Knee Osteoarthritis Market

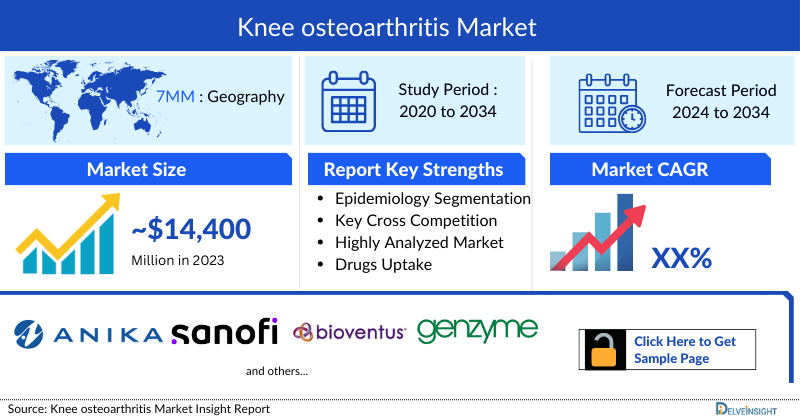

- The Knee osteoarthritis market size in the 7MM was around USD 14,400 million in 2023.

- Knee osteoarthritis is more prevalent in females than males, accounting for nearly 60% and 40% cases respectively.

- Among the severity-specific cases, the cases of mild-severity accounted for the highest number in the 7MM.

- There is currently no standard lab test to verify the presence of Knee osteoarthritis.

- In May 2024, Organogenesis announced positive topline data from the Phase III randomized control trial evaluating the safety and efficacy of ReNu for the management of knee osteoarthritis symptoms.

- Currently, the drugs used for the Knee osteoarthritis treatment include NSAIDs, Opioids, Intra Articular-Corticosteroids, Intra Articular-Hyaluronic acid and others.

- Expected launch of potential Knee osteoarthritis therapies by key Knee osteoarthritis companies like Taiwan Liposome Company (TLC599), Centrexion Therapeutics (CNTX-4975), Biosplice Therapeutics (Lorecivivint), and others may increase the market size in the coming years, assisted by an increase in the Knee osteoarthritis prevalent population.

DelveInsight’s “Knee osteoarthritis Treatment Market Insight, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Knee osteoarthritis, historical and forecasted epidemiology as well as Knee osteoarthritis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Knee osteoarthritis treatment market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted the 7MM knee osteoarthritis market size from 2020 to 2034. The report also covers current knee osteoarthritis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the Knee osteoarthritis therapeutics market’s potential.

Knee osteoarthritis Disease Understanding and Treatment Algorithm

Knee osteoarthritis, also known as degenerative joint disease, is typically the result of wear and tear and progressive loss of articular cartilage. It is most common in the elderly. Knee osteoarthritis can be divided into two types, primary and secondary. Knee osteoarthritis affects the three compartments of the knee joint (medial, lateral, and patellofemoral joint) and usually develops slowly over 10–15 years, interfering with daily life activities.

Knee osteoarthritis Diagnosis

There is currently no standard lab test to verify the presence of Knee osteoarthritis. Instead of a single lab test, physicians commonly use five diagnostic tools to determine if a patient has knee osteoarthritis or another medical condition. These tools are Patient interview, Physical exam, X-rays, MRI. Lab tests also for other conditions, which requires a blood draw or an aspiration of the knee or taking fluid out from the joint.

Further details related to diagnosis are provided in the report…

Knee osteoarthritis Treatment

Current management modalities are targeted towards symptom control unless the degree of severity dictates the necessity of surgical intervention with joint replacement. There are several approaches to managing osteoarthritis, which include pharmacological management, non-pharmacological management, and surgery. Pharmacological management involves using medications such as Nonsteroidal anti-inflammatory drugs (NSAIDs), Arcoxia (Etoricoxib), opioids, Corticoids, and ZILRETTA (extended-release triamcinolone acetonide). Non-pharmacological management strategies include patient examination, exercise, aquatic therapies, weight management, and adjunct therapies. Surgery is usually considered a last resort for Knee osteoarthritis management.

