Prostate Cancer Market

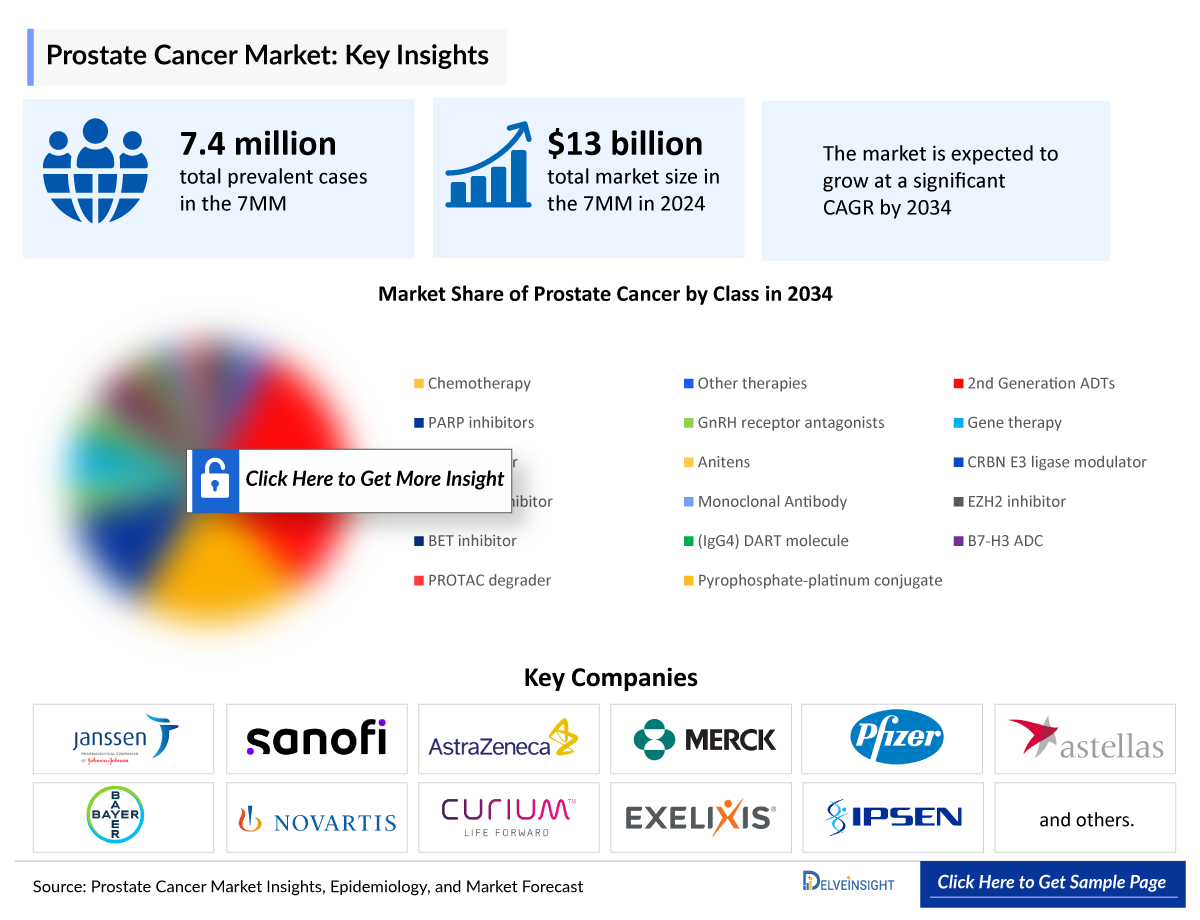

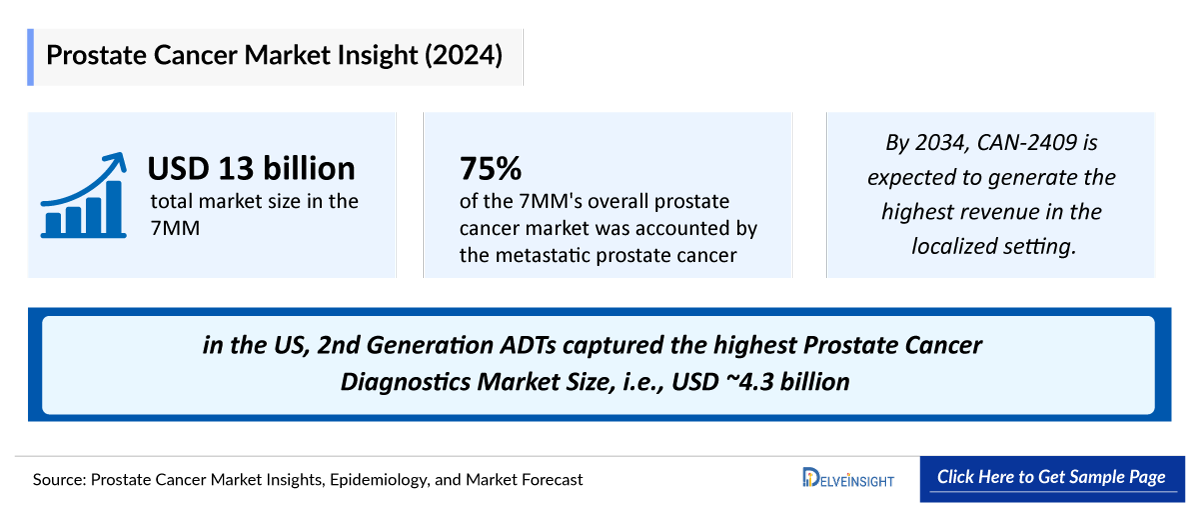

- The total Prostate Cancer Treatment Market Size in the 7MM was nearly USD 12,300 million in 2023 and is expected to show positive growth by 2034. Among the 7MM, the US accounts for the largest Prostate Cancer Market Size in 2023.

