LAG-3 Next-generation Immunotherapies Market Forecast and Competitive Landscape

Key Highlights:

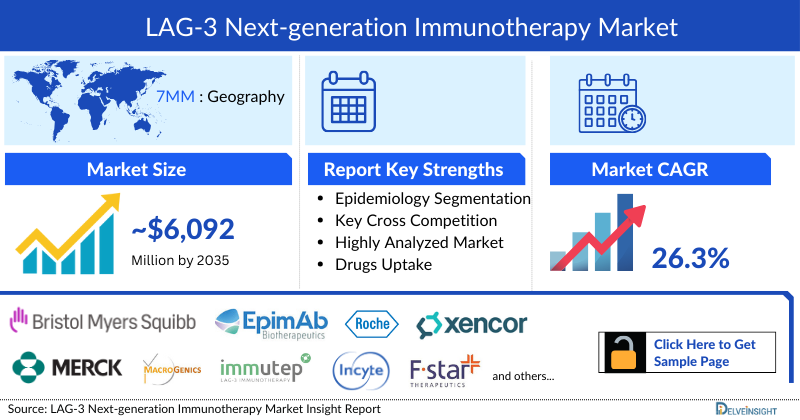

- As per DelveInsight analysis, the LAG-3 Next-generation Immunotherapies market is anticipated to witness growth at a considerable CAGR.

- The total LAG-3 Next-generation Immunotherapies market size will include the market size of the potential upcoming therapies and current treatment regimens in the seven major markets.

- Key LAG-3 Next-generation Immunotherapy companies working in the LAG-3 Next-generation Immunotherapy market are Bristol-Myers Squibb, Merck Sharp & Dohme Corp., MacroGenics, Immutep, Incyte Corporation, F-star Therapeutics, EpimAb Biotherapeutics, Roche, Xencor, AnaptysBio, GlaxoSmithKline, Regeneron Pharmaceuticals, Sanofi, Symphogen, and others.

Download the Sample PDF to Get More Insight @ LAG-3 Next-generation Immunotherapies Market

DelveInsight's “Lymphocyte Activation Gene-3 (LAG-3) Competitive Landscape and Market Forecast – 2035” report delivers an in-depth understanding of the LAG-3, historical and forecasted market trends of LAG-3 in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

The report covers a descriptive overview including history, mechanism, principles, categories, advantages/ limitations of LAG-3 Next-generation Immunotherapies, and currently available therapies from 2019 to 2035 segmented by seven major markets. The report also covers a complete account of both the current and emerging therapies for LAG-3 Next-generation Immunotherapies. Further, the assessment for new therapies is also provided, which might impact the current treatment landscape.

LAG-3 Next-generation Immunotherapies Understanding and Market Scenario

The main treatment options in the case of cancer include chemotherapy, radiotherapy, surgery, hormone therapy, stem cell transplant, immunotherapy, Chimeric Antigen Receptor (CAR) T-Cell Therapy, and targeted therapy. These treatments may be used individually or in combination with one another. With the development and approval of these new treatment options, the survival of cancer patients has also improved.

Among all the choices mentioned above, immunotherapy is at the forefront of cancer research thanks to the broad clinical successes of immune check point-targeted monoclonal antibodies. Immunotherapies have demonstrated efficacy across different cancer types. Immune checkpoint inhibitors such as CTLA-4, PD-1, and PD-L1 have become a mainstay of cancer treatment. However, numerous cancer patients fail to respond, despite the promising impact of cancer immunotherapy targeting CTLA4 and PD1/PDL1.

Cancer research organizations, universities, and pharmaceutical companies are always coming up with innovations to solve such obstacles. LAG-3 (CD223) is regarded as one among them. LAG-3 is involved in various cancers, autoimmune disorders, and other illnesses. LAG-3 is a cell-surface molecule expressed on effector T cells and regulatory T cells (Tregs) and controls T-cell response, activation, and growth. Preclinical research and clinical trial findings indicate that inhibiting LAG-3 may restore effector activity of depleted T cells and perhaps increase an antitumor response. Clinical evidence also shows that LAG-3 works synergistically with PD1/PDL1. LAG-3 might be a very promising immune checkpoint inhibitor in the future.

