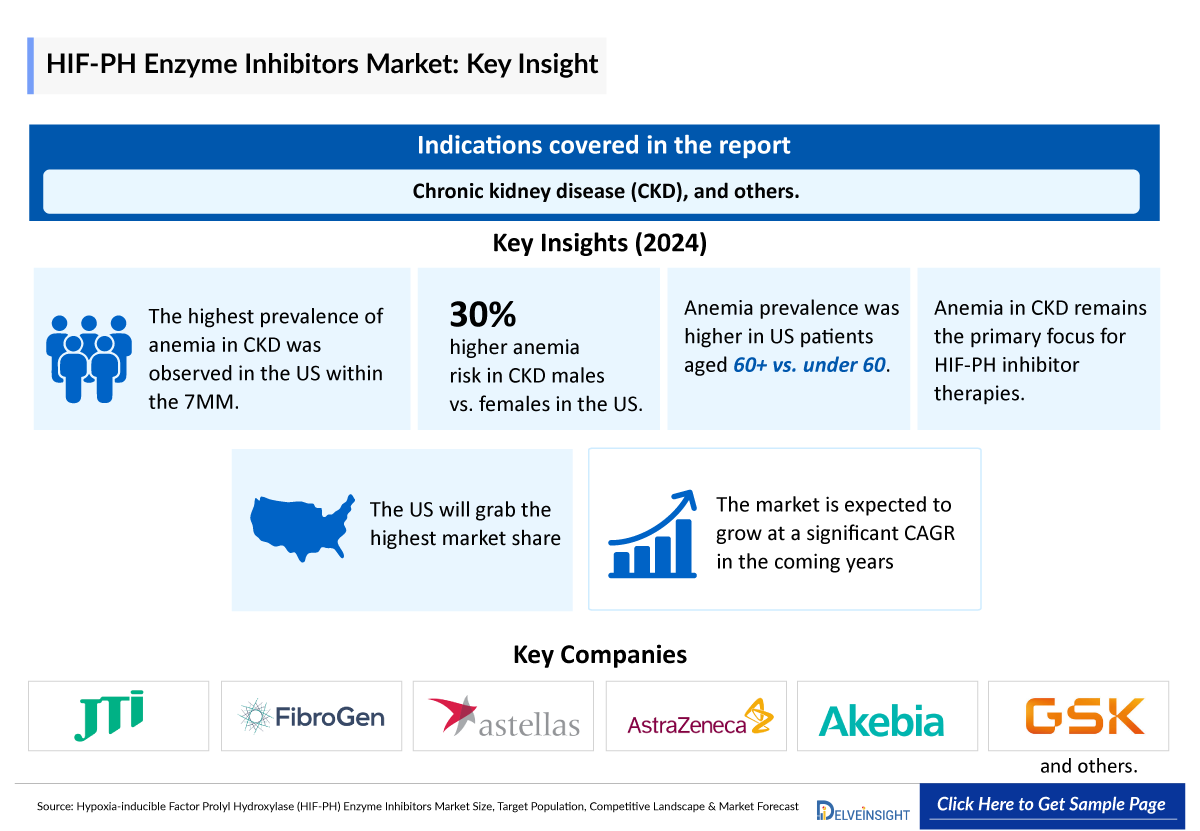

Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Enzyme Inhibitors Market Forecast

- The HIF-PH Inhibitors Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- HIF-PH inhibitors are effective in correcting and maintaining hemoglobin levels in CKD patients and may reduce the need for intravenous iron supplementation by improving iron metabolism.

- HIF-PH inhibitors are approved to treat anemia in chronic kidney disease (CKD) patients. These drugs offer the advantage of being dosed orally as opposed to existing ESA which are administered either intravenously or subcutaneously.

- Secondary analysis highlights a growing anemia burden in CKD — affecting nearly a quarter of patients (23.3%) — yet treatment remains strikingly low, with only 1.9% receiving ESAs and <0.1% intravenous iron.

- Anemia prevalence climbs sharply as disease progresses, surging from 18.2% in Stage 3a to 72.8% in Stage 5.

- Current HIF-PH inhibitor therapies on the market include, VAFSEO (vadadustat), EVRENZO (roxadustat), and ENAROY (enarodustat).

- In January 2025, Er-Kim announced the exclusive distribution agreement with the MEDICE Health Family for VAFSEO in Central & Eastern Europe.

- VAFSEO was approved by the US Food and Drug Administration (FDA) in March 2024 for the treatment of anemia due to chronic kidney disease in adults who have been receiving dialysis for at least three months.

- Daprodustat was successfully marketed as DUVROQ in Japan (August 2020) and JESDUVROQ in the US (February 2023) for anaemia associated with CKD. Although FDA-approved, JESDUVROQ was discontinued in December 2024 due to business decisions, not safety or efficacy issues.

