Metastatic Prostate Cancer Market

- The total metastatic castration-resistant prostate cancer (mCRPC) market size in the 7MM was estimated to be nearly USD 7,000 million in 2023, which is expected to show positive growth by 2034.

- In 2023, the United States held the highest market share for mCRPC Market and mCSPC Market in the 7MM, at 63% and 61%, respectively, followed by the EU4 and the UK.

- In the US, around 60% of cases were under localized/locally advanced stage, followed by biochemical recurrence/progressive stage.

- Even though ZYTIGA’s generics have entered the US market since 2019 and the EU since late 2022, leading to a drastic decline in the revenue mainly in the US, the product is extensively being evaluated in combination with novel emerging therapies, leading to an increase in patient share on the compound abiraterone acetate.

- Janssen’s XTANDI, being the biggest revenue generator in the prostate cancer market, has witnessed stable growth since 2021 owing to increased competition.

- Apart from XTANDI, ZYTIGA, and ERLEADA in the mCSPC market, Bayer’s NUBEQA is another rising contender with a strong uptake in a short period. Bayer is further strategizing to increase the prescription by volume for NUBEQA by label expansion in patients who are not eligible for chemotherapy in the ARANOTE Phase III trial.

- The mCRPC market has witnessed the approval of Novartis’ radioligand therapy, PLUVICTO, in 2022, which has generated unexpected revenue from the third-line mCRPC setting. Novartis is further planning to expand the drug along with mHSPC by 2025 in the United States.

- Moreover, PARP inhibitors are also carving out their place in patients harboring HRR gene mutations (BRCA1/2), with the launch of AstraZeneca’s LYNPARZA in 1L+ and RUBRACA in 3L mCRPC patients in 2020. In 2023, TALZENNA, AKEEGA, and LYNPARZA also received approvals in the 1L setting.

- The prostate cancer market, including both mCRPC and mHSPC, is expected to witness significant growth owing to the rising prevalence of prostate cancer cases due to the rapidly aging population and growing disease awareness among people. In addition, extensive market penetration of approved therapies in mCRPC due to label expansions and entry of new emerging therapies will be crucial factors facilitating the Metastatic Prostate Cancer market growth.

- Several therapies are being investigated for the treatment of prostate cancer. Some key metastatic prostate cancer companies involved in the development are AstraZeneca (capivasertib), Arvinas (ARV-110), Daiichi Sankyo (D-7300), Essa Pharma (EPI-7386), and others.

Request for Sample Page @ Metastatic Prostate Cancer Market Report

DelveInsight’s “Metastatic Prostate Cancer Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the metastatic prostate cancer, historical and forecasted epidemiology as well as the metastatic prostate cancer market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The metastatic prostate cancer market report provides current treatment practices, emerging drugs, metastatic prostate cancer market share of the individual therapies, and current and forecasted metastatic prostate cancer market size from 2020 to 2034, segmented by seven major markets. The report also covers current metastatic prostate cancer treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Metastatic Prostate Cancer Market |

|

|

mHSPC Market Size | |

|

Metastatic Prostate Cancer Companies |

AstraZeneca, Arvinas, Madison Vaccines, Phosplatin Therapeutics, Hinova Pharmaceuticals, Bristol Myers Squibb, Merck, MacroGenics, Daiichi Sankyo, AstraZeneca, Seagen/Merck, Bristol Myers Squibb, Taiho Pharmaceutical, Modra Pharmaceuticals, Xencor, Point Biopharma, Lantheus Holdings, Zenith Epigenetics, Essa Pharma, Telix Pharmaceuticals, Kintor Pharmaceutical, AB Science, Eli Lilly and Company, Exelixis, and others. |

|

Metastatic Prostate Cancer Epidemiology Segmentation |

|

Metastatic Prostate Cancer Treatment Market

Metastatic Prostate Cancer Overview

Prostate cancer is a type of malignancy in the prostate gland, a part of the male reproductive system. Metastatic prostate cancer spreads from the prostate to other parts of the body. It is sometimes called advanced prostate cancer. It most commonly spreads to lymph nodes in other parts of the body or to the bones. It can also spread to other organs, such as the lungs. Metastatic hormone-sensitive prostate cancer (mHSPC) is when cancer has spread past the prostate into the body, but it can be treated with hormone therapy. In the case of metastatic castration-resistant prostate cancer (mCRPC), the cancer stops responding to hormone treatment.

