NTRK Market Summary

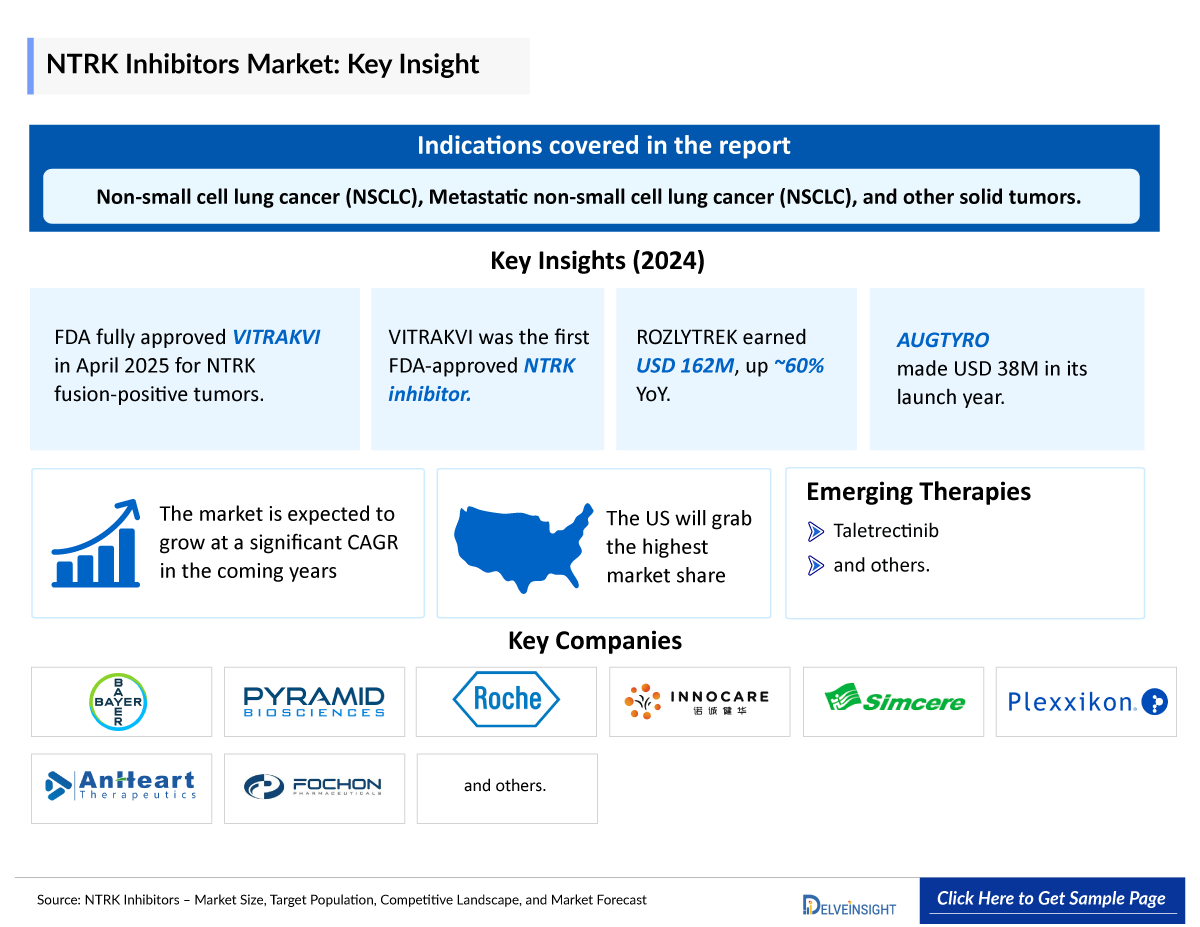

- The NTRK inhibitor Market is witnessing significant growth driven by the rising adoption of precision oncology and tumor-agnostic treatment approaches. NTRK inhibitors target rare NTRK gene fusions that are implicated in various solid tumors, offering effective and personalized therapeutic options for patients with limited alternatives

- The leading NTRK Companies, such as Bayer, Mirati Therapeutics, and others, are currently engaged in the development and production of NTRK inhibitor, which has the potential to significantly impact and enhance the NTRK inhibitors market.

NTRK Inhibitor Market Insights and Forecast

- Neurotrophic tropomyosin receptor kinases (NTRKs) are genes that encode TRK proteins, involved in nervous system development. Gene fusions involving NTRK can drive cancer growth in various tumor types. These fusions are rare but actionable, making them important biomarkers for precision oncology and targeted therapy decisions.

- NTRK inhibitors selectively target TRK fusion proteins, effectively halting tumor growth in NTRK fusion-positive cancers. These therapies show durable responses across diverse malignancies with minimal side effects, offering a personalized, tumor-agnostic treatment approach and significant clinical benefit in both pediatric and adult patients.

- VITRAKVI (larotrectinib), the first US Food and Drug Administration-approved NTRK inhibitor, is currently available for the treatment of adult and pediatric patients with solid tumors having a neurotrophic receptor tyrosine kinase (NTRK) gene fusion without a known acquired resistance mutation that are metastatic or where surgical resection is likely to result in severe morbidity, and have no satisfactory alternative treatments or that have progressed following treatment.

- In April 2025, the FDA granted full approval of VITRAKVI (larotrectinib) for adult and pediatric patients with NTRK gene fusion-positive solid tumors.

- ROZLYTREK (entrectinib), approved in August 2019, is another NTRK inhibitor approved for adult patients with ROS1-positive metastatic non-small cell lung cancer (NSCLC) as detected by an FDA-approved test and for adult and pediatric patients older than 1 month of age with solid tumors that have a neurotrophic tyrosine receptor kinase (NTRK) gene fusion.

- ROZLYTREK achieved impressive global net revenues of USD 162 million in 2024—a nearly 60% year-over-year increase—highlighting its growing clinical adoption. Of this, USD 62 million was generated from the US market, reflecting its strong domestic performance and therapeutic impact.

- AUGTYRO marked a strong commercial debut in its first year. The drug generated USD 38 million in sales during its initial year on the market. This performance reflects growing clinical adoption and demand for next-generation NTRK inhibitors. Continued uptake is expected as awareness and access increase.

- Several NTRK inhibitors are currently being evaluated in clinical trials. One of these assets in the late stage is Nuvation Bio’s, Taletrectinib which is in stage II and being developed for NSCLC and is anticipated to receive approval during the forecast period.

Factors Impacting the NTRK Inhibitor Market Growth

-

Growth of precision oncology & tumor-agnostic approvals

Increasing adoption of precision-medicine approaches and the regulatory acceptance of tumor-agnostic drug approvals boosts demand for NTRK inhibitors that target NTRK-fusion-positive tumors regardless of tissue origin.

-

Rising adoption of comprehensive genomic testing (NGS/IHC)

Broader use of next-generation sequencing panels, IHC screening and other molecular tests increases detection rates of rare NTRK fusions, enlarging the identifiable patient pool for NTRK therapies.

-

Strong clinical efficacy and favorable safety profiles

Demonstrated high response rates and generally manageable toxicities in NTRK-fusion cancers increase clinician confidence and support wider prescribing.

-

Emergence of next-generation NTRK inhibitors addressing resistance

Development of second and third-generation agents that overcome solvent-front and gatekeeper resistance mutations expands treatment options and sustains market growth

DelveInsight’s “NTRK Inhibitors Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the NTRK inhibitors, historical and Competitive Landscape as well as the NTRK inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The NTRK inhibitors Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM NTRK Inhibitors market size from 2020 to 2034. The report also covers current NTRK inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

NTRK Inhibitors Disease Understanding

NTRK Inhibitors Overview

NTRK inhibitors are targeted therapies developed to treat tumors with NTRK gene fusions, which drive abnormal TRK protein expression and uncontrolled tumor growth. Though rare, these fusions occur across a wide range of adult and pediatric cancers, making NTRK inhibitors valuable in a tumor-agnostic context. Their approval represents a major advancement in precision oncology, enabling personalized treatment based on molecular profiling. This class of drugs holds significant potential to improve outcomes, especially for patients with limited treatment options or advanced-stage disease.

Currently, three main NTRK inhibitors are approved by the US FDA: VITRAKVI (larotrectinib), ROZLYTREK (entrectinib), and AUGTYRO (repotrectinib). VITRAKVI is highly selective for TRK; ROZLYTREK also targets ROS1 and ALK, and AUGTYRO is effective against resistance mutations. Each shows strong response rates and manageable side effects across adult and pediatric solid tumors. These inhibitors are used in cancers like non-small cell lung cancer, thyroid cancer, and pediatric sarcomas. They provide durable responses even in metastatic or CNS-involved disease. Selection depends on prior treatment, resistance mutations, and tumor location. Continued research focuses on optimizing efficacy, managing resistance, and expanding access to molecular testing.

NTRK inhibitor Treatment

The NTRK inhibitor treatment landscape has evolved rapidly, driven by its strong clinical efficacy and tumor-agnostic potential. Initially developed for cancers harboring NTRK gene fusions, these therapies are now integrated into precision oncology protocols for diverse adult and pediatric solid tumors. NTRK fusions, though rare, are powerful oncogenic drivers found in various malignancies, including salivary gland tumors, secretory breast carcinoma, thyroid cancer, infantile fibrosarcoma, and other solid tumors.

Currently, US FDA-approved NTRK inhibitors, VITRAKVI (larotrectinib) and ROZLYTREK (entrectinib), have transformed the treatment scenario for patients with NTRK fusion-positive tumors. VITRAKVI, the first approved agent in this class, is indicated for adult and pediatric patients with solid tumors harboring an NTRK gene fusion—without a known resistance mutation—that are metastatic, inoperable without severe morbidity, or have progressed after prior therapies and lack satisfactory alternatives. ROZLYTREK is approved for both adult and pediatric patients (older than 1 month) with NTRK fusion-positive solid tumors meeting similar clinical criteria. Additionally, ROZLYTREK is indicated for adult patients with ROS1-positive metastatic non-small cell lung cancer (NSCLC), expanding its use beyond NTRK-specific targeting.

Both agents offer high response rates and durable clinical benefit, even in challenging cases involving CNS metastases. Their tumor-agnostic approvals highlight the shift toward molecular-driven treatment approaches. The emergence of next-generation inhibitors like repotrectinib and taletrectinib, designed to overcome acquired resistance mutations, further enhances the therapeutic landscape, providing new options for patients who relapse or become refractory to first-line TRK inhibitors.

Ongoing research is expanding the scope of NTRK inhibitors to include novel delivery mechanisms, improved CNS penetration, and combination regimens. As molecular diagnostics become more accessible, early identification of NTRK fusions is increasing, enabling timely intervention. With tumor-agnostic FDA approvals, priority reviews, and ongoing global trials, NTRK inhibitors are redefining cancer therapy, offering targeted, effective, and personalized treatment strategies for rare and aggressive malignancies.

NTRK Inhibitors Drug Analysis

The drug chapter segment of the NTRK inhibitors therapeutics market reports encloses a detailed analysis of NTRK inhibitors marketed drugs and late-stage (Phase III and Phase II) NTRK Inhibitor pipeline drugs. It also helps understand the NTRK inhibitors' clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest NTRK Inhibitor news and press releases.

NTRK Inhibitors Marketed Drugs

-

VITRAKVI (larotrectinib): Bayer

VITRAKVI (larotrectinib), developed by Bayer, is the first FDA-approved TRK inhibitor for treating adult and pediatric patients with solid tumors harboring NTRK gene fusions. It offers a tissue-agnostic, targeted approach, providing durable responses in metastatic or inoperable cancers with no known resistance mutations and limited treatment alternatives.

It first got US FDA approval in November 2018 for the treatment of adults and pediatric patients with NTRK solid tumors while it got full approval for adult and pediatric patients with NTRK gene fusion-positive solid tumors in April 2025. Further, it also got EMA approval in September 2019 and PMDA approval in March 2021.

-

ROZLYTREK (entrectinib): Roche

ROZLYTREK (entrectinib), developed by Roche, is an US FDA-approved TRK, ROS1, and ALK inhibitor. It treats adults with ROS1-positive metastatic NSCLC, and adults and children (1 month and older) with NTRK fusion-positive solid tumors, offering effective, targeted therapy for advanced and hard-to-treat cancers.

It received US FDA approval in August 2019 for the treatment of ROS1-positive, metastatic non-small cell lung cancer and NTRK gene fusion-positive solid tumors. Further, in October 2023, FDA expanded pediatric indication for rozlytrek (entrectinib) and approves new pellet formulation. It also got EMA approval in July 2020 and PMDA approval in June 2019.

|

Product |

Company |

Indication |

|

VITRAKVI (larotrectinib) |

Bayer |

Solid tumors that:

|

|

ROZLYTREK (entrectinib) |

Roche |

Indicated for the treatment of:

|

NTRK Inhibitors Emerging Drugs

-

Taletrectinib: Nuvation Bio

Taletrectinib (DS-6051b/AB-106) is an oral, tyrosine kinase inhibitor of ROS1 and NTRK with potent preclinical activity against ROS1 G2032R solvent-front mutation among others. It is already approved in China in December 2024 for the treatment of adult patients with locally advanced or metastatic ROS1-positive non–small cell lung cancer.

In Dec 2024, US FDA Granted Priority Review to Taletrectinib in ROS1+ Advanced NSCLC. Taletrectinib showed an 88.8% ORR in TKI-naive and 55.8% in previously treated ROS1-positive NSCLC patients. Median PFS was 45.6 months in TKI-naive and 9.7 months in TKI-pretreated cohorts, indicating durable efficacy.

List of Emerging Drugs | ||||

|

Taletrectinib |

Nuvation Bio |

NSCLC |

II |

NCT04919811 |

NTRK Inhibitors Market Outlook

The NTRK inhibitors market is experiencing substantial growth, fueled by increasing tumor-agnostic approvals, advancements in molecular diagnostics, and expanding clinical indications. NTRK gene fusions are rare but potent oncogenic drivers, and their identification has led to the development of precision therapies targeting TRK proteins (TRKA/B/C). Approved agents such as VITRAKVI (larotrectinib) and ROZLYTREK (entrectinib) have demonstrated high efficacy across a wide spectrum of solid tumors, including pediatric and CNS-involved cancers. Further, the recent approval of Bristol-Myers Squibb’s AUGTYRO (repotrectinib), the market is expected to get a boost in near future.

Market expansion is supported by the introduction of next-generation inhibitors like AUGTYRO, designed to overcome acquired resistance mutations. These newer entrants are expected to increase market penetration, especially in patients who progress on first-line therapies. Additionally, ongoing trials and global regulatory submissions are driving broader access, particularly in the 7MM.

As diagnostic capabilities improve and companion testing becomes standard practice, the demand for NTRK inhibitors is projected to rise. With priority review, favorable reimbursement pathways, and continued clinical success, the NTRK inhibitor market is poised for sustained growth and therapeutic innovation in the coming years. Multiple pharma giants, including Bayer, Roche, Bristol Myers Squibb, etc., are investing heavily in the space, while emerging players like Nuvation Bio and Mirati Therapeutics push innovation forward. As selectivity and safety profiles improve, NTRK inhibitors are poised to become a cornerstone of immunotherapy across a growing spectrum of diseases.

With a growing number of clinical trials, expanding indications, and continued pharma investment, the NTRK inhibitor landscape is positioned for accelerated expansion. As current studies mature, they will further define the scope of NTRK inhibitors in oncology and immune-mediated diseases, solidifying their role as a transformative class of therapeutics.

NTRK Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging NTRK inhibitors expected to be launched in the market during 2020–2034.

NTRK Inhibitors Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key NTRK Inhibitor Companies involved in developing targeted therapeutics. The presence of numerous drugs at different stages is expected to generate immense opportunities for the NTRK inhibitors market growth over the forecasted period. The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for NTRK inhibitors emerging therapies.

Major industry players are increasingly pursuing strategic agreements to advance pipeline development and fuel market growth. In October 2023, AnHeart Therapeutics signed an exclusive licensing agreement with Nippon Kayaku to market and distribute its lead investigational NTRK/ROS1 inhibitor, taletrectinib, in Japan—strengthening its position in the Asia-Pacific oncology market.

Latest KOL Views on NTRK Inhibitor Report

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on NTRK inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility. DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Dana-Farber Cancer Institute, M.D. Anderson Cancer Center and others were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or NTRK inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

NTRK Inhibitor KOL Views |

|

“The full US FDA approval of VITRAKVI marks a significant advancement in the treatment of NTRK gene fusion-positive cancers. It reinforces the promise of precision oncology, offering a meaningful option for both adult and pediatric patients, while also setting the stage for continued innovation in targeted NTRK therapies moving forward” |

|

“NTRK fusion-positive tumors can be difficult to manage clinically, making the availability of new treatment options essential. The US FDA approval of AUGTYRO (repotrectinib) introduces a valuable next-generation TKI that broadens therapeutic possibilities for both TKI-naïve and previously treated patients across a wide range of NTRK fusion-positive solid tumors.” |

NTRK Inhibitor Qualitative Analysis Report

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

NTRK Inhibitor Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

In the U.S., reimbursement for VITRAKVI (larotrectinib) is supported through Bayer's Access Services by Bayer and the VITRAKVI $0 Co-Pay Program. The eligible commercially insured patients for VITRAKVI $0 Co-Pay Program may receive financial assistance up to USD 25,000 annually for co-pays or coinsurance. This program is not available to patients enrolled in government insurance programs such as Medicare, Medicaid, TRICARE, or similar federal- or state-funded programs.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on NTRK Inhibitors

- In April 2025, US FDA Granted full approval of VITRAKVI (larotrectinib) for adult and pediatric patients with NTRK gene fusion-positive solid tumors.

- In Jan 2025, EMA has approved AUGTYRO (repotrectinib), a next-generation tyrosine kinase inhibitor (TKI), for the treatment of patients with locally advanced or metastatic solid tumors that are NTRK fusion-positive.

- In Dec 2024, FDA Granted Priority Review to Taletrectinib in ROS1+ Advanced NSCLC.

- In June 2024, US Food and Drug Administration has approved AUGTYRO (repotrectinib) for the treatment of patients with locally advanced or metastatic solid tumors that are NTRK fusion-positive. This approval offers a new targeted option for patients with these difficult-to-treat cancers.

Scope of the NTRK Inhibitor Market Report

- The NTRK Inhibitor Market Report covers a segment of key events, an executive summary, and a descriptive overview of NTRK inhibitors, explaining their mechanism and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the NTRK inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The NTRK Inhibitor Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM NTRK inhibitors market.

NTRK Inhibitors Market Report Insights

- NTRK Inhibitors Targeted Patient Pool

- NTRK Inhibitors Therapeutic Approaches

- NTRK Inhibitors Pipeline Analysis

- NTRK Inhibitors Market Size and Trends

- Existing and Future Market Opportunity

NTRK Inhibitors Market Report Key Strengths

- 10 Years NTRK Inhibitor Market Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake

- Key NTRK Inhibitor Market Forecast Assumptions

NTRK Inhibitors Market Report Assessment

- Current NTRK Inhibitor Treatment Practices

- NTRK Inhibitor Unmet Needs

- NTRK Inhibitor Pipeline Drugs Profiles

- NTRK Inhibitor Drugs Market Attractiveness

- NTRK Inhibitor Qualitative Analysis (SWOT)

Key Questions Answered in the NTRK Inhibitor Market Report

NTRK Inhibitor Market Insights

- What was the NTRK inhibitors market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative NTRK inhibitors Market?

- Which drug type segment accounts for maximum NTRK inhibitor sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for NTRK inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with NTRK inhibitors? What will be the growth opportunities across the 7MM for the patient population on NTRK inhibitors?

- What are the key factors hampering the growth of the NTRK inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for NTRK inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy the NTRK Inhibitor Market Report

- The NTRK Inhibitor Market Size Report will help develop business strategies by understanding the latest trends and changing dynamics driving the NTRK inhibitor Drugs Market.

- Understand the existing NTRK Inhibitor Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the NTRK Inhibitor Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing NTRK Inhibitor Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles @ New DelveInsight Blogs