Diabetes Pen Market

Diabetes Pens Market By Product Type (Disposable and Reusable [Conventional and Smart]), Application (Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes), and End-User (Hospitals & Clinics, Homecare Settings, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to rising technological advancements in product development and increasing prevalence of diabetes.

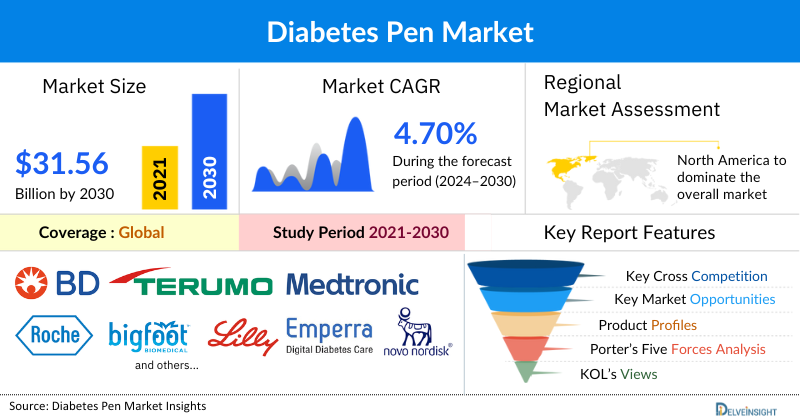

The Diabetes Pens market was valued at USD 24.01 billion in 2023, growing at a CAGR of 4.70% during the forecast period from 2024 to 2030 to reach USD 31.56 billion by 2030. Factors such as the increasing prevalence of lifestyle disorders, such as diabetes and obesity, increasing awareness regarding the ease of use of diabetes pens, the improvement in patient adherence and compliance to the treatment regimen, and technologically advanced products such as smart insulin pens, are expected to drive the diabetes pens market. Additionally, the added advantages offered by diabetes pens over conventional syringes and vials mode of insulin administration are further expected to boost the market growth.

Diabetes Pens Market Dynamics:

The diabetes pens market is witnessing growth due to the rising requirement for these devices to cater to the large diabetic patient population across the globe.

According to the data provided by the International Diabetes Federation (IDF) Diabetes Atlas Ninth Edition 2019, there were approximately 463 million adults in the age group 20-79 years. The figures are expected to reach 700 million by 2045. It further stated that over 20 million live births (1 in 6 live births) are affected by diabetes during pregnancy. Moreover, 374 million people are at increased risk of developing type 2 diabetes. In addition to the above-mentioned facts, as per IDF, across the globe, an estimated 223 million women (20-79 years) were living with diabetes in 2019. This number is projected to increase to 343 million by 2045. It mentioned that 20 million live births had some form of hyperglycemia in pregnancy of which 84% were due to gestational diabetes (GDM).

Diabetes is a major cause of blindness, kidney failure, heart attacks, stroke, and lower limb amputation. Moreover, many women with gestational diabetes mellitus (GDM) experience pregnancy-related complications which include high blood pressure, obstructed labor, and large birth weight babies. It has been observed that on average about half of women with a history of GDM develop type 2 diabetes within five to ten years after delivery.

As diabetes can be extremely debilitating in terms of quality of life, insulin administration becomes imperative in the treatment of diabetes. Diabetes pens are one of the popular devices that have gained traction over the years due to their ease of use and other advantages over conventional syringe administration of insulin.

These devices are virtually painless in their operation, portable and discreet in their appearance, safer in insulin administration, less time-consuming than their conventional counterparts, as well as more cost-effective.

However, the non-availability of all types of insulin in cartridges, the limitation in not mixing two different types of insulin as well as chances of contamination of the diabetes pens may prove to be certain restraints to the diabetes pens market growth.

Diabetes Pens Market Segment Analysis:

Diabetes Pens market by Product Type (Disposable and Reusable [Conventional and Smart]), Application (Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes), End-User (Hospitals & Clinics, Homecare Settings, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product segment of the diabetes pens market, the reusable diabetes pen category is expected to account for the larger market share during the forecast period. This can be ascribed to the benefits offered by diabetes pen.

The reusable diabetes pens allow for the insertion of an insulin cartridge into the delivery chamber of a diabetes pen that is required to be replaced with a new cartridge once the old cartridge is exhausted or expired. Reusable diabetes pens offer advantages such as greater flexibility in terms of reusing the same pen if a prescription for the insulin type changes. Moreover, considering the long-term benefit, the reusable diabetes pen appears to be more economical compared to conventional diabetes pens.

Furthermore, the rising popularity of connected diabetes management devices has led to the development of smart insulin pens such as INPEN System, Novo Pen 6, and Novo Pen Echo. These pens offer patients a smart option for diabetes management. These devices offer features such as dose calculation and tracking and provide helpful reminders, alerts, and reports. They also allow data sharing between healthcare providers and the patient thereby facilitating follow-ups by patients and patient-monitoring by physicians.

