Multiple System Atrophy Market Summary

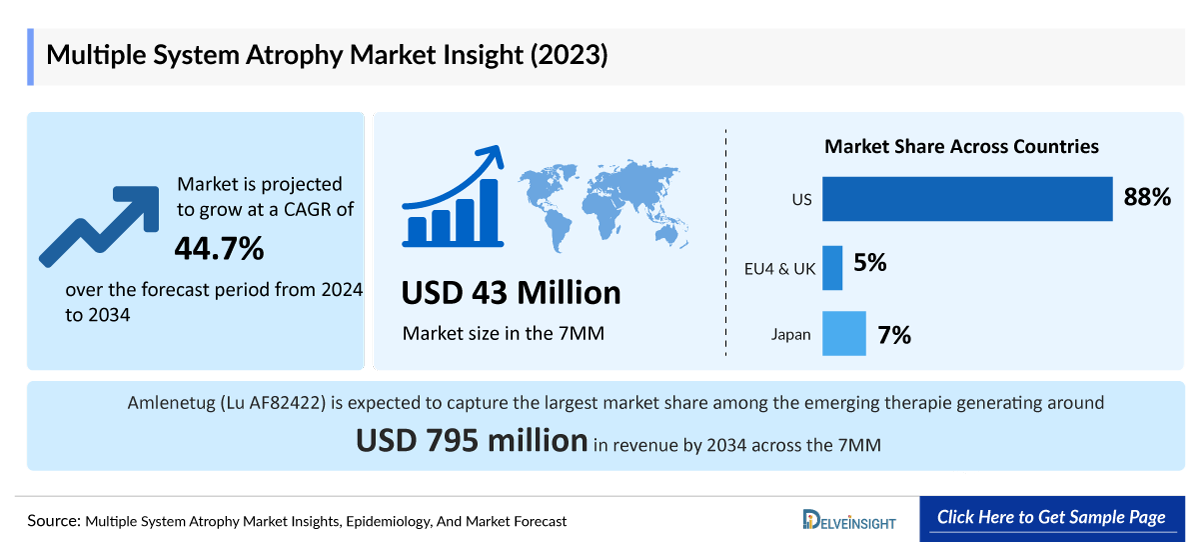

- The Multiple System Atrophy Market Size in the 7MM is expected to grow from USD 44 million in 2025 to USD 1,753 million in 2034.

- The Multiple System Atrophy Market is projected to grow at a CAGR of 50.60% by 2034 in leading countries like the US, EU4, UK, and Japan.

Multiple System Atrophy Market and Epidemiology Analysis

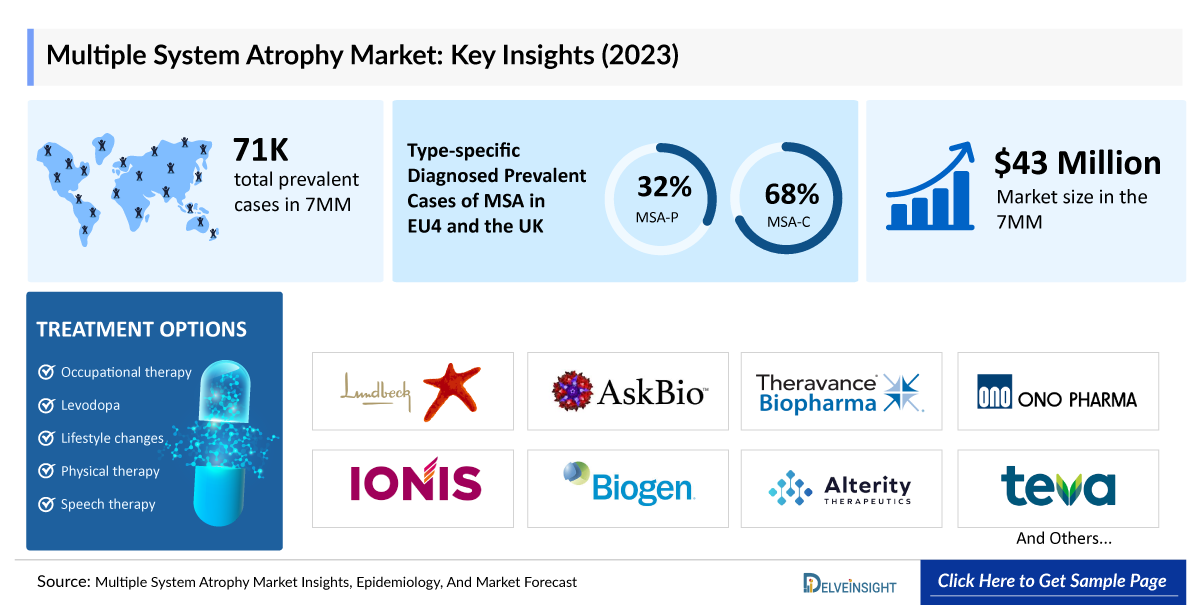

- According to DelveInsight’s analysis, the Multiple System Atrophy in the 7MM was valued at USD 43 million in 2023.

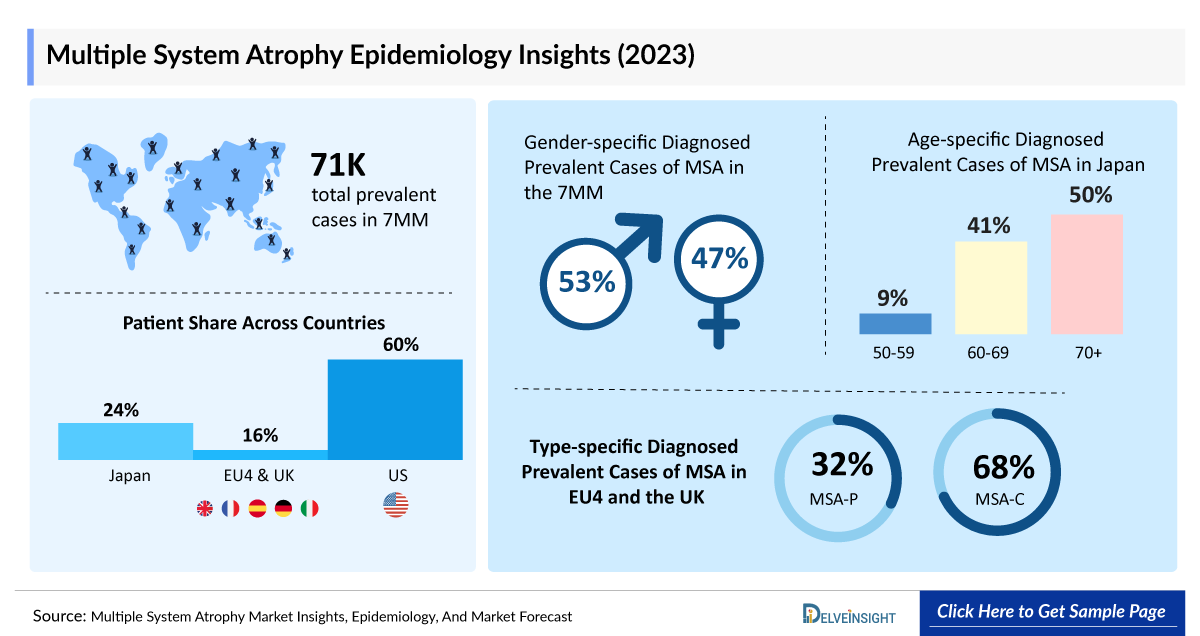

- According to DelveInsight’s estimates, in 2023, there were approximately 70,800 prevalent cases of Multiple System Atrophy in the 7MM. Of these, the US accounted for 60% of the cases, while EU4 and the UK accounted for nearly 16% and Japan represented 24% of the cases, respectively.

- The Multiple System Atrophy Market is poised for steady growth, with a strong compound annual growth rate (CAGR) projected from 2024 to 2034. This expansion across the 7MM will be driven by the launch of innovative therapies, including, Amlenetug (Lu AF82422), Ampreloxetine ATH434, TAK-341/MEDI1341, and Emrusolmin.

- There are no approved therapies to slow Multiple System Atrophy's neurodegeneration, but symptom management options include levodopa, amantadine, droxidopa, adrenergic receptors agonists, and various off-label therapies that provide relief and help patients cope with the disease's effects.

- Challenges in accurately diagnosing and defining the condition hinder the advancement of Multiple System Atrophy clinical trials for potential disease-modifying therapies.

- The rapid progression, severe morbidity, and shortened life expectancy of the disease lead to poor patient outcomes, profoundly affecting the quality of life for individuals and their caregivers, creating significant emotional, physical, and social challenges for both parties.

Multiple System Atrophy Market Size and Forecast

- 2025 Market Size: USD 44 million in 2025

- 2034 Projected Market Size: USD 1,753 million in 2034

- Growth Rate (2025-2034): 50.60% CAGR

- Largest Market: United States

DelveInsight’s “Multiple System Atrophy Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Multiple System Atrophy, historical and forecasted epidemiology, as well as the Multiple System Atrophy market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The Multiple System Atrophy Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Multiple System Atrophy market size from 2020 to 2034. The report also covers Multiple System Atrophy treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the Multiple System Atrophy treatment market potential.

Key Factors Driving the Multiple System Atrophy Market

Increasing Multiple System Atrophy Prevalence

In 2025, the diagnosed prevalent cases of MSA are predicted to be ~72K in the leading markets [the United States, the EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan], projected to increase through 2034. These numbers are increasing due to rising healthcare needs and a growing demand for effective therapies.

Multiple System Atrophy Market Opportunities for Key Companies

With limited FDA-approved disease-modifying treatments currently available for MSA, the field presents a significant opportunity for innovation. Existing options, such as LEVODOPA, provide limited relief, highlighting a clear pathway for novel, targeted therapies to transform patient outcomes and redefine the treatment landscape. Other than that, the companies working in the MSA clinical trial landscape are H Lundbeck A/S, Brain Neurotherapy Bio, Inc., Asklepios BioPharmaceutical, Inc., Theravance Biopharma, Ono Pharmaceutical Co. Ltd, Ionis Pharmaceuticals, Inc., Biogen, Alterity Therapeutics, Teva Pharmaceutical, MODAG GmbH, and others.

Increasing Multiple System Atrophy Clinical Trial Activities

Promising multiple system atrophy drugs in clinical trials include Ampreloxetine (Theravance Biopharma), Amlenetug (H Lundbeck A/S), Emrusolmin (Teva Pharmaceutical/MODAG GmBH), TAK-341/MEDI1341 (AstraZeneca/Takeda Pharma), ATH434 (Alterity Therapeutics), and others.

Multiple System Atrophy Disease Understanding

Multiple System Atrophy overview

Multiple System Atrophy is a progressive neurodegenerative disease marked by symptoms affecting movement and the autonomic nervous system. Its cause remains unknown, and most cases are sporadic. A hallmark of Multiple System Atrophy is the accumulation of alpha-synuclein in oligodendroglial cells, which produce myelin, essential for efficient nerve signal transmission. In 1969, the term Multiple System Atrophy was introduced to combine three previously recognized neurological conditions: Shy–Drager syndrome (focused on autonomic dysfunction), Striatonigral Degeneration (emphasizing Parkinsonian symptoms), and sporadic Olivopontocerebellar Atrophy (highlighting cerebellar symptoms). This unification helped categorize overlapping clinical features under a single diagnosis.

Early symptoms of Multiple System Atrophy include bradykinesia, tremors, stiffness, and lack of coordination. Diagnostic subtypes are Multiple System Atrophy-P, resembling Parkinson’s disease with Parkinsonian features, and Multiple System Atrophy-C, distinguished by cerebellar dysfunction, primarily presenting as ataxia and impaired balance, reflecting the diverse neurological impacts of this progressive disorder. Multiple System Atrophy is divided into two main subtypes: Multiple System Atrophy with predominant Parkinsonism (Multiple System Atrophy-P) and Multiple System Atrophy with predominant cerebellar ataxia (Multiple System Atrophy-C). However, these classifications are flexible, as a patient’s symptoms can shift between the two over time.

