Fabry Disease Market Insights

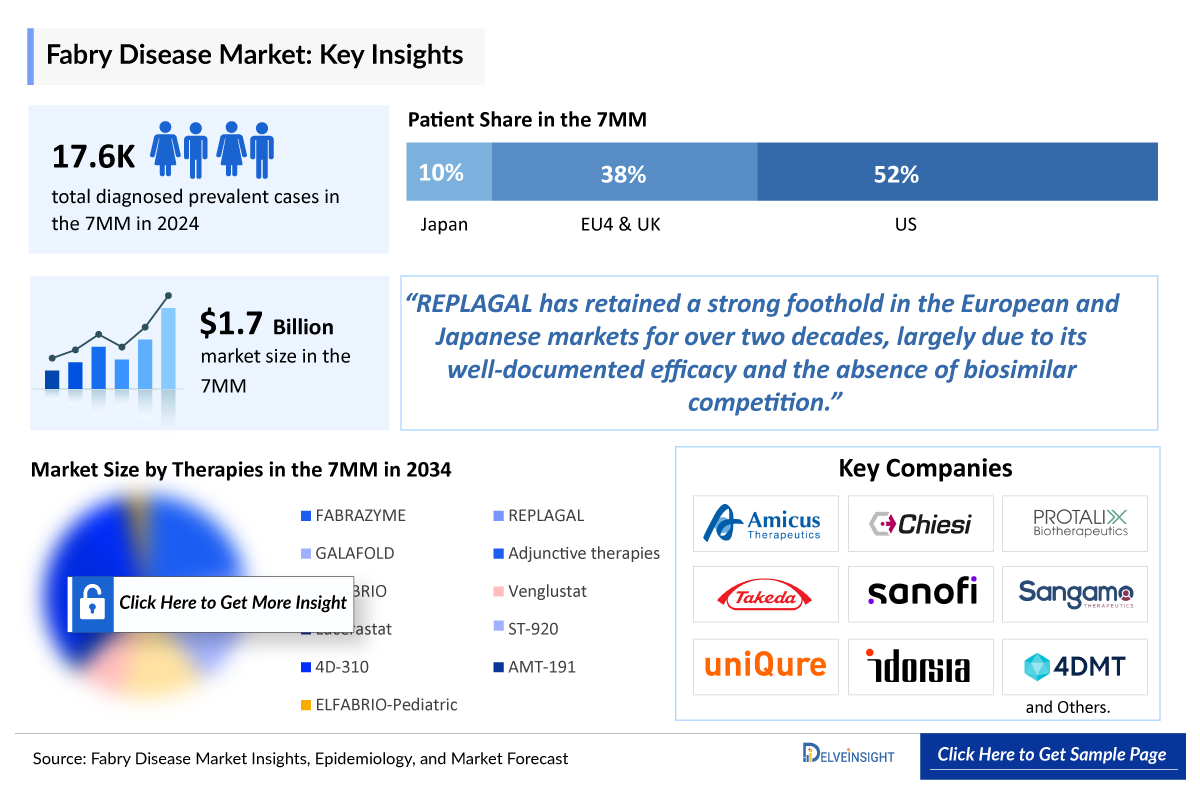

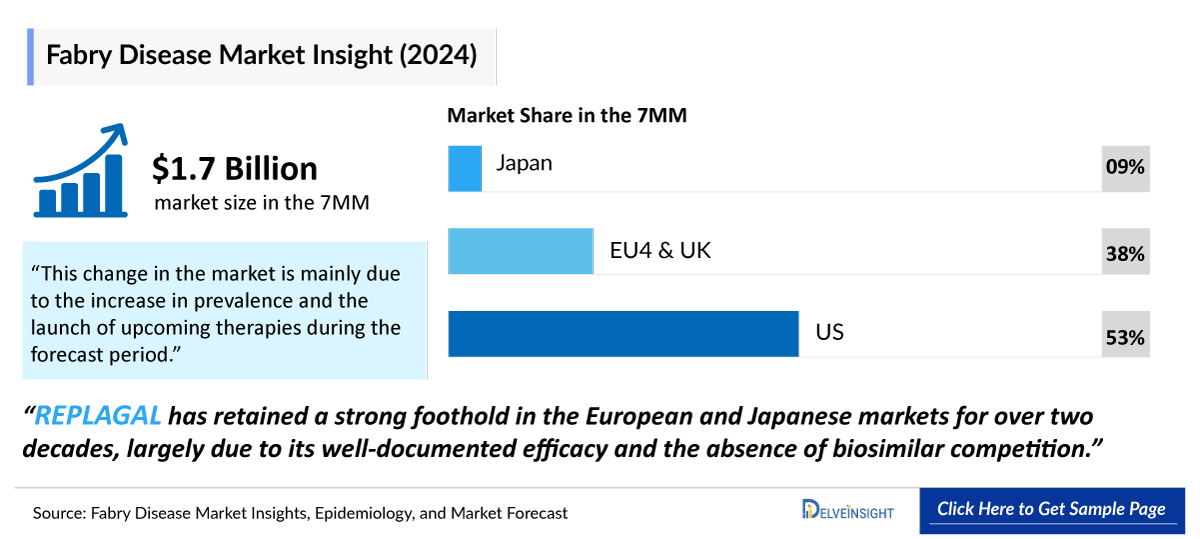

- The Fabry Disease Treatment Market Size was valued ~USD 1,700 million in 2024 and is anticipated to grow with a significant CAGR during the study period (2020-2034).

- The United States accounted for the highest Fabry Disease Treatment Market Size was ~52% of the total market size in 7MM in 2024, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan

- In 2024, the Fabry Disease Therapeutics Market Size was highest in the US among the 7MM accounting for approximately USD 880 million that is further expected to increase at a significant CAGR throughout the study period (2020–2034).

- Fabry disease is a rare X-linked genetic disorder caused by alpha-galactosidase gene mutations, leading to globotriaosylceramide accumulation and symptoms ranging from pain and gastrointestinal issues to severe complications like kidney failure, heart failure, and stroke. It affects 1 in 1,000 to 40,000 people globally, with late-onset cases being more common.

- Newborn screening is becoming more common, which may improve early diagnosis and treatment initiation. Adults with Fabry disease often experience progressive organ damage, leading to significant morbidity and mortality, typically by the fourth or fifth decade of life.

- In February 2025, Amicus Therapeutics announced oral presentations and posters related to migalastat development programs at the 21st Annual WORLD Symposium 2025.

- In October 2024, Amicus Therapeutics announced that it had entered into a license agreement with Teva Pharmaceuticals. This Agreement resolves the patent litigation brought by Amicus in response to Teva’s Abbreviated New Drug Application (ANDA) seeking approval to market a generic version of GALAFOLD prior to the expiration of the applicable patents. Pursuant to the terms of the agreement, Amicus will grant Teva Pharmaceuticals a license to market its generic version of GALAFOLD in the US at the beginning of January 2037.

- Primary Fabry Disease Treatment include Enzyme Replacement Therapies (ERTs) and chaperone therapy.

- The Fabry Disease Marketed Therapies including FABRAZYME (Sanofi (Genzyme)), REPLAGAL (Takeda Pharmaceuticals), GALAFOLD (Amicus Therapeutics), and ELFABRIO (CHIESI Farmaceutici and Protalix Biotherapeutics) provide diverse treatment options targeting the enzyme deficiency, offering patients tailored therapies to manage symptoms and slow disease progression.

- FABRAZYME is FDA-approved for patients aged ≥2 years, making it the primary enzyme replacement therapy (ERT) for Fabry disease in the US. REPLAGAL, approved in Europe for patients aged 7+ years, offers an alternative but is unavailable in the US.

- REPLAGAL has retained a strong foothold in the European and Japanese markets for over two decades, largely due to its well-documented efficacy and the absence of biosimilar competition.

- The new entrant in the Fabry disease Drugs Market is the next-generation ERT ELFABRIO. ELFABRIO, approved for adult Fabry patients in the EU and US, currently follows a bi-weekly regimen, with efforts underway for monthly dosing approval (EMA validation).

- The leading Fabry Disease Companies such as Amicus Therapeutics, CHIESI Farmaceutici and Protalix Biotherapeutics, Sanofi (Genzyme), Takeda Pharmaceuticals, Sangamo Therapeutics, UniQure Biopharma, and others are developing therapies for Fabry Disease treatment.

- The Fabry Disease Pipeline features promising late- and mid-stage therapies, including Substrate Reduction Therapies (SRTs) and gene therapies. Among the most advanced candidates with strong efficacy and safety data are Venglustat (Sanofi [Genzyme]) and ST-920 (Sangamo Therapeutics).

- Additionally, several other therapies, such as lucerastat (Idorsia Pharmaceuticals), 4D-310 (4D Molecular Therapeutics), and AMT-191 (UniQure), are in development and are expected to enter the market during the forecast period. However, their future remains uncertain due to various challenges—4D-310 faced development holds due to safety concerns, lucerastat failed to meet its primary endpoint, and AMT-191 remains in early-stage development with no efficacy data available.

