Malignant Pleural Mesothelioma Market Summary

- The Malignant Pleural Mesothelioma market in the 7MM is valued at approximately USD 250 million in 2025.

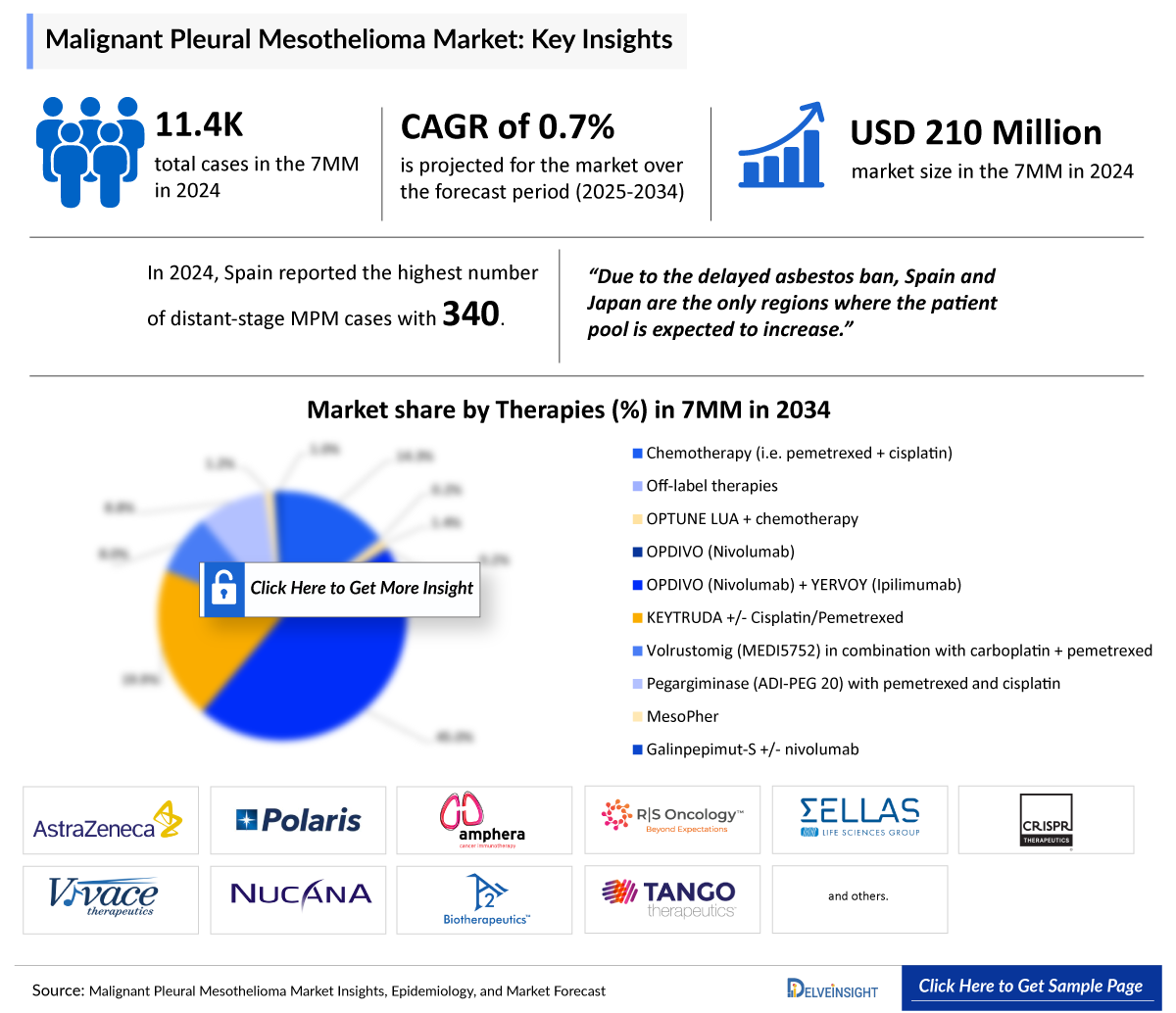

- The Malignant Pleural Mesothelioma market is projected to grow at a CAGR of 0.70%% by 2034 in leading countries like US, EU4, UK and Japan

Malignant Pleural Mesothelioma Market and Epidemiology Analysis

- The Malignant Pleural Mesothelioma market is poised for steady growth during the forecast period (2025–2034). This expansion across the 7MM will be driven by the launch of innovative therapies, including volrustomig (MEDI5752), KEYTRUDA combined with cisplatin/pemetrexed, pegargiminase with pemetrexed and cisplatin, mesopher, and galinpepimut-S.

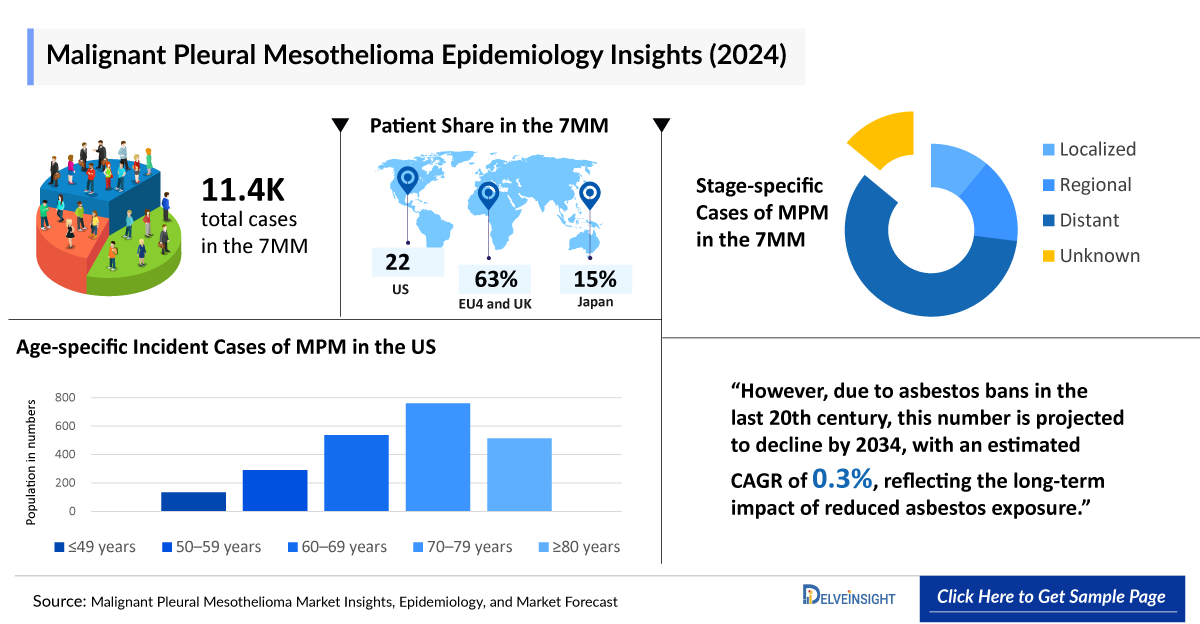

- According to DelveInsight’s estimates, in 2024, the total number of mesothelioma cases across the 7MM was around 11,400. However, this figure is expected to decline by 2034, with a projected CAGR of 0.3%.

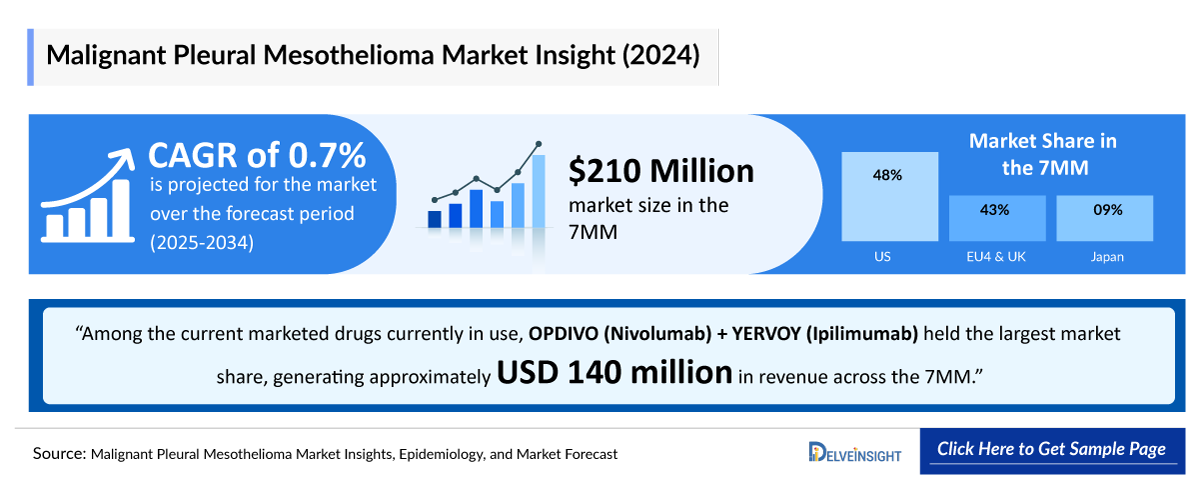

- According to DelveInsight’s analysis, the Malignant Pleural Mesothelioma market in the 7MM was valued at approximately USD 210 million in 2024. Over the forecast period from 2025 to 2034, Malignant Pleural Mesothelioma market is projected to grow at a CAGR of 0.7%.

- Bristol-Myers Squibb, Ono Pharmaceuticals, Merck, and Novocure have been leading Malignant Pleural Mesothelioma companies in the Malignant Pleural Mesothelioma market, offering approved treatments like OPDIVO in combination with YERVOY, OPDIVO as a monotherapy, KEYTRUDA combination with pemetrexed, and battery operated device OPTUNE LUA.

- Malignant Pleural Mesothelioma is a complex disease with vague symptoms and a prolonged latency period, making early detection challenging. Accurate staging often requires invasive procedures, resulting in late diagnoses and limited treatment opportunities.

- Early detection of Malignant Pleural Mesothelioma is challenging due to non-specific symptoms and diagnostic limitations. Advanced imaging and biomarkers show promise but remain suboptimal, highlighting the urgent need for more reliable early detection tools.

Malignant Pleural Mesothelioma Market size and forecast

- 2025 Market Size: USD 250 million in 2025

- 2034 Projected Market Size: USD 267 million in 2034

- Growth Rate (2025-2032): 0.70% CAGR

- Largest Market: United States

Key Factors Driving the Malignant Pleural Mesothelioma (MPM) Market

MPM Patient Pool

According to DelveInsight’s estimates, there were 11.4K mesothelioma cases across the 7MM in 2024. Thanks to asbestos bans implemented in the late 20th century, this number is projected to decline by 2034, with a modest CAGR of 0.3%, reflecting the long-term benefits of reduced asbestos exposure. However, due to delayed asbestos bans, Spain and Japan are the only regions where mesothelioma cases are expected to rise.

MPM treatment market

Bristol-Myers Squibb, Ono Pharmaceuticals, Merck, and Novocure lead the Malignant Pleural Mesothelioma market with approved treatments like OPDIVO (alone and with YERVOY), KEYTRUDA with pemetrexed, and the OPTUNE LUA device. Among the current marketed drugs in use, OPDIVO (Nivolumab) + YERVOY (Ipilimumab) held the largest market share, generating approximately USD 140 million in revenue across the 7MM. While surgery, chemotherapy, radiation, and immunotherapy remain standard, emerging therapies aim to address unmet needs better and improve patient outcomes.

MPM Competitive Landscaspe

Emerging therapies include Volrustomig (MEDI5752) by AstraZeneca, Pegargiminase with Pemetrexed and Cisplatin by Polaris Pharmaceuticals, MesoPher by Amphera BV, and checkpoint inhibitor combinations (pembrolizumab, durvalumab). Tumor vaccines and oncolytic viruses are also under clinical investigation.

MPM market dynamics and opportunity

Market growth depends on expanding IO and ADC adoption. However, payer scrutiny remains high given the rarity and aggressive course of the disease. Targeted and cell therapies may bring meaningful survival benefits and reshape the treatment paradigm by 2034.

DelveInsight’s “Malignant Pleural Mesothelioma Treatment Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Malignant Pleural Mesothelioma, historical and forecasted epidemiology, as well as the Malignant Pleural Mesothelioma market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The Malignant Pleural Mesothelioma Treatment market report provides current treatment practices, emerging Malignant Pleural Mesothelioma drugs, market share of individual therapies, and current and forecasted 7MM Malignant Pleural Mesothelioma therapeutics market size from 2020 to 2034. The report also covers Malignant Pleural Mesothelioma treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess Malignant Pleural Mesothelioma market’s potential.

Malignant Pleural Mesothelioma Understanding

Malignant Pleural Mesothelioma overview

Malignant Pleural Mesothelioma is a highly aggressive cancer originating from mesothelial cells in the pleura, primarily linked to prolonged asbestos exposure. Characterized by rapid progression and high mortality, Malignant Pleural Mesothelioma predominantly affects older males, often emerging decades after exposure. Its significant tumor heterogeneity contributes to therapy resistance, making management particularly challenging. To enhance diagnostic precision, the 2021 WHO Classification of Thoracic Tumors, published by IARC, revised its terminology—replacing "diffuse malignant pleural mesothelioma" with "diffuse pleural mesothelioma" and "localized malignant pleural mesothelioma" with "localized pleural mesothelioma."

Asbestos exposure is the leading risk factor for Malignant Pleural Mesothelioma, with inhaled fibers triggering chronic inflammation and cellular damage over decades. Other risk factors include exposure to zeolites like erionite, prior radiation, and potential links to simian virus 40. Genetic factors, particularly BAP1 mutations, along with age and male gender, further influence susceptibility.

Malignant Pleural Mesothelioma commonly manifests as breathlessness and chest pain, primarily due to pleural effusion in early stages and tumor encasement in advanced disease. Additional symptoms like fatigue, weight loss, and malaise result from cytokine activity. Rarely, tumor invasion causes complications such as superior vena cava obstruction or dysphagia. Asymptomatic cases emphasize the need for vigilant monitoring in asbestos-exposed individuals.

Malignant Pleural Mesothelioma Diagnosis

Diagnosing Malignant Pleural Mesothelioma requires Malignant Pleural Mesothelioma clinical trials evaluation, imaging, and histopathology. Computed Tomography (CT) and Positron Emission Tomography (PET) scans detect pleural abnormalities, while histopathological examination remains the gold standard. Immunohistochemistry aids differentiation, and biomarkers like mesothelin offer potential but lack standalone accuracy. Accurate staging, often requiring invasive procedures, is vital for treatment planning and prognosis.

Further details related to country-based variations are provided in the report…

Malignant Pleural Mesothelioma Treatment

Managing Malignant Pleural Mesothelioma requires a multidisciplinary approach based on disease stage, histology, and patient health. Early-stage cases may undergo surgery, combined with systemic or radiation therapy. Advanced cases rely on chemotherapy, immunotherapy, and anti-angiogenic agents. Multimodal strategies improve outcomes, while palliative care is crucial for symptom management.

Further details are provided in the report…

Malignant Pleural Mesothelioma Epidemiology

As Malignant Pleural Mesothelioma market is derived using a patient-based model, the Malignant Pleural Mesothelioma epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Incident Cases of Malignant Pleural Mesothelioma, Gender-specific Incident Cases of Malignant Pleural Mesothelioma, Age-specific Incident Cases of Malignant Pleural Mesothelioma, Histology-specific Incident Cases of Malignant Pleural Mesothelioma, Stage-specific Incident Cases of Malignant Pleural Mesothelioma and Line-wise Treated Cases of Malignant Pleural Mesothelioma in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Malignant Pleural Mesothelioma Epidemiological Analyses and Forecast

- In 2024, the 7MM recorded approximately 11,400 mesothelioma cases, with projections indicating a decline by 2034.

- In 2024, the US reported 2,250 incident Malignant Pleural Mesothelioma cases, making up approximately 20% of the total cases across the 7MM.

- In 2024, Malignant Pleural Mesothelioma cases were highest among males in EU4 and the UK, totaling nearly 5,000, while females had a lower incidence at around 1,400, highlighting the gender disparity in disease.