Multiple System Atrophy diagnosis

Diagnosing of Multiple System Atrophy is challenging, especially in its early stages, as it shares symptoms with Parkinson's disease. Diagnostic methods may include autonomic testing (e.g., blood pressure and heart rate monitoring), bladder function assessment, and neuroimaging techniques like MRI or PET scans.

Multiple System Atrophy treatment

Pharmacological treatments for Multiple System Atrophy target Parkinsonism, autonomic dysfunction, cerebellar ataxia, and sleep issues. Levodopa is the first-line treatment for Parkinsonism, with temporary benefits, while dopamine agonists and amantadine offer alternative options but may cause more side effects.

Multiple System Atrophy Epidemiology

As Multiple System Atrophy market is derived using a patient-based model, the Multiple System Atrophy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Diagnosed Prevalence Cases of Multiple System Atrophy, Gender-specific Diagnosed Prevalent Cases of Multiple System Atrophy, Age-specific Diagnosed Prevalent Cases of Multiple System Atrophy, Type-specific Diagnosed Prevalent Cases of Multiple System Atrophy in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Multiple System Atrophy Epidemiological Analyses and Forecast

- In 2023, the US accounted for the highest prevalent cases of Multiple System Atrophy with approximately 42,500 cases, which are expected to increase by 2034 at a CAGR of 1.0%.

- In 2023, the Germany reported the highest number of prevalent cases of Multiple System Atrophy among the EU4 and the UK, with approximately 2,700 cases. UK followed with around 2,400 cases, while Spain recorded the lowest prevalent cases, with nearly 1,500 cases.

- In 2023, Japan reported approximately 5,100 prevalent cases of Multiple System Atrophy in males and 12,000 cases in females, with numbers projected to rise by 2034.

- In the US, the number of cases in 2023 were as follows: around 400 cases in stage 0, around 800 in stage 1, ~2,100 in stage 2, ~15,000 in stage 3, ~13,000 in stage 4, and ~10,000 in stage 5 and these numbers projected to rise by 2034.

- In Japan, around 30% of Multiple System Atrophy cases reported in 2023 were associated with Multiple System Atrophy-P, while 70% were linked to Multiple System Atrophy-C, indicating that Multiple System Atrophy-C is the dominant type than Multiple System Atrophy-P.

- In 2023, Germany recorded the highest number of Multiple System Atrophy around 1,400 cases in the 70 years and above age group. Among the age groups 50–59 years and 60–79 years, the 70 years and above group is expected to see an increase to 1,500 cases by 2034.

- In 2023, Japan recorded around 13,700 cases of symptomatic nOH in Multiple System Atrophy patients, with the number projected to reach around 14,100 cases by 2034.

Multiple System Atrophy Epidemiology Segmentation

- Diagnosed Prevalence Cases of Multiple System Atrophy

- Gender-specific Diagnosed Prevalent Cases of Multiple System Atrophy

- Age-specific Diagnosed Prevalent Cases of Multiple System Atrophy

- Type-specific Diagnosed Prevalent Cases of Multiple System Atrophy

Multiple System Atrophy Recent Developments and Breakthroughs

- In September 2025, Teva Pharmaceutical (NYSE:TEVA) announced that its investigational MSA treatment, emrusolmin, received Fast Track designation from the U.S. FDA. The drug is currently in Phase 2 development for Multiple System Atrophy.

- In August 2025, Tiziana Life Sciences received FDA clearance of its IND for a Phase 2a trial of intranasal foralumab in patients with Multiple System Atrophy (MSA), a rare neurodegenerative disease with no approved therapies. The six-month open-label study will evaluate microglial activation, clinical outcomes, and safety of the fully human anti-CD3 monoclonal antibody delivered via nasal spray.

- In July 2025, NKGen Biotech received FDA authorization for an Expanded Access Program (EAP) to use its NK cell therapy, troculeucel, in multiple neurodegenerative diseases—including Alzheimer’s, Parkinson’s, ALS, MSA, PSP, FTD, CBD, MS, and Lewy Body Dementia—beyond its current Phase 2a trial in moderate-stage Alzheimer’s disease.

- In May 2025, Alterity Therapeutics announced that the FDA has granted Fast Track designation for ATH434, its investigational treatment for Multiple System Atrophy (MSA). This designation aims to expedite the development and review of ATH434, recognizing its potential to address the significant unmet need in MSA, a condition currently without an approved therapy.

- In February 2025, Alterity Therapeutics’ ATH434 showed promising Phase 2 results in a randomized, double-blind trial for early-stage multiple system atrophy (Multiple System Atrophy). The treatment, particularly at a 50 mg dose, was well-tolerated and demonstrated both clinical and biomarker-based benefits.

Multiple System Atrophy Drug Analysis

The drug chapter segment of the Multiple System Atrophy report encloses a detailed analysis of Multiple System Atrophy early and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the Multiple System Atrophy clinical trials details, expressive pharmacological action, agreements and collaborations, advantages and disadvantages of each included drug, and the latest news and press releases.

Multiple System Atrophy Emerging Drugs

Emrusolmin (TEV-56286, Anle-138b): Teva Pharmaceutical/MODAG GmBH

Anle138b is a small molecule designed to target toxic alpha-synuclein oligomers, dissolving them and preventing new formations, thus addressing neurodegenerative disorders. Preclinical studies show it halts disease progression. Unlike antibody treatments, it is orally administered and crosses the blood-brain barrier. In July 2022, it received orphan drug designation for Multiple System Atrophy and is currently in Phase II Multiple System Atrophy clinical trials.

Amlenetug (Lu AF82422): H. Lundbeck A/S/Genmab

Lu AF82422 is a human monoclonal antibody designed to target toxic alpha-synuclein proteins involved in Multiple System Atrophy pathology. It seeks to slow or stop disease progression by clearing these harmful proteins. The compound has demonstrated effectiveness in Phase II and has received orphan drug and SAKIGAKE designations. It is now in Phase III trials.

Ampreloxetine (TD-9855): Theravance Biopharma

Ampreloxetine is an investigational norepinephrine reuptake inhibitor being developed for symptomatic neurogenic orthostatic hypotension (nOH) in Multiple System Atrophy patients. It increases norepinephrine levels by blocking its transporters. Currently in Phase III trials, it has received ODD status from the US FDA and patent protection until 2037.

Multiple System Atrophy Drug Class Analysis

Multiple System Atrophy treatment primarily focuses on symptom management, as there is no cure. Pharmacological therapies, such as levodopa for Parkinsonism and other medications for autonomic dysfunction, cerebellar ataxia, and sleep disturbances, are commonly used. Immunotherapy is not typically part of Multiple System Atrophy treatment, as it targets underlying protein aggregation rather than immune response.

Emerging therapies include Amlenetug, Ampreloxetine, ATH434, TAK-341/MEDI1341 and Emrusolmin (Anle138b).

Amlenetug

developed by H. Lundbeck A/S and Genmab, is a monoclonal antibody targeting toxic alpha-synuclein in Multiple System Atrophy, aiming to slow progression, now in Phase III.

Ampreloxetine

A norepinephrine reuptake inhibitor for symptomatic neurogenic orthostatic hypotension in Multiple System Atrophy is in Phase III trials with ODD status. Emrusolmin (Anle138b), is a small molecule targeting toxic alpha-synuclein oligomers to halt disease progression. It is orally administered, crosses the blood-brain barrier, and received orphan drug designation for Multiple System Atrophy, currently in Phase II trials.

Multiple System Atrophy Market Outlook

Multiple System Atrophy is a rare neurodegenerative disorder that typically begins in adulthood, usually after age 30. It shares symptoms with Parkinson’s disease, such as Parkinsonism, but also includes additional features like cerebellar ataxia and autonomic dysfunction, affecting involuntary processes such as heart rate and blood pressure. Multiple System Atrophy is classified as Multiple System Atrophy-P when Parkinsonism predominates, and Multiple System Atrophy-C when cerebellar symptoms are more prominent. Currently, no disease-modifying treatments are approved for Multiple System Atrophy, offering a significant opportunity for pharmaceutical Multiple System Atrophy companies to develop the first effective therapies. Existing Parkinson’s treatments like levodopa have limited effectiveness, underscoring the need for targeted treatments for Multiple System Atrophy.

