Polycythemia Vera Market Summary

Key Highlights:

- Most Polycythemia Vera patients are symptomatic, with approximately ~91,000 patients with JAK2 mutation in the United States in 2025.

- In 2025, the market size of Polycythemia Vera was highest in the United States among the 7MM, accounting for approximately ~USD 1,500 million, which is further expected to increase by 2036, owing to the launch of emerging therapies, assisted by an increase in the diagnosed prevalent population of Polycythemia Vera.

- Polycythemia Vera does not have a cure; treatments can help control the disease and its complications. It is treated with procedures, medicines, and other methods; one or more treatments may be needed to manage the disease.

- The cornerstone of treatment for Polycythemia Vera remains phlebotomy to maintain safe hematocrit levels, often combined with low-dose aspirin. High-risk patients may also receive cytoreductive therapy, such as hydroxycarbamide (hydroxyurea). Ruxolitinib (JAKAFI) and rRopeginterferon alfa-2b (BESREMi) are approved in the US, Europe, and Japan, with Ruxolitinib (JAKAFI) established as a standard second-line therapy since 2015. PEGASYS (peginterferon alfa-2a) received marketing authorization in 2024 and formal approval in the UK in 2025, building on prior off-label use.

- Since BESREMi's label is broad (first and subsequent lines of therapy), PharmaEssentia has more leeway in positioning BESREMi in diverse therapeutic situations. Given BESREMi's position upstream of JAKAFI in the NCCN recommendations, the drug is not a direct competitor for JAKAFI. Still, it has the potential to hinder the progression of patients to JAKAFI usage, which might affect JAKAFI's overall revenue.

- The patent expiration in mid-2028 might be the most significant obstacle to JAKAFI’s supremacy in the Polycythemia Vera market. To address this, Incyte introduced the LIMBER (Leadership in MPNs and GVHD beyond Ruxolitinib) life-cycle management initiative, which was meant to explore different monotherapy and combination methods to enhance and expand therapies for patients with MPNs and GVHD.

- Other emerging Polycythemia Vera therapies in development include Bomedemstat (LSD1 inhibitor, Merck), Sapablursen (TMPRSS6 inhibitor, Ionis Pharmaceutical/Ono Pharmaceutical), Divesiran (TMPRSS6 inhibitor, Silence Therapeutics), PPMX-T003 (anti-TfR1, Perseus Proteomics), and DISC-3405 (anti-TMPRSS6, Disc Medicine), and others highlighting a growing pipeline of innovative treatments.

- Several other potential therapies for Polycythemia Vera are in the early stage of development, which include INCB160058 (Incyte), AG-236 (Agios Pharmaceuticals and Alnylam Pharmaceuticals, Phase I), VGT-1849A and VGT-1849B (Vanda Pharmaceuticals, NA), JAK2V617F (Prelude Therapeutics and Incyte, IND enabling), PN-8047 (Protagonist Therapeutics, IND enabling), and others.

DelveInsight's “Polycythemia Vera – Market Insights, Epidemiology and Market Forecast – 2036” report delivers an in-depth understanding of the Polycythemia Vera, historical and forecasted epidemiology as well as the Polycythemia Vera market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Polycythemia Vera market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Polycythemia Vera market size from 2022 to 2036. The report also covers current Polycythemia Vera treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2022–2036

|

Study Period |

2022–2036 |

|

Forecast Period |

2026–2036 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Polycythemia Vera Epidemiology |

Segmented by:

|

|

Polycythemia Vera Key Companies |

|

|

Polycythemia Vera Key Therapies |

|

|

Polycythemia Vera Market |

Segmented by:

|

|

Analysis |

|

Key Factors Driving the Polycythemia Vera Market

Prevalence driving the Polycythemia Vera market

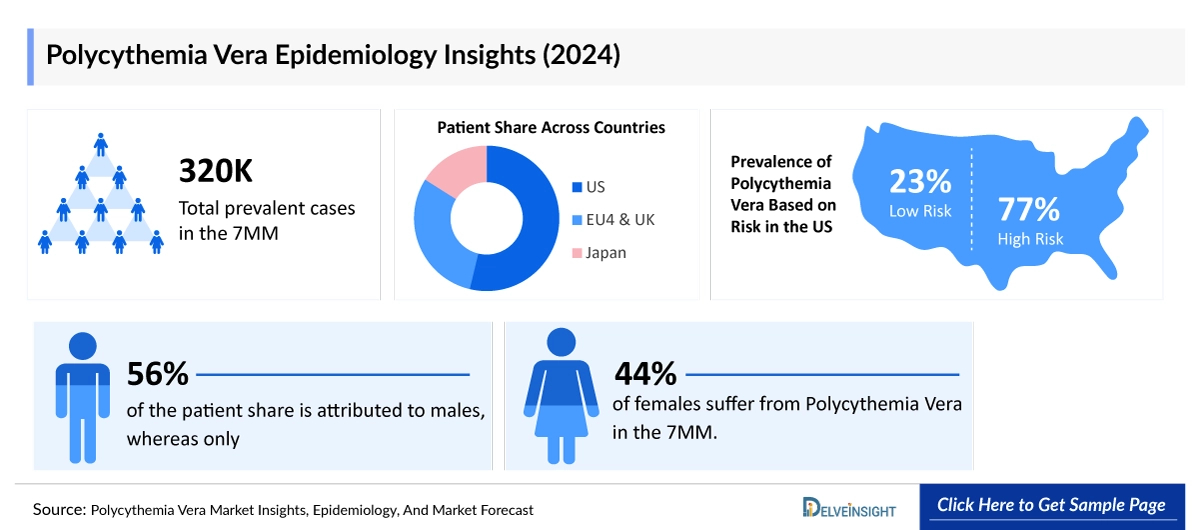

In 2024, the total number of total prevalent Polycythemia Vera cases in leading markets [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] was 320K which are projected to rise modestly by 2034, driven by better diagnostics, growing awareness, and longer patient survival, expanding the PV market and driving demand for more effective PV treatments.

Polycythemia Vera treatment landscape

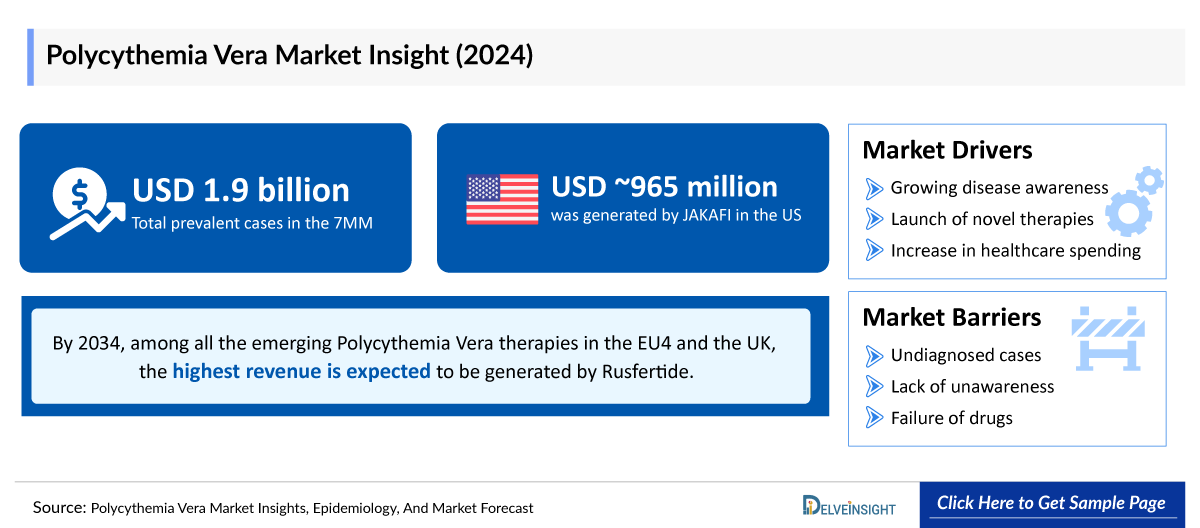

Current Polycythemia Vera treatment typically centers on phlebotomy, cytoreductive therapy, and JAK inhibition for hydroxyurea-intolerant patients, notably JAKAFI (Incyte), which generated the most significant revenue of USD ~965 million in 2024 in the US. These established options anchor the market while creating precise unmet needs around phlebotomy dependency and symptom control.

Polycythemia Vera clinical trial analysis

Late-stage Polycythemia Vera pipeline activity, including hepcidin-mimetic and epigenetic approaches, is boosting the PV market by targeting phlebotomy burden and symptom control. Positive Phase III data for rusfertide (Protagonist/Takeda) as the drug substantially reduces the frequency of phlebotomy. Other notable therapies in development include Bomedemstat (Merck), Givinostat (Italfarmaco), Divesiran (Silence Therapeutics), Sapablursen (Ionis Pharmaceuticals), and PPMX-T003 (Perseus Proteomics), among others.

Polycythemia Vera Disease Understanding and Treatment Algorithm

Polycythemia Vera Overview

Polycythemia Vera is a rare condition characterized by the progressively increased number of red blood cells in the bloodstream, white blood cells (WBC), and platelets also increase in number in the affected people. Polycythemia Vera is the most common myeloproliferative neoplasm (MPN). Out of all the MPNs, Polycythemia Vera is the most common and the only one in which there is an increase in RBC production. Polycythemia Vera usually occurs at an elderly age, and patients are at a higher risk than the usual percentage, as they are more prone to risks and other comorbidities.

Polycythemia Vera Diagnosis

The diagnosis of Polycythemia Vera is based on results from tests assessing elevations in blood counts and the presence of molecular mutations associated with the disease. The initial evaluation should include a focused clinical history, physical examination, hematocrit concentration, and count of RBC, WBC, platelets, serum EPO level, and cytogenetic abnormalities. The patient's journey begins with a referral to a hematologist. However, the current approach to diagnosing these patients is quite similar, as most developing countries establish a patient’s diagnosis journey using WHO criteria, which is based on a composite assessment of clinical and laboratory features, including JAK2 mutation status and serum erythropoietin level. However, when it comes to analyzing the real-world scenario in varying geographies, there are some differences in diagnostic criteria and risk stratification that other organizations in certain European countries have proposed.

For example, even though the WHO classification considers histology useful in distinguishing Polycythemia Vera from other myeloproliferative neoplasms (MPNs), the British Society for Haematology Guideline has also cited several studies that have reported high rates of failure to reach a histological diagnosis in patients with Polycythemia Vera.

Further details related to country-based variations are provided in the report.

Polycythemia Vera Treatment

Based on real-world pattern analysis, patients suffering from Polycythemia Vera receive treatment with certain drugs (myelosuppressive drugs) that suppress the formation of blood cells by the marrow. A chemotherapy drug, hydroxyurea, is most often used, along with another chemotherapy drug known as busulfan. Other drugs, such as chlorambucil and radioactive phosphorus, have also been used. JAKAFI and BESREMi are the two FDA-approved drugs for treating Polycythemia Vera.

Although medication adherence can be elusive, it has been found that the patients who were prescribed injectable cytoreductive drugs had lower adherence rates than their counterparts taking oral formulations. There are many factors when it comes to lower adherence to therapies, for instance, when patients are taking too many therapies together, facing side effects, having cost concerns, and facing issues with dosing regimens.

Over the next few years, the US Polycythemia Vera Market is expected to substantially change and experience growth, as it will be dominated by two already approved products, JAKAFI and BESREMi. In contrast, we also anticipate the launch of a third product, Rusfertide, in the US market in the coming 2–3 years. Considering that the symptomatic cases of Polycythemia Vera are the one’s which get diagnosed, which is around a moderate range of 60–70%, we expect the market to expand, especially as safer and more effective therapies enter the market.

Further details related to country-based variations are provided in the report.

Polycythemia Vera Epidemiology

As the market is derived using a patient-based model, the Polycythemia Vera epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Prevalent Population of Polycythemia Vera, Prevalent Population of Polycythemia Vera Based on Symptoms, Gender-specific Prevalence of Polycythemia Vera, Prevalence of Polycythemia Vera by Gene Mutation, Prevalence of Polycythemia Vera Based on Risk, and Age-specific Prevalence of Polycythemia Vera in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2022 to 2036. The total prevalent cases of Polycythemia Vera in the 7MM comprised approximately ~283,500 cases in 2025 and are projected to increase during the forecasted period

- The United States contributed to the largest prevalent population of Polycythemia Vera, acquiring ~56% of the 7MM in 2025. Whereas EU4 and the UK, and Japan accounted for around ~32% and ~12% of the total population share, respectively, in 2025.

- The total number of prevalent cases of Polycythemia Vera in the United States was around ~158,500 cases in 2025.

- Among the EU4 and the UK, Germany accounted for the largest number of Polycythemia Vera cases based on symptoms, whereas the UK accounted for the lowest number of cases in 2025.

- According to DelveInsight estimates, there were around ~63,000 cases of asymptomatic and ~95,000 cases of symptomatic Polycythemia Vera in the United States in 2025. The prevalence is projected to increase during the forecasted period.

- In Japan, the age-specific data revealed that the highest number of people affected with Polycythemia Vera was found in the age group of 65-74 years, i.e., ~6,000 cases in 2025, while people who belonged to the age group 0–34 years, i.e., ~800 cases, were the least affected.

- In 7MM, approximately ~60% of the patient share is attributed to males, whereas only ~40% of females suffer from Polycythemia Vera.

Polycythemia Vera Drug Chapters

The drug chapter segment of the Polycythemia Vera report encloses a detailed analysis of Polycythemia Vera marketed drugs and late-stage (Phase III, Phase II, Phase I/II, and Phase I) pipeline drugs. It also helps understand the Polycythemia Vera clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Drugs

Ruxolitinib (JAKAFI/JAKAVI): Incyte/Novartis

JAKAFI/JAKAVI is an oral inhibitor of the JAK 1 and JAK 2 tyrosine kinases. It is approved for treating adult patients resistant to or intolerant of hydroxyurea. Incyte’s flagship product, JAKAFI, received approval as a second-line therapy for Polycythemia Vera patients in December 2014 in the United States, followed by approvals in both the EU and Japan in 2015.

In December 2024, the American Society of Hematology (ASH) Annual Meeting and Exposition featured novel research on the long-term safety and efficacy of ruxolitinib for patients with polycythemia vera. The poster presentations in particular shed light on the superiority of ruxolitinib over hydroxyurea and how ruxolitinib can allow patients to rely less on corticosteroids.

Ropeginterferon alfa-2b (BESREMi): PharmaEssentia/AOP Orphan Pharmaceuticals

PharmaEssentia’s BESREMi, a monopegylated proline interferon, is a new entrant for first-line as well as more advanced-line Polycythemia Vera patients without symptomatic splenomegaly; it is one of the first to be approved for the condition. BESREMi was approved in November 2021 in the US; meaningful sales began in 2022. Before the US launch, the drug was approved in the EU in 2019 and has been available in Germany, France, and the UK since 2020, whereas in April 2022, the drug was approved for reimbursement by Italy’s National Health Service (SSN). Later in March 2023, the Ministry of Health, Labor, and Welfare (MHLW) approved BESREMi for the treatment of Polycythemia Vera (limited to cases where existing treatments are inadequate or inappropriate).

As per news released in May 2024, BESREMi showed the greatest benefit among cytoreductive therapies in lowering the symptomatic burden of Polycythemia Vera. The results were further presented at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting Proceedings.

As per Macquarie's investor conference 2025 presentation, the supplemental Biologics License Application (sBLA) for the ropeginterferon alfa-2b prefilled pen device was submitted to the US Food and Drug Administration (FDA) on October 15, 2025, with a US launch anticipated in 2026 for patients with polycythemia vera.

|

Key Cross of Marketed Drug | ||||||

|

Drug |

Company |

Indication |

Molecule Type |

MoA |

RoA |

Marketed Region |

|

Ruxolitinib (JAKAFI/JAKAVI) |

Incyte/Novartis |

Patients with Polycythemia Vera who have had an inadequate response to or are intolerant of hydroxyurea |

Small molecule |

JAK inhibitor |

Oral |

US: 2014 EU: 2015 JP: 2015 |

|

Ropeginterferon alfa-2b (BESREMi) |

PharmaEssentia/AOP Orphan Pharmaceuticals |

Polycythemia Vera patients, regardless of their treatment history |

Recombinant interferon alpha subtype 2b (IFN-a2b) protein |

Binds to the interferon alfa receptor (IFNAR) |

SC |

US: 2021 EU: 2019 JP: 2023 |

|

Peginterferon alfa-2a (PEGASYS) |

pharmaand GmbH |

Polycythemia Vera |

Type 1 interferon |

Antiviral and anti-proliferative activities |

SC |

EU: 2024 UK: 2025 |

Emerging Drugs

Rusfertide (PTG-300): Protagonist Therapeutics

Rusfertide is a novel injectable synthetic mimetic of the natural hormone hepcidin that offers greater potency, solubility, and stability, which translates to better in vivo pharmacokinetics and pharmacodynamics characteristics and manufacturability in comparison to the natural hormone. In December 2024, the final results of rusfertide from the Phase II REVIVE trial were presented at the ASH (4559) meeting. The data demonstrated that rusfertide, when added to therapeutic phlebotomy with or without cytoreductive therapy, effectively controlled erythrocytosis, provided long-term durable control of hematocrit, and reduced the need for therapeutic phlebotomy in patients with Polycythemia Vera.

According to Protagonist Therapeutics’ corporate presentation published in January 2026, the company filed an NDA for rusfertide in 2025, with an anticipated early launch in H2 2026.

Bomedemstat (MK-3543 [IMG-7289]): Merck (Imago BioSciences)

Bomedemstat is an investigational small molecule, irreversible Lysine-specific Demethylase 1 (LSD1) inhibitor being developed by Merck. Bomedemstat is being evaluated in a wide range of myeloproliferative neoplasms, including essential thrombocythemia, myelofibrosis, and Polycythemia Vera. Currently, an ongoing investigator-sponsored Phase III trial evaluates bomedemstat in Polycythemia Vera patients.

In January 2023, Merck announced the successful completion of its cash tender offer through a subsidiary for all outstanding shares of common stock of Imago BioSciences. Earlier in November 2022, Merck and Imago BioSciences announced that the companies had entered into a definitive agreement.

|

Comparison of Emerging Drugs Under Development | ||||||

|

Drug Name |

Company |

Highest Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

Rusfertide (PTG-300) |

Protagonist Therapeutics and Takeda Pharmaceuticals |

III |

Polycythemia vera |

SC |

Targeting the underlying mechanism of iron dysregulation |

Hepcidin mimetic peptide |

|

Givinostat (DUVYZAT) |

Italfarmaco |

III |

JAK2V617F-positive high-risk polycythemia vera |

Oral |

Pan-HDAC inhibitor |

Small molecule |

|

Bomedemstat (MK-3543 [IMG-7289]) |

Merck (Imago BioSciences) |

III |

Polycythemia vera |

Oral |

LSD 1 inhibitor |

Small molecule |

|

Sapablursen (IONIS-TMPRSS6-LRx) |

Ionis Pharmaceuticals and Ono Pharmaceutical |

II |

Phlebotomy-dependent polycythemia vera |

SC |

TMPRSS6 inhibitor |

Antisense oligonucleotide |

|

DISC-3405 |

Disc Medicine’s |

II |

Polycythemia vera |

SC |

TMPRSS6 protein inhibitors |

Monoclonal antibody |

|

Divesiran (SLN124) |

Silence Therapeutics |

I/II |

Polycythemia vera |

SC |

TMPRSS6 inhibitor |

GalNAc-siRNA conjugate |

|

PPMX-T003 |

Perseus proteomics |

I |

Polycythemia vera |

IV Infusion |

TfR1 inhibitors |

Monoclonal antibody |

|

INCB160058 |

Incyte Corporation |

I |

JAK2 V617F -mutated MPNs |

Oral |

JAK 2 inhibitors |

Small molecule |

|

GLB-001 |

Hangzhou GluBio Pharmaceutical |

I |

Relapsed, refractory, or intolerant polycythemia vera |

Oral |

Casein Kinase 1 Alpha (CK1α) protein inhibitor |

Small molecule |

|

AG-236 |

Agios Pharmaceuticals and Alnylam Pharmaceuticals |

I |

Polycythemia vera |

SC |

Targeting TMPRSS6 |

siRNA |

|

VAC85135 |

Johnson & Johnson Innovative Medicine |

I |

Polycythemia vera |

IM |

Immunostimulants |

Neo-antigen Vaccine |

|

Flonoltinib Maleate |

Chengdu Zenitar Biomedical Technology |

II |

Polycythemia vera |

Oral |

JAK 2/FMS-like tyrosine kinase 3 (FLT3) inhibitors |

Small molecule |

|

JAK2V617F |

Prelude Therapeutics and Incyte |

IND enabling |

VF+ MPNs |

Oral |

Mutant-Selective Janus Kinase 2 Pseudokinase (JH2) Domain Inhibitors |

- |

|

PN-8047 |

Protagonist Therapeutics |

IND enabling |

Polycythemia vera |

Oral |

Hepcidin mimetic |

Small molecule |

|

VGT-1849B |

Vanda Pharmaceuticals |

NA |

Polycythemia vera |

Not disclosed |

Selectively targeting JAK2 mRNA |

Antisense oligonucleotides |

|

VGT-1849A |

Vanda Pharmaceuticals |

NA |

Polycythemia vera |

Not disclosed |

JAK 2 inhibitors |

Antisense oligonucleotides |

Drug Class Insights

The existing Polycythemia Vera treatment is mainly dominated by classes such as antimetabolites, platelet-reducing agents, Interferons, and JAK inhibitors.

JAK inhibitors have been developed following the discovery of the JAK2V617F in 2005 as the driver mutation of most non-BCR-ABL1 MPNs. A decade after the beginning of clinical trials, only one JAK inhibitor, JAKAFI, has been approved by the US Food and Drug Administration for hydroxyurea-resistant or intolerant Polycythemia Vera patients since 2014. JAKAFI competes with platelet-reducing agents (Anagrelide), Interferon alpha, and BESREMi in the second line of treatment. Even though there are safety concerns regarding JAK inhibitors, we cannot misconstrue the strong uptake of JAKAFI in the already treated patients with this blood disorder.

Moving on to Interferon’s, BESREMi is not the first one being used in these patients, though it is the first approved interferon for Polycythemia Vera patients. For years, PEGASYS has been commercially available, which is present all along. PEGASYS is a form of pegylated interferon that is used off-label by patients living with a myeloproliferative neoplasm. However, many patients have dealt with access and reimbursement issues, as it is accessed off-label.

Moreover, the upcoming treatment landscape is poised to see further expansion after the emergence of new classes such as iron modulator, LSD1 inhibitor, Pan-HDAC inhibitor, TMPRSS6 inhibitor, TfR targeting, BCL-2 inhibitor, Immunostimulant, CK1a, and others.

Polycythemia Vera Market Outlook

Polycythemia Vera treatment in the US is entering a new era with changing dynamics. Therapeutic options for Polycythemia Vera are limited, and no cure is available. The treatment landscape was dominated by legacy, generic therapies such as Hydroxyurea, second-generation interferon, and Phlebotomy until the approval of BESREMi as both the first and second line of treatment, and JAKAFI in the second line of treatment only; options for third-line treatment are still limited. Adding to that, Low-dose aspirin and phlebotomy are recommended as first-line treatment options for patients at low risk of thrombotic events. Cytoreductive therapy (usually hydroxyurea or interferon alpha) is recommended for high-risk patients. Polycythemia Vera treatment is still inadequate, as approximately 30% of Hydroxyurea-treated patients become resistant/intolerant.

The current market has been segmented into different commonly used therapeutic classes based on the prevailing treatment pattern across the 7MM, which presents minor variations in the overall prescription pattern. JAK inhibitor, Interferons, Hepcidin mimetic, TMPRSS6 inhibitor, CK1a, BCL-2 inhibitor, and LSDI inhibitor are the major classes covered in the forecast model.

The expected launch of upcoming therapies and greater integration of early patient screening, medication in secondary care and other clinical settings, research on best methods for implementation, and an upsurge in awareness will eventually facilitate the development of effective treatment options. However, there are a few potential therapies that are being investigated for managing Polycythemia Vera. If approved, it will create a significant difference in the landscape of Polycythemia Vera in the coming years. The treatment space is expected to experience a significant impact in the coming years, owing to the increase in healthcare spending worldwide.

Key players involved in developing targeted therapies to treat Polycythemia Vera include Protagonist Therapeutics and Takeda Pharmaceuticals (rusfertide), Merck (bomedemstat), Italfarmaco (givinostat), Ionis Pharmaceuticals and Ono Pharmaceutical (sapablursen), Silence Therapeutics (Divesiran (SLN124)), Perseus Proteomics (PPMX-T003), Disc Medicines (DISC-3405), and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of Polycythemia Vera.

- The total market size of Polycythemia Vera in the 7MM is approximately ~USD 2,000 million in 2025 and is projected to increase during the forecast period (2026–2036).

- Among EU4 and the UK, Germany accounts for the maximum market size in 2025, while the United Kingdom occupies the bottom of the ladder in 2025.

- In 2025, among the current therapies for Polycythemia Vera, the largest revenue was generated by JAKAFI, i.e., ~USD 1,000 million in the United States.

- By 2036, among all the emerging therapies in the EU4 and the UK, the highest revenue is expected to be generated by Rusfertide.

Further details will be provided in the report….

Key Updates

- In the J.P. Morgan Healthcare Conference 2026 presentation, Incyte stated that ruxolitinib extended-release (XR), a once-daily (QD) formulation for Polycythemia Vera, is expected to receive regulatory approval and be launched around mid-2026.

- Ionis Pharmaceuticals announced at the J.P. Morgan Healthcare Conference 2026 that it plans to initiate a Phase III clinical trial of sapablursen for the treatment of Polycythemia Vera in 2026.

- In August 2025, Vanda announced that the FDA had granted Orphan Drug Designation for VGT-1849B, a selective peptide nucleic acid-based JAK2 inhibitor for the treatment of Polycythemia Vera.

- According to Italfarmaco's pipeline activity, the company anticipates the launch of DUVYZAT in 2027 for the treatment of Polycythemia Vera.

Polycythemia Vera Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2022–2036. For example, for Rusfertide, although the FDA rescinded its Breakthrough Designation, we expect the drug uptake to be medium-fast with a probability-adjusted peak share of 5.4% in the first line and second line, and years to the peak are expected to be 7 years from the year of launch. The drug was proven to be better among all the other therapies in terms of safety and efficacy.

Further detailed analysis of emerging therapies, drug uptake in the report…

Polycythemia Vera Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, Phase I/II, and Phase I stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Polycythemia Vera's emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SME's opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, include Medical/scientific writers, Medical Oncologists, professors, the Director of Hanns A. Pielenz Clinical Research Center, the Director of the Myeloproliferative Disorders Research Program, Hematologists, and Others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as MD Anderson Cancer Center, Texas, from UT Southwestern Medical Center in Dallas, Cancer Research UK Barts Centre in London, MD Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Polycythemia Vera market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

Region |

KOL Views |

|

United States |

“The approval of JAKAFI represents an important advance for patients with uncontrolled polycythemia vera. For the first time, we can provide these patients a treatment that has been shown to provide effective and consistent control of their blood counts and reduce spleen volume.” |

|

United States |

Polycythemia Vera patients could benefit from a novel treatment option that effectively manages their condition without causing serious adverse effects. In the Phase I portion of the SANRECO study, Divesiran substantially reduced the need for phlebotomy and lowered hematocrit levels following infrequent dosing in a range of Polycythemia Vera patients. The long duration of effect and clean safety/tolerability profile were impressive. These data are very exciting and support further development of Divesiran in polycythemia vera.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in Polycythemia Vera trials, one of the most important primary outcome measures is the reduction in hematocrit levels to <45% while making the patient independent of Phlebotomies.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

United States

|

The US Reimbursement for Polycythaemia Vera Therapies | |

|

Drug |

Access Program |

|

Ruxolitinib (JAKAFI/JAKAVI) |

|

|

Ropeginterferon alfa-2b (BESREMi) |

PharmaEssentia SOURCE:

|

Scope of the Report

- The report covers a segment of key events, an executive summary, a descriptive overview of Polycythemia Vera, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of the diagnosis rate, and disease progression along treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Polycythemia Vera market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Polycythemia Vera market.

Polycythemia Vera Report Insights

- Patient Population

- Therapeutic Approaches

- Polycythemia Vera Pipeline Analysis

- Polycythemia Vera Market Size and Trends

- Existing and future Market Opportunity

Polycythemia Vera Report Key Strengths

- 11 Years Forecast

- 7MM Coverage

- Polycythemia Vera Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

Polycythemia Vera Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

Market Insights:

- What was the Polycythemia Vera total market size, the market size by therapies, market share (%) distribution in 2022, and what would it look like in 2036? What are the contributing factors for this growth?

- How will interferon as a class affect the treatment paradigm in the first line of Polycythemia Vera?

- What kind of uptake JAK inhibitor will JAKAFI witness in the already treated Polycythemia Vera patients in the coming 10 years?

- What will be the impact of JAKAFI’s expected patent expiry in 2028?

- How will Rusfertide compete with BESREMi and JAKAFI in the first- and second-line?

- Which class is going to be the largest contributor in 2036?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What are the disease risks, burdens, and unmet needs of Polycythemia Vera? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Polycythemia Vera?

- What is the historical and forecasted Polycythemia Vera patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Why do only a limited number of patients appear with symptoms? Why is the current year's diagnosis rate not high?

- Which type of mutation is the largest contributor in patients affected with polycythemia Vera?

- What factors are affecting the increase in the diagnosis of symptomatic cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the treatment of Polycythemia Vera? What are the current treatment guidelines for the treatment of Polycythemia Vera in the US and Europe?

- How many companies are developing therapies for the treatment of Polycythemia Vera?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Polycythemia Vera?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What key designations have been granted for the emerging therapies for Polycythemia Vera?

- What will be the impact of JAKAFI’s and BESREMi’s expected patent expiry?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What is the 7MM historical and forecasted market of Polycythemia Vera?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Polycythemia Vera Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights into the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-Market-Vera-(PV)-Market-.png&w=256&q=75)