- In February 2025, UniQure Biopharma announced the completion of enrollment in the first cohort of the Phase I/IIa trial of AMT-191. Additionally, the Independent Data Monitoring Committee (IDMC) reviewed safety data from the initial two patients enrolled in the first cohort.

- Beyond the key emerging therapies, AL01211 by AceLink Therapeutics, an oral small-molecule Glucosylceramide Synthase Inhibitor, has demonstrated potential in reducing globotriaosylceramide levels and stabilizing Fabry disease symptoms. While the therapy has secured regulatory clearance for Phase II trial initiation in the US and China, while clinical trials in the 7MM have yet to commence.

- Emerging treatments, such as gene therapy, may offer more effective management options for Fabry disease. Growing awareness and improved diagnostic techniques are crucial for early detection and better patient outcomes.

Download the Sample PDF to Get More Insight @ Fabry Disease Treatment Market

Factors impacting the Fabry Disease Market Growth

Fabry Disease patient pool supporting growth

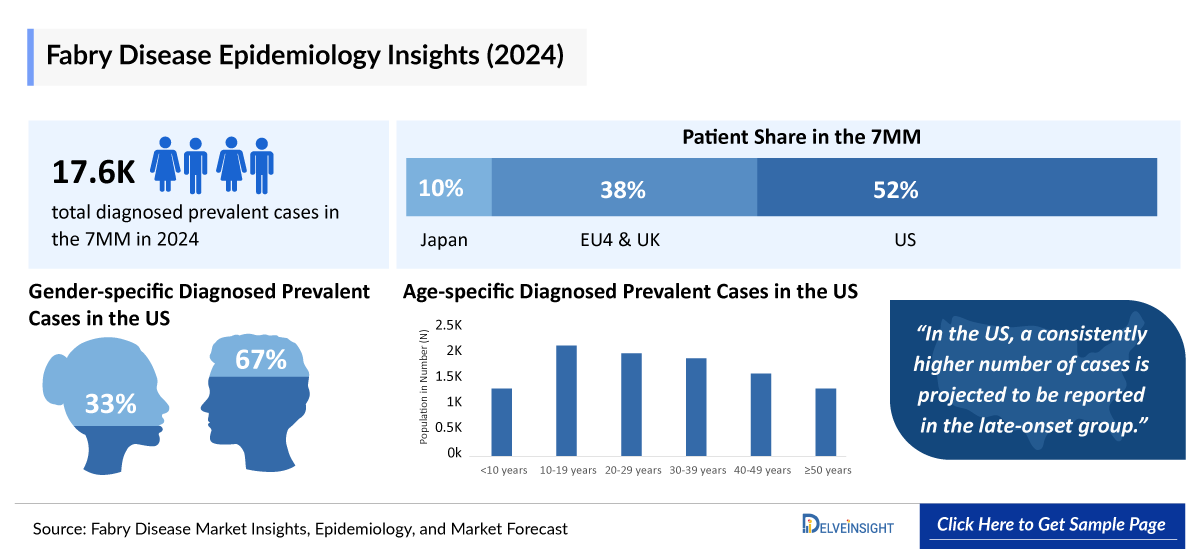

Fabry Disease is a rare X-linked lysosomal storage disorder. In 2024, approximately 17.6K diagnosed prevalent cases were reported in the 7MM. Increased newborn screening and genetic testing are expected to expand this pool, reaching around 58K by 2034, especially in late-onset variants that often remain undiagnosed.

Fabry Disease treatment paradigm

ERT remains the cornerstone, with FABRAZYME (Sanofi) and REPLAGAL (Takeda) as long-standing standards. MIGALASTAT (Amicus), an oral chaperone therapy, offers convenience for eligible patients. Despite these, ERT limitations include infusion burden and incomplete organ protection, highlighting unmet needs.

Fabry Disease Market Recent Developments and Breakthroughs

The Fabry disease market is showing strong growth, driven by innovation and regulatory support. In December 2024, Exegenesis Bio received Orphan Drug Designation from the FDA for EXG110, a novel gene therapy for Fabry disease, underscoring the expanding pipeline. Meanwhile, Amicus Therapeutics continues to advance migalastat, with key presentations at the WORLD Symposium 2025, and secured a licensing agreement with Teva Pharmaceuticals to maintain GALAFOLD’s U.S. exclusivity until 2037. These developments highlight a positive and expanding market outlook.

Fabry Disease pipeline spotlight

The Fabry disease pipeline is among the most innovative in rare diseases, led by gene therapies like Venglustat (Sanofi Genzyme) and ST-920 (Sangamo Therapeutics), aiming for durable correction. Late-stage, next-generation ERTs with longer half-lives are also advancing, promising improved efficacy and reduced treatment burden.

Fabry Disease market dynamics and opportunity

Transition toward one-time therapies (gene therapy) has the potential to disrupt the recurring ERT model. However, reimbursement challenges and durability data will determine long-term market penetration.

DelveInsight’s “Fabry Disease Treatment Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Fabry disease, historical and forecasted epidemiology as well as the Fabry disease therapeutics market trends in the United States, EU4, and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The Fabry Disease Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Fabry disease market size from 2020 to 2034. The Report also covers current Fabry disease treatment practices, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Fabry Disease Market |

|

|

Fabry Disease Market Size | |

|

Fabry Disease Companies |

Amicus Therapeutics, CHIESI Farmaceutici and Protalix Biotherapeutics, Sanofi (Genzyme), Takeda Pharmaceuticals, Sangamo Therapeutics, UniQure Biopharma, and others |

|

Fabry Disease Epidemiology Segmentation |

|

Fabry Disease Treatment Market

Fabry disease is a rare, inherited disorder that affects the body's ability to break down certain fatty substances due to a deficiency of the enzyme alpha-galactosidase A. This genetic mutation leads to the accumulation of globotriaosylceramide (GL-3) in cells throughout the body, causing progressive damage to vital organs, including the heart, kidneys, and nervous system. Symptoms often begin in childhood and can include burning pain in the hands and feet, skin lesions (angiokeratomas), digestive issues, and an inability to sweat properly.

As the disease advances, it increases the risk of serious complications such as kidney failure, heart disease, and stroke. While there is no cure, treatments such as ERT and chaperone therapy can help slow disease progression and improve quality of life. Early diagnosis and management are crucial in reducing long-term complications and enhancing patient outcomes.

Fabry Disease Diagnosis

Diagnosing Fabry disease can be challenging due to its wide range of symptoms, which often overlap with other conditions. A definitive diagnosis typically involves a combination of clinical evaluation, laboratory testing, and genetic analysis. In males, an enzyme assay measuring alpha-galactosidase A activity in the blood can confirm the deficiency. However, since some females with Fabry disease may have normal enzyme levels, genetic testing of the GLA gene is recommended for both men and women to identify disease-causing mutations.

Additional tests, such as kidney function assessments, heart evaluations (ECG, echocardiogram), and MRI scans, may be used to detect organ damage associated with the disease. Early and accurate diagnosis is essential for timely intervention, allowing for better disease management and improved long-term outcomes.

Further details related to diagnosis are provided in the report…

Fabry Disease Treatment

While there is no cure for Fabry disease, several treatment options can help manage symptoms and slow disease progression. The primary treatment is ERT, which provides the missing alpha-galactosidase A enzyme to help reduce the buildup of globotriaosylceramide (GL-3) in cells. Another option is chaperone therapy, which is suitable for specific genetic mutations and works by stabilizing the defective enzyme to improve its function.

Additional treatments focus on managing complications, such as medications to protect kidney function, control heart disease, and relieve nerve pain. Lifestyle modifications, including a balanced diet and regular medical monitoring, are also essential for maintaining overall health. Early diagnosis and personalized treatment plans can significantly improve the quality of life for individuals with Fabry disease. Fabry Disease clinical trials are advancing rapidly, evaluating novel therapies that target the underlying enzyme deficiency, aiming to improve patient outcomes, reduce symptoms, and slow disease progression effectively.

Fabry Disease Epidemiology

As the market is derived using a patient-based model, the Fabry Disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of Fabry disease, gender-specific diagnosed prevalent cases of Fabry disease, age-specific diagnosed prevalent cases of Fabry disease, and phenotype-specific diagnosed prevalent cases of Fabry disease, in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- The total Fabry Disease Diagnosed Prevalent Cases in the United States were around 9,200 cases in 2024.

- The United States contributed to the largest diagnosed prevalent population of Fabry disease, acquiring ~52% of the 7MM in 2024. Whereas, EU4 and the UK, and Japan accounted for around 38% and 10% of the total population share, respectively, in 2024.

- Among EU4 and the UK, Germany accounted for the largest number of diagnosed prevalent Fabry disease (~2,170 Cases) cases followed by the UK, whereas Spain accounted for the lowest number of cases in 2024.

- In 2024, it was estimated that there were around 3,300 diagnosed prevalent cases of classic phenotype and approximately 5,860 cases of late-onset phenotype in the US.

- According to DelveInsight estimates, in 2024, among the age-specific diagnosed prevalent cases of Fabry disease in the US, the highest number of cases was in the 10–19 years age group (~1,920), followed by 20–29 years (~1,780), 30–39 years (~1,700), 40–49 years (~1,430), and those aged below 10 years and 50 and above (~1,180 for each).

Fabry Disease Drugs Analysis

The drug chapter segment of the Fabry disease Therapeutics Market Report encloses a detailed analysis of Fabry disease off-label drugs and late-stage (Phase-III and Phase-II) Fabry Disease pipeline drugs. It also helps to understand the Fabry Disease Clinical Trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases. The Fabry Disease drugs market is witnessing significant growth due to rising awareness, improved diagnostics, and the introduction of innovative enzyme replacement and gene therapies targeting this rare genetic disorder.

Fabry Disease Marketed Drugs

- GALAFOLD (migalastat): Amicus Therapeutics

GALAFOLD is an oral pharmacological chaperone of α-Gal A for the treatment of Fabry disease in adults who have amenable galactosidase-α gene variants. The orally administered therapeutic candidate acts as a pharmacological chaperone designed to selectively and reversibly bind with high affinity to the active sites of certain mutant forms of the lysosomal enzyme α-Gal A.

-

- In February 2025, Amicus Therapeutics announced oral presentations and posters related to migalastat development programs at the 21st Annual WORLD Symposium 2025.

- In October 2024, Amicus Therapeutics announced that it had entered into a license agreement with Teva Pharmaceuticals. This Agreement resolves the patent litigation brought by Amicus in response to Teva’s Abbreviated New Drug Application (ANDA) seeking approval to market a generic version of GALAFOLD prior to the expiration of the applicable patents. Pursuant to the terms of the agreement, Amicus will grant Teva Pharmaceuticals a license to market its generic version of GALAFOLD in the US at the beginning of January 2037.

- In November 2023, GSK and Amicus Therapeutics announced that Amicus had obtained global rights to develop and commercialize migalastat as a monotherapy and in combination with ERT for Fabry disease.

- ELFABRIO (PRX-102/pegunigalsidase alfa): CHIESI Farmaceutici and Protalix Biotherapeutics

ELFABRIO is an investigational, novel, PEGylated ERT to treat unmet medical needs for Fabry patients, such as progressive kidney decline. PRX-102 is a plant cell culture-expressed and chemically modified stabilized version of the recombinant α Gal A enzyme. Protein sub-units are covalently bound via chemical cross-linking using short PEG moieties, resulting in a molecule with unique pharmacokinetic parameters.

- In December 2024, CHIESI Farmaceutici and Protalix BioTherapeutics announced that the EMA had validated the variation submission for pegunigalsidase alfa to label a less frequent dosing regimen at a dose of 2 mg/kg body weight administered every 4 weeks in adult patients with Fabry disease.

- In October 2024, Chiesi Global Rare Diseases announced the publication of results from the Phase III BRIGHT study of ELFABRIO 2 mg/kg administered every four weeks for 52 Weeks in adult patients with Fabry disease who were previously treated with agalsidase alfa or beta administered every two weeks.

- In May 2023, CHIESI Farmaceutici announced that the FDA approved its treatment for adult patients with Fabry disease in the US, followed by the European Commission (EC) granting marketing authorization for PRX-102 in the EU.

- Later, in August 2023, the UK Medicines and Healthcare products Regulatory Agency (MHRA) approved ELFABRIO for long-term ERT in adult patients with a confirmed diagnosis of Fabry disease in Great Britain.

- Looking forward, the company is strategically expanding its reach by conducting clinical trials in pediatric patients and Japanese patients, in addition to the ongoing investigation into a monthly dosing regimen.

Fabry Disease Emerging Drugs

Venglustat: Sanofi (Genzyme)

Venglustat is a novel, oral investigational therapy that has the potential to slow the progression of certain diseases by inhibiting abnormal glycosphingolipids accumulation. The drug inhibits the enzymatic conversion of ceramide to glucosylceramide, reducing available substrate for the synthesis of more complex glycosphingolipids.

- In the January 2025 annual presentation, Sanofi mentioned that the expected date of regulatory submission for venglustat for Fabry disease is in 2026.

- In their annual presentation for January 2025, Sanofi stated that they anticipates the Phase III data for venglustat to be available in the second half of 2025.

