JAK Inhibitors Market Summary

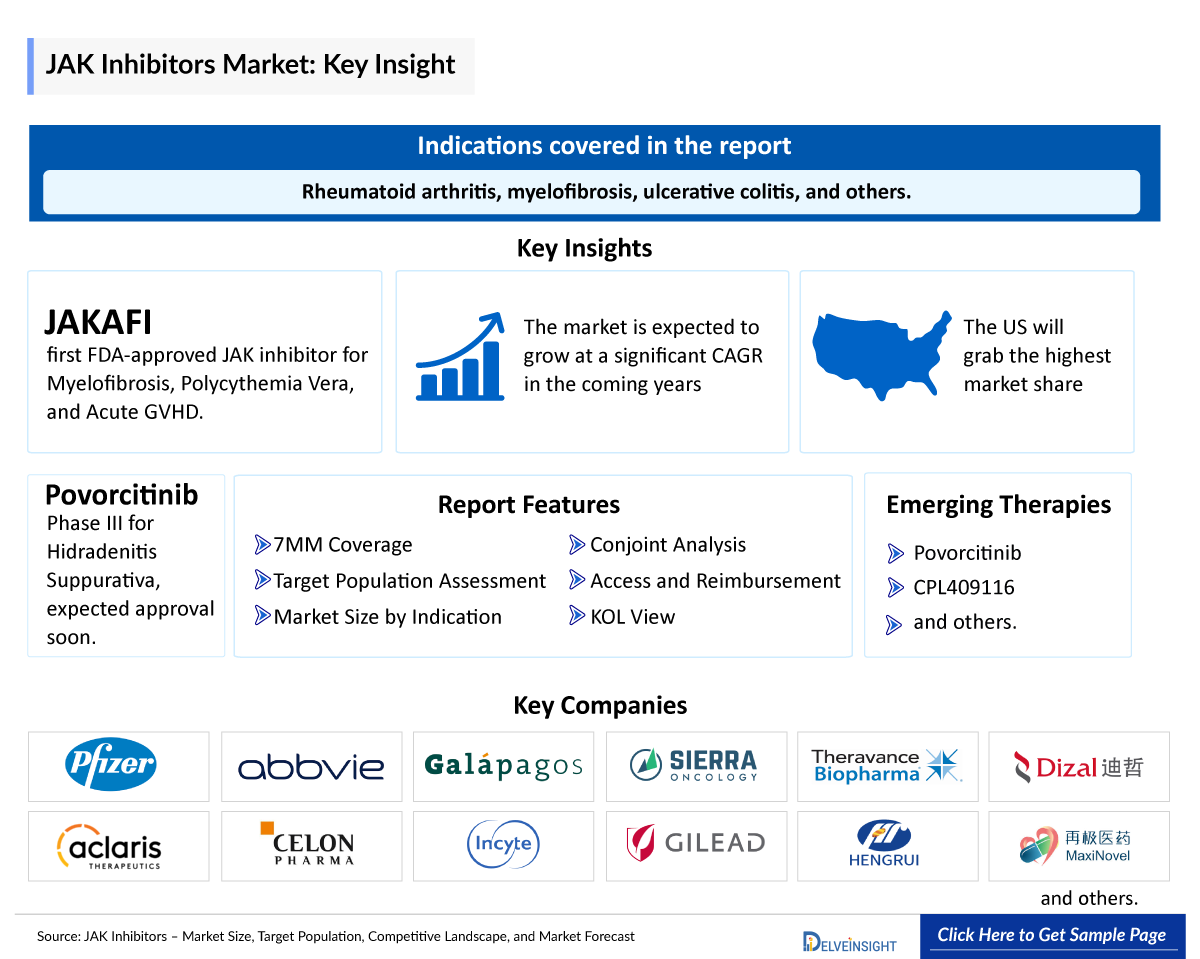

- The JAK Inhibitor market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

JAK Inhibitor Market and Epidemiology Analysis

- Janus Kinase (JAK) is a nonreceptor tyrosine kinase crucial for cytokine signaling and immune system regulation. It is targeted by small-molecule inhibitors and plays a vital role in treating conditions such as rheumatoid arthritis, myelofibrosis, and ulcerative colitis. Ongoing innovations continue to expand its potential in autoimmune and inflammatory diseases.

- JAK inhibitors are small-molecule drugs targeting Janus kinases and modulates the cytokine pathways. Their versatility, oral bioavailability, and expanding indications position JAK inhibitors as a major driver in the evolving biopharmaceutical and immunotherapy markets.

- JAKAFI (ruxolitinib), the first FDA-approved JAK inhibitor, is currently approved for the treatment of Myelofibrosis, Polycythemia Vera, and Acute Graft-Versus-Host Disease. It continues to lead the market with robust performance, generating USD 773 million in Q4 2024 revenue (+11% YoY) and USD 2.8 billion for the full year (+8% YoY), underscoring its blockbuster status and the growing demand for JAK-targeted therapies.

- RINVOQ (upadacitinib), approved in August 2019, is another blockbuster drug, which is a selective JAK inhibitor used to manage multiple inflammatory and autoimmune conditions. RINVOQ achieved impressive global net revenues of USD 5.97 billion, a nearly 50% year-over-year increase, highlighting its growing clinical adoption. Of this, USD 4.26 billion was generated from the U.S. market, reflecting its strong domestic performance and therapeutic impact.

- Several JAK inhibitors are currently being evaluated in clinical trials. One of these assets in the late stage is Incyte’s, Povorcitinib which is in stage III and being developed for Hidradenitis Suppurativa and is anticipated to receive approval during the forecast period.

- In March 2025, Incyte announced positive topline results from two Phase 3 clinical trials of povorcitinib in patients with hidradenitis suppurativa. The trials demonstrated that a significantly higher proportion of patients treated with povorcitinib once daily (QD) achieved Hidradenitis Suppurativa Clinical Response (HiSCR)—defined as a ≥50% reduction from baseline in total abscess and inflammatory nodule (AN) count, with no increase in abscess or draining tunnel count—compared to those receiving placebo, highlighting the drug's promising efficacy.

- In January 2025, VGT-1849A, a novel antisense oligonucleotide-based Janus kinase 2 (JAK2) inhibitor, received Orphan Drug Designation from the FDA for the treatment of polycythemia vera (PV), recognizing its potential to address an unmet need in this rare hematologic disorder.

- In July 2024, Sun Pharmaceutical Industries Limited announced that the U.S. FDA approved LEQSELVI™ (deuruxolitinib) 8 mg tablets for the treatment of adults with severe alopecia areata. This approval marks a significant advancement in addressing the unmet needs of patients suffering from this autoimmune hair loss disorder.

- Celon Pharma, Aclaris Therapeutics, AstraZeneca and several other companies are currently engaged in the development and production of JAK inhibitor, which has the potential to significantly impact and enhance the JAK Inhibitors market.

DelveInsight’s “JAK Inhibitors – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the JAK Inhibitors, historical and Competitive Landscape as well as the JAK Inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The JAK Inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted JAK Inhibitors market size from 2020 to 2034 across 7MM. The report also covers current JAK inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

JAK Inhibitors Understanding and Treatment Algorithm

JAK Inhibitors Overview

Janus kinase (JAK) inhibitors are a class of small-molecule drugs that target the JAK family of enzymes, JAK1, JAK2, JAK3, and TYK2, which are essential mediators of cytokine signaling through the JAK-STAT pathway. These nonreceptor tyrosine kinases play a critical role in immune regulation, hematopoiesis, and inflammation by transmitting signals from cytokine receptors to the cell nucleus, influencing gene expression. Dysregulation of JAK activity has been implicated in a variety of disorders, including autoimmune diseases, hematologic malignancies, and inflammatory conditions.

First-generation JAK inhibitors, such as XELJANZ (tofacitinib) and OLUMIANT (baricitinib), target multiple JAKs, while newer agents are being developed with increased selectivity to minimize side effects and improve efficacy. JAK inhibitors have demonstrated clinical success in treating rheumatoid arthritis, myelofibrosis, ulcerative colitis, and atopic dermatitis. Expanding indications now include Crohn’s disease, alopecia areata, and graft-versus-host disease.

The growing approval and market uptake of JAK inhibitors, such as RINVOQ, JAKAFI, and LEQSELVI, highlight their therapeutic versatility and commercial potential. Advances in structural biology and precision drug design continue to drive development, including novel antisense oligonucleotide-based and highly selective JAK-targeted therapies, making JAK inhibitors a transformative option in modern immunology and personalized medicine.

Further details related to country-based variations are provided in the report

JAK inhibitor Treatment

The current treatment landscape for JAK inhibitors reflects significant clinical and commercial growth, driven by their expanding role in managing chronic immune-mediated and hematologic disorders. Initially introduced for conditions like myelofibrosis and rheumatoid arthritis, JAK inhibitors have rapidly progressed into mainstream therapy for a wide array of indications, including ulcerative colitis, atopic dermatitis, psoriatic arthritis, and alopecia areata. Their ability to modulate multiple cytokine pathways by inhibiting JAK-STAT signaling makes them versatile and effective across disease areas characterized by immune dysregulation.

What distinguishes the evolving treatment landscape is the shift toward increased selectivity and disease-specific targeting. While earlier agents like XELJANZ (tofacitinib) and JAKAFI (ruxolitinib) showed broad JAK inhibition, newer drugs such as RINVOQ (upadacitinib), SOTYKTU (deucravacitinib), and povorcitinib aim for selective JAK1 or TYK2 inhibition, reducing side effects like infections or thrombosis. Investigational therapies, including antisense oligonucleotide-based inhibitors like VGT-1849A, are paving the way for novel mechanisms in JAK modulation.

JAK inhibitors are also gaining traction under orphan drug designations, reflecting their potential in rare diseases like eosinophilic granulomatosis with polyangiitis (EGPA) and polycythemia vera. With growing clinical data, enhanced safety profiles, and broader regulatory approvals, JAK inhibitors are reshaping long-term treatment strategies across immunology, dermatology, gastroenterology, and hematology.

Further details related to country-based variations are provided in the report

JAK Inhibitors Drug Chapters

The drug chapter segment of the JAK Inhibitors reports encloses a detailed analysis of JAK Inhibitors marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the JAK Inhibitor clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

JAK Inhibitor Marketed Drugs

JAKAFI (ruxolitinib): Incyte Corporation

JAKAFI (ruxolitinib) is an oral prescription medicine developed by Incyte that works by inhibiting Janus kinase (JAK) enzymes, which are involved in the signaling pathways that regulate immune function and blood cell production. By blocking these enzymes, JAKAFI helps reduce inflammation and control abnormal blood cell growth in certain conditions.

It first got US FDA approval in November 2011 for the treatment of adults with myelofibrosis. After that, it also got approval for polycythemia vera (2014), acute graft-versus-host disease (GVHD) (2019), and chronic GVHD (2021). In the EU and Japan, it got approval in August 2012 and July 2014, respectively.

RINVOQ (upadacitinib): Sanofi

RINVOQ (upadacitinib) is an oral, once-daily JAK inhibitor developed by AbbVie. It treats several inflammatory conditions by targeting Janus kinase pathways to reduce immune overactivity. RINVOQ is approved for diseases including rheumatoid arthritis, psoriatic arthritis, atopic dermatitis, ulcerative colitis, Crohn’s disease, and various forms of spondyloarthritis. It offers a more favorable safety profile than its rival, such as Pfizer's XELJANZ (tofacitinib), because of its capacity to have modest effects on JAK3.

RINVOQ received its first FDA approval in August 2019 for moderate to severe rheumatoid arthritis. Since then, it has gained approvals for psoriatic arthritis, atopic dermatitis, ulcerative colitis, ankylosing spondylitis, non-radiographic axial spondyloarthritis, and most recently in May 2023, as a once-daily treatment for moderately to severely active Crohn's disease in adults. It also got EMA approval in December 2019 and received PMDA approval in January 2020.

|

Product |

Company |

Indication |

|

JAKAFI (ruxolitinib) |

Incyte Corporation |

|

|

RINVOQ (upadacitinib) |

Sanofi |

|

Note: Detailed current therapies assessment will be provided in the full report of JAK Inhibitors

JAK Inhibitor Emerging Drugs

Povorcitinib: Incyte Corporation

Povorcitinib (INCB054707) is an oral small-molecule JAK1 inhibitor. The chemical structure for povorcitinib was revealed in WHO proposed INN list 126 (Jan 2022), in which it was described as a Janus kinase inhibitor and anti-inflammatory agent. The drug is also being evaluated in Phase II Prurigo Nodularis clinical trials, and others. Currently, the drug is in Phase III stage of Hidradenitis suppurativa clinical trial.

In March 2025, Incyte announced positive topline results from two Phase 3 clinical trials of povorcitinib in hidradenitis suppurativa patients.

CPL409116: Celon Pharma

CPL 409116 is the first in class dual JAK/ROCK inhibitor in clinical development and is designed to generate anti-inflammatory and anti-fibrotic effects in selected autoimmune diseases. CPL’116 was administered orally in single ascending doses in healthy volunteers in order to assess safety and pharmacokinetic parameters (PK). No adverse events associated with administration of the investigational drug were observed, and the trial met its primary endpoint. Currently the drug is in Phase II stage of development for autoimmune indications including in rheumatoid arthritis patients with coexisting interstitial lung disease.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

List of Emerging Drugs | ||||

|

Povorcitinib |

Incyte Corporation |

Hidradenitis Suppurativa |

III |

NCT05620823 |

|

CPL409116 |

Celon Pharma |

Rheumatoid Arthritis |

II |

NCT05374785 |

Note: The emerging drug list is indicative, the full list will be given in the final report.

JAK Inhibitors Market Outlook

The Janus Kinase (JAK) inhibitors market is witnessing rapid expansion, driven by increasing therapeutic applications, technological advancements, and strong commercial performance. JAK enzymes play a critical role in cytokine signaling and immune system regulation, making them a prime target for treating autoimmune and hematologic disorders. Several JAK inhibitors are currently approved and available, targeting a range of autoimmune and hematologic conditions. JAKAFI (ruxolitinib) by Incyte was the first FDA-approved JAK inhibitor. XELJANZ (tofacitinib) by Pfizer, RINVOQ (upadacitinib) by AbbVie, OLUMIANT (baricitinib) by Eli Lilly, SOTYKTU (deucravacitinib) by Bristol Myers Squibb, and others are also approved. These therapies highlight the versatility and expanding utility of JAK inhibitors across a broad spectrum of inflammatory and immune-mediated diseases.

The market is led by blockbuster drugs such as JAKAFI (ruxolitinib), which generated USD 2.8 billion in 2024, and RINVOQ® (upadacitinib), with revenues reaching nearly USD 6 billion, highlighting widespread clinical adoption.

Beyond traditional indications like rheumatoid arthritis and myelofibrosis, JAK inhibitors are now being explored for diseases such as systemic lupus erythematosus (SLE), immune thrombocytopenia (ITP), and light chain amyloidosis. Late-stage candidates like povorcitinib for hidradenitis suppurativa and novel therapies like CPL 409116 for rheumatoid arthritis, and NS-229 (JAK1) for eosinophilic granulomatosis with polyangiitis (EGPA) clinical trials, showing promising efficacy. The recent FDA approval of LEQSELVI for alopecia areata marks further diversification of JAK-targeted therapies.

Multiple pharma giants, including Incyte Corporation, Sanofi, and AbbVie, are investing heavily in the space, while emerging players like Aclaris and Celon Pharma push innovation forward. As selectivity and safety profiles improve, JAK inhibitors are poised to become a cornerstone of immunotherapy across a growing spectrum of diseases.

With a growing number of clinical trials, expanding indications, and continued pharma investment, the JAK inhibitor landscape is positioned for accelerated expansion. As current studies mature, they will further define the scope of JAK inhibitors in oncology and immune-mediated diseases, solidifying their role as a transformative class of therapeutics.

JAK Inhibitors Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging JAK Inhibitors expected to be launched in the market during 2020–2034.

JAK Inhibitors Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunities for the JAK Inhibitors market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for JAK Inhibitors emerging therapies.

The growing efforts by major JAK inhibitor companies to raise substantial funding are expected to accelerate the development of pipeline products and fuel market growth. For instance, in May 2024, Ajax Therapeutics raised USD 95 million in a Series C funding round and announced that the Food and Drug Administration had cleared the company to begin its first clinical trial. The study was set to test AJ1-11095, a JAK2 inhibitor Ajax was developing for the bone marrow cancer myelofibrosis.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on JAK Inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Charite University, Dana-Farber Cancer Institute and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or JAK inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Hidradenitis suppurativa remains a difficult and life-altering disease with no definitive cure. Current treatment options are limited in both efficacy and tolerability, often falling short in addressing the everyday burden patients face—especially pain. These promising results underscore the potential of JAK inhibitors as a meaningful, well-tolerated oral therapy that could significantly improve outcomes for individuals living with Hidradenitis suppurativa.” |

|

“There’s a promising new oral JAK inhibitor, ritlecitinib, recently approved for alopecia areata. What makes it particularly exciting is its approval for use in adolescents—a key distinction from baricitinib, which was limited to adults. This broadens our ability to offer effective treatment earlier in the patient journey.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

In the U.S., eligible patients with commercial insurance may qualify to receive JAKAFI for as little as USD 0 per month through the IncyteCARES program. To qualify, patients must have an FDA-approved prescription, U.S. or Puerto Rico residency, and cannot be enrolled in Medicare, Medicaid, TRICARE, or similar government programs.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

JAK Inhibitors Key Updates

- In March 2025, Incyte announced positive topline results from two Phase 3 clinical trials of povorcitinib in patients with hidradenitis suppurativa.

- In January 2025, VGT-1849A, a novel antisense oligonucleotide-based Janus kinase 2 (JAK2) inhibitor, received Orphan Drug Designation from the FDA for the treatment of polycythemia vera (PV), recognizing its potential to address an unmet need in this rare hematologic disorder.

- In April 2025, NS Pharma, Inc., a subsidiary of Nippon Shinyaku Co., Ltd., announced that the U.S. FDA granted Orphan Drug Designation to NS-229 for the treatment of eosinophilic granulomatosis with polyangiitis (EGPA). NS-229 is being developed as a selective Janus kinase 1 (JAK1) inhibitor aimed at regulating immune cell function and preventing immune-mediated tissue damage.

- In November 2024, Ajax Therapeutics announced that the first patient had been enrolled in a Phase 1 clinical trial (NCT06343805) evaluating AJ1-11095, a first-in-class type II JAK2 inhibitor being developed for the treatment of myelofibrosis.

- In September 2024, RINVOQ got PMDA approval for a new additional pediatric dosage indicated for the treatment of atopic dermatitis in patients who have not responded sufficiently to conventional treatments.

The abstract list is not exhaustive, and will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of JAK Inhibitors, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the JAK Inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM JAK Inhibitors market.

JAK Inhibitors Report Insights

- JAK Inhibitors Targeted Patient Pool

- JAK Inhibitors Therapeutic Approaches

- JAK Inhibitors Pipeline Analysis

- JAK Inhibitors Market Size and Trends

- Existing and Future Market Opportunity

JAK Inhibitors Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- JAK Inhibitors Drugs Uptake and Key Market Forecast Assumptions

JAK Inhibitors Report Assessment

- Current Treatment Practices

- JAK Inhibitors Unmet Needs

- Pipeline Product Profiles

- JAK Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the total JAK Inhibitors market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative JAK Inhibitors market?

- Which drug type segment accounts for maximum JAK inhibitors sales?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape for JAK has Inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with JAK Inhibitors? What will be the growth opportunities across the 7MM for the patient population on JAK Inhibitors?

- What are the key factors hampering the growth of the JAK Inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for JAK Inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the JAK Inhibitors Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-inhibitor-market-report.png&w=256&q=75)

-inhibitor-pipeline.png&w=256&q=75)