Psoriasis Market

-

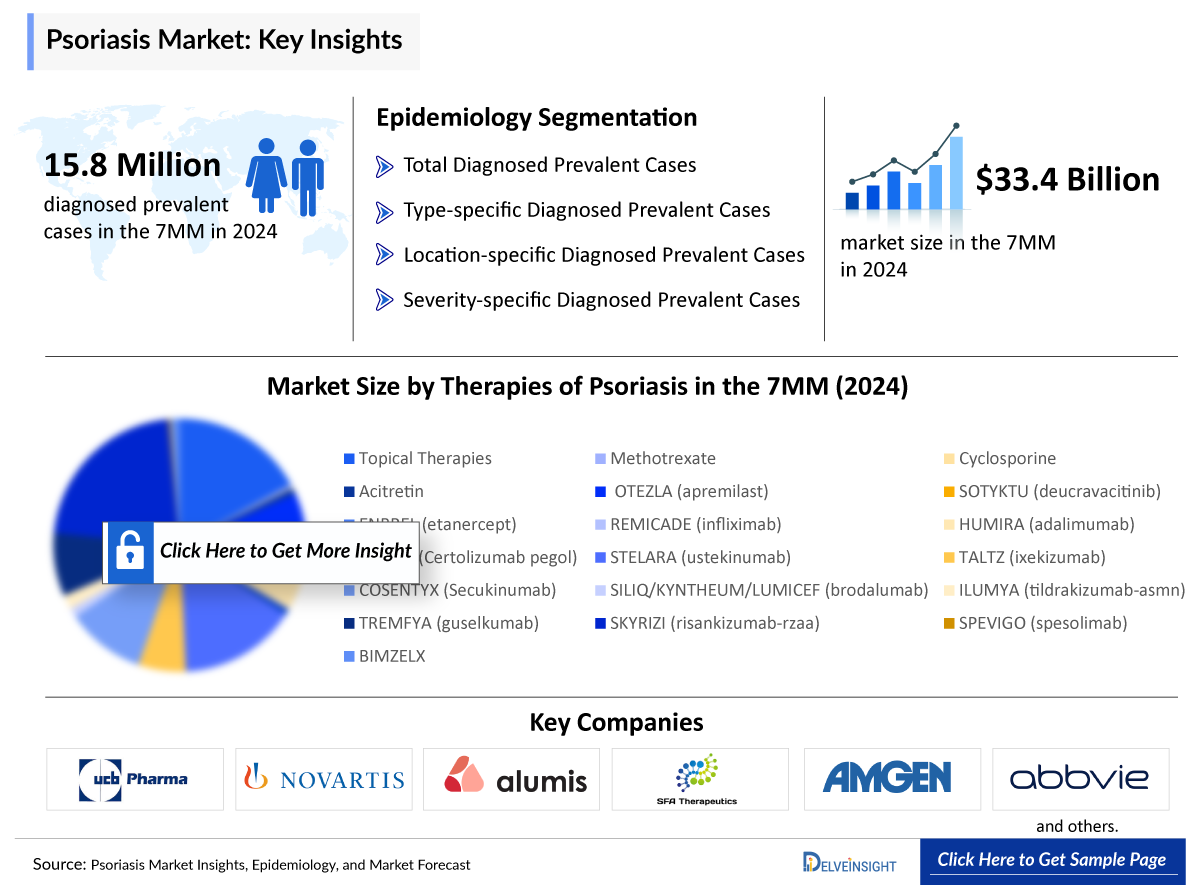

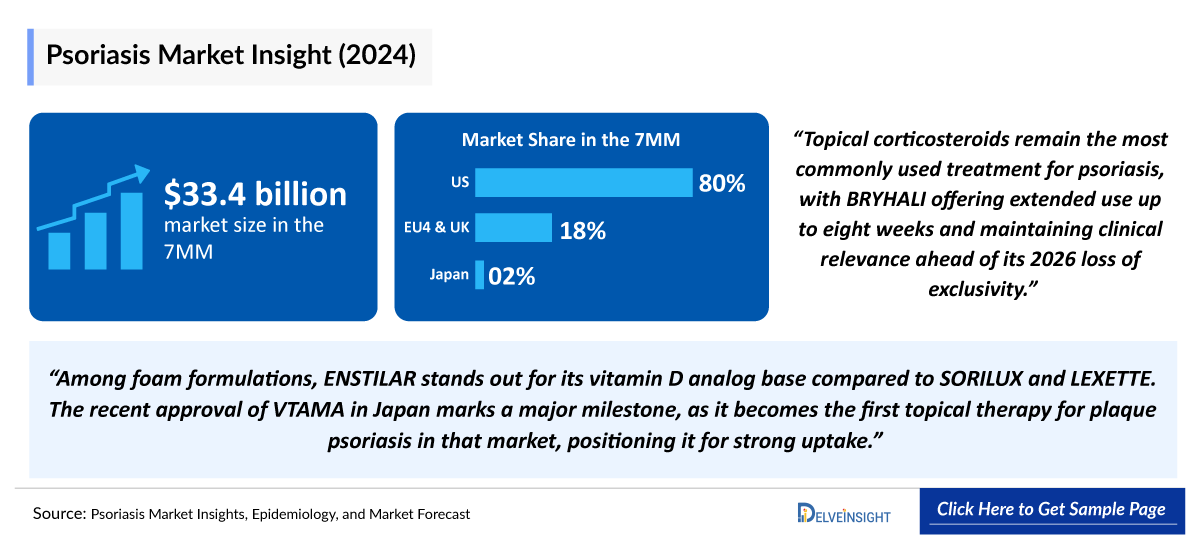

The Psoriasis market in the 7MM was valued at USD 33,803 million in 2025 and is projected to reach USD 39,239 million by 2034 over the forecast period from 2025 to 2034.

-

The Psoriasis market is projected to grow at a CAGR of 1.70% by 2034 in leading countries (US, EU4, UK and Japan).

- Among the 7MM, the US captured the highest psoriasis market with ~USD 26,740 million in 2024, which is projected to rise by 2034.

Psoriasis Market and Epidemiology Analysis

- The psoriasis treatment landscape is changing rapidly, driven by the continuous emergence of novel therapies. These new options offer remarkable efficacy, each with unique characteristics and safety profiles, ensuring that significant improvements are now achievable for virtually all patients who seek them. Treatment decisions are increasingly made through shared decision-making, balancing efficacy, safety, convenience, preferences, and economic consideratios.

- Tumor necrosis factor-alpha (TNF-a) inhibitors (including ENBREL, REMICADE, HUMIRA, and CIMZIA) were the first biologic drugs approved for treating moderate to severe psoriasis.

- In 2024, CMS announced the new negotiated prices for the 10 drugs selected under the Inflation Reduction Act (IRA), including STELARA (ustekinumab) and ENBREL (etanercept), which are expected to face biosimilar competition in the 2025 and 2029, respectively.

- IL-23 inhibitors like TREMFYA, SKYRIZI, and ILUMYA are known for being well-tolerated and having a solid safety track record over time. Meanwhile, IL-17 inhibitors such as COSENTYX, TALTZ, and SILIQ have demonstrated faster psoriasis clearance than IL-23 inhibitors.

- Real-world data show that treatment switching in psoriasis is common, with many patients transitioning from oral therapies to biologics like HUMIRA, STELARA, or ENBREL, often due to better efficacy or tolerability; newer agents like SKYRIZI, TREMFYA, ILUMYA, and oral options like SOTYKTU reflect evolving preferences toward treatments offering long-term control, safety, and convenience.

- Psoriasis is a chronic, immune-mediated disease resulting from the overproduction of skin cells accumulating on the skin’s surface, which causes red, scaly plaques that may itch and bleed.

- Epidemiology assessed for psoriasis showed that the US, in 2024, accounted for approximately 8,018,610 diagnosed prevalent cases of psoriasis.

- Emerging psoriasis drugs development pipeline for Psoriasis include Zasocitinib (TAK-279) (Takeda/Nimbus Therapeutics), and Icotrokinra (JNJ-77242113) (Johnson & Johnson Innovative Medicine and Protagonist Therapeutics), as well as ESK-001 (Alumis), among others.

DelveInsight's ‘Psoriasis Market Insights, Epidemiology and Market Forecast 2034’ report delivers an in-depth understanding of the Psoriasis, historical and forecasted epidemiology as well as the Psoriasis therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Psoriasis therapeutics market report provides current treatment practices, emerging psoriasis drugs, psoriasis market share of individual therapies, and current and forecasted 7MM Psoriasis market size from 2020 to 2034. The psoriasis market report also covers current Psoriasis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the psoriasis market underlying potential.

Key Factors Driving the Psoriasis Market

Rising Psoriasis Disease Prevalence

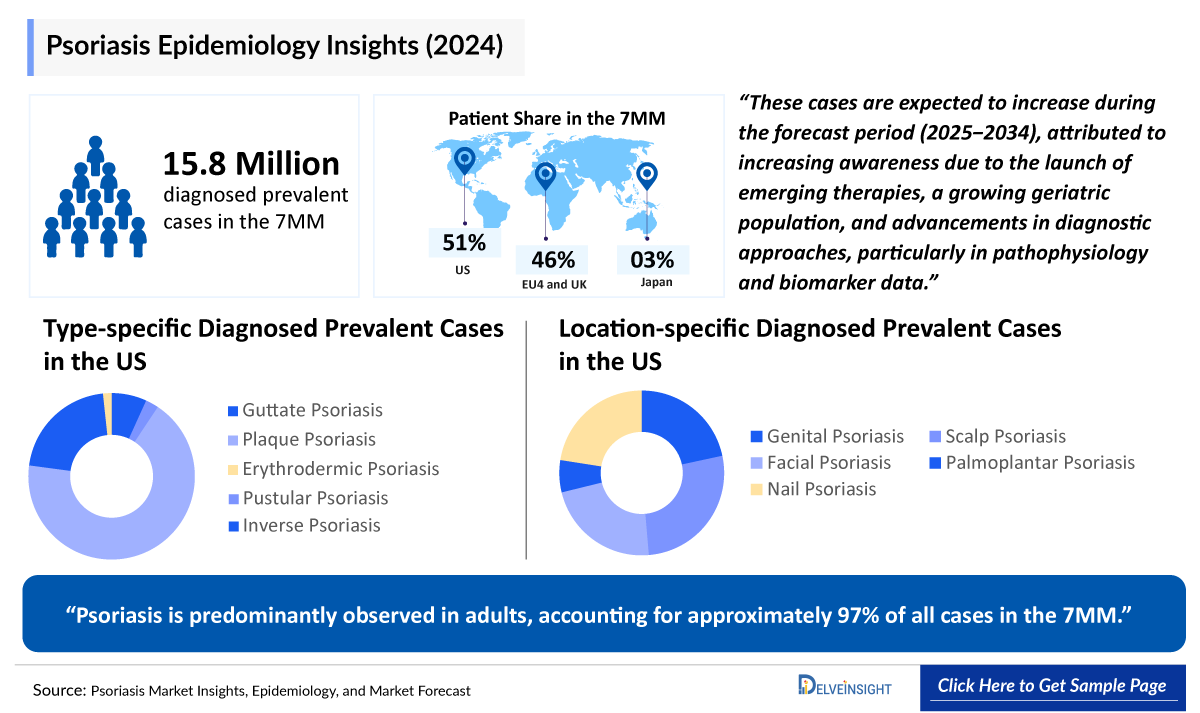

The global prevalence of psoriasis is increasing, with approximately 125 million people affected worldwide. The total number of diagnosed prevalent cases of psoriasis in the 7MM was 15.8 million in 2024. These cases are expected to increase during the forecast period (2025−2034), attributed to increasing awareness due to the launch of emerging therapies, a growing geriatric population, and advancements in diagnostic approaches, particularly in pathophysiology and biomarker data.

Advancements in Biologic Psoriasis Therapies

Innovations in biologic treatments, Tumor necrosis factor-alpha (TNF-α) inhibitors (including ENBREL, REMICADE, and HUMIRA), IL-23 inhibitors (like TREMFYA, SKYRIZI, and ILUMYA), IL-17 inhibitors (such as COSENTYX, TALTZ, and SILIQ ), and others are revolutionizing psoriasis care.

Psoriasis Competitive Landscape

The emerging landscape holds a diverse range of therapeutic alternatives for psoriasis treatment, including zasocitinib (Takeda/Nimbus Therapeutics), icotrokinra (JNJ-77242113 [Johnson & Johnson Innovative Medicine and Protagonist Therapeutics]), piclidenoson (CF101 [Can-Fite BioPharma]), ESK-001 (Alumis), SFA-002 (SFA Therapeutics), and others. The expected launch of these therapies shall further create a positive impact on the psoriasis market.

Emerging Oral Psoriasis Therapies in Development

Current emerging psoriasis drugs, including zasocitinib, ESK-001, piclidenoson, SFA-002, and icotrokinra, consist mainly of oral therapies, offering a potent alternative to injectable biologics and meeting demand from patients seeking convenience without compromising efficacy.

Promise of Takeda/Nimbus Therapeutics’ Zasocitinib

Zasocitinib, a TYK2 inhibitor in Phase III trials, shows promise with its high efficacy and favorable safety profile compared to traditional JAK inhibitors. With up to one-third of patients achieving complete clearance, it represents a new frontier in oral psoriasis treatment.

Psoriasis Disease Understanding

Psoriasis Overview

Psoriasis is a chronic (long-lasting) disease in which the immune system becomes overactive, causing skin cells to multiply too quickly. Patches of skin become scaly and inflamed, most often on the scalp, elbows, or knees, but other parts of the body can be affected as well.

The symptoms of psoriasis can sometimes go through cycles, flaring for a few weeks or months followed by periods when they subside or go into remission. There are many ways to treat psoriasis, and your treatment plan will depend on the type and severity of disease Clinical manifestations of chronic pancreatitis include recurrent severe abdominal pain, weight loss, steatorrhea, diabetes mellitus, nausea, vomiting, bloating, indigestion, and changes in bowel habits. Complications such as pseudocysts, pancreatic duct strictures, bile duct obstruction, and pancreatic cancer may also occur.

Psoriasis is a chronic, immune-mediated disease resulting from the overproduction of skin cells accumulating on the skin’s surface, which causes red, scaly plaques that may itch and bleed.

Psoriasis Diagnosis

Dermatologists can identify psoriasis lesions and diagnose the condition during a physical exam. Occasionally, the doctor may recommend a biopsy to remove a small amount of skin for laboratory testing to distinguish psoriasis from another cause of a rash, such as eczema.

Physical examination

A dermatologist examines the skin and notes the location, distribution, size, shape, and appearance of lesions. During a physical exam, they may also enquire about symptoms and medical history, including whether someone else in the family has been diagnosed with psoriasis.

Skin biopsy

A biopsy is a test in which a pathologist examines skin cells under a microscope to determine whether psoriasis is the cause of symptoms. Dermatologists usually perform a punch biopsy. The “punch” name describes the technique: the doctor uses a device the size and shape of a pencil to puncture the skin and remove a small tissue sample.

Further details are provided in the report.

Psoriasis Treatment

Psoriasis treatments have come a long way and are now more effective than ever. Managing psoriasis can greatly improve symptoms and also help reduce the risk of related health conditions like psoriatic arthritis, heart disease, obesity, diabetes, and depression. Treatment is tailored to the type and severity of psoriasis, as well as the areas affected. It often starts with gentle options such as topical creams and may move to more advanced therapies if needed.

Treatments fall into 3 categories:

- Topical- Creams and ointments applied to your skin

- Phototherapy- Your skin is exposed to certain types of ultraviolet light

- Systemic- Oral and injected medications that work throughout the entire body

Topical treatments

For mild to moderate psoriasis, topical treatments are typically the first option. These include creams and ointments applied directly to the affected skin. Some individuals find these treatments sufficient to manage their condition, though it can take up to six weeks to see visible improvement.

Phototherapy

Phototherapy treats psoriasis using both natural and artificial light. Artificial light therapy is typically administered in hospitals or specialist clinics under the supervision of a dermatologist. It's important to note that this type of treatment is different from using a sunbed.

- Ultraviolet B (UVB) phototherapy

- Psoralen plus ultraviolet A (PUVA)

Systemic

Systemic treatments are often recommended for individuals with severe psoriasis or in cases where other treatment methods have proven ineffective. These medications work by targeting the entire body and can be highly effective in controlling the symptoms of psoriasis.

Several injectable medications are available to treat moderate to severe psoriasis, especially when other treatments have not been effective. These drugs target the immune system to help reduce inflammation and control symptoms, often showing improvement within weeks. Options include COSENTYX (secukinumab), ENBREL (etanercept), REMICADE (infliximab), HUMIRA (adalimumab), STELARA (ustekinumab), and others.

Further details related to country-based variations are provided in the report.

Psoriasis Epidemiology

As the psoriasis therapeutics market is derived using a patient-based model, the Psoriasis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented total diagnosed prevalence cases of psoriasis in the 7MM, type-specific diagnosed prevalence cases of psoriasis in the 7MM, location-specific diagnosed prevalence cases of psoriasis in the 7MM, severity-specific diagnosed prevalence cases of psoriasis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- The total number of diagnosed prevalent cases in the 7MM ranges from 15,887,640 in 2024.

- Among the location-specific contribution, scalp psoriasis had the highest occurrence of cases from 4,811,170 in 2024 in the US.

- In EU4 and the UK, plaque psoriasis cases were maximum in Germany with 2,099,495 in 2024, whereas the minimum number of cases were in Spain, with 1,042,368 cases in 2024.

- Psoriasis is predominantly observed in adults, accounting for approximately 97% of all cases in the 7MM, in 2024.

- The total number of diagnosed prevalent cases of psoriasis in Japan is projected to reach from 490,772 in 2024.

- Among EU4 countries, Germany accounted for the maximum number of psoriasis cases followed by the UK, whereas Spain accounted for the minimum cases, in 2024.

Psoriasis Epidemiology Segmentation:

- Total Diagnosed Prevalent Cases of Psoriasis in the 7MM

- Type-specific Diagnosed Prevalent Cases of Psoriasis in the 7MM

- Location-specific Diagnosed Prevalent Cases of Psoriasis in the 7MM

- Severity-specific Diagnosed Prevalent Cases of Psoriasis in the 7MM

Psoriasis Recent Developments and Breakthroughs

- In March 2025, SFA Therapeutics announced the presentation of two head-to-head preclinical studies of its oral psoriasis treatment candidate, SFA-002, at the American Academy of Dermatology Annual Meeting in Orlando, Florida.

Psoriasis Drug Chapters

The drug chapter segment of the Psoriasis report encloses a detailed analysis of Psoriasis marketed drugs and late-stage (Phase III, Phase II/III, Phase II, Phase I/II, and Phase I) pipeline psoriasis drugs. The marketed drugs segment encloses drugs such as BIMZELX (UCB Pharma), VTAMA (Organon Pharmaceuticals), and COSENTYX (Novartis), among others. It also helps understand the Psoriasis clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Psoriasis Drugs

BIMZELX: UCB Pharma

BIMZELX (bimekizumab) is a monoclonal antibody that selectively neutralizes interleukin 17A (IL17A) and interleukin 17F (IL17F). In vitro, IL17A and IL17F are only moderate signal activators, but they cooperate with other proinflammatory cytokines, including tumor necrosis factor (TNF), to amplify inflammatory responses.

In March 2025, UCB announced further long-term data from the Phase III trials, and their open-label extensions, investigating BIMZELX in adults with moderate-to-severe plaque psoriasis (PSO) was presented as six posters at the 2025 American Academy of Dermatology (AAD) annual meeting in Orlando, Florida.

COSENTYX: Novartis

COSENTYX is a targeted treatment that specifically inhibits the IL-17A cytokine. COSENTYX delivers long-lasting clear or almost clear skin in the majority of patients, with proven sustainability, safety out to four years and convenient once-monthly dosing in a patient-friendly auto injector.

In June 2021, the US FDA approved the use of COSENTYX for the treatment of moderate to severe plaque psoriasis in pediatric patients 6 years old and older who are candidates for systemic therapy or phototherapy.

Emerging Psoriasis Drugs

Zasocitinib (TAK-279): Takeda/Nimbus Therapeutics

TAK-279 is a highly selective, oral allosteric TYK2 inhibitor in late-stage development, with approximately 1.3 million-fold greater selectivity for TYK2 as compared with JAK1. TAK-279 has the potential to become an important treatment option in multiple immune-mediated inflammatory diseases.

In Phase I studies, TAK-279 showed a good tolerability profile, a dose-dependent trend in exploratory clinical activity, and a pharmacokinetic profile allowing for once-daily solid oral dosing. In a Phase IIb study in patients with moderate-to-severe psoriasis, a statistically significant greater proportion of patients receiving TAK-279 achieved PASI 75, 90, and 100 in the 5 mg, 15 mg, and 30 mg dosing arms compared to placebo at 12 weeks. Currently, the drug is being investigated in Phase III and is anticipated to start a head-to-head vs. deucravacitinib trial in 2025.

Icotrokinra (JNJ-77242113): Johnson & Johnson Innovative Medicine and Protagonist Therapeutics

Icotrokinra is the first targeted oral peptide designed to selectively block the IL-23 receptor, which underpins the inflammatory response in moderate-to-severe plaque psoriasis and offers potential in other IL-23-mediated diseases. Icotrokinra binds to the IL-23 receptor with single-digit picomolar affinity and demonstrates potent, selective inhibition of IL-23 signaling in human T cells.

In April 2025, Johnson & Johnson released new icotrokinra data from a subgroup analysis of ICONIC-LEAD in moderate-to-severe plaque psoriasis to assess the efficacy and safety of systemic therapy in adolescents and adults simultaneously. These data were presented at the 2025 WCPD annual meeting.

ESK-001: Alumis

ESK-001 is an investigational next-generation TYK2 inhibitor that is designed to correct immune dysregulation across a spectrum of diseases driven by proinflammatory mediators, including IL-23, IL-17, and type 1 IFN. ESK-001's selective targeting is designed to deliver maximal inhibition while minimizing off-target binding and effects.

- In March 2025, Alumis announced positive 52-week results from its Phase II trial of ESK-001, an oral TYK2 inhibitor for moderate-to-severe plaque psoriasis. The data, presented at the AAD Annual Meeting, showed sustained or improved skin clearance, itch relief, and quality of life, with no new safety concerns.

Psoriasis Drug Class Insights

TNF inhibitors, are a group of medications that block tumor necrosis factor (TNF), a protein that drives inflammation, and are commonly used to treat inflammatory diseases such as psoriasis, psoriatic arthritis, and rheumatoid arthritis. This class includes drugs like infliximab, adalimumab, etanercept, and certolizumab.

PDE4 inhibitors, such as apremilast and roflumilast, are another category of drugs that have demonstrated effectiveness in managing psoriasis. They work by blocking the phosphodiesterase 4 (PDE4) enzyme, which normally breaks down cAMP- a molecule that helps control inflammation. This inhibition leads to the downregulation of inflammatory pathways, including those involving interleukin IL-17A/IL-17F. Additionally, TYK2 inhibitors and other emerging therapies are being used in the treatment of psoriasis.

Psoriasis Market Outlook

The psoriasis treatment landscape has advanced significantly over the years. In the past, patients were mainly treated with topical therapies such as corticosteroids and vitamin D analogues, along with conventional systemic treatments like methotrexate and cyclosporine. These options were helpful but had limitations, especially in moderate to severe cases. The introduction of biologic therapies marked a major turning point. The first biologics approved were TNF inhibitors (such as infliximab, adalimumab, and etanercept), which helped control inflammation more effectively.

Approved psoriasis treatment options such as BIMZELX (UCB Pharma), VTAMA (Organon Pharmaceuticals), and COSENTYX (Novartis) play a significant role in managing moderate to severe cases and emerging drug development pipeline for Psoriasis include Zasocitinib (Takeda/Nimbus Therapeutics) and Icotrokinra (Johnson & Johnson Innovative Medicine and Protagonist Therapeutics), as well as ESK-001 (Alumis), among others.

The psoriasis treatment market is growing steadily, driven by the increasing use of biologics, improved diagnosis, and rising awareness.

Further details will be provided in the report….

Psoriasis Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034. The analysis covers the Psoriasis market's uptake by drugs, patient uptake by therapy, and sales of each drug.

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034. The landscape of Psoriasis treatment has experienced a profound transformation with the uptake of novel medicines. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, professionals, and the entire healthcare community in their tireless pursuit of advancing care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Further detailed analysis of emerging therapies' drug uptake in the report…

Psoriasis Pipeline Development Activities

The Psoriasis pipeline report provides insights into different Psoriasis clinical trails within Phase III, Phase II/III, Phase II, Phase I/II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for chronic pancreatitis emerging therapies.

Latest KOL Views on Psoriasis

To keep up with current market trends, we take KOLs and SME's opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the chronic pancreatitis evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including MD, PhD, Instructor, Postdoctoral Researcher, Professor, Researcher, and Others.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 6+ KOLs in the 7MM. Centers such as the Johns Hopkins University, University Stanford University, and King’s College London, etc. were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Psoriasis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Psoriasis Report Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Psoriasis Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Psoriasis Treatment Market Report

- The psoriasis market report covers a segment of key events, an executive summary, a descriptive overview of Psoriasis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of the diagnosis rate, and disease progression along treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Psoriasis market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Psoriasis market.

Psoriasis Treatment Market Report Insights

- Psoriasis Patient population

- Psoriasis Therapeutic approaches

- Psoriasis pipeline analysis

- Psoriasis market size and trends

- Existing and future market opportunity

Psoriasis Treatment Market Report Key Strengths

- Ten-year forecast

- 7MM coverage

- Psoriasis epidemiology segmentation

- Key cross competition

- Highly analyzed market

- Psoriasis Drug uptake

Psoriasis Treatment Market Report Assessment

- Current Psoriasis treatment practices

- Psoriasis Unmet needs

- Psoriasis Pipeline product profiles

- Psoriasis Market attractiveness

- Qualitative analysis (SWOT and conjoint analysis)

- Psoriasis Market Drivers

- Psoriasis Market Barriers

FAQs

Psoriasis Market Insights

- What was the Psoriasis market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- What can be the future treatment paradigm of Psoriasis?

- What are the disease risks, burdens, and unmet needs of Psoriasis? What will be the growth opportunities across the 7MM concerning the patient population with Psoriasis?

- Who is the major competitor of statins in the market, and how will the competitors affect their market share?

- What are the current options for the treatment of Psoriasis? What are the current guidelines for treating Psoriasis in the US, Europe, and Japan?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

Reasons to Buy Psoriasis Market Forecast Report

- The psoriasis market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Psoriasis market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand KOLs’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing psoriasis treatment market so that the upcoming players can strengthen their development and launch strategy.

Get detailed insights @ DelveInsight Blogs