Further details related to treatment are provided in the report…

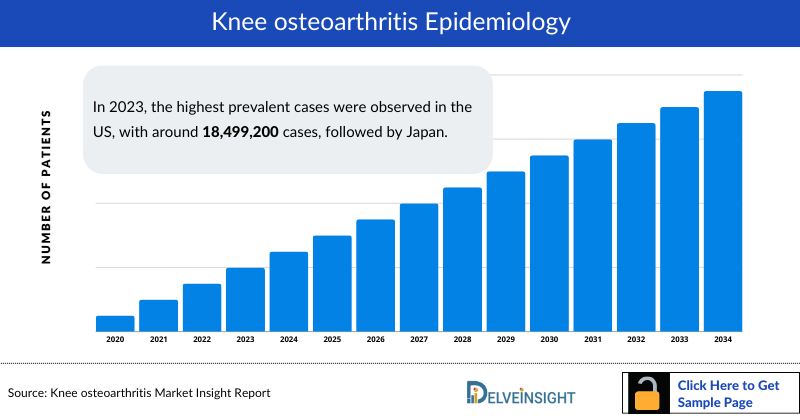

Knee osteoarthritis Epidemiology

The knee osteoarthritis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by prevalence of Knee Osteoarthritis, gender-specific prevalence of Knee osteoarthritis, age-specific cases of Knee osteoarthritis, severity-specific cases of Knee osteoarthritis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- In 2023, the highest Knee osteoarthritis prevalent cases were observed in the US, with around 18,499,200 cases, followed by Japan.

- The knee osteoarthritis prevalent cases are higher in females than males.

- In the US, the age group of 70 years and above accounted for the highest cases in 2023. In contrast, the least cases were found in the age group of 18–39 years.

- Among the EU4 and the UK, Germany accounted for the highest number of Knee osteoarthritis cases, followed by the France, whereas Italy accounted for the lowest cases in 2023.

- Knee osteoarthritis is closely associated with age, as radiographic evidence of OA occurs in most people by age 65 years and in more than 75% of people older than age 75 years.

Knee osteoarthritis Recent Developments

- On November 28, 2024, the US FDA completed a 30-day review of Paradigm Biopharmaceuticals' phase III pivotal Knee osteoarthritis clinical trials protocol for repurposed pentosan polysulfate sodium (Zilosul) to treat knee osteoarthritis (OA), clearing the way for the trial to begin in Q1 CY25.

- On September 6, 2024, Sun Pharma and Moebius Medical announced that the FDA granted Fast Track designation to MM-II (Large Liposomes of DPPC and DMPC) for treating osteoarthritis knee pain, with Phase 3 trials in planning.

Knee osteoarthritis Drug Chapters

The drug chapter segment of the Knee osteoarthritis treatment market report encloses a detailed analysis of the marketed and the late-stage (Phase III, and II) pipeline knee osteoarthritis drugs. The marketed drugs segment encloses Anika Therapeutics (CINGAL), Bioventus (DUROLANE),etc.,. Furthermore, the current key Knee osteoarthritis companies for the upcoming emerging drugs Taiwan Liposome Company (TLC599), Centrexion Therapeutics (CNTX-4975), and others. The drug chapter also helps understand the Knee osteoarthritis clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Marketed Knee osteoarthritis Drugs

CINGAL: Anika Therapeutics

CINGAL is the first and only commercially available combination viscosupplement and is currently being used successfully by physicians to provide rapid and long-lasting relief from pain and discomfort caused by OA for patients in a growing number of countries. CINGAL is a patented formulation composed of the company’s proprietary crosslinked sodium hyaluronate and triamcinolone hexacetonide. In June 2016, Anika Therapeutics announced the commercial launch of CINGAL in the European Union, and in March 2016, Anika Therapeutics announced receiving CE Mark approval for CINGAL as a medical device to treat pain associated with Knee osteoarthritis.

DUROLANE: Bioventus

DUROLANE is a unique, single-injection hyaluronic acid therapy indicated for treating pain in Knee osteoarthritis in patients who have failed to respond adequately to conservative nonpharmacological therapy or simple analgesics. Hyaluronic acid (HA) in the knee acts as a supplemental lubricant and shock absorber. DUROLANE has been tested in more clinical studies than any other single-injection hyaluronic therapy on the market. In September 2017, Bioventus announced receiving the US FDA approval for DUROLANE for joint lubrication in the treatment of pain associated with Knee osteoarthritis steroid injections, and it has been approved in Europe since 2001 for the treatment of Knee osteoarthritis.

