Foot and Ankle Devices Market

Foot & Ankle Devices by Device Type (Orthopedic Implants and Devices, Soft Tissue Orthopedic Devices, Bracing and Support Devices, and Prostheses), Product Type (Joint Implants [Ankle Implants, Subtalar Joint Implants and Phalangeal Implants], Fixation Devices [Internal Fixation Devices {Screws, Plates, Fusion Nails, and Wires & Pins} and External Fixation {Circular Fixators and Others}], Soft Bracing & Support Devices, Hinged Braces & Support Devices, Hard Braces & Support Devices, Solid Ankle Cushion Heel (SACH) Prostheses, Single-Axial Prostheses, Multiaxial Prostheses, and Others), Application (Trauma and Hairline Fractures, Ligament Injuries, Arthritis, Neurological Disorders, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the rising burden of foot and ankle disorders, the surge in diabetes-related limb complications, and increase in product development activities by key market players across the globe.

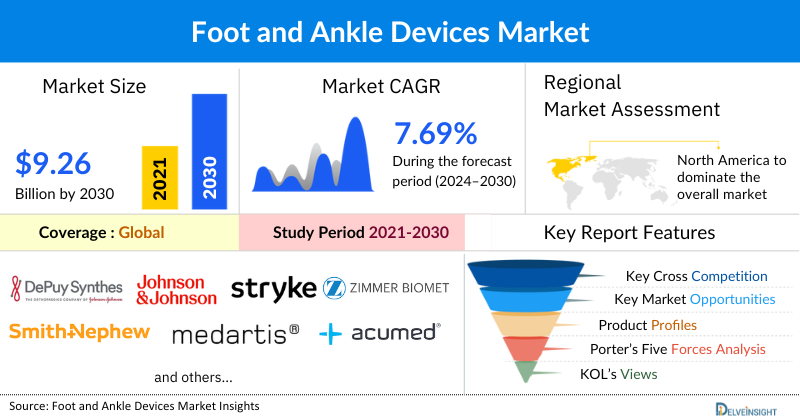

The foot and ankle devices market was valued at USD 5.94 billion in 2023, growing at a CAGR of 7.69% during the forecast period from 2024 to 2030 to reach USD 9.26 billion by 2030. The escalating prevalence of foot and ankle disorders, such as arthritis, fractures, tendon injuries, and deformities, is creating a heightened demand for advanced medical devices designed to provide support, alleviate pain, and facilitate recovery. Concurrently, the surge in diabetes-related complications, such as diabetic foot ulcers and peripheral neuropathy, further amplifies market demand. Diabetes significantly increases the risk of severe foot problems, which necessitates specialized devices for prevention, treatment, and management, thereby expanding the market for foot and ankle devices tailored to diabetic care. Moreover, the increase in product launches and regulatory approvals by key market players worldwide introduces a broader range of advanced, high-quality devices to the market. Collectively, these factors create a dynamic market environment, driving the demand for foot and ankle devices during the forecast period from 2024 to 2030.

Foot and Ankle Devices Market Dynamics:

According to the latest data provided by Diabetes Feet Australia (DFA) (2022), in Australia, 300,000 individuals are at risk of developing diabetic foot disease (DFD) per 100,000 population, with 50,000 already living with the condition. Of these, 12,500 people have undergone diabetes-related amputations, and 1,000 are currently hospitalized due to DFD. Each year, 12 new diabetes-related amputations are performed per 100,000 population.

Additionally, according to the recent data and stats provided by IDF Atlas Report (2022), in African countries, the rates of diabetic foot ulcers (DFU) range from 10.0% to 30.0%, while the prevalence of lower limb amputations (LLA) varies between 3.0% and 35.0%.

The increasing incidence of diabetic foot disease, including diabetes-related amputations and diabetic ulcers, is driving substantial growth in the market for foot and ankle devices. These complications often require advanced interventions to prevent deterioration and improve patient outcomes, leading to a surge in the need for high-quality foot and ankle devices. Innovations in wound care management, custom orthotics, therapeutic footwear, and prosthetics are emerging to meet this demand thereby escalating the overall market of foot and ankle devices across the globe.

Additionally, companies are amplifying their production of foot & ankle devices and securing regulatory approvals, thereby strategically expanding their market presence and driving further growth. For instance, in October 2023, Johnson & Johnson MedTech announced that DePuy Synthes received 510(k) clearance from the FDA for its TriLEAP™ Lower Extremity Anatomic Plating System. This modular system, designed for orthopedic surgeons and foot and ankle specialists, includes a range of contoured and conventional plates, multiple screw diameters, and instruments for bone reduction, internal fixation, and fusion.

