Myopia Treatment Devices Market Summary

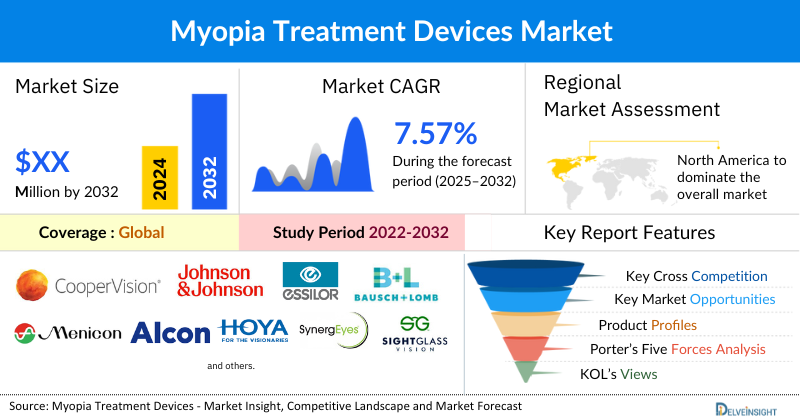

- The global myopia treatment devices market is expected to grow at a CAGR of 7.57% during the forecast period from 2025 to 2032. The factors contributing to the growth of the myopia medical device market are escalating global prevalence of myopia, growing demand for non-invasive and long-term vision correction solutions, and continuous innovation in optical and therapeutic technologies, coupled with expanding access in emerging healthcare markets.

Key Market Trends & Insights

- The leading companies working in Myopia Treatment Devices market are CooperVision (CooperCompanies), Johnson & Johnson, Essilor, Bausch & Lomb Incorporated, Menicon Co., Ltd., LUCID KOREA LTD., Alcon Inc., HOYA VISION CARE COMPANY, SynergEyes., SightGlass Vision, Inc., Ophtec BV, STAAR SURGICAL, Mark'ennovy, SCHWIND eye-tech-solutions, Euclid Systems Corporation, NIDEK USA, Inc., HORUS S.n.C. di Risoldi & C – P, Falco lenses AG, and others.

- Among all the regions, Asia Pacific is anticipated to register the fastest growth in the Myopia Medical Devices market during the forecasted period. This is owing to the rising prevalence of the targeted population.

- In the product type segment of Myopia Medical Devices, the contact lenses segment is expected to hold a significant market share during the forecasted period.

- As per the projections mentioned by the WHO, myopia and high myopia would affect 52% (4949 million) and 10.0% (925 million), respectively, of the world’s population by the year 2050.

Request for unlocking the CAGR of the Myopia Treatment Devices Market

Myopia Treatment Device Market Size & Forecast

- 2025 Market Size: USD XX Million

- 2032 Projected Market Size: USD XX Million

- CAGR (2025-2032): CAGR of 7.57%

- Asia Pacific: Largest market in 2025

Factors Contributing to the Rise in Growth of the Myopia Treatment Device Market

-

Rising Prevalence of Myopia:

The increasing global incidence of myopia, particularly among children and young adults, is driving the demand for effective treatment solutions and devices. -

Growing Adoption of Myopia Devices:

Increased awareness among patients and healthcare providers, along with greater acceptance of medical devices for managing and slowing myopia progression, is fueling market expansion. -

Myopia Devices Technological Advancements & Product Launches:

Ongoing innovation in myopia management technologies—such as advanced contact lenses, spectacle lenses, and pharmacological delivery systems—continues to enhance treatment effectiveness and broaden therapeutic options. -

Government Awareness Initiatives for Myopia:

Supportive public health programs and educational campaigns aimed at early detection and intervention are playing a key role in boosting the uptake of myopia treatment devices. -

Expanding Access in Emerging Markets:

Increased healthcare investment and improved access to vision care services in developing regions are opening new opportunities for market growth.

Myopia Treatment Devices Market By Treatment (Corrective Lenses, Laser Eye Surgery, Lens Implant Surgery), By Product Type (Eyeglasses, Contact Lenses, Ortho-K Lenses, Phakic Intraocular Lenses, Excimer Laser Refractive Surgery Devices), By End-User (Hospitals, Specialty Clinics, And Others), by geography, is projected to grow at a noteworthy CAGR forecast till 2032 owing to the growing burden of myopia across the globe and high adoption rate of myopia treatment devices

The global myopia treatment devices market is growing at a CAGR of 7.57% during the forecast period from 2025 to 2032. The increase in demand for myopia treatment devices is predominantly due to the rising prevalence of myopia across the globe. Moreover, an increase in the adoption rate of Myopia Medical Devices is also expected to bolster the demand for these devices thereby leading to an increased market of myopia treatment devices in the upcoming years. Furthermore, an increase in product launches of various advanced myopia management devices and rising government initiatives to raise awareness among the population regarding myopia treatment are also anticipated to spur the demand for these devices during the forecasted period.

Get More Insights into the Report @ Diabetic Eye Disease Market

What are the latest Myopia Treatment Devices Market Dynamics?

The market for myopia treatment devices is gaining pace at present owing to the growing myopia cases across the globe. According to the World Health Organization (WHO), myopia is a type of uncorrected refractive error that is the most common cause of vision impairment among patients. Also, myopia is associated with a higher risk of cataracts and glaucoma. Moreover, as per the projections mentioned by the WHO, myopia and high myopia would affect 52% (4949 million) and 10.0% (925 million), respectively, of the world’s population by the year 2050.

In addition, as per the data published by the Australian Government in the year 2021, approximately 6.3 million people in the country were affected with short-sightedness (myopia) between the years 2017-2018. Similar trends are expected to be observed in other countries across the globe which is likely to raise the demand for treatment devices for myopia during the forecasted period.

Furthermore, approval of various Myopia Medical Devices in various countries across the globe to slow down the progression of the disease is also projected to augment the market in the upcoming years. For instance, on June 03, 2020, SightGlass Vision achieved CE Mark allowing European Marketing Authorization for novel eyeglasses that slow myopia progression in children. The spectacles developed by the company comprise advanced diffusion optics technology spectacle lenses.

Hence, the above-mentioned factors are expected to increase the market for myopia management devices in the following years.

However, limitations associated with the refractive surgery procedures and stringent regulatory approval process for the Myopia Medical Devices are likely to impede the growth of the myopia treatment devices market.

The unprecedented COVID-19 impact had sluggish the market growth for myopia treatment devices. This is due to the implementation of stringent lockdowns across the nation, reduction in clinic visits due to reluctance among patients during the pandemic, among others. However, a sudden shift towards digital or e-learning approaches from classroom-based learning has subsequently increased myopia and its progression among the students. For instance, as per the report published by UNESCO in the year 2020, approximately 1.37 billion students from more than 130 countries globally were affected by the pandemic as the schools and universities adopted digital learning during the pandemic to curb the infection. Thus, it is expected to increase the risk of myopia among the children which will increase the demand for the Myopia Medical Devices during the post-pandemic situation, thus the market will gain normalcy.

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

CAGR |

7.57% |

|

Key Companies | CooperVision (CooperCompanies), Johnson & Johnson, Essilor, Bausch & Lomb Incorporated, Menicon Co., Ltd., LUCID KOREA LTD., Alcon Inc., HOYA VISION CARE COMPANY, SynergEyes., SightGlass Vision, Inc., Ophtec BV, STAAR SURGICAL, Mark'ennovy, SCHWIND eye-tech-solutions, Euclid Systems Corporation, NIDEK USA, Inc., HORUS S.n.C. di Risoldi & C – P, Falco lenses AG, and others |

Myopia Treatment Devices Market Segment Analysis

Myopia Treatment Devices Market By Treatment (Corrective Lenses, Laser Eye Surgery, Lens Implant Surgery), By Product Type (Eye Glasses, Contact Lenses, Ortho-K Lenses, Phakic Intraocular Lenses, Excimer Laser Refractive Surgery Devices), By End-User (Hospitals, Specialty Clinics, and Others), and By Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the product type segment of Myopia Medical Devices, the contact lenses segment is expected to hold a significant market share during the forecasted period. This is due to their wide availability and cost-effectiveness. Additionally, contact lenses allow a natural field of view, have no frames to obstruct the vision, and greatly reduce distortions. Unlike glasses, they do not fog up or get splattered by mud or rain. Thus, the benefits associated with contact lenses are likely to boost the segment market. Furthermore, as per the CDC, some contact lenses can also provide extra UV protection.