|

Table 1: Comparison of marketed drugs for Knee Osteoarthritis | |||||

|

Drug name |

Company name |

Indication |

Molecule type |

Knee osteoarthritis MoA |

Knee osteoarthritis RoA |

|

CINGAL |

Anika Therapeutics |

Mild to moderate Knee osteoarthritis |

Small Molecule |

Glucocorticoid receptor agonist |

Intra-articular |

|

Durolane |

Bioventus |

Mild to moderate Knee osteoarthritis |

Glycosaminoglycans |

Hyaluronic acid modulators |

Intra-articular |

|

GELSYN-3 |

Bioventus |

Knee osteoarthritis |

Glycosaminoglycans |

Hyaluronic acid modulators |

Intra-articular |

|

ZILRETTA |

Flexion Therapeutics |

Mild to moderate Knee osteoarthritis |

Small molecule |

Glucocorticoid receptor agonists |

Intra-articular |

|

SYNVISC-ONE |

Sanofi/Genzyme |

Knee osteoarthritis |

Glycosaminoglycans |

Hyaluronic acid modulators |

Intra-articular |

Note: Detailed list will be provided in the final report.

Emerging Knee osteoarthritis Drugs

TLC599: Taiwan Liposome Company

TLC599 is a patented dexamethasone sodium phosphate (DSP) BioSeizer formulation intended to provide up to 24 weeks of continuous pain relief. TLC599 has the potential to allow patients to benefit from the local delivery of a highly potent and clinically validated steroid that usually has a very short half-life, both immediate and sustained. TLC599 has completed patient enrollment in its Phase III pivotal Knee osteoarthritis clinical trials and it is ongoing. The Phase III trial is based on the outstanding results of Phase II clinical trial.

CNTX-4975: Centrexion Therapeutics

Centrexion Therapeutics’ lead product candidate, CNTX-4975, is being evaluated for the treatment of moderate to severe pain of Knee osteoarthritis. CNTX-4975 is an ultra-pure, synthetic form of trans-capsaicin that is injected directly into the site of pain. CNTX-4975 was granted Fast Track designation for the treatment of moderate to severe pain associated with Knee osteoarthritis from the US FDA in January 2018. Three Phase III Knee osteoarthritis clinical trials, namely VICTORY-1 VICTORY-2 and VICTORY-3 studies, were conducted in patients with moderate-to-severe Knee osteoarthritis.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

Table 2: Comparison of emerging drugs for Knee Osteoarthritis | |||||

|

Product |

Company |

Knee osteoarthritis Mechanism of Action |

Phase |

Molecule Type | |

|

TLC-599 |

Taiwan Liposome Company |

Glucocorticoid receptor agonist |

III |

Small-molecule | |

|

CNTX-4975 |

Centrexion Therapeutics |

TRPV1 receptor agonists |

III |

Small-molecule | |

|

Lorecivivint (SM04690) |

Biosplice Therapeutic |

CDC2-like kinases (CLK) dual-specificity kinase inhibitors |

III |

Small-molecule | |

|

HP-5000 |

Noven Pharmaceuticals |

Cyclooxygenase inhibitors |

III |

Small-molecule | |

|

Invossa (TG-C) |

Kolon TissueGene |

Kolon TissueGene |

III |

Gene Therapy | |

Note: Detailed list will be provided in the final report.

Drug Class Insights

The landscape of Knee osteoarthritis drug development involves Cell replacement therapy, Cyclooxygenase inhibitors, Nerve growth factor inhibitors, CDC2-like kinases (CLK) dual-specificity kinase inhibitors, TRPV1 receptor agonists, TrkA receptor antagonists, NLRP3 protein inhibitors etc. COX inhibitors divide into non-selective nonsteroidal anti-inflammatory drugs (NSAIDs), COX-2 selective nonsteroidal anti-inflammatory drugs (c2s NSAIDs), and aspirin. The cox enzyme catalyzes the conversion of arachidonic acid into prostaglandin. It has two known isoforms, cyclooxygenase-1 (COX-1) and cyclooxygenase-2 (COX-2), cyclooxygenase-2 (COX-2) inhibitors selectively block the COX-2 enzyme and have been used to treat OA with a low risk of adverse gastrointestinal effects. Blocking this enzyme impedes the production of prostaglandin (PG) E2, which is often the cause of pain and swelling during inflammation.

Note: Detailed insights will be provided in the final report.

