Airway Management Devices Market

Airway Management Devices Market Summary

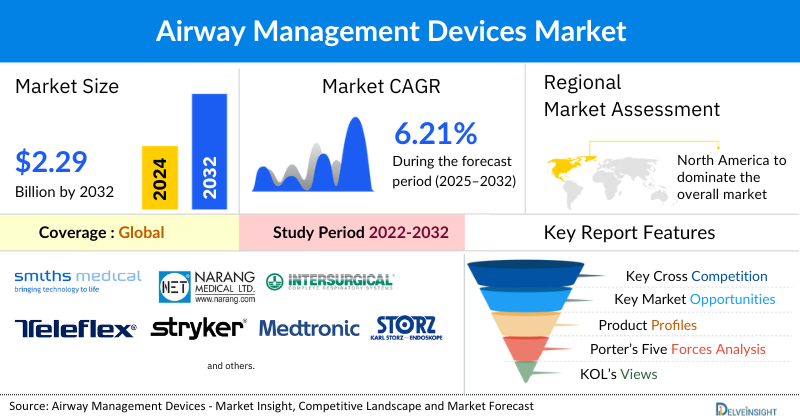

- The global Airway Management Devices market size is projected to increase from USD 1.60 billion in 2023 to USD 2.29 billion by 2032, reflecting strong and sustained growth.

- The global Airway Management Devices market is expected to grow at a CAGR of 6.21% during the forecast period from 2025 to 2032.

- Rising cases of asthma, COPD, and airway disorders, along with growing surgical procedures and worsening air pollution, are boosting demand for advanced airway management devices. Increased awareness, early diagnosis, and new product launches further drive market growth.

- The leading companies working in the Airway Management Devices market are Smiths Medical PLC, Narang Medical Limited, Intersurgical Ltd., Teleflex Incorporated, Stryker Corporation, Medtronic PLC, Dilon Technologies® Inc., Ambu A/S, Medline Industries, LP, ConvaTec Inc., KARL STORZ Endoscopy-America, Inc., Flexicare (Group) Limited, SunMed, Vyaire Medical, Inc., VBM Medizintechnik GmbH, Verathon, Inc., SourceMark™, Mercury Medical, TRACOE medical GmbH, Olympus Corporation, and others.

- North America is set to lead the airway management devices market in 2023, driven by rising respiratory diseases, air pollution, surgical procedures, and government-led awareness initiatives. The presence of key players and frequent market activities further support regional growth.

- Laryngoscopes are anticipated to hold a substantial share of the airway management devices market in the type segment in 2023.

Request for unlocking the report of the Airway Management Devices Market

Factors Contributing to the Rise in Growth of the Airway Management Devices Market

- Rising Prevalence of Respiratory Disorders:

The increasing global burden of respiratory conditions such as COPD, asthma, sleep apnea, and emergency trauma cases is driving strong demand for advanced airway management devices to ensure effective ventilation and oxygenation. - Growing Adoption of Airway Management Devices:

The shift toward rapid, reliable, and minimally invasive airway solutions in emergency medicine, intensive care units, and surgical procedures is fueling wider adoption across healthcare systems. - Technological Advancements & Product Innovation:

Ongoing innovations in video laryngoscopes, supraglottic airway devices, and portable emergency airway kits are enhancing ease of use, procedural success rates, and patient safety, thereby strengthening market penetration. - Government & Healthcare Awareness Initiatives:

Supportive programs aimed at improving emergency preparedness, training healthcare professionals in advanced airway techniques, and ensuring availability of critical care equipment are contributing to market growth. - Expanding Access in Emerging Markets:

Growing healthcare infrastructure, higher investments in critical care facilities, and increased awareness of advanced life-support interventions in developing regions are opening significant opportunities for airway device manufacturers.

Airway Management Devices by Type (Infraglottic Devices [Endotracheal Tubes, Tracheostomy Tubes, and Others], Supraglottic Devices [Oropharyngeal Devices, Nasopharyngeal Devices, Laryngeal Airway Devices, and Others], Resuscitators, Laryngoscopes, and Others), Application (Emergency Medicine, Anesthesia, and Others), End-User (Hospitals, Ambulatory Surgical Care Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising burden of chronic respiratory diseases, increase in laryngeal and pharyngeal disorders, increase in surgical procedures, increase in air pollution, increasing awareness and screening programs, and increase in product launches and approvals by key market players across the globe.

The airway management devices market was valued at USD 1.60 billion in 2023, growing at a CAGR of 6.21% during the forecast period from 2025 to 2032, to reach USD 2.29 billion by 2032. The market for airway management devices is poised for substantial growth due to several interrelated factors. The rising burden of chronic respiratory diseases, such as asthma & COPD, and laryngeal and pharyngeal disorders drive up the demand for effective airway management solutions to manage these conditions. Concurrently, the increase in surgical procedures, both elective and emergency, necessitates advanced airway devices to ensure patient safety and effective ventilation. Additionally, the worsening air pollution further exacerbates respiratory problems, leading to more frequent and severe cases that require airway management. Furthermore, increasing awareness and screening programs promote early detection and better management of respiratory issues, thus amplifying the need for these devices. Moreover, the surge in product launches and approvals by key market players introduces innovative solutions and expands the available options, fueling market growth. Collectively, these factors create a robust demand for airway management devices, supporting market expansion and innovation during the forecast period from 2025 to 2032.

Airway Management Devices Market Dynamics:

According to the latest data provided by the Australian Institute of Health and Welfare, in 2022, around 8.5 million (34%) people in Australia were estimated to have chronic respiratory conditions. Additionally, as per the recent data provided by the Global Burden of Disease (2023), approximately, 1 in 20 people globally suffers from chronic respiratory diseases.

The increasing prevalence of these respiratory conditions often requires frequent interventions to ensure adequate ventilation and oxygenation, thereby increasing the utilization of devices like endotracheal tubes, laryngeal mask airways, and bag-valve-mask systems. The growing patient population necessitates advancements in device technology and a wider range of options, prompting manufacturers to innovate and expand their product lines thereby escalating the overall market of airway management devices.

The airway management tubes and intubation accessories devices market is witnessing steady growth, driven by the rising prevalence of respiratory disorders, increasing surgical procedures, and advancements in critical care infrastructure. These devices play a crucial role in maintaining airway patency, ensuring effective ventilation, and providing life-saving support during emergency and intensive care situations. With healthcare systems globally prioritizing improved patient safety and outcomes, the demand for innovative airway solutions is expected to expand further.

Additionally, as per the recent data provided by GLOBOCAN, in 2022, globally the estimated new cases of trachea, bronchus, and lung cancer was 2.48 million, and the projections are expected to rise by 4.25 million by the year 2045. Lung cancer often necessitates various surgical interventions, such as lobectomies or pneumonectomies, to remove tumors or affected lung tissues. These procedures require effective airway management to ensure proper ventilation and oxygenation during surgery, leading to higher demand for devices like endotracheal tubes, laryngeal mask airways, and video laryngoscopes thereby boosting the overall market of airway management devices across the globe. Thus, higher levels of air pollution lead to a rise in respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and bronchitis thus boosting the overall market of airway management devices across the globe.

Furthermore, according to the recent data provided by the Global Burden of Disease, in 2021, Particulate matter air pollution accounted for approximately 8% of the total disease burden. Additionally, air pollution was responsible for about 48% of chronic obstructive pulmonary disease (COPD) cases, and around 34% of preterm births were attributed to exposure to air pollution.

Additionally, companies are amplifying their production of airway management devices and securing regulatory approvals, thereby strategically expanding their market presence and driving further growth. For instance, on October 31, 2021, Vyaire Medical, announced the launch of SuperNO2VA™ Et. This mask employed breakthrough technology to stent the airway open and monitor end tidal carbon dioxide (EtCO2) accurately. It maintained airway patency and provided precise oxygenation during deep sedation procedures, reducing hypoxemia and hypoventilation. SuperNO2VA™ Et offered continuous patient oxygenation before, during, and after surgery, enabling more patients to undergo procedures under sedation.

Technological advancements, such as the development of video laryngoscopes, specialized endotracheal tubes, and user-friendly intubation kits, are reshaping the airway management tubes and intubation accessories devices market. In addition, the rising incidence of chronic respiratory conditions like COPD, asthma, and sleep apnea continues to fuel market adoption. As hospitals and ambulatory care centers focus on efficiency and reduced complications, the airway management tubes and intubation accessories devices market is anticipated to experience significant opportunities for growth in the coming years.

Thus, the factors mentioned above are likely to boost the market of airway management devices during the forecasted period. However, the risk and complications such as trauma to the airway, accidental extubation, aspiration, and stringent regulatory concerns for product approval may hinder the future market of airway management devices.

Airway Management Devices Market Segment Analysis:

Airway Management Devices by Type (Infraglottic Devices [Endotracheal Tubes, Tracheostomy Tubes, and Others], Supraglottic Devices [Oropharyngeal Devices, Nasopharyngeal Devices, Laryngeal Airway Devices, and Others], Resuscitators, Laryngoscopes, and Others), Application (Emergency Medicine, Anesthesia, and Others), End-User (Hospitals, Ambulatory Surgical Care Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the type segment of airway management devices market the laryngoscopes are expected to hold a significant share in 2023. Laryngoscopes are dominating the airway management devices market due to their critical role in the accurate and effective placement of endotracheal tubes, which is essential for ensuring airway patency during various medical procedures. Their dominance stems from several key factors. First, laryngoscopes provide direct visualization of the vocal cords and the glottis opening, which is crucial for successful intubation, especially in patients with difficult airways or complex anatomies. Advanced laryngoscopes, including video laryngoscopes, offer enhanced visibility through high-definition cameras and monitors, improving the success rates of intubation and reducing the likelihood of complications. This technological advancement addresses challenges associated with traditional direct laryngoscopies, such as limited view and operator skill dependency.

Additionally, the increasing number of surgical procedures and laryngeal and pharyngeal disorders further, amplifies the demand for reliable and effective intubation tools, further driving the market for laryngoscopes. Furthermore, as per the data provided by GLOBOCAN (2024), in 2022 globally the new cases of oropharynx and nasopharynx cancer was 22700 and is expected to rise to 265000. Thus, the increasing prevalence of larynx diseases and pharynx diseases underscores the necessity for laryngoscope adoption. These devices are essential for airway management and intubation in patients with larynx and pharynx conditions, thereby escalating the demand for laryngoscopes during the forecast period.

Furthermore, the growth in emergency medicine and critical care settings, where rapid and accurate airway management is paramount, has also bolstered the market for these devices. Moreover, ongoing innovations in laryngoscope design, such as ergonomically improved handles and disposable or reusable blades, cater to diverse clinical needs and enhance user comfort and safety. As healthcare providers strive to improve patient outcomes and procedural efficiency, the robust performance and technological advancements of laryngoscopes solidify their market dominance, making them an indispensable component of modern airway management.

Additionally, the new product launches in the laryngoscope market can significantly boost the overall market of airway management devices by improving patient outcomes, meeting diverse needs, and enhancing clinical outcomes. For instance, in September 2023, Penlon, a global producer of medical devices in the UK launched a new Diamond Video Laryngoscope, a portable device that gives an increased field of view as compared to other direct rigid laryngoscopes.

Therefore, owing to the above-mentioned factors, the laryngoscope category is expected to generate considerable revenue thereby pushing the overall growth of the global airway management devices market during the forecast period.

Airway Management Devices Market Segmentation

Airway Management Devices Market By Type

-

Infraglottic Devices

-

Endotracheal Tubes

-

Tracheostomy Tubes

-

Others

-

-

Supraglottic Devices

-

Oropharyngeal Devices

-

Nasopharyngeal Devices

-

Laryngeal Airway Devices

-

Others

-

-

Resuscitators

-

Laryngoscopes

-

Others

Airway Management Devices Market By Application

-

Emergency Medicine

-

Anesthesia

-

Others

Airway Management Devices Market By End-User

-

Hospitals

-

Ambulatory Surgical Care Centers

-

Others

Airway Management Devices Market By Geography

North America Airway Management Devices Market

-

United States Airway Management Devices Market

-

Canada Airway Management Devices Market

-

Mexico Airway Management Devices Market

Europe Airway Management Devices Market

-

France Airway Management Devices Market

-

Germany Airway Management Devices Market

-

United Kingdom Airway Management Devices Market

-

Italy Airway Management Devices Market

-

Spain Airway Management Devices Market

-

Russia Airway Management Devices Market

-

Rest of Europe

Asia-Pacific Airway Management Devices Market

-

China Airway Management Devices Market

-

Japan Airway Management Devices Market

-

India Airway Management Devices Market

-

Australia Airway Management Devices Market

-

South Korea Airway Management Devices Market

-

Rest of Asia Pacific

Rest of the World (RoW)

-

Middle East Airway Management Devices Market

-

Africa Airway Management Devices Market

-

South America Airway Management Devices Market

North America is expected to dominate the overall Airway Management Devices Market:

North America is expected to account for the highest proportion of the airway management devices market in 2023, out of all regions. This can be ascribed to the increasing prevalence of respiratory disease across the region, increase in laryngeal and pharyngeal disorders, increase in air pollution, increase in surgical procedures, increase in government initiatives coupled with increased awareness programs for respiratory disorders, and the presence of key market players engaged in merger, acquisition, product launches, and other market activities across the region are expected to escalate the market of airway management devices during the forecast period.

According to the recent data and stats provided by the American Lung Association (2024), in 2022, among children, asthma was more common in males accounting for 7.0% of the population in the United States and 5.4% in females. Additionally, as per the same source, asthma among adults is 10.8% for females and 6.5% for females across the region of the United States. As asthma remains a common chronic respiratory condition, the demand for devices that aid in maintaining open airways and managing acute exacerbations rises. Patients with asthma often require various airway management tools, such as nebulizers, inhalers, and spacer devices, to deliver medication effectively and manage symptoms. In severe cases or during asthma attacks, advanced airway management devices, including laryngeal mask airways or endotracheal tubes, may be needed to ensure adequate ventilation and prevent respiratory distress thereby boosting the overall market of airway management devices across the region.

Additionally, as per the data provided by the GLOBOCAN (2024) in 2022, there were approximately 13,000 new cases of laryngeal cancer and about 18,000 new cases of oropharynx and nasopharynx cancer in North America. This notable prevalence underscores the significance of airway management devices such as laryngoscopes, as they assist healthcare providers in making informed treatment decisions for respiratory and larynx disease patients. Consequently, the market is influenced by the rising number of respiratory and larynx disease cases in the region.

The increasing number of product development activities in the region is further going to accelerate the growth of the airway management devices market. For example, in November 2021, GE Healthcare announced that it had received FDA 510(k) clearance for an artificial intelligence (AI) algorithm designed to assist clinicians in assessing Endotracheal Tube (ETT) placements. This AI solution was one of five in GE Healthcare’s Critical Care Suite 2.0, an industry-first set of AI algorithms embedded on a mobile X-ray device for automated measurements, case prioritization, and quality control.

Additionally, in May 2021, Olympus announced that it had received FDA 510(k) clearance for its Airway Mobilescopes, the MAF-TM2, MAF-GM2, and MAF-DM2. These devices allowed providers to perform various airway management procedures, offering benefits like digital capture and a compact, all-in-one design appreciated by anesthesiologists, pulmonologists, and critical care providers.

Therefore, the above-mentioned factors are expected to bolster the growth of the airway management devices market in North America during the forecast period.

Airway Management Devices Market Key Players:

- Smiths Medical PLC

- Narang Medical Limited

- Intersurgical Ltd.

- Teleflex Incorporated

- Stryker Corporation

- Medtronic PLC

- Dilon Technologies® Inc.

- Ambu A/S

- Medline Industries, LP

- ConvaTec Inc.

- KARL STORZ Endoscopy-America, Inc.

- Flexicare (Group) Limited

- SunMed

- Vyaire Medical, Inc.

- VBM Medizintechnik GmbH

- Verathon, Inc.

- SourceMark™

- Mercury Medical

- TRACOE medical GmbH

- Olympus Corporation

Recent Developmental Activities in the Airway Management Devices Market:

- In April 2025, KARL STORZ introduced the Slimline C-MAC® S, a single-use video laryngoscope featuring a slimmer blade design (28% less material) with enhanced visibility, improved maneuverability, and a more sustainable profile thanks to eco-friendly packaging and reduced electronic waste.

- In July 2025, Verathon launched the GlideScope® ClearFit™, a cover-based video laryngoscope combining one reusable video baton with six interchangeable single-use covers (Mac, Miller, Hyperangle) compatible with both the GlideScope® Go™ 2 and Core™ systems. This design streamlines workflows, inventory, and training.

- In August 2025, researchers introduced an autonomous nasotracheal intubation system powered by a Transformer-based AI model (Recurrent Action-Confidence Chunking with Transformer — RACCT), achieving a 66% reduction in peak insertion force and maintaining comparable success rates to manual techniques—enhancing safety and reducing infection risks.

Key Airway Management Devices Highlights Summary (2022–2025)

| Category | Key Developments |

|---|---|

| Product Launches | In April 2025, KARL STORZ launched the Slimline C-MAC® S single-use video laryngoscope with a slimmer design and eco-friendly packaging. In July 2025, Verathon introduced GlideScope® ClearFit™, a reusable baton with six single-use covers to optimize workflows. In 2025, Ambu unveiled SureSight™ Connect, integrating with digital platforms for efficient airway visualization. |

| Regulatory Approvals | In 2024, Ambu received CE Mark approval for its aScope™ 5 Broncho single-use bronchoscope, enhancing critical care and pulmonology use in Europe. |

| Partnerships | In 2023, Verathon collaborated with multiple hospital systems in the U.S. to expand the adoption of its GlideScope® video laryngoscopes in difficult airway management programs. |

| Acquisitions | In 2022, Medtronic expanded its respiratory portfolio by acquiring Affera Inc., indirectly supporting its airway and respiratory care ecosystem with advanced electrophysiology solutions. |

| Company Strategy | Ambu continued its strategic focus on single-use endoscopy (2022–2025), expanding video laryngoscopy solutions across anesthesia, ICU, and emergency medicine, positioning itself as a global leader in disposable airway devices. |

| Setbacks | In 2023, certain reusable laryngoscope blades faced recalls due to sterilization concerns, highlighting safety and infection control challenges in reusable devices. |

| Emerging Technology | In August 2025, researchers introduced an AI-powered autonomous nasotracheal intubation system (RACCT model), achieving reduced insertion force and improved safety in airway management procedures. |

AI Advancements in Airway Management Devices

-

AI-Powered Intubation Assistance

Machine learning algorithms integrated into video laryngoscopes provide real-time guidance during intubation, improving accuracy and reducing complications in emergency and anesthesia settings. -

Autonomous Intubation Systems

Robotic AI-driven systems, such as the RACCT model, enable semi-autonomous or fully autonomous airway management, minimizing operator dependency and supporting critical care scenarios. -

Predictive Airway Risk Assessment

AI tools analyze patient anatomy and pre-procedure imaging to predict difficult airways, allowing clinicians to choose the most effective devices and approaches in advance. -

Enhanced Image Processing

AI algorithms enhance visualization in video laryngoscopes and bronchoscopes by improving image clarity, contrast, and anatomical landmark detection for safer airway access. -

Decision Support Systems

Integration of AI-powered clinical decision support into airway devices aids anesthesiologists and emergency physicians in selecting device size, predicting success rates, and minimizing adverse outcomes. -

Remote Monitoring & Tele-Airway

AI-enabled airway management devices paired with telemedicine platforms allow remote guidance during intubations, particularly beneficial in rural or resource-limited settings.

Tariff Inclusion in Airway Management Devices

The imposition of tariffs on medical devices and their components has introduced cost pressures and supply chain complexities in the airway management devices market. These trade measures affect global sourcing strategies, pricing structures, and overall market competitiveness. A clear understanding of tariff dynamics is essential for stakeholders to safeguard margins, ensure compliance, and maintain uninterrupted product availability.

How This Analysis Helps Clients

-

Cost Management: By evaluating tariff structures, clients can anticipate cost escalations, optimize pricing strategies, and protect profitability.

-

Supply Chain Optimization: Identifying alternative sourcing and manufacturing hubs helps reduce tariff exposure and enhances resilience against trade disruptions.

-

Regulatory Navigation: Expert insights enable clients to remain compliant with shifting trade policies, avoiding penalties and legal risks.

-

Strategic Planning: Tariff intelligence supports informed decisions on market entry, partnerships, and long-term investment strategies.

Startup Funding & Investment Trends in Airway Management Devices

| Company Name | Total Funding | Main Products/Focus | Stages of Developments | Core Technology |

|---|---|---|---|---|

| Verathon Medical | $150M+ | Video laryngoscopes, airway visualization systems | Commercialized, Expansion | Video laryngoscopy & imaging tech |

| Ambu A/S (Start-up wing) | $90M+ | Single-use airway management devices (laryngoscopes) | Scale-up, Global Expansion | Disposable/Single-use innovation |

| AventAIR Medical | $35M | Smart airway monitoring devices | Clinical Trials | AI-enabled real-time monitoring |

| VenairTech | $20M | Portable resuscitators, supraglottic devices | Early-Stage Pilot Studies | Compact, sensor-integrated systems |

| BreatheClear Systems | $12M | Emergency airway kits & AI-guided intubation devices | Seed to Series A | AI + IoT-enabled airway solutions |

Key Takeaways from the Airway Management Devices Market Report Study

- Market size analysis for current airway management devices size (2023), and market forecast for 6 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the airway management devices market.

- Various opportunities available for the other competitors in the airway management devices market space.

- What are the top-performing segments in 2023? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current airway management devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for airway management devices market growth in the coming future?

Target Audience who can be benefited from this Airway Management Devices Market Report Study

- Airway management devices product providers

- Research organizations and consulting companies

- Airway management devices -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in airway management devices

- Various end-users who want to know more about the airway management devices market and the latest technological developments in the airway management devices market.