Graves Ophthalmopathy Market

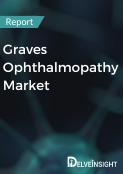

- In 2023, the total Graves’ Ophthalmopathy market size was around USD 2,600 million, which is expected to increase by 2034 during the study period (2020–2034) in the 7MM.

- Graves’ ophthalmopathy, also known as thyroid-associated ophthalmopathy and thyroid eye disease, is the most frequent extrathyroidal manifestation of Graves’ disease.

- With estimated 1 million patients affected in the US, thyroid eye disease is a burben some disorder which become sight threatning in upto 5% of the cases

- Thyroid-associated Ophthalmopathy remains largely undiagnosed due to less awareness among the treating physicians and asymptomatic nature of the disease

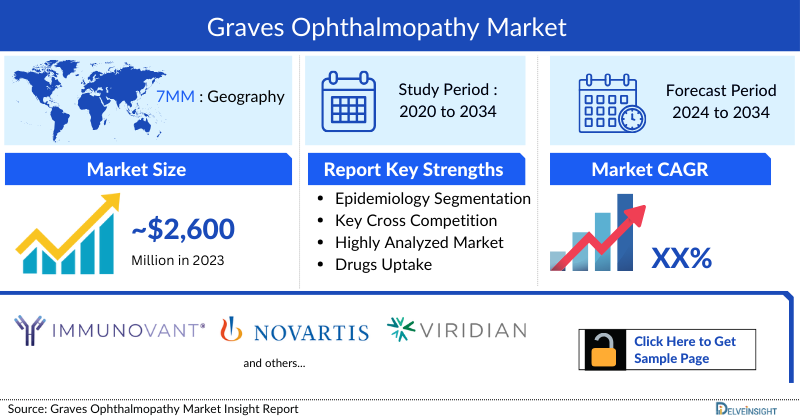

- US has the highest prevalent cases of graves ophthalmopathy among the 7MM. Among the EU4 and the UK, out of all prevalent cases, Germany accounted for the highest number of cases followed by France and Spain accounted for the lowest number of cases in 2023.

- Graves’ Ophthalmopathy management varies based on symptoms and severity, involving basic, medical, and surgical approaches. Corticosteroid therapy for 3 months may prevent or alleviate ophthalmopathy after radioactive iodine therapy. Botulinum toxin can temporarily treat dysthyroid strabismus during the acute phase.

- Untill recently, the drug treatment was largely available only for patients in acute phase of the disease and surgery was the only option for the management of chronic disease form

- Amgen’s TEPEZZA (trepotumab), one of the most successful launch for a rare indication, generated a revenue of ~USD 2 Billion in 2023 after becoming the first launched therapy for thyroid eye disease in the year 2020

- The US FDA has granted clearance to Tourmaline Bio’s investigational new drug (IND) application enabling the initiation of a Phase IIb trial of TOUR006 to treat thyroid eye disease (TED). According to Tourmaline Bio, TOUR006 attributes demonstrated that it is long-acting with a terminal half-life of ~7 weeks and shows high affinity to IL-6.

- In March 2024, ACELYRIN announced positive Phase I/II proof-of-concept data for lonigutamab, the first subcutaneous anti-IGF-1R to demonstrate clinical responses in thyroid eye disease.

- Key Graves Ophthalmopathy Companies such as Immunovant Sciences and Viridian Therapeutics are expected to transform the treatment landscape for Graves’ Ophthalmopathy patients.

- As potential treatments for chronic Graves’ Ophthalmopathy develop, understanding its clinical presentation and impact on QoL grows crucial. Further exploration, particularly through prospective studies integrating patient-reported outcomes and clinical examinations, is warranted. Concurrently, the unique dynamics of the TED market offer a promising opportunity for innovative therapeutic strategies.