Metastatic Prostate Cancer Diagnosis

Metastatic Prostate Cancer Diagnosis is primarily based on prostate-specific antigen (PSA) testing, which is elevated in those with prostate cancer or other conditions affecting the prostate. Screening can also involve a digital rectal exam to feel for prominent prostate tumors, a prostate ultrasound, and a prostate MRI. A definitive diagnosis requires a transrectal ultrasound-guided (TRUS) prostate tissue biopsy. When the cancer is limited to the prostate, it is considered localized and potentially curable. Active surveillance, surgery, or radiation therapy are the three major treatment options for localized or locally advanced prostate cancer.

Further details related to diagnosis will be provided in the report...

Metastatic Prostate Cancer Treatment

Treatment options for advanced or metastatic disease predominantly include hormonal therapies (androgen-deprivation therapy or ADT), radiopharmaceuticals, immunotherapy, focused radiation, and other targeted therapies. Patients who have never received, i.e., are sensitive to ADT, are known as hormone-sensitive prostate cancer (HSPC) or castrate-sensitive prostate cancer (CSPC). Established therapies in the metastatic prostate cancer market include Astellas Pharma/Pfizer’s and Janssen’s blockbuster products XTANDI and ZYTIGA, respectively, approved for metastatic patients for over a decade.

Further details related to treatment will be provided in the report...

Metastatic Prostate Cancer Recent Developments

- In July 2025, the European Commission approved Nubeqa™ (darolutamide), an oral androgen receptor inhibitor, in combination with androgen deprivation therapy (ADT) for treating metastatic hormone-sensitive prostate cancer (mHSPC). The decision was based on Phase III ARANOTE trial results showing a 46% reduction in risk of radiological progression or death versus placebo plus ADT.

- In February 2025, Ibex Medical Analytics, a leader in AI-powered cancer diagnostics, received FDA 510(k) clearance for Ibex Prostate Detect. This in vitro diagnostic device uses AI to generate heatmaps that identify small and rare missed prostatic cancers, providing pathologists with a safety net to ensure accurate diagnoses.

- In September 2024, Ipsen announced that the Phase III CONTACT-02 trial for Cabometyx® and atezolizumab in mCRPC showed a non-significant improvement in overall survival but met the progression-free survival (PFS) endpoint.

- In September 2024, Foundation Medicine received FDA approval for FoundationOne®CDx and Liquid CDx as companion diagnostics for Lynparza® in BRCA-mutated mCRPC.

- In July 2024, the ARANOTE trial showed that NUBEQA® plus ADT significantly improved radiological PFS in metastatic hormone-sensitive castrate-resistant prostate cancer (mHSPC).

- In July 2024, the FDA granted fast-track designation to SYNC-T SV-102 for metastatic castrate-resistant prostate cancer (mCRPC).

- In June 2024, Kangpu Biopharmaceuticals received FDA approval for a Phase II/III trial of KPG-121 with Abiraterone for mCRPC.

- In May 2024, Fusion Pharmaceuticals began the Phase 2 AlphaBreak trial of FPI-2265 in mCRPC patients.

- In April 2024, Astellas Pharma received European approval for XTANDI™ in high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer (nmHSPC).

- In April 2024, FibroGen announced positive Phase 1 trial data for FG-3246 in mCRPC.

- On November 16, 2023, the FDA approved enzalutamide (Xtandi) for non-metastatic castration-sensitive prostate cancer (nmCSPC) with high-risk biochemical recurrence.