- The Metastatic Prostate Cancer Market accounts for around 75% of the 7MM's overall market size in 2023, while the rest 25% belonged to non-metastatic prostate cancer market.

- The Prostate Cancer Diagnostics Market is expected to witness significant growth owing to the rising prevalence of prostate cancer cases, emergence of novel, more accurate, next-generation imaging techniques, extensive market penetration of approved therapies in mCRPC due to label expansions and entry of new emerging therapies.

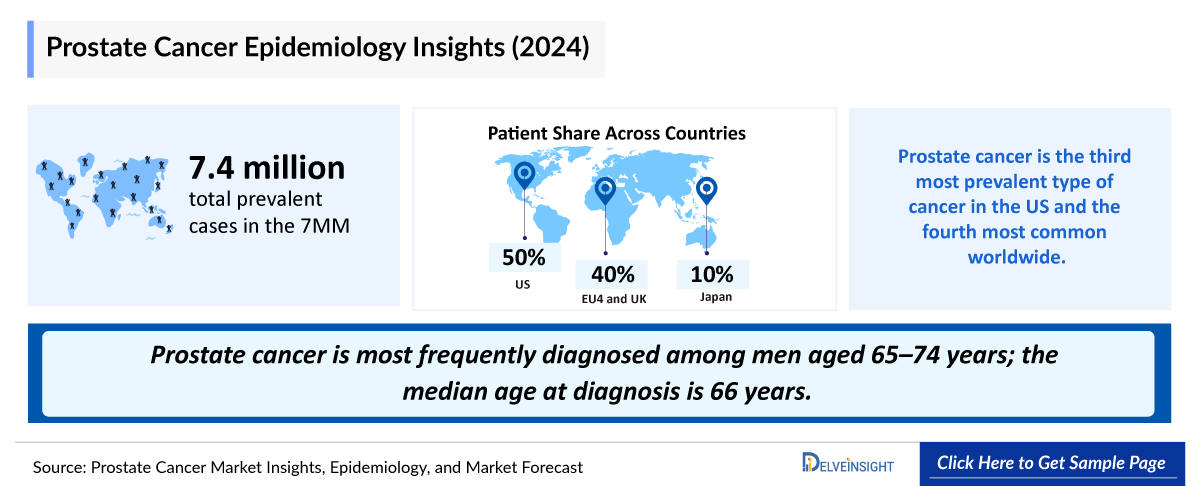

- Prostate Cancer is most frequently diagnosed among men aged 65–74 years; the median age at diagnosis is 66 years. As per DelveInsight’s estimates, the Prostate Cancer Prevalent Cases in the United States were ~3,649,900 in 2023 with a huge number of non-metastatic patients under watchful waiting.

- The majority of prostate cancer cases are diagnosed at a non-metastatic stage. About 80-85% of prostate cancer patients are diagnosed with localized or locally advanced (non-metastatic) prostate cancer.

- Depending on the stage of detection and the tolerance to hormonal therapies, prostate cancer market is segmented into non-metastatic CSPC, non-metastatic CRPC, metastatic CSPC, and metastatic CRPC.

- Established therapies for metastatic prostate cancer include ERLEADA, XTANDI, NUBEQA, JEVTANA, ZYTIGA, with the recent addition of Novartis’ PLUVICTO. Whereas only ERLEADA, XTANDI and NUBEQA have labels for non-metastatic patients.

- Janssen’s XTANDI, the biggest revenue generator with labels in all four segments of prostate cancer, has witnessed stable growth since 2021 due to increased competition. Recent approval of XTANDI in non-metastatic settings, in November 2023, has offered a ray of hope to a subset of men with nmCSPC with biochemical recurrence and at high risk for metastases.

- Approval of ERLEADA for mCSPC has put a barrier to the growth of the sales of ZYTIGA, which is already facing competition. Even though ZYTIGA’s generics have entered the US market since 2019 and the EU since late 2022, leading to a drastic decline in the revenue mainly in the US, the product is extensively being evaluated in combination with novel emerging therapies, leading to an increase in patient share on the compound abiraterone acetate.

- Apart from XTANDI, ZYTIGA, and ERLEADA in the mCSPC market, Bayer’s NUBEQA is another rising contender with a strong uptake in a short period. NUBEQA is emerging as a potential game-changer, with ongoing Phase III trials exploring its efficacy in combination with LHRHa and EBRT for nmCSPC with high-risk BCR..

- The mCRPC Market has witnessed a strong and unexpected commercial uptake of Novartis’ radioligand therapy, PLUVICTO, post its approval in 2022, from the third-line mCRPC setting. PLUVICTO is now set for entry in pre-taxane setting after expected filling in 2H 2024, whereas, mCSPC is the third segment company is eyeing to enter by 2025 in the United States.

- Moreover, PARP inhibitors are also carving out their place in patients harboring HRR gene mutations (BRCA1/2), with the launch of AstraZeneca’s LYNPARZA in 1L+ and RUBRACA in 3L mCRPC patients in 2020. In 2023, TALZENNA, AKEEGA, and LYNPARZA also received approvals in the 1L setting.

- Several Prostate Cancer Therapies are being investigated for Prostate Cancer Therapies. The leading Prostate Cancer Companies such as Sumitomo Pharma (ORGOVYX [relugolix]), Candel Therapeutics (CAN-2409), Kangpu Biopharmaceuticals (KPG-121), AstraZeneca (capivasertib), Arvinas (ARV-110), Daiichi Sankyo (D-7300), Essa Pharma (EPI-7386), Hinova Pharmaceuticals (HC-1119), Eli Lilly/POINT Biopharma (177Lu-PNT2002), Telix Pharmaceuticals (TLX591), Exelixis (Cabozantinib), AB Science (Masitinib), Modra Pharmaceuticals (ModraDoc006/r), Xencor (Vudalimab), Taiho Pharmaceutical (TAS-116), Zenith Epigenetics (ZEN-3694) MacroGenics (Vobramitamab duocarmazine), and others.

- CAN-2409, developed by Candel Therapeutics, is the only gene therapy currently in the prostate cancer pipeline. The company is targeting localized prostate cancer, where no therapies have been approved so far.

Request for Unlocking the Sample Page of the "Prostate Cancer Treatment Market"

Key Factors Driving Prostate Cancer Market

Rising Prostate Cancer Patient Pool Across the 7MM

Prostate cancer remains one of the most common malignancies in men, particularly affecting those aged 65–74 years, with a median diagnosis age of 66. In 2023, the United States recorded nearly 3.65 million prevalent cases, with the majority diagnosed at localized or locally advanced (non-metastatic) stages. Approximately 80–85% of cases are detected as non-metastatic, and many patients remain under active surveillance or watchful waiting before progressing to advanced disease.

Expanding Prostate Cancer Market and Segment Dynamics

The metastatic prostate cancer segment contributed ~75% of the total prostate cancer market in the 7MM in 2023, while the non-metastatic segment accounted for ~25%. Depending on disease progression and treatment eligibility, the market is further segmented into non-metastatic CSPC, non-metastatic CRPC, metastatic CSPC, and metastatic CRPC. Expanding access to next-generation imaging, biomarker-driven diagnostics, and broader label expansions of approved therapies are fueling growth across both metastatic and non-metastatic markets.

Established and Emerging Therapies Driving Growth

The treatment landscape has been strengthened by androgen receptor inhibitors (XTANDI, ERLEADA, NUBEQA), taxanes (JEVTANA), hormonal therapies (ZYTIGA), and radioligand therapies (PLUVICTO). Novartis’ PLUVICTO has shown strong uptake in post-taxane mCRPC and is being advanced to earlier settings, including pre-taxane mCRPC and mCSPC. Meanwhile, PARP inhibitors (LYNPARZA, RUBRACA, TALZENNA, AKEEGA) have expanded options for HRR-mutated patients. XTANDI remains the leading therapy, holding approvals across all four prostate cancer subtypes, while NUBEQA is rapidly gaining share with strong Phase III programs in high-risk non-metastatic disease.

Innovations in Prostate Cancer Pipeline and Clinical Trials

The prostate cancer pipeline is robust, featuring a range of novel mechanisms, including radioligand therapies (177Lu-PNT2002, TLX591, 177Lu-PSMA-I&T), gene therapy (CAN-2409 by Candel Therapeutics), AR degraders (ARV-110, ARV-766), PARP inhibitors (Fuzuloparib, Saruparib), kinase inhibitors (cabozantinib, capivasertib, pamufetinib), and immunotherapies (nivolumab, vudalimab, lorigerlimab). Notably, CAN-2409 is the only gene therapy currently in development for localized prostate cancer, a space with significant unmet needs. With multiple phase II and III trials ongoing, these pipeline agents are expected to redefine treatment sequencing and expand survival benefits.

Strong Industry Participation and Strategic Collaborations

The prostate cancer market is highly competitive, with participation from global leaders such as Astellas/Pfizer, Janssen, Bayer, Novartis, AstraZeneca, Eli Lilly/POINT Biopharma, Merck, Daiichi Sankyo, Exelixis, Bristol Myers Squibb, Telix Pharmaceuticals, and Candel Therapeutics. Strategic collaborations, licensing agreements, and co-developments are fueling innovation, while biomarker-driven trial designs and radioligand advances are aligning with precision medicine trends. The launch of emerging therapies between 2024–2034 is expected to significantly expand patient access and reshape the standard of care.

DelveInsight’s “Prostate Cancer Treatment Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of all prostate cancer types, historical and forecasted epidemiology as well as the prostate cancer market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Prostate Cancer Treatment Market Report provides current treatment practices, emerging drugs, prostate cancer market share of individual therapies, and current and forecasted prostate cancer market size from 2020 to 2034, segmented by seven major markets. The report also covers current prostate cancer treatment market practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Prostate Cancer Treatment Market Disease: Understanding and Algorithm

Prostate cancer is a type of malignancy in the prostate gland, a part of the male reproductive system. Fortunately, most prostate cancers tend to grow slowly and are low-grade with relatively low risk and limited aggressiveness. Prostate cancer is rare in men younger than 40, but the chance of having prostate cancer rises rapidly after age 50.

Diagnosis is primarily based on prostate-specific antigen (PSA) testing, which is elevated in those with prostate cancer or other conditions affecting the prostate. Screening can also involve a digital rectal exam to feel for prominent prostate tumors, a prostate ultrasound, and a prostate MRI. A definitive diagnosis requires a transrectal ultrasound-guided (TRUS) prostate tissue biopsy. When the cancer is limited to the prostate, it is considered localized and potentially curable. Active surveillance, surgery, or radiation therapy are the three major treatment options for localized or locally advanced prostate cancer.

