Chronic Inflammatory Demyelinating Polyneuropathy Market

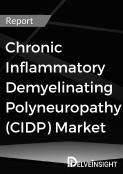

- The Chronic Inflammatory Demyelinating Polyneuropathy market is poised for steady growth, with a strong compound annual growth rate (CAGR) projected from 2024 to 2034. This expansion across the 7MM will be driven by the launch of innovative therapies, including riliprubart, nipocalimab and batoclimab.

- According to DelveInsight’s analysis, the CIDP market in the 7MM was valued at approximately USD 1,780 million in 2023. Over the forecast period from 2024 to 2034, this market is projected to grow at a CAGR of 7.2%.

- Octapharma, Pfizer, CSL Behring, and Takeda have been leading players in the CIDP market, offering approved treatments like HYQVIA in the US and EU, and PRIVIGEN in the US, EU, and Japan.

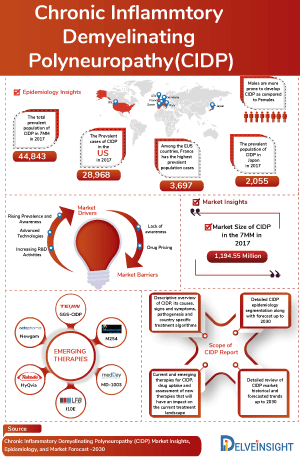

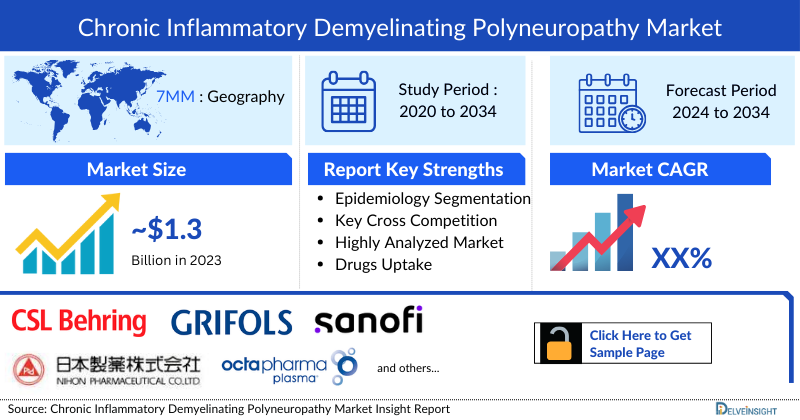

- According to DelveInsight’s estimates, in 2023, there were approximately 45,587 diagnosed prevalent cases of chronic inflammatory demyelinating polyneuropathy in the 7MM. Of these, the United States accounted for 66.3% of the cases, while EU4 and the UK accounted for nearly 29.2% and Japan represented 4.5% of the cases, respectively.

- For some patients, treatments may fail to halt disease progression or prevent frequent relapses, potentially resulting in disability. Additionally, there is a lack of approved therapies specifically for managing CIDP in patients prone to relapses.

- The off-label use of immunoglobulins hinders the adoption of approved therapies such as HIZENTRA and PRIVIGEN, while long-term use of corticosteroids or immunosuppressants elevates the risks of infections, diabetes, and osteoporosis. Moreover, for some patients, ineffective treatments fail to prevent relapses or halt disease progression, resulting in disability and complicating CIDP management.

Request for unlocking the sample page of the "Chronic Inflammatory Demyelinating Polyneuropathy Treatment Market"

Factors affecting Chronic Inflammatory Demyelinating Polyneuropathy Market Growth

- Rising Prevalence of CIDP and Related Neurological Disorders

Increasing diagnosis of CIDP worldwide is a major driver for the market. Growing recognition of its impact on motor and sensory functions is fueling demand for effective therapies. - Advancements in Therapeutic Options

The development of targeted therapies, including intravenous immunoglobulin (IVIG), corticosteroids, plasma exchange, and emerging biologics, is improving patient outcomes and encouraging adoption. - Growing Awareness Among Healthcare Professionals

Enhanced knowledge of CIDP symptoms, diagnosis, and management among neurologists and other specialists is driving early intervention and better disease management. - Expansion of Diagnostic Capabilities

Improvements in diagnostic techniques, such as nerve conduction studies, electromyography (EMG), and biomarker-based tests, allow accurate detection of CIDP, supporting market growth. - Increasing Geriatric Population

CIDP incidence is higher in older adults, and the growing global geriatric population is contributing to a larger patient pool requiring treatment and care. - Investment in Clinical Research and Trials

Ongoing research and clinical trials aimed at exploring novel therapies and treatment regimens are expanding therapeutic options and stimulating market growth. - Expansion of Healthcare Infrastructure in Emerging Markets

Improved access to neurology care, diagnostic facilities, and therapies in developing regions enhances patient reach and adoption of CIDP treatments

DelveInsight’s “Chronic Inflammatory Demyelinating Polyneuropathy Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of CIDP, historical and forecasted epidemiology, as well as the CIDP market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The chronic inflammatory demyelinating polyneuropathy market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CIDP market size from 2020 to 2034. The Chronic Inflammatory Demyelinating Polyneuropathy market report also covers CIDP treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Key Factors Driving the Chronic Inflammatory Demyelinating Polyneuropathy Market

Rising Prevalence of CIDP

According to DelveInsight’s estimates, in 2023, there were approximately 45K diagnosed prevalent cases of chronic inflammatory demyelinating polyneuropathy in the 7MM. These cases are further expected to increase by 2034. The rise in CIDP cases during the forecast period can be attributed to improved diagnostic capabilities, increased awareness among healthcare providers, and advancements in diagnostic technologies.

Approval of VYVDURA

The approval of VYVDURA in Japan for the treatment of CIDP marks a significant advancement in the therapeutic landscape. VYVDURA, the first and only neonatal Fc receptor (FcRn) blocker approved for CIDP, offers a unique mechanism of action and a highly convenient at-home self-injection option, supported by robust efficacy and safety data from the ADHERE trial and real-world evidence.

Expected Launch of Emerging CIDP Therapies

Some of the CIDP drugs in the pipeline include riliprubart ([SAR445088], Sanofi), nipocalimab (Johnson & Johnson Innovative Medicine), batoclimab ([IMVT-1401], Immunovant Sciences GmbH/HanAll Pharma/Roivant Sciences), and others.

Chronic Inflammatory Demyelinating Polyneuropathy Treatment Market

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) overview

Chronic inflammatory demyelinating polyneuropathy is a rare neurological disorder characterized by inflammation and damage to the protective covering of nerves, known as the myelin sheath. This damage disrupts the communication between nerves and muscles, leading to progressive weakness and impaired sensory function.

CIDP is clinically classified into typical and atypical forms. The typical form, the most common, involves symmetrical polyneuropathy, where both proximal and distal muscles are equally affected, leading to widespread weakness and sensory deficits. Symptoms usually progress gradually, but severity varies among patients, impacting walking, fine motor skills, and daily activities.

Atypical CIDP includes variants like Multifocal Acquired Demyelinating Sensory and Motor Neuropathy (MADSAM), or asymmetric CIDP, where nerve damage is localized rather than symmetrical. Another variant, Distal Acquired Demyelinating Symmetric Neuropathy (DADS), affects the lower limbs and progresses more slowly. CIDP may also affect only motor or sensory nerves.

The prognosis of CIDP largely depends on early diagnosis and timely treatment. Many patients respond positively to immunomodulatory therapies, resulting in significant improvement or even remission. However, some cases may become resistant to treatment, resulting in ongoing disability. A small number of patients may experience severe, progressive disease despite receiving therapy.

Chronic Inflammatory Demyelinating Polyneuropathy diagnosis

CIDP diagnosis involves clinical evaluation for symptoms like muscle weakness and sensory loss, along with nerve conduction studies (NCS) to detect slowed conduction. Cerebrospinal fluid (CSF) analysis may reveal elevated protein levels. Electromyography helps exclude other conditions, while imaging techniques, including MRI and ultrasound, support diagnosis and differentiate CIDP.

Further details related to country-based variations are provided in the report…

Chronic Inflammatory Demyelinating Polyneuropathy treatment

CIDP is a condition causing progressive nerve damage due to immune-mediated inflammation. Treatments include corticosteroids, IVIg, plasmapheresis, immunosuppressive agents, and experimental autologous stem cell transplantation. While corticosteroids improve symptoms, they have long-term side effects. IVIg is effective and well-tolerated, often leading to remission. Plasma exchange offers short-term relief, and immunosuppressants are used for resistant cases. Stem cell therapy is experimental but promising.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Epidemiology

As the market is derived using a patient-based model, the CIDP epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Diagnosed Prevalent Cases of CIDP, Gender-specific Diagnosed Prevalent Cases of CIDP, Age-specific Diagnosed Prevalent Cases of CIDP, Clinical Subtype-specific Diagnosed Prevalent Cases of CIDP, and Refractory Cases of CIDP in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- In 2023, the US accounted for the highest diagnosed prevalent cases of CIDP with approximately 30,230 cases, which are expected to increase by 2034.

- Among EU4 and the UK, the UK had the highest diagnosed prevalent cases of CIDP, with nearly 3,250 cases in 2023, followed by Germany with around 3,174 cases. In contrast, Spain has the lowest number, with nearly 1,691 cases.

- In 2023, Japan accounted for approximately 2,045 diagnosed prevalent cases of CIDP which are expected to increase by 2034.

- In 2023, among the subtype-specific cases of CIDP, the US accounted for approximately 15,417 cases for typical CIDP and 14,813 cases for atypical CIDP.

- In 2023, Germany had approximately 2,380 males and 793 females diagnosed with CIDP.

- In 2023, the diagnosed prevalent cases of CIDP across the age groups 0–19 years, 20–39 years, 40–59 years, 60–79 years and 80 years and older were approximately 41, 82, 798, 900 and 225, respectively, in Japan.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Recent Developments

- In April 2025, argenx announced FDA approval of a prefilled syringe option for self-injection of VYVGART® Hytrulo (efgartigimod alfa and hyaluronidase-qvfc) to treat adults with generalized myasthenia gravis (gMG) who are AChR antibody positive and those with chronic inflammatory demyelinating polyneuropathy (CIDP).

- In March 2025, Immunovant, Inc. (Nasdaq: IMVT) reported topline results from its Phase 3 study of batoclimab in myasthenia gravis (MG) and initial results from Period 1 of its Phase 2b study in chronic inflammatory demyelinating polyneuropathy (CIDP).

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Drug Chapters

The drug chapter segment of the CIDP market report encloses a detailed analysis of CIDP-marketed drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the CIDP clinical trial details, expressive pharmacological action, agreements and collaborations and approval, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Chronic Inflammatory Demyelinating Polyneuropathy Drugs

HYQVIA (Immune Globulin Infusion 10% [Human] with Recombinant Human Hyaluronidase): Takeda

HYQVIA is an immunostimulant combining human immunoglobulin (IG 10%) with recombinant human hyaluronidase, enabling SC for easier administration. This treatment offers a convenient alternative to IVIg by allowing larger-volume, less frequent SC due to enhanced absorption. HYQVIA modulates the immune system to reduce autoimmune damage to the nerves in CIDP. In January 2024, the US FDA approved HYQVIA for the maintenance treatment of CIDP in adults. The European Commission also approved it for the same purpose, and the UK’s MHRA granted approval in March 2024. Takeda filed for approval in Japan in August 2024.

VYVGART HYTRULO (Efgartigimod Alfa and Hyaluronidase-Qvfc): Argenx

VYVGART HYTRULO is a coformulation of efgartigimod alfa and recombinant human hyaluronidase, designed to enhance SC absorption. It works by reducing autoantibodies implicated in CIDP through inhibition of the FcRn receptor. Approved by the US FDA in June 2024, it received orphan drug designation for CIDP in 2021. This therapy offers a convenient option for maintaining remission via SC administration.

GAMMAGARD LIQUID/KIOVIG (Immune Globulin Infusion [Human] 10% Solution): Takeda

GAMMAGARD LIQUID/KIOVIG is a ready-to-use IV formulation of IVIg derived from human plasma, offering a broad spectrum of antibodies. It works by modulating the immune system, reducing inflammation, and preventing further nerve damage in CIDP. Clinical studies have shown its effectiveness in improving muscle strength and functional ability, helping manage symptoms and maintain long-term stability. It was approved by the US FDA in January 2024 for adults with CIDP. In May 2019, KIOVIG was also approved in the EU for treating CIDP in adults, children, and adolescents (0–18 years).

|

MoA |

RoA |

|

Immunostimulant |

SC |

|

FcRn inhibitors |

SC |

|

Immunostimulant |

IV |

Emerging CIDP Drugs

Riliprubart (SAR445088): Sanofi

Riliprubart (SAR445088) is an investigational IgG4 humanized monoclonal antibody designed to block activated C1s, a key component of the classical complement pathway. By inhibiting C1s, it aims to reduce inflammation and prevent nerve damage in CIDP. Currently in Phase III, riliprubart targets CIDP patients resistant to standard treatments or IVIg. The FDA granted ODD in July 2021. Submission timelines for CIDP treatment are projected for completion by 2026.

Nipocalimab: Janssen Research and Development

Nipocalimab (JNJ-80202135) is an investigational monoclonal antibody that acts as an FcRn inhibitor, administered IV. It targets harmful IgG antibodies, without broadly suppressing the immune system. It is in Phase II/III trials for CIDP. In October 2021, the US FDA granted ODD to nipocalimab for its potential use in treating CIDP. Additionally it is anticipated that the ongoing trials of nipocalimab could be pivotal in shaping its clinical potential in the realm of CIDP treatment.

Batoclimab (HL161): Immunovant Sciences GmbH/HanAll Pharma/Roivant Sciences

Batoclimab (HL161) is a fully human monoclonal antibody targeting FcRn, developed as a SC injection for autoimmune diseases driven by IgG antibodies, including CIDP. It works by inhibiting FcRn, promoting IgG breakdown and reducing its levels. Currently in Phase II trials for CIDP, top-line results are expected by March 2025. Batoclimab's data will guide the design of future trials and regulatory approval for CIDP therapies.

|

MoA |

RoA |

Company |

Logo |

Chronic Inflammatory Demyelinating Polyneuropathy Drug Class Insights

Chronic inflammatory demyelinating polyneuropathy treatment primarily involves corticosteroids as the first-line therapy, often combined with immunosuppressants like methotrexate or azathioprine for patients who do not respond adequately. In cases of severe or resistant disease, IVIg may be beneficial, and biologics such as rituximab can be considered for some cases.

Emerging therapies include riliprubart (SAR445088), nipocalimab (JNJ-80202135), and batoclimab (HL161).

Riliprubart (SAR445088), is an investigational IgG4 humanized monoclonal antibody designed to selectively block activated C1s, a key component of the classical complement pathway in the innate immune system.

Nipocalimab (JNJ-80202135) is an investigational, high-affinity monoclonal antibody administered IV as an FcRn inhibitor. It is currently in Phase II/III clinical trials for CIDP.

Batoclimab (HL161) a subcutaneous anti-FcRn antibody. Batoclimab specifically inhibits FcRn, promoting the breakdown of IgG and reducing its levels in circulation. It is being developed collaboratively by Immunovant, with HanAll Biopharma leading efforts to expand its indications. It targets rare autoimmune diseases by reducing IgG levels.

Continued in report…

Chronic Inflammatory Demyelinating Polyneuropathy Market Outlook

Chronic inflammatory demyelinating polyneuropathy, though classified as a rare disease, has gained increasing recognition in recent years. This is largely due to improvements in diagnostic techniques, greater awareness among healthcare professionals, and a deeper understanding of the condition. Management of CIDP typically involves a combination of pharmacological therapies and supportive interventions, with the primary objectives to suppress inflammation, modulate immune responses, and improve motor and sensory function.

The treatment landscape for CIDP has advanced with a multi-faceted approach, combining medications, and supportive care. Corticosteroids, such as prednisone and dexamethasone, are often the initial treatment. While they are effective in inducing remission, they carry a high risk of significant long-term side effects, including osteoporosis, weight gain, and increased susceptibility to infections. These adverse effects often necessitate combination therapies with steroid-sparing agents, which may not be universally effective.

Plasma exchange has shown short-term efficacy in removing harmful autoantibodies and improving symptoms. However, it is an invasive procedure that requires highly specialized centers and trained personnel, limiting its accessibility, IVIg has become the gold standard due to its demonstrated efficacy in long-term disease control and symptom improvement. Despite this, IVIg is costly, time-consuming, and heavily reliant on donor plasma, raising concerns about its long-term availability.

Several Chronic Inflammatory Demyelinating Polyneuropathy drugs are currently approved and available for the treatment of CIDP, reflecting the focus on immune modulation therapies. Key options include PANZYGA, an immunoglobulin (human - ifas) co-developed by Pfizer and Octapharma, and PRIVIGEN, an immunoglobulin offered by CSL Behring. PRIVIGEN is a ready-to-use, room-temperature-stored, liquid IVIg stabilized with proline.

There is a significant need for new treatments for CIDP, as existing therapies often fall short of fully managing the condition. Innovative drug development could provide more effective options for patients. Several promising drugs are currently in the pipeline, including riliprubart (SAR445088), nipocalimab (JNJ-80202135), and batoclimab (HL161), among others.

- The Chronic Inflammatory Demyelinating Polyneuropathy market size in the US was approximately USD 1,382 million in 2023 and is anticipated to increase due to the launch of emerging therapies.

- The total Chronic Inflammatory Demyelinating Polyneuropathy market size of EU4 and the UK was calculated to be approximately USD 363 million in 2023, which was nearly 20% of the total Chronic Inflammatory Demyelinating Polyneuropathy market revenue for the 7MM.

- Among EU4 and the UK, the UK accounted for the highest Chronic Inflammatory Demyelinating Polyneuropathy market with approximately USD 88 million in 2023, followed by Germany with approximately USD 87 million in the respective year, and Spain, capturing the least Chronic Inflammatory Demyelinating Polyneuropathy market with nearly USD 46 million in 2023.

- In 2023, the total CIDP market size was approximately USD 35 million in Japan which is anticipated to increase during the forecast period (2024–2034).

- As per the estimates, among the current marketed drugs currently in use, PRIVIGEN held the largest Chronic Inflammatory Demyelinating Polyneuropathy market share, generating approximately USD 441 million in revenue in 2023 across the 7MM.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Drugs Uptake

This section focuses on the uptake rate of potential CIDP drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Pipeline Development Activities

The Chronic Inflammatory Demyelinating Polyneuropathy market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Chronic Inflammatory Demyelinating Polyneuropathy companies involved in developing targeted therapeutics.

Pipeline development activities

The CIDP treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for CIDP.

KOL Views

To keep up with current Chronic Inflammatory Demyelinating Polyneuropathy market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on CIDP evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of Minnesota, the US, University Hospital of Leicester, the US, Thomas Jefferson University, the US, University Hospital Cologne, Germany, Centre Hospitalier Universitaire (CHU) de Saint-Étienne, France, Università degli Studi del Piemonte Orientale, Italy, Hospital de la Santa Creu i Sant Pau, Spain, University College London, the UK, Kindai University, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or CIDP market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, it is becoming increasingly evident that a significant number of patients diagnosed with CIDP may actually have a different underlying condition, or in some cases, no neuropathy at all. Studies suggest that up to half of those diagnosed in the US may be misdiagnosed, highlighting the need for more accurate diagnostic practices.

As per the KOLs from Germany, early diagnosis, swift treatment initiation, and close monitoring of treatment response are crucial in preventing long-term disability in CIDP. Adopting a ‘hit hard and early’ approach to treatment is key to managing the disease effectively, as it can significantly improve outcomes and reduce the risk of permanent nerve damage. Early intervention ensures the best chance for recovery and helps minimize the impact of this debilitating condition.

As per the KOLs from Japan, CIDP is an immune-mediated disorder that causes gradual peripheral nerve damage over two months or more. CIDP requires careful diagnosis and management due to its slow progression, and understanding its epidemiology is crucial for improving treatment strategies and patient outcomes in the region.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging Chronic Inflammatory Demyelinating Polyneuropathy therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Chronic Inflammatory Demyelinating Polyneuropathy Market Access and Reimbursement

Pfizer CIDP Warranty Program

Pfizer’s Pledge Warranty Program provides financial support for eligible adult CIDP patients prescribed PANZYGA. The program offers a refund of out-of-pocket drug costs for up to the first four treatments if the treatment is discontinued by the patient’s healthcare provider for clinical reasons. Aggregate and per-treatment refund limits apply. If a patient’s commercial insurance or other payers covered part of the drug’s cost, they may also receive a refund up to the program maximum, minus the patient’s out-of-pocket expenses.

Further details will be provided in the report.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the CIDP Market Report

- The Chronic Inflammatory Demyelinating Polyneuropathy market report covers a segment of key events, an executive summary, and a descriptive overview of chronic inflammatory demyelinating polyneuropathy, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging CIDP therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the chronic inflammatory demyelinating polyneuropathy market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Chronic Inflammatory Demyelinating Polyneuropathy treatment market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM chronic inflammatory demyelinating polyneuropathy market.

Chronic inflammatory demyelinating polyneuropathy market report insights

- CIDP Patient Population

- Chronic Inflammatory Demyelinating Polyneuropathy Therapeutic Approaches

- Chronic Inflammatory Demyelinating Polyneuropathy Pipeline Analysis

- Chronic Inflammatory Demyelinating Polyneuropathy Market Size

- Chronic Inflammatory Demyelinating Polyneuropathy Market Trends

- Existing and Future CIDP Market Opportunity

Chronic Inflammatory Demyelinating Polyneuropathy market report key strengths

- 11 years Forecast

- The 7MM Coverage

- Chronic Inflammatory Demyelinating Polyneuropathy Epidemiology Segmentation

- Key Cross Competition

- Attribute Analysis

- Chronic Inflammatory Demyelinating Polyneuropathy Drugs Uptake

- Key Chronic Inflammatory Demyelinating Polyneuropathy Market Forecast Assumptions

Chronic Inflammatory Demyelinating Polyneuropathy Market report assessment

- Current Chronic Inflammatory Demyelinating Polyneuropathy Treatment Practices

- Chronic Inflammatory Demyelinating Polyneuropathy Unmet Needs

- CIDP Pipeline Product Profiles

- CIDP Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions

Chronic Inflammatory Demyelinating Polyneuropathy Market Insights

- What was the total Chronic Inflammatory Demyelinating Polyneuropathy market size, the market size of chronic inflammatory demyelinating polyneuropathy by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will riliprubart (SAR445088) affect the treatment paradigm of chronic inflammatory demyelinating polyneuropathy?

- How will PRIVIGEN compete with other upcoming products and marketed Chronic Inflammatory Demyelinating Polyneuropathy therapies?

- Which Chronic Inflammatory Demyelinating Polyneuropathy drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the CIDP market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of chronic inflammatory demyelinating polyneuropathy? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to chronic inflammatory demyelinating polyneuropathy?

- What is the historical and forecasted chronic inflammatory demyelinating polyneuropathy patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent chronic inflammatory demyelinating polyneuropathy population during the forecast period (2024–2034)?

- What factors are contributing to the growth of chronic inflammatory demyelinating polyneuropathy cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of chronic inflammatory demyelinating polyneuropathy? What are the current clinical and treatment guidelines for treating chronic inflammatory demyelinating polyneuropathy?

- How many CIDP companies are developing therapies for the treatment of chronic inflammatory demyelinating polyneuropathy?

- How many emerging therapies are in the mid-stage and late stage of development for treating chronic inflammatory demyelinating polyneuropathy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved Chronic Inflammatory Demyelinating Polyneuropathy therapy in the US?

- What is the 7MM historical and forecasted Chronic Inflammatory Demyelinating Polyneuropathy market?

Reasons to Buy

- The Chronic Inflammatory Demyelinating Polyneuropathy Market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the chronic inflammatory demyelinating polyneuropathy market.

- Insights on patient burden/ Chronic Inflammatory Demyelinating Polyneuropathy prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Chronic Inflammatory Demyelinating Polyneuropathy market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying upcoming Chronic Inflammatory Demyelinating Polyneuropathy companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for chronic inflammatory demyelinating polyneuropathy, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming Chronic Inflammatory Demyelinating Polyneuropathy companies can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

.png&w=256&q=75)