Diabetes Market

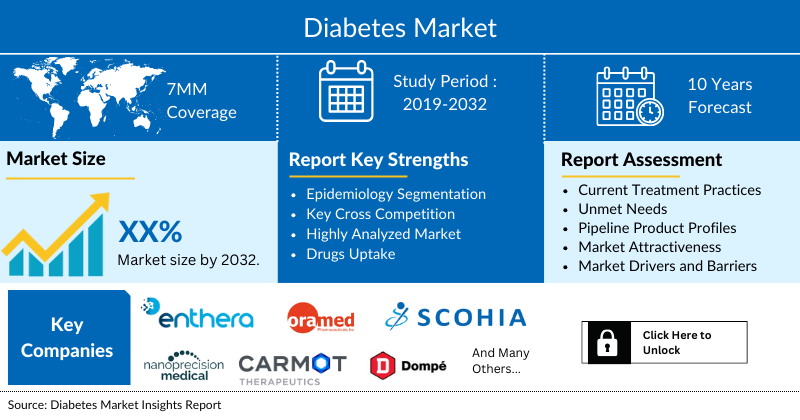

- As per DelveInsight, the Diabetes Market size is expected to expand at a healthy growth rate during the forecast period (2023-2032), owing to the launch of new therapies in the market and the rise in the number of cases.

- The leading Diabetes Companies such as Enthera, Nano Precision Medical, Oramed, Dompe Farmaceutici, Carmot Therapeutics, Scohia Pharma, Genexine, REMD Biotherapeutics and others.

- In February 2025, the FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to NovoLog, marking a significant milestone in diabetes care. This approval is expected to improve patient access to insulin and increase market competition, potentially lowering costs.

- In February 2025, the U.S. FDA issued a safety alert about diabetes devices, including CGMs, insulin pumps, and automated insulin dosing systems, that rely on smartphones for critical safety alerts. Users can customize alert settings (e.g., type, frequency, and delivery method) through the app on their phone.

- In December 2024, Novo Nordisk submitted a Citizen Petition to the FDA requesting the removal of liraglutide from the 503B Bulks List, arguing that its approved products—Victoza, Saxenda, and Xultophy—adequately meet patient needs and that compounded versions could pose safety and efficacy risks.

- In November 2024, Eton Pharmaceuticals announced that it has acquired the U.S. rights to Amglidia (glyburide oral suspension) from AMMTeK for the treatment of neonatal diabetes mellitus.

Download the Sample PDF to Get More Insight @ Diabetes Market

DelveInsight's "Diabetes Market Insights, Epidemiology, and Market Forecast-2032" report delivers an in-depth understanding of the Diabetes, historical and forecasted epidemiology as well as the Diabetes therapeutics market trends in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

The Diabetes market report provides current treatment practices, emerging drugs, Diabetes market share of the individual therapies, current and forecasted Diabetes market size from 2019 to 2032 segmented by seven major markets. The Report also covers current Diabetes treatment practice/algorithm, market drivers, market barriers and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the Diabetes market.

|

Study Period |

2019 to 2032 |

|

Forecast Period |

2023-2032 |

|

Geographies Covered |

|

|

Diabetes Market |

|

|

Diabetess Market Size | |

|

Diabetes Companies |

Enthera, Nano Precision Medical, Oramed, Dompe Farmaceutici, Carmot Therapeutics, Scohia Pharma, Genexine, REMD Biotherapeutics and others |

|

Diabetes Epidemiology Segmentation |

|

Diabetes Treatment Market

The DelveInsight’s Diabetes market report gives a thorough understanding of the Diabetes by including details such as disease definition, symptoms, causes, pathophysiology, diagnosis, and treatment.

Diabetes Diagnosis

This segment of the report covers the detailed diagnostic methods or tests for Diabetes.

Diabetes Treatment

It covers the details of conventional and current medical therapies available in the Diabetes market for the treatment of the condition. It also provides Diabetes treatment algorithms and guidelines in the United States, Europe, and Japan. Ongoing diabetes clinical trials aim to develop advanced therapies for better glucose control, prevention, and long-term management of complications.

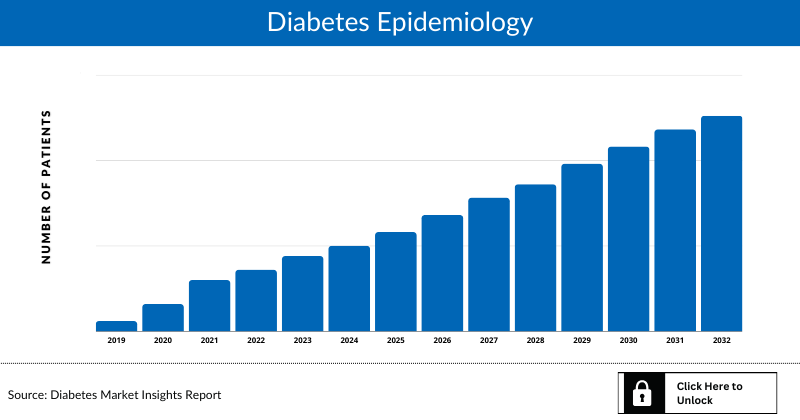

Diabetes Epidemiology

The Diabetes epidemiology section provides insights about the historical and current Diabetes patient pool and forecasted trends for individual seven major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the Diabetes market report also provides the diagnosed patient pool and their trends along with assumptions undertaken.

Key Findings

The Diabetes epidemiology covered in the report provides historical as well as forecasted Diabetes epidemiology scenario in the 7MM covering the United States, EU5 countries (Germany, Spain, Italy, France, and the United Kingdom), and Japan from 2019 to 2032.

Country Wise- Diabetes Epidemiology

The epidemiology segment also provides the Diabetes epidemiology data and findings across the United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan.

Recent Developmental Activities in the Diabetes Market

- In April 2025, DexCom, Inc. (NASDAQ: DXCM) announced FDA clearance of the Dexcom G7 15-Day Continuous Glucose Monitoring (CGM) System for adults with diabetes in the U.S. The updated device, featuring an overall MARD of 8.0%, offers extended wear and builds on Dexcom’s proven ability to improve A1C, reduce glycemic variability, and increase time in range.

- In February 2025, the FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to NovoLog, marking a significant milestone in diabetes care. This approval is expected to improve patient access to insulin and increase market competition, potentially lowering costs.

- In February 2025, the U.S. FDA issued a safety alert about diabetes devices, including CGMs, insulin pumps, and automated insulin dosing systems, that rely on smartphones for critical safety alerts. Users can customize alert settings (e.g., type, frequency, and delivery method) through the app on their phone.

- In December 2024, Novo Nordisk submitted a Citizen Petition to the FDA requesting the removal of liraglutide from the 503B Bulks List, arguing that its approved products—Victoza, Saxenda, and Xultophy—adequately meet patient needs and that compounded versions could pose safety and efficacy risks.

- In November 25, 2024, Eton Pharmaceuticals announced that it has acquired the U.S. rights to Amglidia (glyburide oral suspension) from AMMTeK for the treatment of neonatal diabetes mellitus.

- In October 2024, the U.S. Food and Drug Administration announced that the two-year shortage of Eli Lilly’s weight-loss and diabetes medications, Mounjaro and Zepbound, is over. The FDA confirmed that Eli Lilly can now meet the current and projected national demand for both drugs, which stimulate the hormone GLP-1 to reduce hunger. The shortage began in 2022 due to a surge in demand for weight-loss treatments.

- In September 2024, the FDA lifted a clinical hold on Biomea Fusion's studies of its experimental drug BMF-219 for Type 1 and Type 2 diabetes, originally placed due to liver toxicity concerns. Biomea's shares fell 22% during the hold but rose 9.1% to $9.57 after the announcement. The drug is undergoing early-to-mid-stage trials for Type 2 diabetes and mid-stage trials for Type 1 diabetes.

- In September 2024, the FDA cleared Senseonics’ Eversense 365, an implantable continuous glucose monitoring (CGM) system for adults with diabetes that lasts up to a year, extending the lifespan from the previous Eversense E3, which lasted six months.

- In September 2024, Embecta Corp. received 510(k) clearance from the FDA for its new disposable insulin delivery system designed for adults with Type 1 and Type 2 diabetes. The tubeless patch pump features a 300-unit insulin reservoir, developed with input from T2D patients and healthcare providers.

- In August 2024, the FDA approved Insulet's Omnipod 5, the first automated insulin pump for adults with Type 2 diabetes. This system targets over 6 million people, including 2.5 million who need multiple daily insulin injections, addressing a population where only a quarter are achieving HbA1c goals of 7% or less.