Further details related to diagnosis will be provided in the report…

Prostate Cancer Treatment

Prostate cancer starts as localized prostate cancer when only found in the prostate and surgery or radiation can be used to treat it. Sometimes, hormone therapy might also be used. Patients who have never received, i.e., are sensitive to ADT, are known as hormone-sensitive prostate cancer (HSPC) or castrate-sensitive prostate cancer (CSPC). The main treatments for nmCRPC include androgen deprivation therapy (ADT), also called hormone therapy, second-line ADT, and active surveillance. If the disease has spread to the bones or elsewhere outside the prostate, pain medications, bisphosphonates, rank ligand inhibitors, hormonal treatment, chemotherapy, radiopharmaceuticals, immunotherapy, focused radiation, and other targeted therapies can be used.

Further details related to treatment will be provided in the report…

Prostate Cancer Epidemiology

The prostate cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Prevalent cases of Prostate cancer, Five–year Prevalent cases of Prostate cancer, Age-specific cases of Prostate cancer, and Total cases of Prostate cancer by clinical stages (Total Prevalent cases of nmCSPC, Total Prevalent cases of mCSPC, Total Prevalent cases of nmCRPC, and Total Prevalent cases of mCRPC) in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- In 2023, the 7MM had approximately 7,279,500 Prostate Cancer Prevalence Cases. These are expected to rise due to the growing geriatric population and advancements in diagnostic capabilities during the forecast period (2024-2034).

- The five-year Prostate Cancer Prevalent Cases in the US was ~1,093,300 in 2023.

- Among the EU4 and the UK, Germany accounted for the highest number of metastatic CRPC cases while, Spain had the lowest cases, in 2023.

- As per the estimates, in the US, majority of the cases were found to be localized/locally advanced cases (Stage I-III), comprising approximately 56% of total cases, while nearly 33% belonged to biochemical recurrence/ progressive cases, and ~11% belonged to metastatic cases.

- Around 43% of all metastatic prostate cancer cases are attributed for mCRPC and rest 57% are attributed for mCSPC.

Recent Developments in the Prostate Cancer Treatment Market Landscape

- In September 2025, Shanghai Henlius Biotech and Organon announced that the U.S. FDA approved BILDYOS® (denosumab-nxxp) injection 60 mg/mL and BILPREVDA® (denosumab-nxxp) injection 120 mg/1.7 mL, biosimilars to PROLIA and XGEVA, respectively, for all indications of the reference products. BILDYOS is a RANK ligand (RANKL) inhibitor indicated for osteoporosis treatment in high-risk postmenopausal women and men, glucocorticoid-induced osteoporosis, and bone mass increase in prostate and breast cancer patients receiving specific therapies. Patients with advanced kidney disease face higher risks of severe hypocalcemia, requiring expert supervision before and during treatment.

- In August 2025, Lantheus Holdings announced that the FDA accepted the New Drug Application (NDA) for a new formulation of its F 18 PSMA imaging agent, filed by affiliate Aphelion. The FDA’s action date is set for March 6, 2026. This new formulation aims to match the efficacy of Lantheus’ market-leading PSMA PET agent, PYLARIFY, which shows an 86% median true-positive rate in detecting recurrent prostate cancer.

- In August 2025, Atavistik Bio dosed the first patient in a Phase 1 trial of ATV-1601, a selective inhibitor targeting the AKT1 E17K mutation in solid tumors such as breast, endometrial, and prostate cancers. The drug uses a reversible allosteric mechanism and has shown better efficacy and tolerability than broader AKT inhibitors in preclinical studies.

- In July 2025, Telix announced that its prostate cancer PET imaging agent Illuccix® (gallium-68 gozetotide) received marketing authorization from BASG in Austria. The approval covers detection and localization of PSMA-positive lesions in adults with prostate cancer, allowing wider use of PSMA-PET imaging with this validated gallium-based radiopharmaceutical.

- In July 2025, Artera received FDA Breakthrough Device Designation for ArteraAI Prostate, an AI-based tool designed to help clinicians make risk-based decisions for patients with localized prostate cancer.

- In June 2025, Siemens Healthineers Molecular Imaging partnered with Massachusetts General Hospital to advance theranostics—using radiopharmaceuticals for both diagnosis and treatment—primarily for cancers like thyroid, prostate, and neuroendocrine tumors. Molecular imaging aids in assessing disease extent and treatment response.

- In June 2025, Telix announced that its prostate cancer PET imaging agent Illuccix® (kit for the preparation of gallium-68 gozetotide injection) received marketing authorization in Greece (EOF), Belgium (AFMPS), and Italy (AIFA) for the detection and localization of prostate-specific membrane antigen (PSMA)-positive lesions in adults with prostate cancer. These approvals provide healthcare providers across these countries with access to a clinically validated gallium-based radiopharmaceutical for PSMA-PET imaging, expanding diagnostic options for prostate cancer patients.

- In June 2025, Archeus Technologies received FDA clearance for its IND application for ART-101, a small molecule targeting PSMA for prostate cancer imaging and treatment, showing higher tumor uptake and lower normal tissue exposure.

- In May 2025, Candel Therapeutics (Nasdaq: CADL) announced FDA granted RMAT designation to CAN-2409, its lead biological immunotherapy, for treating newly diagnosed intermediate-to-high-risk localized prostate cancer. CAN-2409 had earlier received Fast Track designation for this use.

- In August 2025, Foresee Pharmaceuticals announced FDA approval of the New Drug Application for CAMCEVI™ (leuprolide mesylate 21 mg), a long-acting injectable for treating advanced prostate cancer.

- In July 2025, the European Commission approved Nubeqa™ (darolutamide), an oral androgen receptor inhibitor, in combination with androgen deprivation therapy (ADT) for treating metastatic hormone-sensitive prostate cancer (mHSPC). The decision was based on Phase III ARANOTE trial results showing a 46% reduction in risk of radiological progression or death versus placebo plus ADT.

- In March 2025, the FDA approved Telix Pharmaceuticals' new drug application (NDA) for TLX007-CDx (Gozellix) for prostate cancer imaging.

- In March 2025, Quibim announced that its QP-Prostate® CAD solution for prostate cancer lesion detection received FDA 510(k) clearance. This milestone advances Quibim’s mission to improve prostate cancer detection and treatment.

- In February 2025, Ibex Medical Analytics, a leader in AI-powered cancer diagnostics, received FDA 510(k) clearance for Ibex Prostate Detect. This in vitro diagnostic device uses AI to generate heatmaps that identify small and rare missed prostatic cancers, providing pathologists with a safety net to ensure accurate diagnoses.

- In January 2025, Clarity Pharmaceuticals announced that the FDA granted Fast Track Designation (FTD) for 64Cu-SAR-bisPSMA for PET imaging of PSMA-positive prostate cancer lesions in patients with biochemical recurrence (BCR) of prostate cancer following definitive therapy.

- In January 2025, Clarity Pharmaceuticals announced that the FDA granted Fast Track Designation for its 64Cu-SAR-bisPSMA, a PET imaging agent for prostate cancer, specifically for patients with biochemical recurrence after definitive therapy. This designation allows for expedited development and review, potentially accelerating its market availability.

- On November 1, 2024, ESSA Pharma announced the termination of its Phase II clinical trial for masofaniten, a new treatment for prostate cancer. Previously known as EPI-7386, masofaniten is an investigational oral small-molecule androgen receptor (AR) inhibitor. The trial, which was evaluating masofaniten in combination with enzalutamide versus enzalutamide alone for patients with metastatic castration-resistant prostate cancer (mCRPC), was halted based on an interim review.

- On October 14, 2024, Clarity Pharmaceuticals, a clinical-stage company specializing in radiopharmaceuticals aimed at enhancing treatment outcomes for cancer in both children and adults, announced the initiation of a crucial Phase III trial for its 64Cu-SAR-bisPSMA diagnostic in patients experiencing biochemical recurrence (BCR) of prostate cancer.

- In October 2024, a study revealed that Johnson & Johnson's Erleada outperformed Astellas and Pfizer's Xtandi in a real-world comparison for treating metastatic castration-sensitive prostate cancer (mCSPC). Although Xtandi had previously dominated the market, the analysis of over 3,700 patients indicated that Erleada reduced the risk of death by 23% compared to Xtandi after 24 months. Following this period, 88% of patients on Erleada were still alive, consistent with results from the phase 3 TITAN trial, whereas the survival rate for Xtandi was 85%.

- In September 2024, Ipsen announced that the Phase III CONTACT-02 trial for Cabometyx® and atezolizumab in mCRPC showed a non-significant improvement in overall survival but met the progression-free survival (PFS) endpoint.

- In September 2024, Foundation Medicine received FDA approval for FoundationOne®CDx and Liquid CDx as companion diagnostics for Lynparza® in BRCA-mutated mCRPC.

- In July 2024, the ARANOTE trial showed that NUBEQA® plus ADT significantly improved radiological PFS in metastatic hormone-sensitive castrate-resistant prostate cancer (mHSPC).

- In July 2024, the FDA granted fast-track designation to SYNC-T SV-102 for metastatic castrate-resistant prostate cancer (mCRPC).

- In June 2024, Kangpu Biopharmaceuticals received FDA approval for a Phase II/III trial of KPG-121 with Abiraterone for mCRPC.

- In May 2024, Fusion Pharmaceuticals began the Phase 2 AlphaBreak trial of FPI-2265 in mCRPC patients.

- In April 2024, Astellas Pharma received European approval for XTANDI™ in high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer (nmHSPC).

- In April 2024, FibroGen announced positive Phase 1 trial data for FG-3246 in mCRPC.

- On Feb. 12, 2024, BioXcel Therapeutics, Inc. announced that the FDA granted Fast Track designation for BXCL701 with a CPI to treat metastatic small cell neuroendocrine prostate cancer (SCNC) in patients progressing on chemotherapy. This designation allows for expedited development and review by the FDA.

- On November 16, 2023, the FDA approved enzalutamide (Xtandi) for non-metastatic castration-sensitive prostate cancer (nmCSPC) with high-risk biochemical recurrence and the enzalutamide moa has also shown a positive shift in the recent developments.

Prostate Cancer Drugs Market Chapters

The drug chapter segment of the Prostate Cancer Diagnostics Market Report encloses a detailed analysis of the marketed and pipeline drugs. The marketed drugs segment encloses drugs such as AKEEGA (Janssen), XTANDI (Astellas Pharma/Pfizer), NUBEQA (Bayer), ERLEADA (Janssen), and others. Furthermore, the current key players for the upcoming emerging drugs and their respective drug candidates include MacroGenics (MGC018), Daiichi Sankyo (DS-7300), Candel Therapeutics (CAN-2409), Kangpu Biopharmaceuticals (KPG-121), and others. The drug chapter also helps understand the prostate cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Prostate Cancer Marketed Drugs

- NUBEQA (darolutamide): Bayer

NUBEQA (darolutamide) is an oral androgen receptor inhibitor. It is indicated for the treatment of adult patients with nmCRPC and mCSPC/mHSPC in combination with docetaxel. NUBEQA is administered 600 mg, (two 300 mg tablets) orally twice daily. In 2023, Bayer reported that its global revenue from NUBEQA amounted to around USD 941 million.

- ERLEADA (apalutamide): Johnson & Johnson Innovative Medicine (Janssen)

ERLEADA is a next-generation oral androgen receptor inhibitor. It is indicated for the treatment of patients with mCSPC/mHSPC and nmCRPC. ERLEADA is administered 240 mg orally once daily. In 2023, Johnson & Johnson Innovative Medicine reported that its global revenue from ERLEADA amounted to USD 2,387 million.

- XTANDI (enzalutamide): Astellas Pharma/Pfizer

XTANDI is an orally bioavailable, organic, non-steroidal small molecule targeting the AR with potential antineoplastic activity. It is indicated for the treatment of patients with CRPC, mCSPC/mHSPC, nmCRPC with biochemical recurrence at high risk for metastasis. XTANDI is administered 160 mg orally once daily. In 2023, Pfizer reported that its global revenue from XTANDI amounted to USD 1,191 million.

Prostate Cancer Emerging Drugs

- Opevesostat (MK-5684; ODM-208): Merck and Orion

Opevesostat is an oral, non-steroidal, and selective inhibitor of CYP11A1 discovered and developed by Orion and is being investigated for the treatment of hormone-dependent cancers, such as prostate cancer. In July 2024, Merck and Orion announced a mutual exercise of options providing Merck global exclusive rights to opevesostat for the treatment of mCRPC. Merck and Orion initiated OMAHA1 (NCT06136624) and OMAHA2a (NCT06136650), two pivotal Phase III Prostate Cancer Clinical Trials evaluating opevesostat in combination with hormone replacement therapy (HRT), for the treatment of certain patients with mCRPC. Final results from the OMAHA1 trial are expected in 2028 and OMAHA2a trial final results are anticipated in 2030. In addition to these, Merck has also presented updated CYPIDES Phase II results of opevesostat mCRPC at ESMO Congress 2024.

- CAN-2409: Candel Therapeutics

CAN-2409, Candel’s most advanced viral immunotherapy candidate, is a replication-defective adenovirus that delivers the herpes simplex virus thymidine kinase (HSV-tk) gene to cancer cells. Moreover, according to the company’s corporate presentation, the company expects to announce topline data from this clinical trial by Q4 2024 for its ongoing placebo-controlled, randomized pivotal Phase III clinical trial of CAN-2409 in patients with low-to-intermediate-risk, localized, non-metastatic-prostate-cancer-and-Phase-II-trial-for-patients-undergoing active surveillance for localized prostate cancer. The drug CAN-2409 is presently undergoing evaluation in a Phase I clinical trial to assess its safety and tolerability in patients.

- KPG-121: Kangpu Biopharmaceuticals

KPG-121 is a modulator of the Cereblon (CRBN) E3 ubiquitin ligase complex CRL4-CRBN targeting rapid ubiquitination and degradation of casein kinase 1A1 (CK1a) and transcription factors Aiolos (IKZF3) and Ikaros (IKZF1). KPG-121 promotes anti-proliferation and anti-angiogenesis activities and enhances immunomodulatory properties. A Phase I study to evaluate the safety, pharmacokinetics, and efficacy of KPG-121 when combined with enzalutamide, abiraterone, or apalutamide for the treatment of patients with mCRPC or nmCRPC was completed in the US. KPG-121 was well tolerated and demonstrated a favorable pharmacokinetic profile as well as promising efficacy.

ASCO 2024 Key Highlights in Prostate Cancer

Prostate Cancer Drugs Market Insights

Currently, the market holds a diverse range of therapeutic alternatives for treatment, including PARP inhibitors, androgen receptor inhibitors, CYP17 inhibitors, microtubule inhibitors, radioligand therapies, GnRH receptor antagonists, and others in different lines of treatment. Androgen receptor pathway inhibitors are a mainstay of treatment for patients with prostate cancer. There are currently four approved androgen receptor pathway inhibitors in the United States: three anti-androgens — apalutamide, enzalutamide, and darolutamide, as well as an androgen receptor pathway inhibitor, abiraterone acetate.

In men with mCRPC and select HRR pathway alterations, PARPi treatment has been shown to induce objective tumor responses and improve progression-free and overall survival. The FDA has approved four PARP inhibitors (olaparib, niraparib, rucaparib, and talazoparib) for men with metastatic castration-resistant prostate cancer. FDA-approved targeted radioligand therapy, PLUVICTO (177lutetium (177Lu)-PSMA-617), proved to be an important clinical advancement for people with progressing mCRPC, as it can significantly improve survival rates for those who have limited treatment options.

ADCs that target B7-H3 are generating early excitement among investigators in prostate cancer, which has been largely unresponsive to currently approved ICIs. MGC018 and DS-7300 have both displayed encouraging results in Prostate Cancer Clinical Trials involving patients with mCRPC. Amgen and Xencor are currently evaluating xaluritamig (AMG 509), a STEAP1 x CD3 XmAb 2 + 1 bispecific antibody, in a Phase I study in patients with mCRPC. STEAP1 is highly expressed in prostate cancers, representing an attractive target for treating mCRPC.

Prostate Cancer Market Outlook

Non-metastatic Prostate Cancer

Prostate cancer starts as localized prostate cancer when only found in the prostate and surgery or radiation can be used to treat it. Sometimes, hormone therapy might also be used. Increased sophistication of prostate imaging has allowed for the rapid emergence of focal therapies such as focal laser ablation, high-intensity focal ultrasound (HIFU), irreversible electroporation (IRE), photodynamic therapy (VTP), and focal cryotherapy. Radical prostatectomy can be open (ORP), laparoscopic (LRP), or robotic-assisted (RARP). ORP is the traditional method, whilst LRP and RARP are increasing in popularity.

As RARP becomes more available, conventional LRP has been overtaken. With non-metastatic CRPC (nmCRPC), cancer no longer responds to hormone treatment. The main goal of treating nmCRPC is to shrink the tumor, control symptoms, and slow progress. The doctor may also suggest taking calcium and vitamin D to protect bones or other medications to help maintain bone density. The main treatments for nmCRPC include Androgen Deprivation Therapy (ADT), also called hormone therapy, second-line ADT, and active surveillance. Established therapies in the market for non-metastatic prostate cancer include ERLEADA, XTANDI, and NUBEQA.

Metastatic Castration-Resistant Prostate Cancer (mCRPC)

Metastatic Castration-Resistant Prostate Cancer (mCRPC) is a stage of prostate cancer that has spread to other parts of the body, such as lymph nodes or bones, and no longer responds to treatment that lowers testosterone. Despite currently approved therapeutics, mCRPC remains a terminal diagnosis with an aggressive disease course. ADT is a stalwart therapy for the initial treatment of metastatic disease. Unfortunately, most men in this situation will go on to develop mCRPC and require secondary systemic therapy. This disease state can be very challenging to treat.

Docetaxel was the only agent available for the treatment of mCRPC until 2010, which showed an increase in overall survival compared with the standard of care. It was approved in 2004 for mCRPC with prednisone. Patients failed to first-line docetaxel for many years, and no standard treatment option was approved. However, in the last few years, several drugs such as JEVTANA, ZYTIGA, XTANDI, LYNPARZA, TALZENNA, AKEEGA, and others have received regulatory approval for mCRPC in the United States.

Most recently, PARP inhibitors have shown tremendous development in this area with AKEEGA (Janssen), followed by TALZENNA (Pfizer/Astellas Pharma) and LYNPARZA in combination (AstraZeneca/Merck) getting approved in mCRPC in 2023.The approval of PLUVICTO has also marked a crucial advancement in treating progressive mCRPC, offering improved survival rates for those with limited treatment options. The drug had an exceptionally robust initial market performance, garnering a stronger-than-expected uptake in the US.

Quantitatively, the mCRPC pipeline seems to be quite strong. ADCs such as MGC018 and DS-7300 have both displayed encouraging results in Prostate Cancer Clinical Trials involving patients with mCRPC.

Metastatic Castrate-Sensitive Prostate Cancer (mCSPC)

Metastatic Castrate-Sensitive Prostate Cancer (mCSPC) is an advanced form of cancer in which cancer cells have spread from the prostate to other body areas. However, the patient is still sensitive to androgen deprivation therapy (ADT) (some mCSPC patients have never had ADT, while others may have had ADT but have recovered testicular function). The backbone of all treatments in mCSPC is androgen deprivation therapy (ADT) with medications that suppress the level of testosterone in the body because testosterone is the fuel for prostate cancer and gives the signals to grow and spread.

Studies over the last decade have demonstrated that intensification of androgen deprivation with different treatment modalities correlates with prolongation of survival. The options for intensification include docetaxel chemotherapy, different androgen receptor-targeted agents, including abiraterone acetate, apalutamide, and enzalutamide, and radiation to the prostate. Most recently, the treatment paradigm for mHSPC shifted to triplet therapy, NUBEQA combined with ADT and chemotherapy.

Key Findings

- The Metastatic Prostate Cancer Market accounts for around 75% of the 7MM's overall prostate cancer market in 2023, while the rest 25% belonged to non-metastatic prostate cancer market.

- Among the EU4 and the UK, Germany captured the maximum Prostate Cancer Diagnostics Market Share in 2023, whereas Spain was at the bottom of the ladder in the same year for prostate cancer.

- In 2023, in the US, 2nd Generation ADTs captured the highest Prostate Cancer Diagnostics Market Size, i.e., USD ~4,350 million.

- The total Prostate Cancer Treatment Market Size in the 7MM was estimated to be nearly USD 6,700 million in 2023 and USD 2,600 million for mHSPC/mCSPC which is expected to show positive growth by 2034.

- By 2034, CAN-2409 is expected to generate the highest revenue in the localized setting.

- The current US market for mCRPC holds therapies like JEVTANA, ZYTIGA, XTANDI, XOFIGO, and others. In the current market, the majority of the share was accounted for by XTANDI, which was around USD 2,700 million in 2023.

- Among all the therapies of mCSPC in the US, NUBEQA (triplet therapy) is expected to garner maximum market share by 2034, followed by PLUVICTO.

Prostate Cancer Drugs Uptake

This section focuses on the uptake rate of potential Prostate Cancer drugs expected to be launched in the Prostate Cancer Hormone Therapy Market during 2020–2034. A medium-fast uptake of POINT Biopharma’s PSMA [Lu-177]-PNT2002. The approval of PLUVICTO has increased the pressure on the drug. For POINT’s PSMA [Lu-177]-PNT2002 to gain a significant market share, it must demonstrate superior clinical performance and cost-effectiveness compared to PLUVICTO.

Detailed emerging therapies assessment will be provided in the final report.

Prostate Cancer Pipeline Development Activities

The Prostate Cancer Hormone Therapy Market Report provides insights into therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Prostate Cancer Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Prostate Cancer Hormone Therapy Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for prostate cancer emerging therapy.

KOL Views

To keep up with current Prostate Cancer Hormone Therapy Market Trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the prostate cancer evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including oncologists, radiation oncologists, surgical oncologists, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers and organizations such as MD Anderson Cancer Center, Prostate Cancer Foundation (PCF), Prostate Cancer UK, Institute for Prostate Cancer Research (IPCR), etc., were contacted. Their opinion helps understand and validate epidemiological trends of prostate cancer.

Prostate Cancer Health Market: Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analyses. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Prostate Cancer Treatment Drugs Market Landscape.

Prostate Cancer Therapeutics Market Access and Reimbursement

Given the high-unmet need, most therapies can secure positive recommendations in this setting. However, ZYTIGA’s patent expiry is estimated to create pricing pressure for newer therapies targeting overlapping patient populations. Considering the threats to penetrate the market, many companies have opted for various reimbursement and patient support programs to ease the cost burden of their drugs and increase patient uptake.

TALZENNA is covered by 96% of the commercially insured population. Copay assistance is available for commercially insured patients who may pay as little as USD 0 per month regardless of income. There are no income requirements, forms, or faxing to enroll. In 2023, IQWIG reported a hint of minor added benefit of olaparib in patients with treatment-naive mCRPC <65 years, a hint of lesser benefit in patients with treatment-naive mCRPC =65 years, and added benefit could not be proven in patients with pretreated mCRPC in whom chemotherapy is not clinically indicated.

XTANDI (enzalutamide), combined with ADT, is a first-line option in treating patients with hormone-sensitive metastatic prostate cancer. In February 2023, Haute Autorité de santé (HAS) gave an opinion in favor of reimbursement in the treatment of mHSPC in adult men in association with androgen suppression treatment (ADT).

Prostate Cancer Therapeutics Market Report Scope

- The Prostate Cancer Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current Prostate Cancer Treatment Market Landscape.

- A detailed review of the Prostate Cancer Therapeutics Market, historical and forecasted Prostate Cancer Treatment Market Size, Prostate Health Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Prostate Cancer Therapeutics Market Forecasting Report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Prostate Health Market.

Prostate Cancer Therapeutics Market Report Insights

- Patient-based Prostate Cancer Market Forecasting

- Therapeutic Approaches

- Prostate cancer Pipeline Drugs Analysis

- Prostate cancer Market Size and Trends

- Existing and Future Prostate Cancer Treatment Drugs Market Opportunities

Prostate Cancer Therapeutics Market Report Key Strengths

- 11 Years Prostate Cancer Market Forecast

- The 7MM Coverage

- Prostate cancer Epidemiology Segmentation

- Key Cross Competition

- Drugs Uptake and Key Prostate Cancer Market Forecast Assumptions

Prostate Cancer Therapeutics Market Report Assessment

- Current Prostate Cancer Treatment Market Practices

- Prostate Cancer Unmet Needs

- Prostate Cancer Pipeline Drugs Analysis Profiles

- Prostate Cancer Treatment Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint analysis)

FAQs

- What was the prostate cancer market size, the Prostate Cancer treatment market size by therapies, Prostate Health Market Share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- What are the disease risks, burdens, and unmet needs of prostate cancer? What will be the growth opportunities across the 7MM concerning the patient population with prostate cancer?

- What is the impact of generics on the sales of ZYTIGA?

- Who is the major competitor of NUBEQA in the market?

- How much market share PARP inhibitors will capture by 2034?

- What are the current options for the treatment of prostate cancer? What are the current guidelines for treating prostate cancer in the US, Europe, and Japan?

- What are the recent novel therapies, targets, Prostate Cancer Mechanisms of Action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in the metastatic and non-metastatic setting?

- Will triplet therapy emerge as a successful treatment option in patients with mCSPC?

Reasons to Buy

- The Prostate Cancer Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Prostate Cancer Treatment Drugs Market.

- Insights on patient burden/disease Prostate Cancer Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Prostate Cancer Treatment Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the Prostate Health Market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Prostate Health Market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- 12 Breakthrough Prostate Cancer Drugs in Late-Stage Development

- Prostate Cancer Awareness Month: Early Detection Saves Lives!!

- PARP inhibitors making inroads towards the first line metastatic Castrate-resistant prostate cancer (CRPC) market soon?

- Exploring the Metastatic Castration-Sensitive Prostate Cancer Market Landscape

- Prostate cancer Market: Infographics

- Prostate Cancer Newsletter

- Two Phase III pembrolizumab trials (KEYNOTE-991 and KEYNOTE-641) showed lack of benefit in prostate cancer: Conference

- Roche’s Ipatasertib (RG7440) in Metastatic Castration-resistant Prostate Cancer (mCRPC): Conference

- PROfound Phase III trial results presented at ESMO established proven clinical activity of Lynparza (olaparib) in men with metastatic castration-resistant prostate cancer (mCRPC) with BRCA1/2 or ATM gene mutations: Conference

- Phase III trial of [177Lu]Lu-PSMA-617 in taxane-naive patients with metastatic castration-resistant prostate cancer: Conference

- Pfizer’s TALA (talazoparib) in metastatic castration-resistant prostate cancer (mCRPC): Conference

- Latest DelveInsight Blogs