Ankylosing Spondylitis Market Summary

- In 2023, the United States represented the largest Ankylosing Spondylitis market within the 7MM, with a market size of approximately USD 5 billion.

- Ankylosing Spondylitis Market predominanetly is dominated by Anti-TNFs, followed by conventional therapies. Initial care involves use of NSAIDs for pain and inflammation, while the use of biologics such as TNF and IL-17 inhibitors is recommended only if NSAIDs are ineffective. JAK holds smallest maret as given to only those patients who do not respond to other therapies.

Ankylosing Spondylitis Market Insight and Trends

- Ankylosing spondylitis/Radiographic axial spondyloarthritis is a chronic inflammatory disease that primarily targets the axial skeleton, causing spinal pain and stiffness and potentially leading to vertebral fusion.

- Ankylosing spondylitis typically emerges in individuals under 40, with around 80% of patients experiencing their first symptoms before the age of 30. Diagnoses after age 45 are rare, occurring in less than 5% of cases.

- Ankylosing spondylitis is notably more common in men than women, reflecting a significant gender disparity in the condition’s prevalence.

- Recent advancements in diagnosing Ankylosing Spondylitis now emphasize genetic factors, inflammation beyond the spine, and MRI changes not visible on X-rays, leading to the differential diagnosis of non-radiographic axial spondyloarthritis. Key biomarkers HLA-B27, present in 90% of gene-specific AS cases, and other genetic factors (ERAP1, IL-12, IL-17, IL-23) are pivotal in understanding genetic predisposition.

- The most recent approval, UCB's BIMZELX (bimekizumab), in 2023 introduced a significant new player in the Ankylosing Spondylitis market across Europe, the UK, and Japan. This advanced interleukin therapy targets both IL-17A and IL-17F, offering a novel treatment approach and intensifying competition in the therapeutic landscape.

- Despite the range of therapies available for ankylosing spondylitis (AS), around 30-40% of patients remain resistant to first-line treatment with tumor necrosis factor (TNF) inhibitors, highlighting a significant challenge in achieving effective disease control and addressing treatment failures. A considerable proportion of patients are still left with limited treatable option and significant morbidity.

- Currently, there is a notable lack of emerging therapies, highlighting a significant gap in the advancement of treatment options.

Factors Affecting Ankylosing Spondylitis Market Growth

Rising Disease Awareness and Early Diagnosis

Increasing awareness among patients and healthcare professionals has led to earlier identification of ankylosing spondylitis (AS). Improved diagnostic practices including enhanced use of HLA-B27 testing, MRI imaging, and referral to rheumatologists help detect the disease sooner, increasing treatment uptake and market growth.

Growing Prevalence of Autoimmune Disorders

The global prevalence of autoimmune and chronic inflammatory diseases, including AS, is rising. Aging populations and lifestyle factors contribute to this trend, expanding the pool of patients requiring long-term management and therapeutic intervention.

Advancements in Therapeutics

Significant progress in drug development including biologic agents (TNF inhibitors, IL-17 inhibitors) and emerging small molecules has revolutionized AS management. These therapies offer superior disease control and improved quality of life, driving higher adoption and prescription rates.

Expansion of Treatment Guidelines

Updated clinical treatment guidelines that recommend early and aggressive intervention with advanced therapies increase physician confidence and broaden therapeutic use. Endorsement by major rheumatology societies helps standardize care and supports market growth.

Increased Healthcare Spending

Rising healthcare expenditure, improved insurance coverage, and expanded reimbursement for biologics and advanced diagnostics facilitate greater access to AS treatments, especially in developed economies.

Patient Education and Support Programs

Improved patient education, advocacy, and support groups help individuals better understand disease progression and available therapies, reducing diagnostic delays and encouraging consistent treatment adherence.

Growth in Research and Development

Active investment in clinical research, including novel mechanism-of-action drugs and combination regimens, bolsters market innovation. Regulatory incentives, such as fast-track and orphan designations where applicable, accelerate product development and approval.

DelveInsight's “Ankylosing Spondylitis Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of ankylosing spondylitis, historical and forecasted epidemiology as well as the ankylosing spondylitis market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Ankylosing spondylitis market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM ankylosing spondylitis market size from 2020 to 2034. The Ankylosing spondylitis market report also covers current ankylosing spondylitis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Scope of the Ankylosing Spondylitis Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

Ankylosing Spondylitis Epidemiology

|

Segmented by:

|

|

Ankylosing Spondylitis key companies |

|

|

Ankylosing Spondylitis key therapies/drug |

|

|

Ankylosing Spondylitis Market |

Segmented by:

|

|

Analysis |

|

Ankylosing Spondylitis Disease Overview

Ankylosing Spondylitis Overview, Country-Specific Treatment Guidelines and Diagnosis

Ankylosing Spondylitis is a chronic inflammatory disease that predominantly targets the axial skeleton, with a particular emphasis on the spine and sacroiliac joints—the pivotal connectors between the spine and pelvis. As a form of spondyloarthritis, ankylosing Spondylitis is marked by persistent back pain and stiffness, which can progressively lead to diminished spinal flexibility and, in severe cases, a pronounced forward-stooped posture. Over time, the inflammation can cause new bone formation, resulting in the fusion of vertebrae, a process known as ankylosis.

Laboratory findings in Ankylosing Spondylitis are generally nonspecific but can support diagnosis. Elevated erythrocyte sedimentation rate (ESR) and C-reactive protein (CRP) levels are seen in 50% to 70% of active cases, though normal levels don't rule out ankylosing spondylitis. Imaging, particularly of the spine and sacroiliac joints, is crucial for diagnosis. Sacroiliitis detected through X-ray or MRI is a key criterion in the ASAS 2009 axial spondyloarthritis guidelines.

The ankylosing spondylitis market report provides an overview of ankylosing spondylitis pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report

Ankylosing spondylitis Treatment

Ankylosing Spondylitis treatment aims to manage symptoms, preserve mobility, and prevent progression, as there is no cure. Initial treatment typically involves nonsteroidal anti-inflammatory drugs (NSAIDs) to relieve pain and inflammation. If NSAIDs are inadequate, biologic therapies, including tumor necrosis factor (TNF) inhibitors and interleukin-17 (IL-17) inhibitors, may be used. For patients unresponsive to TNF inhibitors, Janus kinase (JAK) inhibitors offer an alternative. Physical therapy, including tailored exercise programs, swimming, and hydrotherapy, is essential for maintaining flexibility, strengthening muscles, and improving posture. In severe cases with significant joint damage, surgical options may be considered to repair or replace affected joints.

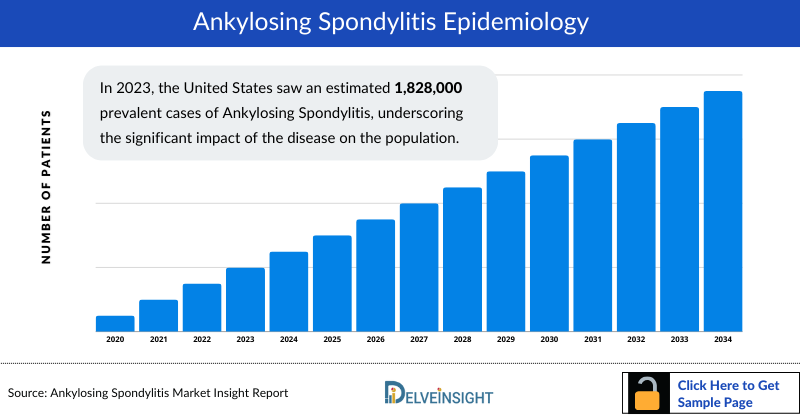

Ankylosing Spondylitis Epidemiology

The ankylosing spondylitis epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The ankylosing spondylitis epidemiology is segmented with detailed insights into Total Prevalent Cases of Axial Spondyloarthritis, Total Diagnosed Cases of Ankylosing Spondylitis, Gender-Specific Cases of Ankylosing Spondylitis, Gene-specific Cases of Ankylosing Spondylitis, Age-specific Cases of Ankylosing Spondylitis, and Total Treated Cases of Ankylosing Spondylitis

Key Findings from Ankylosing Spondylitis Epidemiological Analyses and Forecast

- In 2023, the United States saw an estimated 1,828,000 prevalent cases of Ankylosing Spondylitis, underscoring the significant impact of the disease on the population.

- In 2023, Italy accounted for approximately 20% of diagnosed Ankylosing Spondylitis cases among the EU4 and the UK.

- In the 7MM, males accounted for approximately 60% of Ankylosing Spondylitis cases.

Ankylosing spondylitis Market Recent Developments and Breakthroughs

- On September 23rd, 2024, UCB announced that the FDA had approved BIMZELX (bimekizumab-bkzx) for adults with active psoriatic arthritis, active non-radiographic axial spondyloarthritis with objective signs of inflammation, and active ankylosing spondylitis. This makes BIMZELX the first and only IL-17A and IL-17F inhibitor approved in the U.S. for these four chronic immune-mediated inflammatory diseases.

Ankylosing spondylitis Drug Analysis

The drug chapter segment of the ankylosing spondylitis market report encloses a detailed analysis of ankylosing spondylitis marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the ankylosing spondylitis clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Ankylosing Spondylitis Drugs

RINVOQ (upadacitinib): AbbVie

Upadacitinib (ABT-494) is a second-generation JAK1 selective inhibitor by AbbVie for several inflammatory indications, such as Ankylosing Spondylitis. The Janus-kinases are a family of cytoplasmic tyrosine kinases that play an important role in transducing cytokine-mediated signals via the JAK-STAT pathway. Inhibitors of this enzyme family, such as Upadacitinib, have shown conclusive evidence of efficacy in treating certain inflammatory and autoimmune disease conditions.

BIMZELX (bimekizumab): UCB

BIMZELX (bimekizumab), developed by UCB, is a monoclonal antibody approved for the treatment of axial spondyloarthritis (axSpA). Bimekizumab operates by inhibiting interleukin (IL)-17A and IL-17F, which are pro-inflammatory cytokines involved in the pathogenesis of axSpA. This dual inhibition is designed to reduce inflammation and manage symptoms associated with the disease. It is not approved in the US.

Analysis of Ankylosing Spondylitis Marketed Drugs | ||||

|

Therapy Name |

Company Name |

ROA |

MOA |

Any Special Status |

|

BIMZELX |

UCB |

Subcutaneous |

IL-17A, IL-17F and IL-17AF Inhibitor |

NA |

|

RINVOQ |

AbbVie |

Oral |

Janus kinase (JAK) inhibitor |

NA |

|

TALTZ |

Eli Lilly and Company |

Subcutaneous |

IL-17A cytokine inhibitor |

NA |

|

SIMPONI |

Johnson & Johnson |

Subcutaneous and Intravenous |

Tumor necrosis factor (TNF) blocker |

NA |

Note: Detailed emerging therapies assessment will be provided in the final report.

Click here to download Indication specific and detailed inforgraphic @ Ankylosing Spondylitis Infographic

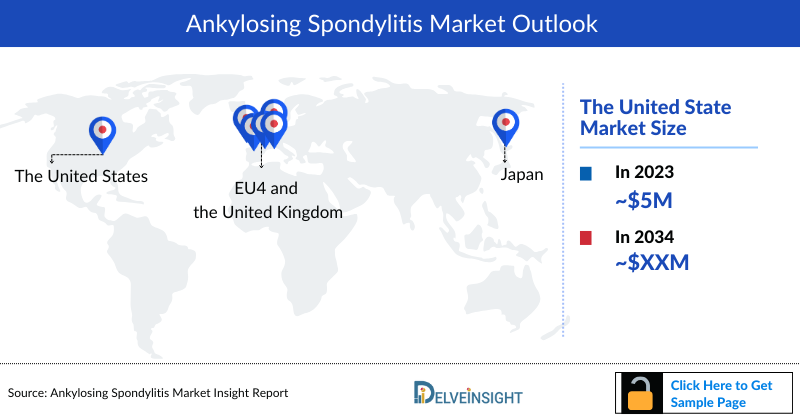

Ankylosing Spondylitis Market Outlook

The Ankylosing Spondylitis market is set for robust growth due to rising prevalence and increase in healthcare access. With a growing patient base, demand for effective therapies is increasing. The market is evolving with new biologics, including TNF and IL-17 inhibitors, and JAK inhibitors. These advancements, coupled with enhanced diagnostic tools and greater awareness, are expected to significantly expand treatment options and improve patient outcomes.

Key Findings from Ankylosing Spondylitis Market Report

- In 2023, the United States represented the largest Ankylosing Spondylitis market within the 7MM, with a market size of approximately USD 5 billion.

- In the EU4 and the UK, Germany held a significant share of the Ankylosing Spondylitis market, accounting for approximately 20%.

- Anti-TNF therapies, such as CIMZIA, SIMPONI, etanercept, adalimumab, and infliximab, collectively represent around 60% of the Ankylosing Spondylitis drugs market.

Ankylosing Spondylitis Drugs Uptake

This section focuses on the uptake rate of potential Ankylosing Spondylitis drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake. Further detailed analysis of emerging therapies drug uptake in the report…

Ankylosing Spondylitis Clinical Trial Activities

The Ankylosing Spondylitis market report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Ankylosing Spondylitis Pipeline Development Activities

The Ankylosing Spondylitis market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Ankylosing spondylitis emerging therapies.

Latest KOL Views on Ankylosing Spondylitis

To keep up with the real-world scenario in current and emerging Ankylosing Spondylitis market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging treatment patterns of ankylosing spondylitis. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Ankylosing Spondylitis market and the unmet needs.

Ankylosing Spondylitis Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Ankylosing Spondylitis Market Access and Reimbursement

The Ankylosing Spondylitis market report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Ankylosing Spondylitis Market Report

- The Ankylosing Spondylitis market report covers a segment of key events, an executive summary, descriptive overview of Ankylosing spondylitis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging Ankylosing Spondylitis therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Ankylosing spondylitis market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Ankylosing Spondylitis market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Ankylosing spondylitis market.

Ankylosing spondylitis Market Report Insights

- Ankylosing Spondylitis Patient Population

- Ankylosing Spondylitis Therapeutic Approaches

- Ankylosing spondylitis Pipeline Analysis

- Ankylosing spondylitis Market Size

- Ankylosing Spondylitis Market Trends

- Existing and future Ankylosing Spondylitis Market Opportunity

Ankylosing spondylitis Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Ankylosing spondylitis Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging Ankylosing Spondylitis therapies

- Key Cross Competition

- Ankylosing Spondylitis Conjoint analysis

- Ankylosing Spondylitis Drugs Uptake

- Key Ankylosing Spondylitis Market Forecast Assumptions

Ankylosing spondylitis Market Report Assessment

- Current Ankylosing Spondylitis Treatment Practices

- Ankylosing Spondylitis Unmet Needs

- Ankylosing Spondylitis Pipeline Product Profiles

- Ankylosing Spondylitis Market Attractiveness

- Ankylosing Spondylitis Qualitative Analysis (SWOT and Conjoint Analysis)

Frequently Asked Questions from Ankylosing Spondylitis Market Report

- What is the growth rate of the 7MM Ankylosing spondylitis treatment market?

- What was the Ankylosing spondylitis market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label Ankylosing Spondylitis therapies?

- How would the market drivers, barriers, and future opportunities affect the Ankylosing Spondylitis market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the treatment of Ankylosing spondylitis ?

- How many Ankylosing Spondylitis companies are developing therapies for the treatment of Ankylosing spondylitis ?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Ankylosing Spondylitis therapies?

Reasons to buy from Ankylosing Spondylitis Market Report

- The Ankylosing Spondylitis market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Ankylosing spondylitis Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing Ankylosing Spondylitis market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Ankylosing Spondylitis companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging Ankylosing Spondylitis therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming Ankylosing Spondylitis companies can strengthen their development and launch strategy.