Coronary Guidewires Market

The Coronary Guidewire Market By Material (Nitinol, Stainless Steel, And Others), End-User (Hospitals, Ambulatory Surgical Centers, And Others), and geography is expected to grow at a steady CAGR forecast till 2030 owing to the increasing prevalence of coronary heart disease and and the rising cases of coronary artery bypass graft surgeries across the globe

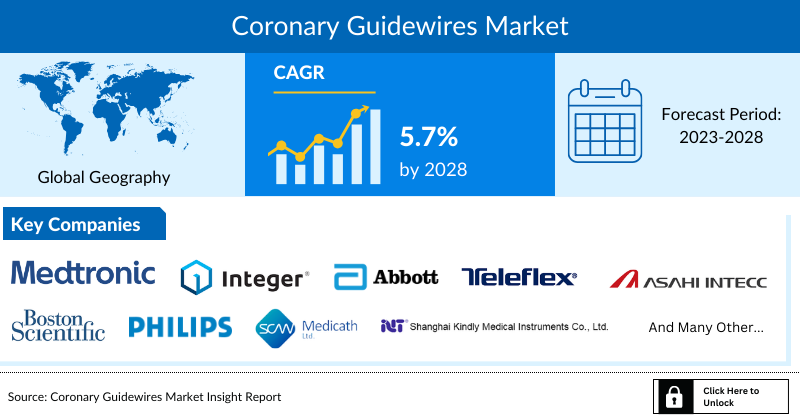

The global coronary guidewire market is estimated to grow at a CAGR of 5.7% during the forecast period from 2024 to 2030. The demand for coronary guidewire is primarily being boosted due to the increasing prevalence of coronary artery disease (CAD) across the globe. Further, the rising adoption of advanced and innovative technologies, the rising awareness about minimally invasive heart surgeries, the increasing geriatric population prone to various cardiovascular diseases, rising figures of various risk factors causing coronary heart diseases, and the increasing product launches and approval among others, are thereby contributing to the overall growth of the coronary guidewire market during the forecast period from 2024-2030.

Coronary Guidewire Market Dynamics:

The coronary guidewire market is witnessing a positive growth in product demand owing to various factors, one of the key factors is the increasing cases of coronary artery bypass graft (CABG) across the globe. For instance, according to the Organization for Economic Co-operation and Development (OECD) 2023, in 2021 cases of CABG were 45,290 in Turkiye and 38,859 in Germany.

A CABG is a surgical procedure used to treat coronary heart disease. It diverts blood around narrowed or clogged parts of the major arteries to improve blood flow and oxygen supply to the heart. Coronary guidewires are used in this surgery to deliver therapies to diseased areas of the coronary arterial system. Therefore, more the cases of CABG, the more the demand for the coronary guidewire, thereby increasing the overall market for coronary guidewires during the forecast period.

Furthermore, over time, high blood sugar can damage blood vessels and the nerves which control the heart. According to the Centers for Disease and Prevention Control (CDC) 2022, if a person has diabetes, he or she is twice likely to have heart disease or a stroke than someone who doesn’t have diabetes. Additionally, according to IDF Diabetes Atlas Tenth Edition 2021, in 2021 approximately 537 million adults worldwide (20-79 years) were living with diabetes, and the total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. From the same source, more than 1.2 million children and adolescents (0-19 years) were living with diabetes, in 2023, globally.

Thus, diabetes may cause damage to blood vessels, hypertension, and others, which can lead to heart disease or stroke. A person suffering from any heart disease may need an angioplasty, in which a catheter is inserted into vessels, using a coronary guidewire that is used to guide the catheter into place during central venous catheter (CVC) insertions, a process done in angioplasty. The purpose of a guidewire is to gain access to the blood vessels using a minimally invasive technique. Thus, the increasing cases of diabetes will increase the figures of people suffering from coronary heart diseases, thereby increasing the demand for coronary guidewires, ultimately propelling the overall market growth.

Therefore, the above-mentioned factors are contributing to the growth of the coronary guidewire market during the forecast period from 2024-2030.

However, the complications related to the coronary guidewire and others may restrict the coronary guidewire market growth during the forecast period.

Coronary Guidewire Recent Developments

- On September 17, 2024, Royal Philips announced FDA approval of its 160cm LumiGuide navigation wire with Fiber Optic RealShape (FORS) technology. Dr. Carlos Timaran used the guidewire for a complex aortic aneurysm repair, marking the 1000th patient treated with FORS since 2020. The longer wire broadens its use for more patients in the US.

Coronary Guidewire Market Segment Analysis:

Coronary guidewire market by Material (Nitinol, Stainless Steel, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the material segment of the coronary guidewire market, the stainless steel category is expected to amass a significant revenue share in the year 2023. This may be ascribed to the advantages offered by the stainless steel material.

The advantages of the stainless steel category over other material is that stainless steel is non-magnetic, non-staining, corrosion-resistant, and possess antibacterial properties. Stainless steel is easier to torque and is more rigid, providing better columnar support. All such advantages offered by the segment are responsible for their increased preference among the end-users.

Furthermore, device launches and approval, rising research & developmental activities among others will also increase the demand for coronary guidewire during the forecast period. For instance, in November 2021, FDA approved ASAHI CONFIANZA PRO 8-20 guidewire by Asahi Intecc Co., Ltd, The guide wire is constructed from a stainless-steel core wire with a platinum-nickel coil.

Therefore, the advantages offered by the stainless steel category, along with increasing device launches and approval among others will increase the demand for the stainless steel coronary guidewire market during the forecast period, thereby responsible for propelling the demand for coronary guidewires during the upcoming years.

|

Report Metrics |

Details |

|

Study Period |

2019 to 2032 |

|

Forecast Period |

2023 to 2032 |

|

CAGR | |

|

Coronary Guidewires Market Size |

USD XX Million by 2032 |

|

Key Coronary Guidewires Companies |

Medtronic, Boston Scientific Corporation, Integer Holdings Corporation, Abbott, Teleflex Incorporated, ASAHI INTECC CO., LTD., Koninklijke Philips N.V, SCW Medicath Ltd., Shanghai Kindly Medical Instruments Co., Ltd., Terumo Medical Corporation, Shenzhen MicroApproach Medical Technology CO., LTD., SP Medical, Rontis Corporation, B. Braun SE, Balton Sp. z o. o, and Many Others. |

North America is expected to dominate the overall Coronary Guidewire Market:

Among all the regions, North America is estimated to account for the largest share of the coronary guidewire market in the year 2023. Owing to the significance of key coronary guidewire market growth factors such as the increasing cases of coronary artery disease (CAD), the rising cases of angioplasty, and others in the region, are driving the North American coronary guidewire market is expected to witness positive growth in the forecast period. Furthermore, high disposable income, sophisticated healthcare infrastructure, rising approvals for new devices, and surging awareness about minimally invasive heart surgery will also help the coronary guidewire market growth in this region.

CAD is caused by plaque build-up in the wall of the arteries that supply blood to the heart which can lead to serious medical conditions such as heart attack, heart failure, and others. To prevent this serious medical condition patient may need to go through a minimally invasive surgery called angioplasty. During the procedure, a cardiologist threads a balloon-tipped catheter to the site of the narrowed or blocked artery and then inflates the balloon to open the vessel. In such complex procedures, the use of guide wires is a must, which permits multiple recrossings of a dilated segment and allows safe serial passage of different-sized balloon catheters.

According to the Center for Disease Control and Prevention 2022, about 20.1 million adults age 20 and older had CAD, in 2020. In 2020, about 2 in 10 deaths from CAD happen in adults less than 65 years old. Thus, to maintain the mortality rate due to CAD, angioplasty at an appropriate time is required. Henceforth, the increasing cases of CAD may increase the cases of angioplasty which will ultimately increase the demand for coronary guidewires in the regional market.

Furthermore, growing preference for cardiovascular procedures such as transcatheter aortic valve replacement (TAVR), replacement, coronary artery bypass graft (CABG), angioplasty, and others to be conducted in a minimally invasive manner utilizing guidewires to transverse in the vascular system and access the desired position for catheter insertion is also crucial for raising the demand of coronary guidewires, thereby, positively impacting the overall coronary guidewire market during the forecast period.

Consequently, the aforementioned factors will increase the demand for a coronary guidewire, thereby driving the North American coronary guidewire market forward during the forecast period.

Key Coronary Guidewire Companies In The Market

Some of the key coronary guidewire companies operating in the market include Medtronic, Boston Scientific Corporation, Integer Holdings Corporation, Abbott, Teleflex Incorporated, ASAHI INTECC CO., LTD., Koninklijke Philips N.V, SCW Medicath Ltd., Shanghai Kindly Medical Instruments Co., Ltd., Terumo Medical Corporation, Shenzhen MicroApproach Medical Technology CO., LTD., SP Medical, Rontis Corporation, B. Braun SE, Balton Sp. z o. o., and others.

Recent Developmental Activities in the Coronary Guidewire Market:

- In April 2022, Boston Scientific Corporation launched its new Kinetix Guidewire for coronary intervention (PCI) procedures.

- In February 2022, Teleflex received FDA Clearance for Expanded Indication for Specialty Catheter and Coronary Guidewire Use in CTO PCI (Chronic Total Occlusion Percutaneous Coronary Intervention) procedure. CTO PCI is an alternative to heart bypass surgery, the procedure is done in a cardiac catheterization laboratory through small incisions in the leg or arm.

Key Takeaways from the Coronary Guidewire Market Report Study

- Market size analysis for current coronary guidewire market size (2023), and market forecast for 5 years (2024-2030)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the coronary guidewire market.

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key current coronary companies dominating the global coronary guidewire market.

- Various opportunities are available for the other competitor in the coronary guidewire market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030.

- Which are the top-performing regions and countries in the current coronary guidewire market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for coronary guidewire market growth in the coming future?

Target Audience who can be benefited from this Coronary Guidewire Market Report Study

- Coronary guidewire products providers

- Research organizations and consulting companies

- Coronary guidewire-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in coronary guidewire

- Various End-users who want to know more about the coronary guidewire market and the latest technological developments in the coronary guidewire market

Frequently Asked Questions for the Coronary Guidewire Market:

1. What is a coronary guidewire device?

Coronary guide wires are specialized pieces of equipment used to deliver therapies to diseased areas of the coronary arterial system. These devices are designed to navigate vessels to reach a lesion or vessel segment. Once the tip of the device arrives at its destination, it acts as a guide that larger catheters can rapidly follow for easier delivery to the treatment site.

2. What is the market for global coronary guidewire?

The global coronary guidewire market is estimated to grow at a CAGR of 5.7% during the forecast period from 2024 to 2030.

3. What are the drivers for the global coronary guidewire market?

The demand for coronary guidewire is being heightened by the increasing prevalence of coronary artery disease and other cardiovascular diseases, rising cases of angioplasty, increasing figures of coronary artery bypass graft (CABG), and others. In addition, the increasing demand for minimally invasive surgery, the increasing device launches, and approvals among others are thereby contributing to the overall growth of the coronary guidewire market during the forecast period from 2024-2030.

4. Who are the key players operating in the global coronary guidewire market?

Some of the key market players operating in the coronary guidewire market include Medtronic, Boston Scientific Corporation, Integer Holdings Corporation, Abbott, Teleflex Incorporated, ASAHI INTECC CO., LTD., Koninklijke Philips N.V, SCW Medicath Ltd., Shanghai Kindly Medical Instruments Co., Ltd., Terumo Medical Corporation, Shenzhen MicroApproach Medical Technology CO., LTD., SP Medical, Rontis Corporation, B. Braun SE, Balton Sp. z o. o., and others.

5. Which region has the highest share in the coronary guidewire market?

North America is expected to dominate the overall coronary guidewire market during the forecast period from 2024-2030. Factors such as the rising geriatric population, the rising cases of obesity, the increasing coronary diseases, and others will propel the demand for coronary guidewire in North America. Furthermore, increasing technological advancement, sophisticated healthcare infrastructure, regulatory approval for new devices, and high awareness about minimally invasive therapy will also help the market growth in this region.