- The UK reported approximately 1,000 Malignant Pleural Mesothelioma cases in the 70–79 age group in 2024, representing 43% of total age-specific cases, indicating a strong correlation between increasing age and disease incidence.

- In 2024, Italy recorded the highest number of 600 histology-specific Malignant Pleural Mesothelioma cases in epithelioid, with projections indicating a decline by 2034.

- In 2024, Japan reported 850 distant-stage Malignant Pleural Mesothelioma cases, the highest recorded, with most 1,000 cases receiving first-line therapy. The patient pool is expected to grow only in Spain and Japan due to the late asbestos ban.

- In 2024, Spain reported the highest number of 250 histology-specific epithelioid Malignant Pleural Mesothelioma cases, with this figure projected to increase by 2034.

- In 2024, France recorded approximately 950 cases of Malignant Pleural Mesothelioma, with projections indicating a decline by 2034.

- In 2024, Germany recorded 900 Malignant Pleural Mesothelioma cases in males, while females accounted for nearly 200 cases.

Malignant Pleural Mesothelioma Epidemiology Segmentation

- Total Incident Cases of Malignant Pleural Mesothelioma

- Gender-specific Incident Cases of Malignant Pleural Mesothelioma

- Age-specific Incident Cases of Malignant Pleural Mesothelioma

- Histology-specific Incident Cases of Malignant Pleural Mesothelioma

- Stage-specific Incident Cases of Malignant Pleural Mesothelioma

- Line-wise Treated Cases of Malignant Pleural Mesothelioma

Malignant Pleural Mesothelioma Recent Developments

- In October 2025, Vivace Therapeutics received FDA Fast Track Designation for VT3989, a TEAD autopalmitoylation inhibitor, for the treatment of unresectable malignant nonpleural or pleural mesothelioma after progression on immune checkpoint inhibitors and platinum-based chemotherapy. The designation supports faster development of this first-in-class Hippo pathway-targeting therapy.

- In June 2025, Oncovita announced that the FDA has granted Orphan Drug Designation to its lead investigational therapy, MVdeltaC, for the treatment of pleural mesothelioma, a rare and aggressive cancer with limited treatment options.

Malignant Pleural Mesothelioma Drug Analysis

The drug chapter segment of the Malignant Pleural Mesothelioma report encloses a detailed analysis of Malignant Pleural Mesothelioma marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the Malignant Pleural Mesothelioma clinical trials details, expressive pharmacological action, agreements and collaborations and approval, advantages and disadvantages of each included drug, and the latest news and press releases.

Malignant Pleural Mesothelioma Marketed Drugs

KEYTRUDA (Pembrolizumab): Merck

KEYTRUDA, an anti-programmed cell death protein 1 (PD-1) immunotherapy, boosts the immune system by blocking PD-1 interactions, enabling T cells to attack tumors. As a humanized monoclonal antibody, it was FDA-approved for Malignant Pleural Mesothelioma following the KEYNOTE-483 trial, where it significantly improved survival with chemotherapy. This marks its first the US indication for Malignant Pleural Mesothelioma, while regulatory reviews for first-line advanced or metastatic Malignant Pleural Mesothelioma are underway in Europe and Japan.

In November 2024, the European Union (EU) Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion on Merck’s KEYTRUDA (pembrolizumab) in combination with chemotherapy as a first-line treatment for adults with unresectable nonepithelioid Malignant Pleural Mesothelioma.

In September 2024, the US FDA approved Merck’s KEYTRUDA (pembrolizumab) alongside pemetrexed and platinum chemotherapy as a first-line treatment for adults with unresectable advanced or metastatic Malignant Pleural Mesothelioma.

OPDIVO (Nivolumab) and YERVOY (Ipilimumab): Bristol Myers Squibb/Ono Pharmaceuticals

Nivolumab, a monoclonal antibody (mAb), inhibits PD-1 to enhance T-cell activity, while ipilimumab blocks CTLA-4, promoting immune response activation. The US FDA approved their combination for Malignant Pleural Mesothelioma based on the CHECKMATE 743 trial, which showed improved survival by boosting immune-mediated tumor destruction.

In October 2020, the US FDA approved nivolumab and ipilimumab as a first-line treatment for adults with unresectable Malignant Pleural Mesothelioma, introducing a new immunotherapy option.

OPDIVO (Nivolumab): Bristol Myers Squibb/Ono Pharmaceutical

OPDIVO, a PD-1 immune checkpoint inhibitor, strengthens the body’s immune response by blocking PD-1 interactions, restoring antitumor activity. In Japan, nivolumab received approval as a monotherapy for unresectable, advanced, or recurrent Malignant Pleural Mesothelioma following progression after first-line chemotherapy. This approval was based on the MERIT study, a Phase II single-arm Malignant Pleural Mesothelioma clinical trials conducted in Japan, demonstrating its efficacy in treating Malignant Pleural Mesothelioma.

In August 2018, Japan approved OPDIVO as a monotherapy for unresectable, advanced, or recurrent Malignant Pleural Mesothelioma that had progressed after chemotherapy.

Emerging Malignant Pleural Mesothelioma Drugs

Volrustomig (MEDI5752): AstraZeneca

Volrustomig (MEDI5752) is a novel bispecific antibody designed to enhance anti-tumor immunity by targeting both PD-1 and Cytotoxic T-lymphocyte-associated protein 4 (CTLA-4). By combining these immune checkpoint inhibitors into a single therapy, it aims to improve immune activation while minimizing toxicity. Currently, a Phase III trial is evaluating its efficacy and safety with carboplatin and pemetrexed for unresectable Malignant Pleural Mesothelioma. The study compares it to standard platinum-based chemotherapy or nivolumab with ipilimumab as first-line treatment, with results expected after 2026.

In April 2022, AstraZeneca presented the first-in-human study of MEDI5752, a novel bispecific checkpoint inhibitor targeting PD-1 and CTLA-4 for advanced solid tumors, at the American Association for Cancer Research (AACR).

Pegargiminase with Pemetrexed and Cisplatin: Polaris Pharmaceuticals

Pegargiminase (ADI-PEG 20) is a first-in-class enzyme therapy that depletes arginine, targeting cancers dependent on external arginine for survival. By hydrolyzing arginine into citrulline and ammonia, it disrupts protein synthesis, selectively killing cancer cells. Currently, a Phase III ATOMIC-Meso trial is evaluating its use with chemotherapy for nonepithelioid pleural mesothelioma. A rolling regulatory submission, based on improved progression-free survival (PFS) and overall survival (OS), may accelerate approval.

As per the JP Morgan Healthcare Conference in January 2024, Polaris Pharma expected to submit the Marketing Authorization Application (MAA) for Malignant Pleural Mesothelioma in Europe in 2024. However, no updated information on the submission is currently available. Additionally, the company anticipates launching Pegargiminase in 2025.

MesoPher: Amphera BV

MesoPher, developed by Amphera BV, is an autologous dendritic cell-based immunotherapy designed to stimulate an anti-tumor immune response. It uses patient-derived dendritic cells loaded with PheraLys to enhance antigen presentation. Through leukapheresis and activation, reinfused cells engage immune components, potentially converting cold tumors into hot tumors. Currently in Phase III, MesoPher shows promising immunogenicity and tolerability.

In June 2024, Amphera published the results of the randomized Phase II/III MesoPher trial in pleural mesothelioma in The Lancet Oncology.

Malignant Pleural Mesothelioma Drugs Class Analysis

Malignant Pleural Mesothelioma treatment has relied on chemotherapy as the standard of care. However, immune checkpoint inhibitors have transformed Malignant Pleural Mesothelioma clinical trials and expanded pharmaceutical revenue. Treatment options include surgery, chemotherapy, radiation, and immunotherapy, with multimodal approaches used selectively based on disease stage, patient health, and tumor resectability.

Emerging therapies include Volrustomig (MEDI5752), Pegargiminase with pemetrexed and cisplatin, and MesoPher

Volrustomig (MEDI5752), developed by AstraZeneca, this therapy is a PD-1 and CTLA-4 inhibitor. Administered via IV infusion, it is currently in Phase III trials, with data expected after 2026.

Pegargiminase with pemetrexed and cisplatin, developed by Polaris Pharmaceuticals, it is an arginine deiminase replacement via IM, it is currently in Phase III Malignant Pleural Mesothelioma clinical trials for the treatment of Malignant Pleural Mesothelioma.

MesoPher, developed by Amphera BV, is an autologous dendritic cell therapy administered via IV and ID. It is currently in Phase III Malignant Pleural Mesothelioma clinical trials for the treatment of Malignant Pleural Mesothelioma.

Continued in report…

Malignant Pleural Mesothelioma Market Outlook

The Malignant Pleural Mesothelioma treatment market includes surgery, radiotherapy, and chemotherapy, with chemotherapy remaining the standard of care. Due to Malignant Pleural Mesothelioma’s aggressive nature, surgery is only suitable for select patients, while radiotherapy primarily provides symptom relief. Chemotherapy, using agents like pemetrexed, cisplatin, gemcitabine, and carboplatin, remains the most widely used approach.

Chemotherapy is categorized into first-line and second-line and above therapies based on disease stage and prior treatment response. However, all modalities have limitations—surgery is viable for few, radiotherapy is not curative, and chemotherapy faces challenges like drug resistance and recurrence. Several drugs have been approved which offer targeted and immunotherapy options to enhance treatment effectiveness and improve survival outcomes for Malignant Pleural Mesothelioma patients.

There is a significant need for new treatments for Malignant Pleural Mesothelioma, as current therapies limited to first-line and face challenges such as resistance, limited durability, and variability in patient response the disease. Several promising drugs are currently in the pipeline, including Volrustomig (MEDI5752), Pegargiminase with Pemetrexed and Cisplatin, MesoPher and among others.

- In 2024, the Malignant Pleural Mesothelioma market size in the US was around USD 100 million, accounting for nearly 48% of the total market. This figure is expected to grow significantly with the introduction of emerging therapies.

- The total market size of EU4 and the UK was estimated to be approximately USD 90 million in 2024, which was nearly 43% of the total market revenue for the 7MM.

- Among EU4 and the UK, the UK accounted for the highest market share with approximately USD 30 million in 2024, followed by Italy with approximately USD 25 million in the respective year, and Spain, capturing the least market with nearly USD 10 million in 2024.

- In 2024, the total market size of Malignant Pleural Mesothelioma was approximately USD 17 million in Japan, which is anticipated to increase during the forecast period (2025–2034).

- As per the estimates, among the current marketed drugs currently in use, OPDIVO (Nivolumab) + YERVOY (Ipilimumab) held the largest market share, generating approximately USD 140 million in revenue in 2024 across the 7MM.

Malignant Pleural Mesothelioma Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

Malignant Pleural Mesothelioma Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Malignant Pleural Mesothelioma players involved in developing targeted therapeutics.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for Malignant Pleural Mesothelioma.

Latest KOL Views on Malignant Pleural Mesothelioma

To keep up with current Malignant Pleural Mesothelioma therapeutics market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Malignant Pleural Mesothelioma evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like The Mount Sinai Hospital, USA, Harvard Medical School, USA, Parkview Health, USA, Berufsgenossenschaftliches Universitätsklinikum Bergmannsheil, Germany, Intercommunal Hospital of Creteil, France, Saint Camillus International University of Health Sciences, Italy, Vall d'Hebron University Hospital, Spain, BartsHealth NHS Trust, the UK, Nagoya City University, Japan, Japanese Red Cross Nagoya Daini Hospital, Japan among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Malignant Pleural Mesothelioma market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on Malignant Pleural Mesothelioma Patient Trends?

As per the KOLs from the US, “There are significant challenges in designing randomized surgical trials for mesothelioma, especially when it comes to standardizing surgical techniques and pathology assessments. International collaboration is essential to harmonize treatment protocols, refine prognostic factors, and integrate personalized, biomarker-guided adjuvant therapies to optimize patient outcomes”.

As per the KOLs from Germany, “Prognostic factors are essential in guiding treatment decisions for Malignant Pleural Mesothelioma, where survival ranges are up to 12 months. Epithelioid histology, younger age, female sex, and early-stage disease are linked to better outcomes. Biomarkers like soluble mesothelin and osteopontin are being explored but are not yet validated for prognosis. Further research is needed to refine prognostic models and enhance patient stratification”.

As per the KOLs from Japan, “The effectiveness of trimodality therapy in Malignant Pleural Mesothelioma remains uncertain due to its high treatment burden and unclear survival benefits. Surgery, radiation, and systemic therapy have shown inconsistent outcomes, with high perioperative risks and low completion rates. Severe radiation toxicities, like pneumonitis, raise concerns, warranting a reassessment of EPP and WHI. Future research should refine patient selection to maximize benefits.”

Malignant Pleural Mesothelioma Qualitative Analysis

We perform Qualitative and Malignant Pleural Mesothelioma treatment market Intelligence analysis using various approaches, such as SWOT and Attribute Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Attribute analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Malignant Pleural Mesothelioma Treatment Market Access and Reimbursement

KEYTRUDA the Merck Access Program

KEYTRUDA, in combination with pemetrexed and platinum-based chemotherapy, is approved as a first-line treatment for adults with unresectable, advanced, or metastatic Malignant Pleural Mesothelioma. The list price is USD 11,564 per dose every three weeks and USD 23,138 every six weeks, based on IV infusion doses of 200 mg and 400 mg, respectively. However, actual patient costs vary depending on insurance coverage.

For commercially insured patients, 59% had no out-of-pocket costs, while others paid between USD 0.01 and 375 per infusion after meeting their deductible. Additional expenses, such as infusion center fees, are not included. Financial assistance is available through The Merck Access Program.

Further details will be provided in the report.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Malignant Pleural Mesothelioma Treatment Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Malignant Pleural Mesothelioma, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of incidence rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Malignant Pleural Mesothelioma, Malignant Pleural Mesothelioma therapeutics market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Malignant Pleural Mesothelioma.

Malignant Pleural Mesothelioma Treatment Market report insights

- Patient Population

- Therapeutic Approaches

- Malignant Pleural Mesothelioma Pipeline Analysis

- Malignant Pleural Mesothelioma Market Size and Trends

- Existing and Future Market Opportunity

Malignant Pleural Mesothelioma Treatment Market Report key strengths

- 10 years Forecast

- The 7MM Coverage

- Malignant Pleural Mesothelioma Epidemiology Segmentation

- Key Cross Competition

- Attribute Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Malignant Pleural Mesothelioma Treatment Market Report assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions Answered in the Malignant Pleural Mesothelioma Report

Market Insights

- What was the total market size of Malignant Pleural Mesothelioma, the market size of Malignant Pleural Mesothelioma, by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will Volrustomig (MEDI5752), affect the treatment paradigm of Malignant Pleural Mesothelioma?

- How will KEYTRUDA compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of Malignant Pleural Mesothelioma? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Malignant Pleural Mesothelioma?

- What is the historical and forecasted Malignant Pleural Mesothelioma patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest incident cases of Malignant Pleural Mesothelioma population during the forecast period (2025–2034)?

- What factors are contributing to the growth of Malignant Pleural Mesothelioma cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Malignant Pleural Mesothelioma? What are the current Malignant Pleural Mesothelioma clinical trials and treatment guidelines for treating Malignant Pleural Mesothelioma?

- How many Malignant Pleural Mesothelioma companies are developing therapies for the treatment of Malignant Pleural Mesothelioma?

- How many emerging therapies are in the mid-stage and late stage of development for treating Malignant Pleural Mesothelioma?

- What are the recent novel therapies, targets, Malignant Pleural Mesothelioma mechanism of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of Malignant Pleural Mesothelioma?

Reasons to Buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Malignant Pleural Mesothelioma market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying upcoming solid Malignant Pleural Mesothelioma companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the attribute analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies for Malignant Pleural Mesothelioma, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming Malignant Pleural Mesothelioma companies wcan strengthen their development and launch strategy.

Get insights through out latest blogs @ DelveInsight Blogs

-pipeline.png&w=256&q=75)