- Key players in the HIF-PH inhibitor market include Japan Tobacco (JT) and Torii Pharmaceutical, FibroGen, Astellas Pharma, AstraZeneca, Akebia Therapeutics, GlaxoSmithKline.

- Currently, there is no prominent emerging therapies of HIF-PH inhibitors in the pipeline of companies for the indication anemia in CKD, highlighting a gap in future innovation.

- The HIF-PH inhibitor market is poised for significant growth, driven by the need for effective oral treatments for CKD-related anemia and the expanding CKD patient population.

DelveInsight’s “Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Inhibitors Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the HIF-PH, historical and Competitive Landscape as well as the HIF-PH Inhibitors therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The HIF-PH Inhibitors market report provides current treatment practices, market share of individual therapies, and current and forecasted 7MM HIF-PH Inhibitors market size from 2020 to 2034. The report also covers current HIF-PH Inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

HIF-PH Inhibitors Market |

|

|

HIF-PH Inhibitors Market Size | |

|

HIF-PH Inhibitors Companies |

Japan Tobacco (JT) and Torii Pharmaceutical, FibroGen, Astellas Pharma and AstraZeneca, Akebia Therapeutics, GlaxoSmithKline, and Others |

|

HIF-PH Inhibitors Epidemiology Segmentation |

|

Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Inhibitors Treatment Market

Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Inhibitors Overview

HIF-PH helps regulate the cell's response to oxygen. When oxygen levels are low, hypoxia-inducible factors (HIFs) modulate gene expression to boost erythropoiesis and to control metabolism and angiogenesis. When oxygen levels are normal, the HIF-PH enzyme hydroxylates HIFs, triggering degradation of the transcription factors. HIF-PH inhibitors prevent the destabilization and degradation of HIFs, allowing the transcription factors to drive hypoxia programming and generate new red blood cells. Since HIFs regulate the transcription of genes related to iron transport, such as Cybrd1 (duodenal cytochrome B, DcytB), Slc11a2 (divalent metal transporter 1, DMT1), and Slc40a1 (ferroportin), HIF-PHIs are anticipated to modulate not only EPO levels but also iron metabolism in anemic patients.

HIF-PH inhibitors are newer medications being developed to treat anemia in CKD patients. These drugs offer the advantage of being dosed orally as opposed to existing ESA which are administered either intravenously or subcutaneously. The drugs inhibit the enzyme HIF-PH which is responsible for HIF-α degradation. This will cause an increase in intracellular HIF-α levels, which binds to the HIF-B subunit to form a functional heterodimer that works on HIF-dependent gene transcription. This process triggers multiple phenomena including increase in EPO and transferrin production, increase in iron bioavailability, and decrease in hepcidin levels, which all aid in treating anemia in CKD patients.

Further details related to country-based variations are provided in the report...

Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Inhibitors Epidemiology

The HIF-PH Inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total incident cases of selected indication for HIF-PH Inhibitors, total eligible patient pool for HIF-PH Inhibitors in selected indication, total treated cases in selected indication for HIF-PH Inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- Anemia in CKD remains the primary focus of HIF-PH inhibitor therapies.

- Among the 7MM, the US accounted for the highest prevalent cases of anemia in CKD.

- Higher prevalence was seen in individuals who are older than 60 years, as compared with those who are less than 60 years in the US in 2024.

- In patients with CKD, the risk of developing anemia is 30% higher in males than in females.

- Among the EU4 and the UK, least number of cases were observed in Spain in 2024.

Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Inhibitors Drug Chapters

The drug chapter segment of the HIF-PH inhibitors reports encloses a detailed analysis of marketed drugs. It also helps understand the HIF-PHI’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

HIF-PH Inhibitors Marketed Drugs

DUVROQ (daprodustat): GSK and Kyowa Kirin

Daprodustat is an orally bioavailable, small-molecule that reversible inhibitor of HIF-PH1, PH2 and PH3 (IC50 in the low nM range). This activity results in the stabilization and nuclear accumulation of HIF-1α and HIF-2α transcription factors, leading to increased transcription of the HIF-responsive genes, including erythropoietin. In November 2018, GSK and Kyowa Hakko Kirin announced a strategic collaboration for the future commercialisation of daprodustat in Japan.

GSK’s DUVROQ was first approved in Japan in February 2020 for the treatment of anemia associated with chronic kidney disease (CKD). It later received FDA approval in the United States in 2023. However, the drug was discontinued in the US market in 2024 due to business and strategic reasons, despite its regulatory approval. But it is still marketed in Japan.

VAFSEO (vadadustat): Akebia Therapeutics

Vadadustat is an orally bioavailable, small-molecule that reversible inhibitor of HIF-prolyl-4-hydroxylases (PH)1, PH2, and PH3 (IC50 in the nM range). This activity results in the stabilization and nuclear accumulation of HIF-1α and HIF-2α transcription factors, and increased production of erythropoietin (EPO). After a single dose of vadadustat 80 to 1200 mg (0.27 to 4 times the approved recommended starting dosage) in healthy male adults, a dose-dependent increase in EPO was observed.