Lucerastat: Idorsia Pharmaceuticals

Lucerastat, a small molecule GCS inhibitor, is in development as a novel SRT for Fabry disease. Preclinical studies showed that lucerastat is a soluble, bioavailable inhibitor of glucosylceramide synthase that reduces the accumulation of α-Gal A substrates in tissues affected by Fabry disease, including kidneys, liver, and dorsal root ganglia.

In clinical pharmacology studies, lucerastat had reproducible pharmacokinetics characterized by rapid absorption, quick elimination, and no evidence for saturation of absorption or elimination mechanisms.

- In the January 2025 presentation, Idorsia Pharmaceuticals mentioned that the company is anticipating the Phase III Open-label Extension (OLE) study results in Q2 2025 and planning the discussion for the regulatory pathway to then be discussed with the US FDA.

- Lucerastat for Fabry disease has received ODD in the US and EU and is under review in Japan.

Isaralgagene civaparvovec (ST-920): Sangamo Therapeutics

Isaralgagene civaparvovec (ST-920) is a liver-tropic rAAV 2/6 vector carrying the cDNA for human α-Gal A that is delivered through a single dose IV infusion. The drug aims to deliver a working copy of the galactosidase-α gene to the liver so that liver cells can start producing functional α-Gal A. ST-920 has the potential as a one-time, durable treatment option for Fabry disease that can improve patient outcomes.

- In February 2025, Sangamo Therapeutics announced updated data from the Phase I/II STAAR study evaluating isaralgagene civaparvovec for the treatment of Fabry disease at the 21st Annual WORLD Symposium.

- In October 2024, Sangamo Therapeutics announced alignment with the FDA on an accelerated approval pathway for isaralgagene civaparvovec in Fabry disease, with a BLA submission expected in the second half of 2025.

- In June 2024, Sangamo Therapeutics held a productive meeting with the EMA on a proposed pathway to potential approval for isaralgagene civaparvovec in Europe, with members of the US FDA in attendance.

AMT-191: UniQure Biopharma

AMT-191 is an investigational AAV5 gene therapy that delivers a galactosidase-α transgene designed to target the liver to produce α-GAL A protein. In patients with Fabry disease, a pathogenic variant in the galactosidase-α gene leads to α-GAL A enzyme deficiency, which results in a progressive accumulation of lipids in multiple cell types, creating a multi-system disorder. The drug represents a novel, potential one-time administered approach to treating Fabry disease.

- The IDMC’s review identified no significant safety concerns and recommended proceeding with enrollment in the second cohort. The company expects to initiate enrollment of the second dose cohort in the first quarter of 2025.

- In September 2024, UniQure Biopharma mentioned that with the support of the designation for its Phase I/IIa clinical trial, the company is eager to rapidly generate clinical proof-of-concept data and provide initial results in 2025.

- In September 2024, UniQure Biopharma announced that the US FDA had granted orphan drug designation (ODD) to AMT-191, followed by the FDA granting fast track designation (FTD) to AMT-191 in October 2024.

Further detail in the report…

|

Drug |

MoA |

RoA |

Company |

Phase |

|

Venglustat |

GCS inhibitor |

Oral |

Sanofi |

III |

|

Lucerastat |

GCS inhibitor |

Oral |

Idorsia Pharmaceuticals |

III |

|

Isaralgagene civaparvovec (ST-920) |

Alpha-galactosidase replacements |

IV Infusion |

Sangamo Therapeutics |

I/II |

|

AMT-191 |

Alpha-galactosidase replacements |

IV Infusion |

UniQure Biopharma |

I/IIa |

|

XXX |

XXX |

XXX |

XXX |

II |

Fabry Disease Market Outlook

Fabry disease is a rare, X-linked lysosomal storage disorder caused by a mutation in the galactosidase-α gene, affecting α-GAL A enzyme function. Newborn screening (NBS) has improved prevalence estimation and early diagnosis, aiding timely treatment. The US has the largest market share, followed by Europe and Japan. Treatment includes ERT, oral chaperone therapy, and adjunctive medications like ACE inhibitors and analgesics. While ERT can delay complications, a multidisciplinary approach with lifestyle modifications and prophylactic treatments is essential for effective disease management.

The Fabry disease treatment landscape includes major pharma players. In the US, three therapies are approved: ELFABRIO (Chiesi/Protalix), GALAFOLD (Amicus), and FABRAZYME (Sanofi-Genzyme). Europe leads the market with four approved therapies, while Japan has two (REPLAGAL and GALAFOLD). Japan also introduced agalsidase beta biosimilars, unlike other major markets.

ERT remains essential, with agalsidase alfa and agalsidase beta mimicking α-Gal A to slow disease progression. FABRAZYME (agalsidase beta), developed by Sanofi-Genzyme, is an ERT given via IV infusion every two weeks. Approved by the FDA in 2003, it is available in over 70 countries. Recently, its patent expired in Japan, leading to the introduction of biosimilars like agalsidase beta BS (JR-051) by JCR Pharmaceuticals. REPLAGAL (agalsidase alfa), developed by Shire (now Takeda), was approved in Europe (2001) and Japan (2007) but not in the US. Due to regulatory challenges, Shire withdrew its FDA application in 2012, transitioning US patients to alternative treatments. REPLAGAL remains approved in over 35 countries.

The FDA-approved pegunigalsidase alfa (ELFABRIO) by Chiesi/Protalix is a pegylated ERT for Fabry disease. While ERT improves outcomes, its IV administration poses challenges like frequent infusions, poor venous access, infection risks, and complications in pediatric patients. Antidrug antibodies (ADAs) may also reduce efficacy. To address these limitations, chaperone therapy has been introduced as an alternative. Chemical chaperone therapy helps stabilize defective enzymes, aiding their proper folding and function. It is used in lysosomal storage diseases like Gaucher, Pompe, and Fabry disease. GALAFOLD (migalastat) is the first FDA-approved oral chaperone therapy for Fabry disease (2018). It is effective for specific GLA mutations, benefiting 35–50% of patients by stabilizing α-Gal A and promoting GL-3 degradation.

Several Fabry Disease Companies are developing novel therapies to address unmet needs in Fabry disease, though late-stage pipeline candidates remain limited. Emerging treatments like venglustat (Sanofi Genzyme), lucerastat (Idorsia), ST-920 (Sangamo), 4D-310 (4D Molecular Therapeutics), and AMT-191 (UniQure) may enter the market soon.

SRTs, including lucerastat and venglustat, aim to inhibit GCS, reducing substrate accumulation. Lucerastat, a GCS inhibitor, showed reduced plasma Gb3 but failed to meet the primary endpoint in the Phase III MODIFY trial. However, long-term OLE study data suggest a potential kidney function benefit. Idorsia is still evaluating Lucerastat’s regulatory pathway.

ST-920 (Sangamo Therapeutics) is an AAV2/6 gene therapy designed for liver-targeted α-Gal A production, potentially offering continuous enzyme supply and improved efficacy over ERT. 4D-310 (4D Molecular Therapeutics) utilizes a proprietary AAV vector to deliver a functional GLA gene, promoting α-GAL A production in target tissues, particularly the heart. AMT-191 (uniQure) uses an AAV5 vector to introduce a functional GLA gene to liver cells, aiming for sustained α-Gal A production and reduced dependence on ERT.

The Fabry disease Therapeutics Market is growing due to rising prevalence and better diagnostics. While ERTs and GALAFOLD dominate, emerging gene therapies and new treatments show promise. However, pediatric treatment gaps and long-term efficacy remain challenges. Innovation and improved access will be key to future expansion.

Few new agents are being developed and tested as potential treatments for Fabry disease; the emerging drugs include Sanofi (Genzyme), Idorsia, Sangamo, 4D Molecular Therapeutics, UniQure, and others.

- The Fabry Disease Therapeutics Market Size in the 7MM was approximately USD 1,700 million in 2024.

- The United States accounted for the highest Fabry Disease Treatment Market Size approximately 52% of the total market size in 7MM in 2024, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Among the European countries, Germany had the highest Fabry Disease Treatment Market Size with nearly USD 210 million in 2024, while Spain had the lowest market size of Fabry disease with ~USD 82 million in 2024.

- The Fabry Disease Therapeutics Market Size in Japan was estimated to be ~USD 150 million in 2024, which accounted for 9% of the total 7MM.

- With the expected launch of upcoming therapies, such as ST-920 the total market size of Fabry disease is expected to show change in the upcoming years.

Fabry Disease Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to launch in the market during 2020–2034.

FABRAZYME, remains a cornerstone of Fabry disease treatment as the first FDA-approved ERT for Fabry disease, been extensively studied in both treatment-naïve and ERT-experienced patients. While FABRAZYME has maintained its stronghold due to extensive real-world data and physician familiarity, competition in the ERT space has intensified. The approval of ELFABRIO, which is also administered biweekly and has a longer half-life, has created a viable alternative that could impact FABRAZYME’s market share, especially if ELFABRIO secures regulatory approval for a monthly dosing regimen.

