Hemophilia B Market

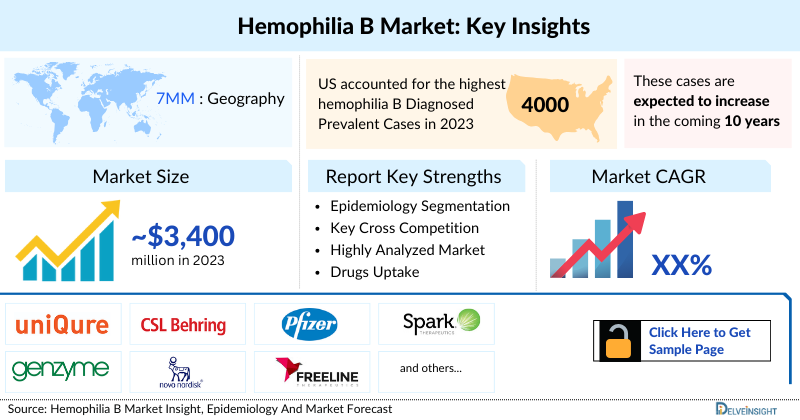

- The hemophilia B market size in 2023, in the 7MM was around ~USD 3,400 million. Among the 7MM, the United States accounted for the highest hemophilia B market size.

- The most common treatment for hemophilia B is replacement therapy. BeneFIX, RIXUBIS, IXINITY, ALPROLIX, IDELVION, and REBINYN are the some available recombinant factor IX products in the US. Apart from these, bypassing agents such as Feiba, Novoseven, and SEVENFACT and human plasma-derived coagulation factor IX – AlphaNine SD and Mononine have bagged the FDA approval as well.

- The advent of gene therapies brings the potential for curing patients with Hemophilia B. HEMGENIX, an approved gene therapy for Hemophilia B in November 2022, carries an astonishing price tag of USD 3.5 million per dosage, making it the most expensive medication worldwide and marking the first gene therapy to be approved for this rare disease.

- The most recent development in hemophilia B is the addition of Pfizer’s BEQVEZ, another gene therapy approved in April 2024 for the treatment of hemophilia B.

- Pfizer is the second company in the indication, trailing CSL and uniQure's HEMGENIX for hemophilia B treatment. Despite having the opportunity to offer a lower price than its competitor, Pfizer opted to price its drug, BEQVEZ, at the same USD 3.5 million.

- Hemophilia B market has diverse pipeline such as extended half-life therapies, siRNA, antibodies and gene therapy. These therapies are expected to provide the patient convenient route of administration and longer treatment duration.

- Key players such as Centessa Pharmaceuticals, Sanofi (Genzyme)/Alnylam Pharmaceuticals, Pfizer/ Spark Therapeutics, Novo Nordisk, and others are in the race for the developing potential therapies for treating hemophilia B.

- Recently, in December 2023, the US FDA has accepted BLA for Pfizer’s Marstacimab treating hemophilia A or B without inhibitors to Factor VIII (FVIII) or Factor IX (FIX). The European MAA for marstacimab also passed validation and is currently under review by the EMA. The Prescription Drug User Fee Act (PDUFA) action date is in the fourth quarter of 2024, and the decision from the European Commission is anticipated by the first quarter of 2025.

- Expected launch of potential therapies, FITUSIRAN (Sanofi), Marstacimab (Pfizer), SerpinPC (Centessa Pharmaceuticals and others may increase the market size in the coming years, assisted by an increase in the prevalent population of hemophilia B. In addition to this, gaining popularity of gene therapies and increased focus on prophylactic treatment will boost the Hemophilia B market 7MM during the forecast period (2024─2034).

DelveInsight’s "Hemophilia B Market Insights, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Hemophilia B, historical and forecasted epidemiology as well as the Hemophilia B market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Hemophilia B market report provides current treatment practices, emerging drugs, Hemophilia B market share of individual therapies, and current and forecasted Hemophilia B market size from 2020 to 2034, segmented by seven major markets. The Hemophilia market covers current Hemophilia B treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Hemophilia B market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Hemophilia B Market |

|

|

Hemophilia Bs Market Size | |

|

Hemophilia B Companies |

UniQure Biopharma B.V., CSL Behring, Pfizer, Spark Therapeutics, Genzyme, a Sanofi Company, Alnylam Pharmaceuticals, Novo Nordisk, Pfizer, ApcinteX Ltd, Freeline Therapeutics, Sangamo Therapeutics, and others. |

|

Hemophilia B Epidemiology Segmentation |

|

Hemophilia B Treatment Market

Hemophilia B Overview

Hemophilia B, also called Christmas disease, is a rare genetic bleeding disorder in which affected individual have insufficient levels of a blood protein called factor IX. Factor IX is a clotting factor and clotting factors are specialized proteins needed for blood clotting, the process by which blood Hemophilia B a wound to stop bleeding and promote healing. The severity of hemophilia that a person has is determined by the amount of factor IX (FIX) in the blood. Although there is currently no cure for Hemophilia B, treatment focuses on managing symptoms and improving quality of life. Research efforts continue to explore potential therapies and better understand the disease.

Hemophilia B Diagnosis

Diagnosis of hemophilia B is made by investigating the patient’s personal history of bleeding, the patient’s family history of bleeding and inheritance, and laboratory testing. Several different specialized tests are necessary to confirm a diagnosis of hemophilia B, including specialized blood coagulation tests are used to measure how long it takes the blood to clot. The initial test is the activated partial thromboplastin time (aPTT). If the results of the aPTT test are abnormal, more specific blood tests must be used to determine if the cause of the abnormal aPTT is due to a deficiency of factor IX/hemophilia B, factor VIII/hemophilia A or another clotting factor. A specific factor assay Hemophilia B determines the severity level of the factor deficiency.

Further details related to diagnosis will be provided in the report...

Hemophilia B Treatment

Treatment for Hemophilia B aims to manage symptoms, improve quality of life, and slow disease progression. The most common treatment for hemophilia B is called Replacement therapy. Concentrates of clotting factor IX are the foundation of this treatment and are administered as an infusion. BeneFIX, RIXUBIS, IXINITY, ALPROLIX, IDELVION, and REBINYN are the some available recombinant factor IX products in the US. Plasma-Derived Factor IX Concentrates and Fresh Frozen Plasma is also used for the treatment. While there is currently no cure for Hemophilia B, a multidisciplinary approach involving healthcare professionals, caregivers, and support networks is essential in providing comprehensive care and support to individuals B living with the disease. While Anti TFPI, Activated protein C Inhibitor, gene therapies and others offer hope for a reduced burden of treatment and improved quality of life, the gene therapy clinical trial results reported to date suggest that people with hemophilia B are closer to achieving a durable, functional cure, a treatment that may relieve them from the need for ongoing prophylaxis.

Further details related to treatment will be provided in the report...

Hemophilia B Epidemiology

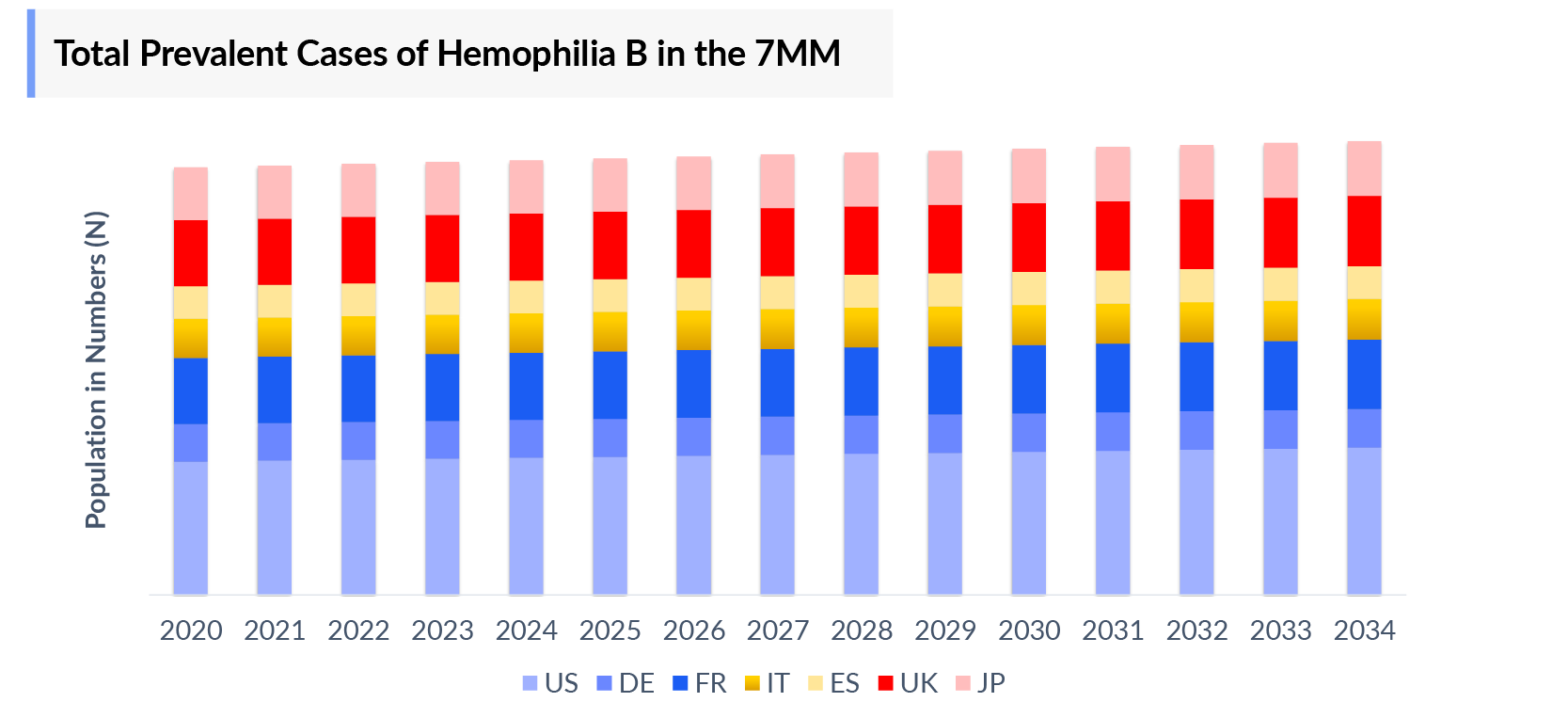

The Hemophilia B epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Diagnosed Prevalent cases of Hemophilia B, Severity-specific Prevalent cases of Hemophilia B Age-specific specific Prevalent Cases of Hemophilia B, Prevalent cases of Hemophilia B with Inhibitors and without Inhibitors, and Treated Patient pool of Hemophilia B in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM, the US accounted for the highest hemophilia B Diagnosed Prevalent Cases in 2023, with approximately 4000 cases; these cases are expected to increase during the forecast period.

- Amongst EU4 and the UK, the Hemophilia B Diagnosed Prevalent Cases were highest in France, while the lowest number of cases was in Germany in 2023.

- According to the estimates, in the US, it is observed that hemophilia B was most prevalent in the 19-44 years age group, accounting for ~35% of the total cases.

- On the basis of severity, the majority of cases in the United States were classified as mild, i.e. nearly 40%.

Recent Developments Hemophilia B Clinical Trials

- In April 2025, the FDA approved Qfitlia (fitusiran) for routine prophylaxis to prevent or reduce bleeding episodes in patients aged 12 and older with hemophilia A or B, with or without factor VIII or IX inhibitors.

- In March 2025, Alnylam Pharmaceuticals announced the FDA's approval of Qfitlia™ (fitusiran), the sixth Alnylam-discovered RNAi therapeutic approved in the U.S. It is the first and only treatment to lower antithrombin (AT), aiming to promote thrombin generation, rebalance hemostasis, and prevent bleeds.

- In December 2024, Novo announced that the FDA approved concizumab, its tissue factor pathway inhibitor (TFPI) antagonist, as a once-daily treatment to prevent or reduce bleeding episodes in patients aged 12 and older with hemophilia A or B with inhibitors.

Hemophilia B Drug Chapters

The drug chapter segment of the hemophilia B treatment market report encloses a detailed analysis of the marketed and late-stage (Phase III) pipeline drug. The marketed drugs segment encloses drugs such as RIXUBIS (Takeda Pharmaceutical/Baxter International), HEMGENIX (CSL Behring/uniQure), BEQVEZ (Pfizer), and others. Furthermore, the current key hemophilia B companies for emerging drugs and their respective drug candidates include fitusiran (Sanofi), Marstacimab (Pfizer), Concizumab (Novo Nordisk) and others. The drug chapter also helps understand the hemophilia B clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Marketed Hemophilia B Drugs

BEQVEZ (fidanacogene elaparvovec-dzkt): Pfizer

BEQVEZ is a product of Pfizer that is an adeno-associated viral (AAV) vector-based gene therapy. This therapy was recently approved in April 2024 for the treatment of adults with moderate to severe hemophilia B who currently use factor IX (FIX) prophylaxis therapy, or have current or historical life-threatening hemorrhage, or have repeated, serious spontaneous bleeding episodes, and do not have neutralizing antibodies to adeno-associated virus serotype Rh74var (AAVRh74var) capsid as detected by an FDA-approved test. BEQVEZ is a one-time treatment that is designed to enable people living with hemophilia B to produce FIX themselves rather than the current standard of care, which requires regular intravenous infusions of FIX that are often administered multiple times a week or multiple times a month.

HEMGENIX (etranacogene dezaparvovec-drlb): CSL Behring/uniQure

HEMGENIX by CSL Behring and uniQure is an AAV5-based gene therapy. AAV5 gene therapies has experienced any confirmed cytotoxic T-cell-mediated immune response to the capsid. Additionally, pre-clinical and clinical data show that AAV5-based gene therapies may be viable treatments in patients with pre-existing antibodies to AAV5, thereby potentially increasing patient eligibility for treatment compared to other gene therapy product candidates. This therapy was approved in November 2022 to treat adults with Hemophilia B (congenital Factor IX deficiency) who currently use Factor IX prophylaxis therapy or have a current or historical life-threatening hemorrhage or have repeated, serious spontaneous bleeding episodes. HEMGENIX also has been granted conditional marketing authorization by the European Commission (EC) for the European Union and European Economic Area, and the United Kingdom's Medicines and Healthcare products Regulatory Agency (MHRA).

|

Comparison of Marketed Drugs | |||||

|

Drugs |

Company Name |

Molecule Type |

MoA |

RoA |

US Approval |

|

BEQVEZ |

Pfizer |

Vector |

Gene delivery to factor IX |

Intravenous infusion |

2024 |

|

HEMGENIX |

CSL Behring/uniQure |

Vector |

Deliver a copy of a gene encoding the Padua variant of human coagulation Factor IX |

Intravenous infusion |

2022 |

|

SEVENFACT |

HEMA Biologics/LFB |

Protein |

Blood coagulation factor replacement |

Intravenous |

2020 |

Emerging Hemophilia B Drugs

Fitusiran: Sanofi (Genzyme)/ Alnylam Pharmaceuticals

Fitusiran, currently under development by Sanofi (Genzyme)/Alnylam Pharmaceuticals, is a subcutaneously administered small interfering RNA (siRNA) technology to target antithrombin. The therapy works by silencing the gene responsible for antithrombin, which inhibits the protein’s anticoagulant function, which further compensates for the imbalance caused by deficiencies in other clotting proteins, such as factor VIII (hemophilia A) or factor IX (hemophilia B). According to the companies, this candidate is based on an Alnylam delivery technology that enables increased potency and durability with SC (under-the-skin) injection.

In April 2023, the company has published FITUSIRAN Phase III studies in “The Lancet and The Lancet Haematology” highlighting the potential to address unmet needs across all types of hemophilia and that the study has achieved primary and secondary endpoints.

PF-06741086 (Marstacimab): Pfizer

Marstacimab, currently under development by Pfizer, is a human monoclonal immunoglobulin G isotype, subclass 1 (IgG1) that targets the Kunitz 2 domain of tissue factor pathway inhibitor (TFPI). Marstacimab is in development as a prophylactic treatment to prevent or reduce the frequency of bleeding episodes in individuals with severe hemophilia A or B (defined as factor VIII or factor IX activity <1%, respectively) with or without inhibitors. It is administered subcutaneously; however, the Phase II trial included SC and IV administration of PF-06741086.

It works as preventive coagulant therapy for hemophilia A and B patients with or without inhibitors. Currently, it is in Phase III (NCT03938792) clinical trial for the treatment of severe hemophilia A and B with or without inhibitors wherein treatment with PF-06741086 is anticipated to demonstrate a clinically relevant advantage and/or a major contribution to patient care in comparison to current methods of treatment for hemophilia A or B because it works differently than factor replacement products and will work in the presence of inhibitors.

|

Comparison of Emerging Therapies | |||||

|

Emerging Drug |

Company |

Phase |

Molecule Type |

MoA |

RoA |

|

Fitusiran |

Sanofi (Genzyme)/Alnylam Pharmaceuticals |

III |

Small interfering RNA |

Targets antithrombin (AT) in the liver and interferes with AT translation by binding and degrading messenger RNA-AT |

Subcutaneous |

|

PF-06741086 (Marstacimab) |

Pfizer |

III |

Monoclonal antibody |

Anti-TFPI |

Subcutaneous |

|

SerpinPC |

Centessa Pharmaceuticals |

IIa |

Protein |

Activated protein C Inhibitor |

Subcutaneous/ Intravenous Infusion |

Hemophilia B Drug Class Insight

The treatment of Hemophilia B primarily focuses on replacing the missing factor IX to manage and prevent bleeding episodes. The main drug classes used for treating Hemophilia B include Factor IX concentrates, extended half-life products, and gene therapies. Factor IX Concentrates (BeneFIX, RIXUBIS, ALPROLIX, IXINITY, REBINYN, and others) are the cornerstone of Hemophilia B treatment for control and prevention of bleeding episodes, and for perioperative management in adults and children. Recombinant factor IX is preferred due to a lower risk of transmitting infections and better availability.

Adeno associated viral vectors and gene therapy have been investigated in Hemophilia B research as potential therapeutic agents. HEMGENIX is an adeno-associated virus five (AAV5)-based gene therapy given as a onetime treatment for moderately severe to severe hemophilia B. Recently BEQVEZ was also approved as a gene therapy designed to introduce in the transduced cells a functional copy of the factor IX gene encoding a high-activity FIX variant. The AAVRh74var capsid is able to transduce hepatocytes, the natural site of factor IX synthesis. Single intravenous infusion of BEQVEZ results in cell transduction and increase in circulating factor IX activity in patients with hemophilia B.

Hemophilia B Market Outlook

Currently, there is no cure for hemophilia B and no effective treatment to halt or reverse the progression of the disease. Scarcely any drugs have been approved by the FDA that can slow the course of the disease but cannot cure it completely. Therefore, the management of hemophilia B remains supportive and symptom-based. In recent years, research on new treatment strategies has increased, taking heed of gene therapy, cellular therapy, and immune tolerance induction agents. There are limited approved drugs that slow disease progression by prolonging autonomy and increasing survival. Moreover, approved by the US FDA to treat hemophilia B, including IDELVION, IXINITY, REBINYN, ALPROLIX, and others.

There have been many advancements in hemophilia treatment over the last 20 years that have encouraged patients to take better control of their illness. However, the development of inhibitors is the primary challenge in treating hemophilia, making it difficult to control bleeding episodes and very difficult to perform surgical procedures. There is a lack of a curative treatment option owing to which the patient’s quality of life and daily activities get hampered severely. Gene therapy holds the promise of a lasting cure with a single drug administration instead of other diverse treatments for the X-linked bleeding condition hemophilia that are currently in clinical progress. HEMGENIX and BEQVEZ are currently FDA approved gene therapies for treating hemophilia B.

The pipeline holds multiple promising hemophilia B therapies in various stages of development. Therapies like fitusiran, Marstacimab, SerpinPC, and various other drugs are in ongoing clinical trial holds great potential as it contains disease-modifying agents, symptomatic treatments, and therapies targeting specific pathways, which could help in fulfilling the unmet treatment needs of hemophilia B patients.

Key Findings

- The total Hemophilia B market size in the US for hemophilia B was estimated to be approximately USD 2 billion in 2023, which is expected to grow during the forecast period (2024–2034).

- In 2023, in the US, among all the therapies, recombinant FIX - Extended Half-Life (EHL) captured the highest Hemophilia B market share.

- In 2034, among the emerging therapies, the highest revenue was generated by HEMIGENIX but approval of BEQVEZ is likely to affect it.

- Most of the treatment therapies are associated with IV administration, which is difficult due to set-up and administration time, and pain associated with poking the vein. Moreover, the frequent injections are not convenient for patients with Hemophilia B.

Hemophilia B Drugs Uptake

This section focuses on the uptake rate of potential Hemophilia B Drugs expected to be launched in the Hemophilia B market during 2024–2034. The landscape of HEMOPHILIA B treatment has experienced a transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. While HEMGENIX has already made its debut in the market, the recent launch of BEQVEZ has raised hopes that it could be a game-changer in the field of gene therapy for hemophilia B. The competition between these two therapies is not only about efficacy but also about accessibility, affordability, and safety. It remains to be seen which of these gene therapies will emerge as the preferred option for patients and healthcare providers. Among the emerging therapies, Fitusiran is expected to have a better uptake owing to monthly subcutaneous dosing, targeting of both inhibitors and non-inhibitors segment, promising efficacy signals observed from early phase trials.

Hemophilia B Pipeline Development Activities

The Hemophilia B treatment market report provides insights into therapeutic candidates in Phase III and Phase II. It Hemophilia B analyzes key players involved in developing targeted therapeutics. Hemophilia B Companies like Sanofi, Pfizer, and Centessa Pharmaceuticals actively engage in late-stage research and development efforts for hemophilia B. The pipeline of hemophilia B possesses many potential drugs and there is a positive outlook for the hemophilia B therapeutics market, with expectations of growth during the forecast period (2024–2034).

Pipeline Development Activities

The Hemophilia B treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging hemophilia B therapy.

KOL- Views on Hemophilia B

To keep up with current Hemophilia B market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the hemophilia B evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including hematology specialists, hematology professors, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as the University of Coimbra, Center for Biologics Evaluation and Research, University of Michigan, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or hemophilia B market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Gene therapy for hemophilia has been on the horizon for more than 2 decades. Despite advancements in the treatment of hemophilia, the prevention and treatment of bleeding episodes can adversely impact individuals quality of life. Today’s approval provides a new treatment option for patients with hemophilia B and represents important progress in the development of innovative therapies for those experiencing a high burden of disease associated with this form of hemophilia.” |

|

“We describe a well-treated hemophilia population with the majority of patients on prophylaxis but, despite this, impaired [quality of life] is reported with a high frequency of pain, mobility problems and anxiety/depression.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Hemophilia B Market Access and Reimbursement

The treatment and management of hemophilia B are expensive. The significant expense for hemophilia B treatment comes from the patient’s pocket, with palliative care and management having a major share of the out-of-pocket expenditure. Expensive drugs like HEMIGENIX pose a burden for hemophilia B patients as not everyone can get access to the drug due to its high cost.

CoPay Assistance Program for IDELVION

Enrolling in this program means you can pay USD 0 co-pay up to the program maximum for out of pocket expenses associated with your IDELVION therapy. If you have US-based private commercial insurance that covers therapy, you may be eligible. IDELVION program is available to US residents with a private commercial insurance plan (US-based). Those covered by state- or federally funded programs are not eligible; these programs include, but are not limited to, Medicare, Medicaid, PCIP, Champus, TriCare, veterans’ health insurance, and any other state- or federally funded programs.

Scope of the Hemophilia B Market Report

- The Hemophilia B market report covers a segment of key events, an executive summary, and a descriptive overview of hemophilia B, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the hemophilia B market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Hemophilia B market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive HEMOPHILIA B.

Hemophilia B Market Report Insights

- Hemophilia B Patient Population

- Hemophilia B Therapeutic Approaches

- Hemophilia B Pipeline Analysis

- Hemophilia B Market Size

- Hemophilia B Market Trends

- Existing and Future Hemophilia B Market Opportunity

Hemophilia B Market Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- Hemophilia B Epidemiology Segmentation

- Key Cross Competition

- Hemophilia B Drugs Uptake

- Key Hemophilia B Market Forecast Assumptions

Hemophilia B Market Report Assessment

- Current Hemophilia B Treatment Practices

- Hemophilia B Unmet Needs

- Hemophilia B Pipeline Product Profiles

- Hemophilia B Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views)

- Hemophilia B Market Drivers

- Hemophilia B Market Barriers

FAQs

- What was the Hemophilia B market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future treatment paradigm for Hemophilia B?

- What are the disease risks, burdens, and unmet needs of Hemophilia B? What will be the growth opportunities across the 7MM concerning the patient population with Hemophilia B?

- What are the current options for the treatment of Hemophilia B? What are the current guidelines for treating Hemophilia B in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in Hemophilia B?

Reasons to Buy Hemophilia B Forecast Report:

- The Hemophilia B market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving Hemophilia B.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Hemophilia B market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the Hemophilia B market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Hemophilia B market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

-02.png)

-03.png)