Knee osteoarthritis Market Outlook

Currently, there are several pharmacologic treatments available for the management of Knee osteoarthritis–related pain and for improving its functionality. These common pharmacologic interventions used to help alleviate the symptoms of Knee osteoarthritis include nonsteroidal anti-inflammatory drugs (NSAIDs), intra-articular corticosteroids, intra-articular hyaluronic acid, and well as opioids. NSAIDs have historically been the most often used medication. However, their long-term use is limited, particularly in elderly patients with multiple comorbidities because of the associated gastrointestinal, renal, cardiac, and hematologic adverse events linked to this class of medication.

Two anti-inflammatory painkillers with a similar effect are celecoxib and etoricoxib. These are COX-2 inhibitors (also known as coxibs) taken as tablets or directly applied to the painful joint in the form of a gel or cream. Some of the emerging NSAIDs and COX-2 inhibitors for Knee osteoarthritis are HP-5000 and AMZ-001.

- Key Knee osteoarthritis companies like Biosplice Therapeutics, Noven Pharmaceuticals, Kolon TissueGene and others are evaluating their lead candidates in different stages of clinical development.

- Among the 7MM, the US accounts for the largest market size for Knee osteoarthritis. The growth of market size for Knee osteoarthritis is attributed to emerging therapies. The market size for Knee osteoarthritis was approximately USD 8,900 million in 2023.

- Among the EU4 and the UK, Germany accounted for the largest Knee osteoarthritis market size, while the smallest Knee osteoarthritis market size was occupied by Italy in 2023.

Knee Ostheoarthritis Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key Knee osteoarthritis companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Knee osteoarthritis Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Knee osteoarthritis companies involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Knee osteoarthritis emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient’s therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Professors and others.

Delveinsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 20+ KOLs in the 7MM. Centers such as University of Texas at Houston, Lotus Clinical Research, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Knee osteoarthritis treatment market trends.

|

KOL Views | |

|

United States |

“RTX is a promising new treatment that fits a clear unmet need for osteoarthritis patients, particularly when traditional pain management options are insufficient or come with significant drawbacks such as those encountered with opioids. After participating in this trial and interacting with treated patients, I am looking forward to the day RTX might be approved as it would be another much needed tool in my specialty to help address difficult to control pain.” |

|

United Kingdom |

“Acetaminophen is a mild analgesic with little meaningful clinical benefit and real risks of harm, and the American Academy of Orthopedic Surgeons suggests no more than 3000mg per day to minimize its risk of liver damage. As patients in the TLC599 group were observed to consume significantly less acetaminophen than the placebo group, TLC599 has the potential to reduce the need for oral medication use in a setting where opioids are frequently resorted to for pain control.” |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Market Access and Reimbursement

Market Access refers to the ability of all patients to have access to a given product quickly, conveniently, and affordably. Reimbursement is the negotiation of a price between the manufacturer and payer that allows the manufacturer access to that market. It is provided to reduce the high costs and make essential drugs affordable.

The Zilretta Copay Assistance Program covers only the copay- or coinsurance-related out-of-pocket cost of Zilretta, up to an annual maximum dollar limit. The Zilretta Copay Assistance Program does not cover administrative or office visit costs. Cash patients are not eligible for this offer. The patient is responsible for reporting receipt of copay assistance to any insurer, health plan, or another third party who pays for or reimburses any part of the prescription filled, as may be required. The Zilretta Copay Assistance Program is available for patients residing in the US, Puerto Rico, or US Territories.

Scope of the Knee osteoarthritis therapeutics market report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Knee osteoarthritis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Knee osteoarthritis therapeutics market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Knee osteoarthritis therapeutics market.

Knee osteoarthritis Treatment Market Report Insights

- Patient Population

- Therapeutic Approaches

- Knee osteoarthritis Pipeline Analysis

- Knee osteoarthritis Market Size and Trends

- Existing and Future Market Opportunity

Knee osteoarthritis therapeutics market report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- Knee osteoarthritis Epidemiology Segmentation

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

Knee osteoarthritis therapeutics market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

FAQs

- What is the historical and forecasted Knee osteoarthritis patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the total Knee osteoarthritis market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- Which therapy is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- What are the recent novel therapies, targets, Knee osteoarthritis mechanism of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Knee osteoarthritis treatment Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming Knee osteoarthritis companies in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming Knee osteoarthritis companies can strengthen their development and launch strategy.

Read our blog to get detailed insights @ DelveInsight Blogs