Metastatic Prostate Cancer Epidemiology

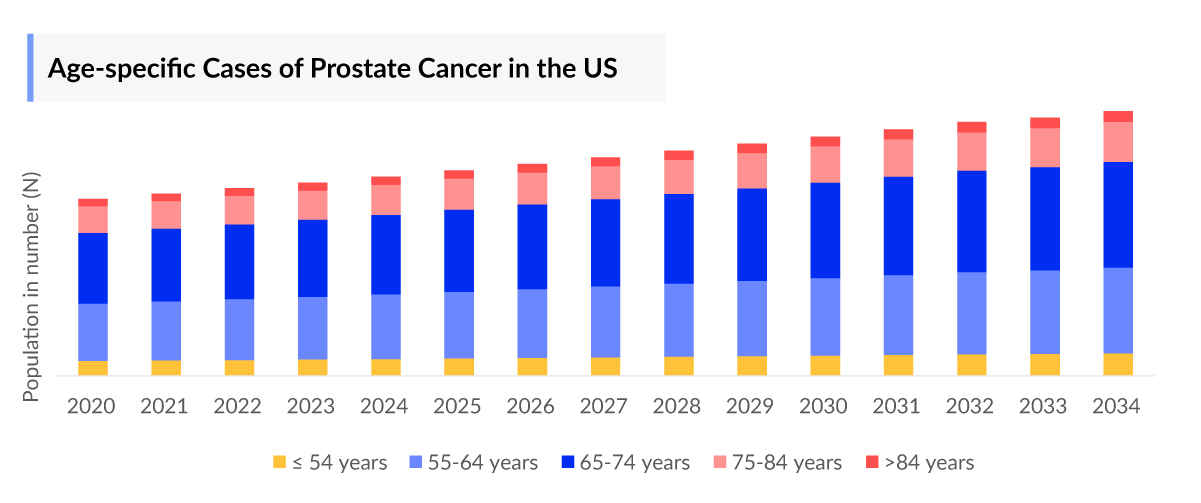

The metastatic prostate cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases of prostate cancer, total diagnosed cases of prostate cancer, age-specific cases of prostate cancer, total diagnosed cases of prostate cancer by clinical stages, total metastatic cases of prostate cancer, total treated cases of mCRPC, and total treated cases of mCSPC in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

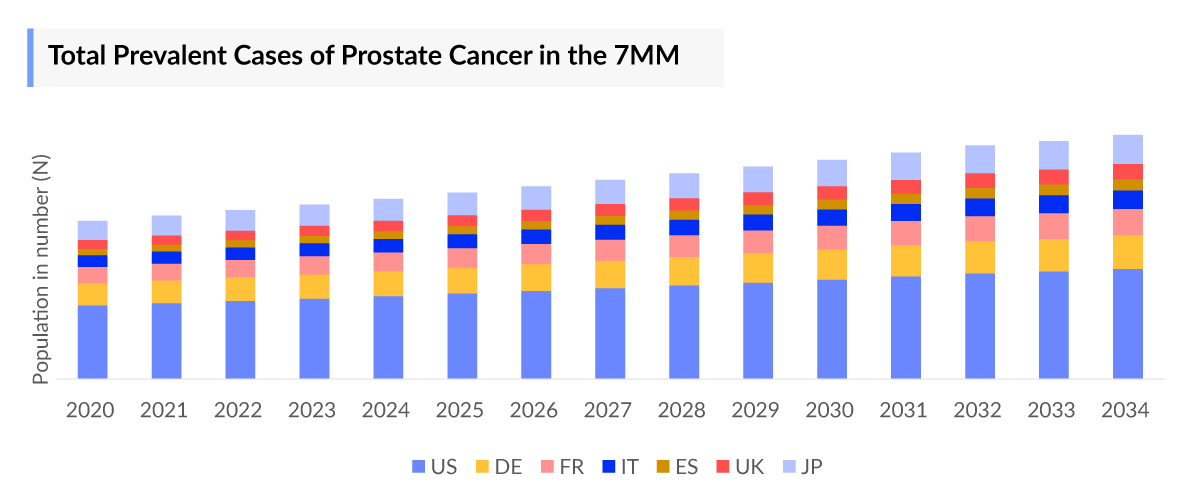

- As per DelveInsight estimates, the total prevalent population of prostate cancer in the 7MM was nearly 8,241,000 cases in 2023. These cases are projected to increase during the forecast period, i.e., 2024–2034.

- The United States had the highest number of diagnosed prostate cancer cases in 2023, with approximately 1,506,000 reported cases.

- In 2023, total cases of metastatic CSPC/HSPC and metastatic CRPC were around 108,000 and 132,000, respectively, in the 7MM. These cases are expected to increase by 2034.

- In the US, the total diagnosed prevalent cases of prostate cancer by clinical stages were highest in locally advanced (Stage I–III), accounting for over 903,700 cases, followed by biochemical recurrence/progressive and metastatic cases, respectively, in 2023.