Another potential disruptor to FABRAZYME’s market position is the introduction of biosimilars. The patent for FABRAZYME has expired in Japan and biosimilar, such as agalsidase beta BS (JR-051), have entered the market, these biosimilars are still not available in the US and EU, allowing FABRAZYME to maintain a significant market share in these regions.

Other than the approved therapies the market of Fabry disease is also expected to witness a revolution by the anticipated launch of first gene therapy in this treatment landscape. Sangamo’s ST-920 (isaralgagene civaparvovec) has emerged as a leading candidate for treating Fabry disease. The company plans to submit the BLA in the second-half of 2025 based on the results of the Phase I/II STAAR study. If approved, ST-920 could capture a significant market share, particularly among patients seeking alternatives to lifelong ERT infusions. Its success may also stimulate further investment and innovation in gene therapies for lysosomal storage disorders and other rare diseases.

Further detailed analysis of emerging therapies drug uptake in the report…

Fabry Disease Pipeline Development Activities

The Fabry Disease pipeline segment provides insights into different Fabry Disease clinical trials within Phase III, Phase II, and Phase I. It also analyzes key Fabry Disease Companies involved in developing targeted therapeutics.

Fabry Disease Pipeline Development Activities

The Fabry Disease clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Fabry disease emerging therapies.

Latest KOL Views on Fabry Disease Pipeline

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Fabry disease evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake` along with challenges related to accessibility, including KOL from Université Sorbonne Paris, Paris, France; Researcher, Division of Nephrology, New England Medical Center, Boston, Massachusetts, USA; Researcher, Advanced Clinical Research Centre, Institute of Neurological Disorders, Kawasaki, Japan; and others.

Delveinsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Fabry disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Fabry Disease Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Fabry Disease Therapeutics Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment. The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Fabry Disease Therapeutics Market Report Scope

- The Fabry Disease Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Fabry disease treatment market, historical and forecasted Fabry Disease market size, Fabry Disease Drugs Market Share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The Fabry Disease Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Fabry disease Drugs Market.

Fabry Disease Therapeutics Market Report Insights

- Patient-based Fabry Disease Market Forecasting

- Fabry Disease Therapeutic Approaches

- Fabry Disease Pipeline Drugs Analysis

- Fabry Disease Market Size and Trends

- Existing and Future Fabry Disease Drugs Market Opportunities

Fabry Disease Therapeutics Market Report Key Strengths

- 10 years Fabry Disease Market Forecast

- The 7MM Coverage

- Fabry Disease Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Fabry Disease Drugs Uptake

- Key Fabry Disease Market Forecast Assumptions

Fabry Disease Therapeutics Market Report Assessment

- Current Fabry Disease Treatment Practices

- Fabry Disease Unmet Needs

- Fabry Disease Pipeline Drugs Profiles

- Fabry Disease Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Fabry Disease Market Drivers

- Fabry Disease Market Barriers

Key Questions Answered In The Fabry Disease Market Report:

Fabry Disease Market Insights

- What was the Fabry disease Drugs Market Share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Fabry disease Market Size as well as market size by therapies across the 7MM during the forecast period (2025–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Fabry disease market size during the forecast period (2025–2034)?

- At what CAGR, the Fabry disease market is expected to grow at the 7MM level during the forecast period (2025–2034)?

- What would be the Fabry disease market outlook across the 7MM during the forecast period (2025–2034)?

- What would be the Fabry disease market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Fabry Disease Epidemiology Insights

- What are the disease risk, burden, and Fabry Disease Unmet Needs?

- What is the historical Fabry disease patient population in the United States, EU4 (Germany, France, Italy, Spain) and the UK, and Japan?

- What would be the forecasted patient population of Fabry disease at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Fabry disease?

- Out of the above-mentioned countries, which country would have the highest Incident population of Fabry disease during the forecast period (2025–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2025–2034)?

Current Fabry Disease Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Fabry disease along with the approved therapy?

- What are the current treatment guidelines for the treatment of Fabry disease in the US, Europe, And Japan?

- What are the Fabry disease-marketed drugs and their MoA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many Fabry Disease companies are developing therapies for the treatment of Fabry disease?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Fabry disease?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to the Fabry disease therapies?

- What are the recent therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Fabry disease and their status?

- What are the key designations that have been granted for the emerging therapies for Fabry disease?

- What are the 7MM historical and forecasted market of Fabry disease?

Reasons to Buy Fabry Disease Report

- The Fabry Disease Therapeutics Market Report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Fabry disease Drugs Market.

- Insights on patient burden/disease Fabry Disease Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing Fabry Disease Drugs Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Fabry Disease Drugs Market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Fabry Disease Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles