Ocular Hypertension Market

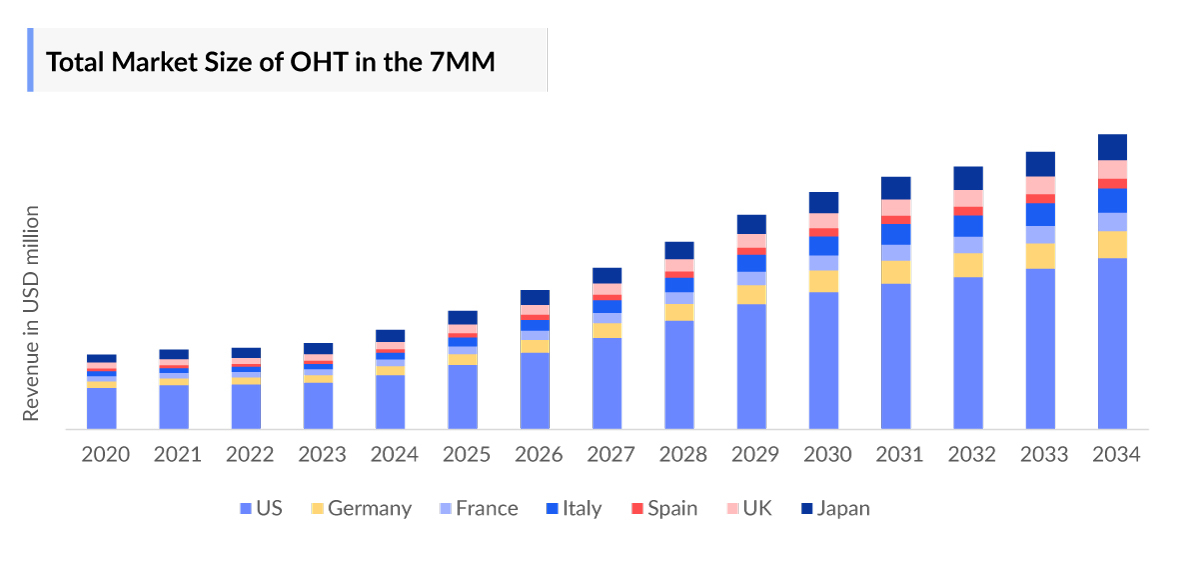

- The Ocular Hypertension Market is poised for steady growth, with a strong CAGR during the forecast period (2024–2034). This expansion in the 7MM is driven by the introduction of novel therapies such as NCX 470, QLS-111, and ST266, alongside a growing aging population. Additionally, chronic conditions like diabetes and hypertension, long-term corticosteroid use, and genetic predispositions contribute to the rising prevalence of ocular hypertension.

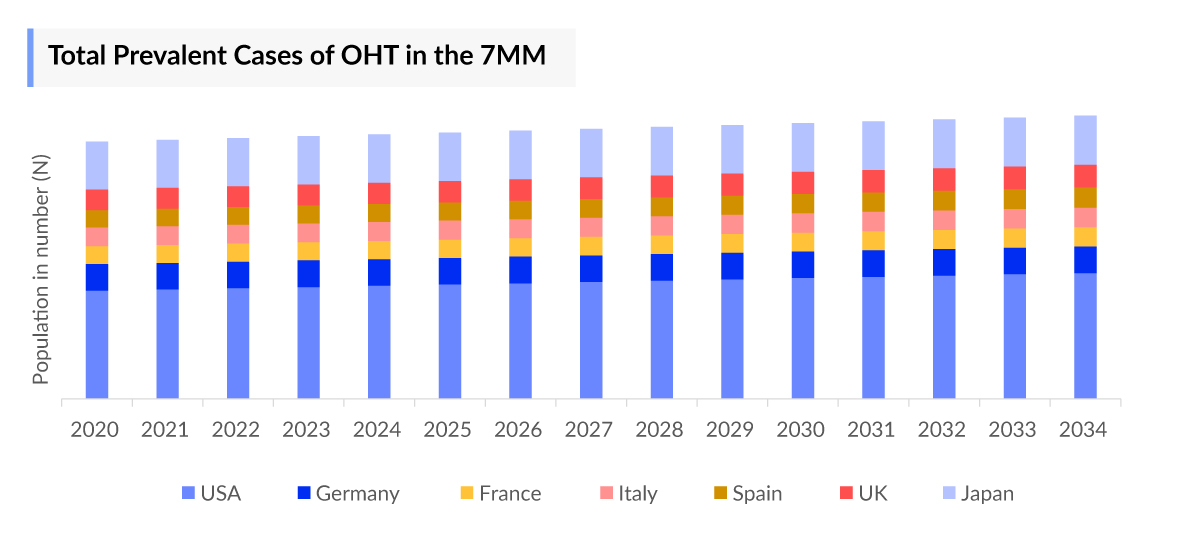

- According to DelveInsight’s estimates, in 2023, there were approximately 13 million cases diagnosed with ocular hypertension in the 7MM. Of these, the United States accounted for 41% of the cases, while EU and the UK represented 38% and Japan represented 21% of the cases, respectively.

- DelveInsight's analysis suggests that the Ocular Hypertension Market in the 7MM is expected to grow at a CAGR of approximately 3% during the forecast period from 2024 to 2034.

- The leading Ocular Hypertension Companies such as Bausch + Lomb with VYZULTA, Alcon, Santen Pharmaceutical with RHOPRESSA, and AbbVie with DURYSTA have established a strong presence in the Ocular Hypertension Market, securing approvals across the 7MM. As the Ocular Hypertension Market evolves, new entrants are increasingly pursuing clinical trials and strategic partnerships to introduce innovative treatment approaches and expand their market share.

- The Ocular Hypertension Market is hindered by the variability in angle configurations, necessitating varied surgical approaches for effective intraocular pressure (IOP) management, especially in complex cases. The frequent need for follow-ups and clinic visits with current treatments often results in patient discontinuation, complicating adherence and optimal outcomes.

Request for Unlocking the Sample Page of the "Ocular Hypertension Treatment Market"

DelveInsight’s “Ocular Hypertension Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of ocular hypertension, historical and forecasted epidemiology, as well as the ocular hypertension market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Ocular Hypertension Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM ocular hypertension market size from 2020 to 2034. The report also covers Ocular Hypertension treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Ocular Hypertension Epidemiology |

|

|

Ocular Hypertension Drugs Market |

|

|

Ocular Hypertension Market Analysis |

|

|

Ocular Hypertension Companies |

|

|

Future opportunity |

Future treatment opportunities for ocular hypertension are expanding with a focus on pharmacological advancements and innovative delivery methods. Current therapies, including prostaglandins, beta-blockers, and carbonic anhydrase inhibitors, aim to lower intraocular pressure (IOP), significantly reducing the risk of developing primary open-angle glaucoma (POAG). Future research targets neuroprotection to preserve optic nerve function, even those with controlled IOP. Additionally, sustained drug delivery systems and personalized medicine approaches offer the potential to improve adherence and treatment outcomes, helping reduce glaucoma-related vision loss. |

Ocular Hypertension Treatment Market: Understanding and Algorithm

Ocular hypertension refers to a condition where intraocular pressure (IOP) exceeds 21 mm Hg in one or both eyes without signs of optic nerve damage or visual field loss. Ocular hypertension is a major risk factor for glaucoma, making individuals with this condition more prone to developing the disease. The underlying cause of ocular hypertension is often a restriction or blockage in the eye’s drainage channels, preventing proper fluid drainage and leading to elevated eye pressure.

Several factors contribute to the development of ocular hypertension, including older age, family history of glaucoma, higher eye pressure, thinner central cornea, lower ocular perfusion pressure, lower systemic blood pressure, and optic nerve head bleeding. Since ocular hypertension does not present early symptoms, it can remain undetected until it advances to glaucoma, emphasizing the importance of regular eye examinations for at-risk individuals.

Ocular Hypertension Diagnosis

Ocular hypertension is diagnosed through a comprehensive eye examination, where IOP is measured using a test called tonometry. Before confirming the diagnosis, it is essential to conduct a thorough evaluation to rule out any secondary causes of elevated IOP. Additionally, other risk factors must be assessed to determine each patient’s likelihood of progressing to glaucoma.

Further details related to country-based variations are provided in the report…

Ocular Hypertension Treatment

When treating ocular hypertension, factors like glaucoma risk, patient preferences, age, health, and life expectancy are key considerations. Patients are categorized as low, moderate, or high risk for developing primary open-angle glaucoma (POAG). Low-risk patients typically don't need treatment, while moderate- to high-risk individuals may benefit from preventive care, but not all will progress to glaucoma. Patient education on risks and benefits is essential.

Treatment decisions often rely on regular monitoring for signs of glaucomatous damage. In challenging cases, such as those with nystagmus or vascular issues, early treatment may be advised. For patients with shorter life expectancy, watchful waiting and regular monitoring might be more appropriate. If treatment begins, first-line therapy includes topical medications like beta-blockers, carbonic anhydrase inhibitors, and prostaglandin analogs, which reduce intraocular pressure by either decreasing fluid production or improving outflow.

Ocular Hypertension Epidemiology

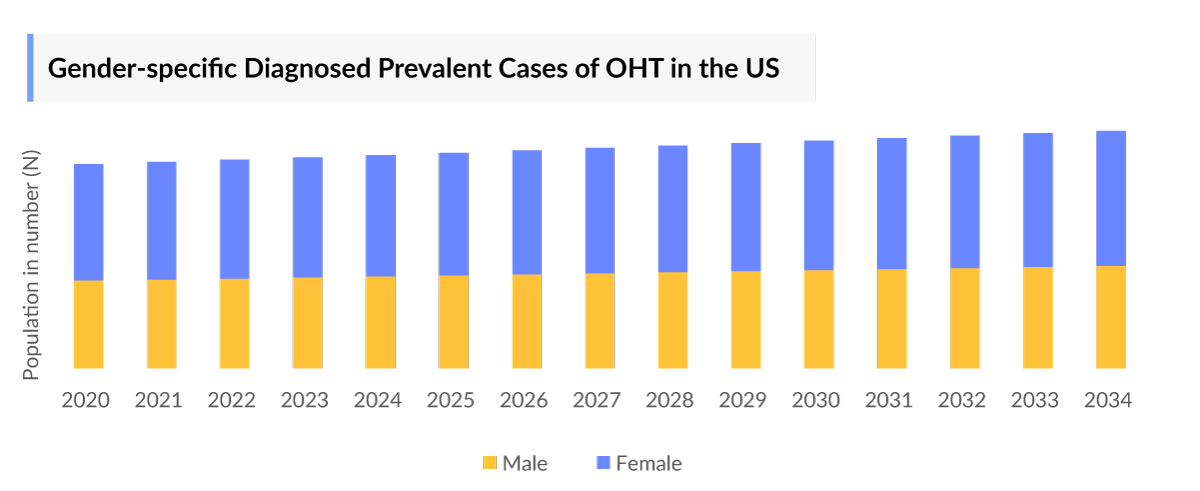

As the market is derived using a patient-based model, the ocular hypertension epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by prevalent cases of ocular hypertension, diagnosed cases of ocular hypertension, gender-specific prevalence of ocular hypertension, and age-specific prevalence of ocular hypertension in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight’s epidemiology model, there were approximately 21 million prevalent cases of ocular hypertension in the 7MM in 2023, with 13 million diagnosed cases. These numbers are projected to rise throughout the study period (2020-2034).

- In 2023, the US had the highest number of diagnosed ocular hypertension cases, with approximately 5.4 million cases.

- Among the EU4 and the UK, Germany reported the highest number of diagnosed ocular hypertension cases in 2023, with nearly 1.3 million cases, followed by the UK with approximately 1.1 million cases. In contrast, Spain had the fewest, with nearly 866 thousand cases.

- Japan accounted for nearly 2.7 million diagnosed cases of ocular hypertension in 2023. This number is expected to increase throughout the study period.

- In 2023, females were more affected by ocular hypertension in the US compared to males.

- In 2023, Japan saw the highest prevalence of ocular hypertension among individuals aged 80 and above, followed by those in the 70–79 age group, 60–69 age group, 50–59 age group, and 40–49 age group.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Ocular Hypertension Prevalence

Ocular Hypertension Recent Developments

- In March 2025, SCIENTURE HOLDINGS, INC. announced it completed a draw on its Equity Line of Credit (ELOC) to support the commercial launch of Arbli™ (losartan potassium) Oral Suspension. The company also temporarily suspended further ELOC draws for the next 30 trading days or until its stock reaches $10 per share, whichever comes first.

Ocular Hypertension Drug Chapters

The drug chapter segment of the ocular hypertension therapeutics market report encloses a detailed analysis of ocular hypertension-marketed drugs and mid to late-stage (Phase III and Phase II) Ocular Hypertension pipeline drugs analysis. It also helps understand the ocular hypertension clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest Ocular Hypertension news and press releases.

Ocular Hypertension Marketed Drugs

- VYZULTA (latanoprostene bunod ophthalmic solution): Bausch + Lomb

VYZULTA is a prostaglandin analog designed to manage IOP in patients with open-angle glaucoma or ocular hypertension. This once-daily monotherapy offers a dual mechanism of action. Upon administration, VYZULTA metabolizes into two active components: latanoprost acid and butanediol mononitrate. Latanoprost acid enhances aqueous humor outflow through the uveoscleral pathway, while butanediol mononitrate releases nitric oxide to facilitate increased outflow via the trabecular meshwork and Schlemm's canal. This combined effect helps effectively reduce IOP. In November 2017, the US FDA approved VYZULTA (0.024%) for the treatment of ocular hypertension.

- RHOPRESSA: Alcon (Aerie Pharmaceuticals)/Santen Pharmaceutical

RHOPRESSA (netarsudil ophthalmic solution) is a 0.02% Rho kinase inhibitor used to treat ocular hypertension. This topical ophthalmic product is provided as a sterile, isotonic, buffered aqueous solution with a pH of approximately 5 and an osmolality of around 295 mOsmol/kg. It contains netarsudil as the active ingredient, with benzalkonium chloride (0.015%) as a preservative. Inactive components include mannitol, boric acid, sodium hydroxide for pH adjustment, and water for injection. RHOPRESSA lowers intraocular pressure (IOP) by increasing aqueous humor outflow through the trabecular meshwork, reducing aqueous humor production, and lowering episcleral venous pressure (EVP). It is approved in the US, EU, and Japan.

- DURYSTA: AbbVie (Allergan)

DURYSTA (bimatoprost implant) is a prostaglandin analog used to reduce IOP in patients with open-angle glaucoma or ocular hypertension. It is delivered via a single intracameral administration of a biodegradable implant containing 10 μg of bimatoprost. The implant is preloaded into a single-use applicator for easy placement directly into the anterior chamber of the eye. In March 2020, the US FDA approved a 10 mcg dose for intracameral administration to lower IOP in patients with OAG or ocular hypertension.

|

Drug |

MoA |

RoA |

Company |

Logo |

|

VYZULTA |

Nitric oxide donors |

Topical ophthalmic solution |

Bausch + Lomb | |

|

RHOPRESSA |

Rho-associated kinase inhibitors |

Topical ophthalmic solution |

Alcon (Aerie Pharmaceuticals)/Santen Pharmaceutical | |

|

DURYSTA |

Prostaglandin F2alpha receptor agonists |

Intracameral |

AbbVie (Allergan) | |

|

XXX |

XXX |

XXX |

XXX |

Ocular Hypertension Emerging Drugs

- NCX 470: Nicox/Kowa

NCX 470 is an innovative eye drop formulation combining nitric oxide and bimatoprost to lower IOP through dual mechanisms. Developed using Nicox’s proprietary nitric oxide-donating technology, it targets open-angle glaucoma and ocular hypertension by delivering both nitric oxide and bimatoprost into the eye. Protected by composition of matter patents until 2029, with potential extensions in the US and EU, and formulation patents extending to 2039, NCX 470 is currently under evaluation in Phase III trials. The Phase III Mont Blanc trial has assessed the safety and efficacy of NCX 470 compared to latanoprost. Additionally, the Whistler and Denali Phase III trials are ongoing.

In July 2024, Nicox reported the enrollment and randomization of the final patient in the US for the Denali Phase III trial of NCX 470. Topline results are expected in the second half of 2025, while results from the Whistler trial are anticipated in the first quarter of 2025. NCX 470 is licensed exclusively to Kowa in Japan, and Nicox is currently pursuing a commercial partnership in the US. The US NDA for NCX 470 is expected to be submitted in H1 2026.

- QLS-111: Qlaris Bio

QLS-111 is a novel formulation based on an ATP-sensitive potassium (KATP) channel modulator platform, designed to lower IOP by relaxing the vessels in vascular and vascular-like tissues distal to the trabecular meshwork, reducing outflow resistance and episcleral venous pressure (EVP). QLS-111 has shown persistent IOP reduction without causing hyperemia or compromising vascular integrity. In April 2024, Qlaris Bio began two US Phase II trials for QLS-111 and secured USD 24 million in Series B funding to support its development.

- ST266: Noveome Biotherapeutics

ST266 is a cell-free biologic containing hundreds of proteins and factors involved in cellular healing, neuroprotection, and inflammation modulation. It is derived from proteins secreted by amnion-derived epithelial cells collected from full-term placentas. This secretome, rich in growth factors and cytokines, has demonstrated anti-inflammatory and neuroprotective effects in preclinical studies. The scalable manufacturing process supports production for multiple indications, with a drug master file submitted to the US FDA for investigational new drug (IND) applications. In June 2021, Noveome Biotherapeutics announced preliminary safety results from a Phase I trial using intranasal delivery in Glaucoma Suspect patients, with plans for further efficacy trials in neurological and ophthalmological conditions.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

NCX 470 |

Nitric oxide donors |

Ophthalmic |

Nicox/Kowa |

III | |

|

QLS-111 |

ATP-sensitive potassium channel modulator |

Ophthalmic |

Qlaris Bio |

II | |

|

ST266 |

Neuron modulators; Paracrine communication modulators; Proto-oncogene protein c-akt modulators; SIRT1 protein stimulants |

Intranasal |

Noveome Biotherapeutics |

I | |

|

XX |

XX |

XXX |

XX |

X |

Note: Further emerging therapies and their detailed assessment will be provided in the final report.

Ocular Hypertension Drugs Market Insights

The current Ocular Hypertension treatment market landscape of ocular hypertension involves both pharmacological and surgical therapies. The ocular hypertension treatment market is segmented into various classes: prostaglandin analogs (PGAs), beta-blockers, alpha-agonists, carbonic anhydrase inhibitors, RHO kinase inhibitors, and combination therapies. PGAs are the first-line therapy for primary open-angle glaucoma (POAG) due to their efficacy, minimal side effects, and once-daily dosing.

Before PGAs, beta-blockers, like timolol and levobunolol, were the standard. They reduce IOP by inhibiting aqueous humor production through beta-adrenergic receptor interaction. Timolol, typically administered twice daily, remains effective, while once-daily levobunolol offers comparable results. Brimonidine, an alpha-2 adrenergic agonist, reduces IOP by decreasing aqueous humor production and enhancing uveoscleral outflow. With minimal cardiovascular impact, it carries a moderate allergy risk. Alphagan-P, containing Purite as a preservative, is better tolerated than Alphagan.

New Ocular Hypertension Therapies such as rho kinase (ROCK) inhibitors and nitric oxide-donating PGAs, focus on improving aqueous humor outflow, specifically targeting the trabecular meshwork.

Ocular Hypertension Market Outlook

Lowering IOP remains the key strategy for managing ocular hypertension. The ideal drug would effectively reduce IOP without adverse effects, be cost-effective, and require minimal dosing. Since no treatment meets all these criteria, therapy selection should prioritize the patient’s individual needs. Besides pharmacological options, surgical interventions are also available. DelveInsight’s market forecast focuses on the revenue generated by ocular hypertension pharmacological treatments, excluding surgical procedures.

Therapies are categorized into prostaglandin analogs (PGAs), beta-blockers, alpha-agonists, carbonic anhydrase inhibitors, rho kinase inhibitors, and combination therapies. Combination therapies, the second-highest revenue generator after PGAs, offer superior efficacy by utilizing agents with different mechanisms of action. Fixed combination drops in Europe include a range of these drug classes. Carbonic anhydrase inhibitors like dorzolamide, favored for their localized action and fewer systemic effects, reduce IOP by decreasing aqueous humor secretion.

Several unmet needs remain in ocular hypertension management, prompting pharmaceutical companies like Nicox, Kowa, Qlaris Bio, and Noveome Biotherapeutics to develop novel treatments. These potential breakthroughs, currently in early to late clinical stages, aim to transform the ocular hypertension treatment landscape.