Moreover, the success of the clinical trials and technological advancement on foot & ankle devices gave a significant boost to the market, enhancing its growth prospects and driving increased interest and investment. For instance, in June 2024, the University of Florida Health introduced a ground-breaking wearable Bluetooth device designed to enhance patient safety in orthopedics. This innovative UF smart sensor, which can be discreetly attached to a limb or embedded in a shoe, was engineered to send real-time alerts to both doctors and patients if the patient puts undue stress on their feet. The device aims to revolutionize patient monitoring by providing timely warnings and improving overall care.

Thus, the factors mentioned above are likely to boost the market of foot & ankle devices during the forecasted period.

However, the metal sensitivity in patients and frequent product recalls for orthopedic devices may hinder the future market of foot & ankle devices.

Foot and Ankle Devices Market Segment Analysis:

Foot & Ankle Devices by Device Type (Orthopedic Implants and Devices, Soft Tissue Orthopedic Devices, Bracing and Support Devices, and Prostheses), Product Type (Joint Implants [Ankle Implants, Subtalar Joint Implants and Phalangeal Implants], Fixation Devices [Internal Fixation Devices {Screws, Plates, Fusion Nails, and Wires & Pins} and External Fixation {Circular Fixators and Others}], Soft Bracing & Support Devices, Hinged Braces & Support Devices, Hard Braces & Support Devices, Solid Ankle Cushion Heel (SACH) Prostheses, Single-Axial Prostheses, Multiaxial Prostheses, and Others), Application (Trauma and Hairline Fractures, Ligament Injuries, Arthritis, Neurological Disorders, and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the product type of foot & ankle devices market the ankle implants are expected to hold a significant share in 2023. Ankle implants are significantly boosting the overall market of foot and ankle devices by addressing a range of complex conditions and contributing to advancements in treatment options. Ankle implants offer a viable alternative to traditional treatments like fusion surgery, which can limit ankle mobility. By providing a solution that preserves joint movement, these implants improve patient outcomes and expand the range of available treatments, driving increased demand for such devices. The development of advanced materials and technologies for ankle implants, such as titanium alloys and polymer composites, has improved their durability and functionality. Additionally, ankle implants are associated with better outcomes in terms of pain relief, joint function, and overall quality of life compared to traditional methods. Positive patient experiences and successful outcomes drive demand and foster confidence in these devices, contributing to market expansion.

Consequently, the competitive landscape in the ankle implant market encourages ongoing innovation. Manufacturers are investing in research and development to create better implants with enhanced functionality and longevity, which drives further market growth. For instance, in December 2022, Enovis received FDA approval for the STAR® Ankle's patient-specific instrumentation (PSI) system. The STAR PSI System offered personalized pre-operative planning with a 3D visualization of the patient's ankle, including details on existing implants and bone defects. This system used with an updated surgical technique, aimed to reduce operative time during total ankle replacement procedures.

Additionally, in February 2021, the FDA approved the Patient Specific Talus Spacer, a 3D-printed talus implant, for humanitarian use. This was the world-first implant that replaced the talus bone to treat avascular necrosis (AVN) of the ankle, offering a joint-sparing alternative to other late-stage AVN surgical interventions that may limit ankle movement.

Moreover, the success of the clinical trial on intensive care units gave a significant boost to the market, enhancing its growth prospects and driving increased interest and investment. For instance, in July 2023, ART MEDICAL, an Israeli medical device company, revealed impressive results from a randomized study on its smART+ Platform, published by ESPEN's Clinical Nutrition. The study showed that the smART+ Platform improved feeding efficiency, meeting nearly 90% of nutrition goals, and reduced ICU stay and ventilation time by 3.3 days. This breakthrough marked a significant step toward commercializing ART MEDICAL's innovative technology.

Hence, all the above-mentioned factors are expected to generate considerable revenue for the segment pushing the overall growth of the global foot & ankle devices market during the forecast period.

|

Report Metrics |

Details |

|

Study Period |

2020 to 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2024 to 2030 |

|

CAGR | |

|

Foot and Ankle Devices Market Size |

USD 9.26 billion by 2030 |

|

Key Foot and Ankle Devices Companies |

DePuy Synthes (Johnson and Johnson), Stryker, Zimmer Biomet, Smith and Nephew, Medartis AG, Acumed, Orthofix Medical Inc., CONMED Corporation, College Park Industries, OsteoMed, Roadrunnerfoot Engineering srl., OTTOBOCK., Advanced Orthopaedic Solutions, Paragon 28 Inc., MedShape Inc, Allard USA Inc., Fillauer LLC, Corin Group, JEIL MEDICAL CORPORATION, and Globus Medical and others. |

North America is expected to dominate the overall Foot and Ankle Devices Market:

North America is expected to account for the highest proportion of the foot & ankle devices market in 2023, out of all regions. This can be ascribed to the increasing prevalence of foot and ankle disorders, increase in lower limb amputations majorly due to diabetes, increase in technological advancement, and the presence of key market players engaged in mergers, acquisitions, product launches, and other strategic activities across the region are expected to escalate the market of foot & ankle devices during the forecast period.

Additionally, as per the recent data provided by the Centre for Disease Control and Prevention (2024), in 2021, 38.4 million people of all ages—or 11.6% of the U.S. population—had diabetes. Additionally, as per the same source, 80% of Lower-limb amputations (LLAs) are a result of complications from diabetes.

Thus, diabetes leads to a range of complications, including peripheral neuropathy and poor circulation, which can cause chronic lower limb pain and increase the risk of severe conditions such as diabetic foot ulcers. If these ulcers or other complications are not managed effectively, they can necessitate lower-limb amputations. The increase in lower-limb amputations and pain directly translates into a greater need for specialized foot and ankle devices. For patients who undergo amputation, there is a growing demand for advanced prosthetics that offer improved comfort, functionality, and mobility thereby boosting the overall market of foot and ankle devices.

The increasing number of product development activities in the region is further going to accelerate the growth of the foot & ankle devices market. For instance, in August 2021, Zimmer Biomet and Canary Medical announced the FDA's approval of De Novo classification and authorization to market the tibial extension for Persona IQ®, the world's first and only smart knee.

Furthermore, in April 2022, Medline UNITE Foot & Ankle announced the launch of its FDA-cleared Calcaneal Fracture Plating System and IM Fibula Implant. The national launch of these two products provided surgeons with a comprehensive titanium foot and ankle trauma system to address nearly all fractures requiring ORIF with plate and screw fixation. Therefore, the above-mentioned factors are expected to bolster the growth of the foot & ankle devices market in North America during the forecast period.

Foot and Ankle Devices Market Key Players:

Some of the key market players operating in the foot & ankle devices market include DePuy Synthes (Johnson and Johnson), Stryker, Zimmer Biomet, Smith and Nephew, Medartis AG, Acumed, Orthofix Medical Inc., CONMED Corporation, College Park Industries, OsteoMed, Roadrunnerfoot Engineering srl., OTTOBOCK., Advanced Orthopaedic Solutions, Paragon 28 Inc., MedShape Inc., Allard USA Inc., Fillauer LLC, Corin Group, JEIL MEDICAL CORPORATION, Globus Medical, and others.

Recent Developmental Activities in Foot and Ankle Devices Market:

- In March 2025, restor3d will showcase its latest foot and ankle innovations at the American College of Foot & Ankle Surgery (ACFAS) Annual Meeting in Phoenix, AZ. Highlights include the FDA 510(k)-cleared Ossera™ AFX Ankle Fusion System, designed to enhance fusion procedures using advanced 3D printing and TIDAL Technology™.

- In September 2023, MiRus® launched the Molybdenum-Rhenium low profile ATLAS™ MoRe® foot and ankle plating system.

- In October 2023, Integrum's OPRA™ Implant System received FDA approval for a clinical study on below-knee amputations.

- In April 2023, the FDA authorized the marketing of the MISHA™ Knee System for people suffering from knee osteoarthritis.

- In April 2023, Smith+Nephew introduced the first of its kind handheld digital tensioning device for robotically-enabled total knee arthroplasty.

Key Takeaways from the Foot and Ankle Devices Market Report Study

- Market size analysis for current foot & ankle devices size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the foot & ankle devices market.

- Various opportunities available for the other competitors in the foot & ankle devices market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current foot & ankle devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for foot & ankle devices market growth in the coming future?

Target Audience who can be benefited from this Foot and Ankle Devices Market Report Study

- Foot & ankle devices product providers

- Research organizations and consulting companies

- Foot & ankle devices -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in foot & ankle devices

- Various end-users who want to know more about the foot & ankle devices market and the latest technological developments in the foot & ankle devices market.