Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Market

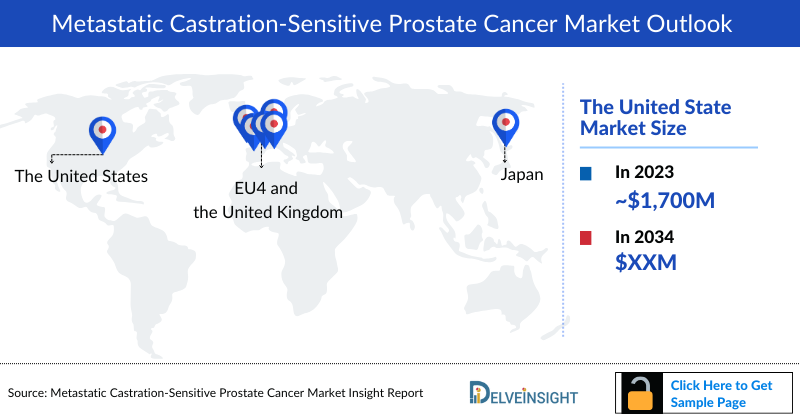

- The total Market Size of mCSPC in 2023 was approximately USD 2,500 million in the 7MM, and the largest market size was occupied by the United States.

- In the 7MM, in 2023, XTANDI accounted for the majority of the market share for mCSPC.

- Among the two types of Prostate cancer (mCRPC and mCSPC ), mCSPC was less prevalent in 2023 in the 7MM.

- Prostate cancer is the third most prevalent type of cancer in the US and the fourth most common worldwide. Approximately one in nine men in the US will be diagnosed with this disease at some point in their lives.

- The total diagnosed prevalent cases of mCSPC in the United States accounted for nearly 54,000 in 2023.

- Treatment options for advanced or metastatic disease predominantly include hormonal therapies (androgen-deprivation therapy or ADT), radiopharmaceuticals, immunotherapy, focused radiation, and other targeted therapies. Patients who have never received i.e. are sensitive to ADT are known as hormone-sensitive prostate cancer (HSPC) or castrate-sensitive prostate cancer (CSPC).

- Several therapies are being investigated for the treatment of prostate cancer. Some key players involved in the development are Arvinas (ARV-110), Daiichi Sankyo (D-7300), Essa Pharma (EPI-7386), and others.

DelveInsight’s “Metastatic Castration-Sensitive Prostate Cancer Market Insight, Epidemiology and Market Forecast – 2034” report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM mCSPC market size from 2020 to 2034. The report also covers current mCSPC treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Understanding and Treatment Algorithm

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Overview and Diagnosis

Prostate cancer is a type of malignancy that occurs in the prostate gland. The prostate is a small walnut-shaped gland in men that produces the seminal fluid that nourishes and transports sperm. Prostate cancer is one of the most common types of cancer found in men. This cancer usually grows slowly and is confined to the prostate gland initially, where it may not cause serious harm. The exact cause of prostate cancer is unknown. However, several things can increase the risk of developing this condition like age, family history, diet, high testosterone level, and genome changes. Since the discovery of ADT by Charles B. Huggins in 1966, hormonal therapy has been a mainstay in the treatment of advanced prostate cancer. However, many prostate cancers ultimately fail to respond to ADT and are termed CRPC. There is also a category of patients who have never received, i.e. are sensitive to ADT known as HSPC.

Diagnosing prostate cancer involves various methods, including analyzing PSA levels in the blood, conducting a digital rectal exam to feel for abnormalities, performing a biopsy to examine tissue samples, utilizing genetic testing to identify potential risk factors, conducting imaging tests like ultrasound or MRI to visualize the prostate, and occasionally conducting a bone scan to check for metastasis. These tests are typically used together to comprehensively assess prostate health and detect any signs of cancer.

Further details related to country-based variations in diagnosis are provided in the report…

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Treatment

Treatment options for prostate cancer include surgery, radiation therapy, hormone therapy, immunotherapy, and chemotherapy. Radiation therapy employs high-energy rays or particles to eliminate cancer cells, with different types used based on the cancer stage and individual factors. Hormone therapy aims to lower levels of male hormones, known as androgens, to halt their role in fueling prostate cancer cells. Immunotherapy involves using medications to prompt the body's immune system to better identify and eradicate cancer cells. Chemotherapy becomes an option when prostate cancer extends beyond the prostate gland and hormone therapy proves ineffective. Chemotherapeutic drugs for prostate cancer may include Docetaxel (Taxotere), Cabazitaxel (JEVTANA), Mitoxantrone (Novantrone), and Estramustine (Emcyt).

Note: Further Details are provided in the final report...

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Recent Developments

- In September 2024, Ipsen announced that the Phase III CONTACT-02 trial for Cabometyx® and atezolizumab in mCRPC showed a non-significant improvement in overall survival but met the progression-free survival (PFS) endpoint.

- In September 2024, Foundation Medicine received FDA approval for FoundationOne®CDx and Liquid CDx as companion diagnostics for Lynparza® in BRCA-mutated mCRPC.

- In July 2024, the ARANOTE trial showed that NUBEQA® plus ADT significantly improved radiological PFS in metastatic hormone-sensitive castrate-resistant prostate cancer (mHSPC).

- In July 2024, the FDA granted fast-track designation to SYNC-T SV-102 for metastatic castrate-resistant prostate cancer (mCRPC).

- In June 2024, Kangpu Biopharmaceuticals received FDA approval for a Phase II/III trial of KPG-121 with Abiraterone for mCRPC.

- In May 2024, Fusion Pharmaceuticals began the Phase 2 AlphaBreak trial of FPI-2265 in mCRPC patients.

- In April 2024, Astellas Pharma received European approval for XTANDI™ in high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer (nmHSPC).

- In April 2024, FibroGen announced positive Phase 1 trial data for FG-3246 in mCRPC.

- On November 16, 2023, the FDA approved enzalutamide (Xtandi) for non-metastatic castration-sensitive prostate cancer (nmCSPC) with high-risk biochemical recurrence.

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Epidemiology

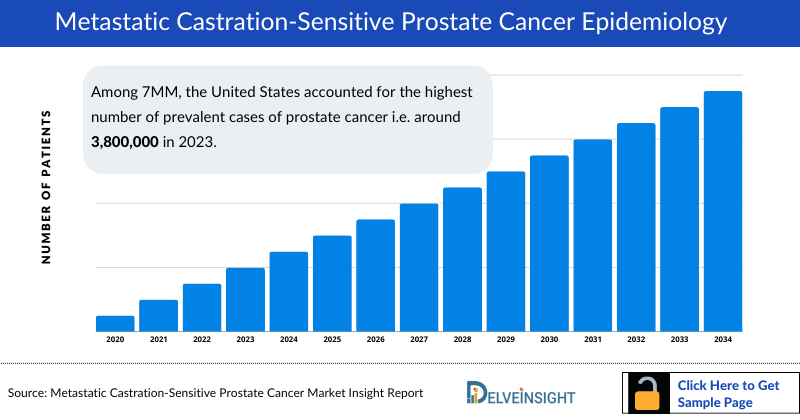

As the market is derived using a patient-based model, the Metastatic Castration-Sensitive Prostate Cancer (mCSPC) epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total Prevalent cases of Prostate cancer, total diagnosed Prevalent cases of Prostate cancer, Age-specific cases of Prostate cancer, total diagnosed cases of Prostate cancer by clinical stages, total cases of mCSPC, total treated cases of mCSPC in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among 7MM, the United States accounted for the highest number of prevalent cases of prostate cancer i.e. around 3,800,000 in 2023.

- In 2023, in the United States, the total cases of mCSPC was around 54,000.

- The diagnosed prevalence of prostate cancer has shown an increasing trend in EU4 and the UK. Among EU4 and the UK, Germany accounted for the highest number of diagnosed prevalent cases of prostate cancer, followed by France, whereas Spain accounted for the lowest cases in 2023.

- Most cases of prostate cancer occur in people aged 65-74 years. In 2023, the total number of age-specific cases in the US for the age group 65-74 was around 600,900 in the United States.

- The most common clinical stages of Prostate cancer, which are locally advanced (stages I-III) cases, represent the largest portion of diagnosed cases.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Metastatic Castration-Sensitive Prostate Cancer Prevalence

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Drug Chapters

The drug chapter segment of the mCSPC report encloses a detailed analysis of mCSPC emerging drugs or late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the mCSPC pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Drugs

ERLEADA (apalutamide): Janssen Pharmaceutical

ERLEADA is a next-generation oral AR inhibitor that blocks the androgen signaling pathway in prostate cancer cells. It is indicated for the treatment of patients with nmCRPC and with mCSPC. It is taken orally, once daily, with or without food. ERLEADA inhibits the growth of cancer cells in three ways: by preventing the binding of androgen to the AR, by stopping the AR from entering the cancer cells, and by preventing the AR from binding to the DNA of the cancer cell. In September 2019, the US FDA approved ERLEADA for treating patients with mCSPC. This approval was followed by the US FDA Priority Review Designation of the sNDA submitted in April 2019 and reviewed through the FDA Real-time oncology review program, In January 2020, the EC approved ERLEADA for use with ADT to treat adult men with Mhspc.

ORGOVYX (relugolix): Myovant Sciences

ORGOVYX is an oral gonadotropin-releasing hormone (GnRH) receptor antagonist approved by the FDA for treating adult patients with advanced prostate cancer. As a GnRH antagonist, ORGOVYX blocks the GnRH receptor and reduces the production of testicular testosterone, a hormone known to stimulate the growth of prostate cancer. Relugolix is a nonpeptide GnRH receptor antagonist that competitively binds to pituitary GnRH receptors, thereby reducing the release of luteinizing hormone (LH) and follicle-stimulating hormone (FSH) and, consequently, testosterone. In December 2020, the US FDA approved ORGOVYX (relugolix) for treating adult patients with advanced prostate cancer. ORGOVYX, for which the FDA granted Priority Review, is the first and only oral gonadotropin-releasing hormone (GnRH) receptor antagonist for men with advanced prostate cancer. In April 2022, the European Commission (EC) approved the marketing authorization application for ORGOVYX (relugolix, 120 mg) to treat adult patients with advanced hormone-sensitive prostate cancer.

|

Comparison of Marketed Drugs | |||

|

Product |

Company |

MoA |

RoA |

|

ERLEADA +ADT |

Jannsen Pharmaceuticals |

Androgen receptor inhibitor |

Oral |

|

ORGOVYX |

Myovant Sciences |

GnRH receptor antagonist |

Oral |

|

XTANDI + ADT |

Astellas/Pfizer |

Androgen receptor inhibitor |

Oral |

|

ZYTIGA + prednisone + ADT |

Janssen Biotech |

CYP17 inhibitor |

Oral |

Get More Insights of this Report @ Prostate Cancer Treatment Market Size

Emerging Drugs

Capivasertib (AZD 5363): AstraZeneca

Capivasertib is a novel pyrrolopyrimidine derivative and an orally available inhibitor of the serine/threonine-protein kinase AKT (protein kinase B) with potential antineoplastic activity. Capivasertib binds to and inhibits all AKT isoforms. Inhibition of AKT prevents the phosphorylation of AKT substrates that mediate cellular processes, such as cell division, apoptosis, and glucose and fatty acid metabolism. Many solid and hematological malignancies show dysregulated PI3K/AKT/mTOR signaling due to mutations in multiple signaling components. By targeting AKT, the key node in the PIK3/AKT signaling network, this agent may be used as monotherapy or combination therapy for various human cancers. The company has completed the Phase Ib and Phase I/II trial of capivasertib for the treatment of prostate cancer. Moreover, AstraZeneca is currently investigating capivasertib in combination with ZYTIGA in the Phase III clinical stage in the CAPItello-281 study for the treatment of mHSPC and in another Phase III clinical development in combination with docetaxel for the treatment of mCRPC. As per the company pipeline, the data of capivasertib + abiraterone (CAPItello-281) and capivasertib + docetaxel (CAPItello-280) is anticipated by 2024+.

VERZENIO (Abemaciclib/LY2835219): Eli Lilly and Company

Abemaciclib (LY28352190; VERZENIO), a chemical entity, is a selective ATP-competitive inhibitor of cyclin-dependent kinases 4 and 6 that inhibits phosphorylation of the Rb tumor suppressor protein and thereby induces G1 cell cycle arrest. LY2835219 is being studied to treat mCRPC (Eli Lilly, n.d.). Currently, abemaciclib is being evaluated in multiple clinical trials in combination with other drugs in mCRPC and mHSPC in Phase III clinical trial.

|

Comparison of Emerging Drugs under Development | ||||

|

Drug Name |

Company name |

MoA |

RoA |

Phase |

|

Capivasertib (AZD 5363) |

AstraZeneca |

AKT inhibitor |

Oral |

III |

|

VERZENIO (Abemaciclib/ LY2835219) |

Eli Lily and Company |

Cyclin-dependent kinases 4 and 6 inhibitor |

Oral |

III |

|

NUBEQA + ADT |

Bayer |

Androgen receptor inhibitor |

Oral |

III |

|

RUBRACA |

Clovis Oncology |

PARP1, PARP2, and PARP3 Inhibitor |

Oral |

II |

Discover key insights and emerging trends in the Metastatic Castration-Sensitive Prostate Cancer Market. Stay ahead with our latest analysis!

Drug Class Insights

Hormone therapy, also known as androgen suppression therapy, aims to reduce levels of male hormones, preventing them from fueling cancer cells. LHRH agonists, such as Leuprolide, Goserelin, Triptorelin, and Histrelin, lower testosterone production effectively, akin to surgical castration. Degarelix, an LHRH antagonist, offers rapid testosterone reduction without causing tumor flare. Anti-androgens like Flutamide, Bicalutamide, and Nilutamide block androgen receptors, impeding tumor growth. PROVENGE, a cancer vaccine, stimulates the immune system against cancer cells, while KEYTRUDA, a PD-1 inhibitor, enhances immune response by blocking inhibitory signals.

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Market Outlook

The backbone of all treatments in mCSPC is androgen deprivation therapy with medications that suppress the level of testosterone in the body because testosterone is the fuel for prostate cancer and gives the signals to grow and spread. Studies over the last decade have demonstrated that intensification of androgen deprivation with different treatment modalities correlates with prolongation of survival. The options for intensification include docetaxel chemotherapy, different androgen receptor-targeted agents, including abiraterone acetate, apalutamide, and enzalutamide, and radiation to the prostate. Most recently, the treatment paradigm for mHSPC shifted to triplet therapy, NUBEQA combined with ADT and chemotherapy and according to the findings presented at the ASCO GU 2023, the regimen should be considered the new standard of care for this patient population.

- Janssen's CYP17 inhibitor, ZYTIGA (abiraterone acetate), received approval for a new indication in the United States in 2018. This approval allowed the use of ZYTIGA in combination with prednisone for the treatment of high-risk metastatic castration-sensitive prostate cancer.

- Companies like Bayer/Orion, Novartis, AstraZeneca, Pfizer, and others are investigating their key products for managing mCSPC/mHSPC.

- The total market size of mCSPC in the United States was approximately USD 1,700 million in 2023 and is projected to increase during the forecast period (2024–2034).

- Among EU4 and the UK, Germany accounted for the maximum market size in 2023, while Spain occupied the bottom of the ladder.

- In 2023, XTANDI accounted for the majority of the market share i.e. ~USD 700 million in the United States.

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Activities

The report provides insights into therapeutic candidates in Phase III and II. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for mCSPC emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Metastatic Castration-Sensitive Prostate Cancer Drugs

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific Writers, Professors, and others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 18+ KOLs in the 7MM. Centers such as Emory University School of Medicine, Anderson Cancer Center, Southwestern Medical Center, etc. were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Metastatic Castration-Sensitive Prostate Cancer (mCSPC) market trends.

|

Region |

KOL Views |

|

United States |

“Effective staging in newly diagnosed prostate cancer is crucial in establishing optimal clinical management strategies because up to 25% of patients with primary prostate cancer may have detectable regional pelvic lymph node metastases, which correlate with a risk for recurrence and associated overall survival.” |

|

United Kingdom |

“As a specialist in the field, I stress the value of routine screenings and the importance of early detection. Prostate-specific antigen (PSA) blood tests and digital rectal examination (DRE) help detect potential cases at an early stage. A healthy lifestyle that includes regular exercise, a balanced diet, and abstinence from tobacco and excessive alcohol is also important for prevention.” |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Market Access and Reimbursement

Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders. The payment models are based on clinical outcomes, annuity payments, and expanded risk pools. The pharmaceutical companies must grant the following rebates: the general rebate of 7% of the manufacturer’s price will be paid by the pharmaceutical companies to the SHIs (Statutory health insurance funds) for all pharmaceuticals that are not subject to more specific price regulations. A special rebate of 10% of the manufacturer’s price is to be paid by the pharmaceutical companies to the SHIs for generics. Special rebates for vaccines are to be paid by the pharmaceutical companies to the SHIs and are calculated based on actual average prices in the four member states of the EU with gross national incomes.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Metastatic Castration-Sensitive Prostate Cancer (mCSPC), explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will impact the current treatment landscape.

- A detailed review of the Metastatic Castration-Sensitive Prostate Cancer (mCSPC) market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Metastatic Castration-Sensitive Prostate Cancer (mCSPC) Market.

Metastatic Castration-Sensitive Prostate Cancer Report Insights

- Patient Population

- Therapeutic Approaches

- Metastatic Castration-Sensitive Prostate Cancer Pipeline Analysis

- Metastatic Castration-Sensitive Prostate Cancer Market Size and Trends

- Existing and future Market Opportunity

Metastatic Castration-Sensitive Prostate Cancer Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- Metastatic Castration-Sensitive Prostate Cancer Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Metastatic Castration-Sensitive Prostate Cancer Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted Metastatic Castration-Sensitive Prostate Cancer patient pool in the United States, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan?

- What was the total Metastatic Castration-Sensitive Prostate Cancer market size, the market size by therapies, and market share (%) distribution in 2023, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for treating Metastatic Castration-Sensitive Prostate Cancer?

- How many companies are developing therapies to treat Metastatic Castration-Sensitive Prostate Cancer?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Metastatic Castration-Sensitive Prostate Cancer Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

Market.png)