FcRn Inhibitor Market Summary

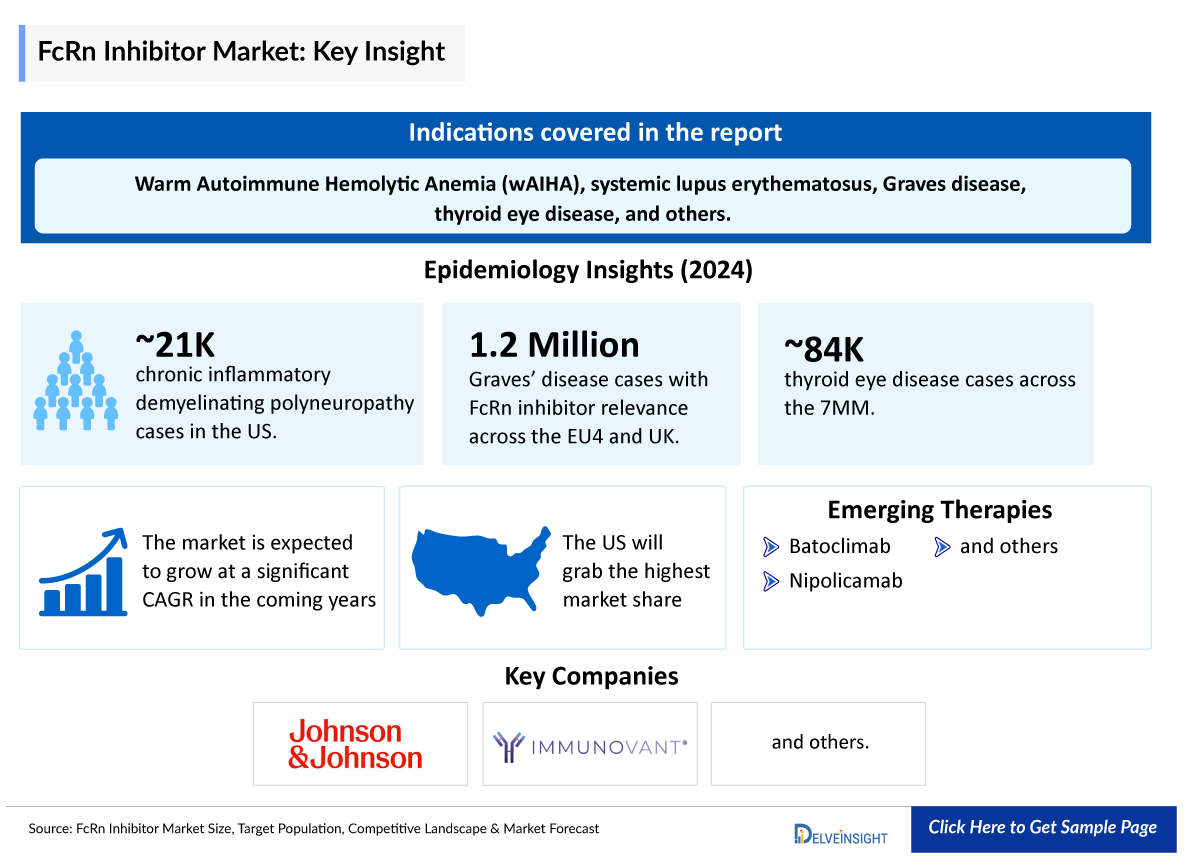

- The FcRn Inhibitors market in the 7MM is projected to grow at a significant CAGR by 2036 in leading countries (US, EU4, UK and Japan).

- In 2025, the FcRn inhibitors market in the US was valued at approximately USD 2.2 billion. Driven by strong clinical demand and expanding indications, the market is projected to grow at a robust CAGR over the forecast period (2026-2036).

- By 2036, VYVGART HYTRULO is anticipated to lead the market, capturing an estimated 30% share, reflecting its strong clinical profile and early market entry advantage.

FcRn Inhibitors Market and Epidemiology Analysis

- The FcRn Inhibitors Market is expected to grow significantly in the coming years due to the increasing number of patients who are being diagnosed with Warm Autoimmune Hemolytic Anemia (wAIHA), systemic lupus erythematosus, Graves disease, thyroid eye disease, and many more indications; the growing awareness of FcRn inhibitors, and the increasing number of emerging drugs that are under clinical trials and filed for approval by various FcRn Inhibitors Companies.

- Neonatal fragment crystallizable (Fc) receptor (FcRn), also known as the Brambell receptor, is the major histocompatibility complex (MHC) I-related receptor encoded by the FCGRT gene. In the 1960s, Brambell was the first to propose that there might be a receptor capable of mediating the transport of IgG from mother to infant.