Ocular Hypertension Drugs Uptake

This section focuses on the uptake rate of potential Ocular Hypertension drugs expected to be launched in the market during 2020–2034.

Ocular Hypertension Pipeline Development Activities

The Ocular Hypertension therapeutics market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Ocular Hypertension Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Ocular Hypertension therapeutics market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Ocular Hypertension emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Ocular Hypertension Treatment Drugs

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the ocular hypertension evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of Arkansas for Medical Sciences, Juntendo University, West Virginia University School of Medicine, and Wilmer Eye Institute, among others were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or ocular hypertension market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, the ideal drug for the treatment of ocular hypertension should effectively lower IOP, produce no adverse effects or systemic exacerbation of the disease, be inexpensive, and have once-a-day dosing. Because no medicine currently possesses all of the above, these qualities should be prioritized based on the patient's individual needs and risks, and therapy should then be chosen accordingly.

As per the KOLs from the UK, new pharmaceuticals may comprise multiple medications in a single bottle, making dosing regimens simpler. Novel drug delivery systems are in development, such as injectable products and implants releasing IOP-lowering medication without the need for self-administration. A comprehensive approach involving these new methods and more effective patient-physician communication may lead to improved adherence.

As per the KOLs from Japan, a number of experts are now considering the second-line treatment as a good first choice. Second-line drugs of choice include alpha-agonists and topical carbonic anhydrase inhibitors.

Ocular Hypertension Drugs Market: Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Ocular Hypertension Therapeutics Market Access and Reimbursement

- VYZULTA: Savings Program

The VYZULTA savings program offers significant cost relief for eligible patients, potentially reducing their copay to as little as USD 25 for a 90-day supply. This supply consists of three 2.5 mL bottles, provided that each bottle is covered by the patient's commercial insurance. For those without insurance, discounted pricing is also available, making VYZULTA more accessible across different patient demographics. This program aims to enhance adherence to treatment by alleviating financial barriers, thereby supporting the effective management of ocular hypertension. The Ocular Hypertension therapeutics market report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Ocular Hypertension Therapeutics Market Report Scope

- The Ocular Hypertension therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Ocular Hypertension treatment market landscape.

- A detailed review of the ocular hypertension therapeutics market, historical and forecasted Ocular Hypertension treatment market size, Ocular Hypertension drugs market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Ocular Hypertension therapeutics report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM ocular hypertension drugs market.

Ocular Hypertension Therapeutics Market Report Insights

- Patient-based Ocular Hypertension Market Forecasting

- Therapeutic Approaches

- Ocular Hypertension Pipeline Drugs Analysis

- Ocular Hypertension Market Size and Trends

- Existing and Future Ocular Hypertension Drugs Market Opportunity

Ocular Hypertension Therapeutics Market Report Key Strengths

- 11 years Ocular Hypertension Market Forecast

- The 7MM Coverage

- Ocular Hypertension Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Ocular Hypertension Drugs Uptake

- Key Ocular Hypertension Market Forecast Assumptions

Ocular Hypertension Therapeutics Market Report Assessment

- Current Ocular Hypertension Treatment Market Practices

- Ocular Hypertension Unmet Needs

- Ocular Hypertension Pipeline Drugs Analysis Profiles

- Ocular Hypertension Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions

Ocular Hypertension Treatment Market Insights

- What was the total Ocular Hypertension treatment market size, the Ocular Hypertension market size by therapies, and Ocular Hypertension drugs market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will NCX 470 affect the treatment paradigm of ocular hypertension?

- How will VYZULTA compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Ocular Hypertension Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of ocular hypertension? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to ocular hypertension?

- What is the historical and forecasted ocular hypertension patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent ocular hypertension population during the forecast period (2024–2034)?

- What factors are contributing to the growth of ocular hypertension cases?

Current Ocular Hypertension Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the Ocular Hypertension Treatment? What are the current clinical and treatment guidelines for treating ocular hypertension?

- How many Ocular Hypertension Companies are developing therapies for the treatment of ocular hypertension?

- How many emerging therapies are in the mid-stage and late stage of development for treating ocular hypertension?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of ocular hypertension?

Reasons to Buy

- The Ocular Hypertension therapeutics market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the ocular hypertension drugs market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for ocular hypertension, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs