Artificial Disc Market Summary

Artificial Disc Market by Product Type (Cervical and Lumbar), Material (Metal-On-Polymer, and Others), End-User (Hospitals, Orthopedic Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to the rising number of trauma and accident cases, increasing instance of musculoskeletal conditions, among others across the globe

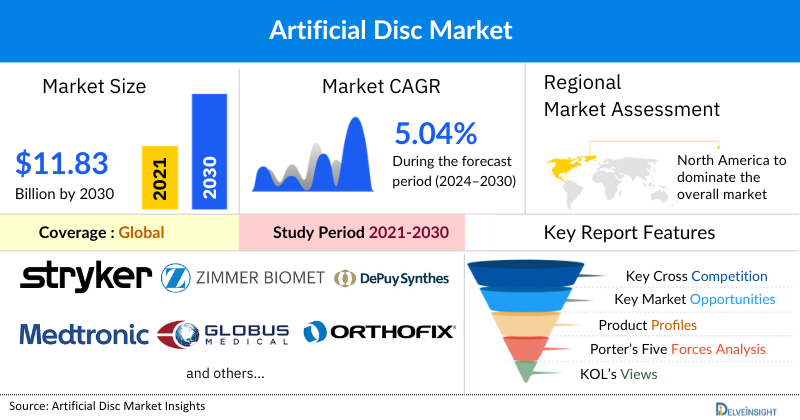

The Artificial Disc Market was valued at USD 8.82 billion in 2023, growing at a CAGR of 5.04% during the forecast period from 2024 to 2030 to reach USD 11.83 billion by 2030. The artificial disc market is growing significantly due to the the rising number of trauma and accident cases leading to spinal injuries, increasing cases of musculoskeletal conditions, and rising sports related injuries across the globe is expected to escalate the demand for artificial disc during the forecast period from 2024 to 2030.

Download the Sample PDF to Get More Insight @ Artificial Disc Market

Artificial Disc Market Dynamics

According to the World Health Organization (WHO) (2024) in 2021, 15.4 million people were living with spinal cord injuries globally. Most cases of spinal cord injury result from trauma, including falls, or acts of violence, and are therefore preventable. Moreover in 2023, it was stated that road traffic injuries were the leading cause of fatality in children and young adults in the age group of 5-29 years. The same factsheet further stated that near about 20-50 million people suffer from non-fatal injuries in road accidents resulting in a disability as a result of their injury globally each year. Artificial discs are used in the treatment of spinal injuries resulting from road traffic accidents, particularly those that cause significant disc damage or degeneration. By replacing damaged discs, artificial discs aim to restore spinal function and alleviate pain, improving mobility and quality of life for individuals who have sustained such injuries.

According to the National Safety Council (2024), it stated that in 2023, emergency departments treated 3.7 million people for injuries related to sports and recreational equipment. The activities that most often led to these injuries were exercise, cycling, and basketball. Furthermore, it stated that injuries from exercise and exercise equipment went up by 8% in 2023, with 482,886 injuries compared to 445,642 in 2022. The highest injury rate was among 15 to 24-year-olds. With a significant number of injuries related to sports and recreational activities, including exercise and cycling, artificial discs can play a crucial role in treating certain musculoskeletal conditions. These injuries often impact the spine, leading to conditions that may require surgical intervention. Artificial discs offer potentially better outcomes for individuals with severe disc degeneration or damage resulting from such activities.

As per data from the WHO in the year 2022, it stated that approximately 1.71 billion people were affected by musculoskeletal conditions worldwide. Further it stated that Low back pain is the main contributor to the overall burden of musculoskeletal conditions which contributes to 570 million prevalent cases worldwide. Musculoskeletal conditions, affecting a significant portion of the global population, often include low back pain as a major issue. Artificial discs offer a treatment option for individuals with degenerative disc disease and related spinal conditions, potentially alleviating pain and restoring function. Therefore, all the factors stated above collectively will drive the overall artificial disc market during the forecast period from 2024 to 2030.

However, availability of alternative treatment, nerve and blood vessel injury, bleeding, and stiffness associated with implants among others may limit their end-user base, thus acting as key constraints limiting the growth of the artificial disc market.

Artificial Disc Market Segment Analysis

Artificial Disc Market by Product Type (Cervical and Lumbar), Material (Metal-On-Polymer, and Others), End-User (Hospitals, Orthopedic Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). In the product type segment of artificial disc, the lumbar artificial discs category is expected to have a significant revenue share in the year 2023. The rapid growth of this product category can be attributed to the features and advantages of the lumbar artificial discs category.

Lumbar artificial discs are designed to mimic the natural motion of the spine, allowing for greater flexibility and movement in the lower back. This motion preservation can help reduce the risk of adjacent segment disease, where stress on neighboring discs leads to degeneration. These aim to alleviate pain and restore functionality while potentially reducing recovery time compared to fusion procedures. Their design often focuses on providing stability and support while maintaining a more natural range of motion in the lumbar region.

Increasing product-related safety studies in order to establish the efficacy of artificial lumbar discs offer a way to increase product reliability among end users. For instance, in July 2021, Aesculap Implant Systems, LLC announced the long-term reporting from its pivotal trial for the activl® artificial disc. The long-term evidence (7-year study period) from the US Food and Drug Administration-non-inferiority study presented in this paper supports lumbar total disc replacement as a safe and effective treatment option for degenerative disc disorder. Such studies provide evidence ensuring long-term product safety thereby promoting their uptake in the Artificial Disc Market.

Therefore, owing to all the above-mentioned factors, the demand for lumbar artificial discs category upsurges, thereby the category is expected to witness considerable growth eventually contributing to the overall growth of the artificial disc market during the forecast period from 2024 to 2030.

North America is expected to dominate the overall Artificial Disc Market

Among all the regions, North America is expected to dominate the artificial disc market in the year 2023 and is expected to do the same during the forecast period from 2024 to 2030. This is due to the high prevalence of vertebral compression fractures (VCFs), advancements in artificial disc technologies, and regulatory approvals that enhance product availability. In addition to this the presence of key industry players and well-established healthcare infrastructure in the region is expected to drive the market for artificial disc during the forecast period from 2024 to 2030.

The National Institute of Health in (2023) stated that VCFs are the most frequently reported type of fragility fracture. In the US, approximately 1 to 1.5 million VCFs occur each year. Studies suggest that about 25% of women aged 50 and older have at least one VCF. Additionally, between 40% and 50% of individuals over the age of 80 are estimated to have experienced a VCF, either as an acute event or discovered incidentally during the evaluation of other health issues. For individuals with VCFs, especially those who are older and who may have sustained these fractures either acutely or incidentally, artificial disc help stabilize the affected vertebrae and restore spinal alignment. This stabilization is essential for reducing pain, improving function, and preventing further vertebral collapse.

Successful milestone highlights the growing adoption of cutting-edge technologies in spinal surgery, potentially boosting the market for artificial discs by demonstrating their efficacy and expanding their availability. For example in March 2024, NGMedical GmbH, a medical device manufacturer exclusively focused on creating innovative technologies for spinal applications, announced the successful implantation of its MOVE®-C cervical artificial disc replacement in Mexico. Various product developmental strategies such as clearances in the region by regulatory authorities in the region play a major role in pushing forward the revenue shares of orthopedic power devices in the region. For example, in April 2021, NuVasive Inc. received the product approval from the US FDA for the Simplify® Cervical Artificial Disc for two-level cervical total disc replacement (cTDR).

The prompt and well-established healthcare services and infrastructure further contribute to the growth of the regional artificial disc market growth. The presence of key players such as Johnson & Johnson Services, Inc, Stryker Corporation, and Zimmer Biomet with their strong distribution networks ensure widespread availability and accessibility of these devices across the region increasing their revenue shares in the market, and supportive reimbursement programs providing immense growth opportunities for the same. Therefore, the interplay of all the aforementioned factors above would provide a conducive growth environment for the North America region in the artificial disc market.

Artificial Disc Companies

The leading Artificial Disc Companies such as Stryker, Zimmer Biomet, Johnson & Johnson Services, Inc, Medtronic, Globus Medical, B. Braun Melsungen AG, Orthofix Medical Inc., NuVasive Inc., Centinel Spine®, LLC, SYNERGY SPINE SOLUTIONS INC., AxioMed LLC, Spineart, NEURO FRANCE Implants, Norm Medical Devices Co. Ltd., Ackermann Medical GmbH & Co. KG, Aditus Medical, Evospine GmbH, Prodorth Spine, SIGNUS Medizintechnik GmbH, Spine Innovations, and others.

Recent Developmental Activities in the Artificial Disc Market

- In November 2023, NGMedical GmbH, a medical device manufacturer exclusively focused on creating innovative technologies for spinal applications, announced the approval of its MOVE®-C cervical artificial disc prosthesis in Mexico.

- In November 2023, Orthofix Medical Inc., a leading global spine and orthopedics company, announced the publication of the five-year results from the U.S. clinical study that compared the M6-C™ artificial cervical disc with anterior cervical discectomy and fusion (ACDF).

- In September 2023, ZimVie announced that the FDA has approved its investigational device exemption (IDE) application, allowing the enrollment of a study on patients undergoing simultaneous cervical disc arthroplasty and anterior cervical discectomy and fusion at adjacent levels between C3 and C7.

- In August 2023, the FDA approved a smaller height for ZimVie’s Mobi-C implant, recognizing that millimeters can make a significant difference in artificial cervical discs. The newly approved 4.5mm artificial discs will provide surgeons with greater flexibility in selecting the best implant for their patients."

- In February 2021, NuVasive Inc. acquired Simplify Medical helping the former expand their product portfolio with the acquisition of the most clinically effective cTDR technology and further distinguishes NuVasive’s cervical portfolio in the market.

Key Takeaways from the Artificial Disc Market Report Study

- Market size analysis for current artificial disc market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/services developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key companies dominating the artificial disc market

- Various opportunities available for the other competitors in the artificial disc market space

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current artificial disc market scenario?

- Which are the regions and countries where Artificial Disc Companies should have concentrated on opportunities for artificial disc market growth in the coming future?

Target Audience who can be benefited from this Artificial Disc Market Report Study

- Artificial disc product providers

- Research organizations and consulting companies

- Artificial disc-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up Artificial Disc Companies, venture capitalists, and private equity firms

- Distributors and traders dealing in artificial disc

- Various end-users who want to know more about the artificial disc market and the latest developments in the artificial disc market

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs