Rare NRG1 Fusion Market

- For NRG1 fusions, there are currently no approved targeted therapies. Standard therapy for advanced tumors harboring NRG1 fusions remains chemotherapy and/or immunotherapy or novel anti–PD-1 or anti–PD-L1 agents.

- The growth of the rare NRG1 fusions market is expected to be mainly driven by expected launch and readily adoption of upcoming tumor-agnostic therapies, expected increase in NRG1 gene fusion testing rate in clinical practice, active research and development, and repurposing of drugs and advancement of precision medicines.

- Occurrence of NRG1 fusions are coming rare condition and along with premium pricing company can also get the orphan designations and can get additional benefits like 7 years of market exclusivity in the US, clinical trials subsidies and reduced regulatory fees, and other benefits. Other than orphan designation benefits, company can also get fast track designation and priority review which will expedite the approval process and also will lessen the development cost and time.

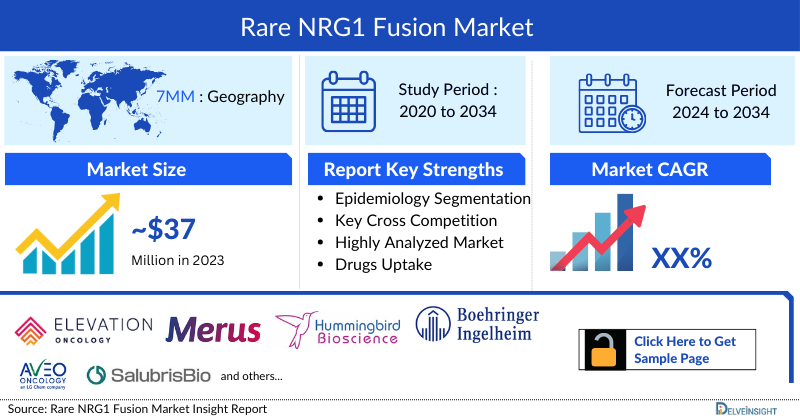

- The total market size of NRG1 fusion in the 7MM was approximately USD 37 million in 2023 and is projected to increase during the forecast period (2024–2034).

- NRG1 gene fusions are rare across different types of cancer, with a reported incidence of ~0.2% across solid tumors, with the notable exception of IMA, which represents ~2%–10% of lung adenocarcinomas.

- The total number of incident cases of Rare NRG1 Fusion in the 7MM was around 5,800 in 2023.

DelveInsight's “Rare NRG1 Fusion Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Rare NRG1 Fusion, historical and forecasted epidemiology as well as the Rare NRG1 Fusion therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Rare NRG1 Fusion Market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Rare NRG1 Fusion market size from 2020 to 2034. The report also covers current Rare NRG1 Fusion treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Rare NRG1 Fusion Market |

|

|

Rare NRG1 Fusions Market Size | |

|

Rare NRG1 Fusion Companies |

Elevation Oncology, Merus, Hummingbird Bioscience, Boehringer Ingelheim, AVEO Oncology, CANbridge Pharmaceuticals, Salubris Biotherapeutics, ānd others. |

|

Rare NRG1 Fusion Epidemiology Segmentation |

|

Rare NRG1 Fusion Treatment Market

Rare NRG1 Fusion Overview

Oncogenic gene fusions are hybrid genes that result from structural DNA rearrangements, leading to deregulated activity. Fusions involving the neuregulin-1 gene (NRG1) result in ErbB-mediated pathway activation and therefore present a rational candidate for targeted treatment. The most frequently reported NRG1 fusion is CD74-NRG1, which most commonly occurs in patients with invasive mucinous adenocarcinomas (IMAs) of the lung, although several other NRG1 fusion partners have been identified in patients with lung cancer, including ATP1B1, SDC4, and RBPMS. NRG1 fusions are also present in patients with other solid tumors, such as pancreatic ductal adenocarcinoma. In general, NRG1 fusions are rare across different types of cancer.

Rare NRG1 Fusion Diagnosis

Fusion proteins and genes in solid tumors were detected primarily using immunohistochemistry and fluorescence in situ hybridization (FISH) techniques; important advances in gene fusion detection include DNA next-generation sequencing (NGS) and the introduction of targeted gene fusion panels on RNA. The gold standard for detection of NRG1 gene fusions is RNA sequencing in comparison with DNA sequencing. RNA-sequencing is associated with higher sensitivity for genetic rearrangements and can increase the detection of NRG1 gene fusions compared with DNA-based methods, which often do not cover the large introns in NRG1.

