Thrombocytopenia Market

- The United States accounts for the largest market size (around 60%) of thrombocytopenia, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- The approved therapies for treating thrombocytopenia in the US include MULPLETA, DOPTELET, TAVALISSE, PROMACTA, NPLATE, CABLIVI, and others. These therapies are approved for various patient groups; for example, MULPLETA and DOPTELET are approved for thrombocytopenia in chronic liver disease, while PROMACTA is approved for chronic immune (idiopathic) thrombocytopenic purpura (ITP).

- In March 2024, Japan’s Ministry of Health, Labour and Welfare (MHLW) approved VYVGART (efgartigimod alfa) for intravenous (IV) use in adults with primary immune thrombocytopenia (ITP).

- In November 2023, Takeda announced that the US Food and Drug Administration (FDA) approved ADZYNMA (ADAMTS13, recombinant-krhn) for the prophylactic and on-demand treatment of adult and pediatric patients with congenital thrombotic thrombocytopenic purpura (cTTP).

- Among all the potential therapies in the 7MM, the highest market is expected to be captured by TAVALISSE.

- In April 2024, Sanofi announced positive results from the LUNA 3 Phase III study, showing that rilzabrutinib achieved the primary endpoint of durable platelet response in adult patients with persistent or chronic immune thrombocytopenia (ITP).

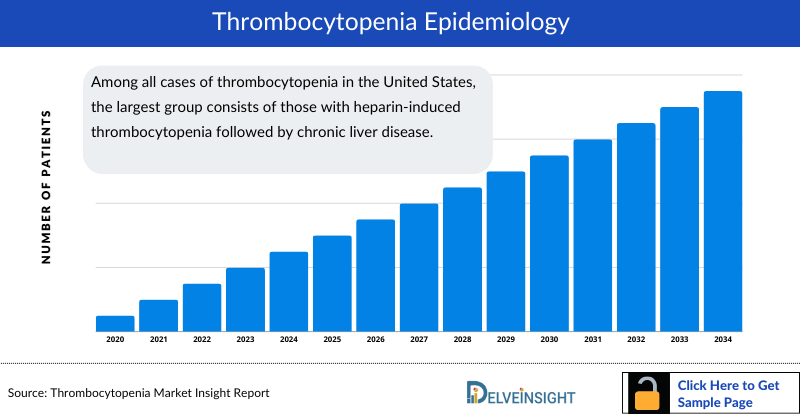

- The United States had the highest cases of thrombocytopenia among the 7MM. As per DelveInsight estimates, the US accounted for approximately 40% of total cases in 2023, for thrombocytopenia.

- The market is expected to grow by factors like an increase in the patient pool, expected entry of emerging therapies and more penetration in the 7MM market.

DelveInsight's “Thrombocytopenia Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of thrombocytopenia, historical and forecasted epidemiology as well as the thrombocytopenia therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Thrombocytopenia market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM thrombocytopenia market size from 2020 to 2034. The report also covers current thrombocytopenia treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Thrombocytopenia Market |

|

|

Thrombocytopenias Market Size | |

|

Thrombocytopenia Companies |

Sanofi, Principia Biopharma, Baxalta, Takeda, Argenx, Millennium Pharmaceuticals, Biotest, GC Pharma, Genosco (Subsidiary of Oscotec), Rigel Pharmaceuticals, Kissei Pharmaceutical, Shionogi & Co., Ltd, Amgen, Novartis, Zenyaku Kogyo, and others. |

|

Thrombocytopenia Epidemiology Segmentation |

|

Thrombocytopenia Treatment Market

Thrombocytopenia Overview, Country-Specific Treatment Guidelines and Diagnosis

Thrombocytopenia is a medical condition in which the platelet count in the blood falls (<150,000/µL of circulating blood) below the normal value. The most common etiologies are heparin-induced thrombocytopenia, chemotherapy-induced thrombocytopenia, thrombocytopenia associated with chronic liver disease, immune thrombocytopenia (ITP), and thrombotic thrombocytopenic purpura (TTP). The common symptoms associated with thrombocytopenia include excessive and recurrent nosebleeds, bruise-like patches (purpura), and excessive bleeding from wounds (hemorrhage). As many people with thrombocytopenia, especially with mild disease, do not have symptoms, the diagnosis is often delayed.

The recommended diagnostics tests include complete blood count (CBC) with platelet count and mean platelet volume (MPV) and peripheral blood smear (PBS). If clinical “nonsense” is observed, the platelet count should be repeated to exclude artifacts or laboratory errors. The coagulopathy associated with CIT is difficult to manage. A coagulation study can be performed using prothrombin time (PT), partial thromboplastin time (PTT), and fibrinogen.

The thrombocytopenia report provides an overview of thrombocytopenia pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report...

Thrombocytopenia Treatment

Treatment for thrombocytopenia depends on its cause and severity. The main goal of treatment is to prevent death and disability caused by bleeding.

The approved therapies for treating thrombocytopenia in the US include MULPLETA, DOPTELET, TAVALISSE, PROMACTA, NPLATE, CABLIVI, GAMMAPLEX, OCTAGAM, RHOPHYLAC, and PRIVIGEN. Danaparoid, argatroban, and lepirudin were approved in the US to treat thrombosis in patients with heparin-induced thrombocytopenia.

Current treatment options for severe thrombocytopenia in chronic liver disease include platelet transfusion, splenic artery embolization, splenectomy, and placement of a transjugular intrahepatic portosystemic stent shunt (TIPSS).

Further details related to country-based variations in treatment are provided in the report...

Thrombocytopenia Epidemiology

The thrombocytopenia epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The thrombocytopenia epidemiology is segmented with detailed insights into Total Cases of Thrombocytopenic Purpura (TTP), Total Cases of Immune Thrombocytopenia (ITP), Total Cases of Thrombocytopenia in Chronic Liver Disease, Total Cases of Chemotherapy-induced Thrombocytopenia, Total Number of Cases of Heparin-induced Thrombocytopenia, and Total Cases of Thrombocytopenia.

- Among all cases of thrombocytopenia in the United States, the largest group consists of those with heparin-induced thrombocytopenia followed by chronic liver disease.

- DelveInsight’s consultant estimates that the United States accounts for approximately 20% of total cases of Thrombocytopenia in Chronic Liver Disease, in the 7MM.

- The United States had the highest cases of thrombotic thrombocytopenia compared to EU4 and the UK and Japan, as assessed in 2023.

- Among the EU4 and the UK, Germany had the highest cases of thrombocytopenia, followed by the UK.

Thrombocytopenia Drug Chapters

The drug chapter segment of the thrombocytopenia report encloses a detailed analysis of thrombocytopenia marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the thrombocytopenia pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Thrombocytopenia Marketed Drugs

ADZYNMA: Takeda

ADZYNMA (ADAMTS13, recombinant-krhn) is a human recombinant (a disintegrin and metalloproteinase with thrombospondin motifs 13) ADAMTS13 (rADAMTS13) indicated for prophylactic or on-demand enzyme replacement therapy (ERT) in adult and pediatric patients with congenital thrombotic thrombocytopenic purpura (cTTP). ADZYNMA was previously granted Orphan Drug Designation (ODD) by the US FDA for the treatment and prevention of TTP, including its acquired idiopathic and secondary forms, as well as Fast Track and Rare Pediatric Disease Designation. The US FDA also granted Takeda a Rare Pediatric Disease Voucher for the approval of ADZYNMA. ADZYNMA has also been granted ODD by the European Medicines Agency (EMA) and Japan’s Ministry of Health, Labour and Welfare (MHLW) for the treatment of TTP.

TAVALISSE (fostamatinib): Rigel Pharmaceuticals/Kissei Pharmaceutical

Fostamatinib disodium (also known as TAVALISSE; R-985788) is an orally-bioavailable investigational agent being developed by Rigel pharmaceuticals and approved for the treatment of patients suffering from persistent/chronic adult idiopathic thrombocytopenic purpura. The therapeutic candidate inhibits FcR-triggered, Syk-dependent cytoskeletal rearrangement during phagocytosis. In April 2018, the US FDA approved Tavalisse (fostamatinib disodium hexahydrate) for the treatment of thrombocytopenia in adult patients with chronic immune thrombocytopenia (ITP) who have had an insufficient response to a previous treatment.

Note: Detailed emerging therapies assessment will be provided in the final report...

Thrombocytopenia Emerging Drugs

Rilzabrutinib (PRN-1008): Sanofi/Principia Biopharma

Rilzabrutinib (PRN-1008) is an orally administered reversible covalent inhibitor of Bruton tyrosine kinase (BTK). BTK is an essential signaling element downstream of the B-cell receptor (BCR), Fc-gamma receptor, and Fc-epsilon receptor pathways. Rilzabrutinib is currently being evaluated in the Phase III stage of development to treat ITP in adults and adolescents with persistent or chronic ITP. Recently, the LUNA 3 Phase III study showed that rilzabrutinib at a dose of 400 mg twice daily orally successfully met the primary endpoint of achieving a durable platelet response in adult patients with persistent or chronic immune thrombocytopenia (ITP). The safety profile observed for rilzabrutinib in this study was consistent with previous findings from other studies.

Nipocalimab (IMAAVY)

Nipocalimab (IMAAVY) is a fully human IgG1 lambda monoclonal antibody that blocks the neonatal Fc receptor (FcRn), reducing circulating IgG and pathogenic autoantibodies. Approved by the FDA in April 2025 for AChR- or MuSK-positive generalized myasthenia gravis in adults and adolescents aged 12+, it features an aglycosylated Fc region without effector functions and is administered intravenously.

Note: Detailed emerging therapies assessment will be provided in the final report...

Thrombocytopenia Market Outlook

Key players, such as Sanofi/Principia Biopharma, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of thrombocytopenia.

- The United States represents approximately 60% of the market size for thrombocytopenia, surpassing the market size of EU4 and the UK, and Japan.

- TAVALISSE/TAVLESSE (Fostamatinib) and DOPTELET (Avatrombopag) are expected to garner the highest market share during the forecast period (2024–2034).

- The United Kingdom accounts for the second highest market size in the 7MM during the forecast period 2024–2034.

Thrombocytopenia Drugs Uptake

This section focuses on the uptake rate of potential Thrombocytopenia drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Thrombocytopenia Activities

The report provides insights into Thrombocytopenia clinical trials within Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for thrombocytopenia emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as Massachusetts General Hospital & Harvard Medical School, University College London Hospital, Hospital Universitario Virgen del Rocío, etc., were contacted. Their opinion helps understand and validate current and emerging treatment patterns of thrombocytopenia. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

With the Rituxan Immunology Co-pay Program, the customer pays USD 5 per drug co-pay (subject to a maximum benefit of USD 15,000 annually and USD 5 per infusion co-pay (subject to a maximum benefit of USD 2,000 annually) if the person has commercial insurance and meet other eligibility criteria. Eligible commercially insured patients who are prescribed Rituxan for an FDA-approved use can receive up to USD 15,000 in assistance annually for drug costs and/or up to USD 2,000 in infusion assistance annually for Rituxan infusion costs. The Genentech Patient Foundation gives Rituxan for free, if patient is eligible.

National Institute for Health and Care Excellence (NICE) in its final appraisal document stated that Avatrombopag is recommended, within its marketing authorization, as an option for treating severe thrombocytopenia (that is, a platelet count of below 50,000 platelets per microlitre of blood) in adults with the chronic liver disease having planned invasive procedures.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Thrombocytopenia Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of thrombocytopenia, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the thrombocytopenia market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM thrombocytopenia market.

Thrombocytopenia Report Insights

- Thrombocytopenia Patient Population

- Thrombocytopenia Therapeutic Approaches

- Thrombocytopenia Pipeline Analysis

- Thrombocytopenia Market Size and Trends

- Existing and Future Market Opportunity

Thrombocytopenia Report Key Strengths

- Eleven-year Forecast

- 7MM Coverage

- Thrombocytopenia Epidemiology Segmentation

- Inclusion of Country Specific Treatment Guidelines

- KOL’s Feedback on Approved and Emerging Therapies

- Key Cross Competition

- Conjoint Analysis

- Thrombocytopenia Drugs Uptake

- Key Thrombocytopenia Market Forecast Assumptions

Thrombocytopenia Report Assessment

- Current Thrombocytopenia Treatment Practices

- Thrombocytopenia Unmet Needs

- Thrombocytopenia Pipeline Product Profiles

- Thrombocytopenia Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Thrombocytopenia Market Drivers

- Thrombocytopenia Market Barriers

FAQs

- What is the growth rate of the 7MM thrombocytopenia treatment market?

- What was the thrombocytopenia total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the treatment of thrombocytopenia?

- How many companies are developing therapies for the treatment of thrombocytopenia?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy Thrombocytopenia Market Forecast Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the thrombocytopenia market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-pipeline.png&w=256&q=75)

-pipeline.png&w=256&q=75)