Surgical Energy Generators Market Summary

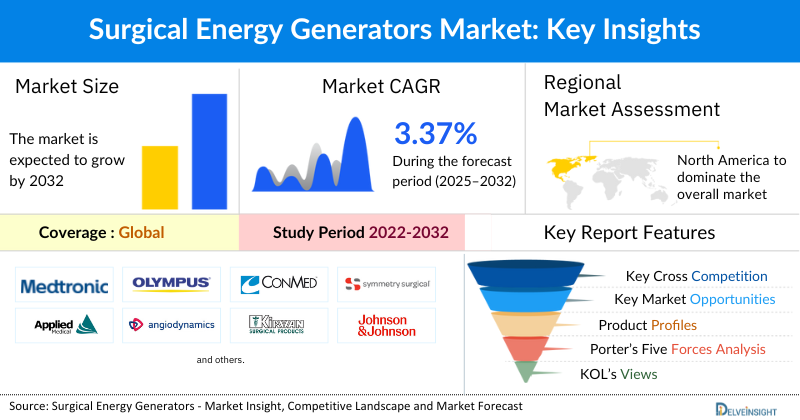

- The Surgical Energy Generators Market Size is estimated to grow at a CAGR of 3.37% during the forecast period from 2025 to 2032.

- The leading Surgical Energy Generators Companies such as Medtronic, Olympus Corporation, CONMED Corporation, Symmetry Surgical Inc., Applied Medical Resources Corporation, ERBE GmbH, AngioDynamics, Kirwan Surgical Products, LLC, KARL STORZ GmbH, Sutter Medizintechnik GmbH, STARmed Co., Ltd., Johnson & Johnson Services, Inc., CooperSurgical Inc., MEDGYN PRODUCTS, INC., Stryker, Bramsys, Boston Scientific Corporation, RF Medical Co., Ltd., OSYPKA AG, Avanos Medical, Inc., and others.

Request for unlocking the Sample Page of the "Surgical Energy Generators Market Trends"

Key Factors Driving the Surgical Energy Generators Market Growth

-

Rising Adoption of Minimally Invasive Surgeries: Minimally invasive procedures, such as laparoscopic and robotic surgeries, are increasingly preferred due to reduced recovery time, lower infection risks, and shorter hospital stays. Surgical energy generators, like electrosurgical and ultrasonic devices, are essential tools in MIS, fueling market demand.

-

Technological Advancements in Energy Devices: Innovations in monopolar, bipolar, and ultrasonic surgical generators have enhanced precision, safety, and efficiency. Smart energy systems with integrated feedback and tissue-sensing capabilities are attracting hospitals and surgical centers to upgrade, driving market growth.

-

Increasing Prevalence of Chronic Diseases and Surgical Procedures: The global rise in cancer, cardiovascular disorders, and obesity-related complications is resulting in more surgical interventions. This surge directly increases the requirement for advanced surgical energy devices to ensure safe and effective procedures.

-

Rising Healthcare Infrastructure Investments: Expansion of healthcare facilities, particularly in emerging economies, along with government initiatives to modernize surgical departments, is boosting the adoption of high-tech surgical energy generators.

-

Growing Awareness of Surgical Safety and Efficiency: Hospitals are emphasizing enhanced patient outcomes, reduced blood loss, and shorter operating times. Surgical energy generators offer precise tissue cutting and coagulation, which aligns with this trend, encouraging adoption and fueling market growth.

Surgical Energy Generators Market by Product Type (Monopolar Generators, Bipolar Generators, and Combination Generators), Application (Cardiology, Gynecology, ENT, Bariatric, Orthopedic, and Others), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2032 owing to the increasing instances of chronic disorders leading to increasing number of surgical procedures, increasing cases of plastic surgeries, and increase in product development activities among the key Market players worldwide.

The Surgical Energy Generators Market is estimated to grow at a CAGR of 3.37% during the forecast period from 2025 to 2032. The Surgical Energy Generators Market is expanding rapidly due to the increasing prevalence of chronic disorders such as cancer, cardiovascular disorders, gastrointestinal disorders, among others, which is creating a sustained demand for surgical interventions. Additionally, the rise in obesity linked to sedentary lifestyles has led to a surge in surgical procedures globally. Another major contributor is the growing adoption of minimally invasive surgical techniques, which rely heavily on energy-based devices for precision and efficiency. Together, these factors are expected to drive significant growth in the Surgical Energy Generators Market throughout the Surgical Energy Generators Market Forecast period from 2025 to 2032.

Surgical Energy Generators Market Segment Analysis

Surgical Energy Generators Market by Product Type (Monopolar Generators, Bipolar Generators, and Combination Generators), Application (Cardiology, Gynecology, ENT, Bariatric, Orthopedic, and Others), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the Surgical Energy Generators Market, the combination generators category is expected to have a significant revenue share in the year 2024. This is because of the widespread use and features of combination generators that enhance their utility and effectiveness. Combination generators are versatile devices that integrate multiple energy modalities, such as monopolar, bipolar, ultrasonic, and advanced energy sources, into a single platform. This versatility allows them to be used across a wide range of surgical procedures, from general surgery to specialized fields like urology, gynecology, and thoracic surgery. The primary advantage of combination generators is their ability to switch seamlessly between different energy types, enabling surgeons to perform various functions such as cutting, coagulation, dissection, and tissue sealing. This not only improves efficiency in the operating room but also enhances surgical precision and reduces procedure times.

Additionally, these generators are often equipped with advanced features like automatic energy adjustment, user-friendly interfaces, and safety mechanisms that ensure optimal performance and minimize the risk of complications. By consolidating multiple energy sources into one device, combination generators offer a comprehensive solution that meets the diverse needs of modern surgical practices.

Moreover, the increase in product development activities among the key Market players is further boosting the Market of the segment. For instance, in March 2025, Johnson & Johnson MedTech announced the launch of the DUALTO™ Energy System, a multi-modality surgical generator designed for open and minimally invasive procedures. The system, which integrates monopolar, bipolar, ultrasonic, and advanced bipolar energy, received FDA 510(k) clearance and was designed to work with the Polyphonic™ Fleet device management software and future integration with the OTTAVA™ Robotic Surgical System. Therefore, the widespread use and various features of combination generators enhance performance and usability, solidifying the significant impact on the growth of the overall Surgical Energy Generators Market Forecast period from 2025 to 2032.

Get More Insights into the Report @ Surgical Energy Generators Market Trends

What are the latest Surgical Energy Generators Market Dynamics and Trends?

According to the data provided by the World Health Organization (WHO) in 2024, the International Agency for Research on Cancer (IARC) stated that 20 million new instances of cancer were registered globally in 2022. Additionally, as per the same source, lung cancer accounted for 2.5 million new cases globally, of all the registered new cancer cases, making it the most common cancer. Surgical Energy Generators play a crucial role in cancer treatment by enabling precise cutting, coagulation, and tissue sealing during tumor removal surgeries. They are used in various procedures, including lung cancer surgeries, to ensure effective resection with minimal blood loss and improved patient outcomes, thereby boosting the overall Surgical Energy Generators Market.

Additionally, according to the data provided by the International Society of Aesthetic Plastic Surgery, in 2023, the top procedures performed were eyelid with more than 1.7 million procedures and a 24% increase, rhinoplasty with 1.1 million procedures and a 21.6% increase, and lip enhancement/perioral procedures with 0.9 million and a 29% increase. There were 4.1 million breast procedures, and 5.1 million body and extremities procedures. Plastic surgeries often require Surgical Energy Generators, especially for procedures that involve cutting, coagulation, tissue dissection, or hemostasis (controlling bleeding). These energy-based devices enhance precision, reduce blood loss, and minimize tissue damage, which is crucial in cosmetic and reconstructive surgery where aesthetic outcomes are critical.

According to the data provided by the World Health Organization (2024), in 2022, globally, out of 8 people, 1 person was living with obesity. Furthermore, as per the same source in 2022, approximately 2.5 billion people were overweight, and out of these, 890 million people were living with Obesity worldwide. As the prevalence of obesity and related comorbidities continues to rise globally, there is a growing demand for bariatric surgery as an effective treatment option for severe obesity. This increased demand for bariatric procedures directly translates to a higher demand for Surgical Energy Generators used in these surgeries.

Moreover, the increase in product development activities among the key companies is further boosting the overall Surgical Energy Generators Market. For instance, In January 2023, Apyx Medical Corporation introduced its newest Renuvion generator, the Apyx One Console, to the US Market, marking the launch of its latest-generation technology. Therefore, the factors stated above collectively will drive the overall Surgical Energy Generators Market growth. However, unintended thermal injury to surrounding tissues, leading to burns, scarring, or delayed wound healing, and the availability of alternative procedures, among others, may prove to be challenging factors for the Surgical Energy Generators Market.

Surgical Energy Generators Market Size is anticipated to be dominated by North America

Among all the regions, North America is expected to dominate the Surgical Energy Generators Market in the year 2024. The growth is attributed to the increasing number of orthopedic surgeries, coupled with a rising demand for aesthetic procedures across the region. In addition, advancements in surgical energy generator technology, supportive regulatory frameworks, and the continuous introduction of innovative devices by leading Market players are significantly contributing to Market expansion. These factors are expected to play a crucial role in propelling the regional Surgical Energy Generator Market Forecast period from 2025 to 2032.

According to the American Academy of Orthopaedic Surgeons (2024), more than 100,000 shoulder replacement surgeries were performed annually in the U.S., encompassing total shoulder replacement, hemi arthroplasty, and reverse total shoulder replacement. As per the same source, it projected that by 2025, the number of shoulder replacement procedures in the U.S. could range between 174,000 and 350,000. As per data by the International Society of Aesthetic Plastic Surgery (2023), the total number of aesthetic procedures that took place in the US was 6,196,701, including both surgical and non-surgical procedures. The US was also the country with the highest number of non-surgical procedures worldwide in 2023, with 4,405,599 procedures 2023. The source further stated that the US was the country with the highest number of aesthetic surgeons globally, with 7,750 surgeons in 2023.

Surgical Energy Generators play a crucial role in both shoulder replacement surgeries and aesthetic procedures. In shoulder replacements, these generators are used to precisely cut, coagulate, and seal tissues, ensuring minimal blood loss and improved surgical outcomes. In aesthetic procedures, particularly those involving skin tightening, fat reduction, or precise tissue modification, energy generators provide the necessary precision and control, enhancing the effectiveness and safety of the procedures. Their versatility across different types of surgeries makes them indispensable in both orthopedic and aesthetic surgical practices.

Rising product development activities by regulatory bodies and key players in the region will further boost the Market for Surgical Energy Generators. For example, in January 2024, Olympus Corporation announced the full Market release of its new ESG-410™ Surgical Energy Platform. This platform supported conventional monopolar and bipolar energy applications, as well as advanced energy modalities, including ultrasonic dissection and hybrid energy.

Therefore, the interplay of all the aforementioned factors would provide a conducive growth environment for the North American Surgical Energy Generator Market.

Key Surgical Energy Generators Companies In the Market Landscape:

The leading Surgical Energy Generators Companies operating in the market include -

- Medtronic

- Olympus Corporation

- CONMED Corporation

- Symmetry Surgical Inc.

- Applied Medical Resources Corporation

- ERBE GmbH

- AngioDynamics

- Kirwan Surgical Products, LLC

- KARL STORZ GmbH

- Sutter Medizintechnik GmbH

- STARmed Co., Ltd.

- Johnson & Johnson Services, Inc.

- CooperSurgical Inc.

- MEDGYN PRODUCTS, INC.

- Stryker, Bramsys

- Boston Scientific Corporation

- RF Medical Co., Ltd.

- OSYPKA AG

- Avanos Medical, Inc., and others.

Recent Developmental Activities in the Surgical Energy Generators Market:

- In April 2025, Erbe Elektromedizin GmbH expanded its VIO® 3 family with the launch of the VIO® 3n, a new-generation electrosurgical generator tailored to various medical specialties. The company also introduced the VIO® seal, its first generator dedicated entirely to bipolar applications.

- In January 2022, Ethicon received FDA approval for the Megadyne™ Electrosurgical Generator K213696. This updated model was designed for use in a wide range of open and laparoscopic procedures, supporting monopolar and bipolar modes via an accessory electrode.

Key takeaways from the Surgical Energy Generators Market report study

- Surgical Energy Generators Market Size analysis for the current Market size (2024), and Surgical Energy Generators Market Forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key Surgical Energy Generators Companies dominating the market.

- Various opportunities available for the other competitors in the Surgical Energy Generators Market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Surgical Energy Generators Market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the Surgical Energy Generators Market growth in the future?

Target audience who can benefit from this Surgical Energy Generators Market report study

- Surgical Energy Generators product providers

- Research organizations and consulting companies

- Surgical Energy Generators-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in Surgical Energy Generators

- Various end-users who want to know more about the Surgical Energy Generators Market and the latest technological developments in the Surgical Energy Generators Market

Stay updated with us for Recent Articles @ New DelveInsight Blogs