Request for unlocking the CAGR of the "Graves Ophthalmopathy Drug Market"

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Graves Ophthalmopathy Market |

|

|

Graves Ophthalmopathys Market Size | |

|

Graves Ophthalmopathy Companies |

Immunovant Sciences, Novartis, Viridian Therapeutics, Sling Therapeutics, Regeneron Pharmaceuticals, ValenzaBio, and others. |

|

Graves Ophthalmopathy Epidemiology Segmentation |

|

Graves’ Ophthalmopathy Market Report Summary

- The Graves’ ophthalmopathy market report offers extensive knowledge regarding the epidemiology segments (by region, prevalent cases of Graves’ Ophthalmopathy, diagnosed prevalent cases of Graves’ Ophthalmopathy, gender-specific cases, diagnosed prevalent cases by chronicity, acute diagnosed prevalent cases by severity, and moderate-to-severe drug-treated cases of acute Graves’ Ophthalmopathy) and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies such as Batoclimab, VRDN-001, and the elaborative profiles of late and mid-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The Graves’ Ophthalmopathy market report also encompasses a comprehensive analysis of Graves’ Ophthalmopathy market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the Graves’ ophthalmopathy market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The Graves’ ophthalmopathy market report also includes drug outreach coverage in the 7MM region.

- The Graves’ ophthalmopathy market report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM Graves’ Ophthalmopathy market.

Graves’ ophthalmopathy Market

Various Graves’ ophthalmopathy companies, such as Immunovant Sciences, Viridian Therapeutics, and others, are involved in developing therapies for Graves’ Ophthalmopathy. The expected launch of emerging therapies and other treatments will lead to a significant increase in the Graves’ ophthalmopathy market size during the forecast period [2024–2034].

- In 2023, the total Graves’ ophthalmopathy market size was around USD 2,600 million, which is expected to increase by 2034 during the study period (2020–2034) in the 7MM.

- Among the 7MM, the United States accounted for the highest Graves’ ophthalmopathy market size in 2023, followed by Germany.

- During the forecast period (2024–2034), pipeline candidates such as batoclimab and VRDN-001 are expected to drive the rise in the Graves’ Ophthalmopathy market size.

- By 2034, TEPEZZA is expected to garner the highest Graves’ ophthalmopathy market share in the 7MM.

Graves’ Ophthalmopathy Drug Chapters

The section dedicated to drugs in the Graves’ Ophthalmopathy market report provides an in-depth evaluation of pipeline drugs (Phase III and Phase II) related to Graves’ Ophthalmopathy. The drug chapters section provides valuable information on various aspects related to clinical trials of Graves’ Ophthalmopathy, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Graves’ Ophthalmopathy.

Click Here @ TEPEZZA Drug Insight

Marketed Graves’ ophthalmopathy Therapies

TEPEZZA (teprotumumab): Horizon Therapeutics/ Amgen

Teprotumumab, an insulin-like growth factor-1 receptor inhibitor (IGF-1R), is a fully human IgG1 monoclonal antibody produced in Chinese hamster ovary (CHO-DG44) cells with a molecular weight of approximately 148 KD. The metabolism of teprotumumab has not been fully characterized; however, it is expected to undergo metabolism via proteolysis. TEPEZZA for injection is supplied as a sterile, preservative-free, and white to off-white, lyophilized powder for IV infusions.

- In October 2023, Amgen announced that it had completed the acquisition of Horizon Therapeutics.

- In January 2020, Horizon Therapeutics announced that the FDA had approved TEPEZZA to treat Graves’ Ophthalmopathy

Note: Detailed assessment will be provided in the final report of Graves’ Ophthalmopathy...

Emerging Graves’ ophthalmopathy Therapies

Batoclimab (IMVT 1401): Immunovant Sciences

Immunovant’s first investigational product, batoclimab (IMVT-1401), is a novel, fully human monoclonal antibody targeting the neonatal Fc receptor (FcRn). In nonclinical studies and clinical trials, batoclimab has been observed to reduce IgG antibody levels. High levels of pathogenic IgG antibodies drive a variety of autoimmune diseases, and, as a result, this product candidate has the potential to address a variety of IgG-mediated autoimmune diseases as a self-administered SC injection.

Batoclimab is being evaluated for treating patients with severe autoimmune diseases mediated by pathogenic immunoglobulin G (IgG), including Graves’ Ophthalmopathy.

- In June 2022, Immunovant announced that it achieved alignment with the US FDA Division of Ophthalmology on plans to initiate two placebo-controlled Phase III clinical trials to evaluate batoclimab in Graves’ Ophthalmopathy

- In November 2021, Immunovant, wholly owned subsidiary, Immunovant Sciences GmbH (“ISG”), entered into a Product Service Agreement (“PSA”), with Samsung Biologics (“Samsung”), according to which Samsung will manufacture and supply batoclimab drug substance for commercial sale and perform other manufacturing-related services for batoclimab

VRDN-001: Viridian Therapeutics

Viridian’s lead product candidate, VRDN-001, is a differentiated monoclonal antibody targeting insulin-like growth factor-1 receptor (IGF-1R), a clinically and commercially validated target for the treatment of Graves’ Ophthalmopathy.

In preclinical studies, VRDN-001 had shown to be a full antagonist of IGF-1R, with complete receptor blockade than other anti-IGF-1R antibodies, including the only approved Graves’ Ophthalmopathy therapy.

The company is running two global Phase III trials, THRIVE (NCT05176639) and THRIVE-2 (NCT06021054), for people living with active and chronic TED, respectively.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Graves’ Ophthalmopathy Drugs

Note: Detailed assessment will be provided in the final report of Graves’ Ophthalmopathy...

Graves Ophthalmopathy Market Outlook

Nearly 50% of patients with Graves’ Disease report symptoms of Graves’ Ophthalmopathy, which are generally mild.

The Graves’ Ophthalmopathy diagnosis is typically made clinically based on presenting ocular symptoms and signs. Timely diagnosis permits appropriate evaluation and treatment and might prevent the progression to more severe disease manifestations. The two most common signs of Graves’ Ophthalmopathy are upper eyelid retraction (around 90% of patients) and proptosis.

Currently, the pharmacological therapies used to manage Graves’ Ophthalmopathy are:

- Glucocorticoids, mycophenolate, rituximab, tocilizumab, teprotumumab, cyclosporine/mTOR inhibitors, and some other forms of treatment.

- A corticosteroid drug, taken by mouth or intravenously, is the main therapy for Graves’ Ophthalmopathy; oral prednisone is often used when the eye bulges and swelling worsens. High-dose prednisone or an IV corticosteroid is used if there is compression of the optic nerve.

- In 2020, TEPEZZA (teprotumumab) was approved by the US FDA; it is a monoclonal antibody that is intravenously administered; it inhibits the insulin-like growth factor 1 [IGF-1] receptor.

- Treatments such as methotrexate, azathioprine, and IV immunoglobulins have been used with little clinical impact or anecdotal benefit.

Some key players such as Immunovant Sciences (batoclimab), Viridian Therapeutics (VRDN-001), Sling Therapeutics (linsitinib), Regeneron Pharmaceuticals (aflibercept), and several others are investigating their candidates for treatment of Graves’ Ophthalmopathy in the 7MM.

Currently, only FDA-approved therapy is teprotumumab for the treatment of Graves’ Ophthalmopathy; for this reason, research into new drugs is unsurprisingly demanding. A few potential Graves’ ophthalmopathy therapies are in the clinical development for treating Graves’ Ophthalmopathy. It is safe to assume that the future of this market will depend upon the success of the trial results of these emerging drugs. New players have a huge opportunity to enter the Graves’ ophthalmopathy market.

Know More @ Batoclimab Drug Insight

Further details are provided in the report…

Graves’ Ophthalmopathy Treatment Market

Graves’ ophthalmopathy is an autoimmune inflammatory disorder associated with thyroid disease, which affects ocular and orbital tissues. It is also known as Graves’ orbitopathy, Graves’ eye disease, thyroid eye disease (TED), and thyroid-associated ophthalmopathy.

It is the main extrathyroidal manifestation of Graves’ disease (GD) and is often disfiguring, significantly impairing the QoL of affected individuals and causing great indirect and direct costs to health systems

Clinically, Graves’ Ophthalmopathy has a wide spectrum of ocular manifestations, including irritation, conjunctival injection, periorbital swelling, exposure keratopathy, lid retraction, exophthalmos, diplopia, and optic neuropathy. These clinical manifestations are caused by inflammation and expansion of the extraocular muscles (EOMs) and fat compartments in orbit.

Orbit computed tomography (CT) or magnetic resonance imaging (MRI) is used to visualize the enlargement of the EOMs and fat compartments. Based on clinical features and imaging, Graves’ Ophthalmopathy patients can be classified into two types:

- Type I: predominant enlargement of the fat compartment

- Type II: predominant enlargement of extraocular muscles (EOMs)

Further details are provided in the report...

Related Report @ Thyroid Eye Disease Market

Graves’ Ophthalmopathy Diagnosis

The diagnosis of Graves’ Ophthalmopathy is based on the following:

- The presence of eye signs and symptoms

- The presence of thyroid autoimmunity

- The exclusion of an alternative diagnosis.

There is no uniform pattern for the diagnosis of Graves’ Ophthalmopathy. Although the diagnosis is generally straightforward without additional laboratory or imaging data in thyrotoxic patients with bilateral proptosis, it can be more difficult in euthyroid patients with unilateral proptosis. In these cases, the presence of thyroid autoimmunity, especially the positivity of TSH receptor antibodies (either thyroid-stimulating immunoglobulins [TSI] or thyrotropin-binding inhibitor immunoglobulins [TBII]), is useful in establishing a diagnosis of Graves’ Ophthalmopathy.

They can also be diagnosed by CT scanning or MRI with special attention to the orbits that may identify an orbital mass lesion, an infiltrative process, idiopathic orbital inflammation (pseudotumor), or orbital abnormality.

Further details related to country-based variations are provided in the report...

Graves’ Ophthalmopathy Treatment

The management of Graves’ Ophthalmopathy depends on the patient’s symptoms and severity, consisting of fundamental, medical, and surgical treatments. The ideal treatment goal is to decrease the risk of visual complications, minimize side effects, eliminate the demand for surgical interventions, restore thyroid function, and avoid the progression or recurrence of Graves’ Ophthalmopathy.

The early diagnosis and preventive management, i.e., removal of modifiable risk factors, may reduce the prevalence and change the clinical manifestations of Graves’ Ophthalmopathy. Generally, fundamental treatments are recommended regardless of the severity, i.e., artificial tears, dark glasses, parasol, raising the pillow at night, and controlling risk factors (like smoking cessation).

Graves’ Ophthalmopathy is usually a single, self-limiting episode that can be divided into two phases, depending on the inflammatory activity of the disease.

- Depending on the degree of involvement, the acute, inflammatory phase usually responds to immunosuppressive anti-inflammatory treatment.

- During the chronic phase or sequel phase, patients can experience abnormalities such as exophthalmos or diplopia. Immunosuppressive treatment is not recommended due to its limited effectiveness.

- ery is typically performed as a part of rehabilitative therapy once the inflammation has resolved and may involve:

- Decompression surgery removes bone and soft tissue from behind the eye to create more space.

- Eye muscle surgery, which corrects severe double vision.

- Eyelid surgery improves the appearance and function of the eyelids.

The pharmacological therapies used to manage Graves’ Ophthalmopathy are glucocorticoids, mycophenolate, rituximab, tocilizumab, teprotumumab, cyclosporine/mTOR inhibitors, and some other forms of treatment.

Also, Read @ VRDN-001 Drug Insight

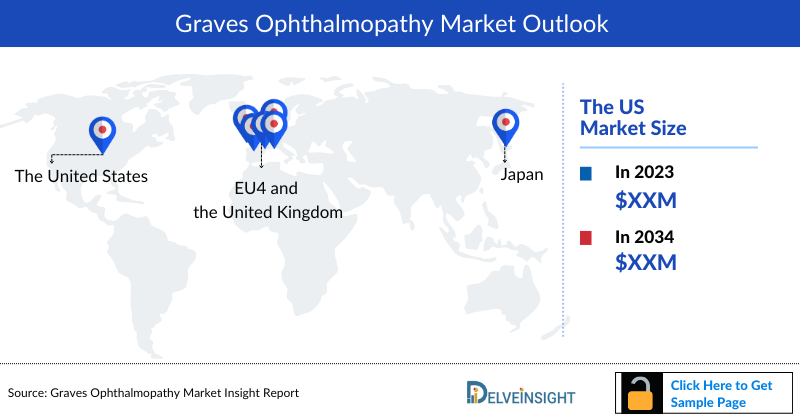

Graves’ Ophthalmopathy Epidemiology

The Graves’ Ophthalmopathy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by prevalent cases of Graves’ Ophthalmopathy, diagnosed prevalent cases, gender-specific cases, diagnosed prevalent cases by chronicity, acute diagnosed prevalent cases by severity, and moderate-to-severe drug-treated cases of acute Graves’ Ophthalmopathy in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM, the United States accounted for the highest number of prevalent cases of Graves’ Ophthalmopathy in 2023.

- In the US, out of all diagnosed prevalent cases of Graves’ Ophthalmopathy by chronicity, chronic cases were highest in 2023.

- Among the EU4 and the UK, Germany accounted for the highest number of diagnosed prevalent cases of Graves’ Ophthalmopathy cases, followed by France, whereas Spain accounted for the lowest number in 2023.

- In Japan, the highest acute diagnosed prevalent cases of Graves’ Ophthalmopathy by severity were for mild cases, followed by moderate -to-severe in 2023.

Unlock comprehensive insights! Click Here to Purchase the Full Report @ Graves’ Ophthalmopathy Incidence

KOL Views

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Graves’ Ophthalmopathy, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at DelveInsight connected with more than 10 KOLs across the 7MM. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Graves’ Ophthalmopathy market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Some expert opinions have been provided below:

“While teprotumumab is the only FDA-approved medication for TAO, a rapidly growing industry is focusing on developing agents to block the IGF-1R pathway. Introducing such agents that could address the wide-reaching effects of TAO may redefine the treatment landscape.”

“The modified clinical activity score (CAS) is currently the most widely used index to determine the acute phase of inflammation in GO. However, CAS may not reflect the inflammatory activity of myopathy, especially in mild-to-moderate GO with low NOSPECS scores. Usage of Deep Learning (DL) systems for the screening of orbital coronal CT images may yield useful information regarding the early treatment of enlarged extraocular muscle (EEM) patients with Graves’ ophthalmopathy.”

Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging Graves’ ophthalmopathy therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Graves’ Ophthalmopathy Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The Graves’ ophthalmopathy market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Graves’ Ophthalmopathy Market Report Insights

- Graves’ Ophthalmopathy Patient Population

- Graves’ Ophthalmopathy Therapeutic Approaches

- Graves’ Ophthalmopathy Market Size

- Graves’ Ophthalmopathy Market Trends

- Existing Graves’ Ophthalmopathy Market Opportunity

Graves’ Ophthalmopathy Market Report Key Strengths

- Eleven-year Forecast

- The 7MM Coverage

- Graves’ Ophthalmopathy Epidemiology Segmentation

- Key Cross Competition

Graves’ Ophthalmopathy Market Report Assessment

- Current Graves’ Ophthalmopathy Treatment Practices

- Reimbursements

- Graves’ Ophthalmopathy Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions

- Would there be any changes observed in the current Graves’ Ophthalmopathy treatment approach?

- Will there be any improvements in Graves’ Ophthalmopathy management recommendations?

- Would research and development advances pave the way for future tests and therapies for Graves’ Ophthalmopathy?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Graves’ Ophthalmopathy?

- What kind of uptake will the new therapies witness in the coming years in Graves’ Ophthalmopathy patients?

Delve into our library of Related Articles, Video, and Infographics to broaden your understanding:-

- Graves’ Ophthalmopathy Treatment Market: A Billion-Dollar Opportunity For Pharma Companies

- Graves Ophthalmopathy Market Infographic

- Graves’ Ophthalmopathy Market: Video

Elevate Your Learning with Related Articles @ Latest DelveInsight Blog