Dental Implants and Prosthesis Market

Dental Implants and Prosthesis Market by Implants (Material [Titanium Implants and Zirconium Implants], Design [Tapered Dental Implants and Parallel-Walled Dental Implants], Type [Endosteal Implants, Subperiosteal Implants, and Others]), Prosthesis (Dentures, Crown, Bridges, Veneer, Abutment, and Inlays & Onlays), End-User (Hospitals, Dental Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to the increase in the number of dental disorders globally and rising product developmental activities worldwide.

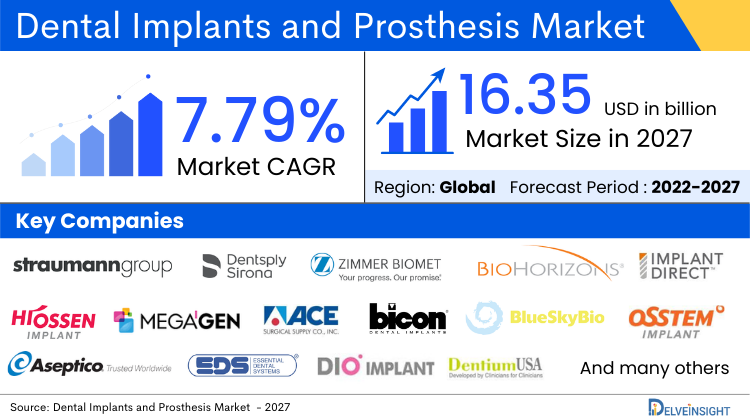

The dental implants and prosthesis market size was valued at USD 9.67 billion in 2023, growing at a CAGR of 7.79% during the forecast period from 2024 to 2030 to reach 15.16 billion by 2030. The dental implants and prosthesis market is expanding rapidly due to the rising incidence of dental health issues, oral illnesses, and periodontal diseases, aging population, which is more likely to experience oral issues, playing a major role in the increased demand for dental services and supplies, serving as key factors driving the growth of the dental implants and prosthesis market during the forecast period from 2024 to 2030.

Dental Implants and Prosthesis Market Dynamics:

According to recent estimates from the World Health Organization (WHO), Global Oral Health Status Report (2022), oral illnesses afflict around 3.5 billion people globally, with middle-income nations accounting for three out of every four cases. The source further stated that 514 million children worldwide suffered from primary tooth caries, whereas an estimated 2 billion adults worldwide suffered from caries of permanent teeth annually on average. Thus, the widespread nature of these conditions underscores the need for accessible and effective dental treatments, driving growth in the dental implants and prosthesis market as individuals seek to restore their oral health.

As per data provided by the WHO (2023), more than 1 billion adults, about 19% of the global population, are affected by severe periodontal diseases. The chief risk factor for this disease is the use of tobacco. As these diseases often lead to tooth loss, the demand for effective tooth replacement solutions like dental implants and prosthesis increases.

Therefore, the factors stated above collectively will drive the overall dental implants and prosthesis market growth.

However, irregular and lack of routine dental health check-ups, availability of alternative procedures, and others may prove to be challenging factors for dental implants and prosthesis market growth.

Dental Implants and Prosthesis Market Segment Analysis:

Dental Implants and Prosthesis Market by Implants (Material [Titanium Implants and Zirconium Implants], Design [Tapered Dental Implants and Parallel-Walled Dental Implants], Types [Endosteal Implants, Subperiosteal Implants, and Others]), Prosthesis (Dentures, Crown, Bridges, Veneer, Abutment, and Inlays & Onlays), End-User (Hospitals, Dental Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the prosthesis segment of the dental implants and prosthesis market, the dentures category is expected to have a significant revenue share in the year 2023. This is because of the widespread uses and features of dentures owing to their utility and effectiveness.

Dentures are removable dental prosthetics designed to replace missing teeth and restore oral function and aesthetics. They come in two primary types, complete dentures, used when all teeth are missing, and partial dentures, designed to replace a few missing teeth. Complete dentures rest on the gums, while partial dentures are supported by the remaining natural teeth. Dentures provide multiple benefits, including improved chewing and speaking abilities, support for facial muscles, and prevention of the sagging appearance that can occur when teeth are missing. Dentures also help in maintaining proper spacing between the remaining teeth, thus preventing them from shifting.

Additionally, product innovation in the dentures category is also playing a major role in boosting the market for the same. For example, in February 2024, Desktop Health based on its bioprinting capabilities launched Flexcera Base Ultra+ resin, for full and partial removable dentures that are 3D printed.

Therefore the widespread uses and various features of dentures enhance performance and usability, solidifying the impact on the growth of the overall dental implants and prosthesis market during the forecast period from 2024 to 2030.

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024-2030 |

|

CAGR |

7.79% (Request Sample To Know More) |

|

Dental Implants and Prosthesis Market |

~USD 15.16 billion by 2030 |

|

Key Dental Implants and Prosthesis Companies |

Nobel Biocare Services AG (Danaher Corporation), Straumann Holding AG, Dentsply Sirona, Zimmer Biomet, BioHorizons, Implant Direct Corporation, HIOSSEN, Inc., MEGA’GEN Implant Co. Ltd., ACE Surgical Supply Co., Inc., and others |

North America is expected to dominate the overall Dental Implants and Prosthesis Market:

Among all the regions, North America is expected to dominate the dental implants and prosthesis market in the year 2023 and is expected to do the same during the forecast period. This is due to the deterioration of oral health in the US because of various factors, including unhealthy dietary habits and the consumption of sugary foods & beverages, the prevalence of oral diseases such as cavities and oral cancer that significantly contribute to tooth loss, necessitating the increase in dental implants and prosthesis market in the North America region during the forecast period from 2024 to 2030.

According to the American Cancer Society (2024), approximately 58,450 new cases of oral cavity or oropharyngeal cancer will be reporting in2024 in the US. As more individuals are diagnosed with oral cancers, many may undergo treatments such as surgery, which can result in the removal of affected tissues, including teeth. This creates a significant need for dental prosthetics, including dentures, to restore functionality and aesthetics.

According to the latest data provided by the Centers for Disease Control and Prevention in 2022, it was stated that around 86.9% of children aged between 2 and 17 visited dental health providers in 2019 in the US. Also according to the same source, it was reported that adults aged 18 and above who visited dental health clinics in 2019 were 64.1% out of all the population. More dental visits for regular check-ups enable early detection of serious dental problems that might require dentures. Furthermore, frequent visits give dentists the chance to educate patients on the advantages of dental implants & prostheses and ensure a smooth transition if necessary.

According to the Population Reference Bureau factsheet “Aging in the United States” (2024), the percentage of Americans aged over 65 increased by 47%, with 58 million people affected in 2022, and this number is expected to reach 82 million by 2050. Tooth decay, gum disease, and tooth loss are among some of the oral health problems common among older individuals. These dental issues may arise from a lifetime of dental wear and tear, altered salivary composition, decreased salivary flow, among others which may increase the demand for dental implants and prosthesis.

Therefore, the interplay of all the aforementioned factors would provide a conducive growth environment for the North American dental implants and prosthesis market.

Key Dental Implants and Prosthesis Companies In The Market Landscape:

Some of the key dental implants and prosthesis companies operating in the market include Danaher Corporation, Straumann Holding AG, Dentsply Sirona, Zimmer Biomet, BioHorizons, Implant Direct Corporation, HIOSSEN, Inc., MEGA’GEN Implant Co. Ltd., ACE Surgical Supply Co., Inc., Bicon, LLC, Blue Sky Bio, Aseptico, Inc., Essential Dental Systems Inc., OSSTEM Implant Co., Ltd., DIO Corporation, Dental GmbH, 3M Company, DentiumUSA, Neoss Limited, Southern Implants, and others.

Recent Developmental Activities in the Dental Implants and Prosthesis Market:

- In January 2024, Dentsply Sirona, one of the leading dental player in the US launched the Lucitone Digital Print Denture™ system for Primeprint™ Solution which is FDA and CE cleared for digital denture manufacturing with Primeprint™ Solution.

- In January 2022, Renew, LLC and Western Dental & Orthodontics entered into a strategic partnership to make high-quality implant-supported removable anchored dentures surgical centers in California and Texas.

- In June 2021, Neoss announced the launch of NeossONE™. NeossONE™ is a solution unique to the Neoss® Implant System - one prosthetic platform, across three implant ranges, including ALL implant diameters and abutments.

Key Takeaways from the Dental Implants and Prosthesis Market Report Study

- Dental Implants and Prosthesis Market size analysis for current Dental Implants and Prosthesis market size (2023), and market forecast for 5 years (2024-2030)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the Dental Implants and Prosthesis market.

- Top key product/services/technology developments, merger, acquisition, partnership, joint venture happened for last 3 years

- Key companies dominating the global Dental Implants and Prosthesis market.

- Various opportunities available for the other competitor in the Dental Implants and Prosthesis market space.

- What are the top performing segments in 2023? How these segments will perform in 2030.

- Which is the top-performing regions and countries in the current Dental Implants and Prosthesis market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Dental Implants and Prosthesis market growth in the coming future?

Target Audience who can be benefited from this Dental Implants and Prosthesis Market Report Study

- Dental Implants and Prosthesis products providers

- Research organizations and consulting companies

- Dental Implants and Prosthesis-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in Dental Implants and Prosthesis

- Various End-users who want to know more about the Dental Implants and Prosthesis market and latest technological developments in the Dental Implants and Prosthesis market.