VAFSEO was approved by the US FDA in March 2024. VAFSEO once daily drug for the treatment of anemia in adults with CKD on dialysis was tested in open-label trials of patients with DD-CKD (INNO2VATE-1 and INNO2VATE-2).

HIF-PH Inhibitors Market Outlook

Currently, the HIF-PH inhibitor market comprises four key approved agents: GSK’s DUVROQ, Akebia Therapeutics’ VAFSEO, FibroGen and AstraZeneca’s EVRENZO, and Japan Tobacco’s ENAROY. Among these, EVRENZO was the first to gain approval (Japan, 2019), followed by ENAROY (Japan, 2020), DUVROQ (JP, 2020/US, 2023) and the more recent entrants and VAFSEO (EU 2023, US 2024). While EVRENZO initially led the market with approvals, VAFSEO is now poised to gain significant market share, particularly in the US and EU. This shift is driven by expanding geographic approvals, the convenience of oral administration, and strong safety and efficacy profiles in treating anemia associated with Chronic Kidney Disease.

The HIF-PH inhibitor class continues to attract clinical and commercial interest due to its novel mechanism of action—stimulating endogenous erythropoietin production under hypoxic conditions—making it a compelling alternative to traditional erythropoiesis-stimulating agents (ESAs) administered via injection. Key advantages, including improved iron utilization, reduced inflammation markers, and ease of administration, position this class well in the nephrology market.

The key differentiator of HIF-PH inhibitors is their oral route of administration, which improves patient compliance, particularly in non-dialysis CKD patients who are less frequently in clinical settings. Additionally, HIF-PHIs demonstrate a favorable inflammatory profile and may be more effective in patients with high levels of C-reactive protein (CRP), a subgroup where ESAs often show reduced efficacy.

Over the forecast period, market dynamics will likely evolve with the increasing adoption of VAFSEO in Western markets, while EVRENZO in Europe and also along with DUVROQ and ENAROY to maintain strongholds in Asia. However, competition from newer ESAs, potential cardiovascular safety concerns, and pricing pressures may temper overall market expansion. The withdrawal of DUVROQ from the US market in 2024, along with GSK restricted its expansion in Europe, has significantly limited its global market capture, falling short of initial expectations despite early regulatory success.

Despite these challenges, the class is expected to continue growing steadily, particularly with the increasing prevalence of CKD globally and the clinical shift toward more physiologic anemia management strategies.

Lastly, the emerging therapy pipeline is very scarce and no prominent therapy can spotted in the market during the forecast period.

Hypoxia-inducible Factor Prolyl Hydroxylase (HIF-PH) Inhibitors Drugs Uptake

This section focuses on the uptake rate of marketed HIF-PH Inhibitors launched in the market.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on HIF-PHI's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 7+ KOLs in the 7MM. Centers such as University of Oxford, Francis Crick Institute, University of Calgary, Italian Society of Nephrology Expert Panel, Japanese Academic Centers, Division of Hematology, University of Illinois Health, and others.

Their opinion helps understand and validate current and marketed therapy treatment patterns or HIF-PH inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the HIF-PH Inhibitors Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the HIF-PH, explaining its mechanism, and therapies (marketed).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of marketed therapies and the elaborative that impact the current landscape.

- A detailed review of the HIF-PH inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM HIF-PH inhibitors market.

HIF-PH Inhibitors Market Report Insights

- HIF-PH inhibitors Targeted Patient Pool

- HIF-PH Inhibitors Therapeutic Approaches

- HIF-PH inhibitors Market Size and Trends

- Existing and Future Market Opportunity

HIF-PH Inhibitors Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- HIF-PH Inhibitors Drugs Uptake

- Key HIF-PH Inhibitors Market Forecast Assumptions

HIF-PH Inhibitors Market Report Assessment

- Current HIF-PH Inhibitors Treatment Practices

- HIF-PH Inhibitors Unmet Needs

- HIF-PH Inhibitors Pipeline Product Profiles

- HIF-PH Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- HIF-PH Inhibitors Market Drivers

- HIF-PH Inhibitors Market Barriers

Key Questions Answered In The HIF-PH Inhibitors Market Report

- What was the HIF-PH inhibitors total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for HIF-PH Inhibitors?

- What are the risks, burdens, and unmet needs of treatment with HIF-PHI-based therapies? What will be the growth opportunities across the 7MM for the patient population of HIF-PHI-based therapies?

- What are the key factors hampering the growth of the HIF-PH Inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for HIF-PH Inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy HIF-PH Inhibitors Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the HIF-PH Inhibitors Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.