Diabetic Peripheral Neuropathy Market

- Diabetic Peripheral Neuropathy market is expected to rise at a significant CAGR during the forecast period.

- A high prevalence of diabetes, an unmet medical need for better treatments, active research and development activities by pharmaceutical Diabetic Peripheral Neuropathy companies, and a rising patient population seeking novel drugs characterize the market for diabetic peripheral neuropathy.

- Innovative pain management solutions, such as non-addictive cannabidiol (CBD) and novel treatments like 8% capsaicin patches and advanced electrical stimulation, offer safer and more effective options for long-term pain relief.

- The market holds certain approved drugs to relieve the pain of Diabetic Peripheral Neuropathy such as antiseizure drugs, antidepressants, opioids, and non-opioid pain relief medication, etc. The antiseizure drugs involve LYRICA (Pfizer), NUCYNTA (Assertio Therapeutics, formerly known as Depomed), CYMBALTA (Eli Lilly and Company), EFFEXOR (Pfizer), QUTENZA (Averitas), etc., are generally used as a symptomatic option to relieve pain, but their usage is frequently associated with unwanted adverse effects.

- A few emerging therapies like Engensis (VM202), MEDI7352, VX-548, etc., are being developed in late-stage clinical development.

- In December 2023, Vertex Pharmaceuticals announced positive results from its Phase II dose-ranging study of the suzetrigine an oral selective NaV1.8 pain signal inhibitor (formerly known as VX-548) in people with painful DPN. Treatment with the NaV1.8 inhibitor VX-548 led to a statistically significant and clinically meaningful reduction in the primary endpoint of change from baseline in the Numeric Pain Rating Scale (NPRS). It was generally well tolerated at all doses tested in the study. Vertex is preparing to initiate a Phase III pivotal program of suzetrigine in patients with diabetic peripheral neuropathy in 2H 2024.

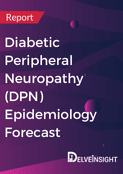

DelveInsight's “Diabetic Peripheral Neuropathy Treatment Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Diabetic Peripheral Neuropathy, historical and forecasted epidemiology as well as the Diabetic Peripheral Neuropathy market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Diabetic Peripheral Neuropathy treatment market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Diabetic Peripheral Neuropathy therapeutics market size from 2020 to 2034. The report also covers current Diabetic Peripheral Neuropathy treatment market/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Diabetic Peripheral Neuropathy Understanding and Treatment Algorithm

Diabetic Peripheral Neuropathy is nerve damage caused by chronically high blood sugar and diabetes. It leads to numbness, loss of sensation, and sometimes pain in the feet, legs, or hands. It is the most common complication of diabetes. About 60% to 70% of all people with diabetes will eventually develop peripheral neuropathy, although not all suffer pain. Yet this nerve damage is not inevitable. Studies have shown that people with diabetes can reduce their risk of developing nerve damage by keeping their blood sugar levels as close to normal as possible.

Diagnosing diabetic peripheral neuropathy involves a thorough physical exam assessing muscle strength, reflexes, and sensitivity. Special tests like filament and sensory testing, nerve conduction studies, electromyography, and autonomic testing may also be conducted to gauge nerve function and muscle response.

The diabetic peripheral neuropathy treatment report provides an overview of diabetic peripheral neuropathy pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report...

Diabetic Peripheral Neuropathy Treatment

The current modality of Diabetic Peripheral Neuropathy treatment largely focuses on the provision of symptomatic relief through pain management in diabetic peripheral neuropathy. To date, no treatment can reverse or reliably prevent disease progression. Certain lifestyle modifications such as foot care, smoking cessation, and alcohol modifications are also considered to manage the symptoms. Consistent maintenance of blood sugar levels within a specific target range is the key to preventing or delaying nerve damage. Appropriate blood sugar management might even lead to improvement in some of the current symptoms being experienced by a patient.

Commonly prescribed medications for managing diabetic peripheral neuropathy pain include gabapentin and pregabalin, which are anticonvulsants known to control nerve-related pain. Tricyclic antidepressants (TCAs) like amitriptyline and nortriptyline can also alleviate pain and improve sleep quality. Serotonin-norepinephrine reuptake inhibitors (SNRIs) such as duloxetine are effective in managing neuropathic pain. However, opioids, reserved for severe cases, carry a risk of addiction and side effects and are typically prescribed only when other treatments have failed.

Further details related to treatment are provided in the report...

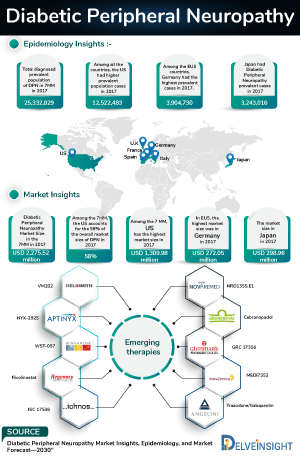

Diabetic Peripheral Neuropathy Epidemiology

The Diabetic Peripheral Neuropathy epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034. The Diabetic Peripheral Neuropathy epidemiology is segmented with detailed insights into total prevalent cases of diabetic peripheral neuropathy, total prevalent cases of painful diabetic peripheral neuropathy, and total treated cases of diabetic peripheral neuropathy.

- In 2023, the highest number of type-specific cases of diabetic neuropathy were observed for peripheral diabetic neuropathy in the 7MM.

- The total prevalent cases of diabetic peripheral neuropathy in the 7MM were around 34,000,000 cases in 2023 out of which the highest prevalent cases of this disease were seen in the United States.

- Among EU4 and the UK, Germany accounted for the highest cases of the total prevalent cases of diabetic neuropathy, whereas Spain accounted for the least number of cases.

- The US accounted for nearly 50% of total treated cases in 2023, which is expected to increase by 2034.

Diabetic Peripheral Neuropathy Market Recent Developments

- In March 2025, Karolinska Development AB (Nasdaq Stockholm: KDEV) announced that portfolio company PharmNovo received positive feedback regarding its most advanced drug candidate, PN6047, in a pre-IND meeting with the U.S. Food and Drug Administration (FDA). The meeting aimed to provide guidance on the design of the company's planned Phase 2a Diabetic Peripheral Neuropathy clinical trials for the treatment of peripheral neuropathy and allodynia.

Diabetic Peripheral Neuropathy Drug Chapters

The drug chapter segment of the Diabetic Peripheral Neuropathy treatment market report encloses a detailed analysis of marketed Diabetic Peripheral Neuropathy drugs and late-stage (Phase III and Phase II) pipeline Diabetic Peripheral Neuropathy drugs market. It also deep dives into the pivotal Diabetic Peripheral Neuropathy clinical trials details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Diabetic Peripheral Neuropathy Drugs

QUTENZA (capsaicin): Grünenthal/Averitas Pharma

QUTENZA (capsaicin), developed by Grünenthal and Averitas Pharma, is an 8% topical system that contains capsaicin in a localized dermal delivery system. Capsaicin is an agonist for the transient receptor potential vanilloid 1 receptor (TRPV1), which is an ion channel-receptor complex expressed on nociceptive nerve fibers in the skin. Topical administration of capsaicin causes an initial enhanced stimulation of the TRPV1-expressing cutaneous nociceptors that may be associated with painful sensations. In July 2020, Grünenthal’s US subsidiary Averitas Pharma received US FDA approval for a QUTENZA (capsaicin) 8% patch for treating neuropathic pain associated with Diabetic Peripheral Neuropathy of the feet in adults.

TARLIGE (mirogabalin besylate): Daiichi Sankyo

TARLIGE (mirogabalin besylate) is an orally administered gabapentinoid developed by Daiichi Sankyo for the treatment of peripheral neuropathic pain, including diabetic Peripheral Neuropathic pain and postherpetic neuralgia. In January 2019, Daiichi Sankyo announced the approval of TARLIGE for marketing in Japan for the treatment of Diabetic Peripheral Neuropathy and expects the drug to benefit patients in Japan by providing a new therapeutic option for the treatment of Peripheral Neuropathy Pain.

|

Comparison of Key marketed Diabetic Peripheral Neuropathy drugs | ||||

|

Drug name |

Company |

Diabetic Peripheral Neuropathy MoA |

Diabetic Peripheral Neuropathy RoA |

Approval |

|

QUTENZA (capsaicin) |

Grünenthal/Averitas Pharma |

Transient receptor potential vanilloid 1 receptor (TRPV1) agonist |

Topical |

US: 2020 |

|

TARLIGE (mirogabalin besylate) |

Daiichi Sankyo |

Binds to the alpha-2 delta subunit of voltage-gated calcium channels in the central nervous system, reducing the release of neurotransmitters involved in pain signaling |

Oral |

US: 2019 |

Note: Detailed current therapies assessment will be provided in the full report of Diabetic Peripheral Neuropathy...

Emerging Diabetic Peripheral Neuropathy Drugs

Engensis (VM202): Helixmith

Engensis (VM202), developed by Helixmith is a DNA-based drug designed to produce two isoforms of HGF (hepatocyte growth factor), HGF728 and HGF723. When VM202 is delivered to the affected area by a single intramuscular injection, this drug enters a small portion of the surrounding muscle cells. In the case of Diabetic Peripheral Neuropathy, it has the potential to reverse the underlying cause of neuropathy through an angio-neurorestorative effect, without simply managing the pain. This drug is currently in Phase III developmental stage and has been granted RMAT (Regenerative Medicine Advanced Therapy) designation by the US FDA in 2018.

Suzetrigine (VX-548): Vertex Pharmaceuticals

VX-548 being developed by Vertex Pharmaceuticals is an oral, selective NaV1.8 inhibitor that is highly selective for NaV1.8 relative to other NaV channels. NaV1.8 is a voltage-gated sodium channel that plays a critical role in pain signaling in the peripheral nervous system. NaV1.8 is a genetically validated target for the treatment of pain and multiple pain indications including acute pain, and neuropathic pain. It is currently in Phase III development stage.

|

TABLE 2: Comparison of Key emerging Diabetic Peripheral Neuropathy drugs | |||||

|

Drug name |

Company |

RoA |

MoA |

Phase |

Any Special Status |

|

Engensis (VM202) |

Helixmith |

Intramuscular Injection |

Tissue regeneration |

III |

US: Regenerative Medicine Advanced Therapy |

|

Suzetrigine (VX-548) |

Vertex Pharmaceuticals |

Oral |

NaV1.8 inhibitor |

III |

US: Fast track Designation, Breakthrough Therapy |

Note: Detailed emerging therapies assessment will be provided in the final report...

Diabetic Peripheral Neuropathy Market Outlook

Treatment modalities focus on optimized diabetic management and symptomatic relief. Glycemic control is the first step in the approach to disease management and has been shown to improve the occurrence of falls and the presence of foot ulcers. The three main principles of treatment for peripheral neuropathy are glycemic control, foot care, and pain management. The prescription medicines commonly used for managing diabetic peripheral neuropathy pain include Gabapentin and Pregabalin, Tricyclic Antidepressants (TCAs), Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs), and Opioids. Other Alternatives include Antiseizure Medications like carbamazepine or lamotrigine.

Individuals with diabetic peripheral neuropathy must collaborate closely with their healthcare team to build a personalized treatment strategy. Because therapy success varies from person to person, regular follow-up meetings are required to assess progress and make any modifications to the treatment plan. Furthermore, proper diabetes management remains a critical component of Diabetic Peripheral Neuropathy treatment.

Key Diabetic Peripheral Neuropathy companies, such as Helixmith, Vertex Pharmaceuticals, AstraZeneca, and others are evaluating their lead candidates in different stages of Diabetic Peripheral Neuropathy clinical trials, respectively. They aim to investigate their products for the treatment of Diabetic Peripheral Neuropathy.

- The United States accounted for the highest market size of Diabetic Peripheral Neuropathy in 2023.

- Major drivers such as the rising prevalent population, technological advancements, and upcoming therapies, will boost the market significantly during the forecast period.

- As novel Diabetic Peripheral Neuropathy therapies are discovered and authorized and diabetes rates continue to climb globally, the market's dynamics are expected to undergo a positive change.

Diabetic Peripheral Neuropathy Drugs Uptake

This section focuses on the uptake rate of potential Diabetic Peripheral Neuropathy drugs market expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key Diabetic Peripheral Neuropathy companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Suzetrigine (VX-548), under development by Vertex Pharmaceuticals, holds promise as a potential game-changer in the treatment landscape of diabetic peripheral neuropathy. Positioned as an oral, selective NaV1.8 inhibitor, Suzetrigine boasts high selectivity for NaV1.8 over other NaV channels, enhancing its therapeutic potential. Its Phase III development stage underscores its advancement towards market entry. The oral route of administration offers a distinct advantage, ensuring ease of uptake for patients compared to alternative pipeline drugs. Moreover, Suzetrigine's mechanism of action aligns with addressing neuropathic pain effectively.

Further detailed analysis of emerging therapies drug uptake in the report...

Diabetic Peripheral Neuropathy Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Diabetic Peripheral Neuropathy companies involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging Diabetic Peripheral Neuropathy therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as Foundation for Peripheral Neuropathy American Optometric Association, American Diabetes Association, etc., were contacted. Their opinion helps understand and validate current and emerging treatment patterns of Diabetic Peripheral Neuropathy. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“NaV1.7s can be used as a single agent or in combination with NaV1.8s. The action potential works in the periphery in transducing the pain signal, and then there is stimulation.” |

|

“HbA1c levels in patients suffering with T2DM have a significant role in DPN. Thus, aiming for HbA1c levels of 6.5–7.0% may be advantageous in preventing the onset.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Diabetic Peripheral Neuropathy Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of Diabetic Peripheral Neuropathy therapeutics market report, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country-specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Diabetic Peripheral Neuropathy therapeutics market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Diabetic Peripheral Neuropathy treatment market.

Diabetic Peripheral Neuropathy Therapeutics Market Report Insights

- Patient Population

- Therapeutic Approaches

- Diabetic Peripheral Neuropathy Pipeline Analysis

- Diabetic Peripheral Neuropathy Market Size and Trends

- Existing and future Market Opportunity

Diabetic Peripheral Neuropathy Treatment Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Diabetic Peripheral Neuropathy Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Diabetic Peripheral Neuropathy Therapeutics Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the growth rate of the 7MM Diabetic Peripheral Neuropathy treatment market?

- What was the total Diabetic Peripheral Neuropathy market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the Diabetic Peripheral Neuropathy treatment?

- How many Diabetic Peripheral Neuropathy companies are developing therapies for the treatment of Diabetic Peripheral Neuropathy?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Diabetic Peripheral Neuropathy Market landscape.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Diabetic Peripheral Neuropathy companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

.jpg)

.jpg)