- FcRn inhibitors are effective treatments for myasthenia gravis, thyroid eye disease, and other indications like bullous pemphigoid, chronic inflammatory demyelinating polyneuropathy (CIDP), warm autoimmune hemolytic anemia, Graves’ disease, and many more indications.

- FcRn Inhibitors Companies such as Johnson & Johnson Innovative Medicine, UCB Biopharma, Pfizer, and Viridian Therapeutics are engaged in the FcRn inhibitors development, with many approved and emerging FcRn Inhibitors drugs.

- Efgartigimod alfa is leading with established dominance and potential expansion into indications like myasthenia gravis with the trial ADHERE. It is the largest randomized controlled CIDP trial to date. It supports the role of pathogenic autoantibodies in CIDP pathology.

- Dubbed the FLEX trial, the study will explore whether batoclimab will address important patient needs throughout different phases of the disease, including reducing symptoms during flares, preventing myasthenic exacerbation/crisis, and maintaining remission. The 4-part phase 3 study will randomize 3 groups of patients to receive 1 of 2 doses of batoclimab or placebo (AJMC, 2024).

- In the full year 2023, the global net product revenues generated by VYVGART and VYVGART SC were USD 908 million and USD 246 million respectively.

- FcRn inhibitors have the potential to meet an urgent need for a more targeted therapeutic approach to pathogenic IgG reduction and provide a less invasive and time-consuming alternative to PLEX, IA, and immunomodulatory high-dose IVIg therapies.

Key Factors Driving the FcRn Inhibitor Market

Rising Prevalence of Autoimmune Diseases

- Increasing incidence of IgG-mediated autoimmune conditions like generalized myasthenia gravis (gMG), chronic inflammatory demyelinating polyneuropathy (CIDP), and thyroid eye disease is expanding the patient population seeking targeted IgG reduction therapies.

Emerging Clinical Pipeline and Approvals

- Advancing late-stage candidates such as nipocalimab, batoclimab, and IMVT-1402 alongside approved drugs like efgartigimod (VYVGART) and rozanolixizumab (RYSTIGGO) are diversifying treatment options across multiple indications.

Superior Mechanism Targeting IgG Recycling

- FcRn inhibitors' ability to selectively reduce pathogenic IgG levels without impacting other immunoglobulin classes offers a safer, more precise alternative to broad immunosuppression therapies.

Improved Safety Profile Over Existing Treatments

- Lower risk of serious infections and adverse events compared to plasma exchange, IVIg, or other immunomodulators is enhancing physician confidence and patient acceptance.

Regulatory Designations Accelerating Development

- Frequent FDA Breakthrough Therapy, Fast-Track, and EMA approvals for pipeline agents like nipocalimab are shortening timelines and facilitating faster market entry.

Expanding Indications Beyond Generalized Myasthenia Gravis

- Successful trials in CIDP, pemphigus vulgaris, warm autoimmune hemolytic anemia, Graves' disease, and rheumatoid arthritis are broadening therapeutic applications.

Strategic Industry Investments and Partnerships

- Active collaborations among companies like argenx, UCB, Immunovant, and Johnson & Johnson are fueling R&D, manufacturing scale-up, and global commercialization efforts.

Healthcare Infrastructure and Awareness Growth

- Expanding specialty care centers, reimbursement support in key markets, and heightened awareness of biologics in emerging regions like Asia-Pacific are driving adoption.

DelveInsight’s “FcRn inhibitors Market Forecast, Target Population, and Competitive Landscape – 2036” report delivers an in-depth understanding of the FcRn inhibitor, historical and Competitive Landscape as well as the FcRn inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The FcRn inhibitors Drugs Market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted FcRn inhibitor market size across 7MM from 2022 to 2036. The report also covers current FcRn inhibitor treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the FcRn inhibitors market potential.

Scope of the FcRn Inhibitor Market Report | |

|

Study Period |

2022 to 2036 |

|

Forecast Period |

2026-2036 |

|

Geographies Covered |

|

|

FcRn Inhibitors Market |

|

|

FcRn Inhibitorss Market Size | |

|

FcRn Inhibitors Companies |

|

|

FcRn Inhibitors Epidemiology Segmentation |

|

FcRn Inhibitors Understanding

FcRn Inhibitors Overview

The neonatal fragment crystallizable (Fc) receptor (FcRn) functions as a recycling mechanism to prevent degradation and extend the half-life of IgG and albumin in circulation. FcRn plays a crucial role in the maintenance of IgG levels by salvaging IgG from lysosomal degradation, thereby prolonging its half-life. In non-human primates, anti-FcRn antibodies reduced IgG levels by over 60%, without significant concomitant changes in the serum content of albumin, IgA, or IgM. FcRn inhibitors are anti-FcRn monoclonal antibodies with high affinity for FcRn at both neutral and acidic pH. Inside the cell, FcRn inhibitors compete with IgG for binding to FcRn. Because of their higher affinity, FcRn inhibitors prevent IgG from binding to FcRn, and IgG is transported to the lysosome and degraded, which leads to a decrease in circulating IgG levels. FcRn: Neonatal Fc receptor; IgG: immunoglobulin G.

Further details related to country-based variations are provided in the report

Neonatal Fc receptor-targeted therapies are engineered to selectively target FcRn through various methods, such as Fc fragments or monoclonal anti-FcRn antibodies. These approaches enhance the breakdown of autoantibodies by blocking the immunoglobulin G recycling pathway. This mechanism reduces overall plasma immunoglobulin levels, including the levels of pathogenic autoantibodies, without affecting the other immunoglobulin classes, immunoglobulin A, immunoglobulin E, immunoglobulin M, and immunoglobulin D levels. Drugs that inhibit FcRn include efgartigimod, rozanolixizumab, batoclimab, and nipocalimab. These medications can be administered either intravenously or subcutaneously. Numerous clinical trials are currently underway to investigate their effectiveness, safety, and tolerability in various neurological conditions, including myasthenia gravis and other neurological disorders such as chronic inflammatory demyelinating polyneuropathy, myositis, neuromyelitis optica, and myelin oligodendrocyte glycoprotein (MOG) antibody disease. Positive results from clinical trials of efgartigimod and rozanolixizumab led to their approval for the treatment of generalized myasthenia gravis. Additional clinical trials are still ongoing.

FcRn Inhibitors Epidemiology

The FcRn inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indications for FcRn inhibitors, total eligible patient pool of selected indication for FcRn inhibitors, total treated cases in selected indications for FcRn inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2022 to 2036.

Key Takeaways from the FcRn Inhibitor Patient Pool Analysis

- In 2023, chronic inflammatory demyelinating polyneuropathy cases were approximately 21,000 in the United States.

- Graves’ disease had an estimated FcRn Inhibitors prevalence of around 1,241,720 cases across the EU4 and the UK in 2023.

- Thyroid eye disease cases were approximately 84,000 across the 7MM in 2023.

FcRn Inhibitor Market Recent Developments and Breakthroughs

- In March 2026, Johnson & Johnson announced that the U.S. FDA had granted Fast Track status to nipocalimab for the potential treatment of adult patients with systemic lupus erythematosus (SLE).

- In February 2026, argenx SE announced encouraging topline results from its Phase 3 ADAPT OCULUS study investigating VYVGART for adults diagnosed with ocular myasthenia gravis.

- In January 2026, argenx SE announced that the FDA had granted priority review to a supplemental Biologics License Application (sBLA) for VYVGART, seeking approval for its use in adults with acetylcholine receptor antibody (AChR-Ab) seronegative generalized myasthenia gravis (gMG).

- In January 2026, Johnson & Johnson reported encouraging topline findings from the Phase 2b JASMINE (NCT04882878) trial involving adults with Systemic Lupus Erythematosus, and has begun advancing the therapy into a Phase 3 clinical development program.

- In December 2025, Johnson & Johnson announced that the European Commission granted Marketing Authorisation for IMAAVY (nipocalimab) as an add-on therapy for gMG in adults and adolescents aged twelve years and older who are anti–AChR or anti–MuSK antibody-positive.

- In June 2025, Argenx presented Phase 2 efgartigimod data at EULAR 2025, showing efficacy in myositis and Sjögren’s disease, supporting precision therapy potential.

- In April 2025, the FDA approved IMAAVY (nipocalimab-aahu) by Johnson & Johnson, the first FcRn blocker for generalized myasthenia gravis (gMG) in anti-AChR or anti-MuSK antibody-positive adults and pediatric patients aged 12+, based on Vivacity-MG3 (adults) and Vibrance (pediatrics) trials showing IgG reduction and symptom improvement.

The list is not exhaustive, and will be provided in the final report

FcRn Inhibitor Drug Analysis

The drug chapter segment of the FcRn inhibitor drugs market reports encloses a detailed analysis of approved FcRn inhibitors, late-stage (Phase III and Phase II) FcRn inhibitors. It also helps understand the FcRn inhibitor clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

FcRn Inhibitors Marketed Drugs

-

VYVGART (Efgartigimod): Argenx

Efgartigimod is designed as a first-in-class investigational antibody fragment to target the neonatal Fc receptor (FcRn). It is being evaluated for the treatment of patients with severe autoimmune diseases with confirmed presence of pathogenic immunoglobulin G and IgG autoantibodies, where a severe unmet medical need exists. Efgartigimod’s subcutaneous form is coformulated with recombinant human hyaluronidase PH20 (rHuPH20), Halozyme's ENHANZE drug delivery technology, which allows for subcutaneous delivery of biologics that are typically administered via infusion. In December 2021, it was approved by the FDA for Generalised Myasthenia Gravis. It is in the pipeline for various other indications, including thyroid eye disease, Myositis, and many more diseases.

-

RYSTIGGO (rozanolixizumab-noli): UCB Biopharma

It is a high-affinity humanized immunoglobulin G4 monoclonal antibody directed against human neonatal Fc receptor (FcRn). It is administered subcutaneously. It received its first approval on 27 June 2023 in the USA for the treatment of generalized myasthenia gravis (gMG) in adults who are anti-acetylcholine receptor (AChR) or anti-muscle-specific kinase (MuSK) antibody positive. Rozanolixizumab is the first agent to be approved in the USA for both anti-AChR and anti-MuSK antibody-positive gMG. A regulatory assessment of rozanolixizumab for the treatment of gMG is currently underway in the EU and Japan. Clinical development is ongoing for the treatment of leucine-rich glioma-inactivated 1 autoimmune encephalitis, myelin oligodendrocyte glycoprotein (MOG) antibody disease, and severe fibromyalgia.

|

Company |

RoA |

|

Argenx |

IV |

|

UCB Biopharma |

Subcutaneous infusion |

FcRn Inhibitors Emerging Drugs

-

Batoclimab: Immunovant

Batoclimab (HBM9161), a fully human anti-FcRn mAb, blocks FcRn-IgG interactions, accelerating the degradation of autoantibodies and leading to the treatment of pathogenic IgG-mediated autoimmune diseases. A Phase II study in myasthenia gravis clinical trial showed that batoclimab can quickly and significantly alleviate patients' symptoms and improve quality of life. Earlier studies demonstrated that batoclimab is well tolerated and can rapidly reduce total IgG in a wide array of pathogenic IgG-mediated autoimmune diseases. It is being developed as a low-volume subcutaneous (SC) injection for the treatment of a variety of IgG-mediated autoimmune disorders, including myasthenia gravis, thyroid eye disease, chronic inflammatory demyelinating polyneuropathy (CIDP), and Graves’ disease. It is currently being evaluated for the Phase II trial for myasthenia gravis. Immunovant is conducting its trials in Phase II and III.

- IMVT-1402: Immunovant

Immunovant had received IND clearance for IMVT-1402 from the US FDA. It is designed to be a potentially best-in-class anti-FcRn antibody for the treatment of IgG-mediated autoimmune diseases. In the initial results of a Phase I clinical trial in healthy adults, IMVT-1402 demonstrated favorable pharmacodynamic and safety data. These attributes, combined with a convenient route of administration that may enable patient self-administration, position IMVT-1402 well as a potential treatment for a variety of autoimmune diseases associated with patient unmet need.

IMVT-1402 development is progressing with potentially registrational studies in Graves’ disease, myasthenia gravis, chronic inflammatory demyelinating polyneuropathy (CIDP), difficult-to-treat rheumatoid arthritis (D2T RA) and Sjögren’s disease (SjD) remains on track.

Immunovant expects to report results from the open-label portion of the potentially registrational trial of IMVT-1402 in D2T RA and topline results from the proof-of-concept trial of IMVT-1402 in Cutaneous lupus erythematosu (CLE) in calendar year 2026.

|

Company |

RoA |

Phase |

Designation |

|

Immunovant |

Subcutaneous infusion |

III |

Orphan |

|

Johnson & Johnson Innovative Medicine |

IV |

III |

Orphan |

FcRn Inhibitor Market Outlook

The FcRn Inhibitors Market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with wAIHA, systemic lupus erythematosus, Graves disease, thyroid eye disease, and many more indications; the growing awareness of FcRn inhibitors, and the increasing number of emerging drugs that are under clinical trials and filed for approval by various FcRn Inhibitors Companies.

The greater affinity of FcRn has adverse effects on IgG-mediated autoimmune diseases like rheumatoid arthritis, myasthenia gravis, or pemphigus vulgaris. Targeting FcRn and inhibiting FcRn circulation can improve IgG catabolism, resulting in reduced IgG and pathogenic autoantibody levels, which is anticipated to decrease all autoimmune abnormalities induced by IgG. There are many drugs in the pipeline like Nipocalimab and Batoclimab, that are being developed to target FcRn to cure various indications like Myasthenia gravis, thyroid eye disease, CIPD, and many more. FcRn Inhibitors Drugs like VYVGART and RYSTIGGO have received FDA approval for Myasthenia gravis and are in the pipeline for other indications.

The leading FcRn Inhibitors Companies such as ArgenX, UBC Biopharma, Pfizer, and others, are involved in developing drugs for FcRn inhibitors for various indications such as myositis, myasthenia gravis, fibromyalgia, systemic lupus erythematosus, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of FcRn inhibitors and define their role in the therapy of autoimmune and neurological disorders.

FcRn inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging FcRn inhibitors market expected to be launched in the market during 2022–2036.

FcRn Inhibitor Clinical Trials Analysis

The FcRn Inhibitors pipeline segment report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key FcRn Inhibitors Companies involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense FcRn inhibitors market growth opportunities over the forecasted period.

FcRn Inhibitor Pipeline Development Activities

The FcRn Inhibitors pipeline segment report covers information on collaborations, acquisitions and mergers, licensing, and patent details for FcRn inhibitor therapies.

Latest KOL Views on FcRn Inhibitors

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on FcRn inhibitors' evolving FcRn Inhibitors treatment market landscape, patient reliance on conventional therapies, patient therapy switching acceptability, FcRn Inhibitors drug uptake, along with challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others. Their opinion helps understand and validate current and emerging therapy treatment patterns or FcRn inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the FcRn Inhibitors unmet needs.

|

“Among the biologics that inhibit FcRn, Efgartigimod caused rapid reduction of the circulating IgG in the lysosomes, and induced sustained clinical remission with a good safety profile leading to FDA-approved indication.” |

|

“FcRn inhibitors, like efgartigimod and rozanolixizumab, are incredibly promising for MG. By reducing pathogenic IgG levels selectively, they offer targeted symptom control without the broader immunosuppression we see in traditional therapies. This could really shift how we approach MG treatment.” |

|

“One of the standout features of FcRn inhibitors is the speed and duration of their effects. Patients often experience symptom relief within days, and the impact on IgG levels can last several weeks post-treatment. It’s a substantial improvement over IVIG and plasma exchange, especially for patients looking for longer intervals between treatments.” |

FcRn Inhibitors Drugs Market: Qualitative Analysis

We perform Qualitative and FcRn Inhibitors market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, FcRn Inhibitors competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

FcRn Inhibitors Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The FcRn Inhibitors Drugs Market Report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

FcRn Inhibitors Market Report Scope

- The FcRn Inhibitors market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the FcRn Inhibitors competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current FcRn Inhibitors treatment market landscape.

- A detailed review of the FcRn inhibitor drugs market, historical and forecasted FcRn Inhibitors market size, FcRn Inhibitors market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The FcRn Inhibitors market forecasting report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM FcRn inhibitor drugs market.

FcRn Inhibitor Market Report Insights

- FcRn inhibitors Targeted Patient Pool

- Therapeutic Approaches

- FcRn Inhibitor Pipeline Drugs Analysis

- FcRn Inhibitor Market Size and Trends

- Existing and Future FcRn Inhibitors Market Opportunity

FcRn Inhibitor Market Report Key Strengths

- 11 years FcRn Inhibitors Market Forecast

- The 7MM Coverage

- Key Cross Competition

- FcRn Inhibitor Drugs Uptake

- Key FcRn Inhibitors Market Forecast Assumptions

FcRn Inhibitor Market Report Assessment

- Current FcRn Inhibitors Treatment Market Practices

- FcRn Inhibitors Unmet Needs

- FcRn Inhibitors Pipeline Drugs Profiles

- FcRn Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the FcRn Inhibitor Market Report

- What was the FcRn inhibitor market size, the FcRn Inhibitors market size by therapies, FcRn Inhibitors market share (%) distribution, and what would it look like in 2036? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2036?

- Which is the most lucrative FcRn inhibitors Market?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for FcRn inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with FcRn inhibitors? What will be the growth opportunities across the 7MM for the patient population of FcRn inhibitors?

- What are the key factors hampering the growth of the FcRn inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for FcRn inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy the FcRn Inhibitor Market Report

- The FcRn Inhibitors market report will help develop business strategies by understanding the latest trends and changing dynamics driving the FcRn inhibitor market.

- Understand the existing FcRn Inhibitors market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the FcRn Inhibitors market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing FcRn Inhibitors market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with Recent Articles