Opdualag, a new, first-in-class, fixed-dose combination of nivolumab and relatlimab, administered as a single intravenous infusion, was approved by the US FDA to treat adult and pediatric patients 12 years of age or older with unresectable or metastatic melanoma. The approval is based on Phase II/III RELATIVITY-047 trial, comparing Opdualag (n = 355) to nivolumab alone (n = 359).

Currently, many companies are focusing on the LAG-3 immune checkpoint in their search for novel approaches to treat malignant tumors and autoimmune disorders, many of which are now in clinical development. The LAG-3 next-generation therapies market is expected to grow in the upcoming years owing to the potential entry of major LAG-3 candidates, and their readily uptake, increase in incident cases of various solid tumors, increase in PD-1/PD-L1 relapsed/refractory cases in various cancers, label-expansion in multiple cancer types, robust and unique pipeline (anti-LAG-3 monoclonal, bispecific antibodies and, soluble LAG-3 molecule), and improvement in the outcome of patients.

Some challenges, such as precedence of failure of emerging therapies in the autoimmune space, the economic burden on cancer patients due to premium pricing, as well as knowledge gaps, may impede the commercial expansion of LAG-3 therapeutics. Competition from new technologies in the same space can be another major challenge.

LAG-3 Next-generation Immunotherapies Drug Chapters

The drug chapter segment of the LAG-3 report encloses the detailed analysis of LAG-3 marketed drugs and late-stage (Phase-III and Phase-II) pipeline drugs. It also helps understand the LAG-3 clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed LAG-3 Next-generation Immunotherapies Drugs

Opdualag (nivolumab + relatlimab) by Bristol Myers Squibb is administered as a single intravenous infusion; this is the first LAG-3 inhibitor that has been granted approval by the US FDA in March 2022 for the treatment of adult and pediatric patients 12 years of age or older with unresectable or metastatic melanoma. The approval is based on the Phase II/III RELATIVITY-047 trial, which compared Opdualag (n = 355) to nivolumab alone (n = 359). Relatlimab is also being tested in other cancers like non-small cell lung cancer, head and neck squamous cell carcinoma, and others.

Note: Detailed Current therapies assessment will be provided in the full report of LAG-3 Next-generation Immunotherapies

Emerging LAG-3 Next-generation Immunotherapies Drugs

Favezelimab (MK-4280) by Merck is a humanized, IgG4 anti-LAG-3 monoclonal antibody that prevents LAG-3 from binding to its major ligand, MHC Class II. MK-4280 is being evaluated as monotherapy and in combination with KEYTRUDA in clinical trials to treat solid tumors and hematologic malignancies. The Phase I study revealed that favezelimab alone or in combination with pembrolizumab had a manageable safety profile, with no treatment-related deaths. Promising antitumor activity was observed with combination therapy, including MK-4280A, compared with monotherapy, most notably in PD-L1 CPS ≥1 tumor patients. In November 2021, the company recently initiated a Phase III study co-formulated favezelimab/pembrolizumab (MK-4280A) versus standard of care in subjects with previously treated metastatic PD-L1 positive colorectal cancer (MK-4280A-007).

Eftilagimod Alpha (IMP321) by Immutep is a recombinant protein consisting of a dimer of LAG-3 that has been engineered to be soluble rather than expressed on the surface of cells. It is a first-in-class antigen-presenting cell (APC) activator, proven to induce sustained immune responses in cancer patients when used at a low dose, as a cancer vaccine adjuvant, or at higher doses to get a systemic effect (i.e., general APC activation). The drug binds to a subset of MHC class II molecules to mediate antigen-presenting cells and CD8 T-cell activation. Investigators hypothesized that the stimulation of the dendritic cell network and subsequent T-cell recruitment could lead to stronger antitumor responses when combined with pembrolizumab vs. pembrolizumab alone. In addition, it has been shown to be safe and well-tolerated, thus making it an ideal combination partner for other drugs or drug candidates. The clinical trials with eftilagimod alpha are combined with either chemotherapy or immunotherapy. AIPAC-003 for Metastatic Breast Cancer (Chemo – IO) is planned. The trial has also received positive feedback from EMA. In addition, FDA discussion is also ongoing as planned.