- Among the EU4, Germany accounted for the highest number of prevalent metastatic prostate cancer cases, followed by France, whereas Spain accounted for the lowest number of cases in 2023.

- The total number of diagnosed prevalent cases of prostate cancer in Japan was ~282,100 in 2023 and is expected to increase during the forecast period.

Discover crucial insights with our Metastatic Prostate Cancer Epidemiology Forecast 2032. Stay ahead in healthcare innovation.

Metastatic Prostate Cancer Drug Chapters

The drug chapter segment of the metastatic prostate cancer report encloses a detailed analysis of the marketed and pipeline drugs. The marketed drugs segment encloses drugs such as AKEEGA (Janssen), XTANDI (Astellas Pharma/Pfizer), NUBEQA (Bayer), ERLEADA (Janssen), and others. Furthermore, the current key players for the upcoming emerging drugs and their respective drug candidates include Arvinas (ARV-110), MacroGenics (MGC018), Daiichi Sankyo (DS-7300), and others. The drug chapter also helps understand the metastatic prostate cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Metastatic Prostate Cancer Marketed Drugs

NUBEQA (darolutamide): Bayer

NUBEQA (darolutamide) is an oral androgen receptor inhibitor with a distinct chemical structure that binds to the receptor with high affinity and exhibits strong antagonistic activity, inhibiting the receptor function and the growth of prostate cancer cells.

NUBEQA is indicated for treating adult patients with non-metastatic castration-resistant prostate cancer and metastatic hormone-sensitive prostate cancer in combination with docetaxel.

ERLEADA (apalutamide): Janssen

ERLEADA is a next-generation oral androgen receptor inhibitor that blocks the androgen-signaling pathway in prostate cancer cells. ERLEADA inhibits the growth of cancer cells in three ways: by preventing the binding of androgen to the androgen receptor, by stopping the androgen receptor from entering the cancer cells, and by preventing the AR from binding to the DNA of the cancer cell. It is indicated for treating patients with non-metastatic castration-resistant prostate cancer and metastatic hormone-sensitive prostate cancer.

Detailed current therapies assessment will be provided in the report..

Emerging Metastatic Prostate Cancer Drugs

MGC018 (vobramitamab duocarmazine): MacroGenics

MGC018 (vobramitamab duocarmazine) is an investigational ADC comprised of a humanized B7-H3 mAb conjugated via a cleavable linker to the prodrug Seco-DUocarmycin hydroxyBenzamide Azaindole (DUBA). MacroGenics began enrolling the TAMARACK Phase II study of vobramitamab duocarmazine (vobra duo) in patients with mCRPC under an amended protocol during the second quarter. This study is designed to evaluate vobra duo at two different doses, 2.0 mg/kg or 2.7 mg/kg every 4 weeks, across 100 patients. MacroGenics is also evaluating the activity of MGC018 plus lorigerlimab (an investigational PD-1 × CTLA-4 bispecific DART® molecule) in a Phase 1 study in patients with advanced solid tumors.

Bavdegalutamide (ARV-110): Arvinas

ARV-110 is an oral PROTAC protein degrader that targets the androgen receptor for potentially treating men with mCRPC and who have progressed on existing therapies. ARV-110 has demonstrated activity in preclinical models of androgen receptor mutation or overexpression, both common mechanisms of resistance to currently available androgen receptor-targeted therapies.

The company plans to initiate a global Phase III trial with a confirmed bavdegalutamide dose in metastatic castration-resistant prostate cancer (mCRPC) for patients with AR T878/H875 tumor mutations by the First half of 2024.

