Coagulation Factor Deficiency Market

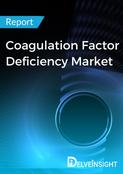

- In 2023, the total Coagulation Factor Deficiency Market size accounted for ~USD 13.5 billion in the 7MM.

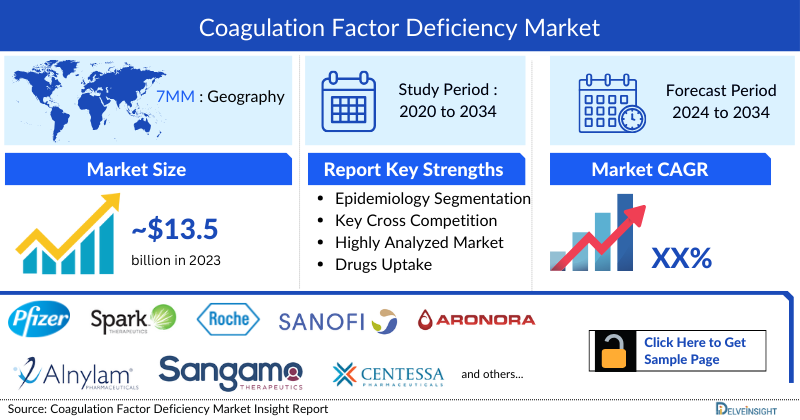

- The total 7MM prevalent cases of coagulation factor deficiency in 2023 were 105,000 out of which the highest prevalent cases estimated in the United States.

- In March 2024, ReciBioPharm signed a collaboration agreement with GeneVentiv Therapeutics, a preclinical gene therapy company, to advance the development of an adeno-associated virus (AAV)-based universal gene therapy for hemophilia, and reportedly the first to treat hemophilia patients with inhibitors.

- In June 2023, the US FDA accepted the company’s BLA for fidanacogene elaparvovec for the treatment of adults with hemophilia B. In parallel, the European marketing authorization application (MAA) for fidanacogene elaparvovec has also been accepted and is under review by the European Medicines Agency (EMA).

- In May 2023, Novo Nordisk notified the National Hemophilia Foundation that they have received a Complete Response Letter (CRL) from the US Food and Drug Administration (FDA) for their investigational, subcutaneous therapy concizumab. While Novo Nordisk had anticipated potential FDA approval of the therapy in the Spring of 2023, the additional information outlined in the CRL will stretch that timeline.

- Among the factor-specific cases, Hemophilia A accounted for highest number of cases among other types.

Request for unlocking the CAGR of the Coagluation Factor Deficiency Market

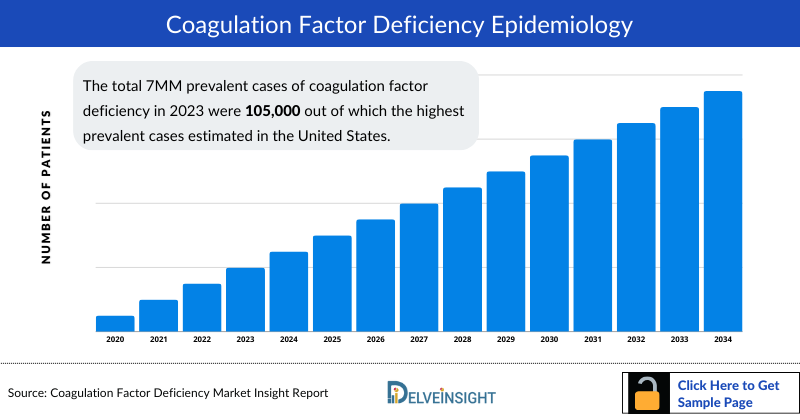

DelveInsight’s "Coagulation Factor Deficiency Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Coagulation Factor Deficiency, historical and forecasted epidemiology as well as the Coagulation Factor Deficiency market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Coagulation Factor Deficiency market report provides current treatment practices, emerging drugs, Coagulation Factor Deficiency market share of individual therapies, and current and forecasted Coagulation Factor Deficiency market size from 2020 to 2034, segmented by seven major markets. The report also covers current Coagulation Factor Deficiency treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Geography Covered

- The United States

- EU5 (Germany, France, Italy, Spain, and the United Kingdom)

- Japan

Study Period: 2020–2034

Coagulation Factor Deficiency Treatment Market

Coagulation Factor Deficiency Overview

Coagulation factor deficiency diseases, also known as bleeding disorders or clotting disorders, are a group of inherited or acquired conditions characterized by the lack or dysfunction of specific proteins involved in the blood clotting process. These proteins are known as coagulation factors, and they play a crucial role in stopping bleeding by forming clots to seal off injured blood vessels.