Currently, no disease-modifying treatments are approved for Multiple System Atrophy in the 7MM, creating a significant opportunity for pharmaceutical Multiple System Atrophy companies to develop the first approved therapy. While Parkinson’s drugs like levodopa are used, their effectiveness varies. northera (droxidopa) is commonly prescribed for neurogenic orthostatic hypotension (nOH), a common Multiple System Atrophy symptom. Approved in 2014, northera addresses nOH but lost market exclusivity in 2021, despite its impact on Multiple System Atrophy-related disability and injury risk.

Pharmacological treatments for Multiple System Atrophy focus on Parkinsonism, autonomic dysfunction, cerebellar ataxia, and sleep issues. Levodopa is the first-line treatment for Parkinsonism, providing temporary relief, especially in Multiple System Atrophy-P patients. While effective, its benefits are limited, and side effects like orthostatic hypotension require management. Dopamine agonists and amantadine may offer alternatives, though they are less preferred due to side effects.

Currently, there are no approved therapies to slow neurodegeneration in Multiple System Atrophy. However, symptom management includes options like Levodopa, Amantadine, Droxidopa, Anticholinergic agents, and off-label treatments to help patients cope. Potential future therapies for Multiple System Atrophy include Lu AF82422 (H. Lundbeck A/S/Genmab), Ampreloxetine (Theravance Biopharma), Emrusolmin (Teva Pharmaceutical/MODAG GmbH), and others.

- In 2023, the Multiple System Atrophy market size in the US was around USD 38 million, accounting for 88% of the total Multiple System Atrophy market. This figure is expected to grow significantly with the introduction of emerging therapies.

- The total Multiple System Atrophy market size of EU4 and the UK was estimated to be USD 2.3 million in 2023, which was nearly 5% of the total market revenue for the 7MM.

- Among EU4 and the UK, Germany accounted for the highest Multiple System Atrophy market share with USD 0.57 million in 2023, followed by UK with USD 0.50 million in the respective year, and Spain, capturing the least Multiple System Atrophy market with nearly USD 0.32 million in 2023.

- In 2023, the total market size of Multiple System Atrophy was USD 2.98 million in Japan which is anticipated to increase during the forecast period (2024–2034).

- According to estimates, among the emerging therapies, Amlenetug (Lu AF82422) is expected to capture the largest Multiple System Atrophy market share, generating around USD 795 million in revenue by 2034 across the 7MM.

Multiple System Atrophy Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the Multiple System Atrophy market during 2020–2034.

Multiple System Atrophy Pipeline Development Activities

The report provides insights into different Multiple System Atrophy clinical trials within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for Multiple System Atrophy.

Latest KOL Views on Multiple System Atrophy

To keep up with current Multiple System Atrophy market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Multiple System Atrophy evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of California, the US, University of Maryland School of Medicine, the US, University of Texas Southwestern, the US, University Medical Center, Johannes-Gutenberg-University, Germany, Department of Neurology Center Hospitalier de la Côte Basque Bayonne, France, University of Pisa, Italy, Barcelona Clinical Hospital, Spain, University of Aberdeen, the UK, Hyogo College of Medicine, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Multiple System Atrophy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Multiple System Atrophy therapeutics market and the unmet needs.

Physician’s View

As per the KOLs from the US, The diagnosis of Multiple System Atrophy is complicated, and this is mostly due to the overlap with other similar Parkinsonian syndromes. It was found that some cases are misdiagnosed as other clinical syndromes when there is no severe dysautonomia or cerebellar dysfunction (like cerebellar ataxia or dysarthria). Importantly, there are not great treatment options for the autonomic and cerebellar symptoms in patients with Multiple System Atrophy clinical phenotype, but there are many Multiple System Atrophy clinical trials still in progress to find treatments for these aspects.