Further details related to country-based variations in diagnosis are provided in the report…

Rare NRG1 Fusion Treatment

For NRG1 fusions, there are currently no approved targeted therapies. Standard therapy for advanced tumors harboring NRG1 fusions remains chemotherapy and/or immunotherapy or novel anti–PD-1 or anti–PD-L1 agents. The problem with utilizing these therapies is that response tends to be suboptimal for patients with NRG1 fusions. Development of new drugs for rare diseases is challenging, but the evaluation of drugs already approved for other indications is a pragmatic option. In the case of NRG1 fusion-driven tumors, existing ErbB-targeted treatments have potential as targeted therapies in tumors harboring NRG1 fusions. As NRG1 proteins are ligands of ErbB receptors, ErbB targeted treatments, such as monoclonal antibody zenocutuzumab (MCLA-128) and small molecules such as afatinib, are of particular interest.

Note: Further Details are provided in the final report....

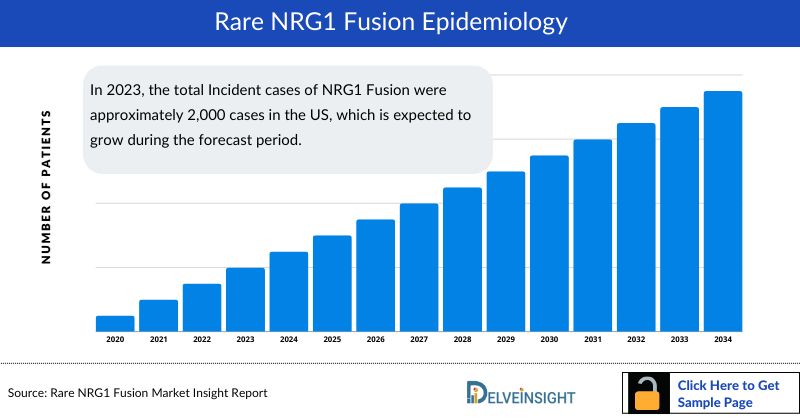

Rare NRG1 Fusion Epidemiology

The Rare NRG1 Fusion epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total Incident cases of NRG1 Fusion, stage-specific cases of NRG1 Fusion, total treated cases of NRG1 Fusion in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM, the US accounted for the highest incident cases of NRG1 Fusion in 2023.

- In 2023, the total Incident cases of NRG1 Fusion were approximately 2,000 cases in the US, which is expected to grow during the forecast period.

- Among EU4 and the UK, Germany accounted for the highest number of NRG1 Fusion Incident cases, while Spain accounted for the least Incident cases.

- Among the stage-specific incident cases of NRG1 Fusion, metastatic cases contribute the most in the US.

- NSCLC accounts for around 40% of total treated cases of NRG1 Fusions in 2023.

Rare NRG1 Fusion Drug Chapters

The drug chapter segment of the Rare NRG1 Fusion report encloses a detailed analysis of Rare NRG1 Fusion emerging drugs of late-stage (Phase I and Phase II) pipeline drugs. It also deep dives into the Rare NRG1 Fusion pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Rare NRG1 Fusion Marketed Drugs

Currently, there are no approved targeted therapies for NRG1 fusions. Standard therapy for advanced tumors harboring NRG1 fusions remains chemotherapy and/or immunotherapy or novel anti–PD-1 or anti–PD-L1 agents.

Rare NRG1 Fusion Emerging Drugs

Seribantumab (MM-121): Elevation Oncology

Seribantumab (MM-121) is a fully human monoclonal antibody by Elevation Oncology. It is designed to stop the HER3 signaling that sustains an NRG1 fusion-positive tumor. Seribantumab binds to HER3, so the NRG1 fusion protein that over-activates it cannot bind to it. Seribantumab is being developed as a precise treatment path for patients whose tumor growth is driven by an NRG1 fusion. Seribantumab is currently in the Phase II CRESTONE study clinical development stage. It is now being studied in patients with solid tumors of any origin that test positive for an NRG1 fusion. The topline data from the CRESTONE Phase II study was presented at AACR Annual meeting 2023.

In May 2022, the US FDA granted the drug with Fast Track Designation for the treatment of advanced solid tumors that harbor NRG1 gene fusions.

Zenocutuzumab (MCLA-128): Merus

Zenocutuzumab (MCLA-128) is an experimental medicine developed by Merus. It blocks the action of the growth factor NRG1, a protein that can be overproduced due to NRG1 fusions, and prohibits it from binding to HER3. It is a bispecific antibody, i.e., it can recognize two different proteins, specifically HER2 and HER3. It is designed to have a dock and block mechanism. First, zenocutuzumab (MCLA-128) docks onto HER2, which then leads to blocking HER3’s ability to bind NRG1. Currently, zenocutuzumab is in the Phase II clinical development stage to treat NRG1 fusion solid tumors. This trial is a Phase I/II study of MCLA-128, a full-length IgG1 bispecific antibody targeting HER2 and HER3, in solid tumors patients and is still in the recruiting stage for the Phase II part of the trial. Merus also announced initial clinical data for three patients with cancers harboring NRG1 fusions treated with MCLA-128 through EAP.

In Januray 2021, the US FDA granted Fast Track Designation to Zenocutuzumab for the treatment of patients with metastatic solid tumors harboring NRG1 gene fusions (NRG1+ cancers) that have progressed on standard of care therapy.

|

Comparison of emerging drugs for Rare NRG1 Fusion | ||||

|

Drug name |

Company |

RoA |

MoA |

Phase |

|

HMBD-001 |

Hummingbird Bioscience |

Intravenous infusion |

HER3 inhibitor |

I/II |

|

AV-203 |

HER3 inhibitor |

Intravenous |

HER3 inhibitor/ERBB-3 receptor antagonists |

I |

Note: Detailed emerging therapies assessment will be provided in the final report.

Drug Class Insights

The landscape of NRG1 Fusion drug development involves HER3 inhibitor/ERBB-3 receptor antagonists, Tyrosine kinase inhibitor. ERBB family members including epidermal growth factor receptor (EGFR) also known as HER1, ERBB2/HER2/Neu, ERBB3/HER3 and ERBB4/HER4 are aberrantly activated in multiple cancers and hence serve as drug targets and biomarkers in modern precision therapy. The therapeutic potential of HER3 has long been underappreciated, due to impaired kinase activity and relatively low expression in tumors. However, HER3 has received attention in recent years as it is a crucial heterodimeric partner for other EGFR family members and has the potential to regulate EGFR/HER2-mediated resistance.

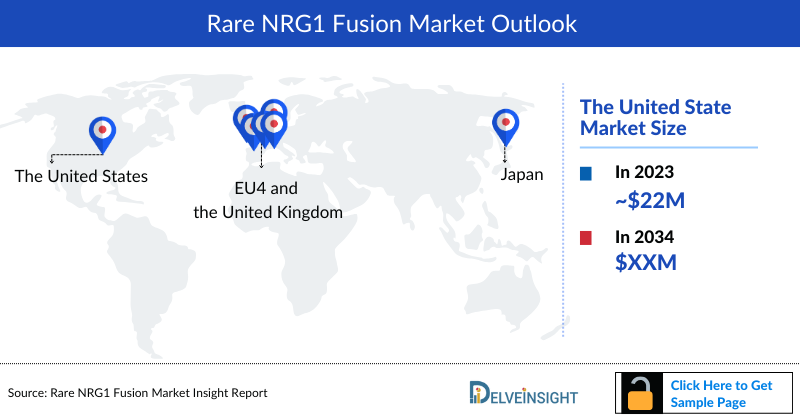

Rare NRG1 Fusion Market Outlook

NRG1 fusions have been identified in over 10 solid tumor types, making it a strong candidate for a tumor-agnostic development approach. Moreover, an increase in awareness, research, and development can be seen in this area making it an attractive opportunity for the key players. Several ERBB3 inhibitors showing promising preclinical data are currently in different phases of clinical trials. Several of these are being tested in combination with ERBB2-targeting drugs in breast and gastric ERBB2-positive tumors.

Out of all the emerging players Merus’s zenocutuzumab is currently leading the race to become the first drug to cross the registration line in NRG1 fusion. The data presented at ASCO 2022 looks promising, there have been five prior approvals for tumor agnostic settings for solid tumors (among them, response rates ranged from 29% to 75% with durability of 5 months all the way to 1 year. Another contender like Seribantumab, and other potential drugs that are currently being studied have a slightly different mechanism, as they require binding to more than 1 HER agent, typically HER2 and HER3. Studies are still ongoing to find out whether binding to HER3 or binding to mutual HER2 and HER3 is a more effective mechanism.

At present, some companies have indulged themselves in initiating clinical trials that investigate new treatment options or studying how to use existing treatment options better. Key players such as Elevation Oncology (Seribantumab), Merus (Zenocutuzumab), AVEO Oncology (AV-203), Hummingbird Bioscience (HMBD-001), and several others are investigating their candidates for the management of Rare NRG1 Fusions.

- The total market size of NRG1 Fusion in the United States was approximately USD 22 million in 2023 and is projected to increase during the forecast period (2024–2034).

- Among EU4 countries, Germany accounted for the maximum market size in 2023, while Spain occupied the bottom of the ladder.

- In the market size of NRG1 Fusion by therapies , the highest revenue was generated by current/off-label therapies in the United States in 2023.

Rare NRG1 Fusion Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

With Merus's zenocutuzumab and Seribantumab emerging as key contenders in the NRG1 fusion treatment landscape, the market anticipation is palpable. Zenocutuzumab, leading the race with its promising data presented at ASCO 2022 and backed by Fast Track Designation from the US FDA, holds potential as the first drug to reach the registration line for NRG1 fusion. Its unique bispecific antibody targeting HER2 and HER3 simultaneously offers a novel therapeutic approach for patients with NRG1 fusion-positive cancers. However, Seribantumab, with its distinct mechanism of action requiring binding with a single HER agent and recent Fast Track Designation from the FDA, presents a compelling alternative. With ongoing studies and potential market entry for these innovative therapies, the future holds significant promise for advancements in NRG1 fusion treatment.

Further detailed analysis of emerging therapies drug uptake in the report…

Rare NRG1 Fusion Activities

The report provides insights into Rare NRG1 Fusion clincial trials Phase I and II. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Rare NRG1 Fusion emerging therapies. Companies likes Elevation Oncology and Merus are actively engage in late-stage research and development efforts for Rare NRG1 Fusion. Despite the relatively limited pipeline of potential drugs for this condition, the outlook for the therapeutics market is positive, with anticipated growth from 2024 to 2034. This optimism is fueled by ongoing advancements in understanding Rare NRG1 Fusion biology, coupled with increased investment in innovative treatment approaches.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific Writers, Professors, and others.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 18+ KOLs in the 7MM. Centers such as Sarcoma Oncology Center, Abramson Cancer Center, UC Davis Comprehensive Cancer Center in Sacramento etc. were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Rare NRG1 Fusion market trends.

|

KOL Views |

|

“In thoracic oncology, we have become comfortable with chasing down rare but actionable slices of the oncogene pie; NTRK fusions are a great example of this. If you think your NGS [next-generation sequencing] panel should include NTRK, then it should also include NRG1; they are largely mutually exclusive with other oncogenes so they are a true driver” |

|

“In pancreatic cancer, about 7% or less of patients will have KRAS wild-type cancer. Out of these KRAS wild-type tumors, [up to about] 20% could have an NRG1 fusion.” |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

The analyst views analyze multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Market Access and Reimbursement

Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders. The payment models are based on clinical outcomes, annuity payments, and expanded risk pools. The pharmaceutical companies must grant the following rebates: the general rebate of 7% of the manufacturer’s price will be paid by the pharmaceutical companies to the SHIs (Statutory health insurance funds) for all pharmaceuticals that are not subject to more specific price regulations. A special rebate of 10% of the manufacturer’s price is to be paid by the pharmaceutical companies to the SHIs for generics. Special rebates for vaccines are to be paid by the pharmaceutical companies to the SHIs and are calculated based on actual average prices in the four member states of the EU with gross national incomes.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Rare NRG1 Fusion Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Rare NRG1 Fusion, explaining its causes, signs and symptoms, pathogenesis, and currently available and emerging therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will impact the current treatment landscape.

- A detailed review of the Rare NRG1 Fusion market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Rare NRG1 Fusion Market.

Rare NRG1 Fusion Report Insights

- Rare NRG1 Fusion Patient Population

- Rare NRG1 Fusion Therapeutic Approaches

- Rare NRG1 Fusion Pipeline Analysis

- Rare NRG1 Fusion Market Size and Trends

- Existing and future Market Opportunity

Rare NRG1 Fusion Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- Rare NRG1 Fusion Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Rare NRG1 Fusion Drugs Uptake

- Key Rare NRG1 Fusion Market Forecast Assumptions

Rare NRG1 Fusion Report Assessment

- Current Rare NRG1 Fusion Treatment Practices

- Rare NRG1 Fusion Unmet Needs

- Rare NRG1 Fusion Pipeline Product Profiles

- Rare NRG1 Fusion Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Rare NRG1 Fusion Market Drivers

- Rare NRG1 Fusion Market Barriers

FAQs

- What is the historical and forecasted Rare NRG1 Fusion patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the total Rare NRG1 Fusion market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved and off-label therapies?

- What are the disease risks, burdens, and unmet needs of Rare NRG1 Fusion? What will be the growth opportunities across the 7MM concerning the patient population with Rare NRG1 Fusion ?

- What are the current and emerging options for treating Rare NRG1 Fusion?

- How many companies are developing therapies to treat Rare NRG1 Fusion?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

Reasons to buy Rare NRG1 Fusion Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Rare NRG1 Fusion market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.