Therefore, all these above-stated factors are predicted to contribute to driving the diabetes pens market forward in the forecast period.

Asia-Pacific is expected to register the fastest growth in the global Diabetes Pen Market:

Among all the regions, Asia-Pacific is expected to grow at the fastest CAGR in the global diabetes pens market. This is owing to the rapid increase in diabetes cases due to lifestyle changes, urbanization, and aging populations. Countries like China and India have some of the highest numbers of diabetes patients globally. Improved healthcare infrastructure and awareness campaigns in many countries have led to higher diagnosis rates of diabetes, boosting the demand for diabetes management products like diabetes pens.

For instance, the IDF Diabetes Atlas in 2023, stated that an estimated 141 million adults were living with diabetes in China in 2021. Also, as per the data provided by the IDF, in 2019, China had the highest number of diabetics worldwide, with 116 million people with diabetes, which was followed by India (77 million people with diabetes).

As China currently has the largest diabetic population in the world, the Chinese government has employed a slew of measures to deal with the diabetic epidemic in the country. For example, the Healthy China 2030 Plan by the Chinese government listed diabetes, along with cancer, hypertension, and cardiovascular diseases, as the four major non-communicable diseases (NCDs) for which the goal is to “control the prevalence and reduce the probability of early death.”

Considering the presence of a large patient pool in the APAC region coupled with increasing government initiatives in the region, the APAC is expected to provide immense growth opportunities for the diabetes pen market.

Diabetes Pens Market Key Players:

Some of the key market players operating in the diabetes pens market include BD, Medtronic, Terumo Group, F Hoffmann-La Roche Ltd., BIGFOOT BIOMEDICAL, INC, Eli Lilly and Company, Novo Nordisk A/S, Emperra GmbH E-Health Technologies, Copernicus (Nemera), ARKRAY USA, Inc., Ypsomed AG, HTL-Strefa (MTD Medical Technology and Devices S.A), Trividia Health, Inc, Sanofi, and others.

Recent Developmental Activities in the Diabetes Pens Market:

- In May 2021, Medtronic plc received the CE (Conformité Européenne) Mark approval for their InPen smart insulin pen for expanded functionality as multiple daily injections (MDI).

- In May 2021, Eli Lilly entered into agreements with four companies DexCom, Inc., Glooko Inc., myDiabby Healthcare, and Roche – to advance connected solutions and streamline care for diabetic patients living outside of the United States. These companies offer unique diabetes management platforms that will be compatible with Lilly's Tempo Pen™ (approved in several global markets) and Tempo Smart Button™ (currently in late-stage development).

- In May 2021, Bigfoot Medical received 510k approval from the US Food and Drug Administration for their first-of-its-kind Bigfoot Unity™ Diabetes Management System. It features connected smartpen caps that recommend insulin doses for people using multiple daily injections (MDI) therapies.

Key Takeaways from the Diabetes Pens Market Report Study

- Market size analysis for current diabetes pens market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the global diabetes pens market.

- Various opportunities available for the other competitors in the diabetes pens market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current diabetes pens market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for diabetes pens market growth in the coming future?

Target Audience Who Can be benefited from this Diabetes Pens Market Report Study

- Diabetes pens products providers

- Research organizations and consulting companies

- Diabetes pens-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in diabetes pens

- Various End-users who want to know more about the diabetes pens market and the latest technological developments in the diabetes pens market.

Frequently Asked Questions for Diabetes Pens Market:

1. What are diabetes pens?

Diabetes pens are devices that facilitate the administration of insulin in patients with diabetes. These devices contain a dial to measure the dosage, a cartridge, and a disposable needle.

2. What is the market for global diabetes pens?

The diabetes pens market was valued at USD 24.01 billion in 2023, growing at a CAGR of 4.70% during the forecast period from 2024 to 2030 to reach USD 31.56 billion by 2030.

3. What are the drivers for the global diabetes pens market?

The major factors driving the demand for diabetes pens in the market are the growing prevalence of diabetes and other lifestyle disorders, rising technological advancement in product development, and the increasing popularity of self-administrating drug devices among patients.

4. What are the key players operating in global diabetes pens?

Some of the key market players operating in the diabetes pens market include BD, Medtronic, Terumo Group, F Hoffmann-La Roche Ltd., BIGFOOT BIOMEDICAL, INC, Eli Lilly and Company, Novo Nordisk A/S, Emperra GmbH E-Health Technologies, Copernicus (Nemera), ARKRAY USA, Inc., Ypsomed AG, HTL-Strefa (MTD Medical Technology and Devices S.A), Trividia Health, Inc, Sanofi, and others.

5. What region will have the fastest growth in the diabetes pens market?

Asia-Pacific is expected to witness the fastest growth in revenue in the diabetes pens market during the forecast period. The reasons for this fast growth can be correlated to the large patient population in the region, rising disposable income, and increasing focus of the market players in improving their market access in the APAC region.