As per the KOLs from Germany, The Multiple System Atrophy distinction into Multiple System Atrophy-P and Multiple System Atrophy-C is based on the predominant clinical features. Multiple System Atrophy-P is more common in most of the countries, with the exception of Japan, where Multiple System Atrophy-C is the predominant phenotype. Patients with Multiple System Atrophy have an early, usually transient, and in general poorer, response to L-Dopa compared to patients with Parkinson’s disease.

As per the KOLs from Japan, Distinguishing Multiple System Atrophy from other neurodegenerative parkinsonisms, such as Parkinson’s disease, dementia with Lewy bodies, and progressive supranuclear palsy, can be challenging. However, advancements in imaging techniques, like [123I]-Meta-iodo Benzyl Guanidine (MIBG) myocardial scintigraphy, have shown promise in helping differentiate PD from other Parkinsonian syndromes, improving diagnosis and treatment strategies for Multiple System Atrophy.

Multiple System Atrophy Report Qualitative Analysis

We perform Qualitative and Multiple System Atrophy treatment market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Multiple System Atrophy Market Access and Reimbursement

The National Institute of Neurological Disorders and Stroke (NINDS).

The National Institute of Neurological Disorders and Stroke (NINDS), part of the NIH, is crucial in advancing Multiple System Atrophy research. By funding top medical institutions, NINDS supports studies to better understand and treat Multiple System Atrophy. In 2007, NINDS held a global consensus conference to improve diagnostic criteria, aiding quicker and more accurate diagnoses. Ongoing research aims to uncover the mechanisms behind synuclein buildup in Multiple System Atrophy and Parkinson’s disease, with the goal of developing preventative and therapeutic approaches for these neurodegenerative conditions. Further details will be provided in the report.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Multiple System Atrophy Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of multiple system atrophy, explaining its causes, signs and symptoms, pathogenesis, and emerging therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the multiple system atrophy therapeutics market, historical and forecasted Multiple System Atrophy market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM multiple system atrophy.

Multiple System Atrophy Market Report Insights

- Patient Population

- Therapeutic Approaches

- Multiple System Atrophy Pipeline Analysis

- Multiple System Atrophy Market Size and Multiple System Atrophy Therapeutics Market

- Existing and Future Multiple System Atrophy Market Opportunity

Multiple System Atrophy Market Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Multiple System Atrophy Epidemiology Segmentation

- Key Cross Competition

- Attribute Analysis

- Drugs Uptake and Key Multiple System Atrophy Market Forecast Assumptions

Multiple System Atrophy Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions Answered in the Multiple System Atrophy Market

Multiple System Atrophy Market Insights

- What was the total Multiple System Atrophy market size of multiple system atrophy, the market size of multiple system atrophy by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will amlenetug (Lu AF82422) affect the Multiple System Atrophy treatment market of multiple system atrophy?

- What would be the multiple system atrophy market growth till 2034 and what will be the resultant market size in the year 2034?

- Which drug is going to be the largest contributor by 2034?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest multiple system atrophy market size during the forecast period (2024–2034)?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Multiple System Atrophy Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of multiple system atrophy? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to multiple system atrophy?

- What is the historical and forecasted multiple system atrophy patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent cases of multiple system atrophy population during the forecast period (2024–2034)?

- What factors are contributing to the growth of multiple system atrophy cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of multiple system atrophy? What are the current clinical and treatment guidelines for treating multiple system atrophy?

- How many Multiple System Atrophy companies are developing therapies for the treatment of multiple system atrophy?

- How many emerging therapies are in the mid-stage and late stage of development for treating multiple system atrophy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the challenges of multiple system atrophy?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of multiple system atrophy?

Reasons to Buy the Multiple System Atrophy Market Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the multiple system atrophy market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Multiple System Atrophy treatment market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying upcoming solid players in the Multiple System Atrophy therapeutics market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Multiple System Atrophy therapeutics market access and reimbursement policies for multiple system atrophy, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-Market.png&w=256&q=75)