Also, the rising focus of various companies towards developing technologically advanced myopia treating contact lenses is likely to upsurge the segmental market. For instance, on January 19, 2021, CooperVision Specialty EyeCare began offering 5 mm back optic zone diameter (BOZD) customization for Paragon CRT® and Paragon CRT Dual Axis® contact lenses. The new option joined several existing customization choices, further expanding myopia management possibilities for eye care professionals.

Moreover, approval of various contact lenses for better management of myopia progression is also a potential factor contributing to the market growth of contact lenses for myopia treatment. For instance, on September 08, 2021, Johnson & Johnson Vision received approval from Health Canada for ACUVUE® Abiliti™ 1-Day Soft therapeutic lenses for myopia management. These lenses are specifically designed for children who are 7 to 12 years old at the start of treatment.

Thus, the interplay of all the aforementioned factors is projected to bolster the myopia treatment devices market in the forthcoming years.

Myopia Treatment Devices Market Segmentation

Myopia Treatment Devices Market By Treatment

- Corrective Lenses

- Laser Eye Surgery

- Lens Implant Surgery

Myopia Treatment Devices Market By Product Type

- Eyeglasses

- Contact Lenses

- Ortho-K Lenses

- Phakic Intraocular Lenses

- Excimer Laser Refractive Surgery Devices

Myopia Treatment Devices Market By End-User

- Hospitals

- Specialty Clinics

Myopia Treatment Devices Market by Geography

- North America Myopia Treatment Devices Market

- United States Myopia Treatment Devices Market

- Canada Myopia Treatment Devices Market

- Mexico Myopia Treatment Devices Market

- Europe Myopia Treatment Devices Market

- France Myopia Treatment Devices Market

- Germany Myopia Treatment Devices Market

- United Kingdom Myopia Treatment Devices Market

- Italy Myopia Treatment Devices Market

- Spain Myopia Treatment Devices Market

- Russia Myopia Treatment Devices Market

- Rest of Europe

- Asia-Pacific Myopia Treatment Devices Market

- China Myopia Treatment Devices Market

- Japan Myopia Treatment Devices Market

- India Myopia Treatment Devices Market

- Australia Myopia Treatment Devices Market

- South Korea Myopia Treatment Devices Market

- Rest of Asia Pacific

- Rest of the World (RoW)

- Middle East Myopia Treatment Devices Market

- Africa Myopia Treatment Devices Market

- South America Myopia Treatment Devices Market

Myopia Treatment Devices Regional Insights

Asia Pacific is expected to witness the fastest growth in the overall Myopia Medical Devices Market

Among all the regions, Asia Pacific is anticipated to register the fastest growth in the Myopia Medical Devices market during the forecasted period. This is owing to the rising prevalence of the targeted population. For instance, according to the report published by the Government of Singapore in the year 2019, the prevalence of myopia in Singapore is among the highest in the world, with 65% of children being myopic by 6, and 83% of young adults being myopic. Also, Singapore is often labelled as the “Myopia Capital of the World”. It is projected that 80 to 90% of all Singaporean adults above 18 years old would be myopic and 15 to 25% of these individuals may have high myopia by the year 2050.

Moreover, rising government initiatives to raise awareness regarding the proper management of myopia among the population in the region is also a potential factor for market growth. For instance, in support of the UN resolution “Eye health for all by 2030”, and to create public awareness on eye care, the Optometry Council of India (OCI) started a screening initiative on the occasion of World Sight Day (WSD) with 100,000 screenings in 100 days from 1st September 2021. OCI would also be releasing an awareness film on myopia and what interventions can be done to prevent myopia and myopic progression.

Furthermore, the presence of regional companies such as Menicon Co., Ltd., Kubota Pharmaceutical Holdings Co., Ltd., among others, and their increased focus towards developing novel myopia treatment market will also contribute to the fastest market growth in the region.

For instance, Kubota Pharmaceutical Holdings Co., Ltd. with its subsidiary Kubota Vision is planning to use the Kubota Glass technology which leverages nanotechnology in an electronic glasses-based device to reduce the progression of myopia by actively stimulating the retina for shorter periods while maintaining high-quality central vision and not affecting daily activities to develop smart contact lenses for the reduction of myopia progression.

Thus, all the above-mentioned factors would contribute to the regional market growth of Myopia Medical Devices during the forecasted period.

See More Insights of the Report @ Eye Infection Market

Key Myopia Treatment Devices Companies

The following are the leading companies in the Myopia Treatment Devices market. These companies collectively hold the largest market share and dictate industry trends.

- CooperVision (CooperCompanies)

- Johnson & Johnson

- Essilor

- Bausch & Lomb Incorporated

- Menicon Co., Ltd.

- LUCID KOREA LTD.

- Alcon Inc.

- HOYA VISION CARE COMPANY

- SynergEyes

- SightGlass Vision, Inc.

- Ophtec BV

- STAAR SURGICAL

- Mark'ennovy

- SCHWIND eye-tech-solutions

- Euclid Systems Corporation

- NIDEK USA, Inc.

- HORUS S.n.C. di Risoldi & C – P

- Falco Lenses AG

- Others

Recent Developmental Activities in the Myopia Treatment Devices Market:

- In January 2025, the ZEISS MEL 90 Excimer Laser received FDA approval, enhancing precision corneal reshaping for myopia correction in refractive surgery.

- The FDA accepted the New Drug Application for SYD-101, a proprietary low-dose atropine formulation for pediatric myopia, in March 2025. A PDUFA target action date is set for October 23, 2025. If approved, it would become the first pharmaceutical indication for slowing myopia progression in U.S. children.

- On May 25, 2021, CooperVision DreamLite® Ortho-K Lenses gained European approval for slowing the progression of myopia.

- On May 12, 2021, Euclid Systems Corporation, a global leader in advanced orthokeratology and proactive myopia management, launched the latest breakthrough in overnight orthokeratology lens, Euclid MAX in the US.

- On April 07, 2021, Menicon entered into a global collaboration with Johnson & Johnson Vision to bring forward therapeutic contact lens-related products and services to manage the progression of myopia in children.

Key Myopia Treatment Devices Highlights Summary (2022–2025)

|

Category |

Key Developments |

|

Product Launches |

ACUVUE Abiliti, MiSight 1 day expansion, MiYOSMART Sun lenses, Euclid Max Ortho-K |

|

Regulatory Approvals |

MiSight 1 day (FDA), ZEISS MEL 90 Laser |

|

Partnerships |

Ocumetra tools, Alcon–SERI, Essilor–Espansione |

|

Acquisitions |

EnsEyes, SynergEyes |

|

Company Strategy |

CooperVision team expansion & leadership, WCO pledge, consensus endorsements |

|

Setbacks |

Eyenovia trial failure and restructuring |

|

Emerging Technology |

Fundus2Globe, dual‑modality imaging, ChatMyopia AI, affordable SD‑OCT axials |

Impact Analysis

AI Advancement in Myopia Treatment Devices

1. AI-Based 3D Eye Modeling & Personalized Care

Fundus2Globe is a generative AI framework that reconstructs 3D ocular anatomy from standard 2D fundus photos and clinical metadata—without MRI. It achieves sub-millimeter accuracy, enabling simulation of structural changes and precision monitoring of lesions like staphylomas.

2. Risk Prediction & Early Detection

- A collaboration between SNEC and SERI in Singapore produced a deep-learning tool that predicts a child’s likelihood of developing high myopia during teenage years with ≥90% accuracy, using retinal imaging and clinical data.

- Predict My Child’s Vision, developed by Plano (Singapore), leverages AI and predictive analytics to forecast myopia onset, severity, age of progression, and stabilization—tailored for each individual.

- Broader AI systems such as ML/DL models can analyze fundus or OCT images to detect and predict myopia trends, tracking risk factors and supporting early interventions.

3. Behavior Monitoring Wearables

- Vivior Monitor uses machine learning to classify children’s visual behavior patterns (e.g., use of handheld devices, time spent on near tasks) to identify risky habits.

Frontiers - FitSight—a smartwatch app with light sensors—tracks outdoor activity and gives feedback to promote protective behaviors.

- Clouclip attaches to spectacles to monitor near-work distance and duration, issuing real-time vibration alerts to encourage safer habits.

4. AI-Assisted Telemedicine and Screening

- AI-powered telemedicine platforms are emerging to support myopia care by aiding non-specialists with tasks like refraction assessments, enhancing accessibility especially post-pandemic.

- A multi-center AIoT-based prevention project in China utilizes smart devices (bracelets, eye-care lamps, E-ink readers) to track behaviors (reading posture, outdoor time), provide real-time feedback, and support large-scale screening with minimal human supervision.

5. AI in Contact Lens Design & Ortho-K Prediction

- Machine learning models (e.g., SVMs, Gaussian processes) are being used to predict orthokeratology lens curvature, improving fit and efficiency while minimizing trial lenses.

- Additional ML models accurately forecast lens efficacy based on patient data, aiding clinicians in prescribing effective treatments with fewer errors.

Frontiers

6. AI-Powered Patient Education

ChatMyopia, an LLM-based AI agent, handles text and image queries about myopia, delivering personalized, accurate education. In trials, it significantly improved patient satisfaction compared to traditional leaflets, enhancing communication and disease awareness.

Tariff Inclusion in Myopia Treatment Devices

The imposition of import tariffs on medical devices and components has significantly impacted the myopia treatment sector. These tariffs have led to increased costs, supply chain disruptions, and strategic shifts in manufacturing and sourcing. Understanding and navigating these changes is crucial for stakeholders aiming to maintain competitiveness and ensure uninterrupted patient care.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends in Myopia Treatment Devices

| Company Name | Total Funding | Main Products / Focus | Stage of Development | Core Technology |

|---|---|---|---|---|

| Dopavision (Germany) | ~€15M | MyopiaX® digital therapeutic for children | Clinical development | Light-stimulus digital therapy stimulating retinal dopamine |

| S-Alpha Therapeutics (S. Korea) | ~$18.8M | SAT-001 digital treatment via gameplay | Clinical trials (domestic & US) | Digital treatment (non-contact, game-based) |

| NovaSight (Israel) | ~$16M | Eye-tracking glasses for children’s myopia control | Product development & rollout | Eye-tracking spectacle device |

| Azalea Vision | €9M Series A | Intelligent ocular technologies for visual clarity | Early commercial / scale-up | Biosensing + digital connectivity |

| Laclarée | €3.5M Seed | Autofocusing eyeglasses using opto-fluidic tech | Early product development | Opto-fluidic sensor-based autofocusing lenses |

| Myoptechs (USA) | ~$2M | Soft contact lenses to slow myopia progression | Product development | Specialized soft lens design |

| Mediwhale (S. Korea) | $24.8M | AI for eye disease detection (indirect myopia relevance) | Product development | Retinal imagery + AI analytics |

Key Takeaways from the Myopia Treatment Devices Market Report Study

- Market size analysis for current market size (2023), and market forecast for 8 years (2025-2032)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the Myopia Treatment Devices market.

- Top key product/services/technology developments, merger, acquisition, partnership, joint venture happened for last 3 years

- Key companies dominating the Global Myopia Medical Devices Market.

- Various opportunities available for the other competitor in the Myopia Medical Devices Market space.

- What are the top-performing segments in 2023? How these segments will perform in 2032.

- Which are the top-performing regions and countries in the current market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Myopia Treatment Devices market growth in the coming future?

Target Audience who can be benefited from the Myopia Treatment Devices Market Report Study

- Myopia Treatment Devices providers

- Research organizations and consulting companies

- Myopia Treatment Devices-related organization, association, forum, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders in Myopia Treatment Devices

- Various End-users who want to know more about the Myopia Treatment Devices Market and the latest technological developments in the Myopia Treatment Devices market.

Stay Updated with our new articles:-

- How Pharmaceutical Companies Are Mitigating The Gap In The Eye Disorders Treatment Market

- Wet AMD: A chronic eye condition with promising therapies

Also, Read- Latest DelveInsight Blogs