Detailed emerging therapies assessment will be provided in the final report.

|

Comparison of Marketed Drugs | |||||

|

Product |

Company |

Patient Segment |

MoA |

RoA |

Approval |

|

AKEEGA (niraparib + abiraterone acetate + prednisone) |

Janssen Research & Development/Tesaro |

BRCA-positive mCRPC |

PARP inhibitor |

Oral |

mCRPC US: 2023 EU: 2023 |

|

TALZENNA + enzalutamide |

Pfizer/Astellas Pharma |

HRR gene-mutated mCRPC |

PARP inhibitor |

Oral |

mCRPC US: 2023 |

|

XTANDI |

Astellas Pharma/ Pfizer |

mCRPC, mCSPC |

Ionizing radiation emitters |

IV |

mCSPC US: 2019 EU:2021 JP:2020 mCRPC US: 2012 EU:2013 JP:2014 |

|

NUBEQA + docetaxel |

Bayer |

mHSPC |

Androgen receptor inhibitor |

Oral |

mHSPC US: 2022 EU: 2023 JP: 2023 |

A detailed list will be provided in the final report...

|

Comparison of Emerging Drugs | ||||||

|

Product |

Company |

Mechanism of Action |

Phase |

Indication |

RoA |

Molecular Type |

|

ARV-110 |

Arvinas |

Androgen receptor inhibitor |

II |

mCRPC |

Oral |

Small molecule |

|

177Lu-PNT2002 (PNT2002) |

Point Biopharma |

PSMA-Targeted therapy |

III |

mCRPC |

IV |

Small molecule |

|

MGC018 |

MacroGenics |

Anti-B7-H3 ADC |

II |

mCRPC |

IV |

Monoclonal antibody |

A detailed list will be provided in the final report...

Drug Class Insights

Currently, the Metastatic Prostate Cancer market holds a diverse range of therapeutic alternatives for treatment, including PARP inhibitors, androgen receptor inhibitors, CYP17 inhibitors, microtubule inhibitors, radioligand therapies, GnRH receptor antagonists, and others in different lines of treatment.

Androgen receptor pathway inhibitors are a mainstay of treatment for patients with metastatic castration-resistant prostate cancer. There are currently four approved androgen receptor pathway inhibitors in the United States: three anti-androgens — apalutamide, enzalutamide, and darolutamide, as well as an androgen receptor pathway inhibitor, abiraterone acetate.

In men with mCRPC and select HRR pathway alterations, PARPi treatment has been shown to induce objective tumor responses and improve progression-free and overall survival. The FDA has approved four PARP inhibitors (olaparib, niraparib, rucaparib, and talazoparib) for men with metastatic castration-resistant prostate cancer.

FDA-approved targeted radioligand therapy, PLUVICTO (177lutetium (177Lu)-PSMA-617), proved to be an important clinical advancement for people with progressing mCRPC, as it can significantly improve survival rates for those who have limited treatment options.

ADCs that target B7-H3 are generating early excitement among investigators in prostate cancer, which has been largely unresponsive to currently approved ICIs. MGC018 and DS-7300 have both displayed encouraging results in clinical trials involving patients with mCRPC.

Amgen and Xencor are currently evaluating xaluritamig (AMG 509), a STEAP1 x CD3 XmAb 2 + 1 bispecific antibody, in a Phase I study in patients with mCRPC. STEAP1 is highly expressed in prostate cancers, representing an attractive target for treating mCRPC.

With a series of discouraging studies in recent years, Merck’s KEYTRUDA and Bristol Myers Squibb’s OPDIVO are struggling to make headway for their checkpoint inhibitors in prostate cancer.

Metastatic Prostate Cancer Market Outlook

Metastatic Castration-Resistant Prostate Cancer (mCRPC)

Metastatic Castration-Resistant Prostate Cancer (mCRPC) is a stage of prostate cancer that has spread to other parts of the body, such as lymph nodes or bones, and no longer responds to treatment that lowers testosterone. Despite currently approved therapeutics, mCRPC remains a terminal diagnosis with an aggressive disease course. ADT is a stalwart therapy for the initial treatment of metastatic disease. Unfortunately, most men in this situation will go on to develop mCRPC and require secondary systemic therapy. This disease state can be very challenging to treat.

Docetaxel was the only agent available for the treatment of mCRPC until 2010, which showed an increase in overall survival compared with the standard of care. It was approved in 2004 for mCRPC with prednisone. Patients failed to first-line docetaxel for many years, and no standard treatment option was approved. However, in the last few years, several drugs such as JEVTANA, ZYTIGA, XTANDI, LYNPARZA, TALZENNA, AKEEGA, and others have received regulatory approval for mCRPC in the United States.

Most recently, PARP inhibitors have shown tremendous development in this area with AKEEGA (Janssen), followed by TALZENNA (Pfizer/Astellas Pharma) and LYNPARZA in combination (AstraZeneca/Merck) getting approved in mCRPC in 2023.

The approval of PLUVICTO has also marked a crucial advancement in treating progressive mCRPC, offering improved survival rates for those with limited treatment options. The drug had an exceptionally robust initial market performance, garnering a stronger-than-expected uptake in the US.

Quantitatively, the mCRPC pipeline seems to be quite strong. ADCs such as MGC018 and DS-7300 have both displayed encouraging results in clinical trials involving patients with mCRPC. However, except for Point Biopharma’s therapy, none of these potential players have initiated a Phase III trial, even though Arvinas plans to opt for an accelerated approval based on its Phase II data readout.

Metastatic Castrate-Sensitive Prostate Cancer (mCSPC)

Metastatic Castrate-Sensitive Prostate Cancer (mCSPC) is an advanced form of cancer in which cancer cells have spread from the prostate to other body areas. However, the patient is still sensitive to androgen deprivation therapy (ADT) (some mCSPC patients have never had ADT, while others may have had ADT but have recovered testicular function).

The backbone of all treatments in mCSPC is androgen deprivation therapy (ADT) with medications that suppress the level of testosterone in the body because testosterone is the fuel for prostate cancer and gives the signals to grow and spread. Studies over the last decade have demonstrated that intensification of androgen deprivation with different treatment modalities correlates with prolongation of survival. The options for intensification include docetaxel chemotherapy, different androgen receptor-targeted agents, including abiraterone acetate, apalutamide, and enzalutamide, and radiation to the prostate. Most recently, the treatment paradigm for mHSPC shifted to triplet therapy, NUBEQA combined with ADT and chemotherapy. According to the findings presented at the ASCO GU 2023, the regimen should be considered the new standard of care for this patient population.

Key Findings

- The total mHSPC market size in the 7MM was estimated to be nearly USD 108,000 milion in 2023, which is expected to show positive growth by 2034.

- Among the EU4 countries, Germany captured the maximum metastatic prostate cancer market share in 2023, whereas Spain was at the bottom of the ladder in the same year in metastatic prostate cancer setting.

- The current US market for mCRPC holds therapies like JEVTANA, ZYTIGA, XTANDI, XOFIGO, and others. In the current metastatic prostate cancer market, the majority of the share was accounted for by XTANDI, which was around USD 2,800 million in 2023.

- The mCSPC market size in Japan in 2023 was around USD 250 million, which is expected to increase during the study period (2020–2034).

- The upcoming combination therapies of mCRPC are expected to benefit the current market and deliver fewer adverse effects and more effective treatment. Among all the therapies of mCSPC in the US, NUBEQA (triplet therapy) is expected to garner maximum market share by 2034, followed by PLUVICTO.

Metastatic Prostate Cancer Drugs Uptake

This section focuses on the uptake rate of potential Metastatic Prostate Cancer drugs expected to be launched in the Metastatic Prostate Cancer market during 2020–2034. A medium-fast uptake of POINT Biopharma’s PSMA [Lu-177]-PNT2002. The approval of PLUVICTO has increased the pressure on the drug. For POINT’s PSMA [Lu-177]-PNT2002 to gain a significant market share, it must demonstrate superior clinical performance and cost-effectiveness compared to PLUVICTO. Even though we expect a medium-fast uptake of ARV-110 and its launch by 2025, studies have suggested that only patients having specific molecular profiles, e.g., AR T878 and H875 mutations, will have an enhanced response to ARV-110.

Discover the latest advancements in metastatic prostate cancer treatments with our 2024 Pipeline Insight report.

Metastatic Prostate Cancer Pipeline Development Activities

The Metastatic Prostate Cancer market report provides insights into therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The Metastatic Prostate Cancer market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for metastatic prostate cancer emerging therapy.

KOL Views

To keep up with current Metastatic Prostate Cancer market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the metastatic prostate cancer evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including oncologists, radiation oncologists, surgical oncologists, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers and organizations such as MD Anderson Cancer Center, Prostate Cancer Foundation (PCF), Prostate Cancer UK, Institute for Prostate Cancer Research (IPCR), etc., were contacted. Their opinion helps understand and validate epidemiological trends of metastatic prostate cancer.

|

KOL Views |

|

“The highly variable nature of recurrent prostate cancer poses clinical challenges, and nearly up to 40% of patients who undergo radical prostatectomy, and up to 50% of the patients who undergo radiation therapy is likely to develop local or distant recurrences within 10 years.” |

|

“Effective staging in newly diagnosed prostate cancer is crucial in establishing optimal clinical management strategies because up to 25% of patients with primary prostate cancer may have detectable regional pelvic lymph node metastases, which correlate with a risk for recurrence and associated overall survival.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analyses. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Metastatic Prostate Cancer Market Access and Reimbursement

Given the high-unmet need, most therapies can secure positive recommendations in this setting. However, ZYTIGA’s patent expiry is estimated to create pricing pressure for newer therapies targeting overlapping patient populations. Considering the threats to penetrate the market, many companies have opted for various reimbursement and patient support programs to ease the cost burden of their drugs and increase patient uptake.

TALZENNA is covered by 96% of the commercially insured population. Copay assistance is available for commercially insured patients who may pay as little as USD 0 per month regardless of income. There are no income requirements, forms, or faxing to enroll.

In 2023, IQWIG reported a hint of minor added benefit of olaparib in patients with treatment-naive mCRPC <65 years, a hint of lesser benefit in patients with treatment-naive mCRPC ≥65 years, and added benefit could not be proven in patients with pretreated mCRPC in whom chemotherapy is not clinically indicated.

XTANDI (enzalutamide), combined with ADT, is a first-line option in treating patients with hormone-sensitive metastatic prostate cancer. In February 2023, Haute Autorité de santé (HAS) gave an opinion in favor of reimbursement in the treatment of metastatic non-monosensitive prostate cancer (mHSPC) in adult men in association with androgen suppression treatment (ADT).

Scope of the Metastatic Prostate Cancer Market Report

- The Metastatic Prostate Cancer market report covers a segment of key events, an executive summary, and a descriptive overview of metastatic prostate cancer, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the metastatic prostate cancer market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the Metastatic Prostate Cancer market report, covering the 7MM drug outreach.

- The Metastatic Prostate Cancer market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM metastatic prostate cancer market.

Metastatic Prostate Cancer Market Report Insights

- Metastatic Prostate Cancer Patient Population

- Metastatic Prostate Cancer Therapeutic Approaches

- Metastatic Prostate Cancer Pipeline Analysis

- Metastatic Prostate Cancer Market Size

- Metastatic Prostate Cancer Market Trends

- Existing and Future Metastatic Prostate Cancer Market Opportunity

Metastatic Prostate Cancer Market Report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- Metastatic Prostate Cancer Epidemiology Segmentation

- Key Cross Competition

- Metastatic Prostate Cancer Drugs Uptake

- Key Metastatic Prostate Cancer Market Forecast Assumptions

Metastatic Prostate Cancer Market Report Assessment

- Current Metastatic Prostate Cancer Treatment Practices

- Metastatic Prostate Cancer Unmet Needs

- Metastatic Prostate Cancer Pipeline Product Profiles

- Metastatic Prostate Cancer Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint analysis)

- Metastatic Prostate Cancer Market Drivers

- Metastatic Prostate Cancer Market Barriers

FAQs

- What was the metastatic prostate cancer market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- What are the disease risks, burdens, and unmet needs of metastatic prostate cancer? What will be the growth opportunities across the 7MM concerning the patient population with metastatic prostate cancer?

- What is the impact of generics on the sales of ZYTIGA?

- Who is the major competitor of NUBEQA in the Metastatic Prostate Cancer market?

- How much market share PARP inhibitors will capture by 2034?

- What are the current options for the treatment of metastatic prostate cancer? What are the current guidelines for treating metastatic prostate cancer in the US, Europe, and Japan?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in mCRPC and mCSPC?

- Will triplet therapy emerge as a successful treatment option in patients with mCSPC?

Reasons to Buy Metastatic Prostate Cancerv Market Report

- The Metastatic Prostate Cancer market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the metastatic prostate cancer market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Metastatic Prostate Cancer market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the Metastatic Prostate Cancer market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Metastatic Prostate Cancer market so that the upcoming players can strengthen their development and launch strategy.

Related Blog:

.jpg)

-market.png&w=256&q=75)