There are multiple coagulation factors, numbered from I to XIII, and they work in a complex and coordinated manner to achieve hemostasis. Deficiencies in any of these factors can lead to abnormal bleeding, which can range from mild to severe, depending on the specific factor involved and the degree of deficiency.

Coagulation Factor Deficiency Diagnosis

Diagnosis of blood disorders is usually carried out by observing the series of symptoms, which is further accompanied by a variety of blood test, which varies from factor to factor. Coagulation factor I deficiency is usually diagnosed by a series of blood tests, followed by measuring the amount of fibrinogen in the blood. However, in some cases, a low level of fibrinogen may indicate disorders related to the liver and kidney. In case of coagulation factor II, diagnosis is usually made by conducting prothrombin time (PT) and by a partially activated thromboplastin time (aPTT) test. The deficiency levels can range from 2% to 50% of normal. Patients having levels near or at 50% have normal or no bleeding problems.

Further details related to diagnosis will be provided in the report…

Coagulation Factor Deficiency Treatment

Treatment of coagulation factor deficiency is usually based on replacing the coagulation factor that is deficient in the blood, followed by adjunctive therapies when the bleeding is prolonged. There are various treatments available to treat the deficiency of the coagulation factors. Antifibrinolytic drugs and hormones are usually prescribed by physicians for moderate conditions such as mucosal tract hemorrhage or heavy mensuration. Therapies such as Aminocaproic, also known as EACA, and tranexamic acid, also known as TA, were discovered post-1950. These drugs are used to hold the clot in place, such as in the mouth, bladder, and uterus. Additionally, these adjunctive therapies are also very useful in dental surgeries; however, they are not so effective in case of internal bleeding. These drugs are administered via oral route or through injection.

Further details related to treatment will be provided in the report…

Coagulation Factor Deficiency Epidemiology

The Coagulation Factor Deficiency epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total diagnosed prevalent cases, and factor-specific prevalent cases in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- The total 7MM prevalent cases of coagulation factor deficiency in 2023 were 105,000 out of which the highest prevalent cases estimated in the United States.

- In the 7MM, the US accounted for the highest number of cases of Coagulation Factor Deficiency, with nearly 34,000 in 2023.

- Among EU4 and the UK, UK accounted for the highest number of cases of Coagulation Factor Deficiency, followed by France, whereas Spain occupied the bottom of the ladder.

- Among the factor-specific cases, Hemophilia A accounted for highest number of cases among other types.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Coagulation Factor Deficiency Prevalence

Coagulation Factor Deficiency Drugs Chapters

The drug chapter segment of the Coagulation Factor Deficiency market report encloses a detailed analysis of the late-stage (Phase III and Phase II/III) and early-stage (Phase I/II) pipeline drugs. The current key players for emerging drugs and their respective drug candidates include Novo Nordisk (Concizumab), Pfizer/Spark Therapeutics (Fidanacogene elaparvovec), Roche (Spark Therapeutics) (RG6357), Pfizer (Marstacimab), Novo Nordisk (NNC0365-3769 A), and others. The drug chapter also helps understand the Coagulation Factor Deficiency clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details, and the latest news and press releases.

Marketed Coagulation Factor Deficiency Drugs

ESPEROCT (N8-GP; Turoctocog alfa pegol): Novo Nordisk

ESPEROCT (Turoctocog alfa pegol, also known as N8-GP), is an extended half-life glycopegylated factor VIII molecule indicated for routine prophylaxis to reduce the frequency of bleeding episodes, on-demand treatment, and control of bleeding episodes and perioperative management of bleeding.

This product has been evaluated across five prospective, multi-center clinical trials in previously-treated patients with severe hemophilia A and no history of inhibitors. The results of these trials have shown that the overall safety profile of ESPEROCT is similar to what has been reported for other long-action FVIII products. No safety concerns were identified after more than 5-year of clinical exposure.

JIVI (formerly BAY94-9027): Bayer

JIVI (antihemophilic factor [recombinant] PEGylated-aucl) is a product of Bayer which is specifically used in previously treated adults and adolescents (12 years of age and older) with hemophilia A (congenital Factor VIII deficiency) for:

- On-demand treatment and control of bleeding episodes

- Perioperative management of bleeding

- Routine prophylaxis to reduce the frequency of bleeding episodes.

It works by replacing the reduced or missing factor VIII (FVIII) in patients with hemophilia A. It is also known as Damoctocog alfa pegol.

Emerging Coagulation Factor Deficiency Drugs

Concizumab (NN7415): Novo Nordisk

Concizumab, under development by Novo Nordisk, is a high-affinity monoclonal antibody against tissue factor pathway inhibitor (TFPI) intended for bleeding prevention after subcutaneous administration. It allows the body to generate adequate amounts of Factor Xa to ensure effective hemostasis. In 2018, Novo Nordisk completed the main phase of the Phase II trials explorer4, in people with hemophilia A and B with inhibitors, and explorer5, in people with severe hemophilia A without inhibitors, with concizumab to evaluate the efficacy and safety of prophylactic treatment in people with hemophilia. Currently, it is in Phase III clinical trial for hemophilia A and B with and without Inhibitors.

Fidanacogene elaparvovec: Pfizer/Spark Therapeutics

Fidanacogene elaparvovec, previously SPK-9001 or PF-06838435, is a novel, investigational bio-engineered AAV vector utilizing a high-activity F9 transgene for hemophilia B or factor IX deficiency.

The Fidanacogene Elaparvovec’s BLA has been accepedted by the FDA. SPK-9001 Phase III (NCT03861273) clinical trial study wherein the study will evaluate the efficacy and safety of SPK-9001 (a gene therapy drug) in adult male participants with moderately severe to severe hemophilia B (participants that have a Factor IX circulating activity of 2% or less). The study’s main objectives are to compare the annualized bleeding rate [ABR] of the gene therapy to routine prophylaxis from the lead-in study and to evaluate its impact on the participant’s Factor IX circulating activity [FIX:C]. This study includes 55 participants, with an estimated completion date of May 2027.

RG6357 (SPK-8011): Roche (Spark Therapeutics)

RG6357 (SPK-8011), which is under development by Roche’s subsidiary Spark Therapeutics, is an intravenously administered novel bio-engineered AAV vector utilizing the AAV-LK03 capsid, also referred to as Spark200, contains a codon-optimized human Factor VIII gene under the control of a liver-specific promoter for hemophilia A, or Factor VIII deficiency.

Currently, the drug is in Phase III and the company is also conducting Phase I/II clinical research study is being conducted by the company to determine the safety and efficacy of the Factor VIII gene transfer treatment with SPK-8011 in individuals with hemophilia A. After announcing the updated data from this trial, the company also claimed that it continues to optimize the dose and immunomodulatory regimen for SPK-8011 for hemophilia A patients. The company is focused on optimizing the dose and immunomodulatory regimen in the Phase I/II study and looks forward to continuing the evaluation of this therapy in a Phase III study.

Coagulation Factor Deficiency Market Outlook

Due to the technological improvements in the manufacture of coagulation proteins, new age recombinants concentrate has been developed in past years. These Recombinants Concentrate products are mainly derived from Chinese hamster ovary (CHO) or baby hamster kidney (BHK) cells that have been transfected with the human factor FVIII. Although the cell lines used in fermentation are considered to be free of viruses, these concentrates are still subjected to a combination of viral clearance and inactivation steps to ensure safety and purity.

- The US accounted for the largest Coagulation Factor Deficiency market size of Coagulation Factor Deficiency in the 7MM, with nearly USD 7.2 billion in 2023.

- Among EU4 and the UK, France accounted for the maximum Coagulation Factor Deficiency market size in 2023, while Spain occupied the bottom of the ladder.

Further details will be provided in the report….

Coagulation Factor Deficiency Drugs Uptake

This section focuses on the rate of uptake of the potential Coagulation Factor Deficiency drugs expected to be launched in the Coagulation Factor Deficiency market during the study period. The analysis covers Coagulation Factor Deficiency market uptake by drugs; patient uptake by therapies; and sales of each drug.

Coagulation Factor Deficiency Pipeline Development Activities

The Coagulation Factor Deficiency market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I/II stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The Coagulation Factor Deficiency market report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Coagulation Factor Deficiency emerging therapies.

Stay ahead with updates on our promising therapies. Dive into our Pipeline Progress Now @ Coagulation Factor Deficiency Treatment Drugs

KOL- Views

To keep up with current Coagulation Factor Deficiency market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, Professor and Vice Chair Department of Critical Care Medicine and Director, PhD, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Coagulation Factor Deficiency market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Brigham and Women's Hospital’s Boston Hemophilia Center, Medical College of Wisconsin, the Blood Center of Wisconsin, University of California, etc., were contacted. Their opinion helps understand and validate Coagulation Factor Deficiency epidemiology and market trends.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Coagulation Factor Deficiency Market Access and Reimbursement

In the US, Medicare provides coverage of self-administered blood clotting factors for hemophilia patients who can use such factors to control bleeding without medical supervision. Medicare covers blood clotting factors for the following conditions:

- Factor VIII deficiency (classic hemophilia, hemophilia A)

- Factor IX deficiency (hemophilia B, Christmas disease, plasma thromboplastin component)

- Von-Willebrand’s disease Anti-inhibitor coagulant complex (AICC) is a drug used to treat hemophilia in patients with Factor VIII inhibitor antibodies. AICC is safe and effective and is covered by Medicare when furnished to patients with hemophilia A and inhibitor antibodies to Factor VIII who have major bleeding episodes and fail to respond to other less expensive therapies.

Further detailed analysis will be provided in the report….

Scope of the Coagulation Factor Deficiency Market Report

- The Coagulation Factor Deficiency Market report covers a descriptive overview of Coagulation Factor Deficiency, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into Coagulation Factor Deficiency epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Coagulation Factor Deficiency is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the Coagulation Factor Deficiency market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The Coagulation Factor Deficiency market report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM Coagulation Factor Deficiency market.

Coagulation Factor Deficiency Market Report Insights

- Coagulation Factor Deficiency Report Insights

- Patient Population

- Therapeutic Approaches

- Coagulation Factor Deficiency Pipeline Analysis

- Coagulation Factor Deficiency Market Size

- Coagulation Factor Deficiency Market Trends

- Coagulation Factor Deficiency Market Opportunities

- Impact of Upcoming Therapies

Coagulation Factor Deficiency Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Coagulation Factor Deficiency Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Coagulation Factor Deficiency Market

- Coagulation Factor Deficiency Drugs Uptake

Coagulation Factor Deficiency Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Coagulation Factor Deficiency Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

Coagulation Factor Deficiency Market Insights:

- What was the Coagulation Factor Deficiency market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Coagulation Factor Deficiency market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings about the Coagulation Factor Deficiency market across the 7MM and which country will have the largest Coagulation Factor Deficiency market size during the study period (2020–2034)?

- At what CAGR, the Coagulation Factor Deficiency market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the Coagulation Factor Deficiency market outlook across the 7MM during the study period (2020–2034)?

- What would be the Coagulation Factor Deficiency market growth till 2034 and what will be the resultant market size in the year 2034?

- What are the disease risks, burdens, and unmet needs of Coagulation Factor Deficiency?

- What is the historical Coagulation Factor Deficiency patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What would be the forecasted patient pool of Coagulation Factor Deficiency at the 7MM level?

- What will be the growth opportunities across the 7MM concerning the patient population of Coagulation Factor Deficiency?

- Out of the above-mentioned countries, which country would have the incident population of Coagulation Factor Deficiency during the study period (2020–2034)?

- At what CAGR the population is expected to grow across the 7MM during the study period (2020–2034)?

- How many companies are developing therapies for the treatment of Coagulation Factor Deficiency?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Coagulation Factor Deficiency?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to Coagulation Factor Deficiency therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Coagulation Factor Deficiency and their status?

- What are the key designations that have been granted for the emerging therapies for Coagulation Factor Deficiency?

- What are the 7MM historical and forecasted Coagulation Factor Deficiency market?

Reasons to buy

- The Coagulation Factor Deficiency market report will help in developing business strategies by understanding trends shaping and driving Coagulation Factor Deficiency.

- To understand the future market competition in the Coagulation Factor Deficiency market and Insightful review of the SWOT analysis of Coagulation Factor Deficiency.

- Organize sales and marketing efforts by identifying the best opportunities for Coagulation Factor Deficiency in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Coagulation Factor Deficiency market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Coagulation Factor Deficiency market.

- To understand the future market competition in the Coagulation Factor Deficiency market.

Click Here for Related Articles