- In July 2024, the FDA issued a Complete Response Letter (CRL) to Novo Nordisk concerning its Biologics License Application (BLA) for basal insulin icodec, intended for the treatment of diabetes mellitus.

Diabetes Drugs Chapters

The drug chapter segment of the Diabetes market report encloses the detailed analysis of Diabetes marketed drugs and late-stage (Phase-III and Phase-II) Diabetes pipeline drugs. It also helps to understand the Diabetes clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases. The diabetes drugs market is rapidly expanding due to rising prevalence, innovation in therapies, and growing global health awareness.

Diabetes Marketed Drugs

The report provides the details of the marketed products/off-label treatments available for Diabetes treatment.

Diabetes Emerging Drugs

The report provides the details of the emerging therapies under the late and mid-stage of development for Diabetes treatment.

- Cadisegliatin: vTv Therapeutics

Cadisegliatin, also known as TTP399, is an innovative oral medication developed by vTv Therapeutics, designed as a liver-selective glucokinase activator. It aims to serve as an adjunctive therapy to insulin for individuals with type 1 diabetes (T1D). This drug has been recognized for its potential to improve glycemic control by enhancing hepatic glucose uptake and glycogen storage independently of insulin, addressing a critical need in diabetes management. Currently, the drug is in the Phase III stage of its clinical trial for the treatment of Diabetes.

- LY-3209590: Eli Lilly and Company

Insulin efsitora alfa (LY3209590) is a once-weekly basal insulin, a fusion protein that combines a novel single-chain variant of insulin with a human IgG2 Fc domain. It is specifically designed for once-weekly subcutaneous administration, and with its low peak-to-trough ratio, it has the potential to provide more stable glucose levels (less glucose variability) throughout the week. Efsitora is in phase III development for adults with type 1 and 2 diabetes.

- THDB0206: Tonghua Dongbao Pharmaceutical

BC Lispro (THDB0206) is an ultra-rapid-acting insulin analog developed by Tonghua Dongbao Pharmaceutical Co., Ltd. for the treatment of Diabetes. BC Lispro is designed to restore early-phase insulin secretion, which is often impaired in diabetic patients. This insulin analog utilizes a new formulation technology that allows for rapid absorption and action, mimicking the physiological pattern of insulin secretion after meals. Such characteristics are expected to reduce the risk of late postprandial hypoglycemia, providing patients with greater flexibility in managing their insulin injections. Currently, the drug is in the Phase III stage of its clinical trial for the treatment of Diabetes.

- CPL207280: Celon Pharma

CPL207280 is a novel G-protein-coupled receptor 40 (GPR40) agonist under development for the treatment of Diabetes. CPL207280 acts as an agonist for GPR40, a receptor that plays a crucial role in enhancing glucose-stimulated insulin secretion from pancreatic beta cells. This mechanism is particularly beneficial for T2D patients, as it can improve glycemic control without the risk of hypoglycemia, a common side effect associated with other diabetes medications. Currently, the drug is in the Phase II stage of development to treat Diabetes.

- XW014: Sciwind Biosciences

XW014 is an oral small molecule glucagon-like peptide-1 (GLP-1) receptor agonist developed by Sciwind Biosciences for the treatment of obesity and Diabetes (T2D). XW014 functions as a GLP-1 receptor agonist, which means it mimics the action of the GLP-1 hormone that is released after meals. This hormone plays a key role in regulating glucose metabolism by stimulating insulin secretion, inhibiting glucagon release, and promoting satiety. As an oral small molecule, XW014 offers advantages over traditional peptide-based GLP-1 therapies, such as ease of administration and the potential for combination therapies with other oral medications. Currently, the drug is in Phase I stage of its clinical trial for the treatment of Diabetes.

- KN056: Suzhou Alphamab Co., Ltd.

KN-056 is a glucagon-like peptide-1 receptor (GLP-1R) modulator developed by Suzhou Alphamab Co., Ltd. for the treatment of Diabetes. KN-056 functions as a GLP-1R modulator, which means it targets the glucagon-like peptide-1 receptor. GLP-1 is a hormone that plays a key role in regulating glucose metabolism by stimulating insulin secretion, inhibiting glucagon release, and promoting satiety. By modulating the GLP-1 receptor, KN-056 aims to improve glycemic control in patients with Diabetes. Currently, the drug is in the Phase I stage of its clinical trial for the treatment of Diabetes.

Diabetes Market Outlook

The Diabetes market outlook of the report helps to build a detailed comprehension of the historic, current, and forecasted Diabetes market trends by analyzing the impact of current Diabetes therapies on the market, unmet needs, drivers and barriers, and demand for better technology.

This segment gives a thorough detail of Diabetes market trend of each marketed drug and late-stage pipeline therapy by evaluating their impact based on the annual cost of therapy, inclusion and exclusion criteria's, mechanism of action, compliance rate, growing need of the market, increasing patient pool, covered patient segment, expected launch year, competition with other therapies, brand value, their impact on the market and view of the key opinion leaders. The calculated Diabetes market data are presented with relevant tables and graphs to give a clear view of the market at first sight.

According to DelveInsight, the Diabetes market in 7MM is expected to witness a major change in the study period 2019-2032.

Key Findings

This section includes a glimpse of the Diabetes treatment market in 7MM.

The United States Diabetes Market Outlook

This section provides the total Diabetes market size and market size by therapies in the United States.

EU-5 Countries Diabetes Market Outlook

The total Diabetes market size and market size by therapies in Germany, France, Italy, Spain, and the United Kingdom is provided in this section.

Japan Diabetes Market Outlook

The total Diabetes market size and market size by therapies in Japan is also mentioned.

Diabetes Drugs Uptake

This section focuses on the rate of uptake of the potential Diabetes drugs recently launched in the Diabetes market or expected to get launched in the market during the study period 2019-2032. The analysis covers Diabetes market uptake by drugs; patient uptake by therapies; and sales of each drug.

Diabetes Drugs Uptake helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allow the comparison of the drugs on the basis of Diabetes market share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Diabetes Pipeline Development Activities

The Diabetes treatment market report provides insights into different Diabetes clinical trials within Phase II, and Phase III stage. It also analyses Diabetes Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Diabetes treatment market report covers the detailed information of collaborations, acquisition, and merger, licensing, patent details, and other information for Diabetes emerging therapies.

Reimbursement Scenario

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In a report, we take reimbursement into consideration to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

KOL Views

To keep up with current Diabetes market trends, we take KOLs and SMEs ' opinion working in the Diabetes domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps to understand and validate current and emerging therapies treatment patterns or Diabetes market trends. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the market and the unmet needs.

Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Diabetes Market by using various Competitive Intelligence tools that include - SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of The Diabetes Market Report

- The Diabetes treatment market report covers the descriptive overview of Diabetes, explaining its causes, signs and symptoms, pathophysiology, diagnosis and currently available therapies

- Comprehensive insight has been provided into the Diabetes epidemiology and treatment in the 7MM

- Additionally, an all-inclusive account of both the current and emerging therapies for Diabetes is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape

- A detailed review of the Diabetes market; historical and forecasted is included in the report, covering drug outreach in the 7MM

- The Diabetes treatment market report provides an edge while developing business strategies, by understanding trends shaping and driving the global Diabetes treatment market

Diabetes Market Report Highlights

- In the coming years, the Diabetes treatment market is set to change due to the rising awareness of the disease, and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence Diabetes R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- Several major Diabetes companies are involved in developing therapies to improve the treatment scenario. The launch of emerging therapies will significantly impact the Diabetes market

- A better understanding of disease pathogenesis will also contribute to the development of novel therapeutics for Diabetes

- Our in-depth analysis of the pipeline assets across different stages of development (Phase III and Phase II), different emerging trends and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

Diabetes Market Report Insights

- Diabetes Patient Population

- Diabetes Therapeutic Approaches

- Diabetes Pipeline Analysis

- Diabetes Market Size and Trends

- Diabetes Treatment Market Opportunities

- Impact of Upcoming Diabetes Therapies

Diabetes Market Report Key Strengths

- 10 Years Diabetes Market Forecast

- 7MM Coverage

- Diabetes Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Diabetes Treatment Market

- Diabetes Drugs Uptake

Diabetes Market Report Assessment

- Current Diabetes Treatment Market Practices

- Diabetes Unmet Needs

- Diabetes Pipeline Product Profiles

- Diabetes Market Attractiveness

- Diabetes Market Drivers and Barriers

Key Questions Answered In The Diabetes Market Report:

Diabetes Treatment Market Insights:

- What was the Diabetes drugs market share (%) distribution in 2019 and how it would look like in 2032?

- What would be the Diabetes total market size as well as market size by therapies across the 7MM during the forecast period (2023-2032)?

- What are the key findings pertaining to the market across 7MM and which country will have the largest Diabetes market size during the forecast period (2023-2032)?

- At what CAGR, the Diabetes market is expected to grow by 7MM during the forecast period (2023-2032)?

- What would be the Diabetes market outlook across the 7MM during the forecast period (2023-2032)?

- What would be the Diabetes market growth till 2032, and what will be the resultant market Size in the year 2032?

- How would the unmet needs affect the market dynamics and subsequent analysis of the associated trends?

Diabetes Epidemiology Insights:

- What are the disease risk, burden, and regional/ethnic differences of the Diabetes?

- What are the key factors driving the epidemiology trend for seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What is the historical Diabetes patient pool in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What would be the forecasted patient pool of Diabetes in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- Where will be the growth opportunities in the 7MM with respect to the patient population pertaining to Diabetes?

- Out of all 7MM countries, which country would have the highest prevalent population of Diabetes during the forecast period (2019-2032)?

- At what CAGR the patient population is expected to grow in 7MM during the forecast period (2019-2032)?

Current Diabetes Treatment Market Scenario, Marketed Drugs and Emerging Therapies:

- What are the current options for the Diabetes treatment in addition to the approved therapies?

- What are the current treatment guidelines for the treatment of Diabetes in the USA, Europe, and Japan?

- What are the Diabetes marketed drugs and their respective MOA, regulatory milestones, product development activities, advantages, disadvantages, safety and efficacy, etc.?

- How many companies are developing therapies for the treatment of Diabetes?

- How many therapies are in-development by each company for Diabetes treatment?

- How many are emerging therapies in mid-stage, and late stage of development for Diabetes treatment?

- What are the key collaborations (Industry - Industry, Industry - Academia), Mergers and acquisitions, licensing activities related to the Diabetes therapies?

- What are the recent novel therapies, targets, mechanisms of action and technologies being developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Diabetes and their status?

- What are the current challenges faced in drug development?

- What are the key designations that have been granted for the emerging therapies for Diabetes?

- What are the global historical and forecasted market of Diabetes?

Reasons to buy Diabetes Market Forecast Report

- The report will help in developing business strategies by understanding trends shaping and driving the Diabetes treatment market

- To understand the future market competition in the Diabetes market and Insightful review of the key market drivers and barriers

- Organize sales and marketing efforts by identifying the best opportunities for Diabetes in the US, Europe (Germany, Spain, Italy, France, and the United Kingdom) and Japan

- Identification of strong upcoming Diabetes companies in the market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for Diabetes treatment market

- To understand the future market competition in the Diabetes treatment market

Stay Updated with us for Recent Articles:-

- Cell and Gene Therapies for Diabetes Treatment: A Permanent Cure for Patients?

- FDA Approves Teplizumab to Delay the Onset of Type 1 Diabetes; FDA Backs Ardelyx’s CKD Therapy Xphozah; Merck to Acquire Imago BioSciences; Accelerated Approval to ImmunoGen’s ELAHERE

- Insights Into the Key Advancements Transforming the Type 2 Diabetes Treatment and Management

- Diabetic Retinopathy: The Hornet’s Nest of Diabetes Mellitus

- Evolution in Diabetes Management

- New Approaches and Evolutions to Reshape the Diabetes Management and Care

- Intellia's Quest with CRISPR; Innovent, Synaffix ADC Tech Deal; Lilly's Diabetes Blockbuster Tirzepatide; Polyphor’s Bleak Future

- Understanding The Increasing Prevalence Of Diabetes And Its Complications

- FDA rejects BioMarin's Valoctocogene Roxaparvovec; J&J inks $6.5B deal; Alzheon bags $47M; Research updates on diabetes

- World Diabetes Day

- Cancer, Diabetes and Eczema on list; AbbVie's Humira; Teva weighs $2B; Fresenius in buyout talks

- Diabetic Kidney Disease Infographic

- Type 1 Diabetes Market Infograhics

- Diabetic Retinopathy Market

- Diabetic Macular Edema Infographic

- Diabetic Foot Ulcer Market