Leramilimab (LAG525) by Novartis is a therapeutic antagonist antibody originally developed by Immutep S.A. (now Immutep S.A.S.) to target LAG-3 and LAG525, a humanized form of IMP701. The antibody controls signaling pathways in both effector T cells and regulatory T cells (Treg). The antibody activates effector T cells by blocking inhibitory signals that would otherwise switch them off. The antibody also inhibits Treg function, which normally prevents T cells from responding to antigen stimulation. Both mechanisms of action prevent the immune system from responding to and killing cancer cells. Other antagonist LAG-3 antibodies in development target only the effector T-cell pathway but do not address the Treg pathway. LAG525 is being evaluated in several Phase I and/or Phase II clinical trials in combination with spartalizumab, Novartis’ programmed cell death 1 (PD1) inhibitor to treat various cancers.

INCAGN2385 is a monoclonal antibody that blocks the binding of LAG-3 with its MHC class II ligand, being developed by Agenus and Incyte Corporation. LAG-3 is a checkpoint protein expressed on the surface of certain immune system cells. LAG-3 modulates signaling between immune cells and their targets. When LAG-3 is activated, the immune response is suppressed. Antibodies that block LAG-3 can block this inhibitory signal, thereby boosting the immune system’s response to cancer cells. LAG-3 acts synergistically with other checkpoint modulators. This suggests antibodies against LAG-3 may be valuable as combination therapies. This is why the company believes that LAG-3 checkpoint inhibitors may have potential in both combination and monotherapy settings. LAG-3 checkpoint inhibitor is part of the global alliance with Incyte. The program is funded by Incyte, with Agenus eligible for potential milestones and royalties ranging from 6% to 12%, subject to a reduction for certain third-party obligations. In addition, the clinical proof of concept study associated with INCAGN2385 is being used in combination to treat participants with advanced malignancies.

FS118 by F-star Therapeutics is a potentially first-in-class dual checkpoint inhibitor developed to overcome tumor evasion mechanisms promoted by two highly immunosuppressive pathways, LAG-3 and PD-L1. Despite the clinical progress made with PD-L1 therapies, the upregulation of other immune checkpoints in cancer, such as LAG-3, plays a vital role in promoting resistance to these drugs. Therapeutic antibodies that target the immune checkpoints (LAG-3) and PD-1 have shown increased clinical antitumor activity when given in combination. FS118 has shown in clinical trials and preclinical studies that it blocks both PD-L1 and LAG-3 simultaneously and has an additional mechanism of action to promote the shedding of LAG-3 from the surface of immune cells. Expanding the FS118 clinical development into checkpoint naïve, biomarker enriched NSCLC, and DLBCL patients will broaden the clinical reach of this exciting LAG-3 & PD-L1 targeting bispecific antibody. This adds to the ongoing checkpoint inhibitor relapsed head and neck cancer study that is anticipated to report data in mid-2022. Currently, the drug is in Phase I/II trial in patients with advanced tumors to determine the efficacy in participants with squamous cell carcinoma of the head and neck (SCCHN). As per the company presentation, the Initial data from the NSCLC CPI-naïve trial is expected to release between H1 and H2-2023. In addition, initial data from the DLBCL CPI-naïve trial is expected to be released in H2-2023.

MGD013 (Tebotelimab), which is under development by MacroGenics, is an investigational, bispecific DART molecule designed to independently or coordinately block PD-1 and LAG-3 checkpoint molecules to sustain or restore the function of exhausted T cells for the treatment of cancer. MacroGenics has presented data from a Phase I study of tebotelimab in 205 patients with advanced or solid and hematologic neoplasms. Although the results, based on 152 evaluable responses, were unspectacular, tebotelimab effector cell activation was enhanced when combined with margetuximab. In data released last November, across multiple advanced HER2+ tumor types, an ORR of 28.6% was observed, with 64.3% of patients experiencing a decrease in tumor size when tebotelimab was combined with Margenza. As per the company pipeline portfolio, the drug is in the Phase I developmental stage; however, combination studies are also ongoing and in the late clinical stage of development.

Note: Detailed emerging therapies assessment will be provided in the final report.

LAG-3 Next-generation Immunotherapies Market Outlook

Cancer is a generic term for a large group of diseases that can affect any part of the body. One of its outlining features is the speedy creation of abnormal cells that grow beyond their usual boundaries. These cells can then invade adjoining parts of the body and spread to other organs; the latter process is called metastasis.

With rapidly changing lifestyles, increasing consumption of tobacco and smoking, more exposure to sun and other types of radiation, viruses, and other infections, cancer cases per year are rising. As per World Health Organization (WHO, 2021), cancer is a leading cause of death worldwide, which accounted for nearly 10 million deaths in 2020. Given the severity of the condition, cancer has been a focal point for R&D for decades, and the treatment paradigm has improved significantly with time. Cancer treatment primarily comprises surgery, radiation therapy, chemotherapy, hormone therapy, targeted therapy, and immunotherapy. However, death rates are relatively high even with several treatment options, as these therapies have some limitations and cannot target every patient. Few cancer therapies face the challenge of accessing targets deep within tumor tissue; on the other hand, some cause serious adverse effects. Cancer immunotherapies targeting inhibitory coreceptors programmed cell death 1 (PD-1) and cytotoxic T lymphocyte antigen 4 (CTLA-4) have significantly improved the outcomes of patients with diverse cancer types, revolutionizing cancer treatment. The success of these therapies verified that inhibitory coreceptors serve as critical checkpoints for immune cells not to attack the tumor cells and self-tissues. However, response rates are typically lower, and immune-related adverse events (irAEs) are also observed in patients administered with immune checkpoint inhibitors. As a result of these treatment-related unmet needs, researchers have been developing next-generation immunotherapies – a game-changer in cancer treatment. Pharmaceutical companies have an intense competition to develop novel immunotherapies such as LAG-3, where current treatment choices are not working.

Companies like Bristol-Myers Squibb (relatlimab [BMS-986016]) and Merck Sharp & Dohme Corp. (favezelimab [MK-4280]), Immutep (eftilagimod alpha [IMP321]), Incyte Corporation (INCAGN02385), F-star Therapeutics (FS118), EpimAb Biotherapeutics (EMB-02), Roche (RG6139 [RO7247669]), Xencor (XmAb22841 [XmAb841]), AnaptysBio/GlaxoSmithKline (Encelimab [TSR-033]), Macrogenics (Tebotelimab [MGD013]), Regeneron Pharmaceuticals/Sanofi (Fianlimab [(REGN3767]), Symphogen (Sym022) and others are involved in the development of LAG-3 therapies. For the peak share estimation of below mentioned forecasted therapies, factors like the probability of success, precedence of trial failure and therapy effect, current unmet need, competition from established current key players, and emerging novel targets such as TIM-3 agents, B3-H7 agents, IDO-1 agents, SIRP agents, STING, CSF-1R CD40, TIGIT, and others are considered. Several intratumoral therapies are also coming into the market, targeting PD-refractory Pool, are also considered. Drugs in the early phase with less visibility on clinical evidence have assigned a low probability of success. With several potential therapies being investigated for the management of LAG-3, it is safe to predict that the treatment space will experience a significant impact during the forecast period of 2022–2035. According to DelveInsight, the LAG-3 market in 7MM is expected to witness a major change in the study period 2019-2035.

Key Findings

- The total LAG-3 Next-generation Immunotherapies market size in the 7MM is expected to rise from ~USD 588 million in 2025 to reach ~USD 6,092 million by 2035, at a CAGR of 26.3% during the study period.

- The United States accounts for the largest total LAG-3 Next-generation Immunotherapies market size compared to the EU5 (the United Kingdom, Germany, Italy, France, and Spain) and Japan. In the United States, the total LAG-3 Next-generation Immunotherapies market size is anticipated to rise from ~USD 20 million in 2022 to reach ~USD 3,783 million by 2035.

- Among the EU5 countries, Germany had the largest total LAG-3 Next-generation Immunotherapies market size while Spain had the smallest market size for LAG-3 therapies. By 2035, the market size is anticipated to reach ~USD 472 million and ~USD 224 million for Germany and Spain, respectively.

- In 2024, Japan accounted for a total LAG-3 Next-generation Immunotherapies market size of ~USD 1 million, which is expected to reach ~USD 572 million by 2035.

The United States Market Outlook

The total LAG-3 Next-generation Immunotherapies market size in the United States is expected to increase with a CAGR of 23% in the study period (2025–2035).

EU-5 Countries: Market Outlook

The total LAG-3 Next-generation Immunotherapies market size in EU5 is expected to increase with a CAGR of 31% in the study period (2023–2035).

Japan Market Outlook

The total LAG-3 Next-generation Immunotherapies market size in Japan is expected to increase with a CAGR of 48% in the study period (2023–2035).

Analyst Commentary on LAG-3 Next-generation Immunotherapies Market

- The drug pipeline of LAG-3 is robust, and with a few major LAG-3 Next-generation Immunotherapies companies, the market for next-generation immunotherapies, specifically the LAG-3 immune checkpoint therapeutics, is not jam-packed. It has become a focus of attention for drugmakers because of the relatively large patient population. With these rich and unique emerging pipelines, large-scale companies hold a considerable potential to acquire a good market share.

- BMS recent success in a Phase III study and approval of the relatlimab anti-LAG-3 monoclonal antibody (MAb) proved that the combination of LAG-3 and programmed cell death protein 1 (PD-1) is more effective than the standard of care in the first-line metastatic melanoma.

- Although combination immunotherapy is an obvious strategy to pursue, the fact that there have been more failures than successes in this effort has served as a wake-up call, emphasizing the importance of building a solid scientific foundation for the development of next-generation immuno-oncology (IO) agents. Furthermore, there are several other immune checkpoint receptors (TGIT, TIM-3) that can compete with LAG-3 products in the future.

- Companies are exploring the best combination strategy to provide the greatest antitumor effect while synergistically producing LAG-3 PD-L1/CTLA-4.

- There is also an expansion of LAG-3 immune checkpoints in other indications that may be a significantly promising immune checkpoint, to suppress T-cell activation and cytokine secretion, thereby ensuring a state of immune homeostasis.

LAG-3 Next-generation Immunotherapies Drugs Uptake

This section focuses on the uptake rate of the potential drugs recently launched in the LAG-3 Next-generation Immunotherapies market or expected to get launched in the market during the study period 2019–2035. The analysis covers LAG-3 market uptake by drugs, patient uptake by therapies, and sales of each drug. For example-

Eftilagimod alpha (IMP321) by Immutep is a recombinant protein consisting of a dimer of LAG-3 that has been engineered to be soluble rather than expressed on the surface of cells. It is a first-in-class APC activator, proven to induce sustained immune responses in cancer patients when used at a low dose, as a cancer vaccine adjuvant, or used at higher doses to get a systemic effect (i.e., general APC activation). If approved, the medicine will be the first immunotherapy to be licensed to treat metastatic HR+ breast cancer. Unlike in breast cancer, eftilagimod alpha impresses in HNSCC, with the addition of eftilagimod alpha to standard-of-care Keytruda more than doubling the response rates seen in Keytruda trials. As per our estimates, the drug will likely generate a revenue of approximately USD 1,000 million, USD 500 million, and USD 180 million in the US, EU-5, and Japan, respectively, by 2035. As per our analysis, Eftilagimod alpha drug uptake in the 7MM is expected to be medium with a 50% probability of success.

Note: Detailed emerging therapies assessment will be provided in the final report.

LAG-3 Next-generation Immunotherapies Pipeline Development Activities

The report provides insights into different LAG-3 immunotherapies candidates in Phase II and Phase III stages. It also analyses LAG-3 Next-generation Immunotherapies companies with their leading drug candidates, focusing on different diseases.

Pipeline Development Activities

The report covers the details of collaborations, acquisitions, mergers, licensing, patent details, and other information for LAG-3 emerging therapies.

Reimbursement Scenario in LAG-3 Next-generation Immunotherapies

In the US, various organizations decide which treatments they will provide health insurance coverage for and under what conditions. The Institute for Clinical and Economic Review (ICER) assessed Kymriah and Yescarta and found that their incremental cost-effectiveness ratios were USD 45,871 per QALY for Kymriah (in ALL) and USD 136,078 per QALY for Yescarta (in B-cell lymphoma). Considerations around product value and evidence limitations at launch are also at play in the US; however, the management of the resulting decision uncertainty differs.

Medicare

Medicare provides coverage for immunotherapy under each of its parts, but the patient can expect some out-of-pocket expenses as well. The coverage may vary depending on where the patient receives the medication and its type.

Medicare covers some of the costs associated with immunotherapy. Let us look at the costs when immunotherapy is covered under each part of Medicare.

Part A costs

The deductible amount for Medicare Part A in 2021 is USD 1,484 per benefit period. This will most likely be covered if the patient completes all the necessary visits and cancer treatment sessions.

Part B costs

The typical costs for Part B in 2021 are as follows:

- Monthly premium: typically USD 148.50, but possibly higher depending on the income of the patients

- Deductible: USD 203

- Copayment: 20% of the Medicare-approved cost of the immunotherapy treatments after patients’ deductible has been met

Part C costs

With Medicare Part C plans, costs will vary depending on the patient’s plan and provider, and each plan will have a different copayment amount, coinsurance, and deductible.

Part D costs

Medicare Part D costs and coverage for individual immunotherapy drugs can vary based on the medication.

Let us look at the costs of Keytruda as an example:

- Without insurance, a single dose of Keytruda costs USD 9,724.08. Typically, patients who receive Keytruda will need more than one dose of the medication.

- Eighty percent of patients with traditional Medicare plans and no supplemental insurance paid between USD 1,000 and USD 1,950 per Keytruda infusion.

- Forty-one percent of patients with a Medicare Advantage plan paid no out-of-pocket costs. For those who did have to pay out-of-pocket, the cost was between USD 0 and USD 925

KOL Views

To keep up with current market trends, we take KOLs and SME’s opinions working in the LAG-3 domain through primary research to fill the data gaps and validate our secondary research. Some leaders are MD Anderson Cancer Center, Kimmel Institute for Cancer Immunotherapy, USA, University of Pittsburgh Hillman Cancer Center, US, and others. Their opinion helps to understand and validate current and emerging therapies treatment patterns or LAG-3 immunotherapies market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Competitive Intelligence Analysis

We perform a competitive and market intelligence analysis of the LAG-3 Market by using various Competitive Intelligence tools that include – SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the LAG-3 Next-generation Immunotherapies Market Report

- The report provides comprehensive insight and the competitive landscape of the nine cancer types selected for LAG-3 Next-generation Immunotherapies market estimation in the 7MM.

- Additionally, a complete account of both the current and emerging therapies for LAG-3 Next-generation Immunotherapies is provided, along with the assessment of new therapies which is likely to impact the current treatment landscape.

- A detailed review of the global historical and forecasted LAG-3 Next-generation Immunotherapies market is included in the report, covering drug outreach in the 7MM.

LAG-3 Next-generation Immunotherapies Market Report - Key Highlights

- In the coming years, the LAG-3 Next-generation Immunotherapies market is set to change due to the rising awareness of the disease and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence LAG-3 Next-generation Immunotherapies R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- Several major LAG-3 Next-generation Immunotherapies companies are involved in developing therapies to improve the treatment of different types of cancer. The launch of emerging therapies will significantly impact the LAG-3 Next-generation Immunotherapies market

- A better understanding of the mechanism of action structure and ligands of LAG-3 will also contribute to the development of novel therapeutics

- Our in-depth analysis of the pipeline assets across different stages of development (Phase III and Phase II), different emerging trends, and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

LAG-3 Next-generation Immunotherapies Market Report Insights

- Therapeutic Approaches

- LAG-3 Next-generation Immunotherapies Pipeline Analysis

- LAG-3 Next-generation Immunotherapies Market Size and Trends

- Market Opportunities

- Impact of upcoming Therapies

LAG-3 Next-generation Immunotherapies Market Report Key Strengths

- 14 Years Forecast

- 7MM Coverage

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

LAG-3 Next-generation Immunotherapies Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Market Drivers and Barriers

Key Questions

Market Insights:

- What was the LAG-3 Next-generation Immunotherapies drug cancer therapies market share (%) distribution in 2022, and how would it look in 2035?

- What would be the total market size of LAG-3 cancer therapies, the total market size of LAG-3 cancer therapies by indications, and the market size by LAG-3 type during the forecast period (2022–2035)?

- What are the key findings pertaining to the market across 7MM, and which country will have the largest LAG-3 Next-generation Immunotherapies market size during the forecast period (2022-2035)?

- At what CAGR the LAG-3 Next-generation Immunotherapies market is expected to grow in 7MM during the forecast period (2019–2035)?

- What would be the LAG-3 Next-generation Immunotherapies market outlook across the 7MM during the forecast period (2022–2035)?

- What would be the LAG-3 Next-generation Immunotherapies market growth till 2035, and what will be the resultant market size in the year 2035?

- How would the unmet needs affect the market dynamics and subsequent analysis of the associated trends?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the LAG-3 Next-generation Immunotherapies in addition to the approved therapies?

- What are the LAG-3 Next-generation Immunotherapies marketed drugs and their respective MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many companies are developing LAG-3 Next-generation Immunotherapies for the treatment of different types of cancer?

- How many LAG-3 Next-generation Immunotherapies are in development by each company for different types of cancer?

- How many emerging therapies are in the mid- and late stages of development for LAG-3 Next-generation Immunotherapies?

- What are the key collaborations (Industry–Industry, Industry–Academia), Mergers and acquisitions, licensing activities related to the LAG-3 Next-generation Immunotherapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitation of existing therapies?

- What clinical studies are available for LAG-3 Next-generation Immunotherapies and their status?

- What are the current challenges faced in drug development?

- What are the key designations that have been granted for the emerging therapies for LAG-3 Next-generation Immunotherapies?

- What is the global historical and forecasted market for LAG-3 Next-generation Immunotherapies?

Reasons to buy LAG-3 Next-generation Immunotherapies Market Report

- The report will help in developing business strategies by understanding trends shaping and driving the LAG-3 Next-generation Immunotherapies market

- To understand the future market competition in the LAG-3 Next-generation Immunotherapies market and Insightful review of the key market drivers and barriers

- Organize sales and marketing efforts by identifying the best opportunities for LAG-3 Next-generation Immunotherapies in the US, Europe (Germany, Spain, Italy, France, and the United Kingdom), and Japan

- Identification of strong upcoming LAG-3 Next-generation Immunotherapies companies in the market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for the LAG-3 Next-generation Immunotherapies market

- To understand the future market competition in the LAG-3 Next-generation Immunotherapies market